As expected, MedTech mergers and acquisitions (M&A) are heating

up in 2013. Finally, the much-hyped takeover battle for

Life Technologies Corporation (LIFE) came to an

end last month with

Thermo Fisher Scientific (TMO)

emerging as the clear winner.

For most of the last seven years, Thermo Fisher has supported its

business momentum by acquiring several entities. Nevertheless, the

proposed acquisition of Life Technologies is the biggest-ever deal

for the company since its inception in 2006. The takeover will

inevitably strengthen Thermo Fisher’s global foothold and

commercial reach.

It's a Buyer’s Market

Medical device M&As are not stopping there. Wary of an

uncertain economy, MedTech companies have resorted to the

acquisition route to harness their strength and diversify

offerings.

Last month, in a bid to strengthen its contraceptive portfolio,

Bayer (BAYRY) inked a deal to buy contraceptive

device-maker

Conceptus Inc. (CPTS) for

approximately $1.1 billion in cash. This impending acquisition will

add the Essure permanent (non-surgical) birth control system to

Bayer’s product portfolio. The transaction is expected to close by

mid-2013.

In Mar 2013,

Becton, Dickinson and Company (BDX)

acquired AustriA-based Cato Software Solutions, the manufacturer of

“catoA? and chemocatoA?” software, a suite of comprehensive

medication safety solutions for pharmacy intravenous medication

preparation, physician therapy planning and nurse bedside

documentation.

Low global penetration and demand outstripping supply provide a

positive long-term thesis for investing in the blood processing and

supply chain management industry. With the acquisition of the

transfusion medicine business of

Pall Corporation

(PLL),

Haemonetics (HAE) entered the $1.2 billion

whole blood collection market. Moreover, in May 2013, Haemonetics

acquired Hemerus Medical that develops technologies for the

collection of whole blood, and processing and storage of blood

components.

Also,

Quest Diagnostics’ (DGX) acquisition of

UMass Medical Lab in Jan 2013 is in sync with its goal to create a

planned 'lab of the future.' According to the company, this will

help boost its long-term growth opportunities in the faster-growing

esoteric markets.

Additionally, earlier this month the company announced the

acquisition of the outreach testing operations of Dignity Health in

California and Nevada. Quest Diagnostics expects to complete

additional fold-in acquisitions, consistent with its goal of

generating 1–2% revenue growth per year through accretive

acquisitions.

Apart from the abovementioned takeovers and/or acquisitions, at the

end of last year, Baxter International (BAX)

entered into a $4 billion deal to take over Gambro AB, a

Sweden-based privately-owned renal products company. The deal which

is expected to close in the second quarter of 2013, is going to

strengthen the company’s role in the hemodialysis market.

Moreover, after the three successive acquisitions of Cameron

Health, Rhythmia Medical and BridgePoint Medical last year, Boston

Scientific (BSX) recently acquired Vessix Vascular, which has

developed the percutaneous radiofrequency balloon catheter

technology for the treatment of hypertension. The company expects

commercial launch of this platform in Europe and other

international markets in 2013.

Other major deals inked in recent times in the MedTech space

include six successive acquisitions by healthcare products maker

Covidien (COV) exceeding $1.2 billion. In Jan

2013, the company completed the acquisition of Fremont,

California-based medical device company, CV Ingenuity. In Mar 2013,

leading vendor of cloud-based services for physician practices

Athenahealth (ATHN) took over Epocrates, a pioneer

of mobile health workflows and POC health apps.

The past year also witnessed significant M&A deals, including

the acquisition of Switzerland-based Synthes Inc. by

Johnson & Johnson (JNJ) for a whopping $19.7

billion, and Gen-Probe Inc. by Hologic (HOLX) for

$3.8 billion.

Trends over the recent past reflect focus on the diagnostics space.

A prime example is that of Agilent Technologies

(A) entering into the Diagnostics and Genomics space through the

$2.2 billion acquisition of cancer diagnostic company Dako. The

acquisition is intended to augment Agilent’s portfolio and build a

global market share to better fight its major peers, especially

Teradyne (TER), Thermo Fisher Scientific and

Danaher Corp. (DHR) in this space.

In order to expand into the large and lucrative market for

drug-coated balloons, C.R. Bard (BCR) purchased

Lutonix Inc. in Dec 2012. The worldwide peripheral vascular market

for drug-coated balloons is forecast to hit roughly $1 billion

annually over the next ten years. Further, the acquisition of

Neomend will allow Bard to expand into another $1 billion market

for surgical specialties offerings.

