Carpenter Announces Strategic Initiatives

September 21 2006 - 8:00AM

Business Wire

Carpenter Technology Corporation (NYSE:CRS) announced today its

strategic initiatives to drive long-term growth. These initiatives

will provide a cornerstone for Carpenter to further enhance Total

Shareholder Return ("TSR"). They include: -- Accelerated growth in

certain core markets, in particular aerospace, medical, and energy,

resulting in a greater mix of higher value materials and products

-- Profitable growth through complementary acquisitions that can be

quickly integrated -- Establishment of a share repurchase program

-- More competitive dividend These actions will be consistent with

Carpenter's financial discipline and its stated financial

objectives. The Company has previously committed to, at a minimum:

-- Sales growth of 5% -- Operating margin of 12% -- Return on Net

Assets of 10% -- Debt-to-Capital of 35% or less -- Economic Profit

"Our success over the last few years has been achieved by focusing

on operational excellence and by investing capital with greater

financial discipline," said Robert J. Torcolini, chairman,

president and chief executive officer. "Through a comprehensive

review process led by Carpenter's Vice Chairman Mike Fitzpatrick,

we have identified significant growth opportunities close to our

core business. Our strong financial position will allow us to grow

profitably, organically and through acquisitions while at the same

time providing our shareholders with increased cash returns through

dividends and share repurchases." Organic Growth At the heart of

the Company's strategy is its plan to build on its core business in

four attractive and fast growing end-use markets: aerospace,

medical, energy, and high value segments of automotive. These

markets require high performance products made to exacting

specifications that cannot be easily substituted. Typically,

Carpenter is one of a few companies worldwide that is able to

supply these technically demanding materials and products. Today,

sales of Carpenter products into these four markets represent

approximately 55 percent, or $875 million, of the Company's fiscal

2006 revenue. As a result of the strategic review process,

Carpenter believes that approximately $500 million of organic

growth opportunities in its highest margin businesses exist in

these markets over the next four years. In the aerospace market,

commercial aircraft build rates are forecast to increase, on

average, 10% annually through 2011. Airbus and Boeing have five

years of production on their order books. These strong order

patterns are coming primarily from Middle Eastern and Asian

airlines and regional and low cost airlines in the United States

and Europe. The major United States and European airlines are also

expected to begin replacing a greater percentage of their fleets

during this period, which would further strengthen demand. Many of

the new, lighter, more fuel efficient aircraft will use

significantly more titanium for their airframes than current models

and will require more of the high temperature superalloys that

Carpenter specializes in for the new generation of high performance

engines. The medical products market is also set for strong growth,

which will generate increasing demand for Carpenter's titanium, CCM

(cobalt / chrome / molybdenum), and specialty stainless products.

These high performance materials are used in medical implants,

surgical instruments, and other critical medical applications. In

the United States and Europe, the population entering its sixties

carries an expectation of additional years of active lifestyles

and, in many cases, a preference for joint replacement rather than

reduced mobility. A better standard of living in Asia is also

generating demand for the latest health care advances. Carpenter

continues to develop new alloys and products to meet the growing

demand of these technology advances. Growth rates in the aerospace

and medical markets are expected to be greater than 10%, on

average, over the next four years. The Company believes this robust

activity will generate increased demand for its highest margin

products, including nickel-based alloys and titanium, in excess of

those growth rates. To capitalize on these opportunities, Carpenter

plans to invest approximately $200 million in capital expenditures

over the next four years, which will include additional premium

melt capacity. Additionally, the company will increase its focus on

key end-use markets and place a greater emphasis on research and

development. Recently, Carpenter modernized two previously idled

electro-slag-remelting ("ESR") furnaces to increase the production

of premium melt products. Carpenter is also currently installing

two additional vacuum arc remelting ("VAR") furnaces that are

expected to be operational by December 2006 and will augment its 17

existing furnaces. The ESR and VAR furnaces are used in the

production of higher margin products for critical end product

applications such as rotating aircraft engine parts, high

performance automotive and truck engine parts, and medical devices.

