Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 27 2022 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

June 27, 2022

|

| BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE,

VICTORIA 3000 AUSTRALIA

(Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form

20-F ☐ Form 40-F

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): n/a

BHP GROUP LIMITED

Notification and public disclosure of transactions by

Persons Discharging Managerial Responsibilities

The PDMR notifications below relate to changes in unvested share rights awards under BHP’s employee incentive schemes as a result of the Petroleum merger

with Woodside which completed on 1 June 2022. BHP paid an in specie dividend and distributed Woodside shares received as consideration for the sale of BHP Petroleum in line with the details described in BHP’s announcement on 20 May 2022.

Employees who continued to be employed by BHP after completion of the Petroleum merger did not receive the in specie dividend in respect of any unvested share

rights, and the value of the underlying BHP shares to which they will receive on vesting will be reduced as a result of the in specie dividend that has been determined.

To treat BHP employees fairly and restore the value of the unvested share rights to their pre-completion value, BHP granted those employees a one-off grant of

additional matching entitlements on the same substantive terms as the original unvested share rights.

|

|

|

|

|

|

|

| 1 |

|

Details of the person discharging managerial responsibilities / persons closely associated |

|

|

|

|

| a) |

|

Name |

|

Edgar Basto-Baez |

|

|

|

|

|

| 2 |

|

Reason for the notification |

|

|

|

|

|

|

| a) |

|

Position/status |

|

PDMR (President Minerals Australia) |

|

|

|

|

|

|

| b) |

|

Initial notification/Amendment |

|

Initial notification |

|

|

|

|

| 3 |

|

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|

|

|

|

| a) |

|

Name |

|

BHP Group Limited |

|

|

|

|

|

|

| b) |

|

LEI |

|

WZE1WSENV6JSZFK0JC28 |

|

|

|

|

| 4 |

|

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted. |

|

|

|

|

| a) |

|

Description of the financial instrument, type of instrument

Identification code |

|

BHP Group Limited ordinary shares

ISIN: AU000000BHP4 |

|

|

|

|

|

| b) |

|

Nature of the transaction |

|

The grant of 14,579 Uplift awards under BHP Group Limited’s Long Term Incentive Plan, 10,212 Uplift awards under BHP Group Limited’s Management Award Plan, 6,584 Uplift Awards under BHP Group Limited’s

Cash and Deferred Plan. |

|

|

|

|

| c) |

|

Price(s) and volume(s) |

|

Price(s) |

|

Volume(s) |

|

|

|

|

1. Nil |

|

31,375 |

|

|

|

|

| d) |

|

Aggregated information |

|

N/A |

|

|

|

|

|

|

|

- Aggregated volume |

|

|

|

|

|

|

|

|

- Price |

|

|

|

|

|

|

|

|

| e) |

|

Date of the transaction |

|

2022-06-17 |

|

|

|

|

|

|

| f) |

|

Place of the transaction |

|

Australian Securities Exchange (ASX) |

|

|

|

|

|

|

|

|

|

| 1 |

|

Details of the person discharging managerial responsibilities / persons closely associated |

|

|

|

|

| a) |

|

Name |

|

John Udd |

|

|

|

|

|

| 2 |

|

Reason for the notification |

|

|

|

|

|

|

| a) |

|

Position/status |

|

PDMR (President Minerals Americas) |

|

|

|

|

|

|

| b) |

|

Initial notification/Amendment |

|

Initial notification |

|

|

|

|

| 3 |

|

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|

|

|

|

| a) |

|

Name |

|

BHP Group Limited |

|

|

|

|

|

|

| b) |

|

LEI |

|

WZE1WSENV6JSZFK0JC28 |

|

|

|

|

| 4 |

|

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted. |

|

|

|

|

| a) |

|

Description of the financial instrument, type of instrument

Identification code |

|

BHP Group Limited ordinary shares

ISIN: AU000000BHP4 |

|

|

|

|

|

| b) |

|

Nature of the transaction |

|

The grant of 13,045 Uplift awards under BHP Group Limited’s Long Term Incentive Plan, 7,677 Uplift awards under BHP Group Limited’s Management Award Plan, 3,962 Uplift Awards under BHP Group Limited’s Cash

and Deferred Plan. |

|

|

|

|

| c) |

|

Price(s) and volume(s) |

|

Price(s) |

|

Volume(s) |

|

|

|

|

1. Nil |

|

24,684 |

|

|

|

|

| d) |

|

Aggregated information |

|

N/A |

|

|

|

|

|

|

|

- Aggregated volume |

|

|

|

|

|

|

|

|

- Price |

|

|

|

|

|

|

|

|

| e) |

|

Date of the transaction |

|

2022-06-17 |

|

|

|

|

|

|

| f) |

|

Place of the transaction |

|

Australian Securities Exchange (ASX) |

|

|

|

|

|

|

|

|

|

| 1 |

|

Details of the person discharging managerial responsibilities / persons closely associated |

