| Media Inquiries: |

|

Investor Inquiries: |

| William J. Rudolph, Jr. |

|

Michael A. Hajost |

| (610) 208 -3892 |

|

(610) 208-3476 |

| wrudolph@cartech.com |

|

mhajost@cartech.com |

CARPENTER

TECHNOLOGY REPORTS THIRD QUARTER RESULTS

-

Reported earnings per share of $0.62, or $0.69 per

share excluding special items.

-

Third quarter net sales of $581.4 million.

Net sales excluding raw material surcharge up 12% from prior

year and up 9% sequentially.

-

Latrobe contributed $12.9 million of operating

income in the third quarter, or $0.05 per share. Integration now

complete with earnings and synergies above plan.

WYOMISSING, Pa., April 25, 2013 - Carpenter

Technology Corporation (NYSE:CRS) today reported net income of

$32.9 million or $0.62 per diluted share for the quarter ended

March 31, 2013 compared to $33.0 million or $0.69 per share in the

prior year third quarter. Excluding special items of $0.07 per

share, earnings were $0.69 per share in the current quarter.

Last year's quarter included $0.15 per share of Latrobe

acquisition related costs resulting in $0.84 per share on an

adjusted basis.

Earnings and

Revenue

Operating income excluding pension earnings,

interest and deferrals (EID) was $61.0 million in the third quarter

compared to $59.5 million in the prior year period. Earnings

growth due to the acquisition of Latrobe was offset by lower SAO

earnings as a result of in-quarter mix degradation, increased

deferrals and related loss of manufacturing overhead cost

absorption. Third quarter net sales excluding raw material

surcharges grew by $52.2 million or 12 percent over the third

quarter of fiscal 2012 due to the inclusion of Latrobe.

Excluding surcharge revenue and pension EID, operating margin

in the third quarter was 12.9 percent compared to 14.2 percent in

the third quarter of fiscal year 2012.

"Our third quarter had gains and challenges," said

William A. Wulfsohn, President and Chief Executive Officer.

"We achieved solid growth in our aerospace and energy

markets. However, increased customer deferrals during the

quarter, combined with low sales to distribution customers and a

weak defense related mix, resulted in lower sales and operating

income. While the recent pattern of these deferrals has

slowed and order intake has increased, we now expect our full year

earnings to be lower than previously forecasted. We are

still targeting low double-digit growth in full year operating

income, on an adjusted basis versus prior year. However, if

Q4 has similar in-quarter mix and deferrals as we experienced in

Q3, we may have difficulty achieving this target.

"At the same time, we completed the successful

integration of Latrobe, realizing above plan synergies. In

addition, with our recent capital investments and operations

improvement initiatives, we now have the available capacity to

realize near term growth as demand recovers. This added

volume should help to improve our operating margins as we benefit

from volume leverage over existing assets. Finally, starting

in the second half of fiscal year 2014, the Athens facility will

add critical hot working capacity for premium products, which is

currently a constraint, to enable longer term profitable

growth."

End Markets:

|

Q3 FY13

Revenues

Ex. Surcharge

$ Millions |

Prior Year

Change

Vs.

Q3 FY12 |

Sequential

Change

Vs.

Q2 FY13 |

| Aerospace and Defense |

214.7 |

20% |

10% |

| Energy |

71.0 |

24% |

3% |

| Medical |

25.3 |

-26% |

5% |

| Transportation |

28.4 |

0% |

17% |

| Industrial and Consumer |

97.1 |

2% |

14% |

Aerospace and Defense

-

Latrobe's aerospace products contributed to

year-over-year growth.

-

Aircraft build rate increases drove demand growth

for engine related materials and titanium fasteners versus prior

year and prior quarter.

-

Demand and mix for Premium and Ultra-Premium

nickel and stainless fastener and structural materials was down

versus the prior year. The Company attributes these

reductions to distribution destocking and uncertainty related to

sequestration.

Energy

-

Sales of Ultra-Premium materials for oil & gas

completions grew in the quarter.

-

Amega West sales were down due to reduced rig

count activity and supply chain inventory destocking.

-

Demand for power generation materials was up

sequentially in the context of light build schedules.

Medical

Transportation

-

Demand is growing for Premium and Ultra-Premium

products used in fuel delivery systems supporting higher fuel

efficiency standards.

-

Reduced European OEM build rates negatively

impacted demand in the region.

Industrial and Consumer

-

The inclusion of Latrobe contributed to year over

year growth.

-

Infrastructure project activity and distribution

demand was down.

-

Higher value valves and fittings showing signs of

returning strength.

