Definitive Materials Filed by Investment Companies. (497)

July 01 2013 - 6:01AM

Edgar (US Regulatory)

John

Hancock Sovereign Investors Fund (the fund)

Supplement

dated 7–1–13

to

the current Class A, Class B and Class C shares Prospectus

Effective

July 1, 2013, the management fee rate for the fund has been reduced.

In

the “Fund summary” section, the information under the headings “Fees and expenses” and “Expense

example” is amended and restated as follows:

Fees

and expenses

This

table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts

on Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 in the John Hancock family

of funds. More information about these and other discounts is available on pages 12 to 14 of the prospectus under “Sales

charge reductions and waivers” or pages 69 to 73 of the fund’s statement of additional information under “Initial

Sales Charge on Class A Shares.”

|

Shareholder

fees

(%) (fees paid directly from your investment)

|

Class

A

|

Class

B

|

Class

C

|

|

Maximum front-end sales charge (load) on purchases

as a % of purchase price

|

5.00

|

None

|

None

|

|

|

1.00

|

|

|

|

|

(on certain purchases,

|

|

|

|

Maximum deferred sales charge (load) as a % of purchase or sale

price,

|

including those of

|

|

|

|

whichever is less

|

$1

million or more)

|

5.00

|

1.00

|

|

Annual

fund operating expenses

(%)

|

|

|

|

|

(expenses

that you pay each year as a percentage of the value of your investment)

|

Class

A

|

Class

B

|

Class

C

|

|

Management fee

1

|

0.58

|

0.58

|

0.58

|

|

Distribution and service (12b-1) fees

|

0.30

|

1.00

|

1.00

|

|

Other expenses

|

0.29

|

0.29

|

0.29

|

|

Total annual fund operating expenses

|

1.17

|

1.87

|

1.87

|

1 “Management

fee” has been restated to reflect the contractual management fee schedule effective July 1, 2013.

Expense

example

This

example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please

see below a hypothetical example showing the expenses of a $10,000 investment in the fund for the time periods indicated (Kept

column) and then assuming a redemption of all of your shares at the end of those periods (Sold column). The example assumes a

5% average annual return. The example assumes fund expenses will not change over the periods. Although your actual costs may be

higher or lower, based on these assumptions, your costs would be:

|

Expenses

($)

|

Class

A

|

Class

B

|

Class

C

|

|

Shares

|

Sold

|

Kept

|

Sold

|

Kept

|

Sold

|

Kept

|

|

1

Year

|

613

|

613

|

690

|

190

|

290

|

190

|

|

3

Years

|

853

|

853

|

888

|

588

|

588

|

588

|

|

5

Years

|

1,111

|

1,111

|

1,211

|

1,011

|

1,011

|

1,011

|

|

10

Years

|

1,849

|

1,849

|

2,008

|

2,008

|

2,190

|

2,190

|

In

the “Fund details” section, under the heading “Who’s who — Investment adviser — Management

fee,” the disclosure regarding the fund’s management fee schedule is modified as follows:

The

fund pays the advisor a management fee for its services to the fund. The fee is stated as an annual percentage of the current

value of the net assets of the fund determined in accordance with the following schedule, and that rate is applied to the average

daily net assets of the fund:

|

Average

daily net assets

|

Annual

Rate

|

|

First $750 million

|

0.575%

|

|

Next $750 million

|

0.550%

|

|

Next $1 billion

|

0.500%

|

|

Excess over $2.5 billion

|

0.450%

|

You

should read this Supplement in conjunction with the Prospectus and retain it for your future reference.

John

Hancock Sovereign Investors Fund (the fund)

Supplement

dated 7–1–13

to

the current Class I shares Prospectus

Effective

July 1, 2013, the management fee rate for the fund has been reduced.

In

the “Fund summary” section, the information under the headings “Fees and expenses” and “Expense

example” is amended and restated as follows:

Fees

and expenses

This

table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

Shareholder

fees

(%) (fees paid directly from your investment)

|

Class

I

|

|

Maximum

front-end sales charge (load) on purchases as a % of purchase price

|

None

|

|

Maximum

deferred sales charge (load) as a % of purchase or sale price, whichever is less

|

None

|

|

Annual

fund operating expenses

(%)

|

|

|

(expenses

that you pay each year as a percentage of the value of your investment)

|

Class

I

|

|

Management

fee

1

|

0.58

|

|

Other expenses

|

0.19

|

|

Total

annual fund operating expenses

|

0.77

|

1 “Management

fee” has been restated to reflect the contractual management fee schedule effective July 1, 2013.

Expense

example

This

example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please

see below a hypothetical example showing the expenses of a $10,000 investment at the end of the various time frames indicated.

The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although your

actual costs may be higher or lower, based on these assumptions, your costs would be:

|

Expenses

($)

|

Class

I

|

|

1

Year

|

79

|

|

3

Years

|

246

|

|

5

Years

|

428

|

|

10

Years

|

954

|

In

the “Fund details” section, under the heading “Who’s who — Investment adviser — Management

fee,” the disclosure regarding the fund’s management fee schedule is modified as follows:

The

fund pays the advisor a management fee for its services to the fund. The fee is stated as an annual percentage of the current

value of the net assets of the fund determined in accordance with the following schedule, and that rate is applied to the average

daily net assets of the fund:

|

Average

daily net assets

|

Annual

Rate

|

|

First

$750 million

|

0.575%

|

|

Next $750 million

|

0.550%

|

|

Next $1 billion

|

0.500%

|

|

Excess

over $2.5 billion

|

0.450%

|

You

should read this Supplement in conjunction with the Prospectus and retain it for your future reference.

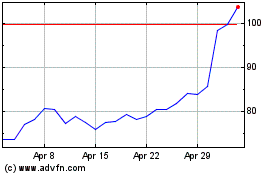

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

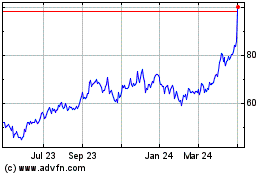

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024