UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2015

————————————

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

————————————

|

| |

001-33220 | 33-1151291 |

(Commission file number) | (I.R.S. Employer Identification No.) |

1981 Marcus Avenue

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2015, Broadridge Financial Solutions, Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and fiscal year ended June 30, 2015. On August 7, 2015, the Company also posted an Earnings Webcast & Conference Call Presentation dated August 7, 2015 on the Company’s Investor Relations website at www.broadridge-ir.com. In addition, on August 7, 2015, the Company posted key statistics related to its Investor Communication Solutions and Global Technology Operations businesses for the fourth quarter and fiscal year ended June 30, 2015, on the Company’s Investor Relations website at www.broadridge-ir.com.

On August 7, 2015, the Company issued a press release announcing that its Board of Directors declared a quarterly cash dividend of $0.30 per share payable on October 1, 2015 to stockholders of record on September 15, 2015. This declaration reflects the approval of the Company’s Board of Directors of an increase in the annual dividend amount from $1.08 per share to $1.20 per share. However, the declaration and payment of future dividends to holders of the Company’s common stock will be at the discretion of its Board of Directors, and will depend upon many factors, including the Company’s financial condition, earnings, capital requirements of its businesses, legal requirements, regulatory constraints, industry practice, and other factors that the Board of Directors deems relevant.

The Company also announced in the press release issued on August 7, 2015, that the Company’s Board of Directors authorized the repurchase of up to an additional 5.3 million shares of the Company’s common stock. The share repurchases will be made in open market or privately negotiated transactions in compliance with applicable legal requirements and other factors.

Copies of the press release, earnings presentation, and key statistics are being furnished as Exhibits 99.1, 99.2, and 99.3 attached hereto, respectively, and are incorporated herein by reference. The information furnished pursuant to Items 2.02 and 9.01, including Exhibits 99.1, 99.2, and 99.3 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This current report on Form 8-K and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, statements about Broadridge’s future financial performance are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this 8-K and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the investor communication services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

Exhibits. The following exhibits are furnished herewith:

|

| | | | |

| | |

Exhibit No. | | | Description |

| |

99.1 |

| | Broadridge Financial Solutions, Inc. Press Release dated August 7, 2015. |

| | |

99.2 |

| | Broadridge Financial Solutions, Inc. Earnings Webcast & Conference Call Presentation dated August 7, 2015. |

| | |

99.3 |

| | Broadridge Financial Solutions, Inc. Key Statistics dated August 7, 2015. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 7, 2015

|

| |

| BROADRIDGE FINANCIAL SOLUTIONS, INC. By: /s/ James M. Young Name: James M. Young Title: Vice President and Chief Financial Officer |

| |

BROADRIDGE REPORTS FOURTH QUARTER AND FISCAL YEAR 2015 RESULTS

Announces Record Revenues, Earnings, and Closed Sales

Increases Annual Dividend Amount 11% to $1.20 per share

LAKE SUCCESS, N.Y., August 7, 2015 - Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the fourth quarter and fiscal year ended June 30, 2015.

|

| |

Fourth Quarter Fiscal Year 2015 Results: | Fiscal Year 2015 Results: |

- Recurring fee revenues increased 7% to $606 million | - Recurring fee revenues increased 6% to $1.741 billion |

- Total revenues increased 5% to $930 million | - Total revenues increased 5% to $2.694 billion |

- Adjusted Net earnings increased 19% to $172 million | - Adjusted Net earnings increased 10% to $307 million |

- Net earnings increased 18% to $166 million | - Net earnings increased 9% to $287 million |

- Adjusted Diluted earnings per share increased 21% to $1.40 | - Adjusted Diluted earnings per share increased 10% to $2.47 |

- Diluted earnings per share increased 19% to $1.35 | - Diluted earnings per share increased 9% to $2.32 |

- Recurring revenue closed sales decreased 41% to $39 million | - Recurring revenue closed sales increased 15% to $146 million |

Richard J. Daly, president and chief executive officer, commented, “I am pleased with our performance in fiscal year 2015. The strong fourth quarter performance enabled Broadridge to achieve another record year driven by 10% growth in Adjusted Diluted EPS primarily from Net New Business and record recurring revenue closed sales, which grew 15%. The very strong recurring revenue closed sales results coupled with our exceptional client revenue retention levels highlight the value that Broadridge is creating for our clients.”

Mr. Daly added, “Given our financial strength and confidence in the business, the Board has raised our annual dividend amount by 11% to $1.20 per share, representing the eighth consecutive annual increase in our dividend. Additionally, our strong free cash flows have enabled us to continue to return capital to our stockholders through increased levels of share repurchases, while also investing in our business by completing four tuck-in acquisitions during fiscal 2015.”

Mr. Daly concluded, “Given the strong fiscal year 2015 performance, I remain confident in Broadridge’s ability to continue to successfully execute our long term strategy and achieve our three-year performance objectives which, on a compounded annual growth rate basis, include recurring fee revenue growth of 7% to 10% and adjusted net earnings growth of 9% to 11%. Our fiscal year 2016 guidance is highlighted by planned strong recurring fee revenue growth of 10% to 12% and Adjusted Diluted earnings per share growth of 8% to 12%. This guidance is consistent with our three-year performance objectives. We believe we are well positioned to continue to generate sustainable top quartile total shareholder return going forward.”