Special Items in the

Quarter

There were $0.07 per share of special items in the

current period including consulting fees for the inventory

reduction initiative, restructuring costs from certain

manufacturing footprint optimization activities, increased interest

from the recent debt offering and impacts on the tax provision

related to the discretionary pension contribution, partially offset

by benefits realized from the enactment of the American Taxpayer

Relief Act of 2012 (R&D tax credit extension).

| (in millions, except per share amounts) |

Expense

before

Income

Taxes |

Income

Tax

Expense

(Benefit) |

Net

Expense |

Impact

Per

Diluted

Share |

|

|

|

|

|

| Inventory reduction initiative costs |

$ 0.9 |

$ (0.3) |

$ 0.6 |

$ 0.01 |

Restructuring costs from

footprint optimization activities |

2.0 |

(0.7) |

1.3 |

0.02 |

| Additonal interest expense |

1.1 |

(0.4) |

0.7 |

0.01 |

Income tax impact of

discretionary pension contribution |

- |

2.9 |

2.9 |

0.06 |

Income tax impact of

R&D tax credit extension |

- |

(1.7) |

(1.7) |

(0.03) |

|

|

|

|

|

| Total impact of special items |

$ 4.0 |

$ (0.2) |

$ 3.8 |

$ 0.07 |

Cash Flow and

Pension

Excluding a $75 million discretionary pension

contribution, cash flow from operations in the current quarter was

$104.5 million which was used to finance $86.6 million of capital

spending, largely related to the Athens facility construction.

Including the discretionary pension contribution, free cash

flow was negative $66.4 million in the current quarter. Total

liquidity, including cash and available revolver balance, was

approximately $638 million at the end of the third quarter.

Liquidity in the quarter was augmented by the issuance of a

$300 million 10-year borrowing.

During the third quarter, the Company recorded

expense associated with its pension and other post-retirement

benefit plans of $17.4 million or $0.21 per diluted share.

Pension expense in the prior year third quarter was $10.6

million or $0.14 per diluted share. The Company made cash

contributions of $85.4 million during the third quarter of fiscal

year 2013, and expects to make additional cash contributions of up

to $90 million in the fourth quarter of fiscal year 2013.

"Our financing actions significantly increased our liquidity

and improved our pension funding status. We now have more

financial flexibility to pursue near term business development

opportunities," said Wulfsohn.

Non-GAAP Financial Measures

This press release includes discussions of

financial measures that have not been determined in accordance with

U.S. generally accepted accounting principles ("GAAP"). A

reconciliation of the non-GAAP financial measures to their most

directly comparable financial measures prepared in accordance with

GAAP, accompanied by reasons why the Company believes the measures

are important, are included in the attached schedules.

Conference Call and Webcast Presentation

Carpenter will host a conference call and webcast

presentation today, April 25, at 9:00 a.m., ET, to discuss

financial results and operations for the fiscal third quarter.

Please call 610-208-2097 for details of the conference call. Access

to the call and presentation will also be made available at

Carpenter's web site (http://www.cartech.com) and through CCBN

(http://www.ccbn.com). A replay of the call will be made available

at http://www.cartech.com or at http://www.ccbn.com. The

presentation materials used during this conference call will be

available for viewing and download at 8:30 a.m. today at

http://www.cartech.com.

About Carpenter Technology

Carpenter produces and distributes premium alloys,

including special alloys, titanium alloys and powder metals, as

well as stainless steels, and alloy and tool steels. Information

about Carpenter can be found on the Internet at

http://www.cartech.com.

Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Act of 1995. These forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ from those projected, anticipated or implied. The

most significant of these uncertainties are described in

Carpenter's filings with the Securities and Exchange Commission

including its annual report on Form 10-K for the year ended June

30, 2012, the 10Q for the quarters ending September 30, 2012 and

December 31, 2012 and the exhibits attached to those filings. They

include but are not limited to: (1) expectations with respect to

the synergies, costs and other anticipated financial impacts of the

Latrobe acquisition transaction could differ from actual synergies

realized, costs incurred and financial impacts experienced as a

result of the transaction; (2) the cyclical nature of the specialty

materials business and certain end-use markets, including

aerospace, defense, industrial, transportation, consumer, medical,

and energy, or other influences on Carpenter's business such as new

competitors, the consolidation of competitors, customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; (3) the ability of Carpenter to

achieve cost savings, productivity improvements or process changes;

(4) the ability to recoup increases in the cost of energy, raw

materials, freight or other factors; (5) domestic and foreign

excess manufacturing capacity for certain metals; (6) fluctuations

in currency exchange rates; (7) the degree of success of government

trade actions; (8) the valuation of the assets and liabilities in

Carpenter's pension trusts and the accounting for pension plans;