In Nov 2012, the neurovascular division of Stryker

Corporation (SYK) acquired Surpass Medical (for $135

million) to expand its Complete Stroke Care portfolio. Surpass’

mainstay, the CE-Marked NeuroEndoGraft family of flow diverters is

an attractive addition to the company’s product line.

In the light of the discussion above, 2013 is going to be another

big year for M&As in the MedTech space. We expect a significant

pickup in in-licensing activities and collaborations for the

development of pipeline candidates. Several MedTech majors

struggling in their core businesses are looking to explore

potential emerging therapies through collaborations and

alliances.

Emerging Markets

The US still holds the leading position with almost one-third of

the market share. However, emerging economies like Brazil, Russia,

India and China -- collectively known as the BRICs -- are fast

coming up in the medical devices space and are attracting a lot of

attention.

These emerging economies are seeing an increasing uptake of medical

devices due largely to growing medical awareness and economic

prosperity. An aging population, increasing wealth, government

focus on healthcare infrastructure and expansion of medical

insurance coverage make these markets a happy hunting ground for

global medical device players. Expansion in emerging markets,

especially those with double-digit annual growth rates, represents

one of the best potential avenues for growth in 2013 and

beyond.

The focus on emerging markets is all the more significant given the

saturation and uncertain growth in the developed markets of US,

Europe and Japan. Companies like Medtronic Inc.

(MDT), Boston Scientific, Thermo Fisher Scientific, Stryker and

Smith and Nephew (SNN) are all vying to expand

their presence in the BRICs and other emerging markets. These

companies are also looking to establish their manufacturing

facilities abroad.

According to a McKinsey & Co. report (Jul 2012), health-care

spending in China has more than doubled from $156 billion in 2006

to $357 billion in 2011. It is expected to grow to $1 trillion by

2020. China is also setting up proper health insurance coverage

that should boost the healthcare sector. It is expected that within

the next decade, China will be the biggest healthcare market in the

world, even outpacing the US.

Among the other BRIC members, Brazil is currently the largest

health-care market in Latin America, covering almost one-fourth of

the population. Though India has one of the largest and fastest

growing health-care markets in the world, it is considered to have

the least developed health-care infrastructure and spends

relatively little on health care. In order to reverse the trend,

during the 12th Plan (2012-2017), the Indian government planned to

spend 2.5% of its GDP (up from 1.2% earlier) on healthcare and

raise it to at least 3% by 2022.

Given the huge potential in these emerging regions, in Mar 2013,

Stryker acquired China-based Trauson Holdings for $685 million.

Trauson was a competitor in the Spine segment and a producer of

Trauma products. The company sold as many as 120 offerings and

maintained a decent pipeline.

Smith & Nephew, on the other hand, entered into two definitive

agreements to expand in the BRIC regions. In Apr 2013, it

contracted to purchase its Brazilian distributor, Pró Cirurgia

Especializada (PCE). PCE has been associated with the company for

the last 30 years and has distributed its sports medicine,

orthopedic reconstruction and trauma offerings in Brazil.

In May 2013, the company announced another agreement, to take over

Adler Mediequip Private Limited and with it the brands and assets

of Sushrut Surgicals Private Limited, a leader in mid-tier,

orthopedic trauma products for the Indian market.

Johnson & Johnson has already set up manufacturing and R&D

centers in Brazil, China and India. While it has been doing

business in China for more than 25 years, it established a new

innovation center in the country in 2011. The Guangzhou Bioseal

Biotech deal marked the company’s first MedTech acquisition in

China. The company is expected to expand further in China on the

back of the Synthes acquisition.

Medtronic is targeting 20% of its revenues from emerging markets by

fiscal 2015−16. After setting up its Innovation Center in Shanghai,

the first outside the US and Europe, last October the company

acquired China Kanghui Holdings and formed a strategic alliance

with China-based LifeTech Scientific Corporation (both in Oct

2012). The acquisition is expected to strengthen its orthopedic

franchise in the country.

Boston Scientific is aiming to increase its below-average market

share in the $700 million combined drug-eluting stent market in

China and India, which is growing sharply at 20%. The company plans

to invest $150 million in China over the next five years to build a

local manufacturing operation.