Financial Results for Fourth Quarter Fiscal Year 2015

For the fourth quarter of fiscal year 2015, revenues increased $44 million, or 5%, to $930 million, compared to $886 million for the prior year period. The increase was driven by higher recurring fee revenues of approximately $40 million, or 7%, as a result of Net New Business (defined by the Company as recurring revenue from closed sales less recurring revenue from client losses) (3 pts), contributions from acquisitions (2 pts), and internal growth (2 pts). Pre-tax margins were 27.5% compared to 23.3% for the prior year period. Adjusted Pre-tax margins were 28.4%, compared to 24.1% for the same period last year.

For the fourth quarter of fiscal year 2015, Net earnings increased $26 million, or 18%, to $166 million, compared to $140 million for the prior year period, due to higher revenues and lower strategic initiative spend. Adjusted Net earnings increased $27 million, or 19% to $172 million, compared to $145 million for the same period last year. Diluted earnings per share increased 19% to $1.35 per share, compared to $1.13 per share in the same period last year. Adjusted Diluted earnings per share increased 21% to $1.40 per share, compared to $1.16 per share for the same period last year. Acquisition Amortization

and Other Costs, net of taxes decreased Diluted earnings per share by $0.05 and $0.04 for the three months ended June 30, 2015 and 2014, respectively.

In addition, during the fourth quarter, the Company repurchased approximately 2.2 million shares of Broadridge common stock at an average price of $53.57 per share under its stock repurchase program.

Analysis of Fourth Quarter Fiscal Year 2015

Investor Communication Solutions

Revenues for the Investor Communication Solutions segment increased $48 million, or 7%, to $766 million in the fourth quarter of fiscal year 2015, compared to $718 million in the fourth quarter of fiscal year 2014. The increase was attributable to higher recurring fee revenues which contributed $33 million, higher event-driven fee revenues which contributed $4 million, and an $11 million increase in distribution revenues. Higher recurring fee revenues of 8% were driven by contributions from our recent acquisitions (3 pts), market-based internal growth activities (3 pts), and Net New Business (2 pts). Position growth, a component of internal growth, was 7% for mutual fund interim communications and 6% for annual equity proxy communications, compared to the same period in the prior year. Higher event-driven fee revenues were primarily from increased proxy contest activity. Pre-tax margins increased by 160 basis points to 32.1% as a result of higher fee revenues combined with lower strategic initiative spend.

Global Technology and Operations (formerly known as Securities Processing Solutions)

Revenues for the Global Technology and Operations segment increased $7 million, or 4%, to $178 million in the fourth quarter of fiscal year 2015 compared to $171 million in the fourth quarter of fiscal year 2014. The increase was attributable to higher Net New Business (3 pts) and the contribution from a recent acquisition (1 pt). Pre-tax margins increased by 720 basis points to 16.1% primarily as a result of lower strategic initiative spend.

Other

Pre-tax loss decreased by $10 million in the fourth quarter of fiscal year 2015 compared to the same period last year, primarily due to a $5 million decrease in performance-based compensation and benefits expenses and a $3 million decrease in strategic initiative spend.

Financial Results for Fiscal Year 2015

For the fiscal year ended June 30, 2015, revenues increased $136 million, or 5%, to $2.694 billion, compared to $2.558 billion for the comparable period last year. The $136 million increase was driven by higher recurring fee revenues of $99 million, higher distribution revenues of $45 million, and higher event-driven fee revenues of $17 million. The positive contribution from recurring fee revenues reflected gains from Net New Business (3 pts), contributions from acquisitions (2 pts), and internal growth (1 pt). Fluctuations in foreign currency exchange rates unfavorably impacted revenues by $25 million. Pre-tax margins of 16.3% increased compared to 15.5% for the previous fiscal year, primarily due to higher revenues and operating leverage. Adjusted Pre-tax margins of 17.4% increased compared to 16.4% for the same period last year.

For the fiscal year ended June 30, 2015, Net earnings of $287 million increased 9%, compared to $263 million in the comparable period last year. Adjusted Net earnings increased to $307 million, or 10%, compared to $279 million in the prior year period. Diluted earnings per share increased to $2.32 per share compared to $2.12 per share for the comparable period last year. Adjusted Diluted earnings per share were $2.47 per share compared to $2.25 per share for the comparable period last year. Acquisition Amortization and Other Costs, net of taxes decreased Diluted earnings per share by $0.16 and $0.13 for the fiscal years ended June 30, 2015 and 2014, respectively.

During the fiscal year ended 2015, our recurring revenue closed sales increased 15% from last year's comparable period to $146 million. During fiscal year 2015 Free cash flows increased 9% to $365 million from $334 million in the prior year. During fiscal year 2015, the Company repurchased approximately 5.2 million shares of Broadridge common stock at an average price of $52.18 per share under its stock repurchase program.