(9) possible labor disputes or work stoppages; (10) the potential

that our customers may substitute alternate materials or adopt

different manufacturing practices that replace or limit the

suitability of our products; (11) the ability to successfully

acquire and integrate acquisitions, including the Latrobe

acquisition; (12) the availability of credit facilities to

Carpenter, its customers or other members of the supply chain; (13)

the ability to obtain energy or raw materials, especially from

suppliers located in countries that may be subject to unstable

political or economic conditions; (14) Carpenter's manufacturing

processes are dependent upon highly specialized equipment located

primarily in facilities in Reading and Latrobe, Pennsylvania for

which there may be limited alternatives if there are significant

equipment failures or catastrophic event; and (15) Carpenter's

future success depends on the continued service and availability of

key personnel, including members of our executive management team,

management, metallurgists and other skilled personnel and the loss

of these key personnel could affect our ability to perform until suitable replacements are found. Any of these

factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements.

# # #

| PRELIMINARY |

| CONSOLIDATED STATEMENTS OF

INCOME |

| (in millions, except per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

| NET SALES |

|

|

$ 581.4 |

|

$ 539.9 |

|

$1,659.9 |

|

$1,385.1 |

| Cost of sales |

|

|

480.4 |

|

434.8 |

|

1.346.9 |

|

1.114.5 |

| Gross profit |

|

|

101.0 |

|

105.1 |

|

313.0 |

|

270.6 |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

48.0 |

|

41.5 |

|

145.7 |

|

115.3 |

| Acquisition-related costs |

|

- |

|

7.9 |

|

- |

|

11.7 |

| Operating income |

|

|

53.0 |

|

55.7 |

|

167.3 |

|

143.6 |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(5.0) |

|

(5.6) |

|

(14.7) |

|

(18.4) |

| Other income, net |

|

|

1.2 |

|

1.7 |

|

5.2 |

|

1.4 |

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

49.2 |

|

51.8 |

|

157.8 |

|

126.6 |

| Income tax expense |

|

|

16.3 |

|

18.8 |

|

52.2 |

|

46.0 |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

32.9 |

|

33.0 |

|

105.6 |

|

80.6 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Net income attributable

