UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

(Mark One)

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020

OR

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number 001-38769

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

Cigna 401(k) Plan

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

Cigna Corporation

900 Cottage Grove Road

Bloomfield, Connecticut 06002

CIGNA 401(k) PLAN

Financial Statements and

Supplemental Schedule

December 31, 2020 and 2019

|

CIGNA 401(k) PLAN

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

Report of Independent Auditors

|

4

|

|

|

|

|

|

Financial Statements

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2020 and 2019

|

6

|

|

|

Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2020

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule*

|

|

|

|

Form 5500 Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2020

|

18

|

|

|

|

|

|

|

|

|

|

*Other supplemental schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable

|

Report of

Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of Cigna 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for

benefits of Cigna 401(k) Plan (the “Plan”) as of December 31, 2020 and December 31, 2019 and the related statement of changes

in net assets available for benefits for the year ended December 31, 2020, including the related notes (collectively referred to as the

“financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets

available for benefits of the Plan as of December 31, 2020 and December 31, 2019, and the changes in net assets available for benefits

for the year ended December 31, 2020 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management.

Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm

registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect

to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange

Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with

the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material

misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule of Assets (Held at End of Year) as of December

31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The

supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental

schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures

to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental

schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department

of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our

opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

June 24, 2021

We have served as the Plan’s auditor since at least 1994. We have

not been able to determine the specific year we began serving as auditor of the Plan

|

CIGNA 401(k) PLAN

|

|

|

|

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

|

As of

December 31,

|

|

|

|

2020

|

|

2019

|

|

|

|

(In thousands)

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at fair value (See Note 4)

|

|

$

|

7,544,239

|

|

|

$

|

6,655,971

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at contract value (See Note 5)

|

|

|

3,488,571

|

|

|

|

3,091,873

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes receivable

|

|

|

145,293

|

|

|

|

150,760

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer contributions receivable

|

|

|

19,470

|

|

|

|

27,603

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash in transit related to merger (See Note 3)

|

|

|

214,132

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

11,411,705

|

|

|

$

|

9,926,207

|

|

|

The accompanying Notes to the Financial Statements are an integral part of these statements.

|

|

CIGNA 401(k) PLAN

|

|

|

|

|

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

|

For the Year Ended

|

|

|

|

December 31, 2020

|

|

|

|

(In thousands)

|

|

Investment Income

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

1,090,772

|

|

|

Other investment income

|

|

|

178

|

|

|

Interest

|

|

|

93,772

|

|

|

Dividends

|

|

|

170

|

|

|

Net investment income

|

|

|

1,184,892

|

|

|

Interest income on notes receivable from participants

|

|

|

7,523

|

|

|

Contributions

|

|

|

|

|

|

Employee contributions

|

|

|

435,553

|

|

|

Employer contributions

|

|

|

246,554

|

|

|

Rollover contributions

|

|

|

46,472

|

|

|

Total contributions

|

|

|

728,579

|

|

|

Deductions

|

|

|

|

|

|

Benefits paid to participants

|

|

|

(646,818

|

)

|

|

Plan expenses

|

|

|

(2,810

|

)

|

|

Total deductions

|

|

|

(649,628

|

)

|

|

Net increase

|

|

|

1,271,366

|

|

|

Transfers from other plans (See Note 3)

|

|

|

214,132

|

|

|

Net assets available for benefits

|

|

|

|

|

|

Beginning of year

|

|

|

9,926,207

|

|

|

End of year

|

|

$

|

11,411,705

|

|

|

|

|

|

The accompanying Notes to the Financial Statements are an integral part of these statements.

|

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Note 1 – Description of the Plan

The following description of the Cigna 401(k) Plan (the “Plan”)

provides general information only. A more complete explanation of the features and benefits available under the Plan, a defined contribution

plan, is contained in the Plan’s Summary Plan Description and Prospectus. Generally, all U.S.-based employees of participating affiliates

of Cigna Holding Company (the “Company” or “Plan Sponsor”) are eligible to participate in the Plan. The Plan is

subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). As of December 31, 2020

and 2019 and for the year ended December 31, 2020, Prudential Bank & Trust, FSB, was the Trustee for the Plan.

The Company is a subsidiary of Cigna Corporation ("Cigna").

The Cigna Stock Fund refers to shares of Cigna.

Plan Administration

The Cigna Corporation Retirement Plan Committee, which is comprised

of three members of Cigna's management, is the primary Plan fiduciary. This committee delegates responsibility for administration of the

Plan to the Plan Administrator, a Cigna employee, and responsibility for the Plan’s financial management to Cigna's Chief Financial

Officer ("CFO"). The Plan Administrator and CFO have arranged with Prudential Retirement Insurance and Annuity Company ("PRIAC")

to perform the primary administrative, recordkeeping and asset management functions on behalf of the Plan. The Retirement Plan Committee

is responsible for, among other things, selecting and monitoring the Plan’s investments.

Investments

The Plan’s investment options include a fixed income

fund, which is supported by both traditional and synthetic fully benefit-responsive investment contracts (see Note 5); Cigna common stock;

and pooled separate accounts that invest in equities, bonds, derivatives or funds. Participants may transfer assets among the investment

options, subject to certain restrictions. For example, transfers involving assets invested in Cigna common stock may be subject to restrictions

imposed under Cigna Corporation’s Policy on Securities Transactions and Insider Trading. See Notes 4 and 5 for additional information

regarding the Plan’s investment options.

The Plan uses an age-appropriate Moderate target portfolio

under Prudential Retirement’s GoalMaker® asset allocation program ("GoalMaker") as its default investment option.

GoalMaker meets the requirements to be a Qualified Default Investment Alternative ("QDIA") under federal law. Participants are

invested in the QDIA if they have not made their own investment allocation election or may be invested due to a plan merger if they do

not elect how their old plan account should be invested after the plan merger occurs.

Employee Contributions

The Plan permits employees to make pre-tax and Roth contributions

(regular and catch-up). A Roth 401(k) is an employer-sponsored investment savings account that is funded with after-tax contributions

up to the plan's limit and future withdrawals are tax-free. The contribution rate maximum is 80% of a participant’s eligible pay.

This is a total limit that applies to all employee contributions. As a result of the Plan’s use of a “qualified automatic

contribution arrangement” ("QACA") safe harbor, highly-compensated employees are not subject to a separate contribution

rate limit.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

The Plan uses an automatic contribution rate increase program

called Contribution Accelerator. If an eligible participant’s pre-tax contribution rate is at least 1% but less than 9%, the contribution

rate is automatically increased by 1% at the beginning of each year until it reaches 10%. Eligible participants can opt out of Contribution

Accelerator or change the date when the increase would go into effect each year.

