Filed Pursuant to Rule 424(b)(2)

Registration No. 333-272447

PRICING SUPPLEMENT dated February 29, 2024

(To Product Supplement No. WF-1 dated September 5, 2023,

ETF Underlying Supplement dated September 5,

2023, Prospectus Supplement dated September 5, 2023 and Prospectus dated September 5, 2023)

|

|

Canadian Imperial Bank of Commerce

|

| Senior

Global Medium-Term Notes |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside |

| Principal

at Risk Securities Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the Energy Select Sector

SPDR® Fund and the Health Care Select Sector SPDR® Fund due March 1, 2027 |

| ¨ |

|

Linked

to the lowest performing of the Technology Select Sector SPDR® Fund, the Energy Select Sector SPDR®

Fund and the Health Care Select Sector SPDR® Fund (each referred to as a “Fund”) |

| ¨ |

|

Unlike

ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal

at maturity and are subject to potential automatic call prior to maturity upon the terms described below. Whether the securities

pay a Contingent Coupon Payment, whether the securities are automatically called prior to maturity and, if they are not automatically

called, whether you receive the face amount of your securities at maturity will depend, in each case, on the Fund Closing Price of

the Lowest Performing Fund on the relevant Calculation Day. The Lowest Performing Fund on any Calculation Day is the Fund that has

the lowest Fund Closing Price on that Calculation Day as a percentage of its Starting Price |

| ¨ |

|

Contingent

Coupon Payments. The securities will pay a Contingent Coupon Payment on a quarterly basis until the earlier of the Stated Maturity

Date or automatic call if, and only if, the Fund Closing Price of the Lowest Performing Fund on the related Coupon Determination

Date is greater than or equal to its Coupon Threshold Price. However, if the Fund Closing Price of the Lowest Performing Fund on

a Coupon Determination Date is less than its Coupon Threshold Price, you will not receive any Contingent Coupon Payment for the relevant

quarter. If the Fund Closing Price of the Lowest Performing Fund is less than its Coupon Threshold Price on every Coupon Determination

Date, you will not receive any Contingent Coupon Payments throughout the entire term of the securities. The Coupon Threshold Price

for each Fund is equal to 70% of its Starting Price. The Contingent Coupon Rate is 10.50% per annum |

| ¨ |

|

Automatic

Call. If the Fund Closing Price of the Lowest Performing Fund on any of the quarterly Call Observation Dates from August 2024

to November 2026, inclusive, is greater than or equal to its Starting Price, the securities will be automatically called for the

face amount plus a final Contingent Coupon Payment |

| ¨ |

|

Potential

Loss of Principal. If the securities are not automatically called prior to maturity, you will receive the face amount at maturity

if, and only if, the Ending Price of the Lowest Performing Fund on the Final Calculation Day is greater than or equal to its

Downside Threshold Price. If the Fund Closing Price of the Lowest Performing Fund on the Final Calculation Day is less than its Downside

Threshold Price, you will lose more than 30%, and possibly all, of the face amount of your securities. The Downside Threshold Price

for each Fund is equal to 70% of its Starting Price |

| ¨ |

|

If

the securities are not automatically called prior to maturity, you will have full downside exposure to the Lowest Performing Fund

on the Final Calculation Day from its Starting Price if its Ending Price is less than its Downside Threshold Price, but you will

not participate in any appreciation of any Fund and will not receive any dividends on the shares of any Fund or any securities held

by a Fund |

| ¨ |

|

Your

return on the securities will depend solely on the performance of the Fund that is the Lowest Performing Fund on each Calculation

Day. You will not benefit in any way from the performance of the better performing Funds. Therefore, you will be adversely affected

if any Fund performs poorly, even if the other Funds perform favorably |

| ¨ |

|

All

payments on the securities are subject to the credit risk of Canadian Imperial Bank of Commerce and you will have no ability to pursue

the shares of any Fund or any securities held by a Fund for payment; if Canadian Imperial Bank of Commerce defaults on its obligations,

you could lose all or some of your investment |

| ¨ |

|

No

exchange listing; designed to be held to maturity or earlier automatic call |

The securities

have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities.

See “Selected Risk Considerations” beginning on page PRS-9 herein and “Risk Factors” beginning on page S-1 of

the accompanying underlying supplement, page S-1 of the prospectus supplement and page 1 of the prospectus.

The securities are unsecured obligations of

Canadian Imperial Bank of Commerce and all payments on the securities are subject to the credit risk of Canadian Imperial Bank of Commerce.

The securities will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation

or any other government agency or instrumentality of Canada, the United States or any other jurisdiction. The securities are not bail-inable

debt securities (as defined on page 6 of the prospectus).

Neither the Securities and Exchange Commission(the

“SEC”) nor any state or provincial securities commission or other regulatory body has approved or disapproved of these securities

or passed upon the accuracy or adequacy of this pricing supplement or the accompanying product supplement, underlying supplement, prospectus

supplement and prospectus. Any representation to the contrary is a criminal offense.

| |

|

Original

Offering Price |

|

Underwriting Discount

(1) (2) |

|

Proceeds to CIBC |

| Per

Security |

|

$1,000.00 |

|

$23.70 |

|

$976.30 |

| Total |

|

$7,889,000.00

|

|

$186,969.30 |

|

$7,702,030.70

|

| (1) | The

agent, Wells Fargo Securities, LLC (“Wells Fargo Securities”), will receive an

underwriting discount of $23.70 per security. The agent may resell the securities to other

securities dealers at the original offering price less a concession of $17.50 per security.

Such securities dealers may include Wells Fargo Advisors (“WFA”) (the trade name

of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors

Financial Network, LLC, each an affiliate of Wells Fargo Securities). In

addition to the selling concession allowed to WFA, the agent may pay $0.75 per security of

the underwriting discount to WFA as a distribution expense fee for each security sold by

WFA. See “Terms of the Securities—Agent’s Underwriting Discount

and Other Fees” in this pricing supplement and “Use of Proceeds and Hedging”

in the underlying supplement for information regarding how we may hedge our obligations under

the securities. |

| (2) | In

respect of certain securities sold in this offering, the Issuer may pay a fee of $1.00 per

security to selected securities dealers in consideration for marketing and other services

in connection with the distribution of the securities to other securities dealers. |

Our estimated value of the securities on the Pricing

Date, based on our internal pricing models, is $950.90 per security. The estimated value is less than the original offering price of the

securities. See “The Estimated Value of the Securities” in this pricing supplement.

