By Chris Matthews and William Watts, MarketWatch

U.S. consumer prices edge up in June, but inflation still

muted

U.S. stocks advanced at the start of trade Thursday, attempting

to build on gains that saw the Nasdaq Composite index end in record

territory after Federal Reserve Chairman Jerome Powell reinforced

expectations for an interest rate cut later this month.

Powell, who testified Wednesday before the House Financial

Services Committee, will appear before the Senate Banking Committee

on Thursday.

What are major benchmarks doing?

The Dow Jones Industrial Average rose 74 points, or 0.2%, to

26,927, while the S&P 500 index was 5 points higher at 2,998, a

gain of 0.2%. The Nasdaq Composite index rose 11 points, or 0.1%,

to 8,214.

On Wednesday

(http://www.marketwatch.com/story/stock-futures-point-slightly-lower-ahead-of-testimony-by-feds-powell-2019-07-10),

the Nasdaq gained 60.80 points, or 0.8%, closing out the session at

a record 8,202.53. The Dow added 76.71 points, or 0.3%, to finish

at 26,860.20, while the S&P closed 13.44 points higher, up

0.5%, at 2,993.07.

The S&P 500 opened above its July 3 closing high of

2,995.82. The Dow remains within striking distance of its July 3

record of 26,966.

Read:S&P 500 index tops 3,000 for first time -- here's how

the stock market got here and what it means

(http://www.marketwatch.com/story/sp-500-index-tops-3000-for-first-time-heres-what-it-means-and-how-the-stock-market-got-here-2019-07-10)

What's driving the market?

Investors cheered remarks Wednesday by Powell, who told House

lawmakers that uncertainty around trade policy tensions and the

global economic outlook

(http://www.marketwatch.com/story/powell-says-uncertainties-continue-to-weigh-on-us-economic-outlook-and-fed-stands-ready-to-act-2019-07-10),

has continued since the Fed's June policy meeting, while citing

persistently low inflation as a key reason to consider easing

policy. Powell's testimony was seen affirming expectations the

central bank will move to cut interest rates when policy makers

meet at the end of the month.

"Markets were in buoyant mood on Thursday as Fed Chairman Jerome

Powell gave his strongest indication yet that the Federal Reserve

will slash interest rates at the July 30-31 meeting," said Raffi

Boyadjian, senior investment analyst at XM, in a note.

Rex Nutting:Trump and the stock market are spooking Powell into

making this rookie mistake

(http://www.marketwatch.com/story/trump-and-the-stock-market-are-spooking-powell-into-making-this-rookie-mistake-2019-07-10)

Powell's remarks were followed by minutes of the Fed's June

policy meeting which showed that "many" officials had expressed

support for a future interest-rate cut if concerns about the

economic outlook continued.

An important reading of consumer price inflation

(http://www.marketwatch.com/story/consumer-inflation-edges-up-01-in-june-cpi-shows-but-price-pressures-still-muted-2019-07-11)

rose

(http://www.marketwatch.com/story/consumer-inflation-edges-up-01-in-june-cpi-shows-but-price-pressures-still-muted-2019-07-11)

0.1% in May, versus a 0.2% rise expected by economists polled by

MarketWatch, with core CPI, which strips out volatile food and

energy prices, rising 0.3%, above the consensus expectations of

0.2%, and the fastest monthly gain since January of 2018.

Year-over-year, CPI inflation fell to 1.6%, from 1.8% in April,

with core CPI rising to 2.1% in May, up from 2.0% in April. Though

not the Federal Reserve's preferred measure of inflation, the CPI

data should factor into how aggressive the Fed will be in cutting

interest rates in the coming months.

"It's a little higher than we thought but it seems like it's

going to take a lot more than a monthly data point to push Powell

away from his dovish stance," wrote Mike Loewengart, vice president

of investment strategy at E-Trade, in an email. "The Fed has pretty

much made it clear that the negatives of a cooling economy and

ongoing trade tensions outweigh the positives of a Goldilocks

inflation number and last week's solid jobs read."

Read:Fed minutes of June meeting bolster sense of imminent

interest-rate cut

(http://www.marketwatch.com/story/minutes-of-feds-june-meeting-bolster-sense-of-imminent-interest-rate-cut-2019-07-10)

Investors will also continue to pay close attention to the

developments on the international trade front, with the Washington

Post reporting

(https://www.washingtonpost.com/business/economy/trump-team-fears-new-face-on-china-trade-team-signals-tougher-stance/2019/07/10/5b6c24d2-a349-11e9-b732-41a79c2551bf_story.html?utm_term=.23a1dcb423e2)

that the Trump administration is growing concerned about prospects

for a trade deal with China.

