UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 2, 2015

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other

jurisdiction of incorporation)

|

|

|

| 001-33220

(Commission file number) |

|

33-1151291

(I.R.S. Employer Identification No.) |

5 Dakota Drive

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On October 2, 2015, Broadridge Financial Solutions, Inc. (the “Company”) made available to its stockholders its fiscal year 2015 annual report

to stockholders (the “Annual Report”) which included the letter to stockholders (the “Letter to Stockholders”). The Letter to Stockholders is attached hereto as Exhibit 99.1.

The Company’s results in the Annual Report are presented in accordance with generally accepted accounting principles in the United States

(“GAAP”) except where otherwise noted. In certain circumstances, results have been presented in the Annual Report including the Letter to Stockholders that are not generally accepted accounting principles measures (“Non-GAAP”).

These Non-GAAP measures should be viewed in addition to, and not as a substitute for, the Company’s reported results.

With regard to statements in

the Annual Report including the Letter to Stockholders that include certain Non-GAAP financial measures, the adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that

management believes are not indicative of our ongoing performance.

We also provide information on our Free cash flows because we believe this information

helps our investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by

operating activities less capital expenditures and purchases of intangibles.

The Company believes Non-GAAP information helps investors understand the

effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and

prior reported results, and as a basis for planning and forecasting for future periods.

Set forth below is a reconciliation of such Non-GAAP measures

(unaudited) to the most directly comparable GAAP measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

(Dollars and shares in millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Fiscal years ended June 30, |

|

|

2015 |

|

|

|

2014 |

|

|

|

2013 |

|

|

|

| |

|

|

|

|

|

| |

|

Earnings before interest and income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Earnings before interest and income taxes (Non-GAAP) |

|

$ |

464 |

|

|

$ |

420 |

|

|

$ |

359 |

|

|

|

| |

|

|

|

|

|

| |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Interest and other, net |

|

|

(25) |

|

|

|

(25) |

|

|

|

(15) |

|

|

|

| |

|

|

|

|

|

| |

|

Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

(20) |

|

|

|

| |

|

|

|

|

|

| |

|

Earnings before income taxes (GAAP) |

|

$ |

439 |

|

|

$ |

396 |

|

|

$ |

323 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Earnings before income taxes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Adjusted earnings before income taxes (Non-GAAP) |

|

$ |

469 |

|

|

$ |

420 |

|

|

$ |

367 |

|

|

|

| |

|

|

|

|

|

| |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Acquisition amortization and other costs |

|

|

(30) |

|

|

|

(25) |

|

|

|

(24) |

|

|

|

| |

|

|

|

|

|

| |

|

Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

(20) |

|

|

|

| |

|

|

|

|

|

| |

|

Earnings before income taxes (GAAP) |

|

$ |

439 |

|

|

$ |

396 |

|

|

$ |

323 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Pre-tax margins: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Adjusted pre-tax margins (Non-GAAP) |

|

|

17.4% |

|

|

|

16.4% |

|

|

|

15.1% |

|

|

|

| |

|

|

|

|

|

| |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Acquisition amortization and other costs |

|

|

(1.1%) |

|

|

|

(1.0%) |

|

|

|

(1.0%) |

|

|

|

| |

|

|

|

|

|

| |

|

Restructuring charges |

|

|

- |

|

|

|

- |

|

|

|

(0.8%) |

|

|

|

| |

|

|

|

|

|

| |

|

Pre-tax margins (GAAP) |

|

|

16.3% |

|

|

|

15.5% |

|

|

|

13.3% |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Note: Amounts

may not sum due to rounding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

(Dollars and shares in millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Fiscal years ended June 30, |

|

|

2015 |

|

|

|

2014 |

|

|

|

2013 |

|

|

|

| |

|

|

|

|

|

| |

|

Net earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Adjusted net earnings (Non-GAAP) |

|

$ |

307 |

|

|

$ |

279 |

|

|

$ |

236 |

|

|

|

| |

|

|

|

|

|

| |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Acquisition amortization and other costs, net of taxes |