Wells Fargo Securities

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| Issuer: |

|

Canadian

Imperial Bank of Commerce |

| Market

Measure: |

|

The

lowest performing of the Technology Select Sector SPDR® Fund (Bloomberg ticker symbol “XLK”) (the “XLK”),

the Energy Select Sector SPDR® Fund (Bloomberg ticker symbol “XLE”) (the “XLE”) and the Health

Care Select Sector SPDR® Fund (Bloomberg ticker symbol “XLV”) (the “XLV”) (each

referred to as a “Fund,” and collectively as the “Funds”). |

| Original

Offering Price: |

|

$1,000

per security. |

| Face Amount: |

|

The

principal amount of $1,000 per security. References in this pricing supplement to a “security” are to a security with

a face amount of $1,000. |

| Pricing

Date: |

|

February

29, 2024 |

| Issue Date: |

|

March

5, 2024 |

| Final

Calculation Day: |

|

February

24, 2027, subject to postponement as described below under “—Market Disruption Events and Postponement Provisions.” |

| Stated Maturity Date: |

|

March

1, 2027, subject to postponement. The securities are not subject to redemption at the option of CIBC or repayment at the option of

any holder of the securities prior to maturity or automatic call. |

| Contingent

Coupon Payment: |

|

On each Coupon Payment Date, you will receive

a Contingent Coupon Payment at a per annum rate equal to the Contingent Coupon Rate (each a “Contingent Coupon Payment”)

if, and only if, the Fund Closing Price of the Lowest Performing Fund on the related Coupon Determination Date is greater

than or equal to its Coupon Threshold Price.

Each Contingent Coupon Payment, if any, will

be calculated per security as follows:

($1,000× Contingent Coupon

Rate)/4.

Any Contingent Coupon Payment will be rounded

to the nearest cent, with one-half cent rounded upward.

If the Fund Closing Price of the Lowest

Performing Fund on any Coupon Determination Date is less than its Coupon Threshold Price, you will not receive any Contingent Coupon

Payment on the related Coupon Payment Date. If the Fund Closing Price of the Lowest Performing Fund is less than its Coupon Threshold

Price on all Coupon Determination Dates, you will not receive any Contingent Coupon Payments over the term of the securities. |

| Contingent

Coupon Rate: |

|

10.50%

per annum |

| Coupon

Threshold Price: |

|

$144.886

with respect to the XLK, $60.298 with respect to the XLE and $101.374 with respect to the XLV, each of which is 70% of its Starting

Price. |

| Coupon

Determination Dates: |

|

Quarterly,

on the 24th of each February, May, August and November, commencing May 2024 and ending on the Final Calculation Day, each subject

to postponement as described below under “—Market Disruption Events and Postponement Provisions.” |

| Coupon

Payment Dates: |

|

Quarterly,

on the third Business Day following each Coupon Determination Date (as each such Coupon Determination Date may be postponed pursuant

to “—Market Disruption Events and Postponement Provisions” below, if applicable); provided that the Coupon Payment

Date with respect to the Final Calculation Day will be the Stated Maturity Date. |

| Automatic

Call: |

|

If the Fund Closing Price of the Lowest

Performing Fund on any Call Observation Date is greater than or equal to its Starting Price, the securities will be automatically

called, and on the related Call Payment Date, you will be entitled to receive a cash payment per security in U.S. dollars equal to |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

|

|

the face amount plus a final Contingent Coupon

Payment. The first Call Observation Date is approximately six months after the Issue Date.

If the securities are automatically called,

they will cease to be outstanding on the related Call Payment Date and you will have no further rights under the securities after

such Call Payment Date. You will not receive any notice from us if the securities are automatically called.

|

| Call

Observation Dates: |

|

Quarterly,

the Coupon Determination Dates beginning August 2024 and ending November 2026 (together with the Coupon Determination Dates, the

“Calculation Days”) |

| Call

Payment Dates: |

|

The

Coupon Payment Date immediately following the applicable Call Observation Date. |

| Maturity

Payment Amount: |

|

If the securities are not automatically called

prior to maturity, you will be entitled to receive at maturity a cash payment per security in U.S. dollars equal to the Maturity

Payment Amount (in addition to the final Contingent Coupon Payment, if any). The “Maturity Payment Amount” per security

will equal:

•

if the Ending Price of the Lowest Performing Fund on the Final Calculation Day is greater than

or equal to its Downside Threshold Price:

$1,000; or

•

if the Ending Price of the Lowest Performing Fund on the Final Calculation Day is less than its Downside Threshold Price:

$1,000 × Performance

Factor of the Lowest Performing Fund on the Final Calculation Day

If the securities are not automatically

called prior to maturity and the Ending Price of the Lowest Performing Fund on the Final Calculation Day is less than its Downside

Threshold Price, you will lose more than 30%, and possibly all, of the face amount of your securities at maturity.

Any return on the securities will be limited

to the sum of your Contingent Coupon Payments, if any. You will not participate in any appreciation of any Fund, but you will have full

downside exposure to the Lowest Performing Fund on the Final Calculation Day if the Ending Price of such Fund is less than its Downside

Threshold Price. |

| Downside

Threshold Price: |

|

$144.886

with respect to the XLK, $60.298 with respect to the XLE and $101.374 with respect to the XLV, each of which is 70% of its Starting

Price. |

| Lowest

Performing Fund: |

|

On

any Calculation Day, the “Lowest Performing Fund” will be the Fund with the lowest Performance Factor on that Calculation

Day. |

| Performance

Factor: |

|

With

respect to a Fund on any Calculation Day, its Fund Closing Price on such Calculation Day divided by its Starting Price (expressed

as a percentage). |

| Starting

Price: |

|

$206.98

with respect to the XLK, $86.14 with respect to the XLE and $144.82 with respect to the XLV, each of which was its Fund Closing Price

on the Pricing Date. |

| Ending

Price: |

|

With

respect to each Fund, its Fund Closing Price on the Final Calculation Day. |

| Fund

Closing Price: |

|

With

respect to each Fund, the Fund Closing Price, the Closing Price and the Adjustment Factor have the meanings set forth under “General

Terms of the Securities — Certain Terms for Securities Linked to a Fund — Certain Definitions” in the accompanying

product supplement. |

| Market

Disruption Events and Postponement Provisions: |

|

Each

Calculation Day is subject to postponement due to non-Trading Days and the occurrence of a Market Disruption Event. In addition,

the Stated Maturity Date will be postponed if the Final Calculation Day is postponed and will be adjusted for non-Business Days.

