UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 16, 2021

|

|

|

|

|

BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE,

VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

|

|

BHP GROUP PLC

(REG. NO. 3196209)

(Exact

name of Registrant as specified in its charter)

ENGLAND AND WALES

(Jurisdiction of incorporation or organisation)

NOVA SOUTH, 160 VICTORIA STREET

LONDON, SW1E 5LB

UNITED

KINGDOM

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): n/a

16 February 2021

|

To:

|

Australian Securities Exchange

|

New York Stock Exchange

RESULTS PRESENTATION FOR HALF YEAR ENDED 31 DECEMBER 2020

Attached are the presentation slides for a presentation by the Chief Executive Officer and Chief Financial Officer.

A video of this presentation can be accessed at:

https://edge.media-server.com/mmc/p/wok57pbf

Further

information on BHP can be found at bhp.com.

Authorised for lodgement by:

Geof Stapledon

Acting Group Company Secretary

+44 (0)20 7802 4000

|

|

|

|

|

BHP Group Limited ABN 49 004 028 077

|

|

BHP Group Plc Registration number 3196209

|

|

LEI WZE1WSENV6JSZFK0JC28

|

|

LEI 549300C116EOWV835768

|

|

Registered in Australia

|

|

Registered in England and Wales

|

|

Registered Office: Level 18, 171 Collins Street

|

|

Registered Office: Nova South, 160 Victoria Street,

|

|

Melbourne Victoria 3000

|

|

London SW1E 5LB United Kingdom

|

|

Tel +61 1300 55 4757 Fax +61 3 9609 3015

|

|

Tel +44 20 7802 4000 Fax +44 20 7802 4111

|

The BHP Group is headquartered in Australia

Financial results Half year ended 31 December 2020 Spence Growth Option

Disclaimer The information in this presentation is current as at 16 February 2021. It is in summary form

and is not necessarily complete. It should be read together with the BHP Results for the half year ended 31 December 2020. Forward-looking statements This presentation contains forward-looking statements, including statements regarding: trends

in commodity prices and currency exchange rates; demand for commodities; production forecasts; plans, strategies and objectives of management; closure or divestment of certain assets, operations or facilities (including associated costs);

anticipated production or construction commencement dates; capital costs and scheduling; operating costs and shortages of materials and skilled employees; anticipated productive lives of projects, mines and facilities; provisions and contingent

liabilities; and tax and regulatory developments. Forward-looking statements may be identified by the use of terminology, including, but not limited to, ‘intend’, ‘aim’, ‘project’, ‘anticipate’,

‘estimate’, ‘plan’, ‘believe’, ‘expect’, ‘may’, ‘should’, ‘will’, ‘would’, ‘continue’, ‘annualised’ or similar words. These statements discuss future

expectations concerning the results of assets or financial conditions, or provide other forward-looking information. These forward-looking statements are based on the information available as at the date of this release and are not guarantees or

predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained

in this release. BHP cautions against reliance on any forward-looking statements or guidance, particularly in light of the current economic climate and the significant volatility, uncertainty and disruption arising in connection with COVID-19. For example, our future revenues from our assets, projects or mines described in this release will be based, in part, upon the market price of the minerals, metals or petroleum produced, which may vary

significantly from current levels. These variations, if materially adverse, may affect the timing or the feasibility of the development of a particular project, the expansion of certain facilities or mines, or the continuation of existing assets.

Other factors that may affect the actual construction or production commencement dates, costs or production output and anticipated lives of assets, mines or facilities include our ability to profitably produce and transport the minerals, petroleum

and/or metals extracted to applicable markets; the impact of foreign currency exchange rates on the market prices of the minerals, petroleum or metals we produce; activities of government authorities in the countries where we sell our products and

in the countries where we are exploring or developing projects, facilities or mines, including increases in taxes; changes in environmental and other regulations; the duration and severity of the COVID-19

pandemic and its impact on our business; political uncertainty; labour unrest; and other factors identified in the risk factors discussed in BHP’s filings with the U.S. Securities and Exchange Commission (the ‘SEC’) (including in

Annual Reports on Form 20-F) which are available on the SEC’s website at www.sec.gov. Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any

forward-looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance. Presentation of data Unless specified otherwise: variance analysis relates to the relative

performance of BHP and/or its operations during the half year ended 31 December 2020 compared with the half year ended 31 December 2019; operations includes operated assets and non-operated assets;

total operations refers to the combination of continuing and discontinued operations; continuing operations refers to data presented excluding the impacts of Onshore US from the 2017 financial year onwards; copper equivalent production based on 2020

financial year average realised prices; references to Underlying EBITDA margin exclude third party trading activities; data from subsidiaries are shown on a 100 per cent basis and data from equity accounted investments and other operations is

presented, with the exception of net operating assets, reflecting BHP’s share; medium term refers to our five year plan. Queensland Coal comprises the BHP Mitsubishi Alliance (BMA) asset, jointly operated with Mitsubishi, and the BHP Mitsui

Coal (BMC) asset, operated by BHP. Numbers presented may not add up precisely to the totals provided due to rounding. All footnote content (except in the Annexures) is contained on slide 40. Alternative performance measures We use various

alternative performance measures to reflect our underlying performance. For further information please refer to alternative performance measures set out on pages 63 – 74 of the BHP Results for the half year ended 31 December 2020. No offer

of securities Nothing in this presentation should be construed as either an offer or a solicitation of an offer to buy or sell BHP securities in any jurisdiction, or be treated or relied upon as a recommendation or advice by BHP. Reliance on third

party information The views expressed in this presentation contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or

reliability of the information. This presentation should not be relied upon as a recommendation or forecast by BHP. BHP and its subsidiaries In this presentation, the terms ‘BHP’, the ‘Company’, the ‘Group’, ‘our

business’, ‘organization’, ‘Group’, ‘we’, ‘us’ and ‘our’ refer to BHP Group Limited, BHP Group Plc and, except where the context otherwise requires, their respective subsidiaries set out in note

