Regulatory News:

Air Liquide (Paris:AI):

Key Figures

(in millions of euros)

Q1 2023

2023/2022 as published

2023/2022

comparable(a)

Group Revenue

7,174

+4.2%

+6.2%

of which Gas & Services

6,893

+4.6%

+6.7%

of which Engineering &

Construction

87

-19.0%

-18.6%

of which Global Markets &

Technologies

194

+2.4%

+2.8%

(a) Change excluding the currency, energy (natural gas and

electricity) and significant scope impacts, see reconciliation in

appendix.

Commenting on sales in the first quarter of 2023, François

Jackow, Chief Executive Officer of the Air Liquide Group,

stated:

“Air Liquide started 2023 with a very solid performance. In the

first quarter, growth was higher than in the fourth quarter and its

investment momentum remained strong.

Group sales increased by +6.2% on a comparable basis,

after growth of +4.5% in the fourth quarter. As published, sales

were up by +4.2% year-over-year, integrating in particular the

decline in energy prices, whose variations are passed on to Large

Industries customers. Revenue reached 7.2 billion euros,

including 6.9 billion euros for the Gas & Services

business.

The Gas & Services business, which represents 96% of

the Group’s revenue, was up +6.7% on a comparable basis and

that of Global Markets & Technologies was up +2.8%, with

divestitures impacting growth this quarter. Sales to third-party

Engineering & Construction customers decreased by

-18.6%; the outlook remaining solid with a high level of internal

and external order intake.

Within Gas & Services, all our geographies posted comparable

growth, in particular the Americas. By business line, Industrial

Merchant and Electronics remained on a strong upward

trend; growth in Healthcare accelerated and Large

Industries recovered compared to the fourth quarter in a more

favorable energy price environment in Europe.

In line with the priorities of its strategic plan,

ADVANCE, Air Liquide continued to improve its operational

performance. The Group generated significant efficiencies of 91

million euros, up +18.1% year-over-year despite an inflationary

environment unfavorable to savings on purchases, and continued

dynamic management of its business portfolio. The Group’s ability

to create value allows it to adjust its prices in Industrial

Merchant (+13%) while preserving sales volumes. The cashflow

progressed by +14.3% in the first quarter.

Investment decisions amounted to close to 800 million

euros. 12-month investment opportunities continued to

rise, reaching 3.4 billion euros. More than 40% of these

opportunities are related to the energy transition, with in

particular decarbonization projects in the United States.

In 2023, the Group will continue deployment of its ADVANCE

strategic plan. Air Liquide is confident in its ability to further

increase its operating margin and to deliver recurring net profit

growth, at constant exchange rates(1)."

(1) Operating margin excluding energy passthrough impact. Net

profit recurring excluding exceptional and significant transactions

that have no impact on the operating income recurring.

Highlights of the 1st quarter

2023

- Sustainable development

- Signature by Air Liquide and Sasol

of Power Purchase Agreements (PPA) to secure a total capacity of

480 MW of renewable power to supply Sasol’s Secunda site, in

South Africa, where Air Liquide operates the biggest oxygen

production site in the world. For Air Liquide, this will

represent an annual reduction in its CO2 emissions of more than

850,000 tonnes that will notably contribute to the targeted

reduction by 30% to 40% of the CO2 emissions associated with oxygen

production by 2031.

- Appointment of Diana Schillag,

member of the Executive Committee in charge of Healthcare

activities, Group Procurement and Efficiency Programs, as Head of

Sustainable Development and the Group’s Societal Programs,

including the Air Liquide Foundation in addition to her current

role. Diana Schillag will take up her new responsibilities on May

4, the day after the Group General Meeting, replacing Fabienne

Lecorvaisier, who will leave the Group on that date to focus on

non-executive mandates.

- Annual publication of the Air Liquide

Sustainability Report, highlighting progress in this area as

well as additional objectives, in particular for scope 3 and

biodiversity.

- Inclusion in the Dow Jones Sustainability

Europe Index, an index established by S&P Global that assesses

the progress of companies in terms of sustainable development.

- Hydrogen

- Decision with TotalEnergies to create

a 50/50 joint venture to develop a network of more than 100

hydrogen refueling stations for trucks on major European

highways. This initiative will facilitate access to hydrogen,

making it possible to develop its use in the transportation of

goods and contribute to strengthening the hydrogen sector.

- Selection of Air Liquide’s autothermal

reforming (ATR) technology for a demonstration project, owned and

operated by INPEX CORPORATION, for the large-scale production of

hydrogen and low-carbon ammonia, a first in Japan.