For more information regarding adjustments to the Calculation Days and the Stated Maturity Date, see “General Terms of the

Securities—Consequences of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to Multiple

Market Measures” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying

product supplement, each Coupon |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| |

|

Determination

Date, each Call Observation Date and the Final Calculation Day is a “calculation day,” and each Coupon Payment Date and

Call Payment Date and the Stated Maturity Date is a “payment date.” In addition, for information regarding the circumstances

that may result in a Market Disruption Event, see “General Terms of the Securities—Certain Terms for Securities Linked

to a Fund—Market Disruption Events” in the accompanying product supplement. |

| Calculation Agent: |

|

CIBC |

| Material

U.S. Tax Consequences: |

|

For

a discussion of the material U.S. federal income tax consequences of the ownership and disposition of the securities, see “Summary

of U.S. Federal Income Tax Consequences” in this pricing supplement and “Material U.S. Federal Income Tax Consequences”

in the underlying supplement. |

| Agent’s

Underwriting Discount and Other Fees: |

|

Wells Fargo Securities. The agent will receive

an underwriting discount of $23.70 per security. The agent may resell the securities to other securities dealers, including securities

dealers acting as custodians, at the original offering price of the securities less a concession of $17.50 per security. Such securities

dealers may include WFA. In addition to the selling concession allowed to WFA, Wells Fargo Securities may pay $0.75 per security

of the underwriting discount to WFA as a distribution expense fee for each security sold by WFA. In addition, in respect of certain

securities sold in this offering, the Issuer may pay a fee of $1.00 per security to selected securities dealers in consideration

for marketing and other services in connection with the distribution of the securities to other securities dealers.

We expect to hedge our obligations through

the agent, one of our or its affiliates and/or another unaffiliated counterparty, which expects to realize hedging profits projected

by its proprietary pricing models to the extent it assumes the risks inherent in hedging our obligations under the securities. If any

dealer participating in the distribution of the securities or any of its affiliates conducts hedging activities for us in connection

with the securities, that dealer or its affiliate will expect to realize a profit projected by its proprietary pricing models from such

hedging activities. Any such projected profit will be in addition to any discount, concession or fee received in connection with the

sale of the securities to you. |

| Denominations: |

|

$1,000

and any integral multiple of $1,000. |

| CUSIP

/ ISIN: |

|

13607XQF7

/ US13607XQF77 |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| About

This Pricing Supplement |

You should read this pricing supplement together

with the prospectus dated September 5, 2023 (the “prospectus”), the prospectus supplement dated September 5, 2023 (the “prospectus

supplement”), the Product Supplement No. WF-1 dated September 5, 2023 (the “product supplement”) and the ETF Underlying

Supplement dated September 5, 2023 (the “underlying supplement”), relating to our Senior Global Medium-Term Notes, of which

these securities are a part, for additional information about the securities. Information included in this pricing supplement supersedes

information in the product supplement, the underlying supplement, the prospectus supplement and the prospectus to the extent it is different

from that information. The section entitled “General Terms of the Securities” in the product supplement shall supersede and

replace the section entitled “Certain Terms of the Notes” in the underlying supplement. Certain defined terms used but not

defined herein have the meanings set forth in the product supplement, the underlying supplement, the prospectus supplement and the prospectus.

You should rely only on the information contained

in or incorporated by reference in this pricing supplement, the accompanying product supplement, underlying supplement, prospectus supplement

and prospectus. This pricing supplement may be used only for the purpose for which it has been prepared. No one is authorized to give

information other than that contained in this pricing supplement, the accompanying product supplement, underlying supplement, prospectus

supplement and prospectus, and in the documents referred to in these documents and which are made available to the public. We have not,

and Wells Fargo Securities has not, authorized any other person to provide you with different or additional information. If anyone provides

you with different or additional information, you should not rely on it.

We are not, and Wells Fargo Securities is not,

making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

contained in or incorporated by reference in this pricing supplement, the accompanying product supplement, underlying supplement, prospectus

supplement or prospectus is accurate as of any date other than the date of the applicable document. Our business, financial condition,

results of operations and prospects may have changed since that date. Neither this pricing supplement, nor the accompanying product supplement,

underlying supplement, prospectus supplement or prospectus constitutes an offer, or an invitation on our behalf or on behalf of Wells

Fargo Securities, to subscribe for and purchase any of the securities and may not be used for or in connection with an offer or solicitation

by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make

such an offer or solicitation.

The Bank may use this pricing supplement in the

initial sale of the securities. In addition, Wells Fargo Securities or any of our or its affiliates may use this pricing supplement in

market-making transactions in the securities after their initial sale. However, it is not obligated to do so and may discontinue making

a market at any time without notice. Any use of this pricing supplement by Wells Fargo Securities in market-making transactions after

the initial sale of the securities will be solely for the purpose of providing investors with the description of the terms of the securities

that were made available to investors in connection with the initial distribution of the securities.

References to “CIBC,” “the

Issuer,” “the Bank,” “we,” “us” and “our” in this pricing supplement are references

to Canadian Imperial Bank of Commerce and not to any of our subsidiaries, unless we state otherwise or the context otherwise requires.

You may access the product supplement, the underlying

supplement, the prospectus supplement and the prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by

reviewing our filing for the relevant date on the SEC website):

| · | Product

supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098182/tm2322483d93_424b5.htm

| · | Underlying

supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098171/tm2322483d88_424b5.htm

| · | Prospectus

supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098166/tm2322483d94_424b5.htm

| · | Prospectus

dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098163/tm2325339d10_424b3.htm

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

The

securities are not appropriate for all investors. The securities may be an appropriate investment for investors who:

| § | seek

an investment with Contingent Coupon Payments at a rate of 10.50% per annum until the earlier

of maturity or automatic call, if, and only if, the Fund Closing Price of the Lowest Performing

Fund on the related Coupon Determination Date is greater than or equal to 70% of its Starting

Price; |

| § | understand

that if the securities are not automatically called prior to maturity and the Ending Price

of the Lowest Performing Fund on the Final Calculation Day has declined by more than 30%

from its Starting Price, they will be fully exposed to the decline in the Lowest Performing

Fund from its Starting Price and will lose more than 30%, and possibly all, of the face amount

at maturity; |

| § | are

willing to accept the risk that they may receive few or no Contingent Coupon Payments over

the term of the securities; |

| § | understand

that the securities may be automatically called prior to maturity and that the term of the

securities may be as short as approximately six months; |

| § | understand

that the return on the securities will depend solely on the performance of the Lowest Performing

Fund on each Calculation Day and that they will not benefit in any way from the performance

of the better performing Funds; |

| § | understand

that the securities are riskier than alternative investments linked to only one of the Funds

or linked to a basket composed of the Funds; |

| § | understand

and are willing to accept the full downside risks of each Fund; |

| § | are

willing to forgo participation in any appreciation of any Fund and dividends on the shares

of any Fund or any securities held by a Fund; and |

| § | are

willing to hold the securities to maturity or earlier automatic call. |

The

securities may not be an appropriate investment for investors who:

| § | seek

a liquid investment or are unable or unwilling to hold the securities to maturity or earlier

automatic call; |

| § | require

full payment of the face amount of the securities at maturity; |

| § | seek

a security with a fixed term; |

| § | are

unwilling to purchase securities with an estimated value as of the Pricing Date that is lower

than the original offering price; |

| § | are

unwilling to accept the risk that the securities are not automatically called prior to maturity

and the Fund Closing Price of the Lowest Performing Fund on the Final Calculation Day may

decline by more than 30% from its Starting Price; |

| § | seek

certainty of current income over the term of the securities; |

| § | seek

exposure to the upside performance of any or each Fund; |

| § | seek

exposure to a basket composed of the Funds or a similar investment in which the overall return

is based on a blend of the performances of the Funds, rather than solely on the Lowest Performing