13 ‘Related undertaking of the Group’ in section 5.2 of BHP’s Annual Report and Form 20-F. Those terms do not include non-operated assets. This

presentation includes references to BHP’s assets (including those under exploration, projects in development or execution phases, sites and closed operations) that have been wholly owned and/or operated by BHP and that have been owned as a

joint venture operated by BHP (referred to as ‘operated assets’ or ‘operations’) during the period from 1 July 2020 to 31 December 2020. Our functions are also included. BHP also holds interests in assets that are owned

as a joint venture but not operated by BHP (referred to in this release as ‘non-operated joint ventures’ or ‘non-operated assets’). Our non-operated assets include Antamina, Cerrejón, Samarco, Atlantis, Mad Dog, Bass Strait and North West Shelf. Notwithstanding that this presentation may include production, financial and other information

from non-operated assets, non-operated assets are not included in the Group and, as a result, statements regarding our operations, assets and values apply only to our

operated assets unless otherwise stated. References in this release to a ‘joint venture’ are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal

relationship between the owners of the asset. Financial results 16 February 2021 2

Financial results Half year ended 31 December 2020 Mike Henry Chief Executive Officer Western Australia

Iron Ore

Consistent approach delivers strong results Delivering strong safety and operational performance; continuing to

grow value as the global economy recovers Safer, more reliable with higher margin Strong free cash flow and balance sheet High shareholder returns Strong social value performance Improving macro environment for resources Western Australia Iron Ore

Financial results 16 February 2021 4

H1 FY21 operational highlights Safer and more reliable SafetyProductionUnit costs Zero fatalitiesRecordOn track

TRIF 16% to 3.5 per million hours workedproduction at WAIO and concentratorfor FY21 guidance1 compared to FY20throughput at Escondida ReliabilityPortfolioMajor projects No major operational Adding options On track disruptions

completed acquisition of additionalfirst production achieved at SGO; South in our operated assets; well managed28% in Shenzi; exploration advancingFlank on schedule for production mid-CY21 through COVID-19 Notes: TRIF – Total Recordable Injury Frequency; WAIO – Western Australia Iron Ore; SGO – Spence Growth Option. Financial results 16 February 20215

H1 FY21 financial highlights Higher margin enables higher shareholder returns EarningsEBITDA marginFree cash

flow US$14.7 bn59%US$5.2 bn Underlying EBITDA 21% 3% points 39% Net debtShareholder returnsROCE US$11.8 bn101 US cps24% 7%dividend determined, 5% points payout ratio of 85% Note: All comparisons are

against H1 FY20; Net debt excludes vessel lease contracts that are priced with reference to a freight index. Financial results 16 February 20216

H1 FY21 social value highlights Social value is integrated into all we do Operational emissionsInclusion and

diversitySocial investment Set target mid-term27.4%US$35.4 m female participation across group to reduce operational emissions from 0.9% points compared to FY20;including for

COVID-19 continued response community and recovery support FY20 levels by 30% by FY30gender balanced executive team Value chain emissionsLocal procurement spendWater Partnerships to support our Scope 3

goals2US$0.9 bnOn track progressed; partnerships with twoto support the growth of local businessesfreshwater withdrawal below reduction steelmakers, and LNG shipping andin the regions where we operatetarget on an annualised basis bunkering

agreements Financial results 16 February 20217

Financial results Half year ended 31 December 2020 David Lamont Chief Financial Officer Nickel West

Financial performance EBITDA margin of 59%, record dividend and strong growth in earnings per share Summary

income statementStrong earnings delivery H1 FY21% change (US$ billion)(US cents per share)(Index, FY16=100) Underlying EBITDA14.7 21%150200 Underlying EBITDA margin59% Underlying EBIT11.3 25% Adjusted effective tax rate334.1%100 41.7% Adjusted

effective tax rate incl. royalties3100 Underlying attributable profit6.0 16% 50 Net exceptional items(2.2) Attributable profit3.9 Underlying basic earnings per share119.4 US cps 16% 00 Dividend per share101 US cps 55%FY16FY17FY18FY19FY20H1 FY21

Underlying basic EPS (H1) Underlying basic EPS (H2) Revenue (RHS) Note: Presented on a total operations basis. Financial results 16 February 20219

Segment performance Full year unit cost guidance remains unchanged Iron Ore4CopperMetallurgical CoalPetroleum

EBITDA:US$10.2 bnUS$3.7 bnUS$0.1 bnUS$0.8 bn EBITDA margin:73%60%3%49% WAIOEscondidaQueensland CoalPetroleum (US$/t)(US$/lb)(US$/t)(US$/boe) Unit cost at realised FX5:14.38 10%0.90 18%84.92 20%10.30 8% C1 unit cost6:12.46 2%

Full year guidance Half year Recordpartially Record co Lower voto Lower vo offset unfavourable FXthroughput and strong costadverse weather; strong H2adverse weather and market

Performance driversmovements and highermanagementas plannedconditions third-party royalties Higher planned maintenance Higher exploration expenses and FX movements n track / in line or better than full year guidance1 behind full year guidance

Financial results 16 February 202110

Consistent cash generationand returns Strong underlying operations deliver consistent cash flow and dividends

Net operating cash flowFree cash flow and dividends (US$ billion)(Index, FY10=100)(US$ billion)(% of FCF after dividends to NCIs) 3020030120 95%200 2525100 86% 76% 202080 58% 151001560 49%37% H2 101040 H2200 5520 H1 H1 0000 FY16FY17FY18FY19

