2015 FFO guidance increased to a range of $2.75

to $2.83 per share

CoreSite Realty Corporation (NYSE:COR), a premier provider of

secure, reliable, high-performance data center solutions across the

US, today announced financial results for the second quarter ended

June 30, 2015.

Quarterly Highlights

- Reported second-quarter funds from

operations (“FFO”) of $0.68 per diluted share and unit,

representing 19.3% growth year over year on an unadjusted basis and

33.3% growth year over year excluding non-recurring items in Q2

2014

- Reported second-quarter total operating

revenues of $81.5 million, representing a 24.0% increase year over

year; total data center revenues increased 24.7% year over

year

- Executed 243,477 net rentable square

feet (NRSF) of new and expansion data center leases representing

$19.6 million of annualized GAAP rent at a rate of $81 per square

foot, comprised of 106,897 square feet of turn-key data center

space in addition to a previously-announced 136,580 square-foot

powered-shell build-to-suit on CoreSite’s Santa Clara Campus in

California

- Commenced 122,872 net rentable square

feet of new and expansion leases representing $15.1 million of

annualized GAAP rent at a rate of $123 per square foot, increasing

stabilized data center occupancy to 89.9%

- Realized rent growth on signed renewals

of 5.7% on a cash basis and 9.1% on a GAAP basis and recorded

rental churn of 1.6%

Tom Ray, CoreSite’s Chief Executive Officer, commented, “Our Q2

results reflect continued execution against our stated business

plan with solid financial and operational performance.” Mr. Ray

continued, “We are pleased to have executed upon our core

objectives of increasing the number of smaller leases we sign,

continuing to grow interconnection count and revenue, adding key

network and cloud deployments to our platform, and making our

company more efficient as reflected by our earnings margins. In

addition, during the quarter we were pleased to execute upon two

larger lease opportunities – our build-to-suit in Santa Clara and a

35,000 square-foot anchor lease at our new SV7 building currently

in preconstruction. We are encouraged by our continued strength in

the performance-sensitive colocation segment and we remain focused

upon executing our business plan in what we believe are

strengthening market conditions.”

Financial Results

CoreSite reported FFO per diluted share and unit of $0.68 for

the three months ended June 30, 2015, an increase of 33.3% compared

to $0.51 per diluted share and unit for the three months ended June

30, 2014, excluding non-recurring items. On a sequential-quarter

basis, FFO per diluted share and unit increased 6.3%.

Total operating revenues for the three months ended June 30,

2015, were $81.5 million, a 24.0% increase year over year and an

increase of 9.0% on a sequential-quarter basis. Total data center

revenues for the three months ended June 30, 2015, were $79.5

million, a 24.7% increase year over year and an increase of 9.5% on

a sequential-quarter basis. CoreSite reported net income

attributable to common shares of $5.5 million, or $0.22 per diluted

share.

Sales Activity

CoreSite executed 122 new and expansion data center leases

representing $19.6 million of annualized GAAP rent during the

second quarter, comprised of 243,477 NRSF at a weighted-average

GAAP rental rate of $81 per NRSF. The recently-announced

136,580-square foot powered-shell build-to-suit, SV6, is included

in the second-quarter new and expansion leasing results.

CoreSite’s second-quarter data center lease commencements

totaled 122,872 NRSF at a weighted average GAAP rental rate of $123

per NRSF, which represents $15.1 million of annualized GAAP

rent.

CoreSite’s renewal leases signed in the second quarter totaled

$6.5 million in annualized GAAP rent, comprised of 35,272 NRSF at a

weighted-average GAAP rental rate of $185 per NRSF, reflecting a

5.7% increase in rent on a cash basis and 9.1% increase on a GAAP

basis. The second-quarter rental churn rate was 1.6%.

Development Activity

Santa Clara – In April 2015, CoreSite began construction on a

136,580 square-foot powered shell data center on land CoreSite owns

on its Santa Clara campus. The building, which will be known as

SV6, is 100% pre-leased. As of June 30, 2015, CoreSite has incurred

$5.0 million of the estimated $30.0 million required to complete

the development project, and expects to deliver the build-to-suit

to a strategic customer in the first half of 2016.