All employees, however, are still subject to the annual dollar

limit set by the Internal Revenue Service ("IRS"). Employee contributions may be invested in any combination of investment options

offered by the Plan subject to certain other Internal Revenue Code ("IRC") limitations and any restrictions imposed under Cigna

Corporation’s Policy on Securities Transactions and Insider Trading.

Employer Contributions

All employees are eligible for employer-matching contributions

as soon as they join the Plan. As of 01/01/2020, the maximum effective regular matching contribution increased from 4.5% to 5% of a participant's

first 6% of eligible pay. The new match formula is equal to 100% on the first 4% of eligible pay contributed (a 4% of pay match) plus

50% on the next 2% of pay contributed (a 1% pay match). The company match rate applies to pre-tax, Roth contributions and catch-up contributions

– to the extent those contributions are part of an employee’s first 6% of pay contributed. New employees are automatically

enrolled in the Plan after 30 days from date of hire and are eligible to receive the maximum regular matching contribution. These new

employees can opt out of auto enrollment as well as the contribution accelerator. Regular matching contributions are made at the same

time employee contributions are made, typically bi-weekly, but no less frequently than monthly.

The Plan also provides a “true-up” matching contribution

after the close of each Plan year. The true-up match is an added employer contribution, if necessary to make the year’s total matching

contributions equal to what they would have been on a “look-back” if all employee match eligible contributions were made as

of the end of the year and matching contributions were based on the participant’s total annual eligible earnings as of the end of

the year. The true-up match provides otherwise missed regular matching contributions for eligible participants caused by changes in an

employee’s contribution rates during the year.

All types of matching contributions (regular and true-up) are

collectively referred to as "employer contributions."

In addition to providing

regular matching contributions and true-up contributions, the Plan also provides for discretionary matching contributions. The Company

did not make a discretionary matching contribution to the Plan for the 2020 Plan Year. With respect to the 2019 Plan Year, the Company

made a discretionary matching contribution equal to $17.1 million in the first quarter of 2020. This discretionary matching contribution

was reflected as a receivable in the 2019 financials.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Service Contract Act Contributions

Certain former participants of the Express Scripts, Inc. 401(k) Plan

are eligible for additional contributions (“SCA Contributions”) to comply with the Service Contract Act (“SCA”)

of 1965. SCA Contributions are determined by multiplying the contractually required hourly rate by the hours worked by such participant

during the period from which such contribution is made (but not in excess of the hours required by the SCA to be credited for such purposes).

This amount is then reduced by the cost of fringe benefits otherwise credited to such participant outside of the Plan for such period.

For the 2020 plan year, the total SCA contributions were $2.6 million. This amount is included in the employer contributions receivable

as of December 31, 2020.

Rollover Contributions

The Plan may accept rollover contributions. Rollover contributions

represent distributions received from other “eligible retirement plans,” as defined in IRC section 401(a)(31)(E). Distributions

from other plans are subject to certain conditions to be eligible for rollover into the Plan.

Participant Accounts

Each participant’s account is credited with the participant’s

contribution, the employer contribution and investment earnings, net of expenses. A participant is entitled to their vested account balance.

Vesting

Employee contributions and related investment earnings are

fully vested at all times.

Employer contributions and related investment earnings become

fully vested upon completion of two years of service. Employer contributions made at any time and related investment earnings become fully

vested earlier when an employee reaches age 65; dies; becomes totally and permanently disabled; or continues to be employed by a participating

Cigna company that is sold and does not maintain a successor plan. Early vesting also would occur if Cigna discontinues matching contributions

or terminates the Plan.

Participants earn a year of vesting service if they have at

least 1,000 hours of service during the calendar year.

In 2020, the Plan was amended to provide for full vesting of any employer

contributions for Plan participants employed in Cigna's group life and disability insurance business (the “CGI business”)

in connection with the sale of the CGI business to New York Life. This vesting treatment was effective upon the closing of the sale transaction

on December 31, 2020.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Forfeitures

During the year ended December 31, 2020, employer contributions

were reduced by approximately $3.2 million. No forfeiture amounts were used to offset Plan expenses.

Notes Receivable

The notes receivable amount represents the unpaid principal

balance on unpaid loans. The Plan permits participants to borrow a portion of their vested Plan account, subject to certain limitations,

including restriction of post-2009 Cigna employer contributions, at an annual rate of interest with a specified repayment period. The

minimum amount that may be borrowed is $1,000; the maximum total loan amount is the lesser of $50,000 or 50% of the participant’s

vested account balance. A participant may have no more than two outstanding loans. Loan terms range from 12 to 60 months or up to 120

months if the loan is used to buy or build a participant’s primary residence. The annual interest rate for a Plan loan is 2% plus

the yield of actively traded U.S. Treasury securities, adjusted by the U.S. Treasury Department to 3-year or 7-year constant maturities.

The maximum Plan loan interest rate is the bank prime loan rate that is in effect on the same date that the applicable Treasury rate is

determined. Loan interest rates remain fixed during the term of the loan. The loan is secured by the participant’s vested account

balance. PRIAC charges the participant a $50 fee to process Plan loans and a $25 annual loan maintenance fee for new loans initiated after

March 29, 2018. Effective April 1, 2021, the maintenance fee for loans will decrease to $20 annually. There is no change to the $50 processing

fee. At December 31, 2020, loan interest rates ranged from 2.36% to 11.00%.

Payment of Benefits

Participants may withdraw funds subject to the requirements

of the Plan. Upon termination of employment for any reason, a participant may elect to receive either a lump-sum amount equal to the value

of the participant’s vested account balance, monthly installments over a period of years, an annuity, or a combination of these

forms of payment. If the participant’s vested account balance is more than $1,000 but not more than $5,000 and the participant does

not agree within 80 days to accept a lump sum, the amount will automatically be rolled over to an Individual Retirement Account or Individual

Retirement Annuity ("IRA") sponsored by a Prudential Retirement affiliate. The IRA will be invested in an investment product

designed to preserve principal and provide a reasonable rate of return and liquidity. All related expenses will be charged to the IRA.

If a Plan participant with a balance greater than $5,000 terminates and does not withdraw funds, the account becomes inactive. Inactive

plan participants can request withdrawals at any time. As a result of the Setting Every Community Up for Retirement Enhancement ("SECURE")

Act, the required minimum distribution age was increased to age 72 effective January 2020 and as a result, terminated participants must

begin taking minimum distributions in April of the year following the year they turn age 72. However, for terminated participants who

were age 70 ½ in 2019 or earlier, the required minimum distribution age of 70 ½ is unchanged. Additionally, the CARES Act

suspended RMDs for the 2020 Plan Year. To the extent a participant’s account is invested in Cigna common stock, the participant

may elect to receive such amounts in shares.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Plan Expenses

Administrative expenses and certain investment management fees

are reported separately, and participant accounts are directly charged, on a quarterly basis, with the same administrative fee regardless

of their investment options. Effective January 1, 2020, the annual administrative fee was 0.0175% of the participant’s account up

to a maximum of $100. Additionally, effective January 1, 2021, the annual administrative fee will further reduce to 0.0140% of the participant’s

account up to a maximum of $93.