These investments are in addition to the nearly $500 million of

prior capital spending made between 1997 and 2002. Growth Through

Acquisitions In addition to organic growth, Carpenter will seek to

acquire companies that sell into high growth markets including, but

not limited to, the aerospace, medical, energy and automotive and,

which provide a strong fit with the Company's expertise in high

performance materials. In addition, the Company will seek

opportunities to expand its geographic base. Carpenter's priority

will be acquisitions close to its core businesses and markets that

can make an immediate and meaningful contribution to Carpenter's

operating income. In maintaining Carpenter's financial discipline,

acquired companies will be expected to: -- Generate earnings that

will exceed Carpenter's cost of capital -- Generate earnings that

are accretive to earnings per share in year one Transactions will

be structured in a manner that maintains an investment grade debt

rating. Share Repurchase Program As part of the company's strategy

to enhance TSR, the Board of Directors has authorized a share

repurchase program of up to $250 million of Carpenter's outstanding

common stock. The share repurchase program reaffirms management's

view that Carpenter's stock is an attractive investment based on

its strategic initiatives and expected growth in earnings and cash

flow. The repurchases will occur at such times and at such prices

as the management of the Company determines. The share repurchase

program will be funded with the Company's excess cash after giving

consideration to capital investments, acquisitions and future cash

flows. It is expected that the authorization will be utilized over

the next 12-18 months, subject to market conditions. Dividend

Increase Another element of Carpenter's TSR strategy is its

dividend rate, which was reflected in the 50% increase in the

company's quarterly cash dividend that was announced on August 24,

2006. Carpenter's new annualized dividend is $0.90 per share of

common stock. Torcolini added, "Over the last several years, we

have transformed Carpenter into a company producing and

distributing higher value products. At the same time, we have

lowered our cost structure to further enhance our overall

competitiveness throughout the business cycle. Carpenter expects to

continue generating returns in excess of its cost of capital, and

combined with strong cash flows, is in a position to further reward

shareholders with this increased dividend." The company intends to

maintain a dividend that delivers a return to shareholders

competitive with that of other materials stocks and relevant

indices. Future dividend increases will be made at a measured pace,

consistent with business conditions. There are a number of factors

that the Company will consider in determining the size of future

dividend increases and share repurchases. It is critical that the

Company maintains its strong and flexible financial position in

order to ensure that regardless of the stage of the business cycle,

it will be able to: -- Continue the research, development, and

introduction of new products -- Continue to identify and make

acquisitions that meet its financial criteria -- Make key

investments, capital expenditures and pursue other activities to

achieve its long term profitability. Torcolini concluded,

"Carpenter recently achieved several milestones, including another

record fiscal year and a fourth quarter that surpassed last year's

fourth quarter earnings by more than 40 percent. We are excited

about the growth prospects in our core markets and we are confident

in our ability to capture opportunities which will enable us to

continue to profitably grow our Company and to continue to reward

our shareholders." Carpenter produces and distributes specialty

alloys, including stainless steels, titanium alloys, and

superalloys, and various engineered products. Information about

Carpenter can be found on the Internet at www.cartech.com. Except

for historical information, all other information in this news

release consists of forward-looking statements within the meaning

of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter's filings with the Securities and

Exchange Commission including its annual report on Form 10-K for

the year ended June 30, 2006, and the exhibits attached to those

filings. They include but are not limited to: 1) the cyclical

nature of the specialty materials business and certain end-use

markets, including aerospace, industrial, automotive, consumer,

medical, and energy including power generation, or other influences

on Carpenter's business such as new competitors, the consolidation

of customers, and suppliers or the transfer of manufacturing

capacity from the United States to foreign countries; 2) the

ability of Carpenter to achieve cost savings, productivity

improvements or process changes; 3) the ability to recoup increases

in the cost of energy and raw materials or other factors; 4)

domestic and foreign excess manufacturing capacity for certain

metals; 5) fluctuations in currency exchange rates; 6) the degree

of success of government trade actions; 7) the valuation of the

assets and liabilities in Carpenter's pension trusts and the

accounting for pension plans; 8) possible labor disputes or work

stoppages; 9) the potential that our customers may substitute

alternate materials or adopt different manufacturing practices that

replace or limit the suitability of our products; and 10) the

ability to successfully acquire and integrate acquisitions. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements.

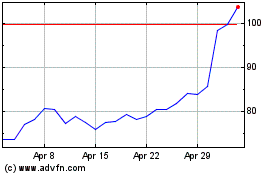

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

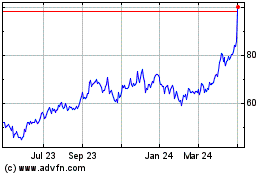

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024