|

|

(20) |

|

|

|

(16) |

|

|

|

(15) |

|

|

|

| |

|

|

|

|

|

| |

|

Restructuring charges, net of taxes |

|

|

- |

|

|

|

- |

|

|

|

(13) |

|

|

|

| |

|

|

|

|

|

| |

|

Discrete tax items |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

| |

|

|

|

|

|

| |

|

Net earnings (GAAP) |

|

$ |

287 |

|

|

$ |

263 |

|

|

$ |

212 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Free cash flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Free cash flows (Non-GAAP) |

|

$ |

365 |

|

|

$ |

334 |

|

|

$ |

220 |

|

|

|

| |

|

|

|

|

|

| |

|

Cash Flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Capital expenditures and purchases of intangibles |

|

|

66 |

|

|

|

54 |

|

|

|

51 |

|

|

|

| |

|

|

|

|

|

| |

|

Net cash flows provided by operating activities (GAAP) |

|

$ |

431 |

|

|

$ |

388 |

|

|

$ |

271 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Adjusted diluted earnings per share (Non-GAAP) |

|

$ |

2.47 |

|

|

$ |

2.25 |

|

|

$ |

1.88 |

|

|

|

| |

|

|

|

|

|

| |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Acquisition amortization and other costs, net of taxes |

|

|

(0.16) |

|

|

|

(0.13) |

|

|

|

(0.12) |

|

|

|

| |

|

|

|

|

|

| |

|

Restructuring charges, net of taxes |

|

|

- |

|

|

|

- |

|

|

|

(0.10) |

|

|

|

| |

|

|

|

|

|

| |

|

Discrete tax items |

|

|

- |

|

|

|

- |

|

|

|

0.03 |

|

|

|

| |

|

|

|

|

|

| |

|

Diluted earnings per share (GAAP) |

|

$ |

2.32 |

|

|

$ |

2.12 |

|

|

$ |

1.69 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Note: Amounts may not sum due to rounding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference

into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This current report on Form 8-K and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,”

“projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, statements about our future performance are

forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and

uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future

reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this Annual Report and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients;

Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations

affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of

Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services;

overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the

impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to

reflect the occurrence of unanticipated events, other than as required by law.

Item 9.01. Financial

Statements and Exhibits.

Exhibits. The following exhibit is furnished herewith:

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Letter to Stockholders from the Broadridge Financial Solutions, Inc. Annual Report to Stockholders for the fiscal year ended June 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: October 2, 2015

|

| BROADRIDGE FINANCIAL SOLUTIONS, INC. |

|

| By: /s/ James M.

Young |

| Name: James M. Young |

| Title: Vice President and Chief Financial Officer |

Exhibit 99.1

Annual Report 2015

Broadridge®

Our

Journey Progresses

Positioned to accelerate growth

Revenues

(Millions)

2015

$2,694

2014

$2,558

Record Earnings Per Share

(Adjusted diluted earnings per share)

$2.47 up 10%

Record Recurring Revenue Closed Sales

$146M up 15%

Increased Annual Dividend by

11% to $1.20

22% CAGR of Annual Dividends since 2008 8th Consecutive Year of Dividend

Increases

$1.20

$1.00

$.80

$.60

$.40

$.20

$.00

FY 08 FY 09 FY 10 FY 11 FY 12 FY 13 FY 14 FY 15 FY 16*

$.24 $.28 $.56 $.60 $.64 $.72 $.84 $1.08 $1.20

*Projected

Significant Events in Fiscal Year 2015

Delivered record performance, with total revenues

increasing by 5%, recurring fee revenues increasing by 6%, adjusted net earnings growing by 10%, and adjusted diluted earnings per share growing by 10%.

Generated

total shareholder return for the one-year and three-year periods ended June 30, 2015 of 23% and 36%, respectively; performance comparable to the top quartile of companies in the S&P 500 over these periods.

Continued to generate strong cash flow, with free cash flows of $365 million.

Board of

Directors approved an 11% increase in Broadridge’s annual dividend amount to $1.20 per share in August, marking the eighth consecutive year of dividend increases.

Consistent execution of capital stewardship strategy; completed four strategic tuck-in acquisitions with an aggregate spend of over $200 million, and returned a total of $332

million to stockholders in the form of cash dividends and share repurchases, net of proceeds from option exercises.

Acquired TwoFour Systems LLC, a provider of

real-time foreign exchange solutions for banks and broker-dealers, augmenting our ability to address the rising demand for foreign exchange and cash management services among financial institutions.