FY20CY20FY16FY17FY18FY19FY20CY20 Free cash flow (H2) Operating cash flow (H1)Operating cash flow (H2)Free cash flow (H1) Revenue (RHS)Dividend determined (% of FCF after dividends to NCIs) Note: The Free Cash Flow used to present the Dividend

determined (% of FCF) excludes dividends paid to Note: Presented on a total operations basis.non-controlling interests. Cash flow results for FY16 and FY17 are presented on a total operations basis. Financial results 16 February 202111

Capital allocation Disciplined adherence to our Capital Allocation Framework H1 FY21 OperatingCapital

productivityproductivity Net operating cash flow US$9.4 bn Maintenance capitalUS$1.1 bn Strong balance sheet Minimum 50% payout ratio dividendUS$1.9 bn Excess cash US$5.4 bnIncludes net cash outflow of US$1.0 bn

AdditionalOrganicAcquisitions/ Balance sheetBuy-backs dividends7development(Divestments) US$1.5 bnUS$0.9 bnUS$0.0 bnUS$2.5 bnUS$0.5 bn H2 FY20 US$1.3bn improvement US$0.1bn latent capacity US$0.8bn major projects US$0.3bn exploration Note: Includes

total net cash out flow of US$1.0 billion (H1 FY20: US$0.7 billion) which comprises dividends paid to non-controlling interests of US$0.8 billion (H1 FY20: US$0.6 billion); net investment and funding

of equity accounted investments of US$0.4 billion (H1 FY20: US$0.3 billion) and an adjustment for exploration expenses of US$(0.2) billion (H1 FY20: US$(0.2) billion) which is classified as organic development in accordance with the Capital

Allocation Framework. Financial results 16 February 202112

Return on Capital Employed H1 FY21 of ROCE 24% ROCEROCE by asset H1 FY21 (%, excluding Onshore US)(%)

2570Excludes investment in major projects in execution Antamina8,9 20 30 15WAIO8 20 Escondida 10Pampa 10NortePotash10 PetroleumExploration8 ex-ExplorationOlympicNSWEC8 5Dam 0 QCoal Cerrejón8,9 0(10)

FY16FY17FY18FY19FY20H1 FY210102030405060 Half year resultsFull year resultsAverage capital employed (US$ billion) Note: ROCE represents profit after tax excluding exceptional items and net finance costs (after tax), which are annualised for half

year results, divided by average capital employed. Average capital employed is net assets less net debt for the last two reporting periods. Financial results 16 February 202113

Financial results Half year ended 31 December 2020 Mike Henry Chief Executive Officer Pyrenees

A constructiveoutlook Recovery from COVID-19 dominates the near term;

major inflection points beckon beyond that Policy makersFears ofGrowth & inflation Macro environmentremainausterity &expectationsSynchronised upswing growth focuseddeflation recedeincrease The resources

cycleDemandDisciplinedTightens marketBHP thrives recoverysupplybalances Climate strategiesEasier-to-abatePervasive carbonIncreased Decarbonisationtake shapesectors “take-off”pricinglikelihood of Paris outcomes Financial results

16 February 202115

Longer term drivers for resources Population growth, decarbonisation and rising living standards will drive

demand for energy, metals and fertilisers for decades Population growth……of which urban……creates new demand……including for capex (world GDP nominal US$)(world capex nominal US$) 2019201920192019 7.7 billion4.3 billion88

trillion23 trillion 2030203020302030 8.5 billion5.2 billion152 trillion35 trillion @ 2% inflation Sources: UN World Population Prospects 2019, UN World Urbanization Prospects 2008 Revision, IMF World Economic Outlook October 2020, and BHP analysis.

Financial results 16 February 202116

Delivering on our agenda We continue to execute levers to deliver leading financial returns and social value

SafeHigh performingLeanFuture fit Relentless focus on High level of operational Sector leading low-cost, Portfolio benefits in eliminating fatalities; tworeliabilityhigh-margin producer1.5 degree scenario

years fatality free at our operated assets Investments assessed Reducing global functional Adding exposure to through rigorous risk andcost basetechnology and partnerships Lowered TRIF with continuedreturn matrix efforts to improve South Flank

project on track Adding future facing Embedded approach towith leading capital intensitycommodity options Effective management ofsocial value COVID-19 Capital discipline aligned with strong balance sheet

Levers CultureCapabilityCapital allocationTechnologyAsset centric Financial results 16 February 202117

Growthoptions to capitalise on market opportunities Assessing options with exposure to strategic themes, while

adding more options in future facing commodities Iron oreMetallurgical CoalPetroleumCopperNickelPotash Large resource base gives us optionality Latent capacityNickel West South FlankBMA optionalityConventional oilJansen Stage 1 projectsexpansion

(Iron Ore)(Metallurgical Coal)(Petroleum)(Potash) (Copper)(Nickel) Australia, WAIO optionalityAdvantaged gasResolutionCanadaJansen Stage 2-4 (Iron Ore)(Petroleum)(Copper)exploration(Potash) (Nickel) Ecuador,

Australia exploration (Copper) Line of sight for growth pathway should marketFocus on value enhancingAdding options in future facing commodities, throughWell placed to benefit from a conditions warrantoptionstechnology, exploration and early stage

entrynumber of global megatrends Financial results 16 February 202118

Social value is core to everything we do The world will not decarbonise without more mined resources, produced

sustainably A history of actionCommitted to leadership Operational emissions: Setting public GHG emissions Operational emissions: 30% reduction by 2030; net zero by 2050 reduction targets since the

