- 4Q22 diluted GAAP EPS of $0.47, diluted non-GAAP(1) EPS of

$0.93, on revenue of $624.2 million

- 4Q22 net income of $43.0 million, adjusted EBITDA(1) of $130.1

million

- 2022 diluted GAAP EPS of $2.60, diluted non-GAAP(1) EPS of

$3.13, on revenue of $2.23 billion

- 2022 net income of $238.6 million, adjusted EBITDA(1) of $439.4

million

- 2022 operating cash flow of $244.7 million, free cash flow(1)

of $46.4 million

- Initiates 2023 guidance in-line with prior outlook

commentary

- Increases quarterly cash dividend to $0.23 per share

BWX Technologies, Inc. (NYSE: BWXT) ("BWXT", "we", "us" or the

"Company") reported fourth-quarter and full-year 2022 results. A

reconciliation of non-GAAP results are detailed in Exhibit 1.

“As we expected, BWXT closed out 2022 with solid fourth quarter

financial results," said Rex D. Geveden, president and chief

executive officer. “We benefited from our balanced and growing

portfolio this year as strong performance in Commercial Operations

largely offset headwinds in the Government Operations segment owing

to a tough labor market. Operating performance outpaced

macroeconomic and accounting headwinds, including lower pension

income and increasing interest rates, resulting in high-single

digit underlying EBITDA and positive earnings per share growth for

the year.”

“We continue to face labor pressures and expect that to detract

from our full potential in 2023 because our growth will likely be

muted by attrition and the availability of qualified workers.

Despite these macroeconomic headwinds, I am energized about the

expected future trajectory of BWXT because we see increasing demand

in every market in which we participate. We see near-term

opportunity in space-based microreactors, DOE services, commercial

small modular reactors, nuclear medicine, and potential new demand

related to the AUKUS trilateral security agreement. Accordingly, we

expect 2023 to shape up as another strategic milestone year as we

continue to drive top-line gains, accelerate EBITDA growth, and

inflect free cash flow,” said Geveden.

Financial Results Summary

Three Months Ended December

31,

Year Ended December

31,

2022

2021

$ Change

% Change

2022

2021

$ Change

% Change

(Unaudited)

(In millions, except per share

amounts)

Revenue

Government Operations

$

517.6

$

479.2

$

38.5

8%

$

1,808.5

$

1,725.1

$

83.4

5%

Commercial Operations

$

107.1

$

114.5

$

(7.4

)

(6)%

$

427.4

$

407.1

$

20.3

5%

Consolidated

$

624.2

$

592.0

$

32.2

5%

$

2,232.8

$

2,124.1

$

108.8

5%

Operating Income

Government Operations

$

102.8

$

90.9

$

11.9

13%

$

336.5

$

329.5

$

7.0

2%

Commercial Operations

$

3.7

$

18.4

$

(14.6

)

(80)%

$

27.4

$

35.2

$

(7.8

)

(22)%

Unallocated Corporate (Expense)

$

(4.6

)

$

(7.1

)

$

2.4

NM

$

(15.3

)

$

(18.9

)

$

3.6

NM

Consolidated

$

101.9

$

102.2

$

(0.3

)

—%

$

348.6

$

345.8

$

2.7

1%

Consolidated non-GAAP(1)

$

111.1

$

104.6

$

6.5

6%

$

365.6

$

349.0

$

16.6

5%

EPS (Diluted)

GAAP

$

0.47

$

1.26

$

(0.79

)

(63)%

$

2.60

$

3.24

$

(0.64

)

(20)%

Non-GAAP(1)

$

0.93

$

0.95

$

(0.02

)

(2)%

$

3.13

$

3.06

$

0.07

2%

Net Income

GAAP

$

43.0

$

116.9

$

(73.9

)

(63)%

$

238.6

$

306.3

$

(67.7

)

(22)%

Non-GAAP(1)

$

85.7

$

88.2

$

(2.5

)