- Launch of a project for an innovative

industrial-scale ammonia cracking pilot plant in the port of

Antwerp, Belgium. Transformed into ammonia, hydrogen can be

easily transported over long distances. Equipped with innovative

technology, this unit will enable the conversion of ammonia into

hydrogen (H2), with an optimized carbon footprint.

- Industry & Decarbonization

- Investment of around 60 million

euros to modernize two Air Separation Units (ASU) operated by

Air Liquide in the Tianjin industrial area, China, as

part of the renewal of a long-term contract with YLC, a

subsidiary of the Bohua group. The electrification of these two

ASUs will prevent the emission of 370,000 tonnes of CO2 per year,

which is comparable to the emissions related to the electricity

consumption of more than one million Chinese households.

- Decarbonization and reduction of

energy consumption: as part of a long-term contract,

implementation of an innovative solution to support the conversion

of the Verallia plant in Pescia, Italy, from traditional combustion

to optimized oxycombustion on the occasion of the

construction of a new glass furnace on the site.

- Announcement of the signature of 52

new long-term contracts for on-site production in its Industrial

Merchant business line in 2022, following a record number of 48

new contracts in 2021 and continuous progress for more than five

years.

- Corporate

- Early bond redemption, for a total of

382 million US dollars, at the end of a Tender Offering process

for two series of US dollar bonds maturing in 2026 for the first

and 2046 for the second. This transaction enables the Group to

reinforce its financing structure.

Group revenue totaled 7,174 million euros in the

1st quarter of 2023, up a strong +6.2% on a comparable

basis. As published Group sales were up +4.2% with an

energy impact (-2.0%) negative for the first time in 2 years and

neutral currency (-0.1%) and significant scope (+0.1%) impacts.

Gas & Services revenue reached 6,893 million

euros, up sharply by +6.7% on a comparable basis. As

published revenue for Gas & Services were up

+4.6% in the 1st quarter of 2023, with a negative energy

impact of -2.1% and neutral currency (-0.1%) and significant scope

(+0.1%) impacts.

- Gas & Services revenue in the Americas region

totaled 2,629 million euros in the 1st quarter of

2023, showing a dynamic comparable growth of +9.2%.

Industrial Merchant sales were up sharply by +13.2%, supported by

price increases that remained high (+9.9%) and volumes which are

back to positive. The increase in prices in proximity care in the

United States and the dynamism of Home Healthcare in Canada were

the main contributors to the strong growth in Healthcare revenue

(+11.2%). Large Industries sales were down -3.0% impacted by

customer turnarounds. Lastly, Electronics sales remained stable

(-1.0%) this quarter, with no new unit start-ups.

- Revenue in Europe was up +5.5% during the 1st

quarter of 2023 and reached 2,639 million euros. In

Industrial Merchant, the strong increase in sales of +22.1%

benefited from price increases that remained very high at +21.8%.

Healthcare sales were up +5.7%, driven by strong development of

diabetes treatment in Home Healthcare and higher medical gas prices

in response to inflation. Strongly impacted by high energy prices

in the 2nd half of 2022, activity in Large Industries saw a rebound

in the 1st quarter of 2023: lower energy prices supported sales

down by -4.1%, a sharp upturn following a -18% decline in the 4th

quarter of 2022.

- Sales in Asia-Pacific were up +4.8% on a

comparable basis in the 1st quarter of 2023 and amounted to

1,385 million euros. They were supported by price

increases of +9.9% in Industrial Merchant, leading to sales rising

by +11.0%, and by the continued strong growth in revenue in the

Electronics business (+10.5%). In Large Industries, sales were down

by -5.1%, impacted in particular by weak demand and customer

turnarounds.

- Revenue in the Middle East and Africa reached 240

million euros, up +4.6%. Industrial Merchant sales were

down slightly, impacted by divestitures in the Middle East in 2022.

Large Industries revenue grew strongly in Egypt and South Africa.

The Home Healthcare business also posted strong growth.

While the dynamism of the Industrial Merchant and Electronics

activities continued in the 1st quarter of 2023, Healthcare became

the 3rd growth driver. Industrial Merchant revenue continued

to grow strongly (+14.8%), supported by a high price effect

of +12.9% and growing volumes. Large Industries sales, down

-3.6% in a context of weak demand, showed a strong

sequential improvement linked to the recovery of activity in Europe

in a more favorable environment of reduced energy prices.

Electronics revenue posted dynamic growth (+10.4%),

driven in particular by the ramp-up of carrier gas units, dynamic

growth in sales of specialty materials, and strong Equipment &

Installations sales in all regions. Lastly, Healthcare

revenue growth accelerated (+7.7%) in the 1st quarter, due

especially to the increase in medical gas prices in an inflationary

context and the dynamism of Home Healthcare, particularly in Europe

and Canada.