1990s Water: 15 year strategy to cease ground water extraction byEnvironmental Value chain emissions: Expanding partnerships (China BaoWu, 2030 achieved 10 years ahead of schedule at EscondidaaccountabilityJFE, LNG bulk

carriers) Biodiversity: Commitments in place since the 1990s Impact investing: Renewable power in Chile and Australia Taxes and royalties: First disclosed our aggregate payments Social investment: No

less than 1% of pre-tax profit11 around the world in 2000Creating Indigenous employment: Targeting 8% in Australia by end-FY25 Health and safety:

Our top priority; cultivated a culture of careSocial Health and safety: Target fatality elimination (technology and and implemented effective controls to deliver better health andvaluecontractor partnerships); support wellbeing (mental health

framework) safety outcomes relating to fatalities and occupational exposures Local suppliers: Supporting growth of local businesses Culture: Charter and Code of Conduct since early 2000sLeading Diversity: Female Executive

Leadership Team—50%; Board—33%; Executive remuneration: Introduced HSEC component in 2002Aspirational goal to achieve gender balance by 2025 Governance Transparency: Improved our ESG

disclosures over past decade Executive remuneration: Linked to long-term safety, returns and practices to help users better understand our operational performanceclimate targets (where weighting increased in FY21) Financial results 16 February

202119

Investment proposition We grow long-term shareholder value through reliable operations, optimal allocation of

capital and creating social value Maximise cashflowCapital disciplineValue and returns Net debt Low-cost producertargeting lower end24% ROCE disciplined focus on cost control asof US$12-17 billion rangein H1 FY21 headwinds increase PortfolioShareholder returns Reliable operationsre-shaping to better align withUS$30 billion announced improving operational efficiency throughfuture

megatrendsover the last 3 years use of technology Capital AllocationHigh return projects Constructive outlookFrameworkdelivered reliably, in copper SGO; for our commodities as demand recoversis working and remains corein iron ore South Flank on

track to how we run BHP Financial results 16 February 202120

BHP

Appendix

Social value scorecard We are making good progress on our social value commitments CategoryKey indicatorsH1

FY21H2 FY20H1 FY20FY20Target Fatalities0000Zero work-related fatalities High Potential Injury (HPI) frequency Safety and0.200.140.320.24Year-on-year improvement of our

HPI frequency Health(per million hours worked)1 Total Recordable Injury Frequency (TRIF) (per3.53.74.64.2Year-on-year improvement in TRIF million hours worked)

Operational greenhouse gas (GHG) emissionsMaintain FY22 operational GHG emissions at or below FY17 levels2 and 8.17.97.915.8 (Mt CO2 -e)reduce emissions by at least 30% from FY20 levels3 by FY30 Value chain

emissions – steelmakingï—-Goal: Support industry to develop technologies and pathways capable of Environment30% emissions intensity reduction4 Value chain emissions – transportationï—-Goal: Support 40% emissions

intensity reduction of BHP-chartered shipping of our products Fresh water withdrawals (GL)52.652.075.0127.0Reduce FY22 fresh water withdrawal by 15% from FY17 levels5 Social investment

(US$m)35.4119.829.8149.6No less than one% of pre-tax profit (three-year rolling average) Community Local procurement spend (US$m)9479729491,922Support the growth of local businesses in the regions where we

operate Female workforce participation (%)27.426.524.826.5Aspirational goal for gender balance by CY25 Inclusion andAustralia Indigenous workforce participation (%)6.76.55.86.5Aim to achieve 8.0% by the end of FY256 Diversity Chile Indigenous

workforce participation (%)6.776.66.36.6Increase representation from prior year8 1.HPI frequency: number of injuries from events where there was the potential for a fatality per million hours worked. 2.In FY17, our operational GHG emissions were

14.6 Mt CO2-e (excluding Onshore US). Greenhouse gas emissions are subject to final sustainability assurance review. 3.FY17 and FY20 baseline will be adjusted for any material acquisitions and divestments

based on GHG emissions at the time of the transaction. Carbon offsets will be used as required. FY17 baseline is on a Continuing operations basis and has been adjusted for divestments. 4.With widespread adoption expected post-2030. 5.In FY17, our

fresh water withdrawals were 156.1 GL (on an adjusted basis, excluding Onshore US). 6.New medium term target established to achieve 8.0% Aboriginal and Torres Strait Islander representation within our employee and contractor workforce by the end of

FY25. 7.Subject to verification of underlying data by the CONADI (National Indigenous Development Corporation). 8.Work is underway to establish medium term targets for Indigenous workforce participation in Chile. Financial results 16 February

202123

HY21 social value highlights Our purpose is to bring people and resources together to build a better world

People, CultureCommunity and Capabilityand SocietyClimate ChangeEnvironment DiversityPrinciples around AboriginalPortfolio reviewFresh water withdrawals Female participation 27.4%Heritage in Australiain line with transition toof 52.6 GL for HY21; On

track with a gender balancedjointly developed with First1.5 degree scenario completedto meeting 15% reduction from executive team and 33%Nations Heritage ProtectionFY17 levels female board; Aspirational goalAlliance and BHP traditionalSet mid-term targets to achieve gender balance byowner partnersto reduce operationalWater Stewardship 2025emissions by 30% by 2030;context based water target US$947 mNet zero by 2050development started at 5 assets

Australian Indigenousdirected to local suppliers representationScope 3 partnershipsAir quality of 6.7% progressing towardsUS$35.4 mexpanding (Baowu, JFE andimprovements dust actions FY25 aspirational target of 8%social investment to supportLNG bulk

carriers)commenced in the Pilbara within our employee andlocal communities contractor workforceImpact investing leadershipTailings Taskforce Community sentimentincluding in desalination andcontinues work, with focus on Executive remunerationand

concerns monitored inrenewable power in Chilereduction in tailings risk linked to long-term safety,developing social value plans returns and climate targets Financial results 16 February 202124