Brokers’ commissions resulting from buying or selling

Cigna common stock are paid from the participants’ account balances and are reflected as a reduction of investment income in these

financial statements. Fees related to pooled separate accounts and underlying fund investments are netted against investment returns of

each pooled separate account. Other costs associated with the operation of the Plan, including trustee and legal fees, are paid by Cigna.

Plan Termination

Cigna intends to continue the Plan indefinitely but reserves

the right to discontinue employer contributions or terminate the Plan in whole or in part at any time prior to that. If contributions

are discontinued or the Plan is terminated, affected participants will become fully vested. Upon Plan termination, net assets of the Plan

will be distributed in the manner Cigna elects in accordance with the Plan document and in accordance with ERISA and its related regulations.

CARES Act Provisions

The Coronavirus Aid, Relief, and Economic Security Act (the "CARES

Act"), adopted on March 27, 2020, contained optional changes for defined contribution plans including 401(k) plans. Generally, these

provisions only apply to transactions entered into between January 1, 2020 and December 30, 2020 and expire thereafter. The Plan implemented

the following optional features of the CARES Act: 1) suspended required minimum distributions; 2) increased the loan limit to $100,000

and delayed loan repayments for up to one year; and 3) allowed "Coronavirus-Related Distributions ("CRDs") of up to $100,000

for individuals who satisfied the eligibility requirements for CRDs. The 10% penalty typically applicable to distributions before age

59 1/2 does not apply to CRDs. In addition, the taxes on a CRD may be paid over a three year period and participants are permitted to

repay the CRD to their account over three years to avoid a taxable distribution.

Written amendments to the Plan reflecting the CARES Act and SECURE

Act changes were adopted in 2020.

Note 2 - Significant Accounting Policies

Basis of Presentation

The financial statements have been prepared on the accrual

basis of accounting in conformity with accounting principles generally accepted in the United States of America ("GAAP"). Amounts

recorded in the financial statements reflect management’s estimates and assumptions that affect the reported amount of assets, liabilities,

and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Significant estimates

are discussed throughout these Notes; however, actual results could differ from those estimates.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Valuation of Investments and Income Recognition

Except for the fully benefit-responsive benefit investment

contracts, which are valued at contract value, plan investments are reported at fair value. Fair value is the price that would be received

to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair

value of Cigna common stock is based upon its quoted market price. Fair value of pooled separate accounts is measured by the net unit

value, which is based on the fair value of the underlying assets of the account.

Purchases and sales of securities are recorded on a trade-date

basis. Interest is recognized when earned. Dividends are recognized on the ex-dividend date. Net appreciation or depreciation includes

realized gains and losses on investments that were both purchased and sold during the period as well as unrealized appreciation or depreciation

of the investments held at year end.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid

principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms

of the Plan document.

Payment of Benefits

Benefits are recorded when paid.

Note 3 – Plan Mergers

On December 31, 2020, the eviCore Inc. 401(k) Plan ("eviCore

Plan") was merged into the Plan. In connection with this merger, approximately $214 million in assets were transferred from the eviCore

Plan into the Plan. The assets transferred consist of cash. This amount is reflected as a cash in transit as of December 31, 2020. These

assets were deposited into individual accounts in January 2021 according to the participant investment allocations and participants were

eligible to make contributions and receive matching contributions beginning on January 1, 2021.

In addition, $28,320 of outstanding loans taken by eviCore Plan participants

were transferred into the Plan on December 31, 2020. These loans were not required to be re-amortized at the time of the plan merger.

The Plan retained the vesting schedule of the participants of the

eviCore Plan and preserved all of their vested employer contributions from the eviCore Plan. No benefit payments were made by the Plan

to the participants of the eviCore Plan during 2020.

Note 4 - Fair Value Measurements

Accounting Standards Codification 820, Fair Value Measurements

and Disclosures, provides a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs

to valuation techniques used to measure fair value, as follows: Level 1, which refers to securities valued using unadjusted quoted prices

from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable

market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. Assets and

liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Financial Assets Carried at Fair Value

The following table provides information as of December 31, 2020 and

2019 about the Plan’s financial assets carried at fair value on a recurring basis.

|

|

|

|

|

|

|

|

|

2020

|

|

Quoted Prices in Active Markets for Identical Assets

|

|

Significant Other Observable Inputs

|

|

|

|

(In thousands)

|

|

(Level 1)

|

|

(Level 2)

|

|

Total

|

|

Assets at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

$

|

827,257

|

|

|

$

|

—

|

|

|

$

|

827,257

|

|

|

Pooled separate accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed maturities

|

|

|

|

|

|

|

241,446

|

|

|

|

241,446

|

|

|

Equity securities

|

|

|

|

|

|

|

6,475,536

|

|

|

|

6,475,536

|

|

|

Total assets at fair value

|

|

$

|

827,257

|

|

|

$

|

6,716,982

|

|

|

$

|

7,544,239

|

|

|

2019

|

|

Quoted Prices in Active Markets for Identical Assets

|

|

Significant Other Observable Inputs

|

|

|

|

(In thousands)

|

|

(Level 1)

|

|

(Level 2)

|

|

Total

|

|

Assets at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

$

|

891,882

|

|

|

$

|

—

|

|

|

$

|

891,882

|

|

|

Pooled separate accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed maturities

|

|

|

|

|

|

|

216,956

|

|

|

|

216,956

|

|

|

Equity securities

|

|

|

|

|

|

|

5,547,133

|

|

|

|

5,547,133

|

|

|

Total assets at fair value

|

|

$

|

891,882

|

|

|

$

|

5,764,089

|

|

|

$

|

6,655,971

|

|

Note 5 – Financial Assets Carried at Contract Value

The Plan’s Fixed Income Fund is supported by four separate

fully benefit-responsive investment contracts, including a traditional investment contract and three synthetic investment contracts. The

Fixed Income Fund functions as a “fund of funds”, and blends the crediting rates of the individual investment contracts to

create a single melded crediting rate for the Fixed Income Fund. The melded rate approximates the rates of the supporting investment contracts

and is utilized for Plan accounting purposes only. While PRIAC does not guarantee, support or otherwise back the melded book value, participants

may ordinarily direct the withdrawal or transfer of all or a portion of their investment at their melded book value.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

The Plan transacts with each of the four separate contract

issuers at contract value. These contracts meet the fully benefit-responsive investment contract criteria and therefore are reported at

their contract value in the statements of net assets available for benefits. Contract value is the relevant measure for fully benefit-responsive

investment contracts because this is the amount received by the Plan if participants were to initiate permitted transactions. Contract

value represents contributions made under each contract, plus earnings, less withdrawals, and administrative expenses.

