Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 15 2022 - 7:01AM

Edgar (US Regulatory)

1934 Act Registration No. 1-31731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated April 15, 2022

Chunghwa Telecom Co., Ltd.

(Translation of Registrant’s Name into English)

21-3 Hsinyi Road Sec. 1,

Taipei, Taiwan, 100 R.O.C.

(Address of Principal Executive Office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ☐ No☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable )

1

|

|

|

|

|

Exhibit |

|

Description |

|

99.01 |

|

Announcement on 2022/4/15: |

To announce the differences between consolidated financial statements for the year of 2021 under Taiwan-IFRSs and that under IFRSs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Chunghwa Telecom Co., Ltd. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

Date: April 15, 2022 |

|

|

|

|

|

|

Chunghwa Telecom Co., Ltd. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/Yu-Shen Chen |

|

|

Name: |

Yu-Shen Chen |

|

|

Title: Chief Financial Officer |

|

|

|

|

|

3

EXHIBIT 99.01

To announce the differences between consolidated financial statements for the year of 2021 under Taiwan-IFRSs and that under IFRSs

Date of events: 2022/4/15

Contents:

|

1. |

Date of occurrence of the event: 2022/4/15 |

|

2. |

Of which year/ quarter financial report required to be adjusted: The year of 2021 |

|

3. |

Accounting principles applied (domestic listing securities): |

Regulations Governing the Preparation of Financial Reports by Securities Issuers and the International Financial Reporting Standards, International Accounting Standards, International Financial Reporting Interpretations Committee and SIC Interpretations endorsed and issued into effect by the Financial Supervisory Commission of the Republic of China (“Taiwan-IFRSs”)

|

4. |

Inconsistent items/ amounts (domestic listing securities): |

Under Taiwan-IFRSs, Chunghwa Telecom Co., Ltd. and its subsidiaries (or the “Company”) reported consolidated net income of NT$37,194,879 thousand, consolidated net income attributable to stockholders of the parent of NT$35,753,579 thousand, and basic earnings per share of NT$4.61 for the year ended December 31, 2021, respectively. The Company also reported total consolidated assets of NT$513,070,360 thousand, total consolidated liabilities of NT$121,807,910 thousand, and total consolidated equity of NT$391,262,450 thousand as of December 31, 2021.

|

5. |

Accounting principles applied (securities issued overseas): |

International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRSs”)

|

6. |

Inconsistent items/ amounts (securities issued overseas): |

Under IFRSs, the Company reported consolidated net income of NT$37,047 million, consolidated net income attributable to stockholders of the parent of NT$35,616 million, and basic earnings per share of NT$4.59 for the year ended December 31, 2021, respectively. The Company also reported total consolidated assets of NT$512,875 million, total consolidated liabilities of NT$123,745 million, and total consolidated equity of NT$389,130 million as of December 31, 2021.

|

7. |

Cause of the inconsistency: |

The differences between consolidated net income under Taiwan-IFRSs and that under IFRSs followed by the Company mainly come from the timing of the recognition of income tax on unappropriated earnings. In addition, prior to incorporation, the Company was subject to the laws and regulations applicable to state-owned enterprises in Taiwan which differed from the generally accepted accounting principles as applicable to commercial companies. As such, revenue from providing fixed line connection service and selling prepaid phone cards was recognized at the time the service was performed or the card was sold by the Company. Upon incorporation, net assets greater than the capital stock was credited as additional paid-in-capital and part of the additional paid-in-capital was from the unearned revenues generated from connection fees and prepaid cards as of the date of incorporation. Under IFRSs, revenue from connection fees and prepaid phone cards was deferred at the time of the service performed or sale and recognized as revenue over time as the service is continuously performed or as consumed. This reclassification from additional paid-in capital to retained earnings did not affect total equity.

|

8. |

Any other matters that need to be specified: |

4

Chunghwa Telecom’s earnings distribution and stockholders’ equity matters are in accordance with Taiwan-IFRSs.

5

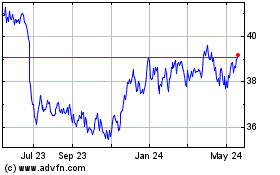

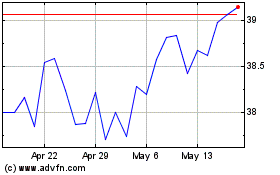

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Jul 2024 to Jul 2024

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Jul 2023 to Jul 2024