Acquired Direxxis LLC, a provider of cloud-based marketing solutions and services for financial advisors, further building out the capabilities of our Financial Advisor Solutions

suite.

Acquired the trade processing business of the Wilmington Trust Retirement and Institutional Services unit of M&T Bank Corporation, further enhancing our

best-in-class mutual fund and trade processing platform.

Acquired the Fiduciary Services and Competitive Intelligence unit of Thomson Reuters’ Lipper

division, a provider of global market intelligence for fund industry flows, reinforcing our position as a leading provider of data solutions and market intelligence for mutual funds.

Continued to win the trust of leading financial institutions and global brands, signing an agreement with Scottrade, Inc. to provide both trade processing and investor

communication solutions.

Ranked one of the “Best Companies to Work for in New York State” for the eighth consecutive year.

Named to FORTUNE® Magazine’s 2015 list of the World’s Most Admired Companies.

To Our Stockholders,

Fiscal year 2015 marked

another year of excellent operational and financial performance for Broadridge. We built on the momentum of last year’s strong results, and continued enhancing our position as a market leader in providing investor communications and

technology-driven solutions to banks, broker-dealers, mutual funds and corporate issuers. In short, we once again delivered on our commitments. We continued to make progress on our journey, demonstrated by another year of record financial results,

which enabled us to again generate top quartile total shareholder return when compared to companies in the S&P 500.

Our success this past year was enabled by

the underlying trends driving demand for our products and services, which continue to be strong. The regulatory environment our clients face remains challenging, and their need to effectively and securely communicate with shareholders and customers

is increasing. At the same time, financial services firms are experiencing increased pricing pressure for their products and services. Against this backdrop, we remain focused on helping our clients solve their challenging business problems and

achieve operational excellence so they can concentrate on driving growth. We built on our position as a trusted partner who earns our clients’ confidence every day and invested to drive both our near-term performance and our long-term growth

through Broadridge’s continued evolution.

I say evolution because Broadridge is constantly evolving. We have evolved since the financial crisis, and

Broadridge is a very different company today from the one that went public in 2007. We have diversified our business through internal product development as well as strategic alliances and acquisitions, and built a more resilient business model that

is no longer predominantly tied to market-driven, transactional volumes but instead benefits from new product revenue growth. Today, we control our destiny with a business driven by a balanced portfolio of products and services. This can be clearly

seen in our solid fiscal year 2015 financial performance.

We continuously invest your cash in the business to maintain and extend the leadership role we have

today. As a result, we have an expanding portfolio of new growth products and services. Some of these new products are aligned with the three industry macro trends of mutualization, digitization, and data and analytics that I’ll discuss in more

detail later in this letter. These investments have resulted in a consistent increase in revenues generated from new growth businesses that weren’t part of Broadridge a few years ago. In fact, at the end of fiscal year 2015, these businesses

represented greater than 25% of our recurring fee revenues, up from 10% five years ago.

What makes this compelling is the fact that these businesses grow faster, have higher margin potential, and tend to generate revenue

that is recurring in nature. This makes them less sensitive to market fluctuations, therefore enhancing the resiliency of our business overall. Our solid fiscal year 2015 performance coupled with our portfolio of new growth businesses position us

well to accelerate growth going forward.

Fiscal Year 2015: Another Solid Year

Broadridge again executed against its strategy. Driven by recurring fee revenue momentum that primarily came from Net New Business, we achieved another year of

record performance, with adjusted diluted earnings per share increasing by 10% to $2.47. We define Net New Business as our recurring revenue from closed sales less recurring revenue from client losses.

Total revenues rose 5% to $2.7 billion, while recurring fee revenues were up 6% to $1.7 billion. Our solid overall revenue performance was driven by strong Net New Business

performance, as well as our acquisitions and event-driven activity.

We took this revenue growth and converted it into double-digit earnings growth again in fiscal

year 2015. Our adjusted earnings before income taxes grew by 12% to $469 million, and adjusted net earnings grew by 10% to $307 million. Our adjusted pre-tax margins increased by 100 basis points to 17.4% as a percentage of revenue. We achieved

these results despite a headwind from foreign exchange, as the strong U.S. dollar reduced our earnings for the year by approximately 1%. In addition, during fiscal year 2015 we generated strong free cash flows of $365 million.