Our approach to Heritage Developing mutually beneficial long-term relationships founded on respect and

understanding BHP Indigenous Peoples Policy Statement We aim to be a partner of choice for Indigenous Peoples through which our relationships contribute to their economic empowerment, social development and cultural wellbeing Cultural Heritage

ManagementOur Commitments include: Undertaking participatory and inclusive social and environmental We will not act on our section 18 consents without further impact assessments.extensive consultation with traditional owners; Seeking to agree on and

document engagement and consultation If we learn new information that materially changes the plans with potentially impacted Indigenous Peoples.significance of a site, we will not disturb it without Working to obtain the consent of Indigenous

Peoples to BHPagreement; and activities consistent with the ICMM Position Statement. Confirmed with traditional owners that no term of our Seeking to avoid or minimise impacts on places of significantagreements shall operate to prevents them from

making heritage value.public statements about cultural heritage concerns. Supporting the preservation of cultural heritage through implementing a framework for identifying, documenting and managing places ofcultural significance. Financial results

16 February 202125

le future A charitable organisation solely funded by BHP but operates independently.Focus Areas: Contributes to

the achievement of many of the UN SDGs, addressing global sustainable development challenges.Natural Resource Governance OVERVIEW Since 2014 the Foundation has committed US$262 million to 30 projects workingTo harness the transformative power

of natural resource wealth for with 32 partner organizations implementing across 44 countries.sustainable and inclusive human development. Australia: 17,000 Indigenous students across 680 schools have participated inEnvironmental Resilience STEM

Education pathways.To support new ways of conserving and sustainably managing large- Australia: Contributed A$3 million to the prevention and treatment of COVID-19scale, globally significant natural environments for the benefit of future with

two world-leading research institutionsgenerations. IMPACT Afghanistan: opening up public procurement resulted in savings of AFN 58 billion (US$740 million).Education Equity & Colombia: exposure of a price-fixing scheme resulted in

700,000 schoolTo harness the potential of young people most at risk of being left students receiving cheaper, higher quality daily school meals.behind by enabling equitable access to quality education and learning. Establishment of a Global

Knowledge Network connecting organizations OUTCOMESsupporting Indigenous Peoples to self-determine use of their lands. ‘Real-time Education Innovation Scaling Labs’ established to support successfulCountry Programs education reform pilots

being mainstreamed through education systems.Australia/Chile/Canada/USA Australia: more than 800 Aboriginal and Torres Strait Islander organizationsComplementing the Foundation’s global efforts to improve long-term have benefited from enhanced

governance and management training.economic, social and environmental sustainability at a national level. Financial results 16 February 202126

Asset performance and plans Resilient core asset with quality growth options Petroleum delivering low cost

barrels today……while replenishing the portfolio for tomorrow Progressing our sanctioned projects and pipeline of near-term opportunitiesTranslating Exploration and Appraisal success to development Robust resilient

volumes with breakeven ranges below $40/boe Exploration 2C resource additions from FY17-FY20 (758 MMboe)13 are moving Well executed sanctioned projects adding new volumes from July 2020ahead toward development with first

production expected mid-2020s –Atlantis Phase 3 achieved first production ahead of schedule and on budget–Trion, Shenzi North and Wilding progressing development planning and –Ruby, Mad Dog

Phase 2 and West Barracouta on plan and on targetvalue optimisation Opportunistic acquisition of additional Shenzi working interest, adding–Calypso (T&T North) appraisal in FY2022 to advance the opportunity

high-margin barrels leveraging existing infrastructure –Sanctioned new infill wells & Shenzi North near-field success in January 2021 CY20212022202320242025202620272028 Transition to higher value liquids production (Production,

MMboe)(% Liquids)Barracouta WestMad Dog Ph2 14056SanctionedRubyShenzi SSMPP Scarborough Mad Dog – Water Injection 7048Shenzi North Trion UnsanctionedAtlantis MFX Calypso 040Western GoM FY16-FY20 averageFY21eMTEastern Canada US GoMRoWAustralia%

LiquidsExplorationCentral GOM Note: Production excludes Onshore US; FID – Final Investment Decision;FID rangeFirst production rangeExploreAppraise Shenzi SSMPP – Shenzi Sub-Sea Multi-Phase Pumping;

GoM – Gulf of Mexico; T&T—Trinidad and Tobago; Atlantis MFX – Atlantis Major Facilities Expansion;RoW includes Trinidad & Tobago and Algeria. Financial results 16 February 202127

Asset performance and plans Escondida sets new record; Spence Growth Option delivers first copper

EscondidaPampa Norte Strong operational performance lowers costs Spence Growth Option (SGO) delivers first copper New concentrator throughput record of 386 ktpd SGO produced first copper December 2020 on

time and budget BHP Operating System (BOS) continues to improve performance and stability After 12 month ramp up, will support ~300 ktpa at Spence for first four years, Exploring potential latent

capacity optionalityincluding current cathode operations Escondida celebrates first year of switch to desalinated water, after investing Spence Growth Option to operate with 100 per cent desalinated water, using more than

US$4 billion in desalination capacity since 20061000 l/s new desalination plant More cost efficient renewables power contracts to start in FY22 Spence aiming to source vast majority of water from desalinated sources by mid-2020s BOS improves concentrator throughput and unit costsSpence Growth Option (Throughput, ktpd)(Unit costs, US$/lb) 4001.20 3400.60 2800.00 FY18FY19FY20H1 FY21 Unit costs (RHS)Concentrator throughput (LHS)

Financial results 16 February 202128

Asset performance and plans Olympic Dam and Nickel West sustainably increasing production and returns Olympic

DamNickel West Focused on operational stabilityBuilding strong, stable foundations Highest production for a half in five years through improved smelter performance Improved operational stability following resource transition

and completion of Multi-year asset integrity program supporting stability and tracking to planmajor four yearly planned shutdowns in FY20 Improved underground mining equipment operating efficiency

