UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2015

————————————

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

————————————

|

| |

001-33220 | 33-1151291 |

(Commission file number) | (I.R.S. Employer Identification No.) |

1981 Marcus Avenue

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On May 21, 2015, Broadridge Financial Solutions, Inc. (the “Company”) issued a press release announcing that the Company has signed an agreement with Thomson Reuters Corporation to acquire the Fiduciary Services and Competitive Intelligence unit from Thomson Reuters Lipper. The Company’s agreement with Thomson Reuters also includes a long term content and brand licensing services agreement in which Thomson Reuters Lipper will provide the Company with data on investment product classifications, pricing, performance, benchmarking, product asset positions, and product flows, ensuring continuity of underlying content and methodology. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

Exhibits. The following exhibit is filed herewith:

|

| |

Exhibit No. | Description |

99.1 | Press Release of Broadridge Financial Solutions, Inc. dated May 21, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 21, 2015

|

| |

| BROADRIDGE FINANCIAL SOLUTIONS, INC. By: /s/James M. Young Name: James M. Young Title: Corporate Vice President and Chief Financial Officer

|

EXHIBIT 99.1

Broadridge to Acquire Fiduciary Services and Competitive Intelligence Business

from Thomson Reuters

Acquisition will significantly expand Broadridge's mutual fund data and reporting solutions globally

LAKE SUCCESS, N.Y., May 21, 2015 – Broadridge Financial Solutions, Inc. (NYSE:BR) has signed an agreement with Thomson Reuters (NYSE: TRI) to acquire the Fiduciary Services and Competitive Intelligence unit from Thomson Reuters Lipper. Broadridge’s agreement with Thomson Reuters also includes a long term content and brand licensing services agreement in which Thomson Reuters Lipper will provide Broadridge with data on investment product classifications, pricing, performance, benchmarking, product asset positions, and product flows, ensuring continuity of underlying content and methodology. The acquisition will expand Broadridge’s leading enterprise data and analytics solutions for mutual fund manufacturers, ETF issuers, and fund administrators, adding new global data and research capabilities.

Thomson Reuters Fiduciary Services and Competitive Intelligence business provides global market intelligence for fund industry flows by country and distribution channel. It is also the leading provider of 15(c) advisory contract renewal services for validating and benchmarking fee and expense agreements to more than 250 mutual fund families, including three-quarters of the world’s largest mutual fund organizations.

“This acquisition will reinforce Broadridge’s position as one of the leading providers of data solutions and market intelligence for the mutual fund sector, and expand our footprint globally,” said Richard J. Daly, president and chief executive officer, Broadridge. “It is aligned with our long term strategy to grow Broadridge’s enterprise data and analytics capabilities. As regulatory pressures increase and new digital opportunities emerge, these solutions will help our clients mitigate risks, meet their fiduciary responsibilities and enhance sales productivity.”

Broadridge will integrate the acquired capabilities within its well established mutual fund and retirement business, expanding its existing Access Data suite of market intelligence solutions. These include compliance and reporting tools that cover 90 percent of all U.S long-term mutual fund assets and 95 percent of all ETF assets.

Gerard F. Scavelli, president of Broadridge’s Mutual Funds and Retirement Solutions business division commented, “With the addition of these fiduciary services and competitive intelligence capabilities, we will expand our reach and innovative solutions for the mutual fund industry globally. These new capabilities will help our clients meet the growing demand for compliance oversight, fee benchmarking and analysis and global market intelligence, including access to fund flow, expense data and fund profile information on more than 80,000 portfolios worldwide.” Mr. Scavelli continued, “We remain firmly committed to delivering the same high level of service and quality that customers have come to expect from Thomson Reuters. The same team that currently delivers these solutions will transition to Broadridge and will continue in their roles so that service will continue uninterrupted.”

“Thomson Reuters and Broadridge share a common objective of providing the highest quality information and reporting services for mutual fund companies worldwide,” said Lars Asplund, a managing director at Thomson Reuters. “This sale will enable us to increase our focus on the core content business and further enable development and new capabilities for serving the asset management and wealth management markets. We will continue to provide our highly respected fund data, analytics and research through desktop solutions such as Thomson Reuters Eikon, Thomson One, Lipper for Investment Management, LANA and feeds, as well as through licensed third-party platforms. We look forward to the ongoing relationship with Broadridge.”

The acquisition is expected to close during Broadridge’s fourth fiscal quarter and is subject to customary closing conditions, including the termination or expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Terms of the agreement were not disclosed.

About Broadridge

Broadridge Financial Solutions, Inc. (NYSE:BR) is the leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally. Broadridge’s investor communications, securities processing and business process outsourcing solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge’s infrastructure underpins proxy voting services for over 90% of public companies and mutual funds in North America, and processes more than $5 trillion in fixed income and equity trades per day. Broadridge employs approximately 6,700 full-time associates in 14 countries. For more information about Broadridge, please visit www.broadridge.com.

Forward-Looking Statements

This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2014 (the “2014 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2014 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

# # #

Investor Contact:

Brian S. Shipman, CFA

Broadridge Financial Solutions

+1 516-472-5129

BroadridgeIR@broadridge.com

Media Contacts:

Linda Namias

Broadridge Financial Solutions

+1 631-254-7711

linda.namias@broadridge.com

Lemuel Brewster

Thomson Reuters

+1 646-223-5147

+1 917-805-1089 (mobile)

lemuel.brewster@thomsonreuters.com

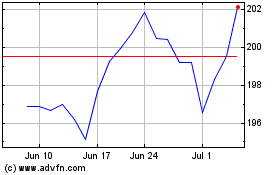

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jun 2024 to Jul 2024

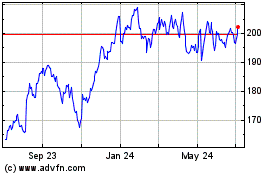

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jul 2023 to Jul 2024