to noncontrolling interest |

- |

|

- |

|

0.5 |

|

0.3 |

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO

CARPENTER |

$ 32.9 |

|

$ 33.0 |

|

$ 105.1 |

|

$ 80.3 |

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

|

|

$ 0.62 |

|

$ 0.69 |

|

$ 1.98 |

|

$ 1.76 |

| Diluted |

|

|

|

$ 0.62 |

|

$ 0.69 |

|

$ 1.97 |

|

$ 1.75 |

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES |

|

|

|

|

|

|

|

| OUTSTANDING: |

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

52.9 |

|

47.2 |

|

52.9 |

|

45.3 |

| Diluted |

|

|

|

53.5 |

|

47.9 |

|

53.4 |

|

46.0 |

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends per common

share |

$ 0.18 |

|

$ 0.18 |

|

$ 0.54 |

|

$ 0.54 |

| PRELIMINARY |

| CONSOLIDATED STATEMENTS OF

CASH FLOWS |

| (in millions) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

| OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net income |

|

|

|

|

$ 105.6 |

|

$ 80.6 |

| Adjustments to

reconcile net income to net cash |

|

|

|

|

| provided from

operating activities: |

|

|

|

|

|

| Depreciation and

amortization |

|

|

77.1 |

|

58.5 |

| Deferred income

taxes |

|

|

|

37.3 |

|

18.2 |

| Net pension

expense |

|

|

|

51.7 |

|

30.3 |

| Net loss on

disposal of property and equipment |

|

1.0 |

|

1.0 |

| Changes in working

capital and other: |

|

|

|

|

|

| Accounts

receivable |

|

|

|

0.7 |

|

(3.3) |

| Inventories |

|

|

|

|

(41.7) |

|

(110.6) |

| Other current

assets |

|

|

|

(32.6) |

|

(3.4) |

| Accounts

payable |

|

|

|

|

(10.5) |

|

(3.8) |

| Accrued

liabilities |

|

|

|

|

(8.5) |

|

20.2 |

| Pension plan

contributions |

|

|

|

(143.3) |

|

(19.3) |

| Boarhead Farms

settlement |

|

|

|

- |

|

(21.8) |

| Other, net |

|

|

|

|

(5.1) |

|

1.3 |

| Net cash provided from

operating activities |

|

31.7 |

|

47.9 |

|

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

|

|

| Purchases of property,

equipment and software |

|

(223.5) |

|

(107.3) |

| Proceeds from disposals

of property and equipment |

|

0.4 |

|

0.6 |

| Acquisition of

business, net of cash acquired |

|

- |

|

(12.9) |

| Proceeds from sale of

equity method investment |

|

7.9 |

|

- |

| Proceeds from sales and

maturities of marketable securities |

- |

|

30.4 |

| Net cash used for investing

activities |

|

|

(215.2) |

|

(89.2) |

|

|

|

|

|

|

|

|

|

| FINANCING ACTIVITIES: |

|

|

|

|

|

|

| Proceeds from issuance

of long-term debt, net of offering costs |

297.0 |

|

- |

| Payments on long-term

debt assumed in connection with acquisition of business |

- |

|

(153.7) |

| Payments on long-term

debt |

|

|

|

- |

|

(100.0) |

| Dividends paid |

|

|

|

|

(28.7) |

|

(24.2) |

| Purchase of subsidiary

shares from noncontrolling interest |

(8.4) |

|

- |

| Tax benefits on

share-based compensation |

|

3.7 |

|

1.3 |

| Proceeds from stock

options exercised |

|

|

2.3 |

|

1.6 |

| Net cash provided from (used

for) financing activities |

265.9 |

|

(275.0) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

1.3 |

|

(1.1) |

|

|

|

|

|

|

|

|

|

| INCREASE (DECREASE) IN CASH

AND CASH EQUIVALENTS |

83.7 |

|

(317.4) |

| Cash and cash equivalents at

beginning of period |

|

211.0 |

|

492.5 |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at

end of period |

|

|

$ 294.7 |

|

$ 175.1 |

| PRELIMINARY |

| CONSOLIDATED BALANCE

SHEETS |

| (in millions) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

June 30, |

|

|

|

|

|

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

$ 294.7 |

|

$ 211.0 |

| Accounts receivable,

net |

|

|

|

353.8 |

|

354.2 |

| Inventories |

|

|

|

|

686.9 |

|

642,0 |

| Deferred income

taxes |

|

|

|

- |

|

10.6 |

| Other current

assets |

|

|

|

65.5 |

|

31.9 |

| Total

current assets |

|

|

|

1,400.9 |

|

1,249.7 |

|

|

|

|

|

|

|

|

|

| Property, plant and equipment,

net |

|

|

1,080.6 |

|

924.6 |

| Goodwill |

|

|

|

|

|

256.7 |

|

260.5 |

| Other intangibles, net |

|

|

|

98.5 |

|

109.9 |

| Other assets |

|

|

|

|

79.6 |

|

83.1 |

| Total assets |

|

|

|

|

$ 2,916.3 |

|

$ 2,627.8 |

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Accounts payable |

|

|

|

|

$ 226.0 |

|

$ 236.1 |

| Accrued

liabilities |

|

|

|

|

230.3 |

|

217.1 |

| Current portion of

long-term debt |

|

|

101.0 |

|

101.0 |

| Total

current liabilities |

|

|

|

557.3 |

|

554.2 |

|

|

|

|

|

|

|

|

|

| Long-term debt, net of current

portion |

|

|

604.4 |

|

305.9 |

| Accrued pension

liabilities |

|

|

|

231.2 |

|

377.3 |

| Accrued postretirement

benefits |

|

|

177.8 |

|

179.8 |

| Deferred income taxes |

|

|

|

61.4 |

|

31.4 |

| Other liabilities |

|

|

|

|

66.2 |

|

66.1 |

| Total liabilities |

|

|

|

|

1,698.3 |

|

1,514.7 |

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Carpenter stockholders'

equity: |

|

|

|

|

|

|

| Common stock |

|

|

|

|

274.6 |

|

274.0 |

| Capital in excess of

par value |

|

|

|

255.1 |

|

252.7 |

| Reinvested

earnings |

|

|

|

1,186.0 |

|

1,109.6 |

| Common stock in

treasury, at cost |

|

|

(110.3) |

|

(120.0) |

| Accumulated other

comprehensive loss |

|

|

(387,4) |

|

(412.5) |

| Total

Carpenter stockholders' equity |

|

|

1,218.0 |

|

1,103.8 |

| Noncontrolling interest |

|

|

|

- |

|

9.3 |

| Total equity |

|

|

|

|

1,218.0 |

|

1,113.1 |

| Total liabilities and

equity |

|

|

|

$ 2,916.3 |

|

$ 2,627.8 |

|

|

|

|

|

|

|

|

|

| PRELIMINARY |

| SEGMENT FINANCIAL DATA |

| (in millions, except pounds

sold) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| Pounds sold* (000): |