We drove a fourth consecutive year of record recurring revenue closed sales, which increased 15% to $146 million. Coupled with our exceptional 97% client revenue retention rate,

our strong sales results highlight the value that Broadridge is creating for our clients as their trusted partner, and provide the foundation for future revenue and earnings growth. Growing the business organically remains core to our strategy, and

this strong performance is key to our revenue growth going forward.

Our performance reflected solid contributions from both of our operating segments. As I’ve

said many times, the investor communications business is a great business. Its performance this past year is proof of this statement. Driven by a combination of recurring fee revenue growth and event-driven revenue, Investor Communication Solutions

(ICS) generated total revenue growth of 8%, and earnings before income taxes for the segment increased by 13%. ICS also posted solid growth in recurring revenue closed sales of 14%.

In our recently renamed Global Technology and Operations (GTO) segment, revenues increased by 2%, and earnings before income taxes increased 1%. This performance is understandable

when you compare it to GTO’s very strong results in the prior year. GTO experienced some timing delays in onboarding clients, and we expect that this revenue will be realized in future periods. Importantly, GTO’s recurring revenue closed

sales grew by 19%, reflecting the ongoing strong demand for its services. Coupled with a robust and growing sales pipeline, GTO is expected to continue to add to Broadridge’s future value creation capabilities.

Across the board, Broadridge posted solid performance, enabling us to generate total shareholder return of 23% and 36% in the one-year and three-year periods ended June 30,

2015, respectively. This performance is comparable to the top quartile of companies in the S&P 500 over these periods. Even more importantly, our performance this year was consistent with the three-year growth objectives we laid out at our

Investor Day held in December. One of our key goals is to continue to generate top quartile total shareholder return. In addition, on a compounded annual growth rate basis, measuring from fiscal years 2014 to 2017, our objectives include:

Total revenue growth of 5-7%;

Recurring fee revenue growth of 7-10%; and

Adjusted net earnings growth of 9-11%.

We take very seriously the commitments

we make to our clients, our associates, and our stockholders, and strive to meet them year-in and year-out. Our financial performance in fiscal year 2015 is clear proof of this.

During the year, we enhanced our go-to-market approach, refreshing the presentation of the Broadridge brand as “One Broadridge”—a unified presentation of our full

value proposition, including our three core solutions: Technology and Operations, Communications, and Data and Analytics solutions. We also aligned our products with the four major client groups we service: Asset Management, Capital Markets,

Corporations, and Wealth Management. This year we continued to go to market with proactive, consultative and thought-leading content focused on the increasingly complex needs of our clients. We also strengthened our sales and marketing capabilities

during the year, hiring Chris Perry as President of Global Sales, Marketing and Client Solutions. Chris has already made a positive impact and I’m confident he will help drive this area of the business to even higher levels of performance going

forward.

2

Business Strategy Update The evolution of the financial services industry continues. Firms are faced with the pressures of increasing

regulation and related compliance costs, cyber and data security challenges, competition, and changing customer communication preferences. Together, these factors are driving a constant need among our clients for innovative solutions that reduce

risk and costs while also ensuring their ability to effectively retain, grow, and communicate with their customers and shareholders. These factors result in an estimated $24 billion market opportunity for Broadridge, one which we are uniquely

positioned to address through our combination of experience, technology and talent. The core of our value proposition is driving our clients’ operational excellence. By proactively delivering solutions that address a constantly changing list of

challenges, we act as a change agent for their businesses. In pursuing the opportunities ahead of us, we have identified three major macro trends-mutualization, digitization, and data and analytics-that we believe are both disruptive and

transformative to the industry. Each of these brings unique challenges for our clients; challenges that Broadridge, with its decades of experience and unique vantage point at the center of the financial services industry, is positioned to address.

