Carpenter Technology Corporation (NYSE:CRS) today reported net

income from continuing operations of $50.8 million or $1.05 per

diluted share for the fiscal third quarter ended March 31, 2008.

This compared with record net income from continuing operations a

year earlier of $64.3 million or $1.22 per diluted share. The third

quarter 2008 results reflected reduced demand in Carpenter�s

economically sensitive industrial, automotive and consumer end-use

markets, combined with higher operating costs. Demand in the global

energy and aerospace markets was strong in the third quarter.

Including results of discontinued operations, and the net gain on

the sale of Carpenter�s ceramics business, net income was $120.0

million or $2.49 per diluted share. For the third quarter a year

earlier, Carpenter reported net income of $66.6 million or $1.27

per share. Financial highlights from the third quarter include:

(millions, except E.P.S. & pounds) � Q3-2008 � Q3-2007 � 9 mos.

2008 � 9 mos. 2007 Sales $509.8 $516.0 $1,407.4 $1,316.8 Sales

excluding surcharge(a) $355.7 $354.9 $987.3 $977.7 Net income from

continuing operations $50.8 $64.3 $164.4 $158.2 Net income $120.0

$66.6 $233.7 $165.9 Diluted E.P.S. from continuing operations $1.05

$1.22 $3.32 $3.00 Diluted E.P.S. $2.49 $1.27 $4.72 $3.15 Cash Flow

from operations $63.0 $38.9 $143.5 $146.7 Free Cash Flow(a) $162.4

$20.0 $186.5 $101.2 Pounds sold (000) 59,218 63,832 158,430 172,688

(a)non-GAAP financial measure that is explained in the attached

tables Third Quarter - Operating Summary "Our third quarter

financial results fell short of our original expectations due to

reduced demand in our economically sensitive markets, and higher

operating costs,� said Anne Stevens, chairman, president and chief

executive officer. "However, we have good overall top-line momentum

on the business moving forward, and we achieved record sales this

quarter in the energy and aerospace markets as a result of strong

demand, particularly in international markets. Based on current

conditions, fourth quarter sales and earnings should be at or above

this quarter�s performance. We expect our full year financial

results to be at record levels for the fourth consecutive year.�

Net sales from continuing operations of $509.8 million were 1

percent lower than a year ago. Adjusted for surcharge revenue,

sales from continuing operations were essentially flat with a year

ago Overall, pounds shipped were 7 percent below an exceptionally

strong third quarter a year ago. The Premium Alloys Operations

generated a 12 percent increase in pounds shipped due largely to

strong demand from the global energy and aerospace markets. This

was more than offset by a 9 percent decline in pounds shipped by

the Advanced Metals Operations, due principally to lower demand

related to the current weakness in the domestic industrial base.

Sales to the aerospace market were a record $210.6 million, an

increase of 11 percent compared with the prior year�s third

quarter. Adjusted for surcharge revenue, aerospace sales grew 6

percent year-over-year. The increase was largely driven by higher

sales of specialty alloys used in jet engines and fasteners, as

well as titanium coil used in fasteners. Energy market sales, which

include oil and gas and power generation, increased 25 percent from

a year ago to $57.9 million. Excluding surcharge revenue, sales

improved by 38 percent. The improvement resulted from strong demand

for specialty alloys used in the manufacture of industrial gas

turbines and increased global sales of high-strength corrosion

resistant materials to the oil and gas market. Medical market sales

were $35.5 million, an increase of 6 percent compared with the

third quarter a year earlier. Excluding surcharge revenue, sales

grew 3 percent. Sales to the industrial market were $104.7 million

or 19 percent lower than last year's third quarter. Adjusted for

surcharge revenue, sales decreased 16 percent. The decrease

reflected lower demand primarily for materials used in the

manufacture of capital goods and valves and fittings. Automotive

and truck market sales declined 14 percent to $55.1 million

compared with a year earlier. Excluding surcharge revenue, sales

declined 12 percent. The decrease primarily reflected the general

slowdown in the domestic automotive industry. Sales to the consumer

market were $46.0 million compared with $54.2 million a year

earlier, a decline of 15 percent. Excluding surcharge revenue,

consumer sales were 4 percent lower. The reduction in sales

primarily reflected the negative impact on demand for materials

used in the housing sector and the weakening domestic economy.

