Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

June 14 2024 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Braemar Hotels and Resorts Inc.

(Name of Registrant as Specified In Its Charter)

Blackwells Capital LLC

Blackwells Onshore I LLC

Jason Aintabi

Michael Cricenti

Jennifer M. Hill

Betsy L. McCoy

Steven J. Pully

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11 |

From time to time, Blackwells Capital LLC (“Blackwells”)

and/or the other participants in its solicitation may make certain posts and/or reposts regarding the campaign to their respective social

media pages, including each of their X (formerly known as Twitter) pages, Instagram pages and/or YouTube pages. A copy of the posts are

attached hereto as Exhibit 1.

IMPORTANT ADDITIONAL INFORMATION

Blackwells, Blackwells Onshore I LLC, Jason Aintabi, Michael Cricenti,

Jennifer M. Hill, Betsy L. McCoy and Steven J. Pully (collectively, the “Participants”) are participants in the solicitation

of proxies from the stockholders of Braemar Hotels & Resorts Inc. (the “Corporation”) for the Corporation’s 2024

annual meeting of stockholders. On April 3, 2024, the Participants filed with the Securities and Exchange Commission (the “SEC”)

their definitive proxy statement and accompanying WHITE universal proxy card in connection with their solicitation of proxies

from the stockholders of the Corporation.

ALL STOCKHOLDERS OF THE CORPORATION ARE ADVISED TO READ THE DEFINITIVE

PROXY STATEMENT, THE ACCOMPANYING WHITE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES

BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT

OR INDIRECT INTERESTS IN THE CORPORATION, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement and an accompanying WHITE

universal proxy card will be furnished to some or all of the Corporation’s stockholders and are, along with other relevant documents,

available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the definitive

proxy statement without charge, upon request. Requests for copies should be directed to Blackwells.

The Corporation’s board of directors has purported to reject

as invalid our nominations to elect each of Blackwells’ nominees and determined that our notice is purportedly non-compliant with

the Corporation’s Fifth Amended and Restated Bylaws, as amended (the “Bylaws”) and defective. On March 24, 2024, the

Corporation brought suit against each of the Participants, Blackwells Holding Co. LLC, Vandewater Capital Holdings, LLC, Blackwells Asset

Management LLC and BW Coinvest Management I LLC in the United States District Court for the Northern District of Texas (the “District

Court”), seeking injunctive relief against solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’

nomination is invalid due to Blackwells’ alleged violations of the Bylaws, and, as a result, Blackwells’ slate of purported

nominees is invalid and ineligible to stand for election by the Corporation’s stockholders. Ultimately, Blackwells believes the

Corporation’s claims have no merit. On April 11, 2024, Blackwells filed a Complaint in the District Court against the Corporation

and the Corporation’s directors. Blackwells alleges, among other things, that the Corporation improperly rejected Blackwells’

nomination notice, breached the Bylaws, and violated Section 14(a) of the Securities Exchange Act of 1934 by issuing false and misleading

statements and failing to disclose The Dallas Express as a proxy participant. The action filed by the Corporation on March 24, 2024 and

the action filed by Blackwells on April 11, 2024 have been consolidated (the “Consolidated Litigation”). The Consolidated

Litigation is currently stayed. The outcome of the Consolidated Litigation and any related litigation may affect our ability to deliver

proxies submitted to us on the WHITE universal proxy card.

Exhibit 1

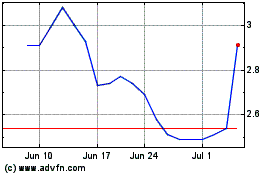

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Jan 2024 to Jan 2025