Fund; |

| § | are

unwilling to accept the risk of exposure to the Funds; |

| § | are

unwilling to accept the credit risk of CIBC; or |

| § | prefer

the lower risk of conventional fixed income investments with comparable maturities issued

by companies with comparable credit ratings. |

The considerations identified above are not

exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you

should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered

the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the

“Selected Risk Considerations” herein and the “Risk Factors” in the accompanying underlying supplement for risks

related to an investment in the securities.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| Determining

Payment On A Coupon Payment Date and at Maturity |

If the securities have not been previously automatically

called, on each Coupon Payment Date, you will either receive a Contingent Coupon Payment or you will not receive a Contingent Coupon

Payment, depending on the Fund Closing Price of the Lowest Performing Fund on the related Coupon Determination Date.

Step 1: Determine which Fund is the Lowest

Performing Fund on the related Coupon Determination Date. The Lowest Performing Fund on any Coupon Determination Date is the Fund with

the lowest Performance Factor on that Coupon Determination Date. The Performance Factor of a Fund on a Coupon Determination Date is its

Fund Closing Price on that Coupon Determination Date as a percentage of its Starting Price (i.e., its Fund Closing Price on that Coupon

Determination Date divided by its Starting Price).

Step 2: Determine whether a Contingent

Coupon Payment is payable on the applicable Coupon Payment Date based on the Fund Closing Price of the Lowest Performing Fund on the

related Coupon Determination Date, as follows:

If the securities have not been automatically

called prior to maturity, then at maturity, you will receive (in addition to the final Contingent Coupon Payment, if any) a cash payment

per security (the Maturity Payment Amount) calculated as follows:

Step 1: Determine which Fund is the Lowest

Performing Fund on the Final Calculation Day. The Lowest Performing Fund on the Final Calculation Day is the Fund with the lowest Performance

Factor on the Final Calculation Day. The Performance Factor of a Fund on the Final Calculation Day is its Ending Price as a percentage

of its Starting Price (i.e., its Ending Price divided by its Starting Price).

Step 2: Calculate the Maturity Payment

Amount based on the Ending Price of the Lowest Performing Fund on the Final Calculation Day, as follows:

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| Hypothetical

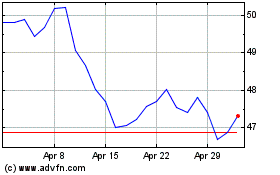

Payout Profile |

The following profile illustrates the potential

Maturity Payment Amount payable on the securities (excluding the final Contingent Coupon Payment, if any) for a range of hypothetical

performances of the Lowest Performing Fund on the Final Calculation Day from its Starting Price to its Ending Price, assuming the securities

have not been automatically called prior to maturity. As this profile illustrates, in no event will you have a positive rate of return

based solely on the Maturity Payment Amount received at maturity; any positive return will be based solely on the Contingent Coupon Payments,

if any, received during the term of the securities. This graph has been prepared for purposes of illustration only. Your actual return

will depend on the actual Ending Price of the Lowest Performing Fund on the Final Calculation Day, whether the securities are automatically

called prior to maturity, and whether you hold your securities to maturity. The performance of the better performing Funds is not relevant

to your return on the securities.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| Selected

Risk Considerations |

The securities have complex features and investing

in the securities will involve risks not associated with an investment in conventional debt securities. Some of the risks that apply

to an investment in the securities are summarized below, but we urge you to read the more detailed explanation of the risks relating

to the securities generally in the “Risk Factors” beginning on page S-1 of the accompanying underlying supplement, page S-1

of the prospectus supplement and page 1 of the prospectus. You should reach an investment decision only after you have carefully considered

with your advisors the appropriateness of an investment in the securities in light of your

particular circumstances. The index underlying a Fund is sometimes referred to as an “Underlying Index” of that Fund.

Risks Relating To The Structure Of The

Securities

If The Securities Are Not Automatically Called

Prior To Maturity, You May Lose A Significant Portion Or All Of The Face Amount Of Your Securities At Maturity.

We will not repay you a fixed amount on the securities

at maturity. If the securities are not automatically called prior to maturity, you will receive a Maturity Payment Amount that will be

equal to or less than the face amount, depending on the Ending Price of the Lowest Performing Fund on the Final Calculation Day.

If the securities are not automatically called

prior to maturity and the Ending Price of the Lowest Performing Fund on the Final Calculation Day is less than its Downside Threshold

Price, the Maturity Payment Amount will be reduced by an amount equal to the decline in the price of the Lowest Performing Fund from

its Starting Price (expressed as a percentage of its Starting Price). The Downside Threshold Price for each Fund is 70% of its Starting

Price. For example, if the securities are not automatically called and the Lowest Performing Fund on the Final Calculation Day has declined

by 30.1% from its Starting Price to its Ending Price, you will not receive any benefit of the contingent downside protection feature

and you will lose 30.1% of the face amount. As a result, you will not receive any protection if the price of the Lowest Performing Fund

on the Final Calculation Day declines significantly and you may lose a significant portion, and possibly all, of the face amount at maturity,

even if the price of the Lowest Performing Fund is greater than or equal to its Starting Price or its Downside Threshold Price at certain

times during the term of the securities.

Even if the Ending Price of the Lowest Performing

Fund on the Final Calculation Day is greater than its Downside Threshold Price, the Maturity Payment Amount will not exceed the face

amount, and your yield on the securities, taking into account any Contingent Coupon Payments you may have received during the term of

the securities, may be less than the yield you would earn if you bought a traditional interest-bearing debt security of CIBC or another

issuer with a similar credit rating.

The Securities Do Not Provide For Fixed Payments

Of Interest And You May Receive No Coupon Payments On One Or More Coupon Payment Dates, Or Even Throughout The Entire Term Of The Securities.

On each Coupon Payment Date you will receive

a Contingent Coupon Payment if, and only if, the Fund Closing Price of the Lowest Performing Fund on the related Coupon Determination

Date is greater than or equal to its Coupon Threshold Price. The Coupon Threshold Price for each Fund is 70% of its Starting Price. If

the Fund Closing Price of the Lowest Performing Fund on any Coupon Determination Date is less than its Coupon Threshold Price, you will

not receive any Contingent Coupon Payment on the related Coupon Payment Date, and if the Fund Closing Price of the Lowest Performing

Fund is less than its Coupon Threshold Price on each Coupon Determination Date over the term of the securities, you will not receive

any Contingent Coupon Payments over the entire term of the securities.

The Securities Are Subject To The Full Risks

Of Each Fund And Will Be Negatively Affected If Any Fund Performs Poorly, Even If The Other Funds Perform Favorably.