Geographically, sales outside the United States were a quarterly

record $178.6 million or 18 percent higher than the third quarter a

year ago. Sales to Europe were particularly strong, increasing 26

percent over last year�s third quarter, driven largely by the

aerospace and power generation markets. International sales

represented 35 percent of total sales during the recent third

quarter. Gross profit for the third quarter was $109.3 million,

compared with $122.4 million a year earlier. The lower gross profit

primarily reflected reduced volume against a strong year ago

period, higher operating costs due to production inefficiencies in

the quarter, and investments in our Manufacturing systems to drive

long-term operational effectiveness. These expenses were partially

offset by continued favorable mix improvement. Gross margin for the

third quarter 2008 was 21.4 percent, compared to 23.7 percent in

the same quarter a year ago. Adjusted for the dilutive impact of

the surcharge revenue, the year-to-year difference in the lag

effect in our surcharge mechanism, and other inventory effects,

gross margin on a comparable basis would have been an estimated

32.6 percent in the third quarter versus an estimated 34.3 percent

in the same quarter a year earlier. Operating income was $75.3

million compared with $92.5 million in the 2007 third quarter. The

decrease in operating income was the result of the lower gross

profit and a $4.1 million increase in selling, general and

administrative expenses, primarily from investments to drive future

growth initiatives. Adjusted for the lag effect, surcharge revenue

and other inventory effects, operating margin would have been an

estimated 23.1 percent in the third quarter compared to an

estimated 25.9 percent in the third quarter of 2007. Other income

in the recent third quarter was $3.7 million, compared with other

income of $6.0 million in the third quarter of 2007. The decrease

was primarily due to reduced interest income from invested cash as

a result of lower interest rates. The income tax provision on

continuing operations for third quarter 2008 was $23.1 million or

31.3 percent of pre-tax income. The comparable income tax provision

for the 2007 third quarter was $28.5 million or 30.7 percent. Net

income from continuing operations for the third quarter was $50.8

million or $1.05 per diluted share, compared with net income of

$64.3 million or $1.22 per diluted share in the third quarter of

2007. Free cash flow was $162.4 million for the third quarter 2008,

and $186.5 million for the nine month period. Excluding cash

amounts associated with the acquisition and divestitures in the

quarter, free cash flow was $26.0 million for the quarter and $50.1

million for the nine month period. Capital expenditures in the

third quarter were $29.9 million, primarily reflecting Carpenter�s

expansion of its premium melt capacity. The Company reconfirmed its

fiscal year 2008 free cash flow of approximately $100 million after

capital expenditures of about $125 million. Discontinued Operations

On March 31, 2008, Carpenter completed the sale of its ceramics

businesses, Certech and Carpenter Advanced Ceramics, to the Morgan

Crucible Company plc for $144.5 million and paid $1.5 million in

expenses related to the sale. Carpenter recorded a pre-tax gain in

the quarter of $102.7 million, or $1.43 per share on an after tax

basis. Results for the ceramics business for the third quarter were

reported as discontinued operations. The income from discontinued

operations of $69.2 million for the third quarter 2008 compares

with income of $2.3 million for the third quarter of 2007. Details

for the quarter and year to date are as follows: (millions) �

Q3-2008 � Q3-2007 � 9 mos. 2008 � 9 mos. 2007 Income from

operations $ 4.0 � $3.2 � $ 10.5 � $11.1 � Gain on sale, net of

expenses 102.7 � -- � 101.5 � -- � Income tax expense (37.5 ) (0.9

) (42.7 ) (3.4 ) Net income from discontinued operations $ 69.2 �

$2.3 � $ 69.3 � $ 7.7 � Share Repurchase Program During the third

quarter 2008, Carpenter repurchased $25.0 million or 361,300 shares

of its common stock under the $250 million share repurchase plan

that was authorized by the Board of Directors on December 21, 2007.