Undercut at Leinster B11, BHP’s first block cave development, tracking well against revised plan allowing prioritisation of quality over feed Safe and reliable performance in the medium term Future options Scheduled major

smelter maintenance (SCM21) in H1 FY22 will lift smelter bottleneck in latter part of five year plan Honeymoon Well acquisition completed Continue to review downstream options Strong Mine Performance will underpin increased productionOperational

stability foundation for increased equity production (CuEq* production, Kt)(Development, ‘0000 m; Run of Mine Stock, Mt)(Contained nickel, kt)Quadrennial maintenance 350Smelter maintenance6120and resource1,800 ↑ ~90% to 1,740

ktNitransition 1753601,100 Target Operating Window 000400 FY17FY18FY19FY20FY21eFY22eFY23eFY24eFY16 ActFY17 ActFY18 ActFY19 ActFY20 ActFY21e Run of Mine (RHS)UG development (RHS)CuEq production (LHS)ProvedProbableEquity productionThird party

production *Copper equivalent (CuEq) production based on FY20 average realised commodity prices, refer to page 17 of the Results Announcement for the six months ended 31 December 2020. The calculation applied the following formula: CuEq=

â^‘(commodity production tonnes x (commodity price/copper price)). Financial results 16 February 202129

Asset performance and plans Value growth through continuous improvement; South Flank on track for first

production in mid-CY21 WAIOQueensland Coal Supply chain reliability underpins record productionSolid operating and cost performance in a challenging environment Achieved 290 Mtpa of

shipments in CY20 FY21 production is now expected to be at the lower half of the guidance Improve car dumper reliability enabled by BOS, maintenance centre ofrange following significant wet weather impacts from La Niña

excellence, and operations services Focus on improving truck and shovel productivity over the medium term to Autonomous truck roll-out completed at Newman East, enabling increasedenable

continuous wash plant feed annualised truck hours and improved safety Goonyella Riverside and Daunia commenced autonomous truck operations, South Flank progressing on track (90% complete)increasing truck productivity and recovery times post wet

weather events First production expected mid-CY21 Cost reduction initiatives embedded to preserve margins in a volatile price environment Unit costs below $13/t in medium term, with

South Flank onlineStrip ratio headwinds to unwind to 2025 (Unit costs, US$/t)(Iron Ore production, Mtpa)(Unit costs, US$/t)(Prime to product strip ratio) 203009014 CY20 shipments (RHS) 15250607 10200300 FY15FY16FY17FY18FY19FY20FY21e

MediumFY14FY15FY16FY17FY18FY19FY20FY21e Medium termterm Unit costsProductionUnit costsStrip ratio Note: BOS – BHP Operating System ; FY21 and medium-term unit cost guidance are based on exchange rates of AUD/USD 0.70. Financial results

16 February 202130

Samarco and Renova Foundation Renova has spent R11.3 billion on remediation and compensation programs;

New, court-sanctioned payment system in place CompensationResettlementSamarco ~R3.1 billion indemnification and financial aid paid Resettlement progress continues despite Iron ore pellet production restarted in to about 320,000 people by

December 2020COVID-19 challengesDecember 2020, gradual ramp-up to production New court-designated “Novel system” for claims Bento Rodrigues: civil works,

healthcare centrecapacity of ~8 Mtpa from people in the most informal sectors launchedcomplete, public buildings nearing completion, One concentrator operating with a new tailings in August 2020. More than 5,000 paymentssome houses completefiltering

and disposal system to a confined pit totalling ~R400 million made in 5 months toreducing environmental risk Paracatu: construction of public buildings and January 2021houses is progressing Germano dam decommissioning

work progressing – Claimants include informal & subsistence fisher- folks, artisans and informal launderers Gesteira: Progress on negotiations for alternatives Increase in cost estimates for Samarco dam failure to urban

resettlementprovision, in part due to resettlement program delays, including impacts due to COVID-19 Bento Rodrigues housesBento Rodrigues schoolSamarco filtration plant Note: R3.1 billion is

approximately US$770 million at actual transactional (historical) exchange rates related to Renova funding, while R400 million is approximately US$77 million at 5.2 BRL/USD. Financial results 16 February 202131

Exceptional items Attributable profit of US$3.9 billion includes an exceptional loss of

US$2.2 billion GrossTaxNet Half year ended 31 December 2020US$MUS$MUS$MHalf year ended 31 December 2020US$M Other income- Exceptional items by categoryExpenses excluding net finance costs: Costs incurred directly by BHP Brasil and

other BHP entities in Samarco dam failure(358)(19)(377)(19) relation to the Samarco dam failure COVID-19 related costs2(298)79(219)Loss from equity accounted investments, related impairments and expenses:

Impairment of Energy coal assets and associatedSamarco impairment expense(90) (927)(647)(1,574) tax losses3Samarco Germano dam decommissioning- Total(1,583)(587)(2,170)Samarco dam failure provision(300) Fair value change on forward exchange

derivatives92 Attributable to non-controlling interests(15)5(10)Net finance costs(41) Income tax expense(19) Attributable to BHP shareholders(1,568)(592)(2,160)Total(377) Notes: 1.Additional commentary is

included within Results for the half year ended 31 December 2020, Financial Report, note 3. 2.COVID-19 can be considered a single protracted globally pervasive event with financial impacts expected over a

number of reporting periods. The exceptional item reflects the directly attributable COVID-19 pandemic related additional costs for the Group for HY2021, including costs associated with the increased provision

of health and hygiene services, the impacts of maintaining social distancing requirements and demurrage and other standby charges related to delays caused by COVID-19. 3.The Group recognised an impairment