Northern Virginia – During the second quarter, CoreSite placed

into service 48,137 NRSF associated with Phase 2 at VA2. As of June

30, 2015, CoreSite had an incremental 48,137 NRSF of data center

space under construction in Phase 3 at VA2 and had incurred $5.7

million of the estimated $14.5 million required to complete Phase

3. CoreSite expects to complete construction in the fourth quarter

of 2015.

New York – During the second quarter, CoreSite placed into

service 49,050 NRSF associated with Phase 2 at NY2, comprised of

three computers rooms of approximately 16,000 NRSF each. As of June

30, 2015, one computer room was 100% leased and occupied by a

single customer.

Los Angeles – During the second quarter, CoreSite began

construction of 12,500 NRSF at LA2. As of June 30, 2015, CoreSite

had incurred approximately $600,000 of the estimated $1.7 million

required to complete the project, and expects to complete

construction in the third quarter of 2015.

Additional markets – As of June 30, 2015, CoreSite had 26,853

NRSF of turn-key data center capacity under construction across its

existing facilities at BO1 (Boston) and CH1 (Chicago). As of the

end of the second quarter, CoreSite had incurred $5.4 million of

the estimated $16.5 million required to complete these two

projects.

Balance Sheet and

Liquidity

As of June 30, 2015, CoreSite had net debt of $344.7 million,

correlating to 2.1 times second-quarter annualized adjusted EBITDA,

and net debt and preferred stock outstanding of $459.7 million,

correlating to 2.8 times second-quarter annualized adjusted

EBITDA.

On June 24, 2015, CoreSite executed an amendment to its

revolving credit facility, increasing debt capacity to $500

million. The amended unsecured credit facility is comprised of a

4-year $350 million revolving credit facility and a 5-year $150

million term loan. CoreSite used the term loan proceeds to pay down

a portion of the balance on its existing revolving credit

facility.

At quarter end, CoreSite had $7.5 million of cash available on

its balance sheet and $241.4 million of capacity available under

its revolving credit facility.

Dividend

On May 21, 2015, CoreSite announced a dividend of $0.42 per

share of common stock and common stock equivalents for the second

quarter of 2015. The dividend was paid on July 15, 2015, to

shareholders of record on June 30, 2015.

CoreSite also announced on May 21, 2015, a dividend of $0.4531

per share of Series A preferred stock for the period April 15, 2015

to July 14, 2015. The preferred dividend was paid on July 15, 2015,

to shareholders of record on June 30, 2015.

2015 Guidance

CoreSite is increasing its 2015 guidance of FFO per diluted

share and unit to a range of $2.75 to $2.83 from the previous range

of $2.55 to $2.65. In addition, CoreSite is increasing its 2015

guidance for net income attributable to common shares to a range of

$0.93 to $1.01 from the previous range of $0.75 to $0.85 per

diluted share, with the difference between FFO and net income being

real estate depreciation and amortization.

CoreSite is increasing its guidance for 2015 total capital

expenditures by $20 million to a range of $135 million to $165

million primarily to reflect the development of the recently

announced SV7 data center on its Santa Clara campus.

This outlook is predicated on current economic conditions,

internal assumptions about CoreSite’s customer base, and the supply

and demand dynamics of the markets in which CoreSite operates. The

guidance does not include the impact of any future financing,

investment or disposition activities beyond what has already been

disclosed.

Upcoming Conferences and

Events

CoreSite will participate in a number of upcoming investor

conferences, including the Pacific Crest 17th Annual Global

Technology Leadership Forum on August 11th in Vail, Colorado; the

Cowen and Company Communications Infrastructure Summit on August

12th in Boulder, Colorado; the Bank of America Merrill Lynch 2015

Media, Communications & Entertainment Conference on September

9th in Beverly Hills, California; and the Bank of America Merrill

Lynch 2015 Global Real Estate Conference on September 16th in New

York, New York.

Conference Call Details

CoreSite will host a conference call on July 23, 2015, at 12:00

p.m., Eastern Time (10:00 a.m., Mountain Time), to discuss its

financial results, current business trends and market

conditions.