To leverage these opportunities, we have utilized our strong client relationships to understand their changing needs. We also continuously invest in our products and capabilities, either by developing solutions in-house, through strategic

partnerships, or via acquisition. We are focused on continuing to drive growth in our businesses across these three trends. And we’ve been doing just that. Mutualization Our Capital Markets clients operate in an increasingly regulated and

competitive environment. Research conducted by The Economist Intelligence Unit showed that 77% of senior financial services executives indicated that their firms were either in the process of, or about to begin, a business model transformation to

reduce their cost structures and free up capital that can be re-allocated for profitable growth. For many of these institutions, mutualization is the primary focus of their transformation efforts. Mutualization is the drive to gain efficiencies and

scale by standardizing and sharing duplicative, non-differentiating functions and costs in a secure manner. Broadridge has been at the forefront of this effort for over 50 years, providing business solutions that enable the financial services

industry to address the increasing regulatory pressures that are driving up costs and shrinking returns on equity. In short, we provide functionally rich solutions that provide scale to reduce costs and drive growth while providing our clients with

the security of knowing that their mission-critical back-office functions are in the hands of a trusted partner. A key example of our capabilities in this area is our market leading post-trade processing solution, which supports the technology and

operations of the trade settlement process for our Capital Markets and Wealth Management clients. We provide post-trade processing services to eight of the 10 largest global investment banks. Our core North American post-trade processing business

has meaningful growth opportunities ahead due to the mutualization trend, as we continue to have active dialogues with large Capital Markets and Wealth Management firms on a number of fronts. Our recent agreement with Scottrade, Inc., through which

we will provide both trade processing and investor communication solutions, is clear evidence of this. In addition, we signed a contract with a large global financial services firm during the year for the performance of U.S. based Managed Services.

In total, our North American Managed Services solutions now support the post-trade operations of 27 clients. Beyond investing in our ability to grow through internal development and strategic alliances, we completed two strategic acquisitions in the

mutualization space that further build out our capabilities and will help drive growth opportunities. We acquired TwoFour Systems LLC, a provider of real-time foreign exchange solutions for our Capital Markets and Wealth Management clients. TwoFour

gives us a strong platform from which to address the growing need among financial institutions for advanced foreign exchange and cash management technology, and will enhance our ability to provide solutions that enable firms to expand their

offerings and revenue streams. TwoFour has been integrated into our GTO segment, where its significant capabilities have been rebranded as Broadridge FX and Liquidity Solutions. In April, we acquired the trade processing business of the Wilmington

Trust Retirement and Institutional Services unit of M&T Bank Corporation. Combined with Matrix Financial Solutions in our Mutual Funds and Retirement Solutions business, this transaction provides us with a best-in-class mutual fund and ETF trade

processing platform and a comprehensive solution for the growing Asset Management market. The combined businesses had more than $300 billion in assets under administration at fiscal year-end, and will enable us to meet an ever greater set of client

needs. 3

Going forward, with GTO’s core North American post-trade processing as the foundation, Broadridge continues to be well positioned

to play a meaningful role as an industry-wide utility for both equity and fixed income post-trade processing. There are over 20 financial services industry utilities in various stages of market readiness, and their scope spans the capital markets

ecosystem from trade processing to client onboarding. Our decades of experience providing mutualization services have earned us a place in these discussions, which enable Broadridge to demonstrate its unique capabilities and the value we add to

individual firms and across the industry. Our unique insights and capabilities position us well to advise our clients on the achievement of their efficiency and risk management goals. During the year, we launched a professional services practice to

better support our clients in their efforts to achieve efficiencies and better manage operational risk, as well as their compliance and capital requirements. Digitization For years, Broadridge has been a leader in providing digital regulatory

communications, such as electronic delivery of proxy materials and online proxy voting, and the opportunities only continue to grow. Whether it is the digitization of investor communications, or the development of electronic marketing materials and

statements, Broadridge has the technology and expertise to provide cutting-edge solutions that enable increased investor engagement and significant reductions in distribution costs. Being an industry leader in digital communications is one of

Broadridge’s most important strategic initiatives, and the investments we’re making should deliver substantial returns given this truly transformative opportunity. We have built a new series of solutions in an effort to transform static

one-way investor communications into interactive touch points that help firms create a better digital experience for their customers. Our Mailbox Solutions continue to gain momentum. Our Investor Mailbox®, which is an Enhanced Brokers’