Dividend Declaration and Increase

On August 6, 2015, the Company's Board of Directors approved a quarterly dividend of $0.30 per share payable on October 1, 2015 to stockholders of record on September 15, 2015. This declaration reflects the Board's approval of an increase in the annual dividend amount by approximately 11% from $1.08 per share to $1.20 per share, subject to the discretion of the Board of Directors to declare quarterly dividends. With this increase, the Company's annual dividend has increased for the eighth consecutive year since its first full year of dividend payments in fiscal year 2008.

Share Repurchase Authorization

In addition, on August 6, 2015, the Board also authorized the repurchase of up to an additional 5.3 million shares of

Broadridge common stock. The share repurchases will be made in the open market or privately negotiated

transactions in compliance with applicable legal requirements and other factors. With this authorization, the Company currently has approximately 10.0 million shares available for repurchase under its share repurchase program.

Fiscal Year 2016 Financial Guidance The Company anticipates:

| |

• | Recurring fee revenue growth in the range of 10% to 12% and total revenue growth in the range of 8% to 10% |

| |

• | Adjusted Operating income margin of ~18.4% |

| |

• | Effective tax rate of ~34.8% |

| |

• | Adjusted Diluted earnings per share growth in the range of 8% to 12% |

| |

• | Free cash flows in the range of $350 million to $400 million |

| |

• | Recurring revenue closed sales in the range of $120 million to $160 million |

Our guidance does not take into consideration the effect of any future acquisitions, additional debt or share repurchases.

Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures

The Company's results in this press release are presented in accordance with generally accepted accounting principles in the United States ("GAAP") except where otherwise noted. In certain circumstances, results have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results.

With regard to statements in this press release that include certain Non-GAAP financial measures, the adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing performance. These adjusted measures exclude the impact of Acquisition Amortization and Other Costs which represent the amortization charges associated with intangible asset values as well as other deal costs associated with the Company’s acquisitions.

The Adjusted Operating income margin and Adjusted Diluted earnings per share fiscal year 2016 guidance provided above is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs.

We also provide information on our Free cash flows because we believe this information helps our investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by operating activities less capital expenditures and purchases of intangibles.

The Company believes Non-GAAP financial information helps investors understand the effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between our current results and prior reported results, and as a basis for planning and forecasting for future periods.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this press release.

Earnings Conference Call

An analyst conference call will be held today, Friday, August 7, 2015 at 8:30 a.m. ET. A live webcast of the call will be available to the public on a listen-only basis. To listen to the webcast and view the slide presentation, go to www.broadridge-ir.com. The presentation will also be available to download and print approximately one hour before the webcast. Broadridge’s news releases, current financial information, SEC filings and Investor Relations presentations are accessible on the same website.

About Broadridge

Broadridge Financial Solutions, Inc. (NYSE:BR) is the leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally. Broadridge’s investor communications, securities processing and managed services solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge’s infrastructure underpins proxy voting services for over 90% of public companies and mutual funds in North America, and processes on

average $5 trillion in equity and fixed income trades per day. Broadridge employs approximately 7,400 full-time associates in 14 countries. For more information about Broadridge, please visit www.broadridge.com.

Forward-Looking Statements

This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2016 Financial Guidance” section and references to our three-year performance objectives and outlook are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

Contact Information

Investors:

Brian S. Shipman, CFA

Broadridge Financial Solutions, Inc.

Vice President, Head of Investor Relations

(516) 472-5129

Broadridge Financial Solutions, Inc.

Consolidated Statements of Earnings

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues | $ | 929.6 |

| | $ | 885.9 |

| | $ | 2,694.2 |

| | $ | 2,558.0 |

|

Cost of revenues | 555.1 |

| | 551.2 |

| | 1,828.2 |

| | 1,761.4 |

|

Selling, general and administrative expenses | 112.0 |

| | 120.9 |

| | 396.8 |

| | 376.0 |

|

Other expenses, net | 7.1 |

| | 7.2 |

| | 30.3 |

| | 25.1 |

|

Total expenses | 674.2 |

| | 679.3 |

| | 2,255.3 |

| | 2,162.5 |

|

Earnings before income taxes | 255.4 |

| | 206.6 |

| | 438.9 |

| | 395.5 |

|

Provision for income taxes | 89.5 |

| | 66.4 |

| | 151.8 |

| | 132.5 |

|

Net earnings | $ | 165.9 |

| | $ | 140.2 |

| | $ | 287.1 |

| | $ | 263.0 |

|

| | | | | | | |

Basic earnings per share | $ | 1.39 |

| | $ | 1.16 |

| | $ | 2.39 |

| | $ | 2.20 |

|

Diluted earnings per share | $ | 1.35 |

| | $ | 1.13 |

| | $ | 2.32 |

| | $ | 2.12 |

|

Weighted-average shares outstanding: | | | | | | | |

Basic | 119.1 |

| | 120.5 |

| | 119.9 |

| | 119.6 |

|

Diluted | 122.6 |

| | 124.6 |

| | 124.0 |

| | 124.1 |

|

Broadridge Financial Solutions, Inc.