(3)%

$

287.5

$

289.6

$

(2.2

)

(1)%

Adjusted EBITDA(1)

Government Operations

$

115.8

$

102.9

$

12.8

12%

$

386.5

$

372.2

$

14.3

4%

Commercial Operations

$

13.6

$

23.9

$

(10.3

)

(43)%

$

53.9

$

56.0

$

(2.1

)

(4)%

Corporate

$

0.7

$

(3.7

)

$

4.3

NM

$

(1.1

)

$

(10.2

)

$

9.1

NM

Consolidated

$

130.1

$

123.2

$

6.9

6%

$

439.4

$

418.1

$

21.3

5%

Cash Flows

Operating Cash Flow(2)

$

107.7

$

160.4

$

(52.8

)

(33)%

$

244.7

$

386.0

$

(141.3

)

(37)%

Capital Expenditures(2)

$

63.7

$

74.4

$

(10.7

)

(14)%

$

198.3

$

311.1

$

(112.7

)

(36)%

Free Cash Flow(1)

$

43.9

$

86.1

$

(42.1

)

(49)%

$

46.4

$

75.0

$

(28.6

)

(38)%

Share Repurchases(2)

$

—

$

40.0

$

(40.0

)

NM

$

20.0

$

225.8

$

(205.8

)

(91)%

Dividends Paid(2)

$

20.2

$

19.4

$

0.8

4%

$

81.1

$

79.7

$

1.4

2%

NM = Not Meaningful

(2) Items named in the Financial Results

Summary differ from names in BWXT Financial Statement. Operating

Cash Flow = Net Cash Provided by Operating Activities; Capital

Expenditures = Purchases of Property, Plant and Equipment; Share

Repurchases = Repurchases of Common Stock; Dividends Paid =

Dividends Paid to Common Shareholders

Revenue

The fourth quarter consolidated revenue increase resulted from

higher revenue in Government Operations partially offset by lower

revenue in Commercial Operations. The Government Operations

increase was driven by higher microreactor volume, uranium

processing and the DCL/Cunico acquisition, partially offset by

lower long-lead material production. The Commercial Operations

decrease resulted from lower commercial nuclear power, primarily

fuel volume, partially offset by increased medical sales.

The full year consolidated revenue increase was driven by growth

in both operating segments. The Government Operations increase was

driven by higher microreactor volume, naval reactors, uranium

processing, long-lead material production and the DCL/Cunico

acquisition, partially offset by lower missile tube production. The

Commercial Operations increase resulted from higher commercial

nuclear power, primarily field services, as well as higher medical

sales.

Operating Income and Adjusted EBITDA(1)

Fourth quarter consolidated operating income was about flat

compared with the prior-year period, as higher operating income in

Government Operations and lower unallocated corporate expense was

offset by lower operating income in Commercial Operations. The

Government Operations increase resulted from higher income in joint

venture projects, microreactors and more favorable contract

adjustments on missile tubes, partially offset by decreased labor

and cost efficiencies that resulted in fewer favorable contract

adjustments, lower recoverable CAS pension income, and higher

depreciation and acquisition amortization. The Commercial

Operations decrease was driven by lower commercial nuclear power,

primarily fuel volume. Lower unallocated corporate expense was

driven by decreases in healthcare costs and stock-based

compensation.

The fourth quarter total adjusted EBITDA(1) increase was driven

primarily by the reasons noted above as higher Government

Operations adjusted EBITDA(1) and lower unallocated corporate

expense was partially offset by lower Commercial Operations

adjusted EBITDA(1).

The 2022 consolidated operating income increase was driven by

higher operating income in Government Operations and lower

unallocated corporate expense, which was offset by lower operating

income in Commercial Operations. The Government Operations increase

was driven by higher income from joint venture projects, uranium

processing, microreactors and long-lead material production,

partially offset by decreased labor and cost efficiencies that

resulted in fewer favorable contract adjustments, lower recoverable

CAS pension income, and higher depreciation and acquisition

amortization. The Commercial Operations decrease was driven by a

less favorable business mix and the absence of CEWS COVID-19 wage

subsidy. Lower unallocated corporate expense was driven by a

decrease in healthcare costs and lower compensation related expense

inclusive of stock-based compensation.