|

|

|

|

|

|

|

| Specialty Alloys

Operations |

53,202 |

|

55,552 |

|

147,986 |

|

146,840 |

| Latrobe |

|

17,946 |

|

5,994 |

|

48,518 |

|

5,994 |

| Performance Engineered

Products |

3,338 |

|

3,470 |

|

9,950 |

|

10,342 |

| Intersegment |

|

(2,718) |

|

(1,580) |

|

(8,090) |

|

(3,672) |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated pounds

sold |

71,768 |

|

63,436 |

|

198,364 |

|

159,504 |

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

| Specialty Alloys

Operations |

|

|

|

|

|

|

|

|

Net sales excluding

surcharge |

$ 297.6 |

|

$ 309.7 |

|

$ 847.6 |

|

$ 802.3 |

|

Surcharge |

|

95.2 |

|

116.3 |

|

275.2 |

|

319.9 |

|

|

|

|

|

|

|

|

|

|

|

| Specialty Alloys

Operations net sales |

392.8 |

|

426.0 |

|

1,122.8 |

|

1,122.2 |

|

|

|

|

|

|

|

|

|

|

|

| Latrobe |

|

|

|

|

|

|

|

|

|

Net sales excluding

surcharge |

114.1 |

|

45.3 |

|

321.7 |

|

65.0 |

|

Surcharge |

|

15.4 |

|

6.2 |

|

43.6 |

|

6.1 |

|

|

|

|

|

|

|

|

|

|

|

| Latrobe net sales |

129.5 |

|

51.5 |

|

365.3 |

|

71.1 |

|

|

|

|

|

|

|

|

|

|

|

| Performance Engineered

Products |

|

|

|

|

|

|

|

|

Net sales excluding

surcharge |

89.2 |

|

89.6 |

|

278.6 |

|

253.8 |

|

Surcharge |

|

1.2 |

|

1.2 |

|

3.4 |

|

3.6 |

|

|

|

|

|

|

|

|

|

|

|

| Performance Engineered

Products net sales |

90.4 |

|

90.8 |

|

282.0 |

|

257.4 |

|

|

|

|

|

|

|

|

|

|

|

| Intersegment |

|

|

|

|

|

|

|

|

|

Net sales excluding

surcharge |

(29.7) |

|

(25.6) |

|

(105.3) |

|

(58.2) |

|

Surcharge |

|

(1.6) |

|

(2.8) |

|

(4.9) |

|

(7.4) |

| Intersegment net

sales |

(31.3) |

|

(28.4) |

|

(110.2) |

|

(65.6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net

sales |

$ 581.4 |

|

$ 539.9 |

|

$ 1,659.9 |

|

$1,385.1 |

|

|

|

|

|

|

|

|

|

|

|

| Operating income: |

|

|

|

|

|

|

|

| Specialty Alloys

Operations |

$ 48.8 |

|

$ 66.7 |

|

$ 152.9 |

|

$ 163.9 |

| Latrobe |

|

12.3 |

|

2.1 |

|

41.2 |

|

3,4 |

| Performance Engineered

Products |

10.0 |

|

10.6 |

|

30.4 |

|

32.8 |

| Corporate costs

(including acquisition-related costs) |

(10.3) |

|

(18.5) |

|

(31.3) |

|

(41.3) |

| Pension earnings,

interest & deferrals |

(8.0) |

|

(3.8) |

|

(23.9) |

|

(11.1) |

| Intersegment |

|

0.2 |

|

(1.4) |

|

(2.0) |

|

(4.1) |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated

operating income |

$ 53.0 |

|

$ 55.7 |

|

$ 1 67.3 |

|

$ 143.6 |

The Company has three reportable segments,

Specialty Alloys Operations ("SAO"), Latrobe, and Performance

Engineered Products ("PEP"). During the first quarter of fiscal

year 2013, the Company moved the Speciatly Steel Supply business

acquired in connection with the Latrobe Acquisition from the

Latrobe segment to the Performance Engineered Products segment.

The SAO segment is comprised of Carpenter's major

premium alloy and stainless steel manufacturing operations.

This includes operations performed at mills primarily in

Reading, Pennsylvania and the surrounding area, South Carolina, and

the new premium products manufacturing facility being built in

Limestone County, Alabama.

The Latrobe segment is comprised of the operations

of the Latrobe business acquired effective February 29, 2012 (the

"Latrobe Acquisition"). The Latrobe segment provides management

with the focus and visibility into the business performance of

these newly acquired operations. The Latrobe segment also

includes the results of Carpenter's distribution business in

Mexico, which is being managed together with the Latrobe's

distribution business. As the Latrobe business becomes

integrated with Carpenter, its results will likely be reported

within the SAO business segment sometime in the future.