Internet Platform (EBIP), and Advisor Mailbox® are integrated into our Capital Markets, Corporation, and Wealth Management clients’ websites to provide digital delivery of regulatory communications to individual investors and financial

advisors. These solutions provide opportunities for more efficient and proactive communications, increased transparency for investors, and an overall enhanced customer experience. We currently have 29 Capital Markets clients of our Mailbox Solutions

in the U.S. and U.K. In the U.S. these solutions currently cover about 55% of all brokerage accounts, twice the level of accounts from just two years ago. In addition, we are partnering with leading companies to enable the financial services

industry to communicate with investors through a host of new channels, including digital mailboxes, cloud drives, and productivity applications. Last year we introduced Inlet™, a joint venture with Pitney Bowes, a solution that enables digital

communications through these new channels. Leveraging Broadridge’s FluentSM technology platform, Inlet enhances the customer experience by allowing investors to receive information when and where they choose. Simultaneously, our Wealth

Management clients benefit through broader digital relationships with their customers, enhanced marketing capabilities, and lower distribution costs. It is a win-win for Broadridge and our clients, and it is gaining traction. By the end of fiscal

year 2016 we expect to complete the integration of Fluent with eight consumer channels that reach a total of over 200 million consumers in the U.S. and Canada. Data and Analytics As a strategic partner of banks, broker-dealers, mutual funds and

corporate issuers, our operating platforms handle more than two billion investor communications per year, and process on average over $5 trillion in trading value every day. We are in the business of handling, processing, analyzing and storing data

while maintaining its security. Increasingly, our clients are seeking advice in leveraging their data assets as they look for additional ways of meeting their business goals and serving their customers. In response, we have again expanded our data

and analytics capabilities through both internally developed and acquired solutions, and by adding products that further strengthen our client relationships.

Our

Data Aggregation and Analysis platform, which includes capabilities acquired through our Access Data and Bonaire acquisitions, provides comprehensive data gathering, data management, and business solutions. These services assist Capital Markets and

Asset and Wealth Management firms in processing commission and distribution payments, calculating fee revenue, monitoring expense management and compliance with regulatory requirements, and assembling shareholder and intermediary data in a form to

better drive their sales strategy, product development and marketing programs. Our fiscal year 2015 acquisition of the Fiduciary Services and Competitive Intelligence unit of Thomson Reuters’ Lipper division, now known as Broadridge Fund

Information Services, substantially enhances our capabilities in data and analytics. This transaction expands our leading enterprise data and analytics solutions, and reinforces our position as the 4

“go-to” provider of data solutions and market intelligence for the Wealth Management sector. When combined with our existing

market intelligence and compliance solutions, Broadridge can now provide a comprehensive view of global fund flows, helping guide product development, marketing, and distribution for our mutual fund clients, as well as present additional insights to

their boards in support of their regulatory obligations. Our suite of data and analytics solutions for the Wealth Management market also includes tools that enable financial advisors to advise, educate and communicate with their customers and

prospects. Our tools help advisors create content and provide a library of financial planning topics and customer communications, such as customizable advisor websites, search engine marketing, and electronic and print newsletters. Fiscal year 2015

also saw us enhance our data and analytics solutions through the acquisition of Direxxis LLC, a provider of cloud-based marketing solutions and services for financial advisors. Direxxis’ unique analytics capabilities enhance the effectiveness

of sales and marketing efforts for Asset and Wealth Management firms and insurers. Faced with the growing trend of shareholder activism, the stakes have never been higher for our corporate issuer clients, who are increasingly looking for ways to

better prepare for and execute the proxy voting process while increasing shareholder engagement. Last year we introduced Shareholder Data Services, a platform that provides Corporations with data and analytics on their shareholder base. This

solution enables issuers to more effectively target their communications with shareholders to drive additional proxy participation and support. We have seen a strong response to this product, and today have over 40 clients using this capability. To

complement our Shareholder Data Services offering, we introduced our Enhanced Packaging service for the 2015 proxy season. By sending shareholders a strong call to action from the CEO or showcasing a company’s financial results or products,

Enhanced Packaging enables Corporations to engage their shareholders before they even open the envelope. If you received a paper copy of our annual meeting materials in the mail, then you’ve seen an example of this innovative new solution. For

our Capital Markets and Wealth Management clients, we launched our Wealth Insight SolutionsSM product this past year. A partnership between Broadridge and Experian, this product observes and models more than $25 trillion in retail assets, providing

our clients with wealth data to support their growth initiatives by more effectively targeting prospects and identifying new market opportunities. These days, a discussion of data can’t be had without talking about the issue of cybersecurity.