The 2022 total adjusted EBITDA(1) increase was driven primarily

by the reasons noted above as higher Government Operations adjusted

EBITDA(1) and lower unallocated corporate expense was partially

offset by lower Commercial Operations adjusted EBITDA(1).

EPS

The fourth quarter GAAP EPS decrease was driven primarily by the

absence of gains associated with the mark-to-market of the pension

that occurred in the fourth quarter 2021, higher interest expense,

a higher effective tax rate and lower FAS/CAS pension income,

partially offset by better operational performance and a lower

share count. The fourth quarter non-GAAP EPS decrease was driven by

the items above excluding mark-to-market pension gains and losses

and restructuring and other costs and other one-time items.

The 2022 GAAP EPS decrease was driven primarily by the absence

of gains associated with the mark-to-market of the pension that

occurred in the fourth quarter 2021, higher interest expense, a

higher effective tax rate and lower FAS/CAS pension income,

partially offset by better operational performance and a lower

share count. The 2022 non-GAAP EPS(1) increase was driven by the

items above excluding mark-to-market pension gains and losses and

restructuring costs and other one-time items.

Cash Flows

The fourth quarter operating cash flow decrease was driven by

increases in working capital, primarily accounts payable. Lower

fourth quarter capital expenditures resulted from lower spending on

the two major growth capital campaigns for U.S. naval nuclear

reactors and medical radioisotopes that are nearing completion,

partially offset by an increase in capital expenditures for

microreactors.

The 2022 operating cash flow decrease was driven by the absence

of large payment that occurred in 2021, higher cash taxes for

R&D amortization and an increase in working capital. Lower 2022

capital expenditures were driven by less spending on two major

growth capital campaigns for U.S. naval nuclear reactors and

medical radioisotopes that are nearing completion.

Dividend

BWXT paid $20.2 million, or $0.22 per common share, to

shareholders in the fourth-quarter 2022 and paid $81.1 million to

shareholders for the full-year 2022. On February 22, 2023, the BWXT

Board of Directors declared an increase of $0.01 to the quarterly

cash dividend. A $0.23 cash dividend per common share will be

payable on March 28, 2023, to shareholders of record on March 10,

2023.

2023 Guidance

BWXT announced its expectations for fiscal year 2023 financial

results, providing the following guidance:

(In millions, except per share

amounts)

Year Ended

Year Ending

December 31, 2022

December 31, 2023

Results

Guidance

Revenue

$2,233

~$2,400

Adjusted EBITDA(1)

$439

~$475

Adjusted Pre-tax Income(1)

$378

~$350

Non-GAAP(1) Earnings Per Share

$3.13

$2.80 - $3.00

Free Cash Flow(1)

$46

~$200

Additional information can be found in the 2022 fourth quarter

earnings call presentation on the BWXT investor relations website

at www.bwxt.com/investors. The Company

does not provide GAAP guidance because it is unable to reliably

forecast most of the items that are excluded from GAAP to calculate

non-GAAP results. These items could cause GAAP results to differ

materially from non-GAAP results.

Conference Call to Discuss Fourth-Quarter and Full-Year 2022

Results

Date:

Thursday, February 23, 2023, at

5:00 p.m. EST

Live Webcast:

Investor Relations section of

website at www.bwxt.com

Full Earnings Release Available on BWXT Website

A full version of this earnings release is available on our

Investor Relations website at http://investors.bwxt.com/4Q2022-release

BWXT may use its website (www.bwxt.com) as a channel of

distribution of material Company information. Financial and other

important information regarding BWXT is routinely accessible

through and posted on our website. In addition, you may elect to

automatically receive e-mail alerts and other information about

BWXT by enrolling through the “Email Alerts” section of our website

at http://investors.bwxt.com.