The following represents the disaggregation of contract value

between types of investment contracts held by the Plan.

|

|

|

As of December 31,

|

|

(In thousands)

|

|

2020

|

|

2019

|

|

Financial assets at contract value:

|

|

|

|

|

|

|

|

|

|

Traditional investment contract

|

|

$

|

644,420

|

|

|

$

|

783,714

|

|

|

Synthetic investment contracts

|

|

|

2,844,151

|

|

|

|

2,308,159

|

|

|

Total assets at contract value

|

|

$

|

3,488,571

|

|

|

$

|

3,091,873

|

|

The key difference between a synthetic investment contract

and a traditional investment contract is that the Plan owns the underlying assets of the synthetic investment contract. A synthetic investment

contract includes a wrapper contract, which is an agreement for the wrap issuer insurance company to make payments to the Plan in certain

circumstances. The wrapper contract typically includes certain conditions and limitations on the underlying assets owned by the Plan.

With traditional investment contracts, the Plan owns only the contract itself and there are no reserves against contract value for the

credit risk of the contract issuer.

Synthetic and traditional investment contracts are designed

to accrue interest based on crediting rates established by the contract issuers. The synthetic investment contracts held by the Plan include

three wrapper contracts with the Prudential Insurance Company of America ("PICA"), Voya Retirement Insurance and Annuity Company

("VRIAC"), and Massachusetts Mutual Life Insurance Company ("MassMutual"), each of which provide a guarantee that

their crediting rate will not fall below 0 percent. Assets supporting these contracts are comprised of diversified fixed income securities.

Cash flow volatility (for example, timing of benefit payments) as well as asset underperformance can be passed through to the Plan through

adjustments to future contract crediting rates. Crediting rates are reviewed not less than annually for resetting, and any adjustments

can then be passed through to participants, which would generally be performed through updating of the crediting rate for the Fixed Income

Fund in order to bring the melded book value of the participants in line with the Plan’s cumulative contract value on the four underlying

fully benefit-responsive investment contracts.

The traditional investment contract held by the Plan is a guaranteed

investment contract with PRIAC. The contract issuer is contractually obligated to repay the principal and interest at a specified interest

rate that is guaranteed to the Plan. The crediting rate is based on a formula established by the contract issuer but may not be less than

0 percent and is reviewed not less than annually for resetting.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

The Plan’s ability to receive amounts due in accordance

with fully benefit-responsive investment contracts is dependent on the third-party issuer’s ability to meet its financial obligations.

The issuer’s ability to meet its contractual obligations may be affected by future economic and regulatory developments.

Certain events might limit the ability of the Plan to transact

at contract value with the contract issuer. These events may be different under each contract. Examples of such events include the following:

-

The Plan’s failure to qualify under Section 401(a) of the Internal

Revenue Code or the failure of the trust to be tax-exempt under Section 501(a) of the Internal Revenue Code;

-

Premature termination of the contracts;

-

Plan termination or merger;

-

Changes to the Plan’s prohibition on competing investment options;

-

Bankruptcy of the plan sponsor or other plan sponsor events (for

example, divestitures or spinoffs of a subsidiary) that significantly affect the Plan’s normal operations;

-

Bankruptcy of PRIAC, the contract issuer to the traditional

investment contract.

Note that if these certain events were to occur, the

Plan may not be able to transact at contract value with the contract issuers and may elect to reflect any difference between market value

and contract value by adjusting participants’ melded book value in the Fixed Income Fund. It is possible that under such events

participants’ melded book value may decrease, however, the Plan Sponsor does not believe it is probable that such events will occur.

Note 6 - Tax Status

The Plan's design and current operations are consistent

with all IRS requirements for tax exemption. This was confirmed by the IRS through the issuance to Cigna of a favorable determination

letter dated March 27, 2018. The Plan has been amended since receiving the determination letter; however, the plan administrator

believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue

Code. Additionally, as a result of the Plan merger with Express Scripts, Inc. 401(k) Plan, the Plan did file an application for a new

determination letter on December 29, 2020. The determination letter application is currently pending with the IRS. The Plan may be subject

to IRS audit but there is no such audit currently in progress, nor has there been one in the recent past. However, the federal tax

years that remain open and subject to an audit based on IRS general procedures are 2017 to 2019. Tax years 2015 and 2016 are under review

due to amended return filings and the claim of right doctrine.

Accounting principles generally accepted in the United States of America

require the Plan’s management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has

taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. As of December

31, 2020 and 2019, there were no uncertain positions taken that had an effect on the Plan financial statements or that required disclosure.

|

CIGNA 401(k) PLAN

NOTES TO THE FINANCIAL STATEMENTS

|

Note 7 - Related Party Transactions and Party in Interest

Transactions

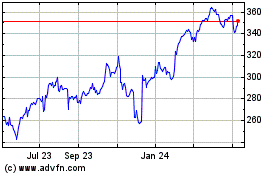

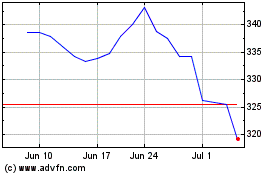

The Plan invests in Cigna common stock. During the year ended

December 31, 2020, the Plan purchased shares of Cigna common stock for $53,172,566 (291,342 shares) and sold shares of Cigna common stock

for $132,250,871 (679,091 shares). The Cigna Stock Fund experienced net appreciation of $14,454,371 for the year ended December 31, 2020.

The Plan also invests in pooled separate accounts and fully

benefit-responsive investment contracts, which are administered by PRIAC, the Plan’s third party administrator and record-keeper.

Activity reported by PRIAC for these investments qualify as party in interest transactions. Fees incurred by the Plan for administrative

services are included in Plan expenses and totaled $2.7 million in 2020. These have been paid directly to PRIAC.

eviCore became a wholly-owned subsidiary of Cigna on December 20,

2018 and sponsored a separate 401(k) plan for their eligible employees until that plan was merged into the Plan on December 31,2020. See

Note 3 – Plan Mergers for additional details.