You are subject to the full risks of each Fund.

If any Fund performs poorly, you will be negatively affected, even if the other Funds perform favorably. The securities are not linked

to a basket composed of the Funds, where the better performance of some Funds could offset the poor performance of others. Instead, you

are subject to the full risks of whichever Fund is the Lowest Performing Fund on each Calculation Day. As a result, the securities are

riskier than an alternative investment linked to only one of the Funds or linked to a basket composed of the Funds. You should not invest

in the securities unless you understand and are willing to accept the full downside risks of each Fund.

Your Return On The Securities Will Depend

Solely On The Performance Of The Lowest Performing Fund On Each Calculation Day, And You Will Not Benefit In Any Way From The Performance

Of The Better Performing Funds.

Your return on the securities will depend solely

on the performance of the Lowest Performing Fund on each Calculation Day. Although it is necessary for each Fund to close above its respective

Coupon Threshold Price on the related Coupon Determination Date in order for you to receive a Contingent Coupon Payment and above its

respective Downside Threshold Price on the Final Calculation Day for

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

you to receive the face amount of your securities

at maturity, you will not benefit in any way from the performance of the better performing Funds. The securities may underperform an

alternative investment linked to a basket composed of the Funds, since in such case the performance of the better performing Funds would

be blended with the performance of the Lowest Performing Fund, resulting in a better return than the return of the Lowest Performing

Fund alone.

You Will Be Subject To Risks Resulting From

The Relationship Among The Funds.

It is preferable from your perspective for the

Funds to be correlated with each other so that their prices will tend to increase or decrease at similar times and by similar magnitudes.

By investing in the securities, you assume the risk that the Funds will not exhibit this relationship. The less correlated the Funds,

the more likely it is that any one of the Funds will be performing poorly at any time over the term of the securities. All that is necessary

for the securities to perform poorly is for one of the Funds to perform poorly; the performance of the better performing Funds is not

relevant to your return on the securities. It is impossible to predict what the relationship among the Funds will be over the term of

the securities. Each Fund represents a different sector of the U.S. equity market. These different sectors of the U.S. equity market

may not perform similarly over the term of the securities.

You May Be Fully Exposed To The Decline In

The Lowest Performing Fund On The Final Calculation Day From Its Starting Price, But Will Not Participate In Any Positive Performance

Of Any Fund, And Your Maximum Possible Return On The Securities Will Be Limited To The Sum Of Any Contingent Coupon Payments.

Even though you will be fully exposed to a decline

in the price of the Lowest Performing Fund on the Final Calculation Day if its Ending Price is below its Downside Threshold Price, you

will not participate in any increase in the price of any Fund over the term of the securities. Your maximum possible return on the securities

will be limited to the sum of the Contingent Coupon Payments you receive, if any. Consequently, your return on the securities may be

significantly less than the return you could achieve on an alternative investment that provides for participation in an increase in the

price of any or each Fund.

Higher Contingent Coupon Rates Are Associated

With Greater Risk.

The securities offer Contingent Coupon Payments

at a higher rate, if paid, than the fixed rate we would pay on conventional debt securities of the same maturity. These higher potential

Contingent Coupon Payments are associated with greater levels of expected risk as of the Pricing Date as compared to conventional debt

securities, including the risk that you may not receive a Contingent Coupon Payment on one or more, or any, Coupon Payment Dates and

the risk that you may lose a substantial portion, and possibly all, of the face amount at maturity. The volatility of the Funds and the

correlation among the Funds are important factors affecting this risk. Volatility is a measurement of the size and frequency of daily

fluctuations in the price of a Fund, typically observed over a specified period of time. Volatility can be measured in a variety of ways,

including on a historical basis or on an expected basis as implied by option prices in the market. Correlation is a measurement of the

extent to which the prices of the Funds tend to fluctuate at the same time, in the same direction and in similar magnitudes. Greater

expected volatility of the Funds or lower expected correlation among the Funds as of the Pricing Date may result in a higher Contingent

Coupon Rate, but it also represents a greater expected likelihood as of the Pricing Date that the Fund Closing Price of at least one

Fund will be less than its Coupon Threshold Price on one or more Coupon Determination Dates, such that you will not receive one or more,

or any, Contingent Coupon Payments during the term of the securities, and that the Fund Closing Price of at least one Fund will be less

than its Downside Threshold Price on the Final Calculation Day such that you will lose a substantial portion, and possibly all, of the

face amount at maturity. In general, the higher the Contingent Coupon Rate is relative to the fixed rate we would pay on conventional

debt securities, the greater the expected risk that you will not receive one or more, or any, Contingent Coupon Payments during the term

of the securities and that you will lose a substantial portion, and possibly all, of the face amount at maturity.

You Will Be Subject To Reinvestment Risk.

If your securities are automatically called,

the term of the securities may be reduced to as short as approximately six months. There is no guarantee that you would be able to reinvest

the proceeds from an investment in the securities at a comparable return for a similar level of risk in the event the securities are

automatically called prior to maturity.

A Coupon Payment Date, A Call Payment Date

And The Stated Maturity Date May Be Postponed If A Calculation Day Is Postponed.

A Calculation Day (including the Final Calculation

Day) with respect to a Fund will be postponed if the applicable originally scheduled Calculation Day is not a Trading Day with respect

to any Fund or if the calculation agent determines that a market disruption event has occurred or is continuing with respect to that

Fund on that Calculation Day. If such a postponement occurs with respect to a Calculation Day other than the Final Calculation Day, then

the related Coupon Payment Date or Call Payment Date, as applicable, will be postponed. If such a postponement occurs with respect to

the Final Calculation Day, the Stated Maturity Date will be the later of (i) the initial Stated Maturity Date and (ii) the third Business

Day after the last Final Calculation Day as postponed.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

Risk Relating To The Credit Risk Of CIBC

The Securities Are Subject To The Credit Risk

Of Canadian Imperial Bank of Commerce.

The securities are our obligations exclusively

and are not, either directly or indirectly, an obligation of any third party. Any amounts payable under the securities are subject to

our creditworthiness, and you will have no ability to pursue the shares of any Fund or any securities held by any Fund for payment. As

a result, our actual and perceived creditworthiness and actual or anticipated decreases in our credit ratings may affect the value of

the securities and, in the event we were to default on our obligations, you may not receive any amounts owed to you under the terms of

the securities. See “Description of Senior Debt Securities—Events of Default” in the prospectus.

Risks Relating To The Estimated Value Of

The Securities And Any Secondary Market

Our Estimated Value Of The Securities Is Lower

Than The Original Offering Price Of The Securities.

Our estimated value is only an estimate using

several factors. The original offering price of the securities exceeds our estimated value because costs associated with selling and

structuring the securities, as well as hedging the securities, are included in the original offering price of the securities. See “The

Estimated Value of the Securities” in this pricing supplement.

