By Mark DeCambre, MarketWatch , Joy Wiltermuth

Mnuchin says U.S. was '90% of the way there' on China trade

deal

U.S. stocks clawed back some of the previous day's loss in trade

Wednesday as semiconductor shares scored a bounce from Micron

Technologies's late-Tuesday quarterly results.

Comments from U.S. Treasury Secretary Steven Mnuchin suggesting

that a Sino-American trade deal had been close, also triggered some

modest buying on Wall Street.

The Dow Jones Industrial Average was up 69 points, or 0.26%, to

26,617, the S&P 500 ) advanced 6 points, or 0.2%, at 2,923,

while the Nasdaq Composite Index climbed 52 points, or about 0.65%,

to 7,936.

Mnuchin told CNBC

(https://www.cnbc.com/2019/06/26/mnuchin-says-us-china-trade-deal-is-90-percent-complete.html)

that Beijing and Washington had come near to a deal on tariffs. "We

were about 90% of the way there (with a deal) and I think there's a

path to complete this," he told the financial network in

Bahrain.

The U.S. Treasury Secretary said he was "hopeful" that a deal

could be struck as the market awaits a sideline conversation

between President Donald Trump and Chinese President Xi Jinping at

the Group of 20 gathering in Osaka, Japan, which kicks off on

Friday.

But optimism over the prospects for a trade war detente faded

somewhat tempered during the session.

"I am not optimistic of anything of significance to be achieved

for the meetings in Japan this week," said Mariann Montagne, a

portfolio manager at Gradient Investments, in a telephone

interview.

"Mnuchin or members of his team have used that phrase several

times over the past several months," she told MarketWatch. "I think

people are getting too excited."

Separately, President Trump, appearing on Fox Business on

Wednesday said that he was happy to collect China tariffs

(http://www.marketwatch.com/story/trump-today-president-threatens-tariffs-on-china-as-he-jokes-draghi-should-lead-fed-2019-06-26)

if talks broke down.

Concerns about escalating trade tensions between the China and

the U.S., the world's largest economies, have fed a sense of rising

uncertainty about the health of the global economy, at least partly

contributing to central banks across the world signaling a

willingness to reinstitute a fresh wave of economic stimulus.

"Certainly, when we came in pre-open, futures were higher on the

Mnuchin comments," said Sahak Manuelian, an equities trader at

Wedbush Securities.

"It seems things are starting to fall off a bit."

On Tuesday, equity markets suffered one of the worst declines in

about a month, led by a selloff in trade-sensitive technology

shares, after the S&P 500 index last week saw a new record

high. Even with yesterday's slide, the Dow Jones Industrial Average

stands about 1% shy of its Oct. 3 record, while the tech-heavy

Nasdaq Composite Index is within reach of its May 3 all-time

closing high, despite giving up 121 points, or 1.5%, in the prior

session.

Tuesday's slump in stocks came after Federal Reserve Chairman

Jerome Powell, speaking at the Council on Foreign Relations in New

York, signaled that an interest-rate cut in July is not a done

deal, emphasizing that the central bank was still monitoring the

economy and "grappling" with signs of weakness to avoid a knee-jerk

reaction.

What's more, St. Louis Fed President James Bullard said he

wasn't advocating for an aggressive cut of 50 basis point to key

federal-funds futures rates when the Fed meets next month.

Wall Street currently has the chances of an interest rate cut in

July at 100%, according to the CME Group's FedWatch tool.

Read: Fed's Bullard says he is not in favor of half point rate

cut in July

(http://www.marketwatch.com/story/feds-bullard-says-he-is-not-in-favor-of-half-point-rate-cut-in-july-2019-06-25)

Check out: Powell says the Fed is 'grappling' with whether to

cut interest rates

(http://www.marketwatch.com/story/powell-says-the-fed-is-grappling-with-whether-to-cut-interest-rates-2019-06-25)

"Positioning ahead of the G20 summit meeting between Trump and

Xi could see investors want skin in the game ahead of what many

feel could yield a very positive outcome," said Edward Moya, senior

market analyst at brokerage Oanda, in a daily research note.

"A reset of talks is likely becoming the base case scenario and

if we see a timeline put in place, we could see equities resume the

march towards uncharted territory," he said.

U.S. economic data published Wednesday was again weak, with

durable-goods orders for May dropping 1.3%, weighed down by Boeing

Co.'s (BA) woes from its grounded 737 MAX jets.

Check out: Durable-goods orders drop 1.3% in May, but business

investment picks up in reassuring sign

(http://www.marketwatch.com/story/durable-goods-orders-drop-13-in-may-but-business-investment-picks-up-in-reassuring-sign-2019-06-26)

A separate report on international trade in goods also showed

the U.S. trade deficit climbed 5.1% for the same month, which was

wider than expected.

Read: U.S. trade deficit in goods widens 5.1% to $74.5 billion

in May

(http://www.marketwatch.com/story/us-trade-deficit-in-goods-jumps-51-to-745-billion-in-may-2019-06-26)

Market participants may also be partly watching for any response

from the White House after reports indicated that Special Counsel

Robert Mueller will testify

(http://www.marketwatch.com/story/robert-mueller-to-testify-before-house-panels-on-july-17-2019-06-25)before

the House Judiciary and Intelligence committees on July 17.

Democrats have been wanting to hear from Mueller personally,

regarding his investigation into Russian interference in the 2016

election as well as possible obstruction of justice by President

Donald Trump.

Which stocks are in focus?

Shares of Apple Inc.(AAPL) were in focus after the iPhone maker

and tech giant acquired autonomous-driving startup Drive.ai

(http://www.marketwatch.com/story/apple-buys-autonomous-car-startup-driveai-reports-2019-06-25),

according to multiple reports. Apple confirmed the deal to both

Axios and the San Francisco Chronicle

(https://www.sfchronicle.com/business/article/Drive-ai-a-self-driving-car-startup-once-worth-14047625.php).

Shares of Apple were up nearly 5% on Wednesday.

Micron Technology Inc. shares (MU) rose 13% on Wednesday after

the memory-chip maker's results topped expectations

(http://www.marketwatch.com/story/micron-stock-surges-after-hours-as-earnings-top-lowered-expectations-2019-06-25)

for the quarter, and executives forecast improvement in the fourth

quarter.

That was good news for other semiconductor companies. Shares of

Advanced Mico Devices(AMD) climbed more than 4%; Nvidia Corp.

almost 10% and shares of exchange-traded semiconductor fund iShares

PHLX Semiconductor ETF (SOXX) climbed 1.8%.

Shares of Boeing (BA) were up more than 1% on Wednesday.

Consumer goods giant General Mills(GIS) shares fell more than

4%, a day after it reported disappointing sales for its fiscal

fourth-quarter

(http://www.marketwatch.com/story/general-mills-stock-falls-after-profit-beats-but-sales-come-up-short-2019-06-26).

Shares of retailer Big Lots(BIG) gained 3% after the retailer

said it would appoint former Abercrombie & Fitch veteran

Jonathan Ramsden as chief financial officer in August.

FedEx Corp(FDX) shares bumped up more than 1% a day after it

beat earnings estimates

(http://www.marketwatch.com/story/fedex-shares-tick-down-after-earnings-beat-2019-06-25).

(END) Dow Jones Newswires

June 26, 2019 12:36 ET (16:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

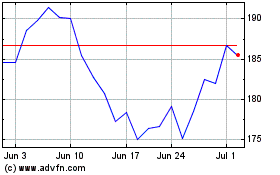

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024