Consolidated Balance Sheets

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | |

| June 30,

2015 | | June 30,

2014 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 324.1 |

| | $ | 347.6 |

|

Accounts receivable, net of allowance for doubtful accounts of $3.8 and $3.3, respectively | 444.5 |

| | 424.8 |

|

Other current assets | 92.8 |

| | 108.2 |

|

Total current assets | 861.4 |

| | 880.6 |

|

Property, plant and equipment, net | 97.3 |

| | 88.3 |

|

Goodwill | 970.5 |

| | 856.1 |

|

Intangible assets, net | 195.7 |

| | 130.0 |

|

Other non-current assets | 243.2 |

| | 237.1 |

|

Total assets | $ | 2,368.1 |

| | $ | 2,192.1 |

|

Liabilities and Stockholders’ Equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 115.9 |

| | $ | 116.3 |

|

Accrued expenses and other current liabilities | 320.4 |

| | 306.6 |

|

Deferred revenues | 72.6 |

| | 61.5 |

|

Total current liabilities | 508.9 |

| | 484.4 |

|

Long-term debt | 689.4 |

| | 524.1 |

|

Deferred taxes | 61.7 |

| | 62.4 |

|

Deferred revenues | 75.2 |

| | 59.0 |

|

Other non-current liabilities | 105.1 |

| | 100.5 |

|

Total liabilities | 1,440.3 |

| | 1,230.4 |

|

Commitments and contingencies | | | |

Stockholders’ equity: | | | |

Preferred stock: Authorized, 25.0 shares; issued and outstanding, none | — |

| | — |

|

Common stock, $0.01 par value: Authorized, 650.0 shares; issued, 154.5 and 154.5 shares, respectively; outstanding, 118.2 and 119.5 shares, respectively | 1.6 |

| | 1.6 |

|

Additional paid-in capital | 855.5 |

| | 810.7 |

|

Retained earnings | 1,132.0 |

| | 973.9 |

|

Treasury stock, at cost: 36.3 and 35.0 shares, respectively | (1,040.4 | ) | | (834.8 | ) |

Accumulated other comprehensive income (loss) | (20.9 | ) | | 10.3 |

|

Total stockholders’ equity | 927.8 |

| | 961.7 |

|

Total liabilities and stockholders’ equity | $ | 2,368.1 |

| | $ | 2,192.1 |

|

Broadridge Financial Solutions, Inc.

Segment Results

(In millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Revenues |

| Three Months Ended

June 30, 2015 | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Investor Communication Solutions | $ | 765.8 |

| | $ | 717.6 |

| | $ | 2,030.2 |

| | $ | 1,881.0 |

|

Global Technology and Operations | 177.6 |

| | 171.0 |

| | 692.5 |

| | 680.7 |

|

Other | — |

| | — |

| | — |

| | — |

|

Foreign currency exchange | (13.8 | ) | | (2.7 | ) | | (28.5 | ) | | (3.7 | ) |

Total | $ | 929.6 |

| | $ | 885.9 |

| | $ | 2,694.2 |

| | $ | 2,558.0 |

|

|

| | | | | | | | | | | | | | | |

| Earnings (Loss) before Income

Taxes |

| Three Months Ended

June 30, | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Investor Communication Solutions | $ | 246.0 |

| | $ | 218.6 |

| | $ | 381.4 |

| | $ | 336.3 |

|

Global Technology and Operations | 28.6 |

| | 15.3 |

| | 120.3 |

| | 118.8 |

|

Other | (20.0 | ) | | (30.0 | ) | | (73.5 | ) | | (75.3 | ) |

Foreign currency exchange | 0.8 |

| | 2.7 |

| | 10.7 |

| | 15.7 |

|

Total | $ | 255.4 |

| | $ | 206.6 |

| | $ | 438.9 |

| | $ | 395.5 |

|

In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Global Technology and Operations reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results have been revised to reflect this change in reportable segments.

Broadridge Financial Solutions, Inc.

Reconciliation of Non-GAAP to GAAP Measures

(Unaudited)

(In millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

EBIT (Non-GAAP) | $ | 262.2 |

| | $ | 213.0 |

| | $ | 463.8 |

| | $ | 420.3 |

|

Acquisition Amortization and Other Costs | 8.6 |

| | 6.9 |

| | 30.2 |

| | 24.7 |

|

Interest and Other, net | (6.8 | ) | | (6.4 | ) | | (24.9 | ) | | (24.8 | ) |

Adjusted Earnings before income taxes (Non-GAAP) | $ | 264.0 |

| | $ | 213.5 |

| | $ | 469.1 |

| | $ | 420.2 |

|

Acquisition Amortization and Other Costs | (8.6 | ) | | (6.9 | ) | | (30.2 | ) | | (24.7 | ) |

Earnings before income taxes (GAAP) | $ | 255.4 |

| | $ | 206.6 |

| | $ | 438.9 |

| | $ | 395.5 |

|

EBIT margins (Non-GAAP) | 28.2 | % | | 24.0 | % | | 17.2 | % | | 16.4 | % |

Adjusted Pre-tax margins (Non-GAAP) | 28.4 | % | | 24.1 | % | | 17.4 | % | | 16.4 | % |

Pre-tax margins (GAAP) | 27.5 | % | | 23.3 | % | | 16.3 | % | | 15.5 | % |

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Net earnings (Non-GAAP) | $ | 171.5 |

| | $ | 144.6 |

| | $ | 306.9 |

| | $ | 279.0 |

|

Acquisition Amortization and Other Costs, net of taxes | (5.6 | ) | | (4.4 | ) | | (19.8 | ) | | (16.0 | ) |