Consolidated revenue from Engineering & Construction

totaled 87 million euros in the 1st quarter of 2023, down

-18.6% compared to the high sales in the 1st quarter of

2022. Order intake amounted to 366 million euros, up sharply

(+39%) compared to the 1st quarter of 2022.

Sales in Global Markets & Technologies totaled 194

million euros in the 1st quarter, up +2.8%. Organic

growth reached +16.0%, excluding the divestiture of the

biogas distribution for mobility and the manufacture of small-scale

cryogenic vessels businesses. Order intake for Group projects and

third-party customers amounted to 240 million euros, up +12%

compared to 2022.

In the 1st quarter of 2023, industrial and financial

investment decisions amounted to 0.8 billion

euros. The investment backlog stood at a very high

level of 3.5 billion euros, stable compared to the 4th

quarter of 2022.

The additional contribution to sales of unit start-ups

and ramp-ups totaled 66 million euros in the 1st quarter of

2023. Over the year, it is expected to be between 300 and 330

million euros.

The 12-month portfolio of investment opportunities

increased to the high level of 3.4 billion euros at the end

of March.

In an inflationary environment, the price effect in the

Industrial Merchant activity remained very high, in the 1st

quarter of 2023, at +12.9%. Efficiencies(1) reached

91 million euros, up +18.1% compared to the 1st

quarter of 2022. Portfolio management continued in the 1st

quarter with 2 acquisitions in Industrial Merchant in the

United States and Italy, and the divestiture of Large Industries

activities in Trinidad and Tobago.

Cash flow from operating activities before changes in net

working capital amounted to 1,600 million euros, up

sharply by +14.3% compared to the 1st quarter of 2022 and by

+12.3% excluding currency impact and an exceptional

indemnity payment received in the 1st quarter. In particular, cash

flow from operating activities ensures the financing of

industrial investments, which amounted to 815 million

euros.

In the 1st quarter of 2023, the Group was active in the field of

energy transition in order to reduce CO2 emissions from

its own assets and those of its customers. It includes in

particular the electrification of several ASUs in China, the

signing of major renewable energy power purchase agreements

in South Africa and the implementation of an oxy-combustion

solution for a customer in the glass industry. In addition, the

Group announced 2 projects in the hydrogen value chain:

upstream, the construction of an industrial-scale pilot ammonia

cracking unit, and downstream, the creation of a joint venture

with TotalEnergies to develop a network of hydrogen stations

in Europe. Finally, an additional “scope 3” objective and

new biodiversity commitments were also announced in the 1st

quarter.

Analysis of 1st quarter 2023 revenue

Unless otherwise stated, all variations in revenue outlined

below are on a comparable basis, excluding currency, energy

(natural gas and electricity) and significant scope impacts.

REVENUE

Revenue

(in millions of euros)

Q1 2022

Q1 2023

2023/2022 published

change

2023/2022 comparable

change

Gas & Services

6,590

6,893

+4.6%

+6.7%

Engineering & Construction

108

87

-19.0%

-18.6%

Global Markets & Technologies

189

194

+2.4%

+2.8%

TOTAL REVENUE

6,887

7,174

+4.2%

+6.2%

Group

Group revenue totaled 7,174 million euros in the

1st quarter of 2023, up a strong +6.2% on a comparable

basis. Global Markets & Technologies sales were up

+2.8% and showed an organic growth of +16.0%, excluding the

impact of divestitures. Engineering & Construction

revenue was down -18.6% compared to a high level in the 1st

quarter of 2022. As published Group sales were up

+4.2% with an energy impact (-2.0%) negative for the first

time in 2 years and neutral currency (-0.1%) and significant scope

(+0.1%) impacts.

Gas & Services

Gas & Services revenue reached 6,893 million

euros, up sharply by +6.7% on a comparable basis.

While the dynamism of the Industrial Merchant and Electronics

activities continued in the 1st quarter of 2023, Healthcare became

the 3rd growth driver. Industrial Merchant revenue continued

to grow strongly (+14.8%), supported by a high price effect

of +12.9% and growing volumes. Large Industries sales, down

-3.6% in a context of weak demand, showed a strong

sequential improvement linked to the recovery of activity in Europe

in a more favorable environment of reduced energy prices.

Electronics revenue posted dynamic growth (+10.4%),

driven in particular by the ramp-up of carrier gas units, dynamic

growth in sales of specialty materials, and strong Equipment &

Installations sales in all regions. Lastly, Healthcare

revenue growth accelerated (+7.7%) in the 1st quarter, due

especially to the increase in medical gas prices in an inflationary

context and the dynamism of Home Healthcare, particularly in Europe

and Canada.