Thermo Fisher is also expanding its presence in emerging markets.

It expects to garner 25% of total revenues from the high-growth

Asia-Pacific region and emerging markets by 2016, up from 19% in

2011 and 10% in 2006.

Divestments

Another trend that we have been observing of late is the divestment

of non-core business segments. For example, in an effort to focus

on its high-margin surgical product portfolio, healthcare products

maker Covidien is spinning off its pharmaceuticals business

Mallinckrodt plc, which is expected to take place by Jun 2013.

In early January, Abbott Laboratories (ABT)

separated its research-based pharmaceuticals business by creating a

new company, AbbVie (ABBV), to allow the two

separate entities to focus more on their operations.

Quest Diagnostics has also been focusing on areas with high

potential such as gene-based esoteric testing for cancer,

cardiovascular disease, infectious disease and neurological

disorders. As a part of this strategy, in Apr 2013, the company

completed the divestiture of the HemoCue diagnostics products

business.

Last December, the company divested its OralDNA Labs

salivary-diagnostics business in order to redirect its resources to

core diagnostic information services. Johnson & Johnson, too,

is currently looking for opportunities to sell or spin off its

Ortho Clinical Diagnostics business.

In November last year, Becton, Dickinson and Company divested its

Discovery Labware sub-segment (excluding Advanced Bioprocessing

capability) to Corning (GLW) for $730 million. In

May 2012, Smith & Nephew, through an agreement with Essex

Woodlands, completed the disposal of its Clinical Therapies

business, to the newly formed Bioventus LLC, in which it will

retain a 49% investment.

Earnings Numbers

Challenging economic conditions, a competitive environment,

pressure on core segments and a larger-than-expected currency

headwind continue to remain as major causes of concern for medical

device majors like Boston Scientific and St. Jude

Medical (STJ). Both these companies barley managed to stay

in line with the Zacks Consensus Estimate for earnings in the first

quarter.

The still choppy U.S. defibrillator and global drug-eluting stents

(“DES”) markets remain an overhang on these two stalwarts, and we

expect the same to affect the performance of their peer Medtronic,

which is slated to release its first quarter result on May 20,

2013.

While we are to some extent relieved with the signs of stability in

Medtronic’s core spine markets, challenges remain in the Pacing and

Spine business, which are expected to remain sluggish, in turn

affecting the company’s overall performance. With the earnings

Expected Surprise Prediction or ESP (Read: Zacks Earnings ESP: A

Better Method

http://www.zacks.com/stock/news/90676/Zacks-Earnings-ESP-A-Better-Method)

of 0.0% and a Zacks Rank #3 (Hold) for the company, we are

uncertain about a likely earnings beat in the first quarter.

Other major earnings reports by industry players include the first

quarter earnings beat of Stryker Corporation. The austerity

measures in Europe notwithstanding, which dampened sales growth at

some of its segments, the recent stability in the company’s

domestic recon market is encouraging.

However, there was a negative earnings surprise from Quest

Diagnostics and its arch rival Laboratory Corporation of America

(LH). We believe that the overall soft industry trends leading to

challenging volume environment for testing laboratories and

utilization weaknesses are looming headwinds. Moreover, their poor

fiscal 2013 revenue guidance reflected the fact that the industry

trend will not improve in the near future.

Notable in this regard, the implementation of the Medical Device

Excise Tax (implemented in Jan 2013) will have an

incrementally negative impact on earnings per share of most

of the medical device majors. This is also reflected in the

conservative guidance posted by these companies.

OPPORTUNITIES

We continue to have a Neutral outlook on large-cap medical device

stocks. While the companies will keep facing challenges like

pricing pressures, declines in procedural volume from economic

uncertainties and sluggish growth in the Cardiac Rhythm Management

(CRM) business, increased M&A activities, focus on emerging

markets and product approvals in latent areas could help reduce the

impact. Better pipeline visibility and appropriate utilization of

cash should increase confidence in the medical device sector.

With the announcement of its proposed acquisition by Bayer, shares

of Conceptus reached a new high, leading to a Zacks Rank #1 (Strong

Buy) for the stock. The Zacks Rank #2 (Buy) stocks in the MedTech

sector include Becton, Dickinson and Company and The Cooper

Companies Inc. (COO) among others.