Net earnings (GAAP) | $ | 165.9 |

| | $ | 140.2 |

| | $ | 287.1 |

| | $ | 263.0 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Fiscal Year Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Diluted earnings per share (Non-GAAP) | $ | 1.40 |

| | $ | 1.16 |

| | $ | 2.47 |

| | $ | 2.25 |

|

Acquisition Amortization and Other Costs, net of taxes | (0.05 | ) | | (0.04 | ) | | (0.16 | ) | | (0.13 | ) |

Diluted earnings per share (GAAP) | $ | 1.35 |

| | $ | 1.13 |

| | $ | 2.32 |

| | $ | 2.12 |

|

|

| | | | | | | | |

| | Fiscal Year Ended

June 30, |

| | 2015 | | 2014 |

Free Cash Flows (Non-GAAP) | | $ | 365.4 |

| | $ | 334.3 |

|

Capital expenditures and purchases of intangibles | | 66.0 |

| | 53.4 |

|

Net cash flows provided by operating activities (GAAP) | | $ | 431.4 |

| | $ | 387.7 |

|

Note: Amounts may not sum due to rounding.

Broadridge Financial Solutions, Inc.

Reconciliation of Non-GAAP to GAAP Measures

Diluted Earnings Per Share Growth and Operating Income Margin

Fiscal Year 2016 Guidance

(Unaudited)

|

| | |

Earnings Per Share Growth Rate (1) | | FY16 Guidance |

Adjusted Diluted earnings per share (Non-GAAP) | | 8% - 12% growth |

Diluted earnings per share (GAAP) | | 7% - 12% growth |

| | |

Operating Income Margin (2) | | FY16 Guidance |

Adjusted Operating income margin % (Non-GAAP) | | ~18.4% |

Operating income margin % (GAAP) | | ~17.3% |

| | |

(1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Diluted EPS guidance estimates exclude Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share.

(2) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin guidance estimates exclude Acquisition Amortization and Other Costs of $34 million.

Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt, and/or share repurchases.

1© 2014 | Earnings Webcast & Conference Call Fourth Quarter and Fiscal Year 2015 August 7, 2015 EXHIBIT 99.2

2 Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” could be” and other words of similar meaning, are forward-looking statements. In particular, information referred to as “Fiscal Year 2016 Financial Guidance” or our three-year performance objectives and outlook are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

3 Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company's results in this presentation are presented in accordance with generally accepted accounting principles in the United States (“GAAP”) except where otherwise noted. In certain circumstances, results have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results. With regard to statements in this presentation that include certain Non-GAAP financial measures, the adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing performance. These adjusted measures exclude the impact of Acquisition Amortization and Other Costs which represent the amortization charges associated with intangible asset values as well as other deal costs associated with the Company’s acquisitions. The Adjusted Operating income margin and Adjusted Diluted earnings per share fiscal year 2016 guidance provided in this presentation is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. We also provide information on our Free cash flows because we believe this information helps our investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by operating activities less capital expenditures and purchases of intangibles. The Company believes Non-GAAP financial information helps investors understand the effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between our current results and prior reported results, and as a basis for planning and forecasting for future periods. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the attached Appendix. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. You may reproduce information contained in this presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc.

4 Key Messages • FY15 performance and FY16 guidance are consistent with our Investor Day three-year objectives • Net New Business drove solid Q4 and full-year recurring fee revenue growth along with contribution from tuck-in acquisitions • Strong recurring revenue closed sales performance led to another record year • Delivered on our capital stewardship commitments including tuck- in acquisitions and the return of capital to shareholders • Our FY16 guidance is highlighted by strong recurring fee revenue growth building on a strong sales performance and high client revenue retention rates B Note: Net New Business is defined by the Company as recurring revenue from closed sales less recurring revenue from client losses.

5 FY15 Financial Highlights and FY16 Guidance • Continuation of recurring fee revenue momentum ▪ Recurring fee revenue growth of 6% primarily from Net New Business • Recurring revenue closed sales growth of 15% to a record $146M • Adjusted Diluted EPS growth of 10% to $2.47 • Closed four tuck-in acquisitions totaling over $200M • Share repurchases of $210M ($106M in Q4), net of proceeds from option exercises • Board increased annual dividend amount by 11% to $1.20 per share ▪ Increased dividend eight consecutive years (CAGR ~22%) • FY16 guidance is consistent with our three-year performance objectives and includes: ▪ Recurring revenue closed sales of $120M-160M ▪ Recurring fee revenue growth of 10-12% (total revenue growth of 8-10%) ▪ Adjusted Diluted EPS growth of 8-12% ▪ Free cash flows of $350-400M Note: Adjusted results are Non-GAAP measures.