As published revenue for Gas & Services were

up +4.6% in the 1st quarter of 2023, with a negative energy

impact of -2.1% and neutral currency (-0.1%) and significant scope

(+0.1%) impacts.

Revenue by geography and business

line

(in millions of euros)

Q1 2022

Q1 2023

2023/2022 published

change

2023/2022 comparable

change

Americas

2,331

2,629

+12.8%

+9.2%

Europe

2,718

2,639

-2.9%

+5.5%

Asia-Pacific

1,340

1,385

+3.4%

+4.8%

Middle East & Africa

201

240

+19.4%

+4.6%

GAS & SERVICES REVENUE

6,590

6,893

+4.6%

+6.7%

Large Industries

2,413

2,202

-8.8%

-3.6%

Industrial Merchant

2,638

3,038

+15.2%

+14.8%

Healthcare

955

1,016

+6.4%

+7.7%

Electronics

584

637

+9.0%

+10.4%

Americas

Gas & Services revenue in the Americas region totaled

2,629 million euros in the 1st quarter of 2023,

showing a dynamic growth of +9.2%. Industrial Merchant sales

were up sharply by +13.2%, supported by price increases that

remained high (+9.9%) and volumes which are back to positive. The

increase in prices in proximity care in the United States and the

dynamism of Home Healthcare in Canada were the main contributors to

the strong growth in Healthcare revenue (+11.2%). Large Industries

sales were down -3.0% impacted by customer turnarounds. Lastly,

Electronics sales remained stable (-1.0%) this quarter, with no new

unit start-ups.

Americas Gas & Services Q1 2023 Revenue

- Revenue in Large Industries was down -3.0%,

impacted by customer turnarounds, especially in air gases in Mexico

and in hydrogen in the United States. Oxygen volumes increased

sequentially on the US Gulf Coast, supported in particular by the

commissioning of a new Air Separation Unit. Sales of cogeneration

units were also up in the United States.

- In Industrial Merchant, the strong increase in sales

(+13.2%) was supported by price increases that

remained high (+9.9%) in an inflationary context, and by

volumes that are once again increasing (>+3%) for hardgoods,

bulk or cylinders. Volumes were up in most sectors, notably

Manufacturing, Construction, Energy and Food.

- Sales growth in Healthcare accelerated to +11.2%

in the 1st quarter of 2023. Price increases in proximity care in

the United States, the dynamism of Home Healthcare in Canada,

particularly for the treatment of sleep apnea, and the development

of the Medical Gases and Home Healthcare businesses in Latin

America were the drivers of this strong growth.

- Revenue from Electronics (-1.0%) was stable in

the 1st quarter, with no additional contribution from new carrier

gas production units. High Equipment & Installations sales

offset lower volumes of specialty and advanced materials.

Europe

Revenue in Europe was up +5.5% during the 1st quarter of

2023 and reached 2,639 million euros. In Industrial

Merchant, the strong increase in sales of +22.1% benefited from

price increases that remained very high at +21.8%. Healthcare sales

were up +5.7%, driven by strong development of diabetes treatment

in Home Healthcare and higher medical gas prices in response to

inflation. Strongly impacted by high energy prices in the 2nd half

of 2022, activity in Large Industries saw a rebound in the 1st

quarter of 2023: lower energy prices supported sales down by -4.1%,

a sharp upturn following a -18% decline in the 4th quarter of

2022.

Europe Gas & Services Q1 2023 Revenue

- In the 1st quarter of 2023, revenue in Large Industries

declined -4.1%, a strong improvement compared to a decrease

of -18% in the 4th quarter of 2022. In a context of declining

energy prices, the beginning of the year was marked by stronger

demand, particularly from customers in Chemicals. Hydrogen volumes

saw a clear improvement compared to the 4th quarter of 2022,

especially in Benelux and Germany. Sales in the quarter also

benefited from the start-up of a new Air Separation Unit in

Poland.

- The Industrial Merchant business line posted extremely

strong sales growth, +22.1%, supported by price

increases that remained very high, at +21.8%, in an

inflationary context. Volumes remained resilient, especially those

of packaged gases. Automotive and Metallurgy were the main markets

that supported the increase in volumes this quarter.

- Sales growth in the Healthcare business increased by

+5.7%. Diabetes treatment was the first contributor to the

strong growth in Home Healthcare sales, followed by sleep apnea.

Growth in the Medical Gases revenue was supported by rising prices

in an inflationary context. The development of sales of specialty

ingredients remained dynamic.