Note 8 – Risks and Uncertainties

The Plan invests in various investment securities. Investment securities

are exposed to various risks such as interest rate, market and credit risks, including credit risk on fully benefit-responsive investment

contracts. Credit risk exists for these contracts because there are no reserves by the insurance company against the contract value disclosed,

other than the underlying assets of the synthetic investment contracts, which the Plan owns. Due to the level of risk associated with

certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably

possible that changes in values of investment securities will occur in the near term and that such changes could materially affect participants’

account balances and the amounts reported in the statements of net assets available for benefits.

Note 9 – Reconciliation of Financial Statements to Form

5500

The following is a reconciliation of net assets available for benefits

per the financial statements to the Form 5500 as of December 31, 2020.

|

|

As of December 31,

|

|

(In thousands)

|

2020

|

2019

|

|

Net Assets available for benefits per the Statements of Net Assets Available for Benefits

|

$

|

11,411,705

|

|

$

|

9,926,207

|

|

|

|

|

|

|

Difference between contract value and current value on fully benefit-responsive contracts (a)

|

175,964

|

|

(3,949)

|

|

|

Net Assets available for benefits per the Form 5500

|

$

|

11,587,669

|

|

$

|

9,922,258

|

|

|

|

(a)

|

Fully benefit-responsive contracts are required to be carried at contract value in the Statements of Net Assets Available for Benefits.

|

Note 10 – Subsequent Events

No subsequent events were identified through June 24, 2021, the date

these financial statements were issued.

SUPPLEMENTAL SCHEDULE

|

CIGNA 401(k) PLAN

|

|

|

|

|

|

|

|

|

|

FORM 5500 SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS

|

|

(HELD AT END OF YEAR)

|

|

|

|

|

|

|

|

|

|

As of December 31, 2020

|

|

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of issue, borrower, lessor or similar party

|

Description of investment including maturity date, rate of interest, collateral, par or maturity value

|

Current Value

|

|

*Cigna

|

CIGNA COMMON STOCK

|

Common Stock

|

|

|

|

$

|

827,258

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

DRYDEN S&P 500 INDEX

|

Pooled Separate Account

|

|

|

|

$

|

2,236,103

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

LARGE CAP BLEND FUND

|

Pooled Separate Account

|

|

|

|

$

|

670,614

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

MID CAP BLEND FUND

|

Pooled Separate Account

|

|

|

|

$

|

429,901

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

SMALL CAP BLEND FUND

|

Pooled Separate Account

|

|

|

|

$

|

378,918

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

INTERNATIONAL STOCK FUND

|

Pooled Separate Account

|

|

|

|

$

|

183,013

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

BLACKROCK EQUITY MARKET INDEX FUND

|

Separate Account

|

|

|

|

$

|

1,141,838

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

ALL WORLD EX-US STOCK INDEX FUND

|

Separate Account

|

|

|

|

$

|

1,292,345

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

US TOTAL STOCK MARKET INDEX FUND

|

Separate Account

|

|

|

|

$

|

142,802

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

PRUDENTIAL INVESTMENT MANAGEMENT, INC.

HIGH YIELD BOND FUND

|

Pooled Separate Account

|

|

|

|

$

|

241,446

|

|

|

|

|

|

|

|

|

|

|

*PRIAC

|

GUARANTEED LONG TERM FUND (CONTRACT INTEREST RATE: 3.20%)

|

General Account Contract

|

|

|

|

$

|

644,420

|

|

|

|

|

|

|

|

|

|

|

VRIAC

|

CIGNA STABLE VALUE FUND (CONTRACT INTEREST RATE: 1/1-6/30 2.97%, 7/1-12/31 2.49%)

|

Synthetic Contract

|

|

|

|

$

|

1,543,384

|

|

|

|

|

|

|

|

|

|

|

*PICA

|

PRUDENTIAL STABLE VALUE FUND (CONTRACT INTEREST RATE: 2.91%):