The call can be accessed live over the phone by dialing

877-407-3982 for domestic callers or 201-493-6780 for international

callers. A replay will be available shortly after the call and can

be accessed by dialing 877-870-5176 for domestic callers or

858-384-5517 for international callers. The passcode for the replay

is 13611864. The replay will be available until July 30, 2015.

Interested parties may also listen to a simultaneous webcast of

the conference call by logging on to CoreSite’s website at

www.CoreSite.com and clicking on the “Investors” link. The on-line

replay will be available for a limited time beginning immediately

following the call.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure,

reliable, high-performance data center solutions across eight key

North American markets. More than 800 of the world’s leading

enterprises, network operators, cloud providers, and supporting

service providers choose CoreSite to connect, protect and optimize

their performance-sensitive data, applications and computing

workloads. Our scalable, flexible solutions and 350+ dedicated

employees consistently deliver unmatched data center options — all

of which leads to a best-in-class customer experience and lasting

relationships. For more information, visit www.CoreSite.com.

Forward Looking

Statements

This earnings release and accompanying supplemental information

may contain forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,”

“seeks,” “approximately,” “intends,” “plans,” “pro forma,”

“estimates” or “anticipates” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters. Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and contingencies, many

of which are beyond CoreSite’s control that may cause actual

results to differ significantly from those expressed in any

forward-looking statement. These risks include, without limitation:

the geographic concentration of the company’s data centers in

certain markets and any adverse developments in local economic

conditions or the demand for data center space in these markets;

fluctuations in interest rates and increased operating costs;

difficulties in identifying properties to acquire and completing

acquisitions; significant industry competition; the company’s

failure to obtain necessary outside financing; the company’s

failure to qualify or maintain its status as a REIT; financial

market fluctuations; changes in real estate and zoning laws and

increases in real property tax rates; and other factors affecting

the real estate industry generally. All forward-looking statements

reflect the company’s good faith beliefs, assumptions and

expectations, but they are not guarantees of future performance.

Furthermore, the company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes. For a further discussion

of these and other factors that could cause the company’s future

results to differ materially from any forward-looking statements,

see the section entitled “Risk Factors” in the company’s most

recent annual report on Form 10-K, and other risks described in

documents subsequently filed by the company from time to time with

the Securities and Exchange Commission.

Consolidated Balance Sheet

(in thousands)

June 30, 2015

December 31, 2014 Assets: Investments in real estate:

Land $ 78,337 $ 78,983 Buildings and improvements 1,012,845

888,966 1,091,182 967,949 Less: Accumulated

depreciation and amortization (247,655 ) (215,978 )

Net investment in operating properties 843,527 751,971 Construction

in progress 106,872 178,599

Net

investments in real estate 950,399 930,570

Cash and cash equivalents 7,542 10,662 Accounts and other

receivables, net 15,269 10,290 Lease intangibles, net 5,815 7,112

Goodwill 41,191 41,191 Other assets 77,569

75,600

Total assets $ 1,097,785

$ 1,075,425 Liabilities and

equity: Liabilities Revolving credit facility $ 102,250

$ 218,500 Senior unsecured term loans 250,000 100,000 Accounts

payable and accrued expenses 41,903 42,463 Accrued dividends and

distributions 22,467 22,355 Deferred rent payable 8,519 8,985

Acquired below-market lease contracts, net 5,126 5,576 Unearned

revenue, prepaid rent and other liabilities 24,734

19,205

Total liabilities 454,999

417,084

Stockholders' equity Series A

cumulative preferred stock 115,000 115,000 Common stock, par value

$0.01 259 212 Additional paid-in capital 337,662 275,038

Accumulated other comprehensive loss (183 ) (125 ) Distributions in

excess of net income (77,772 ) (67,538 ) Total

stockholders' equity 374,966 322,587 Noncontrolling interests

267,820 335,754

Total equity

642,786 658,341

Total

liabilities and equity $ 1,097,785

$ 1,075,425

Consolidated Statement of Operations

(in

thousands, except share and per share data)