As you might imagine, this is a topic we take very seriously. You don’t become a trusted partner to the financial community without consistently demonstrating the ability to safely and reliably process and store client data. We hold a number of

industry certifications, including ISO 27001, and this year we used the National Institute of Standards and Technology (NIST) Framework for Improving Critical Infrastructure Cybersecurity from the U.S. Department of Commerce to benchmark our

security measures. Also during the year, we established an internal Cybersecurity Council, made up of key members from different disciplines within Broadridge to provide additional oversight of our cybersecurity risks and solutions. At Broadridge,

we understand the stakes and are investing significantly in our commitment to keeping our clients’ data secure. We will continue to be a leader in the industry with our capabilities in this important area. Capital Stewardship: Driving Growth

and Returning Cash to our Stockholders Effective capital stewardship has always been a hallmark of Broadridge. We have a low capital intensity business model that generates significant free cash flows, and we fundamentally believe that the cash we

generate is our stockholders’ cash. We are committed to investing this capital to produce the greatest returns for our stockholders. So I am pleased to report that in fiscal year 2015, we returned a total of $332 million to stockholders in the

form of cash dividends and share repurchases, net of proceeds from option exercises. Our priorities surrounding what to do with your cash have remained constant. The first is the payment of a meaningful dividend. When we became a public company, we

paid an annual dividend of $0.24 per share, representing a payout ratio to net earnings of about 20%. Since then we have increased our dividend at a compounded annual growth rate of approximately 22%. In August 2015, we raised our annual dividend

amount for the eighth consecutive year to $1.20 per share, representing a ratio to net earnings that is slightly better than the 45% payout target we set a year ago. Second, we plan to continuously invest in the business to drive growth through our

strategic tuck-in acquisition program. Our 5

criteria for acquisitions are very clear: we look for companies that are complementary to our existing businesses, that can accelerate

our organic growth, and have healthy margin potential. In addition, we target transactions with a 20% IRR threshold and potential to be accretive to our earnings in about a year. The third aspect of our capital stewardship program is share

repurchases. During fiscal year 2015, we repurchased 5.2 million shares of our common stock for a total purchase price of $210 million, net of proceeds from option exercises. Going forward, we remain committed to our capital stewardship

program. As we discussed at our Investor Day, we plan on increasing our debt leverage ratio over the next few years. Our new long-term target will be to maintain an adjusted debt to EBITDAR ratio of 2:1. We believe this will provide more capital to

allocate among our capital stewardship priorities, enhancing our ability to take advantage of our growth opportunities. We expect to achieve this while also maintaining our investment grade credit rating, an important factor for our clients and our

industry when they look for a stable and quality partner with which to do business. The Service Profit Chain: Our Continued Growth Driver None of our success this year, or any other year would have been possible without the hard work, dedication and

entrepreneurial spirit of our worldwide team of over 7,400 associates. They are the foundation of our reputation as a trusted provider in the market and our 97% client revenue retention rate is proof positive that they are engaged and providing

value every day. Through the Service Profit Chain, we are committed to ensuring our associates are highly engaged and servicing our clients at the highest levels of quality. We are committed to providing our associates with an engaging, inclusive

environment that offers significant opportunities to continue building their skill sets, and their professional development only serves to strengthen Broadridge’s position in the marketplace. We also strive to be an engaged corporate partner to

the communities in which we live and work by making social investments and donating our time and talent in ways that improve the lives of others. As a company, Broadridge supports a number of not-for-profit organizations that represent causes that

resonate with our associates, and we encourage associates to volunteer in their local communities. During the year, we launched a new corporate social responsibility program designed to continue to drive our commitment on this front. The program

includes renewed efforts around global volunteering, matching gifts and philanthropic investments supporting youth education. This commitment adds to our history of supporting communities, and being an employer of choice and a valuable corporate

citizen. Our efforts in this area continue to be recognized. Broadridge was ranked among the top 30 large-sized companies in the “Best Companies to Work for in New York State” survey by the New York State Society for Human Resource