6 Acquisitions Update • During Q4, completed the acquisition of the Fiduciary Services and Competitive Intelligence unit from Thomson Reuters Lipper division (now known as Broadridge Fund Information Services) ▪ Closed in June; purchase price of $77M ▪ Powered by Lipper data, expands Broadridge’s leading enterprise Data and Analytics solutions for mutual fund manufacturers, ETF issuers, and fund administrators, adding new global data and research capabilities • For fiscal year 2015, we closed four acquisitions totaling over $200M • Successful tuck-in acquisition strategy is accelerating growth and creating long term value

7 FY16 Business Update • Broadridge's current and planned business solutions enable the financial services industry to address increasing regulatory pressures which are driving up costs and shrinking ROEs • Our investments in digital solutions have enabled increased investor engagement as well as reduced billions in postage costs for the industry • We have expanded our Data and Analytics capabilities through internally developed and acquired solutions • SEC proposed new filing requirements for investment companies which includes a notice and access proposal ▪ As proposed, economics to Broadridge are expected to be neutral to slightly positive ▪ Broadridge will comment later in August to the SEC that better savings and greater investor readership are available through digital communications and/or by implementing summary documents

8 4Q Full Year FY15 FY15 FY15 Guidance Growth Drivers as a % of Recurring Fee Revenues Recurring Revenue From Closed Sales 5% 6% Client Losses (2)% (3)% Net New Business 3% 3% Internal Growth 2% 1% Organic Growth 5% 4% Acquisitions 2% 2% Total Recurring Fee Revenue Growth 7% 6% 5-7% Growth Drivers as a % of Total Revenues Recurring Fee Revenues 4% 4% Event-Driven 0% 1% Distribution 1% 2% FX/Other (1)% (1)% Total Revenue Growth 5% 5% 4-6% EBIT Margins (Non-GAAP) 28.2% 17.2% 17.4-17.8% Note: Guidance did not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases. Note: Amounts may not sum due to rounding. Key Financial Drivers- FY15

9 Investor Communication Solutions (ICS) 4Q14 4Q15 Versus Prior Year FY2014 FY2015 Versus Prior Year Recurring fee revenues $395 $429 8% $961 $1,048 9% Total revenues $718 $766 7% $1,881 $2,030 8% Earnings before income taxes $219 $246 13% $336 $381 13% Pre-tax margin 30.5% 32.1% 160 bps 17.9% 18.8% 90 bps Global Technology and Operations (GTO) 4Q14 4Q15 Versus Prior Year FY2014 FY2015 Versus Prior Year Total revenues $171 $178 4% $681 $693 2% Earnings before income taxes $15 $29 87% $119 $120 1% Pre-tax margin 8.9% 16.1% 720 bps 17.5% 17.4% -10 bps Notes: Earnings before income taxes and EBIT are equivalent for business segment reporting. In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Global Technology and Operations reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results have been revised to reflect this change in reportable segments. Segment Results-FY15

10 Income Statement Presentation Consolidated Statements of Earnings For Illustrative Purposes Only Fiscal Year ended June 30, 2015 (Unaudited) (In millions, except per share amounts) Current Presentation Operating Income Presentation Revenues $2,694.2 $2,694.2 Operating Expenses: Cost of revenues 1,828.2 1,828.2 Selling, general and administrative expenses 396.8 399.1 Other expenses, net 30.3 Total operating expenses 2,255.3 2,227.3 Operating Income 466.9 Interest expense (25.4) Other income/(expense), net 2.9 Earnings/(losses) from equity method investments (5.5) Earnings before income taxes 438.9 438.9 Provision for income taxes 151.8 151.8 Net earnings $287.1 $287.1 Adjusted Diluted EPS (Non-GAAP) $2.47 $2.47 Diluted EPS (GAAP) $2.32 $2.32

11 Broadridge Financial Solutions, Inc. Recurring fee revenue growth 10 - 12% Total revenue growth 8 - 10% Adjusted Operating income margin ~18.4% Effective tax rate ~34.8% Adjusted Diluted earnings per share growth 8 - 12% Diluted earnings per share growth 7 - 12% Free cash flows $350M - 400M Recurring revenue closed sales $120M - 160M Segments ICS Total revenue growth 10 - 12% ICS Pre-tax margin ~18.9% GTO Total revenue growth 4 - 6% GTO Pre-tax margin ~17.3% Notes: Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases. Adjusted results are Non-GAAP measures. FY16 Guidance

12 Closing Summary • Strong FY15 performance and FY16 guidance are consistent with our Investor Day three-year objectives • Net New Business drove solid Q4 and full-year recurring fee revenue growth along with contribution from acquisitions • Strong recurring revenue closed sales performance led to another record year, with a growing pipeline • Delivering on our capital stewardship commitments which feature tuck-in acquisitions and the return of capital to shareholders totaling ~$400M • Highly engaged associates led to another year of record client satisfaction • Confidence in both business segments remains high, evidenced by our FY16 guidance, and we plan to execute on the multiple opportunities in front of us to drive long term performance for the three-year plan and beyond

