Tyson Foods, Hershey and Campbell Soup crowd into the market for

dinner in a box

By Kelsey Gee

Big-food companies are following startups into the meal-kit

market, hunting for new ways to wrest back profit on ingredients

that they already make.

Tyson Foods Inc., Campbell Soup Co. and Hershey Co. are working

with online couriers to challenge meal-kit companies that ship

parcels of ingredients and recipes to consumers looking for an

easier way to cook stir-fry or enchiladas at home.

These purveyors of packaged foods and commodity meats also hope

to stem a consumer shift away from packaged foods that is

benefiting startups such as Blue Apron and HelloFresh, which source

some ingredients directly from farmers. The arrival of these

deep-pocketed rivals and their cupboard of existing products could

crowd a nascent market already showing signs of strain.

At least a half dozen meal-delivery firms have closed or

restructured this year after struggling to recoup the costs of

rapidly growing a food business from scratch. Investors have spent

$177.5 million on meal- and grocery-delivery companies this year,

Dow Jones VentureSource data shows, less than half of the $403

million spent last year.

"There has been a mass rush of people hoping to find the Uber

for food," said Gregory Chang, an investor in Din, a company that

closed in October after 18 months of selling kits inspired by items

on the menus of popular San Francisco restaurants. "There are a lot

of points along the value chain where things could fall apart."

The market is still small. Only 3% of consumers surveyed in May

by market-research firm NPD Group had tried a meal kit. They cost

$10 on average, while many consumers make dinner for an average of

$4 a person.

But the barriers to entry are relatively low for big food

makers, which have been forced to change as they battle the

perception that their products are less fresh and of lower quality

than those offered by a new guard of natural and organic

brands.

The payoff from such a foray could be worthwhile as young

shoppers spend less at the grocery stores they rely on. A January

survey by research firm Technomic showed 54% of consumers inclined

to try meal kits anticipated they would cut back on grocery-store

spending.

"We don't want meal kits to continue to cut into sales," said

Cheryl Bersin, manager of emerging technologies and e-commerce at

ConAgra Foods Inc. Sales at the grocery retailers that generate

about 85% of ConAgra's sales have declined for three consecutive

years.

The Chicago maker of Chef Boyardee in June joined with Ahold

USA's online retailer Peapod to sell kits for Buffalo chicken

quinoa and zucchini noodle primavera. Both incorporate products

such as Hunt's canned tomatoes that ConAgra normally sells at

grocery stores. "Meal kits are a tactic in the strategy needed to

combat the bigger threat of e-commerce and online grocery," said

Diana Sheehan, a director at research firm Kantar Retail.

Hershey, with startup Chef'd, in September launched dessert kits

on Facebook Live, where some food-preparation videos have attracted

millions of views.

Tyson Foods launched kits through Amazon Fresh in September,

working its chicken and beef into tacos, stews and roasts. Tyson

sells a separate line of kits at some grocery and convenience

stores.

Campbell's is also using Peapod to deliver kits to make meals

like chicken pot pie out of its cream of chicken soup and Swanson

vegetable broth.

In a Hershey video, viewed roughly 850 times, executives are

shown unpacking chocolate chips, flour satchels and vanilla vials

from an orange Chef'd box to bake cookies.

"It could be extremely profitable because Tyson already has the

protein available in house," said John Anderson, head of

food-and-beverage research at Franklin Resources Inc.'s equity

investment group.

Dominik Richter, chief executive of Berlin-based meal-kit

pioneer HelloFresh, said he isn't worried big food companies will

edge him off the turf he helped create.

HelloFresh and its rivals like Blue Apron didn't exist six years

ago. Now, more than 150 companies compete in the $1.5 billion U.S.

market, says research firm Packaged Facts.

"It's always the best product that wins. We're not scared of

anyone else coming into this market," Mr. Richter said. HelloFresh

is on track for over $600 million in revenue this year, he said,

twice what it earned in 2015. But the company lost EUR71 million

($75 million) before interest and taxes in the first nine months of

2016, while spending quickly to build its customer base, according

to its investor Rocket Internet SE.

Blue Apron Chief Executive Matt Salzberg wouldn't say whether

his company was profitable or not. The U.S. market leader, Blue

Apron has struggled with ingredient shortages and workforce issues

that led it to cut ties with three different staffing agencies.

Some startups are hedging their bets by diversifying

distribution into supermarkets as well as courier services.

Whole Foods in October began to stock $20 Purple Carrot vegan

meal kits, previously available only by home delivery. Mark

Bittman, a food writer and Purple Carrot part owner, said he isn't

convinced yet that consumers will make a permanent habit of

meal-kit cooking, no matter the company.

"I've been predicting cooking would make a comeback for 30 years

and I've been wrong for 30 years," he said.

Write to Kelsey Gee at kelsey.gee@wsj.com

(END) Dow Jones Newswires

December 06, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

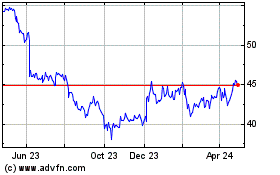

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Dec 2024 to Jan 2025

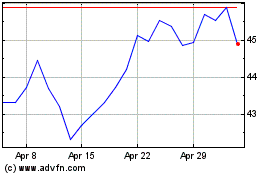

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jan 2024 to Jan 2025