The PEP segment is comprised of Carpenter's

differentiated operations. This includes Dynamet titanium

business, the Carpenter Powder Products (CPP) business, the Amega

West business and the Specialty Steel Supply distribution business

that was acquired in connection with the Latrobe Acquisition. The

businesses in the PEP segment are managed with an entrepreneurial

structure to promote speed and flexibility and drive overall

revenue and profit growth. The pounds sold data above for the

PEP segment includes only the Dynamet and CPP businesses.

The service cost component of net pension expense,

which represents the estimated cost of future pension liabilities

earned associated with active employees, is included in the

operating results of the business segments. The residual net

pension expense, or pension earning, interest and deferrals

(pension EID), is comprised of the expected return on plan assets,

interest costs on the projected benefit obligations of the plans,

and amortization of actuarial gains and losses and prior service

costs, is included under the heading "Pension earnings, interest

& deferrals."

* Pounds sold excludes sales associated with the

distribution businesses.

| PRELIMINARY |

| NON-GAAP FINANCIAL

MEASURES |

| (in millions, except per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

| FREE CASH FLOW |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| Net cash provided from operating activities |

|

|

|

$ 29.5 |

|

$ 75.7 |

|

$ 31.7 |

|

$ 47.9 |

| Purchases of property,

equipment and software |

(86.6) |

|

(47.0) |

|

(223.5) |

|

(107.3) |

| Proceeds from disposals of

property and equipment |

0.3 |

|

0.4 |

|

0.4 |

|

0.6 |

| Purchase of subsidiary shares

from noncontrolling interest |

- |

|

- |

|

(8.4) |

|

- |

| Proceeds from sale of equity

method investment |

- |

|

- |

|

7.9 |

|

- |

| Dividends paid |

|

|

(9.6) |

|

(8.0) |

|

(28.7) |

|

(24.2) |

| Acquisition of business, net

of cash acquired |

- |

|

(11.5) |

|

- |

|

(12.9) |

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

|

$ (66.4) |

|

$ 9.6 |

|

$ (220.6) |

|

$ (95.9) |

|

|

|

|

|

|

|

|

|

|

|

Management believes that the free cash flow

measure provides useful information to investors regarding our

financial condition because it is a measure of cash generated which

management evaluates for alternative uses.

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

| NET PENSION EXPENSE PER

DILUTED SHARE |

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

| Pension plans expense |

|

$ 15.1 |

|

$ 9.7 |

|

$ 44.7 |

|

$ 28.4 |

| Other postretirement benefits

expense |

2,3 |

|

0.9 |

|

7.0 |

|

1.9 |

| Net pension expense |

|

|

17.4 |

|

10.6 |

|

51.7 |

|

30.3 |

| Income tax benefit |

|

|

(6.1) |

|

(4.0) |

|

(18.1) |

|

(11.5) |

| Net pension expense, net of

tax |

|

$ 11.3 |

|

$ 6.6 |

|

$ 33.6 |

|

$ 18.8 |

|

|

|

|

|

|

|

|

|

|

|

| Net pension expense per

diluted share |

$ 0.21 |

|

$ 0.14 |

|

$ 0.63 |

|

$ 0.41 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average diluted

common shares |

53.5 |

|

47.9 |

|

53.4 |

|

46.0 |

Management believes that net pension expense per

diluted share is helpful in analyzing the operating performance of

the Company, as net pension expense may be volatile due to changes

in the financial markets, which may result in significant

fluctuations in operating results from period to period.

| OPERATING MARGIN EXCLUDING

SURCHARGE AND |

Three Months Ended |

|

Nine Months

Ended |

| PENSION EARNINGS, INTEREST AND

DEFERRALS |

March 31, |

|

March 31, |

|

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

|

|

581.4 |

|

$ 539.9 |

|

$ 1,659.9 |

|

$ 1,385.1 |

| Less: surcharge revenue |

|

110,2 |

|

120.9 |

|

317.3 |

|

322.2 |

| Consolidated net sales

excluding surcharge |

$ 471,2 |

|

$ 419,0 |

|

$ 1.342.6 |

|

$ 1.062.9 |

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

$ 53.0 |

|

$ 55.7 |

|

$ 167.3 |

|

$ 143.6 |

| Pension earnings, interest

& deferrals |

8,0 |

|

3.8 |

|

23.9 |

|

11.1 |

| Operating income excluding

pension earnings, interest |

|

|

|

|

|

|

|

| and

deferrals |

|

|

$ 61.0 |

|

$ 59.5 |

|

$ 191.2 |

|

$ 154.7 |

|

|

|

|

|

|

|

|

|

|

|

| Operating margin excluding

surcharge and pension earnings, interest |

|

|

|

|

|

|

|

| and

deferrals |

|

|

12.9% |

|

14.2% |

|

14.2% |

|

14.6% |

Management believes that removing the impacts of

raw material surcharges from operating margin provides a more

consistent basis for comparing results of operations from period to

period. In addition, management believes that excluding the impact

of pension earnings, interest and deferrals, which may be volatile

due to changes in the financial markets, is helpful in analyzing

the true operating performance of the Company.

