0001777393false240 East Hacienda AvenueCampbellCA00017773932023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): November 16, 2023

ChargePoint Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39004 | | 84-1747686 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

240 East Hacienda Avenue Campbell, CA | | 95008 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 841-4500(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 | | CHPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 16, 2023, ChargePoint Holdings, Inc. (the “Company” or “ChargePoint”) issued a press release announcing selected preliminary unaudited financial results of the Company for the third quarter of fiscal year 2024 ended October 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 5.02. Departure of directors or certain officers; election of directors; appointment of certain officers; compensatory arrangements of certain officers.

On November 16, 2023, ChargePoint issued a press release announcing the appointment of Mr. Rick Wilmer to the position of President and Chief Executive Officer and Ms. Mansi Khetani to the position of interim Chief Financial Officer, effective immediately. The Company’s former President and Chief Executive Officer, Pasquale Romano, resigned from the Company and as a member of the Board of Directors of the Company (the “Board”) at the request of the Board and the Company’s former Chief Financial Officer, Rex S. Jackson, separated from the Company, respectively, effective November 16, 2023.

As of November 16, 2023, Mr. Wilmer, 61, was appointed President and Chief Executive Officer and as a member of the Board, serving as a Class III director to hold office until the 2026 Annual Meeting of Stockholders of the Company. Mr. Wilmer has served as the Company’s Chief Operating Officer since December 2022 and prior to that served as the Company’s Chief Customer and Operations Officer beginning in July 2022. Prior to joining ChargePoint, beginning in February 2021, Mr. Wilmer served as the Head of Chowbotics at DoorDash, Inc., an online food delivery platform, after the acquisition of Chowbotics, Inc. by DoorDash. Mr. Wilmer served as Chief Executive Officer of Chowbotics, a manufacturer of a fresh food robot, from September 2019 until February 2021. Prior to Chowbotics, Mr. Wilmer served as the General Manager of Arista Networks, Inc.’s WiFi Business from August 2018 until September 2019 after the acquisition of Mojo Network, Inc. by Arista Networks in August 2018. Prior to that, Mr. Wilmer served as Chief Executive Officer of Mojo Networks, a provider of cloud-managed wireless networking, from December 2014 until September 2019. Mr. Wilmer received his B.S. in Chemistry from the University of California, Berkley. Mr. Wilmer will not be entitled to receive compensation in connection with his Board service and Mr. Wilmer has already entered into the Company’s standard form of indemnification agreement. Further, there are no arrangements or understandings between Mr. Wilmer and any other persons pursuant to which he was elected as a member of the Board. Mr. Wilmer is not a party to any current or proposed transaction with the Company for which disclosure is required under Item 404(a) of Regulation S-K, other than for his compensation as Chief Executive Officer as set forth in this Form 8-K.

In connection with Mr. Wilmer’s appointment as President and Chief Executive Officer, Mr. Wilmer, entered into a new offer letter with the Company (the “Wilmer Offer Letter”) pursuant to which his annual base salary was increased to $625,000, his target fiscal 2024 executive bonus percentage was increased to 100% of his annual base salary and he entered into a new Severance and Change in Control Agreement (the “Wilmer CIC Agreement”). The Wilmer CIC Agreement supersedes the severance provisions in Mr. Wilmer’s prior severance and change in control agreement with the Company and will terminate on December 31, 2026. Pursuant to the Wilmer CIC Agreement, if Mr. Wilmer’s employment is terminated by the Company without Cause or if he resigns for Good Reason (each as defined in the Wilmer CIC Agreement) (collectively, an “Involuntary Termination”), Mr. Wilmer is eligible to receive a lump sum payment equal to the sum of Mr. Wilmer’s then current annual base salary and twelve months of COBRA premiums. If an Involuntary Termination occurs within three months prior to, or within twelve months after, a Change in Control (as defined in the Wilmer CIC Agreement), then the cash severance payment Mr. Wilmer is eligible to receive is increased to the sum of (i) one and half times (1.5x) the sum of Mr. Wilmer’s annual base salary and target annual bonus, and (ii) eighteen months of COBRA premiums. Further, 100% of Mr. Wilmer’s time-based equity awards outstanding at the time of Mr. Wilmer’s termination will vest in full and any outstanding performance-based equity awards will vest at the greater of the target level of achievement or based on actual performance, other than any equity awards excluded from acceleration at the time of grant. As a condition to the receipt of severance benefits, Mr. Wilmer must execute a release of claims, resign from all positions with ChargePoint and return all company property. The description of the Wilmer Offer Letter is qualified in its entirety by reference to the complete text of the Wilmer Offer Letter filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Mr. Wilmer will be eligible to receive time-based and performance-based restricted stock unit (“RSU”) awards in connection with his appointment as President and Chief Executive Officer. The time-based RSU award will be with respect to 800,000 shares of the Company’s common stock and will vest in equal quarterly installments for four years from the date of grant. The performance-based RSU will be with respect to 960,000 shares of the Company’s common stock and will have service-based