Non-GAAP Measures

BWXT uses and makes reference to adjusted EBITDA, free cash flow

and free cash flow conversion, which are not recognized measures

under GAAP. BWXT is providing these non-GAAP measures to supplement

the results provided in accordance with GAAP and it should not be

considered superior to, or as a substitute for, the comparable GAAP

measures. BWXT believes the non-GAAP measures provide meaningful

insight and transparency into the Company’s operational performance

and provides these measures to investors to help facilitate

comparisons of operating results with prior periods and to assist

them in understanding BWXT's ongoing operations. Definitions for

the non-GAAP measures are provided below and reconciliations are

detailed in Exhibit 1, except that reconciliations of

forward-looking GAAP measures are not provided because the company

is unable to reliably forecast most of the items that are excluded

from GAAP to calculate non-GAAP results. Other companies may define

these measures differently or may utilize different non-GAAP

measures, thus impacting comparability.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) is calculated using non-GAAP net income, plus

provision for income taxes, less other – net, less interest income,

plus interest expense, plus depreciation and amortization.

Adjusted pre-tax income is non-GAAP income before provision for

income taxes.

Free Cash Flow (FCF) is calculated using net income to derive

net cash provided by (used in) operating activities less purchases

of property, plant and equipment.

Free Cash Flow conversion is free cash flow divided by net

income.

Forward-Looking Statements

BWXT cautions that this release contains forward-looking

statements, including, without limitation, statements relating to

backlog, to the extent they may be viewed as an indicator of future

revenues; our plans and expectations for each of our reportable

segments, including the expectations, timing and revenue of our

strategic initiatives, such as medical radioisotopes, small modular

reactor components and recent acquisitions; disruptions to our

supply chain and/or operations, changes in government regulations

and other factors, including any such impacts of, or actions in

response to the COVID-19 health crisis; and our expectations and

guidance for 2023 and beyond. These forward-looking statements are

based on management’s current expectations and involve a number of

risks and uncertainties, including, among other things, our ability

to execute contracts in backlog; the lack of, or adverse changes

in, federal appropriations to government programs in which we

participate; the demand for and competitiveness of nuclear products

and services; capital priorities of power generating utilities and

other customers; the timing of technology development; the

potential recurrence of subsequent waves or strains of COVID-19 or

similar diseases; adverse changes in the industries in which we

operate; and delays, changes or termination of contracts in

backlog. If one or more of these risks or other risks materialize,

actual results may vary materially from those expressed. For a more

complete discussion of these and other risk factors, see BWXT’s

filings with the Securities and Exchange Commission, including our

annual report on Form 10-K for the year ended December 31, 2022.

BWXT cautions not to place undue reliance on these forward-looking

statements, which speak only as of the date of this release, and

undertakes no obligation to update or revise any forward-looking

statement, except to the extent required by applicable law.

About BWXT

At BWX Technologies, Inc. (NYSE: BWXT), we are People Strong,

Innovation Driven. Headquartered in Lynchburg, Va. BWXT is a

Fortune 1000 and Defense News Top 100 manufacturing and engineering

innovator that provides safe and effective nuclear solutions for

global security, clean energy, environmental remediation, nuclear

medicine and space exploration. With approximately 7,000 employees,

BWXT has 14 major operating sites in the U.S., Canada and the U.K.

In addition, BWXT joint ventures provide management and operations

at a dozen U.S. Department of Energy and NASA facilities. Follow us

on Twitter at @BWXT and learn more at www.bwxt.com

(1) A reconciliation of non GAAP results

are detailed in Exhibit 1. Additional information can be found in

the materials on the BWXT investor relations website at

www.bwxt.com/investors.

EXHIBIT 1

BWX TECHNOLOGIES, INC.