| PRELIMINARY |

| NON-GAAP FINANCIAL

MEASURES |

| (in millions, except per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

Nine Months Ended

March 31, |

| ADJUSTED LATROBE OPERATING RESULTS |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

| Latrobe segment operating income |

|

$ 12.3 |

|

$ 2.1 |

|

$ 41.2 |

|

$ 3.4 |

Specialty Steel Supply

operating income included in Performance Engineered

Products segment results |

|

|

|

|

|

|

|

|

|

0.9 |

|

0.8 |

|

3.6 |

|

0.8 |

Inventory fair value cost adjustments included in Latrobe

segment operating

income |

|

- |

|

2.9 |

|

- |

|

2.9 |

Carpenter distribution

business operating (loss) income in Mexico included

in Latrobe segment results |

|

|

|

|

|

|

|

|

|

0.3 |

|

(0.5) |

|

(0.6) |

|

(1.8) |

| Latrobe pension EID included in pension EID expense |

|

(0.6) |

|

(0.2) |

|

(1.8) |

|

(0.2) |

| Adjusted Latrobe operating results before income

taxes |

|

12.9 |

|

5.1 |

|

42.4 |

|

5.1 |

| Income taxes |

|

(4.5) |

|

(1.7) |

|

(14.8) |

|

(1.7) |

| Adjusted Latrobe operating results |

|

$ 8.4 |

|

$ 3.4 |

|

$ 27.6 |

|

$ 3.4 |

|

|

|

|

|

|

|

|

|

| Adjusted Latrobe operating results per diluted share |

|

$ 0.16 |

|

$ 0.07 |

|

$ 0.52 |

|

$ 0.07 |

| Dilutive impact of shares issued in connection with

Latrobe acquisition* |

|

(0.11) |

|

(0.04) |

|

(0.35) |

|

(0.03) |

|

|

|

|

|

|

|

|

|

| Net accretion from Latrobe's operating results |

|

$ 0.05 |

|

$ 0.03 |

|

$ 0.17 |

|

$ 0.04 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

53.5 |

|

47.9 |

|

53.4 |

|

46.0 |

* In connection with the Latrobe

Acquisition, Carpenter issued shares of common stock to the former

owners which resulted in an additional 8.1 million, 2.7 million,

8.1 million, and 0.9 million weighted average shares during the

three months ended March 31, 2013 and 2012 and nine months ended

March 31, 2013 and 2012, respectively.

| IMPACTS OF FACILITY START-UP,

RESTRUCTURING AND INVENTORY REDUCTION INITIATIVE COSTS |

|

Three Months Ended

March 31, |

|

Nine Months Ended

March 31, |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

| Facility start-up costs |

|

$ 1.4 |

|

$ - |

|

$ 3.7 |

|

$ - |

| Restructuring costs fom manufacturing footprint

optimization activities |

|

2.0 |

|

- |

|

2.3 |

|

- |

| Inventory reduction initiative costs |

|

0.9 |

|

- |

|

2.5 |

|

- |

| Operating income impact |

|

$ 4.3 |

|

$ - |

|

$ 8.5 |

|

$ - |

|

|

|

|

|

|

|

|

|

| Consolidated net sales excluding surcharges |

|

$ 471.2 |

|

$ 419.0 |

|

$ 1,342.6 |

|

$ 1,062.9 |

|

|

|

|

|

|

|

|

|

| Impact of facility start-up, restructuring from

manufacturing footprint optimization activities and inventory

reduction initiative costs on operating margin excluding

surcharges |

|

0.9% |

|

0.0% |

|

0.6% |

|

0.0% |

|

|

|

|

|

|

|

|

|

| Operating income impact |

|

$ 4.3 |

|

$ - |

|

$ 8.5 |

|

$ - |

| Income tax benefit |

|

(1.5) |

|

- |

|

(3.0) |

|

- |

| Net income impact |

|

$ 2.8 |

|

$ - |

|

$ 5.5 |

|

$ - |

|

|

|

|

|

|

|

|

|

| Impact per diluted share |

|

$ 0.05 |

|

$ - |

|

$ 0.10 |

|

$ - |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

53.5 |

|

47.9 |

|

53.4 |

|

46.0 |

Management believes that removing the impacts of

costs associated with (i.) start-up of our Athens, AL facility,

(ii.) restructuring related to manufacturing footprint optimization

associated with evaluating and executing opportunities primarily as

a result of the Latrobe acquisition to optimize manufacturing

efficiencies, and (iii.) an inventory reduction initiative

aimed at identifying opportunities reduce inventory levels and

improve inventory turnover across the mill operations are helpful

in analyzing the operating performance of the Company, as these

costs are expected to be nonrecurring in nature and may result in

significant fluctuations in operating results from period to period

during fiscal years 2013 and 2014.