Our Estimated Value Does Not Represent Future

Values Of The Securities And May Differ From Others’ Estimates.

Our estimated value of the securities was determined

by reference to our internal pricing models when the terms of the securities were set. This estimated value was based on market conditions

and other relevant factors existing at that time and our assumptions about market parameters, which can include volatility, dividend

rates, interest rates and other factors. Different pricing models and assumptions could provide valuations for the securities that are

greater than or less than our estimated value. In addition, market conditions and other relevant factors in the future may change, and

any assumptions may prove to be incorrect. On future dates, the value of the securities could change significantly based on, among other

things, changes in market conditions, our creditworthiness, interest rate movements and other relevant factors, which may impact the

price, if any, at which Wells Fargo Securities or any other person would be willing to buy securities from you in secondary market transactions.

See “The Estimated Value of the Securities” in this pricing supplement.

Our Estimated Value Was Not Determined By

Reference To Credit Spreads For Our Conventional Fixed-Rate Debt.

The internal funding rate used in the determination

of our estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. If we were to have

used the interest rate implied by our conventional fixed-rate credit spreads, we would expect the economic terms of the securities to

be more favorable to you. Consequently, our use of an internal funding rate had an adverse effect on the terms of the securities and

could have an adverse effect on any secondary market prices of the securities. See “The Estimated Value of the Securities”

in this pricing supplement.

The Estimated Value Of The Securities Is Not

An Indication Of The Price, If Any, At Which Wells Fargo Securities Or Any Other Person May Be Willing To Buy The Securities From You

In The Secondary Market.

The price, if any, at which Wells Fargo Securities

or any of its affiliates may purchase the securities in the secondary market will be based on Wells Fargo Securities’ proprietary

pricing models and will fluctuate over the term of the securities as a result of changes in the market and other factors described in

the next risk factor. Any such secondary market price for the securities will also be reduced by a bid-offer spread, which may vary depending

on the aggregate face amount of the securities to be purchased in the secondary market transaction, and the expected cost of unwinding

any related hedging transactions. Unless the factors described in the next risk factor change significantly in your favor, any such secondary

market price for the securities will likely be less than the original offering price.

If Wells Fargo Securities or any of its affiliates

makes a secondary market in the securities at any time up to the Issue Date or during the three-month period following the Issue Date,

the secondary market price offered by Wells Fargo Securities or any of its affiliates will be increased by an amount reflecting a portion

of the costs associated with selling, structuring, hedging and issuing the securities that are included in the original offering price.

Because this portion of the costs is not fully deducted upon issuance, any secondary market price offered by Wells Fargo Securities or

any of its affiliates during this period will be higher than it would be if it were based solely on Wells Fargo Securities’ proprietary

pricing models less the bid-offer spread and hedging unwind costs described above. The amount of this increase in the secondary market

price will decline steadily to zero over this three-month period. If you hold the securities through an account at Wells Fargo Securities

or one of its affiliates, we expect that this increase will also be reflected in the value indicated for the securities on your brokerage

account statement. If you hold your securities through an account at a broker-dealer other than Wells Fargo Securities or any of its

affiliates, the value of the securities on your brokerage account statement may be different than if you held your securities at Wells

Fargo Securities or any of its affiliates.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

The Value Of The Securities Prior To Maturity

Or Automatic Call Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.

The value of the securities prior to maturity

or automatic call will be affected by the then-current price of each Fund, interest rates at that time and a number of other factors,

some of which are interrelated in complex ways. The effect of any one factor may be offset or magnified by the effect of another factor.

The following factors, among others, are expected to affect the value of the securities: performance of the Funds; volatility of the

Funds; correlation among the Funds; economic and other conditions generally; interest rates; dividend yields on each Fund or the securities

held by each Fund; our credit ratings or credit spreads; and time remaining to maturity. When we refer to the “value” of

your security, we mean the value you could receive for your security if you are able to sell it in the open market before the Stated

Maturity Date.

The value of the securities will also be limited

by the automatic call feature because if the securities are automatically called, you will not receive the Contingent Coupon Payments

that would have accrued, if any, had the securities been called on a later Calculation Day or held until the Stated Maturity Date. You

should understand that the impact of one of the factors specified above, such as a change in interest rates, may offset some or all of

any change in the value of the securities attributable to another factor, such as a change in the price of any or all of the Funds. Because

numerous factors are expected to affect the value of the securities, changes in the prices of the Funds may not result in a comparable

change in the value of the securities.

The Securities Will Not Be Listed On Any Securities

Exchange And We Do Not Expect A Trading Market For The Securities To Develop.

The securities will not be listed on any securities

exchange. Although Wells Fargo Securities and/or its affiliates may purchase the securities from holders, they are not obligated to do

so and are not required to make a market for the securities. There can be no assurance that a secondary market will develop for the securities.

Because we do not expect that any market makers will participate in a secondary market for the securities, the price at which you may

be able to sell your securities is likely to depend on the price, if any, at which Wells Fargo Securities and/or its affiliates are willing

to buy your securities.

If a secondary market does exist, it may be limited.

Accordingly, there may be a limited number of buyers if you decide to sell your securities prior to maturity or automatic call. This

may affect the price you receive upon such sale. Consequently, you should be willing to hold the securities to maturity or automatic

call.

Risks Relating To The Funds

An Investment In The Securities Is Subject

To Risks Associated With Investing In Stocks In The Relevant Sectors.

The stocks included in the Underlying Index for

a Fund and that are generally tracked by such Fund are stocks of companies whose primary business is directly associated with a particular

sector. Because the value of the securities is linked to the performance of the Lowest Performing Fund, an investment in the securities

exposes investors to risks associated with investments in the stocks of companies in the relevant sectors. The value of the securities

may be subject to greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting

the relevant sector than a different investment linked to a more broadly diversified group of underlying stocks. The factors described

in the bullets below for each Fund could have an adverse effect on the Closing Price of the applicable Fund and, therefore, on the value

of the securities.

| · | The

XLK: Market or economic factors impacting technology companies and companies that rely

heavily on technological advances could have a major effect on the securities held by the

XLK. The value of stocks of technology companies and companies that rely heavily on technology

is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence,

government regulation and competition, both domestically and internationally, including competition

from foreign competitors with lower production costs. Stocks of technology companies and

companies that rely heavily on technology, especially those of smaller, less-seasoned companies,

tend to be more volatile than the overall market. Technology companies are heavily dependent

on patent and intellectual property rights, the loss or impairment of which may adversely

affect profitability. Additionally, companies in the technology sector may face dramatic

and often unpredictable changes in growth rates and competition for the services of qualified

personnel. |

| · | The

XLE: Energy companies develop and produce crude oil and natural gas and/or provide drilling

and other energy resources production and distribution related services. Stock prices for

these types of companies are mainly affected by the business, financial and operating conditions

of the particular company, as well as changes in prices for oil, gas and other types of fuels,

which in turn largely depend on supply and demand for various energy products and services.