RECONCILIATION OF NON-GAAP

OPERATING INCOME AND EARNINGS PER SHARE(1)(2)(3)

(In millions, except per share

amounts)

Three Months Ended December

31, 2022

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition -related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

101.9

$

—

$

2.6

$

0.3

$

6.2

$

111.1

Other Income (Expense)

(45.1

)

46.6

0.0

—

—

1.6

Income before Provision for Income

Taxes

56.8

46.6

2.7

0.3

6.2

112.6

Provision for Income Taxes

(13.8

)

(10.9

)

(0.6

)

(0.0

)

(1.6

)

(26.9

)

Net Income

43.0

35.7

2.1

0.3

4.7

85.7

Net Income Attributable to Noncontrolling

Interest

(0.1

)

—

—

—

—

(0.1

)

Net Income Attributable to BWXT

$

43.0

$

35.7

$

2.1

$

0.3

$

4.7

$

85.6

Diluted Shares Outstanding

91.8

91.8

Diluted Earnings per Common Share

$

0.47

$

0.39

$

0.02

$

0.00

$

0.05

$

0.93

Effective Tax Rate

24.3

%

23.9

%

Government Operations Operating Income

$

102.8

$

—

$

—

$

0.3

$

—

$

103.1

Commercial Operations Operating Income

$

3.7

$

—

$

(0.7

)

$

—

$

6.2

$

9.3

Unallocated Corporate Operating Income

$

(4.6

)

$

—

$

3.3

$

0.0

$

—

$

(1.3

)

Three Months Ended December

31, 2021

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring and Other

Costs

Non-GAAP

Operating Income

$

102.2

$

—

$

2.4

$

104.6

Other Income (Expense)

44.9

(39.6

)

—

5.3

Income before Provision for Income

Taxes

147.1

(39.6

)

2.4

109.9

Provision for Income Taxes

(30.2

)

9.1

(0.6

)

(21.7

)

Net Income

116.9

(30.5

)

1.8

88.2

Net Income Attributable to Noncontrolling

Interest

(0.0

)

—

—

(0.0

)

Net Income Attributable to BWXT

$

116.9

$

(30.5

)

$

1.8

$

88.2

Diluted Shares Outstanding

92.5

92.5

Diluted Earnings per Common Share

$

1.26

$

(0.33

)

$

0.02

$

0.95

Effective Tax Rate

20.5

%

19.8

%

Government Operations Operating Income

$

90.9

$

—

$

—

$

90.9

Commercial Operations Operating Income

$

18.4

$

—

$

0.6

$

19.0

Unallocated Corporate Operating Income

$

(7.1

)

$

—

$

1.8

$

(5.3

)

EXHIBIT 1 (continued)

BWX TECHNOLOGIES, INC.

RECONCILIATION OF NON-GAAP

OPERATING INCOME AND EARNINGS PER SHARE(1)(2)(3)

(In millions, except per share

amounts)

Year Ended December 31,

2022

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Operating Income

$

348.6

$

—

$

8.2

$

2.6

$

6.2

$

365.6

Other Income (Expense)

(34.2

)

46.6

0.0

—

—

12.4

Income before Provision for Income

Taxes

314.4

46.6

8.2

2.6

6.2

378.0

Provision for Income Taxes

(75.8

)

(10.9

)

(1.9

)

(0.4

)

(1.6

)

(90.5

)

Net Income

238.6

35.7

6.3

2.2

4.7

287.5

Net Income Attributable to Noncontrolling

Interest

(0.4

)

—

—

—

—

(0.4

)

Net Income Attributable to BWXT

$

238.2

$

35.7

$

6.3

$

2.2

$

4.7

$

287.1

Diluted Shares Outstanding

91.7

91.7

Diluted Earnings per Common Share

$

2.60

$

0.39

$

0.07

$

0.02

$

0.05

$

3.13

Effective Tax Rate

24.1

%

23.9

%

Government Operations Operating Income

$

336.5

$

—

$

1.2

$

0.8

$

—

$

338.6

Commercial Operations Operating Income

$

27.4

$

—

$

1.5

$

—

$

6.2

$

35.1

Unallocated Corporate Operating Income

$

(15.3

)