and performance-based vesting criteria. The performance-based RSU is subject to service-based vesting occurring quarterly in equal installments for four years from the date of grant. The performance-based conditions will be achieved if the average closing price of the Company’s common stock is greater than or equal to four respective stock price appreciation targets for at least 90 consecutive trading days at any time during the five-year performance period. Twenty-five percent (25%) of the shares underlying the performance-based RSU will vest upon achievement of stock price appreciation targets at $5.00 per share, $7.50 per share, $10.00 per share and $12.50 per share. The performance-based RSUs that do not satisfy either the achievement of the service-based conditions or performance-based conditions will not vest and will be cancelled. Each of the time-based and performance-based RSU awards shall be subject to accelerated vesting pursuant to the terms of the Wilmer CIC Agreement.

In connection with Mr. Romano’s resignation, he entered into a Transition and Separation Agreement and General Release (the “Romano Separation Agreement”) pursuant to which, provided Mr. Romano enters into a general release of claims, Mr. Romano will provide the Company with six months of transition services during which time Mr. Romano will be eligible to receive his existing salary, health and welfare benefits and continued vesting of his outstanding equity awards. Pursuant to the Romano Separation Agreement and in accordance with the terms of Mr. Romano’s existing Severance and Change in Control Agreement, after the end of the transition period and provided Mr. Romano enters into a final general release of claims, Mr. Romano will be eligible to receive a cash severance payment equal to six months of Mr. Romano’s current salary and a cash payment equal to six months of the employer portion of Mr. Romano’s monthly COBRA premiums. Subject to Mr. Romano's execution of a final general release of claims and the successful transition of his responsibilities, Mr. Romano will also be eligible for a $200,000 transition bonus payable in cash. In addition, the post-termination exercise period applicable to any of Mr. Romano’s then-outstanding Company stock options will be extended to end on the earlier of (i) January 16, 2025, and (ii) the original expiration date of such options.

Ms. Mansi Khetani, 48, has served as the Company’s Senior Vice President, Financial Planning and Analysis since April 2023. From December 2018 to April 2023, she served as the Company’s Vice President, Financial Planning and Analysis. Prior to joining ChargePoint, Ms. Khetani served as Senior Director, Financial Planning and Analysis at Gainsight, Inc., a customer success software company, from May 2017 until December 2018. Ms. Khetani received her M.B.A. with a specialization in Financial Management from S. P. Jain Institute of Management and Research and is a Chartered Accountant (India). Ms. Khetani received her Bachelor’s degree in Commerce and Economics, from the University of Mumbai. Ms. Khetani is eligible to enter into the Company’s form of Severance and Change in Control Agreement, as previously filed as Exhibit 10.19 on the Company’s Form 10-K filed with the SEC on April 3, 2023, and will be eligible to enter into the Company’s standard form of indemnification agreement. Ms. Khetani has no family relationships with any of the executive officers or directors of the Company. There are no arrangements or understandings between Ms. Khetani and any other person pursuant to which she was designated as an officer of the Company or that would require disclosure under Item 404(a) of Regulation S-K other than for her compensation as interim Chief Financial Officer as set forth in this Form 8-K.

In connection with her appointment as interim Chief Financial Officer, Ms. Khetani entered into an addendum to her offer letter with the Company (the “Khetani Addendum”) pursuant to which she will receive an increase in her annual base salary to $425,000. In addition, Ms. Khetani will be eligible to receive a restricted stock unit award equal to 135,000 shares of the Company’s common stock (the “Khetani RSUs”). The Khetani RSUs will vest in equal quarterly installments over one year from the date of grant, provided, however, the Khetani RSUs will be subject to full accelerated vesting in the event Ms. Khetani is terminated without Cause (as defined in the Khetani Addendum) or as otherwise provided for in Ms. Khetani’s Severance and Change in Control Agreement. The description of the Khetani Addendum is qualified in its entirety by reference to the complete text of the Khetani Addendum filed as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

In connection with Mr. Jackson’s separation from the Company, he entered into a Transition and Separation Agreement and General Release (the “Jackson Separation Agreement”) pursuant to which, provided Mr. Jackson enters into a general release of claims, Mr. Jackson will provide the Company with transition services ending on January 1, 2024, during which time Mr. Jackson will be eligible to receive his existing salary, health and welfare benefits and continued vesting of his outstanding equity awards, provided however, that Mr. Jackson will not be eligible for any payment under the Company’s fiscal 2024 or 2025 executive bonus programs. Pursuant to the Jackson Separation Agreement, after the end of the transition period and provided Mr. Jackson enters into a final general release of claims, Mr. Jackson will be eligible to receive a cash severance payment equal to seven and a half months of Mr. Jackson’s current salary and a cash payment equal to six months of the employer portion of Mr. Jackson’s monthly COBRA premiums.