charge of US$1,194 million (after tax) in relation to NSWEC and associated deferred tax assets. This reflects current market conditions for Australian thermal coal, the strengthening Australian dollar, changes to the mine plan and updated

assessment of the likelihood of recovering tax losses. The impairment charge of US$380 million (after tax) for Cerrejón reflects current market conditions for thermal coal and the status of the Group’s intended exit. Financial

results 16 February 202132

Working capital and balancesheet Net debt of US$11.8 billion and gearing of 18.1% Movements in working

capital (expected to unwind in H2 FY2021)Debt maturity profile3 (US$ billion)(US$ billion) 0.08 Inventory build up due to strong operational throughput (1.0) (0.8)6 (0.4) (0.3)(0.1) (2.0) PriceOther sundry receivablesInventory movementOther related4

impacts Movements in net debt (US$ billion) 2 15 0.9(5.2) 12.00.80.511.8 2.8 10 0 (3.7)FY21 FY22FY23FY24 FY25FY26 FY27FY28FY29 FY30Post 11.8 5FY31 US$EuroSterlingC$ Bonds4Bonds4Bonds4BondsSubsidiaries 034%31%18%4%13% FY20Lease additions Free cash

flow Dividends paid Dividends paidOtherHY21 to NCI 1movements 2% of portfolioCapital markets 87%Asset financing 13% Notes: 1.NCIs: dividends paid to non-controlling interests of US$0.8 billion

predominantly relate to Escondida. 2.Other: Mainly relates to foreign exchange variance due to the revaluation of local currency denominated cash and debt to USD, and impact of the loss on bond repurchase program. 3.Debt maturity profile: all debt

balances are represented in notional USD inception values and based on financial years; as at 31 December 2020; subsidiary debt is presented in accordance with IFRS 10 and IFRS 11. 4.Debt maturity profile: includes hybrid bonds (15% of

portfolio: 10% in Euro, 5% in Sterling) with maturity shown at first call date. Financial results 16 February 202133

Projects in feasibility Jansen Stage 1Scarborough Saskatchewan, CanadaAustralia Shaft equipping, mine

development, processing facility, site13 subsea wells tied back to a semisubmersible FPU2; dry gas infrastructure and outbound logisticspipeline ~435 km in length transports dry gas from the FPU to the onshore LNG plant at Pluto OperatorBHPWoodside

(73.5%) BHP ownership100%26.5% 5,300 – 5,700 Capex (US$m)Sustaining capital ~US$15/t (real) long term average;1,400 – 1,900 (BHP share) +/- 20% in any given year Phase / timingFeasibility study phaseFeasibility study phase Final investment

decision expected mid-CY21Final investment decision expected H2 CY21 First production / Project~5 years construction timeframeFY25 onwards delivery~2 years from first production to ramp up Volumes4.3 –

4.5 Mtpa (Potassium chloride, KCL)8 Mtpa (100% basis, LNG); and 160 MMscf/d (100% basis at peak, domestic gas) 6% royaltyEngineering work continues to progress Federal and Provincial Corporate income tax and Potash Other considerationsProduction

licences awarded for WA-1-R (Scarborough) and Production Tax1WA-62-R (North Scarborough)

in November 2020. Jansen Stage 1 expected mine life of 100 years Notes: 1.Tax consideration for Jansen Stage 1 project includes Royalties, Federal and Provincial Corporate Income taxes, and Potash Production Tax (PPT). Withholding tax on dividend

payments under the current corporate structure is 5%. 2.FPU: Floating production unit. Financial results 16 February 202134

Technology Technology is a key lever for BHP to improve front-line safety, increase production, reduce costs

and create value at velocity EffectivenessPredictabilityDecision Automation OptimisedPASPO5 Digital Centres Reduction of >50% in technologyapplies machine learning to improve feed workforce, on track for ~30% reduction inblend visibility,

predictability in coalrolled out to accelerate data insights, operating costshandlingdecision automation SafetyAutomationPerformance Significant57,000 reduction in vehicle events with fatality2 iron ore sites, converted to autonomous potential at

Jimblebar mine operationshaulage, rollout underway at 2 coal sites,fleet hours reached for consecutive days since autonomous haulage rolled outtrial at Escondidaat Jimblebar, from less than 6,000 Note: PASPO is Process Area Set Point Optimisation.

Note: Fleet hours calculation excludes queuing time. Financial results 16 February 202135

BHP guidance GroupFY21eFY22e Capital and exploration expenditure (US$bn)7.3~8.5Cash basis. Guidance for FY21has

increased by US$0.3 billion to US$7.3 billion due to a stronger Australian dollar. Guidance for FY22 remains unchanged at approximately US$8.5 billion (at guidance exchange rates). Including: Maintenance2.4Includes non-discretionary capital expenditure to maintain asset integrity, reduce risks and meet compliance requirements. Also includes capitalised deferred development and production stripping (FY21e: US$0.8 billion).

Includes US$0.1 billion for petroleum. Improvement2.6Includes Petroleum infill drilling and South Flank. Latent capacity0.2Includes WAIO to 290 Mtpa and West Barracouta. Major growth1.5Includes Spence Growth Option, Mad Dog Phase 2, Jansen,

Ruby and Atlantis Phase 3. Exploration0.6Includes ~US$450 million Petroleum and ~US$50 million Copper exploration programs planned for FY21. PetroleumFY21eMedium term Petroleum production (MMboe)95 – 102~106FY21 volumes now expected

to be in the upper half of the guidance range as additional production from Shenzi, following the acquisition of a further 28 per cent working interest, is partially offset by the impacts of significant hurricane activity in the Gulf of Mexico.