|

Synthetic Contract

|

|

|

|

|

|

|

COMMERCIAL MORTGAGE SEPARATE ACCOUNT

|

Separate Account

|

|

|

|

$

|

89,801

|

|

|

|

PRIVEST SEPARATE ACCOUNT

|

Separate Account

|

|

|

|

$

|

93,682

|

|

|

|

AMERICREDIT AUTOMOBILE RECEI

|

Asset Backed

|

3.13%

|

DUE

|

02/18/2025

|

$

|

207

|

|

|

|

AMERICREDIT AUTOMOBILE RECEI

|

Asset Backed

|

3.36%

|

DUE

|

02/18/2025

|

$

|

316

|

|

|

|

AMERICREDIT AUTOMOBILE RECEIV

|

Asset Backed

|

2.74%

|

DUE

|

04/18/2025

|

$

|

521

|

|

|

|

AMERICREDIT AUTOMOBILE RECEIV

|

Asset Backed

|

2.32%

|

DUE

|

07/18/2025

|

$

|

932

|

|

|

|

AMERICREDIT AUTOMOBILE RECEIV

|

Asset Backed

|

1.06%

|

DUE

|

08/18/2026

|

$

|

402

|

|

|

|

AVIS BUDGET RENTAL CAR FUNDIN

|

Asset Backed

|

3.70%

|

DUE

|

09/20/2024

|

$

|

527

|

|

|

|

AVIS BUDGET RENTAL CAR FUNDIN

|

Asset Backed

|

4.00%

|

DUE

|

03/20/2025

|

$

|

433

|

|

|

|

AVIS BUDGET RENTAL CAR FUNDIN

|

Asset Backed

|

3.35%

|

DUE

|

09/22/2025

|

$

|

854

|

|

|

|

AVIS BUDGET RENTAL CAR FUNDIN

|

Asset Backed

|

2.36%

|

DUE

|

03/20/2026

|

$

|

1,147

|

|

|

|

AVIS BUDGET RENTAL CAR FUNDIN

|

Asset Backed

|

2.33%

|

DUE

|

08/20/2026

|

$

|

722

|

|

|

|

CITIBANK CREDIT CARD ISSUANCE

|

Asset Backed

|

3.96%

|

DUE

|

10/15/2030

|

$

|

2,053

|

|

|

|

COMMONBOND STUDENT LOAN T

|

Asset Backed

|

3.21%

|

DUE

|

02/25/2044

|

$

|

224

|

|

|

|

DISCOVER CARD MASTER TRUST

|

Asset Backed

|

2.53%

|

DUE

|

10/15/2026

|

$

|

321

|

|

|

|

DRIVE AUTO RECEIVABLES TRUST

|

Asset Backed

|

2.65%

|

DUE

|

02/15/2024

|

$

|

404

|

|

|

|

FORD CREDIT AUTO OWNER TRUST

|

Asset Backed

|

1.03%

|

DUE

|

10/15/2022

|

$

|

967

|

|

|

|

FORD CREDIT FLOORPLAN MASTER

|

Asset Backed

|

2.48%

|

DUE

|

09/15/2024

|

$

|

415

|

|

|

|

FORD CREDIT FLOORPLAN MASTER

|

Asset Backed

|

3.06%

|

DUE

|

04/15/2026

|

$

|

433

|

|

|

|

FORD CREDIT AUTO LEASE TRUST

|

Asset Backed

|

0.42%

|

DUE

|

12/15/2022

|

$

|

7,708

|

|

|

|

FORD CREDIT AUTO OWNER TRUST F

|

Asset Backed

|

3.19%

|

DUE

|

07/15/2031

|

$

|

330

|

|

|

|

FORD CREDIT AUTO OWNER TRUST F

|

Asset Backed

|

3.19%

|

DUE

|

07/15/2031

|

$

|

440

|

|

|

|

GM FINANCIAL CONSUMER AUTOMO

|

Asset Backed

|

1.50%

|

DUE

|

03/16/2023

|

$

|

1,048

|

|

|

|

GM FINANCIAL SECURITIZED TERM

|

Asset Backed

|

3.62%

|

DUE

|

06/17/2024

|

$

|

105

|

|

|

|

DRB PRIME STUDENT LOAN TRUST

|

Asset Backed

|

2.81%

|

DUE

|

11/25/2042

|

$

|

127

|

|

|

|

LAUREL ROAD PRIME STUDENT LOA

|

Asset Backed

|

3.54%

|

DUE

|

05/26/2043

|

$

|

297

|

|

|

|

MMAF EQUIPMENT FINANCE LLC

|

Asset Backed

|

2.41%

|

DUE

|

08/16/2024

|

$

|

140

|

|

|

|

MMAF EQUIPMENT FINANCE LLC

|

Asset Backed

|

2.72%

|

DUE

|

06/15/2040

|

$

|

515

|

|

|

|

MMAF EQUIPMENT FINANCE LLC

|

Asset Backed

|

2.29%

|

DUE

|

11/12/2041

|

$

|

743

|

|

|

|

MMAF EQUIPMENT FINANCE LLC

|

Asset Backed

|

3.20%

|

DUE

|

09/12/2022

|

$

|

1,356

|

|

|

|

NAVIENT STUDENT LOAN TRUST

|

Asset Backed

|

4.00%

|

DUE

|

12/15/2059

|

$

|

483

|

|

|

|

NAVIENT STUDENT LOAN TRUST

|

Asset Backed

|

3.19%

|

DUE

|

02/18/2042

|

$

|

594

|

|

|

|

NAVIENT STUDENT LOAN TRUST

|

Asset Backed

|

3.13%

|

DUE

|

02/15/2068

|

$

|

618

|

|

|

|

NISSAN AUTO RECEIVABLES OWNER

|

Asset Backed

|

0.47%

|

DUE

|

10/17/2022

|

$

|

2,280

|

|

|

|

NORTH CAROLINA STATE EDUCATION

|

Asset Backed

|

1.01%

|

DUE

|

07/25/2036

|

$

|

499

|

|

|

|

ONEMAIN DIRECT AUTO RECEIVAB

|

Asset Backed

|

3.63%

|

DUE

|

09/14/2027

|

$

|

1,647

|

|

|

|

ONEMAIN FINANCIAL ISSUANCE TR

|

Asset Backed

|

0.98%

|

DUE

|

09/14/2032

|

$

|

94

|

|

|

|

ONEMAIN FINANCIAL ISSUANCE TR

|

Asset Backed

|

0.98%

|

DUE

|

09/14/2032

|

$

|

19

|

|

|

|

ONEMAIN DIRECT AUTO RECEIVAB

|

Asset Backed

|

3.43%

|

DUE

|

12/16/2024

|

$

|

601

|

|

|

|

ONEMAIN DIRECT AUTO RECEIVAB

|

Asset Backed

|

3.43%

|

DUE

|

12/16/2024

|

$

|

591

|

|

|

|

SANTANDER DRIVE AUTO RECEIVABL

|

Asset Backed

|

2.49%

|

DUE

|

10/15/2025

|

$

|

510

|

|

|

|

SANTANDER DRIVE AUTO RECEIVAB

|

Asset Backed

|

1.01%

|

DUE

|

01/15/2026

|

$

|

603

|

|

|

|

SOCIAL PROFESSIONAL LOAN PROG

|

Asset Backed

|

3.60%

|

DUE

|

02/25/2048

|

$

|

2,219

|

|

|

|

SOCIAL PROFESSIONAL LOAN PROGR

|

Asset Backed

|

2.84%

|

DUE

|

01/25/2041

|

$

|

655

|

|

|

|

SOCIAL PROFESSIONAL LOAN PROGR

|

Asset Backed

|

2.37%

|

DUE

|

11/16/2048

|

$

|

697

|

|

|

|

SOCIAL PROFESSIONAL LOAN PROGR

|

Asset Backed

|

2.54%

|

DUE

|

05/15/2046

|

$

|

930

|

|

|

|

SPRINGFIELD FUNDING TRUST

|

Asset Backed

|

2.68%

|

DUE

|

07/15/2030

|

$

|

122