A copy of the press release announcing the appointment of Mr. Wilmer as President and Chief Executive Officer, the appointment of Ms. Khetani as interim Chief Financial Officer, and the separation from the Company of Mr. Romano and Mr. Jackson is filed herewith as Exhibit 99.2 and is incorporated herein by reference into this Item 5.02.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 10.1 | | |

| 10.2 | | |

| 10.3 | | |

| 104.0 | | Cover Pager Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CHARGEPOINT HOLDINGS, INC. |

| |

| By: | | /s/ Rebecca Chavez |

| | Name: Rebecca Chavez |

| | Title: General Counsel |

Date: November 16, 2023

1 | P a g e Exhibit 10.1 November 14, 2023 Richard Wilmer 240 East Hacienda Avenue Campbell, CA 95008 Dear Rick, On behalf of ChargePoint, Inc. (the “Company”), I am pleased to offer you the full-time position of President and Chief Executive Officer, reporting directly to the Board of Directors of ChargePoint Holdings, Inc., the Company’s parent company (“Parent”), effective as of November 16, 2023 (the “Effective Date”). It is expected that you will continue to work out of our office located in Campbell, CA, unless you are traveling on business. As explained in more detail below, your employment as President and Chief Executive Officer is contingent upon your assent to the terms and conditions set forth in this letter. If, after careful review, the terms discussed below are acceptable to you, please sign this confirmation letter and the Severance and Change in Control Agreement where indicated and return them to us. In addition, subject to your acceptance of the terms of this letter, you will also be appointed as a member of the Board of Directors of Parent (“Parent Board”), serving as a Class III director to hold office until the 2026 Annual Meeting of Stockholders. 1. Compensation a. Salary. As of the Effective Date, you will be eligible to earn an annualized salary of $625,000 per year, paid on a semi-monthly basis, less applicable withholdings and deductions, in accordance with the Company’s regular payroll processes and policies. All reasonable business expenses incurred in the ordinary course of business, as part of your job duties and required for your job, will be reimbursed in accordance with the Company’s standard policies and procedures, which includes that they be supported by documentation. b. Bonus. In addition, you will be eligible for participation in the Company’s executive bonus for each fiscal year, which runs from February 1 through January 31. The executive bonus program is based upon the Company’s execution relative to our Annual Operating Plan (AOP) and progress towards achievement of our annual corporate goals. Beginning with respect to the fiscal year 2024 AOP, your target bonus will be equal to 100% of your annual base salary. A significant purpose of the executive bonus program is employee retention. This means that in order to earn the bonus you must be employed by the Company at the time of payment of the bonus. Any earned bonus for a fiscal year will be calculated and paid after the close of that fiscal year. 2 | P a g e The determinations of the Parent’s Board of Directors (or its compensation committee) with respect to you earning your bonus will be final and binding. c. Equity Awards. In connection with your promotion to Chief Executive Officer, you will be granted 800,000 restricted stock units (or RSUs) and 960,000 performance-contingent RSUs (or PSUs), each representing the right to receive one share of Parent’s common stock. Both the RSUs and PSUs will be subject to vesting restrictions and other terms and conditions set forth in the applicable Restricted Stock Unit Agreement to be entered into between you and Parent and Parent’s 2021 Equity Incentive Plan. d. Severance and Change in Control Benefits. Please see the Severance and Change in Control Agreement for full details, a copy of which is being separately provided to you for your execution. e. Paid Time Away, Holidays and Sick-Leave. As a full-time employee, you will be eligible for paid time away in accordance with the Company’s standard policies and procedures. Paid holidays and paid sick leave will likewise be provided in accordance with the Company’s standard policies and procedures, and as may be required by applicable law. f. Benefits. As a full-time employee, you will be eligible to participate in and to receive benefits under such plans and benefits as may be adopted by the Company for your position. The eligibility criteria and amount and extent of benefits to which you are entitled shall be governed by the specific benefit plan as it may be amended from time to time. 2. At-Will Employment. As acknowledged by you under your Acknowledgement of At-Will Employment, executed by you on May 26, 2022, your employment with the Company is “at-will.” This means that your employment with the Company is not for a specific term and can be terminated by yourself or by the Company at any time for any reason or no reason, with or without cause and with or without notice. Any contrary representations which may have been made or which may hereafter be made to you are superseded by this offer. This offer letter and the Acknowledgement of At-Will Employment constitute the full and complete agreement between the parties regarding the “at-will” nature of your employment and can only be modified by written agreement signed by you and the Chair of Parent Board. 3. Non-Compete and Outside Activities. As more fully set forth in the Company’s Proprietary Information and Inventions Agreement, executed by you on May 26, 2022, you agree that, while serving as an employee of the Company, you will not engage in any activity which is competitive with the Company. 4. Arbitration. As previously acknowledged by you under your Agreement to Arbitrate, executed by you on May 26, 2022, both you and the Company agree that any controversy, claim or dispute arising out of, concerning or relating in any way to your employment with the Company or the termination thereof shall be submitted exclusively to final and binding arbitration. Notwithstanding anything to the contrary in the Agreement to Arbitrate, you acknowledge that the Agreement to Arbitrate may not be modified except by a written agreement executed by you and the Chair of Parent’s Board of Directors or, if you serve as the Chair of Parent’s Board of Directors, the lead independent director. 5. Company Rules. As an employee of the Company, you will be expected to abide by the 3 | P a g e Company’s rules and regulations, including, without limitation, the Company’s stock ownership guidelines, clawback policies, insider trading policies and policies regarding hedging or pledging of Parent Common Stock. As Chief Executive Officer, you will be required to accumulate stock and stock equivalents equal to 5x your annual base salary within five years of the Effective Date. In addition, you will be required to sign an acknowledgment that you have read and understand the Company rules of conduct as provided in the Company’s Employee Handbook, which the Company will distribute. 6. Integrated Agreement. This offer, if accepted, supersedes any prior agreements, representations or promises of any kind, whether written, oral, express or implied between the parties hereto with respect to the subject matters herein, including, without limitation, your prior Offer Letter, dated May 25, 2022, and Severance and Change in Control Agreement, dated as of May 26, 2022. Likewise, the terms of this offer shall constitute the full, complete and exclusive agreement between you and the Company with respect to the subject matters herein. This Agreement may only be changed by writing, signed by you and an authorized representative of the Company. Notwithstanding the foregoing and for the avoidance of doubt, your Acknowledgement of At-Will Employment, Proprietary Information and Inventions Agreement, and Agreement to Arbitrate shall remain in effect. 7. Severability. If this offer is accepted, and any term herein is held to be invalid, void or unenforceable, the remainder of the terms herein shall remain in full force and effect and shall in no way be affected; and the parties shall use their best efforts to find an alternative way to achieve the same result. If you wish to accept employment at the Company under the terms set out above, please sign and date this letter and return them to me. Sincerely, /s/ Bruce Chizen Bruce Chizen Chairman of the Board of ChargePoint Holdings, Inc. Approved and Accepted: /s/ Rick Wilmer Richard Wilmer cc: Employee File