13 Q&A and Closing Comments There are no slides during this portion of the presentation

14 Appendix

15 FY14 - FY15 Annual Income Statement For Illustrative Purposes Only Consolidated Statements of Earnings FY14 FY15 Revenues $ 2,558.0 $ 2,694.2 Operating Expenses: Cost of revenues 1,761.4 1,828.2 Selling, general and administrative expenses 378.7 399.1 Total operating expenses 2,140.1 2,227.3 Operating Income 417.9 466.9 Adjusted Operating income margin % (Non-GAAP) (1) 17.3% 18.5% Operating income margin % (GAAP) 16.3% 17.3% Interest expense (23.9) (25.4) Other income/(expense), net 1.5 2.9 Earnings/(losses) from equity method investments — (5.5) Earnings from continuing operations before income taxes 395.5 438.9 Provision for income taxes 132.5 151.8 Net earnings $ 263.0 $ 287.1 (1) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the impact of Acquisition Amortization and Other Costs. Fiscal years 2014 and 2015 Non-GAAP Adjusted Operating income margin % excludes Acquisition Amortization and Other Costs of $24.7 million and $30.2 million, respectively. Includes Reconciliation of Non-GAAP to GAAP Measures

16 FY14 Income Statement by Quarter For Illustrative Purposes Only 1Q 2Q 3Q 4Q Full Year (Unaudited) FY14 FY14 FY14 FY14 FY14 (In millions, except per share amounts) Revenues $545.2 $520.6 $606.3 $885.9 $2,558.0 Operating Expenses: Cost of revenues 397.5 385.1 427.6 551.2 1,761.4 Selling, general and administrative expenses 75.1 86.4 96.2 121.0 378.7 Total operating expenses 472.6 471.5 523.8 672.2 2,140.1 Operating Income 72.6 49.1 82.5 213.7 417.9 Interest expense (4.8) (6.2) (6.2) (6.7) (23.9) Other income/(expense), net 1.5 (0.2) 0.6 (0.4) 1.5 Earnings/(losses) from equity method investments — — — — — Earnings before income taxes 69.3 42.7 76.9 206.6 395.5 Provision for income taxes 24.9 15.1 26.1 66.4 132.5 Net earnings $44.4 $27.6 $50.8 $140.2 $263.0

17 FY15 Income Statement by Quarter For Illustrative Purposes Only 1Q 2Q 3Q 4Q Full Year (Unaudited) FY15 FY15 FY15 FY15 FY15 (In millions, except per share amounts) Revenues $555.8 $574.6 $634.2 $929.6 $2,694.2 Operating Expenses: Cost of revenues 406.5 414.0 452.6 555.1 1,828.2 Selling, general and administrative expenses 92.2 101.5 92.6 112.8 399.1 Total operating expenses 498.7 515.5 545.2 667.9 2,227.3 Operating Income 57.1 59.1 89.0 261.7 466.9 Interest expense (6.2) (6.2) (6.4) (6.6) (25.4) Other income/(expense), net 0.6 0.6 1.0 0.7 2.9 Earnings/(losses) from equity method investments (1.5) (1.9) (1.7) (0.4) (5.5) Earnings before income taxes 50.0 51.6 81.9 255.4 438.9 Provision for income taxes 17.5 16.9 27.9 89.5 151.8 Net earnings $32.5 $34.7 $54.0 $165.9 $287.1

18 Reconciliation of Non-GAAP to GAAP Measures Three Months Ended June 30, Fiscal Year Ended June 30, 2015 2014 2015 2014 EBIT (Non-GAAP) $ 262.2 $ 213.0 $ 463.8 $ 420.3 Acquisition Amortization and Other Costs 8.6 6.9 30.2 24.7 Interest and Other, net (6.8) (6.4) (24.9) (24.8) Adjusted Earnings before income taxes (Non-GAAP) $ 264.0 $ 213.5 $ 469.1 $ 420.2 Acquisition Amortization and Other Costs (8.6) (6.9) (30.2) (24.7) Earnings before income taxes (GAAP) $ 255.4 $ 206.6 $ 438.9 $ 395.5 EBIT margins (Non-GAAP) 28.2% 24.0% 17.2% 16.4% Adjusted Pre-tax margins (Non-GAAP) 28.4% 24.1% 17.4% 16.4% Pre-tax margins (GAAP) 27.5% 23.3% 16.3% 15.5% Three Months Ended June 30, Fiscal Year Ended June 30, 2015 2014 2015 2014 Adjusted Net earnings (Non-GAAP) $ 171.5 $ 144.6 $ 306.9 $ 279.0 Acquisition Amortization and Other Costs, net of taxes (5.6) (4.4) (19.8) (16.0) Net earnings (GAAP) $ 165.9 $ 140.2 $ 287.1 $ 263.0 Three Months Ended June 30, Fiscal Year Ended June 30, 2015 2014 2015 2014 Adjusted Diluted earnings per share (Non-GAAP) $ 1.40 $ 1.16 $ 2.47 $ 2.25 Acquisition Amortization and Other Costs, net of taxes (0.05) (0.04) (0.16) (0.13) Diluted earnings per share (GAAP) $ 1.35 $ 1.13 $ 2.32 $ 2.12 Fiscal Year Ended June 30, 2015 2014 Free Cash Flows (Non-GAAP) $ 365.4 $ 334.3 Capital expenditures and purchases of intangibles 66.0 53.4 Net cash flows provided by operating activities (GAAP) $ 431.4 $ 387.7 Note: Amounts may not sum due to rounding. (Unaudited) (In millions, except per share amounts)