| PRELIMINARY |

| NON-GAAP FINANCIAL

MEASURES |

| (in millions, except per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

Nine Months Ended

March 31, |

| TOTAL ACQUISITION-RELATED COSTS |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition-related costs (from transaction) |

|

$ - |

|

$ 7.9 |

|

$ - |

|

$ 11.7 |

| Inventory fair value cost adjustments |

|

- |

|

2.9 |

|

- |

|

2.9 |

| Total acquisition related-costs before income taxes |

|

- |

|

10.8 |

|

- |

|

14.6 |

| Income taxes |

|

- |

|

(3.4) |

|

- |

|

(3.8) |

| Total acquisition-related costs |

|

$ - |

|

$ 7.4 |

|

$ - |

|

$ 10.8 |

|

|

|

|

|

|

|

|

|

| Total acquisition-related costs per diluted share |

|

$ - |

|

$ 0.15 |

|

$ - |

|

$ 0.23 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

53.5 |

|

47.9 |

|

53.4 |

|

46.0 |

|

|

|

|

|

|

|

|

|

Management believes that removing the impacts of

the total acquisition related costs is useful when comparing

results of operations from period to period.

| PRELIMINARY |

| SUPPLEMENTAL SCHEDULES |

| (in millions) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

| NET SALES BY END USE

MARKET |

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

| End Use Market Excluding

Surcharge: |

|

|

|

|

|

|

|

| Aerospace and

defense |

|

$ 214.7 |

|

$ 178.3 |

|

$ 604.4 |

|

$ 449.4 |

| Industrial and

consumer |

|

97.1 |

|

95.0 |

|

269.1 |

|

244.2 |

| Energy |

|

|

|

71.0 |

|

57.2 |

|

209.4 |

|

159.3 |

| Transportation |

|

|

28.4 |

|

28.5 |

|

78.8 |

|

73.0 |

| Medical |

|

|

|

25.3 |

|

34.1 |

|

77.3 |

|

91.5 |

| Distribution |

|

|

34.7 |

|

25.9 |

|

103.6 |

|

45.5 |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net sales

excluding surcharge |

471.2 |

|

419.0 |

|

1,342.6 |

|

$1,062.9 |

|

|

|

|

|

|

|

|

|

|

|

| Surcharge revenue |

|

|

110.2 |

|

120.9 |

|

317.3 |

|

322,2 |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net sales |

|

$ 581.4 |

|

$ 539.9 |

|

$1,659.9 |

|

$1,385.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

March 31, |

|

March 31, |

| NET SALES BY MAJOR PRODUCT

CLASS |

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

| Net Sales by Product Class

Excluding Surcharge: |

|

|

|

|

|

|

|

| Special alloys |

|

|

$ 182.6 |

|

$ 173.9 |

|

$ 509.0 |

|

$ 438.2 |

| Stainless steel |

|

|

139.6 |

|

133.1 |

|

399.8 |

|

365.4 |

| Titanium products |

|

|

36.3 |

|

37.9 |

|

112.6 |

|

113.3 |

| Powder metals |

|

|

14.4 |

|

14.2 |

|

41.4 |

|

43.1 |

| Alloy and tool

steel |

|

|

55.6 |

|

23.5 |

|

155.7 |

|

32.8 |

| Distribution and

other |

|

42.7 |

|

36.4 |

|

124.1 |

|

70.1 |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net sales

excluding surcharge |

471.2 |

|

$ 419.0 |

|

1.342.6 |

|

$1,062.9 |

|

|

|

|

|

|

|

|

|

|

|

| Surcharge revenue |

|

|

110.2 |

|

120.9 |

|

317.3 |

|

322.2 |

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net sales |

|

$ 581.4 |

|

$ 539.9 |

|

$1,659.9 |

|

$1,385.1 |

|

|

|

|

|

|

|

|

|

|

|

This

announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: Carpenter Technology Corp. via Thomson Reuters

ONE

HUG#1696119

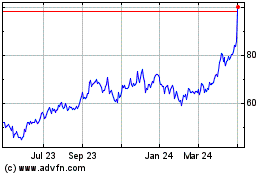

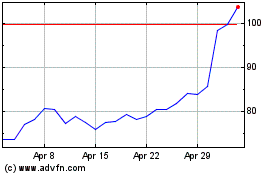

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024