1 | P a g e Mansi Khetani - Offer of Employment - November 2018 November 2, 2018 Mansi Khetani mansi.khetani@gmail.com Dear Mansi, On behalf of ChargePoint, Inc. (the “Company”), I am pleased to offer you the full-time position of Vice President of Financial Planning & Analysis reporting to the Chief Financial Officer. It is expected that you will be working out of our Campbell headquarters office unless traveling on company business. As explained in more detail below, your employment is contingent upon your assent to the terms and conditions set forth in this letter and the attachments hereto. If, after careful review, the terms discussed below and in the attachments hereto are acceptable to you, please sign this confirmation letter and the attached Acknowledgement of At-Will Employment, Proprietary Information and Inventions Agreement and Agreement to Arbitrate where indicated and return them to us. 1. Compensation. a. Salary. You will be paid a salary of $235,000.00 per year, paid on a semi-monthly basis, less applicable withholdings and deductions. All reasonable business expenses that are documented by you and incurred in the ordinary course of business will be reimbursed in accordance with the Company’s standard policies and procedures. b. Bonus. In addition, you will be eligible for a bonus for each fiscal year of the Company. The bonus program is based upon the Company’s execution relative to our Annual Operating Plan (AOP) and progress towards achievement of our annual corporate goals. Your target bonus will be equal to 25% of your annual base salary. Any bonus for the fiscal year in which your employment begins will be prorated, based on the number of days you are employed by the Company during that fiscal year. Any bonus for a fiscal year will be paid after the close of that fiscal year, but only if you are still employed by the Company at the time of payment. The determinations of the Company’s Board of Directors with respect to your bonus will be final and binding. c. Incentive Stock Plan. Subject to approval by the Company’s Board of Directors, you will be granted an option to purchase approximately 130,000 stock options (the “Options”) pursuant to the Company’s 2017 Stock Incentive Plan (the “Plan”). Such grant of stock options shall be subject to the vesting restrictions and other terms and conditions of the Notice of Stock Option Award and Stock Option Agreement to be entered into between you and the Company and the Plan. d. Flexible Time Away, Holidays and Sick-Leave. As a full-time employee, you will be eligible for flexible time away in accordance with the Company’s standard policies and procedures. Holidays and sick-leave will likewise be provided in accordance with the Company’s standard policies and procedures. e. Benefits. As a full-time employee, you will be eligible to participate in and to receive benefits under such plans and benefits as may be adopted by the Company. The eligibility criteria and DocuSign Envelope ID: 0D52B3D4-A3F2-440F-9690-3EBC79507988 2 | P a g e Mansi Khetani - Offer of Employment - November 2018 amount and extent of benefits to which you are entitled shall be governed by the specific benefit plan as it may be amended from time to time. 2. Immigration Documentation. This offer is subject to your submission of an I-9 form on your first day of employment and satisfactory documentation respecting your identification and right to work in the United States on that same day. 3. At-Will Employment. Your employment with the Company is “at-will.” This means that your employment with the Company is not for a specific term, and can be terminated by yourself or by the Company at any time for any reason or no reason, with or without cause and with or without notice. Any contrary representations which may have been made or which may hereafter be made to you are superseded by this offer. Your acceptance of this offer is contingent upon your execution of the Company’s Acknowledgement of At-Will Employment, a copy of which is attached hereto as Exhibit A for your execution. This offer letter and the attached Acknowledgement of At-Will Employment constitute the full and complete agreement between the parties regarding the “at-will” nature of your employment, and can only be modified by written agreement signed by you and the President or CEO of the Company. 4. Proprietary Information and Inventions Agreement. Your acceptance of this offer is contingent upon your execution of the Company’s Proprietary Information and Inventions Agreement, a copy of which is attached hereto as Exhibit B for your execution. 5. Non-Compete and Outside Activities. As more fully set forth in the Company’s Proprietary Information and Inventions Agreement, attached hereto as Exhibit B, you agree that, while serving as a full-time employee of the Company, you will not engage in any activity which is competitive with the Company. 6. Arbitration. Your acceptance of this offer is contingent upon your execution of the Company’s Agreement to Arbitrate, a copy of which is attached hereto as Exhibit C for your execution. As more fully set forth in the Agreement to Arbitrate, both you and the Company agree that any controversy, claim or dispute arising out of, concerning or relating in any way to your employment with the Company or the termination thereof shall be submitted exclusively to final and binding arbitration. 7. Company Rules. As an employee of the Company, you will be expected to abide by the Company’s rules and regulations. You will be required to sign an acknowledgment that you have read and understand the Company rules of conduct as provided in the Company’s Employee Handbook, which the Company will distribute. 8. Integrated Agreement. This offer, if accepted, supersedes any prior agreements, representations or promises of any kind, whether written, oral, express or implied between the parties hereto with respect to the subject matters herein. Likewise, the terms of this offer shall constitute the full, complete and exclusive agreement between you and the Company with respect to the subject matters herein. This Agreement may only be changed by writing, signed by you and an authorized representative of the Company. 9. Severability. If this offer is accepted, and any term herein is held to be invalid, void or unenforceable, the remainder of the terms herein shall remain in full force and effect and shall in no way be affected; and, the parties shall use their best efforts to find an alternative way to achieve the same result. DocuSign Envelope ID: 0D52B3D4-A3F2-440F-9690-3EBC79507988 3 | P a g e Mansi Khetani - Offer of Employment - November 2018 10. Background and Reference Check. This offer is contingent upon a successful background check and as well as reference checks with positive results. If you wish to accept employment at the Company under the terms set out above and in the enclosed Acknowledgement of At-Will Employment, Proprietary Information and Inventions Agreement and Agreement to Arbitrate, please sign and date this letter and the enclosed documents, and return them to me. If you accept our offer, your first day of employment will be on or before December 4, 2018. This offer will terminate if not accepted by you on or before November 9, 2018. Mansi, we look forward to your favorable reply and to a productive and exciting work relationship. Sincerely, Kelly M. Adamkiewicz Director, Talent Acquisition & Engagement Approved and Accepted: Mansi Khetani DocuSign Envelope ID: 0D52B3D4-A3F2-440F-9690-3EBC79507988