19 Reconciliation of Non-GAAP to GAAP Measures- FY16 Guidance Earnings Per Share Growth Rate (1) FY16 Guidance Adjusted Diluted earnings per share (Non-GAAP) 8% - 12% growth Diluted earnings per share (GAAP) 7% - 12% growth Operating Income Margin (2) FY16 Guidance Adjusted Operating income margin % (Non-GAAP) ~18.4% Operating income margin % (GAAP) ~17.3% (2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin % guidance estimates exclude estimated Acquisition Amortization and Other Costs of $34 million. (1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non- GAAP Adjusted Diluted EPS guidance estimates exclude estimated Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt, and/or share repurchases. (Unaudited)

BROADRIDGE FINANCIAL SOLUTIONS, INC. - KEY STATS Exhibit 99.3 INVESTOR COMMUNICATION SOLUTIONS SEGMENT RC= Recurring Q4 FY15 ED= Event Driven (in millions) Fee Revenues 4Q14 4Q15 FY14 FY15 Type Proxy Equities 225.3$ 240.4$ 313.6$ 333.4$ RC Stock Record Position Growth 10% 6% 8% 7% Pieces 242.6 254.4 314.7 330.8 Mutual Funds 20.8$ 17.9$ 56.8$ 55.6$ ED Pieces 29.6 35.8 77.6 88.8 Contests/Specials 6.2$ 12.7$ 17.1$ 29.4$ ED Pieces 6.2 10.6 18.4 27.6 Total Proxy 252.3$ 271.0$ 387.5$ 418.4$ Total Pieces 278.4 300.8 410.7 447.2 Notice and Access Opt-in % 69% 73% 69% 72% Suppression % 63% 66% 62% 65% Interims Mutual Funds (Annual/Semi- Annual Reports/Annual Prospectuses) 46.0$ 45.2$ 172.8$ 179.0$ RC Position Growth 8% 7% 11% 8% Pieces 224.4 228.4 810.6 872.4 Mutual Funds (Supplemental Prospectuses) & Other 8.3$ 7.5$ 41.1$ 45.8$ ED Pieces 39.2 36.1 212.9 220.5 Total Interims 54.3$ 52.7$ 213.9$ 224.8$ Total Pieces 263.6 264.5 1,023.5 1,092.9 Transaction Reporting Transaction Reporting/Customer Communications 40.0$ 37.6$ 161.5$ 162.7$ RC Fulfillment Fulfillment 33.5$ 36.7$ 142.9$ 148.5$ RC Emerging, Emerging/Acquired 50.6$ 68.7$ 170.2$ 224.5$ RC Acquired, Other 13.5$ 14.7$ 40.6$ 42.0$ ED and Other Total Emerging/Acquired and Other 64.1$ 83.4$ 210.8$ 266.5$ Total Fee Revenues 444.2$ 481.4$ 1,116.6$ 1,220.9$ Total Distribution Revenues 273.4$ 284.4$ 764.4$ 809.3$ Total Revenues 717.6$ 765.8$ 1,881.0$ 2,030.2$ Total RC Fees 395.4$ 428.6$ 961.0$ 1,048.1$ % RC Growth 11% 8% 11% 9% Total ED Fees 48.8$ 52.8$ 155.6$ 172.8$ In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Global Technology and Operations reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results have been revised to reflect this change in reportable segments.

BROADRIDGE FINANCIAL SOLUTIONS, INC. - KEY STATS GLOBAL TECHNOLOGY AND OPERATIONS (FORMERLY KNOWN AS SECURITIES PROCESSING SOLUTIONS) RC= Recurring Q4 FY15 ED= Event Driven ($ in millions) 4Q14 4Q15 FY14 FY15 Type Equity Transaction-Based Equity Trades 31.7$ 32.6$ 133.1$ 134.6$ RC Internal Trade Volume (Average Trades per Day in '000) 918 949 952 977 Internal Trade Growth 1% 3% 12% 3% Trade Volume (Average Trades per Day in '000) 921 950 964 980 Non-Transaction Other Equity Services 108.9 114.5 426.2$ 435.5$ RC Total Equity 140.6$ 147.2$ 559.3$ 570.1$ Fixed Income Transaction-Based Fixed Income Trades 14.1$ 14.7$ 57.1$ 58.3$ RC Internal Trade Volume (Average Trades per Day in '000) 303 322 301 309 Internal Trade Growth -7% 6% -2% 3% Trade Volume (Average Trades per Day in '000) 304 334 302 327 Non-Transaction Other Fixed Income Services 16.2$ 15.8$ 64.3$ 64.1 RC Total Fixed Income 30.3$ 30.5$ 121.4$ 122.4$ Total Revenues 171.0$ 177.6$ 680.7$ 692.5$ In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Global Technology and Operations reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results have been revised to reflect this change in reportable segments.

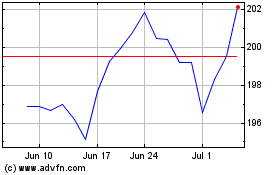

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jun 2024 to Jul 2024

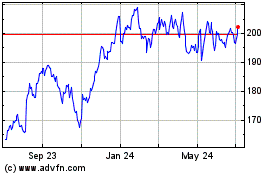

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jul 2023 to Jul 2024