Three

Months Ended Six Months Ended June 30, 2015

March 31, 2015 June 30, 2014 June 30, 2015

June 30, 2014 Operating revenues: Data center

revenue: Rental revenue $ 44,824 $ 41,323 $ 36,938 $ 86,147 $

71,837 Power revenue 21,792 19,669 16,575 41,461 32,577

Interconnection revenue 10,595 10,215 8,591 20,810 16,650 Tenant

reimbursement and other 2,276 1,416

1,627 3,692 4,383 Total

data center revenue 79,487 72,623 63,731 152,110 125,447 Office,

light-industrial and other revenue 1,969 2,134

1,951 4,103 3,966

Total operating revenues 81,456 74,757 65,682 156,213 129,413

Operating expenses: Property operating and

maintenance 22,204 19,780 18,534 41,984 34,823 Real estate taxes

and insurance 3,270 1,935 (980 ) 5,205 1,986 Depreciation and

amortization 24,046 22,816 19,504 46,862 37,386 Sales and marketing

4,256 3,782 3,747 8,038 7,335 General and administrative 7,952

7,865 6,732 15,817 14,437 Rent 5,007 5,243 5,070 10,250 10,136

Impairment of internal-use software - - 1,037 - 1,959 Transaction

costs 45 - 9 45

13 Total operating expenses 66,780

61,421 53,653 128,201

108,075

Operating income 14,676

13,336 12,029 28,012 21,338 Gain on real estate disposal -

36 - 36 - Interest income 2 2 2 4 4 Interest expense (1,730

) (1,265 ) (1,415 ) (2,995 ) (2,588 )

Income before income taxes 12,948 12,109 10,616 25,057 18,754

Income tax benefit (expense) (66 ) (49 ) 22

(115 ) 2 Net income 12,882 12,060

10,638 24,942 18,756 Net income attributable to noncontrolling

interests 5,259 5,408 4,670

10,667 7,971 Net income

attributable to CoreSite Realty Corporation 7,623 6,652 5,968

14,275 10,785 Preferred stock dividends (2,085 )

(2,084 ) (2,085 ) (4,169 ) (4,169 ) Net income

attributable to common shares $ 5,538 $ 4,568 $ 3,883

$ 10,106 $ 6,616 Net income per share

attributable to common shares: Basic $ 0.23 $ 0.21 $ 0.18 $ 0.44 $

0.31 Diluted $ 0.22 $ 0.21 $ 0.18 $ 0.43

$ 0.31 Weighted average common shares

outstanding: Basic 24,536,583 21,372,157 21,131,077 22,963,111

21,062,299 Diluted 25,055,195 21,978,307 21,604,730 23,525,316

21,599,749

Reconciliations of Net Income to FFO

(in thousands,

except share and per share data)

Three Months Ended Six

Months Ended June 30, 2015 March 31, 2015 June

30, 2014 June 30, 2015 June 30, 2014 Net income $

12,882 $ 12,060 $ 10,638 $ 24,942 $ 18,756 Real estate depreciation

and amortization 21,343 20,253 18,163 41,596 34,999 Gain on real

estate disposal - (36 ) -

(36 ) - FFO $ 34,225 $ 32,277 $ 28,801 $ 66,502 $

53,755 Preferred stock dividends (2,085 ) (2,084 )

(2,085 ) (4,169 ) (4,169 ) FFO available to

common shareholders and OP unit holders $ 32,140 $ 30,193

$ 26,716 $ 62,333 $ 49,586

Weighted average common shares outstanding - diluted 25,055 21,978

21,605 23,525 21,600 Weighted average OP units outstanding -

diluted 22,344 25,361 25,361

23,844 25,361 Total weighted

average shares and units outstanding - diluted 47,399 47,339 46,966

47,369 46,961 FFO per common share and OP unit - diluted $

0.68 $ 0.64 $ 0.57 $ 1.32 $ 1.06

Funds From Operations “FFO” is a supplemental measure of our

performance which should be considered along with, but not as an

alternative to, net income and cash provided by operating

activities as a measure of operating performance and liquidity. We

calculate FFO in accordance with the standards established by the

National Association of Real Estate Investment Trusts (“NAREIT”).