Management. We’ve received this recognition for the past eight consecutive years-every year since the program’s inception. In addition, our Journal Square, New Jersey site has received the 2014 Alfred P. Sloan “When Work Works”

award in recognition of our flexible work arrangements. In Canada, we were named one of the “Best Workplaces in Canada” by the Great Place to Work® Institute Canada for the seventh consecutive year. In addition, this past year

Broadridge India received the “Great Place to Innovate Award” by Zinnov, and was recognized as a “Dream Company to Work For - 2015” in the IT sector at the World HRD Congress Awards. Our ongoing commitment to diversity was also

recognized by the Human Rights Campaign’s Corporate Equality Index, which gave Broadridge a perfect score of 100 and identified the Company as a “Best Place to Work for LGBT Equality” for the third year in a row. Finally, in February,

Broadridge was named to FORTUNE® Magazine’s 2015 list of the “World’s Most Admired Companies” in the financial data services category. That Broadridge received this honor is just further proof that our commitment to our

associates through the Service Profit Chain is driving our performance and being recognized in the marketplace. I couldn’t be more pleased with the recognition our efforts and commitment in this area continue to receive. Once again, I’d

like to take this opportunity to thank our associates. It’s their tireless work and commitment that have made Broadridge the market leader it is today, and it is their efforts that will lead the way as we continue to execute our strategy and

grow. I am, as always, grateful for their dedication and efforts. 6

Our Journey Progresses

Fiscal year 2015 was

another year of success for Broadridge. We executed strongly, and delivered record financial results that were consistent with our goals and position us to meet our long-term objectives. We also continued to invest in our future, developing new

products and making strategic tuck-in acquisitions that further expand our capabilities. In the process, we again generated significant value for our stockholders, clients and associates.

The dynamics driving demand among our clients have not changed: they will continue to look for solutions from a trusted partner who provides them with the ability to better compete

and communicate in an increasingly regulated, competitive, and dynamic marketplace. We will continue to ensure that we are the company they call on to address these needs.

As I look to fiscal year 2016 and beyond, my confidence in Broadridge is as strong as ever. We continue to operate from a position of strength based on ongoing solid execution and

demand for our services, demonstrated by our strong recurring revenue closed sales results, client revenue retention rate and sales pipeline. We are laser-focused on these imperatives, all of which require successful execution to continue on our

journey to accelerate growth and achieve top quartile total shareholder return.

We will continue to execute on our growth strategy. In doing so we will seek to

invest in opportunities across the three key industry macro trends to enhance our position and grow our business. The multi-faceted nature of our approach to growth means that we have positioned ourselves with multiple ways of achieving our goals.

Our ICS business is a truly differentiated market leader, with strong recurring revenue growth, exceptional client retention, low capital intensity, and an

expanding product and solution set. Overall, the business is positioned to support clients as they evolve to the next level of secure digital communications with their customers and investors, and to provide the data and analytics they need to grow

their businesses.

At the same time, our GTO business had stable performance in fiscal year 2015, with strong growth in recurring revenue closed sales. Based on its

robust and growing sales pipeline, GTO is expected to continue to be a significant contributor to Broadridge’s performance and our ability to create value for our customers. GTO is particularly well poised to take advantage of the opportunities

presented by the mutualization trend and industry utility discussions impacting the financial services industry.

Our business model is more resilient and our

ability to control our destiny is greater than ever. We have strong positions in large and attractive markets, and with an estimated $24 billion addressable market and a robust sales pipeline, we are positioned to accelerate our growth going

forward. The execution of our strategy and our commitment to our capital stewardship program have placed us in an excellent position to achieve our three-year financial performance goals and generate top quartile total shareholder return over any

multi-year period.

I’d like to thank our associates, clients and stockholders for their continued support, and look forward to reporting on the successful

progress of our journey in the future.

Rich Daly

President and Chief

Executive Officer

7

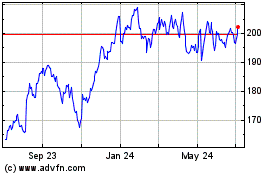

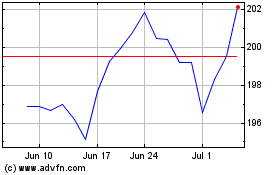

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jul 2023 to Jul 2024