Exhibit 10.3 Addendum to Offer Letter November 14, 2023 Mansi Khetani ADDENDUM TO LETTER OF OFFER for Mansi Khetani as Vice President of Financial Planning and Analysis in the Finance department. Mansi Khetani currently serves as Senior Vice President of Financial Planning and Analysis. This is an addendum to your offer letter dated November 2, 2018 and relates to your service as Interim Chief Financial Officer of the Company commencing November 16, 2023. While serving as Interim Chief Financial Officer, you will be eligible to earn an annualized salary of $425,000 per year, paid on a semi-monthly basis, less applicable withholdings and deductions, in accordance with the Company’s regular payroll processes and policies. In connection with your promotion to Interim Chief Financial Officer of the Company, you will be granted 135,000 restricted stock units (or RSUs), each representing the right to receive one share of common stock of ChargePoint Holdings, Inc (the “Parent”). The RSUs will vest quarterly over one-year from the grant date and will be subject to vesting restrictions and other terms and conditions set forth in the applicable Restricted Stock Unit Agreement to be entered into between you and Parent and Parent’s 2021 Equity Incentive Plan. While the RSUs will be subject to the Parent’s standard treatment upon a termination of employment, in addition, you shall vest in the RSUs in the event your employment is terminated by Parent without cause prior to the full vesting of the RSUs. For purposes of these RSUs, “Cause” means (i) your unauthorized use or disclosure of Parent’s or its affiliates’ confidential information or trade secrets, which use or disclosure causes material harm to Parent or the Company, (ii) your material breach of any agreement with Parent or the Company, (iii) your material failure to comply with Parent’s or the Company’s written policies or rules, (iv) your conviction of, or plea of “guilty” or “no contest” to, a felony under the laws of the United States or any State, (v) your gross negligence or willful misconduct in the performance of your duties for Parent or the Company, (vi) your continuing failure to perform assigned duties after receiving written notification of the failure from Parent’s Board of Directors or (vii) your failure to cooperate in good faith with a governmental or internal investigation of Parent or the Company or their directors, officers or employees, if Parent or the Company has requested such cooperation. In the case of clauses (ii), (iii) and (vii), Parent will not terminate your employment for Cause without first giving you written notification of the acts or omissions constituting Cause and a reasonable cure period of not less than 10 days following such notice to the extent such events are curable (as determined by Parent). If you agree to the foregoing, please indicate your acceptance by electronically accepting this addendum to your offer letter. Signed:__/s/ Mansi Khetani_____________ By: Mansi Khetani Dated: __11/14/2023______________ Sincerely, /s/ Lisa Mulrooney Gross Lisa Mulrooney Gross