Europe

- Air Liquide will implement for Verallia, the European

leader and the world’s third largest producer of glass packaging

for beverages and food products, a customized solution allowing

to reduce CO2 emissions and energy consumption. The Group is

thus mobilizing its innovation capabilities and its know-how to

accompany the conversion of Verallia’s plant in Pescia, Italy, from

a traditional combustion process to an optimized

oxy-combustion on the occasion of the construction of a new

furnace on the site. Air Liquide will supply the oxygen to replace

the air usually injected into the furnace, as well as its HeatOxTM

proprietary technology to recover the heat emitted by the glass

furnace.

- Air Liquide announces the construction of an industrial

scale ammonia (NH3) cracking pilot plant in the port of

Antwerp, Belgium. When transformed into ammonia, hydrogen

can be easily transported over long distances. Using innovative

technology, this plant will make it possible to convert, with an

optimized carbon footprint, ammonia into hydrogen. With this

cracking technology, Air Liquide will further contribute to the

development of hydrogen as a key enabler of the energy

transition.

Asia-Pacific

Sales in Asia-Pacific were up +4.8% in the 1st quarter of

2023 and amounted to 1,385 million euros. They were

supported by price increases of +9.9% in Industrial Merchant,

leading to sales rising by +11.0%, and by the continued strong

growth in revenue in the Electronics business (+10.5%). In Large

Industries, sales were down by -5.1%, impacted in particular by

weak demand and customer turnarounds.

Asia-Pacific Gas & Services Q1 2023 Revenue

- Large Industries sales were down by -5.1% in the

1st quarter. Demand remained low, particularly in air gases for the

Steel industry in Japan and in Chemicals. Sales were also impacted

by customer maintenance turnarounds in air gases, including one

extended stoppage in China.

- Industrial Merchant revenue was up sharply by

+11.0%. Price increases stood at a very high level of

+9.9%, and were sustained broadly in all countries. Volumes

were up slightly, particularly in the Automotive, Food, Energy and

Technology sectors. In China, following a start to the year marked

by a wave of covid-19 and the New Year period, volumes began to

rise again in March.

- Electronics posted a strong increase in revenue

(+10.5%). Sales of Carrier Gases, Equipment &

Installations and Specialty Materials posted double-digit growth.

The development of Carrier Gases was driven by the ramp-up of

several units and the high prices of helium. Sales of Specialty

Materials, which were up sharply, notably in Japan and Singapore,

benefited from the increase in rare gas prices. All countries

contributed to growth, particularly China and Singapore.

Asia-Pacific

- Air Liquide will invest around 60 million euros to

revamp two Air Separation Units (ASUs) the Group operates in

the Tianjin industrial basin, in China. This announcement

comes within the context of the renewal of a long-term industrial

gases supply contract with Tianjin Bohua Yongli Chemical Industry

Co., Ltd (“YLC”), a subsidiary of the Bohua Group. As part

of this modernization plan, Air Liquide will significantly

reduce the CO2 emissions linked to the production of oxygen

and other gases with the adaptation of these ASUs so they can run

on electrical power instead of steam. In addition, the Group

has signed a three-party Memorandum of Understanding with

YLC and the Tianjin Binhai District, notably to explore the

implementation of Carbon Capture, Use and Storage (CCUS)

solutions.

Middle East and Africa

Revenue in the Middle East and Africa reached 240 million

euros, up +4.6%. In Large Industries, air gases sales

saw strong growth in Egypt and South Africa. In Industrial

Merchant, sales were down slightly, with the +8.0% increase in

prices not fully offsetting the impact of the divestitures in the

Middle East in 2022; excluding this impact, growth was up +9%. The

strong increase in Home Healthcare sales was supported by the

development of diabetes treatment in Saudi Arabia and the

contribution of an acquisition in South Africa.

Middle East and Africa

- Air Liquide and Sasol have signed two Power Purchase

Agreements (PPA) with TotalEnergies and its partner

Mulilo for the long-term supply of a total capacity of 260

MW of renewable power to Sasol’s Secunda site, in South

Africa, where Air Liquide operates the biggest oxygen

production site in the world. This is the second set of PPAs signed

by Air Liquide and Sasol, after the PPAs announced in January with

Enel Green Power for a capacity of 220 MW. Together, these PPAs

represent a total of 480 MW of the joint commitment by Air

Liquide and Sasol to pursue the procurement of a total capacity

of 900 MW of renewable energy. These will significantly

contribute to the decarbonization of the Secunda site.

Engineering & Construction

Consolidated revenue from Engineering & Construction totaled

87 million euros in the 1st quarter of 2023, down

-18.6% compared to the high sales in the 1st quarter of

2022.