Meanwhile, the Trump administration is launching an

investigation into France's proposed tax

(http://www.marketwatch.com/story/trump-trade-representative-to-investigate-french-tech-tax-targeting-google-amazon-and-facebook-2019-07-11)

on internet giants like Google parent Alphabet Inc. (GOOGL)

(GOOGL), Amazon.com Inc. (AMZN) and Facebook Inc. (FB). U.S. Trade

Representative Robert Lighthizer's agency will investigate the tax

under Section 301 of the Trade Act of 1974, the same provision it

used last year to investigate China's technology policies, leading

to tariffs on $250 billion worth of Chinese imports, the Associated

Press reported.

Powell will have the opportunity to fine-tune his message when

he appears before the Senate panel at 10 a.m. Eastern Time.

Separately, Fed Vice Chairman Randal Quarles is set to take part in

a conversation at the Bipartisan Policy Center at 1:30 p.m.

Eastern, while New York Fed President John Williams is due to speak

at the University of Albany at the same time.

New applications for jobless benefits for the week ended July 6

fell to 209,000

(http://www.marketwatch.com/story/us-jobless-claims-drop-to-3-month-low-of-209000-around-july-4-holiday-2019-07-11),

versus 221,000 the week prior.

Which stocks are in focus?

Cigna (CI) and CVSHealth (CVS) were up following news the Trump

adminisration is dropping a plan to curb rebates that drug

manufacturers pay to pharmacy-benefit managers such as Cigna's

Express Scripts

(http://www.marketwatch.com/articles/cigna-cvs-health-soar-as-dow-jones-industrial-average-rises-51562850268).

Shares of Delta Air Lines Inc. (DAL) rose 0.2%, after the air

carrier reported

(http://www.marketwatch.com/story/delta-boosts-profit-outlook-dividend-2019-07-11)

that second-quarter revenue rose 8.7% in the second-quarter from a

year ago, while revenue per mile per seat rose by 3.8%. and

earnings growth beat analysts projections.

Unlike its competitors, Delta does not own any of Boeing 737 MAX

jets which have been grounded for four months by the FAA. American,

Southwest and United have lost a combined 72 jets from their

fleets. While their shares have lagged behind the rest of the

market, Delta's have kept pace with it.

Bed Bath and Beyond Inc. (BBBY) reported large losses

(http://www.marketwatch.com/story/bed-bath-beyond-earnings-slammed-by-another-large-impairment-charge-2019-07-10)

due to impairment charges for a second consecutive quarter

Wednesday evening, though it beat analyst estimates for earnings

when adjusting for those costs. Shares in the home goods retailer

fell 6.3% early Thursday

Shares of Weight Watchers International Inc. (WW) rose 5.3%

before the bell Thursday, after J.P. Morgan analyst Christina

Brathwaite said she was no longer bearish

(http://www.marketwatch.com/story/weight-watchers-stock-jumps-after-jp-morgan-backs-off-from-bearish-stance-2019-07-11)

on the weight management and wellness company, citing her belief

that subscriber trends have stabilized.

How are other markets trading?

The yield on the 10-year U.S. Treasury note rose nearly 2 basis points 2.081%.

In Asia, stocks closed mostly higher

(http://www.marketwatch.com/story/asian-shares-rise-after-fed-signals-us-rate-cut-likely-2019-07-11),

with the Nikkei 225 adding 0.5%, while the Shanghai Composite index

rose 0.1% and Hong Kong's Hang Seng added 0.8%. European stocks

were also trading higher, with the Stoxx Europe 600 up 0.2%.

In commodities markets, the price of crude oil rose 0.2% and the

price of gold added 0.4%. The U.S. dollar fell 0.1% versus its

major rivals.

(END) Dow Jones Newswires

July 11, 2019 09:41 ET (13:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

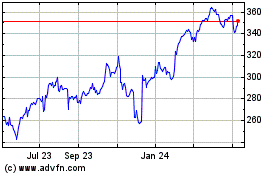

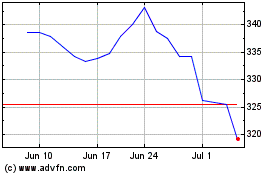

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024