Exhibit 99.1

ChargePoint Provides Certain Preliminary Third Quarter Financial Results and Schedules Earnings Call for December 6, 2023

Campbell, Calif. – November 16th, 2023 – ChargePoint (NYSE:CHPT) (“ChargePoint” or the “Company”), a leading provider of networked solutions for charging electric vehicles (EVs), today announced certain preliminary third quarter financial results for fiscal year 2024. The Company will report its full third quarter financial results and update full year revenue and fourth quarter fiscal 2024 guidance on an investor conference call to be held on Wednesday, December 6, 2023 at 1:30 p.m. PST (4:30 p.m. EST).

As announced separately and effective today, ChargePoint has appointed Rick Wilmer as President and Chief Executive Officer and named Mansi Khetani as Interim Chief Financial Officer.

“Our core markets of North America and Europe both came under pressure late in the third quarter, with revenue falling far short of expectations. Overall macroeconomic conditions, along with fleet and commercial vehicle delivery delays impacted anticipated deployments with government, auto dealership and workplace customers.” said Rick Wilmer, President and CEO of ChargePoint.

Over the past 18 months in his prior role as Chief Operating Officer, Wilmer has completed a thorough analysis of ChargePoint's supply chain, manufacturing partnerships and inventory management approach. “The ChargePoint board and I are committed to significantly improving operational execution to ensure that the Company is building a stronger, more resilient business for the benefit of all stakeholders. Our first steps are to take an additional non-cash inventory impairment charge related to product transitions and to better align inventory with current demand. We remain committed to our goal of generating positive adjusted EBITDA in the fourth quarter of calendar 2024,” said Wilmer.