Order intake amounted to 366 million euros, up sharply

(+39%) compared to the 1st quarter of 2022. Orders for third-party

customers represented more than half of the total and included a

large hydrogen liquefier in the United States. Group projects

include Air Separation Units and an industrial scale pilot ammonia

cracking unit.

Global Markets & Technologies

Sales in Global Markets & Technologies totaled 194

million euros in the 1st quarter, up +2.8%. Organic

growth reached +16.0%, excluding the divestiture of the

biogas distribution for mobility and the manufacture of small-scale

cryogenic vessels businesses. Sales of technological equipment for

gas liquefaction (Turbo-Brayton), extreme cryogenics and

aeronautics saw steady growth. Revenue from hydrogen mobility was

up sharply, supported by the ramp-up of the hydrogen liquefier in

the United States, which started up in 2022.

Order intake for Group projects and third-party customers

amounted to 240 million euros, up +12% compared to

2022. This notably included more than 10 Turbo-Brayton LNG

reliquefaction units, hydrogen refueling stations and equipment for

the Electronics industry.

Global Markets &

Technologies

- Air Liquide and TotalEnergies announce their decision to

create an equally owned joint venture to develop a

network of hydrogen stations, geared towards heavy duty

vehicles on major European road corridors.

This initiative will help facilitate access to hydrogen,

enabling the development of its use for goods transportation and

further strengthening the hydrogen sector.

Investment cycle

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

In the 1st quarter of 2023, industrial and financial

investment decisions amounted to 0.8 billion

euros.

The industrial investment decisions for the 1st quarter

of 2023 amounted to 791 million euros. They include for the

Large Industries business in Europe the replacement of

several existing units reaching the end of their life cycle by a

new generation Air Separation Unit, improving the energy efficiency

and reducing CO2 emissions, with the ambition of eventually using a

significant share of renewable energy. Decisions for the

Electronics business relate in particular to an ultra pure

nitrogen unit in the United States. In Industrial Merchant,

five on-site nitrogen generators will be invested to support the

development of a customer’s activity in several provinces of

China.

Financial investment decisions amounted to 6

million euros in the 1st quarter of 2023 and included two

small acquisitions in Industrial Merchant in the United

States and Italy.

The investment backlog stood at a very high level of

3.5 billion euros, stable compared to the 4th quarter of

2022. Its composition is balanced between Large Industries and

Electronics. These investments should lead to a future contribution

to annual revenue of approximately 1.3 billion euros per

year after full ramp-up of the units.

START-UPS

Several units started-up in the 1st quarter of 2023,

mainly three large Air Separation Units for Large Industries in

Europe and the United States.

The additional contribution to sales of unit start-ups

and ramp-ups totaled 66 million euros in the 1st quarter of

2023. Over the year, it is expected to be between 300 and 330

million euros.

INVESTMENT OPPORTUNITIES

The 12-month portfolio of investment opportunities

increased to the high level of 3.4 billion euros at the end

of March. Projects related to the energy transition

account for more than 40% of the portfolio. Opportunities

are well balanced between America, supported by the Inflation

Reduction Act, Europe, where large electrolyzer and carbon capture

projects are at the advanced development phase, and Asia, with

projects for Large Industries and Electronics. The portfolio of

opportunities beyond 12 months includes other significant projects

related to the Inflation Reduction Act in the United States and the

energy transition in Europe and Canada.

Operating Performance

In an inflationary environment, the price effect in the

Industrial Merchant activity remained very high, in the 1st

quarter of 2023, at +12.9%, demonstrating the Group's

ability to transfer the sharp rise in costs. Prices also increased

in Large Industries, Electronics and Healthcare.

Efficiencies(2) reached 91 million euros in the

1st quarter, up +18.1% compared to the 1st quarter of 2022.

In a context of high inflation unfavorable to procurement

efficiencies, limiting the cost increase remained a priority and

increased focus was put on operational efficiencies. Thus,

industrial efficiencies posted a strong growth and

contributed to more than half of the total. They included in Large

Industries energy efficiency and in Industrial Merchant the

logistical gains linked to the optimization of deliveries of gas.

The pursuit of the global program of continuous improvement,

facilitating the replication of initiatives, also contributed to

efficiencies.

Portfolio management continued in the 1st quarter with

2 acquisitions in Industrial Merchant in the United States

and Italy, and the divestiture of Large Industries activities in

Trinidad and Tobago.

In terms of sustainable development, Air Liquide and

Sasol have signed long-term power purchase agreements for the

supply of a total capacity of 480 MW of renewable energy to the

Sasol site in Secunda in South Africa, which will represent for Air

Liquide an annual reduction in its CO2 emissions of more than

850,000 tonnes. The electrification of 2 ASUs in China will also

reduce CO2 emissions by 370,000 tons per year. Moreover, an

additional “scope 3” objective and new biodiversity

commitments were also announced in the 1st quarter.