|

|

|

|

| a) |

|

Name |

|

Geraldine Slattery |

|

|

|

|

|

| 2 |

|

Reason for the notification |

|

|

|

|

|

|

| a) |

|

Position/status |

|

PDMR (Senior Executive Officer) |

|

|

|

|

|

|

| b) |

|

Initial notification/Amendment |

|

Initial notification |

|

|

|

|

| 3 |

|

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|

|

|

|

| a) |

|

Name |

|

BHP Group Limited |

|

|

|

|

|

|

| b) |

|

LEI |

|

WZE1WSENV6JSZFK0JC28 |

|

|

|

|

| 4 |

|

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted. |

|

|

|

|

| a) |

|

Description of the financial instrument, type of instrument

Identification code |

|

BHP Group Limited ordinary shares

ISIN: AU000000BHP4 |

|

|

|

|

|

| b) |

|

Nature of the transaction |

|

The grant of 24,798 Uplift awards under BHP Group Limited’s Long Term Incentive Plan, 6,876 Uplift awards under BHP Group Limited’s Management Award Plan, 12,222 Uplift Awards under BHP Group Limited’s

Cash and Deferred Plan. |

|

|

|

|

| c) |

|

Price(s) and volume(s) |

|

Price(s) |

|

Volume(s) |

|

|

|

|

1. Nil |

|

43,896 |

|

|

|

|

| d) |

|

Aggregated information |

|

N/A |

|

|

|

|

|

|

|

- Aggregated volume |

|

|

|

|

|

|

|

|

- Price |

|

|

|

|

|

|

|

|

| e) |

|

Date of the transaction |

|

2022-06-17 |

|

|

|

|

|

|

| f) |

|

Place of the transaction |

|

Australian Securities Exchange (ASX) |

|

|

|

|

|

|

|

|

|

| 1 |

|

Details of the person discharging managerial responsibilities / persons closely associated |

|

|

|

|

| a) |

|

Name |

|

David Lamont |

|

|

|

|

|

| 2 |

|

Reason for the notification |

|

|

|

|

|

|

| a) |

|

Position/status |

|

PDMR (CFO) |

|

|

|

|

|

|

| b) |

|

Initial notification/Amendment |

|

Initial notification |

|

|

|

|

| 3 |

|

Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

|

|

|

|

| a) |

|

Name |

|

BHP Group Limited |

|

|

|

|

|

|

| b) |

|

LEI |

|

WZE1WSENV6JSZFK0JC28 |

|

|

|

|

| 4 |

|

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted. |

|

|

|

|

| a) |

|

Description of the financial instrument, type of instrument

Identification code |

|

BHP Group Limited ordinary shares

ISIN: AU000000BHP4 |

|

|

|

|

|

| b) |

|

Nature of the transaction |

|

The grant of 14,579 Uplift awards under BHP Group Limited’s Long Term Incentive Plan, 9,279 Uplift awards under BHP Group Limited’s Executive Incentive Plan, 3,874 Uplift Awards under BHP Group Limited’s

Cash and Deferred Plan. |

|

|

|

|

| c) |

|

Price(s) and volume(s) |

|

Price(s) |

|

Volume(s) |

|

|

|

|

1. Nil |

|

27,732 |

|

|

|

|

| d) |

|

Aggregated information |

|

N/A |

|

|

|

|

|

|

|

- Aggregated volume |

|

|

|

|

|

|

|

|

- Price |

|

|

|

|

|

|

|

|

| e) |

|

Date of the transaction |

|

2022-06-17 |

|

|

|

|

|

|

| f) |

|

Place of the transaction |

|

Australian Securities Exchange (ASX) |

|

|

SIGNATURES

|

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

|

|

|

|

|

|

|

|

|

BHP Group Limited |

|

|

|

| Date: June 27, 2022 |

|

By: |

|

/s/ Stefanie Wilkinson |

|

|

Name: |

|

Stefanie Wilkinson |

|

|

Title: |

|

Group Company Secretary |

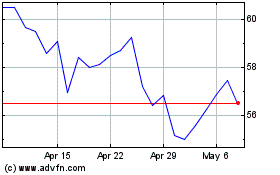

BHP (NYSE:BHP)

Historical Stock Chart

From Aug 2024 to Sep 2024

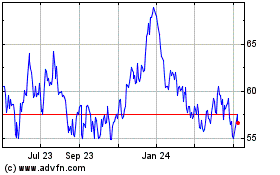

BHP (NYSE:BHP)

Historical Stock Chart

From Sep 2023 to Sep 2024