BILL Unveils New Features for BILL Spend & Expense to Enhance Visibility and Control of Business Finances for SMBs and Accountants

December 13 2023 - 8:55AM

Business Wire

Innovative capabilities empower businesses with

efficiency, time-savings, and customizable control delivered in one

spend and expense management solution

BILL (NYSE: BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today announced new features

for its Spend & Expense solution, formerly known as Divvy, to

help SMBs and accounting firms gain even greater visibility and

control of their business finances. The latest capabilities,

complete with a budgets interface redesign, include additional ways

to customize spend target limits, consolidate controls to manage

spend easier, and group budgets to streamline management of

multiple budgets.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231213541015/en/

“For SMBs, correctly managing spend can be the difference

between success and failure. To do this effectively they need

real-time visibility and precise control of their budgets, but they

also need flexibility and options based on team needs, categories

of spend, or specific periods of time,” said Irana Wasti, Chief

Product Officer at BILL. “Our new BILL Spend & Expense features

deliver exactly that – helping SMBs to be more effective in how

they manage their budgets, while empowering them with the control

and visibility they need for their cash flow, so they can focus on

their business with confidence.”

Customizable Control with Target Spending Limits and Enhanced

Policy Controls

Target spending limits allow businesses to tailor their budgets

to specific needs, increasing efficiency and flexibility of spend

with BILL Divvy Corporate Cards.1 Enhanced policy controls

complement this feature, streamlining the management and compliance

of spending policies.

Key benefits include:

- Customize Spending Thresholds: Adjust spending limits

based on business needs or maintain continued spending with a

buffer.

- Streamline Policy Enforcement: Implement clear spending

policies for easier enforcement and compliance.

- Create Custom Approval Processes: Create sequential or

non-sequential approval flows involving key personnel, ensuring

efficient and controlled budget management.

- Gain Flexibility for Card Spend: Control overspending to

avoid unwanted card declines, or forgo budget limits and only get

declines when a credit limit is reached.

New Budget Groups Feature and Simplified Interface

The BILL Spend & Expense budgets interface has been

reimagined, focusing on making budget management even more

intuitive for spenders and admins. This redesign includes a new

budget groups feature, which enhances the organization and

management of multiple budgets.

Key benefits include:

- Simplify Budget Monitoring: View budgets together and

gain real-time visibility about spend across the entire

organization.

- Organize Multiple Budgets: Efficiently manage various

budgets with the new budget groups feature, improving visibility

and reducing complexity.

- Optimize Budget Workflow: Delegate budget management

responsibilities to group owners without having to give up

control.

SMBs and Accountants Find Success with BILL Spend &

Expense

“BILL Spend & Expense gives us the tools our clients need to

create better visibility, controls, and workflows. It has helped us

build trust and confidence with our clients in that we can provide

what they need for a more economical management of their spend,”

commented Amy Marshall, Director of Growth at Breakwater Accounting

& Advisory. “The new groups feature enables delegation of

budgets by assigning ownership to custom categories such as travel.

The result is a more efficient, controlled, and transparent

approach to overseeing spend.”

“BILL provides a really nice tool for shared budgets across

departments,” said Burke Bess, Vice President of Finance,

Accounting, and Data Analytics at Children’s Miracle Network

Hospitals. “BILL helps us view our expenditures in real-time,

ensuring that we don’t go over our budget. BILL has saved us hours

of back and forth with requests and approvals. It also empowers the

entire organization to manage their spend better and more

efficiently.”

Features Availability

All capabilities mentioned in this announcement are available

now. To get started today, request a demo of BILL Spend &

Expense here.

Watch this video to learn more about how BILL Spend &

Expense can help with visibility and control of business

finances.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

1 Card issued by Cross River Bank, member FDIC

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231213541015/en/

Press Contact: John Welton john.welton@hq.bill.com

IR Contact: Karen Sansot ksansot@hq.bill.com

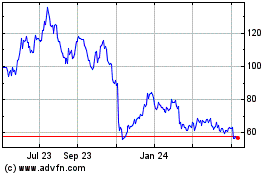

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

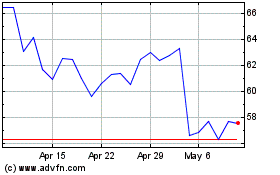

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025