Cash flow from operating activities before changes in net

working capital amounted to 1,600 million euros, up

sharply by +14.3% compared to the 1st quarter of 2022 and by

+12,3% excluding currency impact and an exceptional

indemnity payment received in the 1st quarter. In particular, cash

flow from operating activities ensures the financing of

industrial investments, which amounted to 815 million

euros.

Sustainable development

- Aware of the importance of contributing to the achievement of

carbon neutrality throughout its value chain and the importance of

its customer relationships, the Group made a pledge that 75% of

its 50 largest customers will have a stated carbon neutrality

commitment by 2025 and 100% by 2035.

- New biodiversity objectives:

- Air Liquide committed to submit a set of engagements towards

biodiversity conservation to Act4nature International.

- Air Liquide committed to develop and implement an aggregated

biodiversity KPI by 2025, allowing the Group to monitor and

communicate on its biodiversity performance. This will be defined

in 2023 and be deployed thereafter.

- Air Liquide committed to reinforce its biodiversity

assessment criteria into the investment process for all new

projects by 2024.

Outlook

Air Liquide started 2023 with a very solid performance. In the

first quarter, growth was higher than in the fourth quarter and the

investment momentum remained strong.

Group sales increased by +6.2% on a comparable basis,

after growth of +4.5% in the fourth quarter. As published, sales

were up by +4.2% year-over-year, integrating in particular the

decline in energy prices, whose variations are passed on to Large

Industries customers. Revenue reached 7.2 billion euros,

including 6.9 billion euros for the Gas & Services

business.

The Gas & Services business, which represents 96% of

the Group’s revenue, was up +6.7% on a comparable basis and

that of Global Markets & Technologies was up +2.8%, with

divestitures impacting growth this quarter. Sales to third-party

Engineering & Construction customers decreased by

-18.6%; the outlook remaining solid with a high level of internal

and external order intake.

Within Gas & Services, all the geographies posted comparable

growth, in particular the Americas. By business line, Industrial

Merchant and Electronics remained on a strong upward

trend; growth in Healthcare accelerated and Large

Industries recovered compared to the fourth quarter in a more

favorable energy price environment in Europe.

In line with the priorities of its strategic plan,

ADVANCE, Air Liquide continued to improve operational

performance. The Group generated significant efficiencies of 91

million euros, up +18.1% year-over-year, despite an inflationary

environment unfavorable to savings on purchases, and continued

dynamic management of its business portfolio. The Group’s ability

to create value allows it to adjust prices in Industrial Merchant

(+13%) while preserving sales volumes. The cashflow progressed by

+14.3% in the first quarter.

Investment decisions amounted to close to 800 million

euros. 12-month investment opportunities continued to

rise, reaching 3.4 billion euros. More than 40% of these

opportunities are related to the energy transition, with in

particular decarbonization projects in the United States.

In 2023, the Group will continue deployment of its ADVANCE

strategic plan. Air Liquide is confident in its ability to further

increase its operating margin and to deliver recurring net profit

growth, at constant exchange rates(3).

Appendices - Performance indicators

Performance indicators used by the Group that are not directly

defined in the financial statements have been prepared in

accordance with the AMF position 2015-12 about alternative

performance measures.

The performance indicators are the following:

- Currency, energy and significant scope impacts

- Comparable sales change

- Efficiencies

Definition of Currency, energy and significant scope

impacts

Since industrial and medical gases are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the eurozone. The

currency impact is calculated based on the aggregates for the

period converted at the exchange rate for the previous period.

In addition, the Group passes on variations in the cost of

energy (electricity and natural gas) to its customers via indexed

invoicing integrated into their medium and long-term contracts.

This indexing can lead to significant variations in sales (mainly

in the Large Industries Business Line) from one period to another

depending on fluctuations in prices on the energy market.

An energy impact is calculated based on the sales of each

of the main subsidiaries in Large Industries. Their consolidation

allows the determination of the energy impact for the Group as a

whole. The foreign exchange rate used is the average annual

exchange rate for the year N-1. Thus, at the subsidiary level, the

following formula provides the energy impact, calculated for

natural gas and electricity respectively:

Energy impact = Share of sales indexed to energy year (N-1) x

(Average energy price in year (N) - Average energy price in year

(N-1))

This indexation effect of electricity and natural gas does not

impact the operating income recurring.