|

|

|

|

TOWD POINT MORTGAGE TRUST

|

Asset Backed

|

1.15%

|

DUE

|

12/25/2048

|

$

|

215

|

|

|

|

WORLD OMNI SELECT AUTO TRUST

|

Asset Backed

|

3.68%

|

DUE

|

07/15/2023

|

$

|

535

|

|

|

|

WORLD OMNI SELECT AUTO TRUST

|

Asset Backed

|

3.86%

|

DUE

|

01/15/2025

|

$

|

756

|

|

|

|

BBCCRE TRUST

|

CMO

|

3.97%

|

DUE

|

08/10/2033

|

$

|

1,088

|

|

|

|

BARCLAYS COMMERCIAL MORTGAGE S

|

CMO

|

2.94%

|

DUE

|

08/14/2036

|

$

|

867

|

|

|

|

BANK 2017 BNK6 ASB

|

CMO

|

3.29%

|

DUE

|

07/15/2060

|

$

|

153

|

|

|

|

BANK 2020 BN25 A3

|

CMO

|

2.39%

|

DUE

|

01/15/2063

|

$

|

5,292

|

|

|

|

BANK 2020 BN26 A3

|

CMO

|

2.15%

|

DUE

|

03/15/2063

|

$

|

2,815

|

|

|

|

BANK 2017 BNK9 A2

|

CMO

|

2.77%

|

DUE

|

11/15/2054

|

$

|

722

|

|

|

|

BANK 2017 BNK7 A3

|

CMO

|

3.09%

|

DUE

|

09/15/2060

|

$

|

1,279

|

|

|

|

BANK 2017 BNK7 A3

|

CMO

|

3.09%

|

DUE

|

09/15/2060

|

$

|

586

|

|

|

|

BENCHMARK MORTGAGE TRUST

|

CMO

|

2.67%

|

DUE

|

12/15/2072

|

$

|

2,153

|

|

|

|

BENCHMARK MORTGAGE TRUST

|

CMO

|

3.75%

|

DUE

|

04/10/2051

|

$

|

1,476

|

|

|

|

BENCHMARK MORTGAGE TRUST

|

CMO

|

2.48%

|

DUE

|

12/15/2057

|

$

|

5,352

|

|

|

|

BENCHMARK MORTGAGE TRUST

|

CMO

|

2.04%

|

DUE

|

03/15/2053

|

$

|

941

|

|

|

|

BENCHMARK MORTGAGE TRUST

|

CMO

|

1.68%

|

DUE

|

01/15/2054

|

$

|

4,861

|

|

|

|

CD COMMERCIAL MORTGAGE TRUST

|

CMO

|

3.49%

|

DUE

|

08/15/2051

|

$

|

1,271

|

|

|

|

CD COMMERCIAL MORTGAGE TRUST

|

CMO

|

2.46%

|

DUE

|

08/10/2049

|

$

|

1,267

|

|

|

|

CFK TRUST

|

CMO

|

2.39%

|

DUE

|

03/15/2039

|

$

|

5,731

|

|

|

|

CANTOR COMMERCIAL REAL ESTATE

|

CMO

|

3.66%

|

DUE

|

05/15/2052

|

$

|

485

|

|

|

|

CFCRE COMMERCIAL MORTGAGE TRUS

|

CMO

|

3.59%

|

DUE

|

12/10/2054

|

$

|

669

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

4.05%

|

DUE

|

10/10/2046

|

$

|

271

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

4.05%

|

DUE

|

10/10/2046

|

$

|

487

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

3.69%

|

DUE

|

03/10/2047

|

$

|

1,617

|

|

|

|

COMMERICAL MORTGAGE TRUST

|

CMO

|

3.43%

|

DUE

|

08/10/2048

|

$

|

2,667

|

|

|

|

COMMERICAL MORTGAGE TRUST

|

CMO

|

2.83%

|

DUE

|

10/10/2049

|

$

|

1,177

|

|

|

|

CSAIL COMMERCIAL MORTGAGE

|

CMO

|

4.16%

|

DUE

|

08/15/2051

|

$

|

1,969

|

|

|

|

CSAIL COMMERCIAL MORTGAGE

|

CMO

|

2.72%

|

DUE

|

12/15/2052

|

$

|

2,182

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

3.35%

|

DUE

|

02/10/2048

|

$

|

1,315

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

3.35%

|

DUE

|

02/10/2048

|

$

|

3,039

|

|

|

|

CSMC 18 RPL9

|

CMO

|

3.85%

|

DUE

|

09/25/2057

|

$

|

945

|

|

|

|

COMM MORTGAGE TRUST

|

CMO

|

2.69%

|

DUE

|

08/15/2057

|

$

|

2,323

|

|

|

|

CITIGROUP COMMERCIAL MORTGAGE

|

CMO

|

2.58%

|

DUE

|

08/10/2049

|

$

|

1,273

|

|

|

|

CITIGROUP COMMERCIAL MORTGAGE

|

CMO

|

2.58%

|

DUE

|

08/10/2049

|

$

|

1,273

|

|

|

|

CITIGROUP COMMERCIAL MORTGAGE

|

CMO

|

3.46%

|

DUE

|

12/10/2049

|

$

|

679

|

|

|

|

CGCMT

|

CMO

|

3.11%

|

DUE

|

09/15/2050

|

$

|

1,262

|

|

|

|

CITIGROUP COMMERCIAL MORTGAGE

|

CMO

|

3.96%

|

DUE

|

03/10/2051

|

$

|

1,368

|

|

|

|

CITIGROUP COMMERCIAL MORTGAG

|

CMO

|

2.48%

|

DUE

|

01/15/2053

|

$

|

1,294

|

|

|

|

CBSLT 17 BGS

|

CMO

|

2.68%

|

DUE

|

09/25/2042

|

$

|

248

|

|

|

|

DEUTSCHE BANK COMMERCIAL MO

|

CMO

|

1.64%

|

DUE

|

09/15/2053

|

$

|

5,067

|

|

|

|

DEUTSCHE BANK COMMERCIAL MTG

|

CMO

|

2.63%

|

DUE

|

09/10/2049

|

$

|

1,993

|

|

|

|

CITIGROUP COMMERCIAL MORTGAGE

|

CMO

|

3.52%

|

DUE

|

09/10/2058

|

$

|

1,593

|

|

|

|

FNMA

|

CMO

|

2.48%

|

DUE

|

03/25/2026

|

$

|

291

|

|

|

|

FNMA

|

CMO

|

2.25%

|

DUE

|

07/25/2026

|

$

|

668

|

|

|

|

FNMA ACES

|

CMO

|

2.36%

|

DUE

|

09/25/2026

|

$

|

425

|

|

|

|

FNMA ACES

|

CMO

|

2.36%

|

DUE

|

09/25/2026

|

$

|

468

|

|

|

|

FNMA

|

CMO

|

2.96%

|

DUE

|

02/25/2027

|

$

|

3,231

|

|

|

|

FNMA ACES

|

CMO

|

2.74%

|

DUE

|

04/25/2029

|

$

|

2,329

|

|

|

|

FNMA ACES

|

CMO

|

2.80%

|

DUE

|

01/25/2028

|

$

|

943

|

|

|

|

FNMA ACES

|

CMO

|

2.90%

|

DUE

|

01/25/2028

|

$

|

1,514

|

|

|

|

FNMA ACES

|

CMO

|

2.90%

|

DUE

|

01/25/2028

|

$

|

5,607

|

|

|

|

FNMA ACES

|

CMO

|

2.94%

|

DUE

|

11/25/2027

|

$

|

504

|

|

|

|

FNMA

|

CMO

|

3.32%

|

DUE

|

09/25/2027

|

$

|

1,109

|

|

|

|

FNMA

|

CMO

|

3.37%

|

DUE

|

07/25/2028

|

$

|

260

|

|

|

|

FNMA

|

CMO

|

3.70%

|

DUE

|

03/25/2030

|

$

|

1,252

|

|

|

|

FNMA ACES

|

CMO