Preliminary Third Quarter Fiscal Year 2024 Financial Performance

•Revenue of $108 to $113 million, as compared to $150 to $165 million as previously expected.

•ChargePoint expects to take a non-cash impairment charge of $42 million resulting in GAAP gross margin of negative 23% to negative 21% and non-GAAP gross margin of negative 19% to negative 17%.

•Pre-impairment non-GAAP gross margin of 19% to 21%, as compared to 22% to 25% as previously expected.

•ChargePoint expects GAAP operating expenses of $129 million to $131 million. Non-GAAP operating expenses of $80 million to $82 million, as compared to $81 million to $84 million as previously expected.

•As of October 31, 2023, cash, cash equivalents and restricted cash was approximately $397 million, which includes $232 million of at-the-market share offering gross proceeds, as previously announced on October 11, 2023.

•As of October 31, 2023, ChargePoint's $150 million revolving credit facility remains undrawn, and the Company has no drawn debt maturities until 2028.

The preliminary results for the third quarter fiscal year 2024 ended October 31, 2023 are an estimate, based on information available to management as of the date of this release and are subject to further changes upon completion of ChargePoint’s standard quarter end closing procedures. This update does not present all information necessary for an understanding of ChargePoint’s financial condition as of the date of this release, or its results of operations for the third quarter fiscal year 2024 ended October 31, 2023. As ChargePoint completes its quarter-end financial close process and finalizes its financial statements for the quarter, it will be required to make significant judgments in a number of areas. It is possible that ChargePoint may identify items that require it to make adjustments to the preliminary financial information set forth above, and those changes could be material.

Conference Call Instructions for December 6, 2023 Earnings Call:

ChargePoint will discuss its full third quarter fiscal year 2024 financial results in an investor conference call on Wednesday, December 6, 2023, at 1:30 p.m. PST (4:30 p.m. EST). A live webcast of the conference call will be accessible from the “Events and Presentations” section of ChargePoint’s investor relations website (investors.chargepoint.com). A replay will be available after the conclusion of the webcast and archived for one year. A copy of the press release with the financial results will also be available on ChargePoint’s investor relations website prior to the commencement of the webcast.

About ChargePoint Holdings, Inc.

ChargePoint is creating a new fueling network to move people and goods on electricity. Since 2007, ChargePoint has been committed to making it easy for businesses and drivers to go electric with one of the largest EV charging networks and a comprehensive portfolio of charging solutions. The ChargePoint cloud subscription platform and software-defined charging hardware are designed to include options for every charging scenario from home and multifamily to workplace, parking, hospitality, retail and transport fleets of all types. Today, one ChargePoint account provides access to hundreds-of-thousands of places to charge in North America and Europe. For more information, visit the ChargePoint pressroom, the ChargePoint Investor Relations site, or contact the ChargePoint North American or European press offices or Investor Relations.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks, uncertainties, and assumptions including statements regarding our preliminary financial results for the third fiscal quarter ended October 31, 2023, our ability to improve operational execution to build a stronger, more resilient business, our ability to generate positive adjusted EBITDA in the fourth quarter of calendar 2024, our quarter-end financial close process and preparation of financial statements for the quarter, and current business trends. There are a significant number of factors that could cause actual results to differ materially from the statements made in this press release, including: macroeconomic trends including changes in or sustained inflation, prolonged and sustained increases in interest rates, or other events beyond our control on the overall economy which may reduce demand for our products and services, geopolitical events and conflicts, adverse impacts to our business and those of our customers and suppliers, including due to supply chain disruptions, component shortages, and associated logistics expense increases; our limited operating history as a public company; risks associated with our quarter-end closing procedures, including management’s judgments; our ability as an organization to successfully acquire and integrate other companies, products or technologies in a successful manner; our dependence on widespread acceptance and adoption of EVs and increased demand for installation of charging stations; our current dependence on sales of charging stations for most of our revenues; overall demand for EV charging and the potential for reduced demand for EVs if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated or governmental mandates to increase the use of EVs or decrease the use of vehicles powered by fossil fuels, either directly or indirectly through mandated limits on carbon emissions, are reduced, modified or eliminated; our reliance on contract manufacturers, including those located outside the United States, may result in supply chain interruptions, delays and expense increases which may adversely affect our sales, revenue and gross margins; our ability to expand our operations and market share in Europe; the need to attract additional fleet operators as customers; potential adverse effects on our revenue and gross margins due to delays and costs associated with new product introductions, inventory obsolescence, component shortages and related expense increases; adverse impact to our revenues and gross margins if customers increasingly claim clean energy credits and, as a result, they are no longer available to be claimed by us; the effects of competition; risks related to our dependence on our intellectual property; and the risk that our technology could have undetected defects or errors. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on September 11, 2023, which is available on our website at investors.chargepoint.com and on the SEC’s website at www.sec.gov. Additional information will also be set forth in other filings that we make with the SEC from time to time. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable law.