$

—

$

5.4

$

1.8

$

—

$

(8.1

)

Year Ended December 31,

2021

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring and Other

Costs

Costs Associated With Early

Bond Redemption

Non-GAAP

Operating Income

$

345.8

$

—

$

3.1

$

—

$

349.0

Other Income (Expense)

49.9

(39.6

)

—

15.0

25.3

Income before Provision for Income

Taxes

395.7

(39.6

)

3.1

15.0

374.3

Provision for Income Taxes

(89.4

)

9.1

(0.8

)

(3.5

)

(84.6

)

Net Income

306.3

(30.5

)

2.4

11.5

289.6

Net Income Attributable to Noncontrolling

Interest

(0.4

)

—

—

—

(0.4

)

Net Income Attributable to BWXT

$

305.9

$

(30.5

)

$

2.4

$

11.5

$

289.2

Diluted Shares Outstanding

94.5

94.5

Diluted Earnings per Common Share

$

3.24

$

(0.32

)

$

0.03

$

0.12

$

3.06

Effective Tax Rate

22.6

%

22.6

%

Government Operations Operating Income

$

329.5

$

—

$

0.2

$

—

$

329.7

Commercial Operations Operating Income

$

35.2

$

—

$

0.9

$

—

$

36.2

Unallocated Corporate Operating Income

$

(18.9

)

$

—

$

2.1

$

—

$

(16.9

)

EXHIBIT 1 (continued)

RECONCILIATION OF CONSOLIDATED

ADJUSTED EBITDA(1)(2)(3)

(In millions)

Three Months Ended December

31, 2022

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition- related

Costs

Loss on Asset Disposal

Non-GAAP

Net Income

$

43.0

$

35.7

$

2.1

$

0.3

$

4.7

$

85.7

Provision for Income Taxes

13.8

10.9

0.6

0.0

1.6

26.9

Other – net

33.9

(46.6

)

—

—

—

(12.6

)

Interest Expense

11.4

—

(0.0

)

—

—

11.4

Interest Income

(0.3

)

—

—

—

—

(0.3

)

Depreciation & Amortization

19.0

—

—

—

—

19.0

Adjusted EBITDA

$

120.9

$

—

$

2.6

$

0.3

$

6.2

$

130.1

Three Months Ended December

31, 2021

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring and Other

Costs

Non-GAAP

Net Income

$

116.9

$

(30.5

)

$

1.8

$

88.2

Provision for Income Taxes

30.2

(9.1

)

0.6

21.7

Other – net

(51.9

)

39.6

—

(12.3

)

Interest Expense

7.0

—

—

7.0

Interest Income

(0.0

)

—

—

(0.0

)

Depreciation & Amortization

18.6

—

—

18.6

Adjusted EBITDA

$

120.8

$

—

$

2.4

$

123.2

Year Ended December 31,

2022

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring Costs

Acquisition-

related Costs

Loss on Asset Disposal

Non-GAAP

Net Income

$

238.6

$

35.7

$

6.3

$

2.2

$

4.7

$

287.5

Provision for Income Taxes

75.8

10.9

1.9

0.4

1.6

90.5

Other – net

(1.5

)

(46.6

)

—

—

—

(48.0

)

Interest Expense

36.4

—

(0.0

)

—

—

36.4

Interest Income

(0.8

)

—

—

—

—

(0.8

)

Depreciation & Amortization

73.8

—

—

—

—

73.8

Adjusted EBITDA

$

422.4

$

—

$

8.2

$

2.6

$

6.2

$

439.4

Year Ended December 31,

2021

GAAP

Pension & OPEB MTM (Gain)