In our universe, we see growth potential in companies dealing with

promising technologies. In this respect, both these companies

represent a value proposition. We are positive on Cooper based on

factors such as margin expansion, acquisitions, product line

expansion and geographical reach as well as share buybacks.

In spite of several core market challenges, the big three medical

device players -- Medtronic, Boston Scientific and St. Jude Medical

-- are striving to gain share in the implantable

cardioverter-defibrillator (ICD) market through several new product

launches. The big three are also exploring new avenues of growth

beyond the mature pacemaker and ICD markets. With gradual stability

in the ICD market, they should be able to revive their top

line.

Beyond the MedTech majors, we are optimistic about the Zacks #3

Ranked orthopedic devices player Zimmer Holdings

Inc. (ZMH). The percentage of population over age 65 in

the US, Europe, Japan and other regions is expected to nearly

double by the year 2030. In the US, the oldest baby boomers are now

approaching retirement age. We believe the orthopedic giants will

stand to benefit from this aging demography.

Among the scientific instrument makers, Thermo Fisher Scientific

has been successfully expanding operating margins over the past few

quarters on the back of operational efficiency. Given Life

Technologies’ expansive line of consumables for genomic, and

molecular and cell biology, the proposed buyout will complement

Thermo Fisher’s market-leading portfolio of analytical technologies

and specialty diagnostic.

CHALLENGES AND WEAKNESSES

On the flip side, the MedTech industry is currently hampered by

several issues including the 2.3% medical device excise tax. Many

of the nation’s medical devices players are currently bracing

themselves for the impact of this tax.

The companies are either trying to relocate outside the US or

reduce operations in order to weather the 2.3% tax burden. They are

undertaking various restructuring initiatives to counter costs

associated with the implementation of the new tax.

Other issues include pricing concerns, hospital admission and

procedural volume pressures, Medicare reimbursement issues and

regulatory overhang. While the debt crisis in Europe remains

unresolved, economies throughout the world are trying to come to

terms with myriad challenges. Consequently, procedural volumes in

the US have been hit by a high unemployment rate, which has

resulted in the expiry of health insurance as well as a decline in

enrollment in private health plans.

Governments across several European countries have taken up

measures to curb spending on devices, which is taking a toll on

utilization. Volume headwind is likely to linger as unemployment

continues to influence procedure deferrals.

Last but not least, the highly regulated US medical device industry

is encumbered by stringent and complex procedures leading to

approval delays. This sometimes demotivates companies, deterring

them from investing in product development.

According to a report based on a survey of over 200 medical

technology companies (FDA Impact on U.S. Medical Technology

Innovation), the US FDA takes a significantly high time to review

compared to its European counterpart.

Coming to the weakest link in the MedTech sector, we advise against

names that offer little growth/opportunity over the near term.

These include companies for which estimate revision trends for 2013

and 2014 reflect a bearish sentiment. Covidien currently retains a

Zacks Rank #5 as doubts linger around its proposed divestiture of

its pharmaceuticals business Mallinckrodt plc.

Another Zacks Rank #5 (Strong Sell) stock is Health

Management Associates Inc. (HMA). Also, Edwards

Lifescience Corp (EW), Orthofix International

N.V. (OFIX), Vascular Solutions Inc.

(VASC) and Symmetry Medical, Inc. (SMA) do not

look inspiring and carry a Zacks Rank #4 (Sell).

Further, pricing compressions on hips, knees and spine products,

which impaired the performances of several orthopedic companies,

remain a key concern, at the macro level. We remain skeptical about

companies including Wright Medical Group (WMGI)

although the stock currently carries a Zacks Rank #3 (Hold).

AGILENT TECH (A): Free Stock Analysis Report

BRADY CORP CL A (BRC): Free Stock Analysis Report

DANAHER CORP (DHR): Free Stock Analysis Report

LIFE TECHNOLOGS (LIFE): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

To read this article on Zacks.com click here.

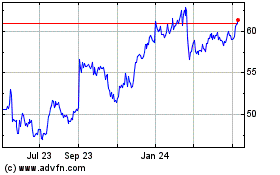

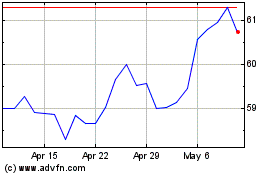

Brady (NYSE:BRC)

Historical Stock Chart

From May 2024 to Jun 2024

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2023 to Jun 2024