|

3.01%

|

DUE

|

06/25/2028

|

$

|

3,073

|

|

|

|

FNMA

|

CMO

|

2.14%

|

DUE

|

09/25/2029

|

$

|

2,232

|

|

|

|

FNMA

|

CMO

|

1.78%

|

DUE

|

02/25/2028

|

$

|

5,491

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.60%

|

DUE

|

01/25/2028

|

$

|

2,931

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.25%

|

DUE

|

09/25/2027

|

$

|

2,679

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.25%

|

DUE

|

09/25/2027

|

$

|

57

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.29%

|

DUE

|

11/25/2027

|

$

|

2,710

|

|

|

|

FHLMC

|

CMO

|

3.50%

|

DUE

|

12/25/2027

|

$

|

2,036

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.21%

|

DUE

|

04/25/2028

|

$

|

1,345

|

|

|

|

FHLMC

|

CMO

|

3.75%

|

DUE

|

11/25/2032

|

$

|

969

|

|

|

|

FHLMC

|

CMO

|

3.85%

|

DUE

|

05/25/2028

|

$

|

214

|

|

|

|

FHLMC

|

CMO

|

3.92%

|

DUE

|

06/25/2028

|

$

|

685

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.93%

|

DUE

|

06/25/2028

|

$

|

1,343

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.99%

|

DUE

|

07/25/2028

|

$

|

2,576

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.99%

|

DUE

|

05/25/2033

|

$

|

3,198

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED

|

CMO

|

3.90%

|

DUE

|

08/25/2028

|

$

|

2,876

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED

|

CMO

|

3.92%

|

DUE

|

09/25/2028

|

$

|

1,560

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED

|

CMO

|

3.88%

|

DUE

|

10/25/2028

|

$

|

2,609

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

3.49%

|

DUE

|

02/25/2052

|

$

|

1,704

|

|

|

|

FHLMC MULTIFAMILY STRUCTURED P

|

CMO

|

1.96%

|

DUE

|

01/25/2030

|

$

|

4,575

|

|

|

|

FREDDIE MAC SCRT

|

CMO

|

3.50%

|

DUE

|

08/25/2058

|

$

|

1,392

|

|

|

|

GS MORTGAGE SECURITIES TRUST

|

CMO

|

3.52%

|

DUE

|

06/10/2047

|

$

|

1,073

|

|

|

|

GS MORTGAGE SECURITIES TRUST

|

CMO

|

3.20%

|

DUE

|

08/10/2050

|

$

|

1,096

|

|

|

|

GS MORTGAGE SECURITIES TRUST

|

CMO

|

2.64%

|

DUE

|

02/13/2053

|

$

|

3,502

|

|

|

|

GS MORTGAGE SECURITIES TRUST

|

CMO

|

1.56%

|

DUE

|

12/10/2053

|

$

|

3,285

|

|

|

|

JP MORGAN CHASE COMMERCIAL MTG

|

CMO

|

2.63%

|

DUE

|

08/15/2049

|

$

|

1,489

|

|

|

|

JPMBB COMMERCIAL MORTGAGE SEC

|

CMO

|

3.23%

|

DUE

|

01/15/2048

|

$

|

1,786

|

|

|

|

JPMBB COMMERCIAL MORTGAGE SEC

|

CMO

|

3.55%

|

DUE

|

07/15/2048

|

$

|

1,259

|

|

|

|

LADDER CAPITAL COMMERCIAL MOR

|

CMO

|

3.36%

|

DUE

|

07/12/2050

|

$

|

4,710

|

|

|

|

MILL CITY MORTGAGE TRUST

|

CMO

|

2.75%

|

DUE

|

01/25/2061

|

$

|

316

|

|

|

|

MORGAN STANLEY BAML TRUST

|

CMO

|

3.46%

|

DUE

|

12/15/2049

|

$

|

678

|

|

|

|

MORGAN STANLEY BAML TRUST

|

CMO

|

3.08%

|

DUE

|

03/15/2048

|

$

|

648

|

|

|

|

MORGAN STANLEY BAML TRUST

|

CMO

|

3.08%

|

DUE

|

03/15/2048

|

$

|

466

|

|

|

|

MORGAN STANLEY BAML TRUST

|

CMO

|

2.73%

|

DUE

|

11/15/2049

|

$

|

620

|

|

|

|

MORGAN STANLEY CAPITAL I TRUST

|

CMO

|

2.53%

|

DUE

|

08/15/2049

|

$

|

637

|

|

|

|

MORGAN STANLEY CAPITAL I TRUST

|

CMO

|

2.45%

|

DUE

|

02/15/2030

|

$

|

3,221

|

|

|

|

NEW RESIDENTIAL MORTGAGE LOA

|

CMO

|

0.90%

|

DUE

|

01/25/2048

|

$

|

380

|

|

|

|

ONE NEW YORK PLAZA TRUST 202

|

CMO

|

1.11%

|

DUE

|

01/15/2026

|

$

|

1,501

|

|

|

|

TOWD POINT MORTGAGE TRUST

|

CMO

|

0.75%

|

DUE

|

02/25/2057

|

$

|

353

|

|

|

|

TOWD POINT MORTGAGE TRUST

|

CMO

|

3.00%

|

DUE

|

01/28/2058

|

$

|

449

|

|

|

|

UBS COMMERCIAL MORTGAGE TRUST

|

CMO

|

3.90%

|

DUE

|

02/15/2051

|

$

|

1,357

|

|

|

|

UBS COMMERCIAL MORTGAGE TRUST

|

CMO

|

4.31%

|

DUE

|

06/15/2051

|

$

|

2,805

|

|

|

|

UBS COMMERCIAL MORTGAGE TRUST

|

CMO

|

3.87%

|

DUE

|

07/15/2051

|

$

|

1,325

|

|

|

|

WF RBS COMMERCIAL MORTGAGE T

|

CMO

|

2.88%

|

DUE

|

03/15/2048

|

$

|

1,529

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

3.19%

|

DUE

|

02/15/2048

|

$

|

2,016

|

|

|

|

WELLS FARGO COMMERCIAL MTG

|

CMO

|

2.67%

|

DUE

|

07/15/2048

|

$

|

1,385

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

2.40%

|

DUE

|

08/15/2049

|

$

|

1,262

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

2.40%

|

DUE

|

08/15/2049

|

$

|

131

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

2.68%

|

DUE

|

10/15/2049

|

$

|

1,299

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

2.81%

|

DUE

|

11/15/2059

|

$

|

634

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG

|

CMO

|

3.52%

|

DUE

|

12/15/2049

|

$

|

672

|

|

|

|

WELLS FARGO COMMERCIAL MTG

|

CMO

|

3.39%

|

DUE

|

11/15/2050

|

$

|

1,320

|

|

|

|

WELLS FARGO COMMERCIAL MORTGAG