Some of the factors that may influence supply and demand for energy products and services

include: general economic conditions and growth rates; weather conditions; the cost of exploring

for, producing and delivering oil and gas; technological advances affecting energy efficiency

and energy consumption; the ability of the Organization of Petroleum Exporting Countries

(OPEC) to set and maintain |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

production levels of oil; currency

fluctuations; inflation; natural disasters; civil unrest, acts of sabotage or terrorism; and other regional or global events. The profitability

of energy companies may also be adversely affected by existing and future laws, regulations, government actions and other legal requirements

relating to protection of the environment, health and safety matters and others that may increase the costs of conducting their business

or may reduce or delay available business opportunities. Increased supply or weak demand for energy products and services, as well as

various developments leading to higher costs of doing business or missed business opportunities, would adversely impact the performance

of companies in the energy sector.

| · | The

XLV: Companies in the health care sector are heavily dependent on patent protection

and the process of obtaining patent approval can be long and costly. The expiration of patents

may adversely affect the profitability of the companies. Health care companies are also subject

to extensive litigation based on product liability and similar claims. Companies in the health

care sector are heavily dependent on obtaining and defending patents, which may be time consuming

and costly, and the expiration of patents may also adversely affect the profitability of

these companies. Health care companies are also subject to extensive litigation based on

product liability and similar claims. In addition, their products can become obsolete due

to industry innovation, changes in technologies or other market developments. As a result

of these factors, the value of the notes may be subject to greater volatility and be more

adversely affected by economic, political, or regulatory events relating to the health care

sector. |

In addition, the Funds are classified as “non-diversified.”

A non-diversified fund generally may invest a larger percentage of its assets in the securities of a smaller number of companies. As

a result, the Funds may be more susceptible to the risks associated with these particular companies, or to a single economic, political

or regulatory occurrence affecting these companies.

Each Fund May Not Be Representative Of An Investment In Its Sector.

Each Fund tracks companies in a particular sector

of the U.S. equity market. However, the Funds do not represent a direct investment in their respective sectors. Each Fund consists of

securities of companies whose primary lines of business are directly associated with its sector. As a result, the Fund Closing Price

of a Fund will be influenced by a variety of economic, financial and other factors affecting companies in the relevant sector, some of

which may be unrelated to the market and other conditions applicable to such sector. As a result, a Fund may not perfectly correlate

with the performance in its sector and the Fund Closing Price of such Fund could decrease even if the performance of its sector as a

whole increases.

Anti-dilution Adjustments Relating To The

Shares Of A Fund Do Not Address Every Event That Could Affect Such Shares.

An Adjustment Factor, as described in the accompanying

product supplement, will be used to determine the Fund Closing Price of each Fund. The Adjustment Factor of a Fund will be adjusted by

the calculation agent for certain events affecting the shares of such Fund. However, the calculation agent will not make an adjustment

for every event that could affect such shares. If an event occurs that does not require the calculation agent to adjust the Adjustment

Factor of a Fund, the value of the securities may be adversely affected.

The Performance Of A Fund May Not Correlate

With The Performance Of Its Underlying Index As Well As The Net Asset Value Per Share Of That Fund, Especially During Periods Of Market

Volatility.

Although a Fund is designed to track the performance

of its Underlying Index, the performance of a Fund and that of its Underlying Index generally will vary due to, for example, transaction

costs, management fees, certain corporate actions, and timing variances. Moreover, it is also possible that the performance of a Fund

may not fully replicate or may, in certain circumstances, diverge significantly from the performance of its Underlying Index. This could

be due to, for example, a Fund not holding all or substantially all of the underlying assets included in its Underlying Index and/or

holding assets that are not included in its Underlying Index, the temporary unavailability of certain securities in the secondary market,

the performance of any derivative instruments held by that Fund, differences in trading hours between that Fund (or the underlying assets

held by that Fund) and its Underlying Index, or due to other circumstances. This variation in performance is called the “tracking

error,” and, at times, the tracking error may be significant.

In addition, because the shares of a Fund are

traded on a securities exchange and are subject to market supply and investor demand, the market price of one share of a Fund may differ

from its net asset value per share; shares of a Fund may trade at, above, or below its net asset value per share.

During periods of market volatility, securities

held by a Fund may be unavailable in the secondary market, market participants may be unable to calculate accurately the net asset value

per share of such Fund and the liquidity of such Fund may be adversely affected. This kind of market volatility may also disrupt the

ability of market participants to create and redeem shares of such Fund. Further, market volatility may adversely affect, sometimes materially,

the prices at which market participants are willing to buy and sell shares of such Fund. As a result, under these circumstances, the

market value of shares of such Fund may vary substantially from the net asset value per share of such Fund.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

For the foregoing reasons, the performance of

a Fund may not match the performance of its Underlying Index over the same period. Because of this variance, the return on the securities,

to the extent dependent on the performance of a Fund, may not be the same as an investment directly in the securities, commodities, or

other assets included in its Underlying Index or the same as a debt security with a return linked to the performance of its Underlying

Index.

Risks Relating To Conflicts Of Interest

We Or One Of Our Affiliates Will Be The Calculation

Agent And, As A Result, Potential Conflicts Of Interest Could Arise.

We or one of our affiliates will be the calculation

agent for purposes of determining, among other things, the Starting Price and the Fund Closing Price of each Fund on each Calculation

Day, calculating the Contingent Coupon Payments, if payable, and the Maturity Payment Amount, determining whether a market disruption

event has occurred on a scheduled Calculation Day, which may result in postponement of that Calculation Day; determining the Fund Closing

Price of a Fund if a Calculation Day is postponed to the last day to which it may be postponed and a market disruption event occurs on

that day; if publication of a Fund is discontinued, selecting a successor or, if no successor is available, determining the Fund Closing

Price of such Fund on the relevant Calculation Day; and determining whether to adjust the Fund Closing Price of a Fund on the relevant

Calculation Day in the event of certain changes in or modifications to such Fund or its Underlying Index. Although the calculation agent

will exercise its judgment in good faith when performing its functions, potential conflicts of interest may exist between the calculation

agent and you.

Our Economic Interests And Those Of Any Dealer

Participating In The Offering Of Securities Will Potentially Be Adverse To Your Interests.

You should be aware of the following ways in

which our economic interests and those of any dealer participating in the distribution of the securities, which we refer to as a “participating

dealer,” will potentially be adverse to your interests as an investor in the securities. In engaging in certain of the activities

described below, our affiliates or any participating dealer or its affiliates may take actions that may adversely affect the value of

and your return on the securities, and in so doing they will have no obligation to consider your interests as an investor in the securities.