/ Loss

Restructuring and Other

Costs

Costs Associated With Early

Bond Redemption

Non-GAAP

Net Income

$

306.3

$

(30.5

)

$

2.4

$

11.5

$

289.6

Provision for Income Taxes

89.4

(9.1

)

0.8

3.5

84.6

Other – net

(85.2

)

39.6

—

(10.8

)

(56.4

)

Interest Expense

35.8

—

—

(4.2

)

31.5

Interest Income

(0.4

)

—

—

—

(0.4

)

Depreciation & Amortization

69.1

—

—

—

69.1

Adjusted EBITDA

$

414.9

$

—

$

3.1

$

—

$

418.1

EXHIBIT 1 (continued)

RECONCILIATION OF REPORTING

SEGMENT ADJUSTED EBITDA(1)(2)(3)

(In millions)

Three Months Ended December

31, 2022

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

102.8

$

0.3

$

12.7

$

115.8

Commercial Operations

$

3.7

$

5.6

$

4.3

$

13.6

Three Months Ended December

31, 2021

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

90.9

$

—

$

12.1

$

102.9

Commercial Operations

$

18.4

$

0.6

$

4.9

$

23.9

Year Ended December 31,

2022

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

336.5

$

2.1

$

48.0

$

386.5

Commercial Operations

$

27.4

$

7.7

$

18.8

$

53.9

Year Ended December 31,

2021

Operating Income

(GAAP)

Non-GAAP

Adjustments(4)

Depreciation &

Amortization

Adjusted EBITDA

Government Operations

$

329.5

$

0.2

$

42.5

$

372.2

Commercial Operations

$

35.2

$

0.9

$

19.9

$

56.0

RECONCILIATION OF CONSOLIDATED

FREE CASH FLOW(1)(2)(3)

(In millions)

Three Months Ended December

31,

2022

2021

Net Cash Provided By Operating

Activities

$

107.7

$

160.4

Purchases of Property, Plant and

Equipment

(63.7

)

(74.4

)

Free Cash Flow

$

43.9

$

86.1

Year Ended December

31,

2022

2021

Net Cash Provided By Operating

Activities

$

244.7

$

386.0

Purchases of Property, Plant and

Equipment

(198.3

)

(311.1

)

Free Cash Flow

$

46.4

$

75.0

(1)

Tables may not foot due to rounding.

(2)

BWXT is providing non-GAAP information

regarding certain of its historical results and guidance on future

earnings per share to supplement the results provided in accordance

with GAAP and it should not be considered superior to, or as a

substitute for, the comparable GAAP measures. BWXT believes the

non-GAAP measures provide meaningful insight and transparency into

the Company’s operational performance and provides these measures

to investors to help facilitate comparisons of operating results

with prior periods and to assist them in understanding BWXT's

ongoing operations.

(3)

BWXT has not included a reconciliation of

provided non-GAAP guidance to the comparable GAAP measures due to

the difficulty of estimating any mark-to-market adjustments for

pension and post-retirement benefits, which are determined at the

end of the year.

(4)

For Non-GAAP adjustment details, see

reconciliation of non-GAAP operating income and earnings per

share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230223005849/en/

Investor Contact: Mark Kratz Vice President, Investor

Relations 980-365-4300 Investors@bwxt.com Media Contact: Jud

Simmons Director, Media and Public Relations 434-522-6462

hjsimmons@bwxt.com

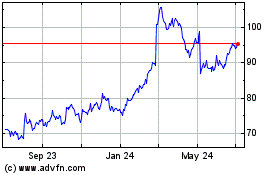

BWX Technologies (NYSE:BWXT)

Historical Stock Chart

From Apr 2024 to May 2024

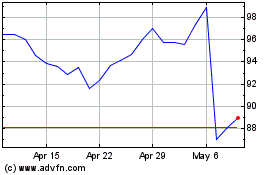

BWX Technologies (NYSE:BWXT)

Historical Stock Chart

From May 2023 to May 2024