Total repurchases under this program and the previously completed

$250 million share repurchase program totaled 4,515,347 shares with

an aggregate cost of $279.6 million. The outstanding common stock

as of March 31, 2008, was 48,212,367. LIFO Effects The Company had

LIFO income of $8.6 million in the third quarter due primarily to

declining nickel prices during the quarter relative to the second

quarter of fiscal 2008. In the third quarter a year earlier, the

Company had LIFO expense of $56.1 million. This LIFO income/expense

is one component of our cost of goods sold and does not by itself

impact reported profit in the period. Sales Excluding Surcharge

This press release includes discussions of net sales as adjusted to

exclude the impact of raw material surcharges, which represents a

financial measure that has not been determined in accordance with

U.S. generally accepted accounting principles ("GAAP"). The Company

provides this additional financial measure because management

believes removing the impact of raw material surcharges from net

sales provides a more consistent basis for comparing results of

operations from period to period. Conference Call Carpenter will

host a conference call and webcast today, April 29th, at 10:00

a.m., ET, to discuss financial results and operations for the

fiscal second quarter. Please call 610-208-2800 for details of the

conference call. Access to the call will also be made available at

Carpenter's web site (www.cartech.com) and through CCBN

(www.ccbn.com). A replay of the call will be made available at

www.cartech.com or at www.ccbn.com. About Carpenter Technology

Carpenter produces and distributes specialty alloys, including

stainless steels, titanium alloys, and superalloys, and various

engineered products. Information about Carpenter can be found on

the Internet at www.cartech.com. Except for historical information,

all other information in this news release consists of

forward-looking statements within the meaning of the Private

Securities Litigation Act of 1995. These forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ from those projected, anticipated or implied. The

most significant of these uncertainties are described in

Carpenter's filings with the Securities and Exchange Commission

including its annual report on Form 10-K for the year ended June

30, 2007, its subsequent Forms 10-Q and the exhibits attached to

those filings. They include but are not limited to: 1) the cyclical

nature of the specialty materials business and certain end-use

markets, including aerospace, industrial, automotive, consumer,

medical, and energy, or other influences on Carpenter's business

such as new competitors, the consolidation of customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; 2) the ability of Carpenter to achieve

cost savings, productivity improvements or process changes; 3) the

ability to recoup increases in the cost of energy and raw materials

or other factors; 4) domestic and foreign excess manufacturing

capacity for certain metals; 5) fluctuations in currency exchange

rates; 6) the degree of success of government trade actions; 7) the

valuation of the assets and liabilities in Carpenter's pension

trusts and the accounting for pension plans; 8) possible labor

disputes or work stoppages; 9) the potential that our customers may

substitute alternate materials or adopt different manufacturing

practices that replace or limit the suitability of our products;

10) the ability to successfully acquire and integrate acquisitions;

and 11) the ability of Carpenter to implement and manage material

capital expansion projects in a timely and efficient manner. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements. � CONSOLIDATED STATEMENT OF INCOME