Non-GAAP Financial Measure

Adjusted EBITDA, Non-GAAP gross margin and Non-GAAP operating expense are non-GAAP financial measures. Descriptions of these Non-GAAP financial measures and the closest GAAP financial measures are available on ChargePoint’s earning release dated September 6, 2023, available on ChargePoint’s investor relations website (investors.chargepoint.com). ChargePoint is not able to present a reconciliation of non-GAAP financial measures to the corresponding GAAP measures because certain items that impact these measures are uncertain or out of ChargePoint’s control, or cannot be reasonably predicted, including stock-based compensation expense, without unreasonable effort.

Patrick Hamer

Vice President, Capital Markets and Investor Relations

Patrick.Hamer@chargepoint.com

investors@chargepoint.com

John Paolo Canton

Vice President, Communications

JP.Canton@chargepoint.com

AJ Gosselin

Director, Corporate Communications

AJ.Gosselin@chargepoint.com

media@chargepoint.com

Exhibit 99.2

ChargePoint Announces Executive Leadership Changes

Campbell, Calif. – November 16th, 2023 – ChargePoint (NYSE:CHPT), a leading provider of networked charging solutions for electric vehicles, has appointed Rick Wilmer as its new President and Chief Executive Officer, effective November 16, 2023. In conjunction with the appointment, Mr. Wilmer has joined the ChargePoint Board of Directors. .

Since joining ChargePoint as Chief Operating Officer in July 2022, Mr. Wilmer has been responsible for Product Management, Development, Engineering, Manufacturing and Supply Chain, as well as Customer Experience. Prior to ChargePoint, Mr. Wilmer’s career spanned more than 30 years in global technology, operations and customer support. He brings business and financial acumen to ChargePoint from his prior leadership roles, including the position of CEO at Pliant Technology, Leyden Energy, Mojo Networks and Chowbotics.

“I am honored to be appointed CEO, and I am excited to guide ChargePoint into our next chapter of growth and evolution.” said Mr. Wilmer. “I look forward to working with our amazing employees, customers and partners to make a positive difference for them and the planet we all share.”

Wilmer succeeds Pasquale Romano, who has served as ChargePoint’s CEO since 2011. Mr. Romano will remain as an advisor to ensure a seamless transition. ChargePoint also announced that Chief Financial Officer Rex Jackson has departed the company, effective today. Mansi Khetani, who is currently ChargePoint’s Senior Vice President of Financial Planning and Analysis, has been named interim CFO and ChargePoint will commence a search to identify a permanent candidate.

Bruce Chizen, Chairman of the Board of Directors, said “On behalf of the ChargePoint Board of Directors, we thank Mr. Romano and Mr. Jackson for their incredible contributions, and wish them the best in their future endeavors. We are fortunate to have Mr. Wilmer as a seasoned executive with a track record of success at ChargePoint to usher the company into its next chapter of growth.”

About ChargePoint Holdings, Inc.

ChargePoint is creating a new fueling network to move people and goods on electricity. Since 2007, ChargePoint has been committed to making it easy for businesses and drivers to go electric with one of the largest EV charging networks and a comprehensive portfolio of charging solutions. The ChargePoint cloud subscription platform and software-defined charging hardware are designed to include options for every charging scenario from home and multifamily to workplace, parking, hospitality, retail and transport fleets of all types. Today, one ChargePoint account provides access to hundreds of thousands of places to charge in North America and Europe. For more information, visit the ChargePoint pressroom, the ChargePoint Investor Relations site, or contact the ChargePoint North American or European press offices or Investor Relations.

ChargePoint

John Paolo Canton

Vice President, Communications

JP.Canton@chargepoint.com

AJ Gosselin

Director, Corporate Communications

AJ.Gosselin@chargepoint.com

media@chargepoint.com

Patrick Hamer

Vice President, Capital Markets and Investor Relations

Patrick.Hamer@chargepoint.com

investors@chargepoint.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

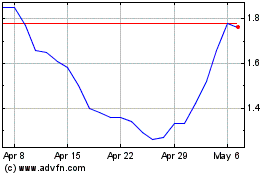

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Apr 2024 to May 2024

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From May 2023 to May 2024