Our affiliates or any participating dealer or its affiliates may realize a profit from these activities even if investors do not receive

a favorable investment return on the securities.

| · | Research

reports by our affiliates or any participating dealer or its affiliates may be inconsistent

with an investment in the securities and may adversely affect the price of a Fund. |

| · | Business

activities of our affiliates or any participating dealer or its affiliates with the companies

whose securities are held by a Fund may adversely affect the price of such Fund. |

| · | Hedging

activities by our affiliates or any participating dealer or its affiliates may adversely

affect the price of a Fund. |

| · | Trading

activities by our affiliates or any participating dealer or its affiliates may adversely

affect the price of a Fund. |

| · | A

participating dealer or its affiliates may realize hedging profits projected by its proprietary

pricing models in addition to any selling concession and/or any fee, creating a further incentive

for the participating dealer to sell the securities to you. |

Risks Relating To Tax

The U.S. Federal Tax Consequences Of An Investment

In The Securities Are Unclear.

There is no direct legal authority regarding

the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the U.S. Internal Revenue Service

(the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court

might not agree with the treatment of the securities as income-bearing prepaid cash-settled derivative contracts. If the IRS were successful

in asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities might

be materially and adversely affected. As described under “Material U.S. Federal Income Tax Consequences” in the underlying

supplement, the U.S. Treasury Department and the IRS released a notice requesting comments on various issues regarding the U.S. federal

income tax treatment of “prepaid forward contracts” and similar instruments. Any Treasury regulations or other guidance promulgated

after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, including

the character and timing of income or loss and the degree, if any, to which income realized by non-U.S. persons should be subject to

withholding tax, possibly with retroactive effect.

Both U.S. and non-U.S. persons considering an

investment in the securities should review carefully “Summary of U.S. Federal Income Tax Consequences” in this pricing supplement

and “Material U.S. Federal Income Tax Consequences” in the underlying supplement and consult their tax advisors regarding

the U.S. federal tax consequences of an investment in the securities (including possible alternative treatments and the issues presented

by the notice), as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

There Can Be No Assurance That The Canadian

Federal Income Tax Consequences Of An Investment In The Securities Will Not Change In The Future.

There can be no assurance that Canadian federal

income tax laws, the judicial interpretation thereof, or the administrative policies and assessing practices of the Canada Revenue Agency

will not be changed in a manner that adversely affects investors. For a discussion of the Canadian federal income tax consequences of

investing in the securities, please read the section entitled “Certain Canadian Federal Income Tax Considerations” in this

pricing supplement as well as the section entitled “Material Income Tax Consequences—Canadian Taxation” in the accompanying

prospectus. You should consult your tax advisor with respect to your own particular situation.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

If the securities are automatically called:

If the securities are automatically called prior

to maturity, you will receive the face amount of your securities plus a final Contingent Coupon Payment on the Call Payment Date. In

the event the securities are automatically called, your total return on the securities will equal any Contingent Coupon Payments received

prior to the Call Payment Date and the Contingent Coupon Payment received on the Call Payment Date.

If the securities are not automatically called:

If the securities are not automatically called

prior to maturity, the following table illustrates, for a range of hypothetical Performance Factors of the Lowest Performing Fund on

the Final Calculation Day, the hypothetical Maturity Payment Amount payable at maturity per security (excluding the final Contingent

Coupon Payment, if any). The Performance Factor of the Lowest Performing Fund on the Final Calculation Day is its Ending Price expressed

as a percentage of its Starting Price (i.e., its Ending Price divided by its Starting Price).

| |

Hypothetical

Performance Factor of

Lowest Performing Fund

on Final Calculation Day |

|

Hypothetical Maturity

Payment

Amount Per Security |

| |

200.00% |

|

$1,000.00 |

| |

175.00% |

|

$1,000.00 |

| |

150.00% |

|

$1,000.00 |

| |

125.00% |

|

$1,000.00 |

| |

100.00% |

|

$1,000.00 |

| |

85.00% |

|

$1,000.00 |

| |

70.00% |

|

$1,000.00 |

| |

69.00% |

|

$690.00 |

| |

50.00% |

|

$500.00 |

| |

40.00% |

|

$400.00 |

| |

25.00% |

|

$250.00 |

| |

0.00% |

|

$0.00 |

The above figures do not take into account Contingent

Coupon Payments, if any, received during the term of the securities. As evidenced above, in no event will you have a positive return

based solely on the Maturity Payment Amount; any positive return will be based solely on the Contingent Coupon Payments, if any, received

during the term of the securities.

The above figures are for purposes of illustration

only and may have been rounded for ease of analysis. If the securities are not automatically called prior to maturity, the actual amount

you will receive at maturity will depend on the actual Starting Price, Downside Threshold Price

and Ending Price of the Lowest Performing Fund. The performance of the better performing Funds is not relevant to your return

on the securities.

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Lowest Performing of the Technology Select Sector SPDR® Fund, the

Energy Select Sector SPDR® Fund and the Health Care Select Sector SPDR® Fund due March

1, 2027 |

|

| Hypothetical

Contingent Coupon Payments |

Set forth below are examples that illustrate

how to determine whether a Contingent Coupon Payment will be paid and whether the securities will be automatically called, if applicable,

on a Coupon Payment Date prior to maturity. The examples do not reflect any specific Coupon Payment Date. The following examples assume

that the securities are subject to automatic call on the applicable Call Observation Date. The first Call Observation Date is approximately

six months after the Issue Date. The following examples reflect the Contingent Coupon Rate of 10.50% per annum and assume the hypothetical

Starting Price, Coupon Threshold Price and Fund Closing Prices for each Fund indicated in the examples. The terms used for purposes of

these hypothetical examples do not represent any actual Starting Price or Coupon Threshold Price. The hypothetical Starting Price of

$100.00 for each Fund has been chosen for illustrative purposes only and does not represent the actual Starting Price for any Fund. The

actual Starting Price and Coupon Threshold Price for each Fund are set forth under “Terms of the Securities” above. For historical

data regarding the actual Closing Prices of the Funds, see the historical information set forth under the section titled “The Funds”

below. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis.

Example 1. The Fund Closing Price of

the Lowest Performing Fund on the relevant Calculation Day is greater than or equal to its Coupon Threshold Price and less than its Starting

Price. As a result, investors receive a Contingent Coupon Payment on the applicable Coupon Payment Date and the securities are not automatically

called.

| |

XLK |

XLE |

XLV |

| Hypothetical

Starting Price: |

$100.00 |

$100.00 |

$100.00 |

| Hypothetical

Fund Closing Price on relevant Calculation Day: |

$90.00 |

$95.00 |

$80.00 |

| Hypothetical

Coupon Threshold Price: |

$70.00 |

$70.00 |

$70.00 |

| Performance

Factor (Fund Closing Price on relevant Calculation Day divided by Starting Price): |

90.00% |

95.00% |

80.00% |

Step 1: Determine which Fund