The significant scope impact corresponds to the impact on

sales of all acquisitions or disposals of a significant size for

the Group. These changes in scope of consolidation are

determined:

- for acquisitions during the period, by deducting from the

aggregates for the period the contribution of the acquisition,

- for acquisitions during the previous period, by deducting from

the aggregates for the period the contribution of the acquisition

between January 1 of the current period and the anniversary date of

the acquisition,

- for disposals during the period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity as of the anniversary date of the disposal,

- for disposals during the previous period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity.

Comparable sales change

Comparable changes for sales exclude the currency, energy and

significant scope impacts described above. The calculations are

the following:

(in millions of euros)

Q1 2023

Q1 2023/2022 Published

Growth

Currency impact

Natural gas impact

Electricity impact

Significant scope

impact

Q1 2023/2022 Comparable

Growth

Revenue

Group

7,174

+4.2%

(11)

(123)

(14)

13

+6.2%

Impacts in %

-0.1%

-1.8%

-0.2%

+0.1%

Gas & Services

6,893

+4.6%

(10)

(123)

(14)

13

+6.7%

Impacts in %

-0.1%

-1.9%

-0.2%

+0.1%

Efficiencies

Efficiencies represent a sustainable cost reduction

resulting from an action plan on a specific project. Efficiencies

are identified and managed on a per project basis. Each project is

followed by a team composed in alignment with the nature of the

project (purchasing, operations, human resources...).

Sales and investments key figures synthesis

The following tables gather data already available in

this report. They complement the key figures indicated in

the table on the first page.

Sales

Q1 2023 split of revenue and comparable

growth in %

Total

Large Industries

Industrial Merchant

Electronics

Healthcare

Americas

100%

18%

68%

4%

10%

+9.2%

-3.0%

+13.2%

-1.0%

+11.2%

Europe

100%

41%

31%

2%

26%

+5.5%

-4.1%

+22.1%

N.C.

+5.7%

Asia-Pacific

100%

35%

28%

33%

4%

+4.8%

-5.1%

+11.0%

+10.5%

N.C.

Middle-East and Africa

100%

N.C.

N.C.

N.C.

N.C.

+4.6%

Gas & Services

100%

32%

44%

9%

15%

+6.7%

-3.6%

+14.8%

+10.4%

+7.7%

Engineering & Construction

-18.6%

Global Markets & Technologies

+2.8%

GROUP TOTAL

+6.2%

N.C.: Not communicated.

Investments

(in billions of euros)

Q1 2023

12-month portfolio of investment

opportunities(a)

3.4

Investment decisions(b)

0.8

Investment backlog(a)

3.5

Additional contribution to revenue of unit

start-ups and ramp-ups(b) (in million euros)

66

(a) At the end of the reporting period.

(b) Cumulated value from the beginning of the

calendar year until the end of the reporting period.

The slideshow that accompanies this release

is available as of 7:20 am (Paris time) at

www.airliquide.com. Throughout the year, follow

Air Liquide on Twitter: @AirLiquideGroup.

UPCOMING EVENTS

Annual General Meeting of Shareholders: May 3, 2023

Dividend Ex-coupon Date: May 15, 2023

Dividend Payout Date: May 17, 2023

2023 First Half Revenue and Results: July 27, 2023

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 73 countries with

approximately 67,100 employees and serves more than 3.9 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Taking action today while preparing the future is at the heart

of Air Liquide’s strategy. With ADVANCE, its strategic plan for

2025, Air Liquide is targeting a global performance, combining

financial and extra-financial dimensions. Positioned on new

markets, the Group benefits from major assets such as its business

model combining resilience and strength, its ability to innovate

and its technological expertise. The Group develops solutions

contributing to climate and the energy transition—particularly with

hydrogen—and takes action to progress in areas of healthcare,

digital and high technologies.

Air Liquide’s revenue amounted to more than 29.9 billion euros

in 2022. Air Liquide is listed on the Euronext Paris stock exchange

(compartment A) and belongs to the CAC 40, CAC 40 ESG, EURO STOXX

50, FTSE4Good and DJSI Europe indexes.

1 See definition in Appendix. 2 See definition in Appendix. 3

Operating margin excluding energy passthrough impact. Net profit

recurring excluding exceptional and significant transactions that

have no impact on the operating income recurring.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230426005791/en/

Investor Relations IRTeam@airliquide.com

Media Relations media@airliquide.com

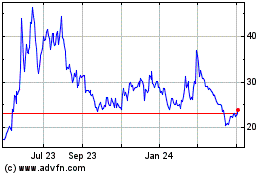

C3 AI (NYSE:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

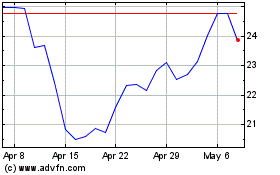

C3 AI (NYSE:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024