(in millions, except per share data) � � � � Three Months Ended

Nine Months Ended March 31 March 31 � 2008 � 2007 � 2008 � 2007 � �

NET SALES $509.8 $516.0 $1,407.4 $1,316.8 � Cost of sales 400.5 �

393.6 � 1,064.3 � 1,006.1 � Gross profit 109.3 122.4 343.1 310.7 �

Selling, general and administrative expenses 34.0 � 29.9 � 104.4 �

90.6 � Operating income 75.3 92.5 238.7 220.1 � Interest expense

5.1 5.7 15.9 17.1 Other income, net (3.7 ) (6.0 ) (22.1 ) (23.8 ) �

Income before income taxes 73.9 92.8 244.9 226.8 Income taxes 23.1

� 28.5 � 80.5 � 68.6 � INCOME FROM CONTINUING OPERATIONS 50.8 64.3

164.4 158.2 � INCOME FROM DISCONTINUED OPERATIONS 69.2 2.3 69.3 7.7

� � � � NET INCOME $120.0 � $66.6 � $233.7 � $165.9 � � � �

EARNINGS PER COMMON SHARE - BASIC: Income from continuing

operations $1.06 $1.25 $3.34 $3.07 Income from discontinued

operations $1.44 � $0.05 � $1.40 � $0.16 � NET INCOME PER SHARE -

BASIC $2.50 � $1.30 � $4.74 � $3.23 � � EARNINGS PER COMMON SHARE -

DILUTED: Income from continuing operations $1.05 $1.22 $3.32 $3.00

Income from discontinued operations $1.44 � $0.05 � $1.40 � $0.15 �

NET INCOME PER SHARE - DILUTED $2.49 � $1.27 � $4.72 � $3.15 � � �

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic 48.0 � 51.4 �

49.3 � 51.2 � Diluted 48.3 � 52.6 � 49.6 � 52.6 � � Cash dividends

per common share $0.15 � $0.1125 � $0.45 � $0.3375 � � �

CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) � Nine Months

Ended March 31 � 2008 � 2007 � � OPERATING ACTIVITIES: Net income

$233.7 $165.9 Adjustments to reconcile net income to net cash

provided from operations: Depreciation 35.3 34.6 Amortization 1.8

1.2 Deferred income taxes (0.9 ) (8.4 ) Net pension (income)

expense (0.8 ) 3.6 Net (gain) loss on asset disposals (1.0 ) 0.4

Gain on sale of businesses (101.5 ) -- Changes in working capital

and other: Receivables 31.0 (58.1 ) Inventories (58.4 ) (32.2 )

Other current assets (5.5 ) (6.3 ) Accounts payable (42.3 ) 63.9

Accrued current liabilities 44.6 (16.0 ) Other, net 7.5 � (1.9 )

Net cash provided from operating activities 143.5 � 146.7 � �

INVESTING ACTIVITIES: Purchases of plant, equipment and software

(72.7 ) (27.8 ) Proceeds from disposals of plant and equipment 1.4

0.2 Acquisition of business (6.6 ) -- Net proceeds from sale of

businesses 143.0 -- Purchases of marketable securities (366.2 )

(544.2 ) Sales of marketable securities 713.2 � 336.7 � Net cash

provided from (used for) investing activities 412.1 � (235.1 ) �

FINANCING ACTIVITIES: Payments on long-term debt (0.2 ) (0.2 )

Payments to acquire treasury stock (250.8 ) (13.9 ) Dividends paid

(22.1 ) (17.9 ) Tax benefits on share-based compensation 1.2 4.9

Proceeds from common stock options exercised 0.6 � 2.7 � Net cash

used for financing activities (271.3 ) (24.4 ) � Effect of exchange

rate changes on cash and cash equivalents (10.2 ) (4.4 ) � INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS 274.1 (117.2 ) Cash and

cash equivalents at beginning of period 300.8 � 352.8 � Cash and

cash equivalents at end of period $574.9 � $235.6 � � �

CONSOLIDATED BALANCE SHEET (in millions) � March 31 June 30 2008 �

2007 � � ASSETS Current assets: Cash and cash equivalents $574.9

$300.8 Marketable securities 25.7 372.7 Accounts receivable, net

263.1 303.2 Inventories 285.7 235.0 Deferred income taxes 13.6 13.3

Other current assets 29.1 � 30.7 � Total current assets 1,192.1

1,255.7 � Property, plant and equipment, net 552.7 537.4 Prepaid

pension cost 139.5 132.4 Goodwill 40.2 46.4 Trademarks and trade

names, net 18.4 19.2 Other assets 43.6 � 34.6 � Total assets

$1,986.5 � $2,025.7 � � LIABILITIES Current liabilities: Accounts

payable $171.8 $215.9 Accrued liabilities 142.6 117.1 Current

portion of long-term debt 33.0 � 33.2 � Total current liabilities

347.4 366.2 � Long-term debt, net of current portion 299.8 299.5

Accrued postretirement benefits 86.5 90.9 Deferred income taxes

137.3 143.5 Other liabilities 77.8 � 57.9 � Total liabilities 948.8

� 958.0 � � STOCKHOLDERS' EQUITY Common stock 273.0 272.8 Capital

in excess of par value - common stock 200.1 191.6 Reinvested

earnings 961.1 751.3 Common stock in treasury, at cost (318.5 )

(65.7 ) Accumulated other comprehensive loss (78.0 ) (82.3 ) Total

stockholders' equity 1,037.7 � 1,067.7 � � Total liabilities and

stockholders' equity $1,986.5 � $2,025.7 � � � SEGMENT FINANCIAL

DATA (in millions) � � � � Three Months Ended Nine Months Ended

March 31 March 31 � 2008 � 2007 � 2008 � 2007 � � Net sales:

Advanced Metals Operations $361.9 $378.4 $997.6 $980.2 Premium

Alloys Operations 146.8 134.0 408.7 326.9 Other 3.4 3.7 10.2 11.0

Intersegment (2.3 ) (0.1 ) (9.1 ) (1.3 ) � Consolidated net sales

$509.8 � $516.0 � $1,407.4 � $1,316.8 � � Operating income:

Advanced Metals Operations $44.9 $65.6 $138.3 $147.6 Premium Alloys

Operations 34.3 29.4 110.4 83.5 Other 0.5 0.9 2.3 3.2 Corporate

costs (9.3 ) (7.1 ) (29.1 ) (25.4 ) Pension earnings, interest

& deferrals 4.9 3.6 16.8 10.8 Intersegment 0.0 � 0.1 � 0.0 �

0.4 � � Consolidated operating income $75.3 � $92.5 � $238.7 �

$220.1 � � � Beginning with the first quarter of fiscal 2008,

Carpenter realigned its reportable business segments to focus more

effectively on our customers, end-use markets, and operational

excellence goals. As a result, we now have two reportable business

segments: Advanced Metals Operations and Premium Alloys Operations.

� The Advanced Metals Operations (AMO) segment includes the

manufacturing and distribution of high temperature and high

strength metal alloys, stainless steels and titanium in the form of

small bars and rods, wire, narrow strip and powder. AMO sales are

spread across many of our end-use markets including aerospace,

industrial, consumer, automotive, and medical. � The Premium Alloys

Operations (PAO) segment includes the manufacturing and

distribution of high temperature and high strength metal alloys and

stainless steels in the form of ingots, billets, large bars and

hollows and primarily services the aerospace and energy markets. �

The service cost component of net pension expense, which represents

the estimated cost of future pension liabilities earned associated

with active employees, is included in the operating results of the

business segments. The residual net pension expense, which is

comprised of the expected return on plan assets, interest costs on

the projected benefit obligations of the plans, and amortization of

actuarial gains and losses and prior service costs, is included

under the heading "Pension earnings, interest & deferrals." � �

� SELECTED FINANCIAL MEASURES (in millions) � � Three Months Ended

Nine Months Ended March 31 March 31 FREE CASH FLOW 2008 � 2007 �

2008 � 2007 � � Net cash provided from operations $63.0 $38.9

$143.5 $146.7 Purchases of plant, equipment and software (29.9 )

(13.2 ) (72.7 ) (27.8 ) Acquisition of business (6.6 ) -- (6.6 ) --

Proceeds from disposals of plant and equipment 0.1 -- 1.4 0.2 Net

proceeds from sale of businesses 143.0 -- 143.0 -- Dividends paid

(7.2 ) (5.7 ) (22.1 ) (17.9 ) Free cash flow $162.4 � $20.0 �

$186.5 � $101.2 � � Free cash flow is a measure of cash generated

which management evaluates for alternative uses. � � � �

SUPPLEMENTAL SCHEDULES (in millions) � � Three Months Ended Nine

Months Ended March 31 March 31 NET SALES BY MAJOR PRODUCT LINE 2008

� 2007 � 2008 � 2007 � � Product Line Excluding Surcharge:

Stainless steel $122.1 $132.9 $333.2 $360.1 Special alloys 165.7

154.1 465.0 414.7 Titanium products 48.2 45.3 129.3 142.3 Tool and

other steel 15.0 16.8 45.4 42.9 Other materials 4.7 � 5.8 � 14.4 �

17.7 � � Consolidated net sales excluding surcharge $355.7 $354.9

$987.3 $977.7 � Surcharge revenue 154.1 � 161.1 � 420.1 � 339.1 � �

Consolidated net sales $509.8 � $516.0 � $1,407.4 � $1,316.8 � �

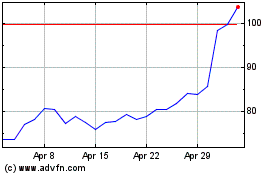

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

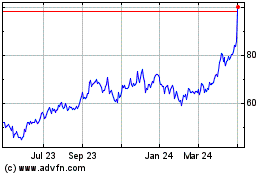

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024