FFO represents net income (loss) (computed in accordance with

GAAP), excluding gains (or losses) from sales of property and

undepreciated land and impairment write-downs of depreciable real

estate, plus real estate related depreciation and amortization

(excluding amortization of deferred financing costs) and after

adjustments for unconsolidated partnerships and joint ventures. FFO

attributable to common shares and units represents FFO less

preferred stock dividends declared during the period.

Our management uses FFO as a supplemental performance measure

because, in excluding real estate related depreciation and

amortization and gains and losses from property dispositions, it

provides a performance measure that, when compared year over year,

captures trends in occupancy rates, rental rates and operating

costs.

We offer this measure because we recognize that FFO will be used

by investors as a basis to compare our operating performance with

that of other REITs. However, because FFO excludes depreciation and

amortization and captures neither the changes in the value of our

properties that result from use or market conditions, nor the level

of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our properties,

all of which have real economic effect and could materially impact

our financial condition and results from operations, the utility of

FFO as a measure of our performance is limited. FFO is a non-GAAP

measure and should not be considered a measure of liquidity, an

alternative to net income, cash provided by operating activities or

any other performance measure determined in accordance with GAAP,

nor is it indicative of funds available to fund our cash needs,

including our ability to pay dividends or make distributions. In

addition, our calculations of FFO are not necessarily comparable to

FFO as calculated by other REITs that do not use the same

definition or implementation guidelines or interpret the standards

differently from us. Investors in our securities should not rely on

these measures as a substitute for any GAAP measure, including net

income.

Reconciliation of earnings before interest, taxes,

depreciation and amortization (EBITDA): (in thousands)

Three Months Ended Six Months

Ended June 30, 2015 March 31, 2015 June 30,

2014 June 30, 2015 June 30, 2014 Net income $

12,882 $ 12,060 $ 10,638 $ 24,942 $ 18,756 Adjustments: Interest

expense, net of interest income 1,728 1,263 1,413 2,991 2,584

Income taxes 66 49 (22 ) 115 (2 ) Depreciation and amortization

24,046 22,816 19,504

46,862 37,386 EBITDA $ 38,722 $ 36,188 $

31,533 $ 74,910 $ 58,724 Non-cash compensation 1,792 1,569 1,532

3,361 3,248 Gain on real estate disposal - (36 ) - (36 ) -

Transaction costs / litigation 45 230 9 275 239 Impairment of

internal-use software - - 1,037

- 1,959 Adjusted EBITDA $ 40,559 $

37,951 $ 34,111 $ 78,510 $ 64,170

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. We calculate adjusted EBITDA by

adding our non-cash compensation expense, transaction costs and

litigation expense as well as adjusting for the impact of

impairment charges, gains or losses from sales of property and

undepreciated land and gains or losses on early extinguishment of

debt. Management uses EBITDA and adjusted EBITDA as indicators of

our ability to incur and service debt. In addition, we consider

EBITDA and adjusted EBITDA to be appropriate supplemental measures

of our performance because they eliminate depreciation and

interest, which permits investors to view income from operations

without the impact of non-cash depreciation or the cost of debt.

However, because EBITDA and adjusted EBITDA are calculated before

recurring cash charges including interest expense and taxes, and

are not adjusted for capital expenditures or other recurring cash

requirements of our business, their utilization as a cash flow

measurement is limited.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150723005644/en/

CoreSiteInvestor Relations Contact:Greer Aviv, +1

303-405-1012 or +1 303-222-7276CoreSite Investor Relations

DirectorGreer.Aviv@CoreSite.com

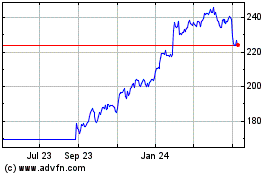

Cencora (NYSE:COR)

Historical Stock Chart

From Jul 2024 to Aug 2024

Cencora (NYSE:COR)

Historical Stock Chart

From Aug 2023 to Aug 2024