Average p.a. production broadly flat over the medium term, with material growth in FY2023 as sanctioned projects come online. ~106 MMboe represents average over medium term. ~103 MMboe is expected in FY25. Capital expenditure

(US$bn)1.2SanctionedCapexFirst productionProduction (BHP share)(100% basis at peak) West BarracoutaDecember 2018~US$140 mCY21104 MMscf/d RubyAugust 2019~US$340 mCY2116,000 bopd (oil) and (~US$280 m excl.

pre-commitment)80 MMscf/d (gas) Mad Dog Phase 2February 2017US$2.2 bnCY22140,000 boe/d Exploration expenditure (US$m)~450Focused on Trinidad & Tobago and the US Gulf of Mexico. Unit cost (US$/boe)11

– 12<13Costs to increase in medium term as a result of natural field decline. Excludes inventory movements, embedded derivatives movements, freight, third party product purchases and exploration expense. Based on exchange rate of AUD/USD

0.70. Financial results 16 February 202136

BHP guidance (continued) CopperFY21eMedium term Copper production (kt)1,510 – 1,645Escondida: 970 –

1,030 kt; Pampa Norte 240 – 270 kt; Olympic Dam: 180 – 205 kt; Antamina: 120 – 140 kt (zinc 140 – 160 kt). Capital and exploration expenditure (US$bn)2.5Includes ~US$52 million exploration expenditure. SanctionedCapexFirst

productionProduction (BHP share)(100% basis) Spence Growth OptionAugust 2017US$2.5 bnAchieved in December~185 ktpa of 2020, on schedule andincremental copper on budget(over first 10 years) Escondida Copper production (kt, 100% basis)970 –

1,030~1,200~1,200 kt represents average per annum over medium term. Unit cash costs (US$/lb)1 – 1.25<1.10Excludes freight; net of by-product credits; based on an exchange rate of USD/CLP 769. Iron

OreFY21eMedium term Iron ore production (Mt)245 – 255Increased following the restart of Samarco in December 2020 (1 – 2 Mt). FY21 guidance for WAIO remains unchanged at 244 – 253 Mt. Capital and exploration expenditure

(US$bn)1.9SanctionedCapexFirst productionProduction (BHP share)(100% basis) South FlankJune 2018US$3.1 bnMid-CY2180 Mtpa sustaining mine Western Australia Iron Ore Iron ore production (Mt, 100% basis)276 – 286290 Unit cash costs (US$/t)13

– 14<13Excludes freight and government royalties; based on an exchange rate of AUD/USD 0.70. Sustaining capital expenditure (US$/t)~4Medium term average; +/- 50% in any given year. Includes South Flank; Excludes costs associated with

automation programs. Financial results 16 February 202137

BHP guidance (continued) Coal FY21e Medium term Metallurgical coal production (Mt) 40 – 44 46 – 52

Expected to be at the lower half of the guidance range. Energy coal production (Mt) 21 – 23 NSWEC: 15 – 17 Mt, expected to be at the lower half of the guidance range; Cerrejón: ~6 Mt, revised down from ~7 Mt due to the impact of the

91 day strike in HY21. Capital and exploration expenditure (US$bn) 0.6 Queensland Coal Production (Mt, 100% basis) 71 – 77 Expected to be at the lower half of the guidance range. Unit cash costs (US$/t) 69 – 75 58 – 66 Excludes

freight and royalties; based on an exchange rate of AUD/USD 0.70. Sustaining capital expenditure (US$/t) ~9 Medium term average; +/- 50% in any given year. Excludes costs associated with automation programs. Other FY21e Other capex (US$bn) 0.6

Includes Nickel West and Jansen. Including: Jansen current scope (US$m) ~260 Note: Queensland Coal production guidance for the 2021 financial year remains on track, subject to any potential impacts on volumes from restrictions on coal imports into

China and further significant wet weather during the remainder of the 2021 financial year. Financial results 16 February 2021 38

Key Underlying EBITDA sensitivities Approximate impact1 on FY21 Underlying EBITDA of changes of: US$ million

US$1/t on iron ore price2 236 US$1/bbl on oil price3 37 US$1/t on metallurgical coal price 37 US¢1/lb on copper price2 33 US$1/t on energy coal price2 15 US¢1/lb on nickel price 1.6 AUD (US¢1/A$) operations4 132 CLP (US¢1/CLP)

operations4 31 Notes: 1. EBITDA sensitivities: assumes total volume exposed to price; determined on the basis of BHP’s existing portfolio. 2. EBITDA sensitivities: excludes impact of equity accounted investments. 3. EBITDA sensitivities:

excludes impact of change in input costs across the Group. 4. EBITDA sensitivities: based on average exchange rate for the period Financial results 16 February 2021 39

Footnotes 1. Slide 5: Unit cost guidance for the 2021 financial year remains on track, subject to any potential

impacts on volumes from restrictions on coal imports into China and further significant wet weather during the remainder of the 2021 financial year. 2. Slide 7: Scope 3 goals to contribute to decarbonisation in our value chain are 1) supporting

industry to develop technologies and pathways capable of 30 per cent emissions intensity reduction in integrated steelmaking, with widespread adoption expected post-2030 and 2) supporting 40 per cent emissions intensity reduction of BHP-chartered shipping of our products. 3. Slide 9: Adjusted effective tax rate and Adjusted effective tax rate incl. royalties: excludes the influence of exchange rate movements and exceptional items. 4. Slide 10:

Iron ore: unit cost, EBITDA margin: refers to Western Australia Iron Ore. 5. Slide 10: Costs related to the impact from COVID-19 are reported as an exceptional item and are not included in unit costs for the

2021 half year. At our major assets these additional costs were: US$1.42 per tonne at Queensland Coal, US$0.56 per tonne at WAIO (including US$0.26 per tonne of demurrage and US$0.19 per tonne relating to projects), US$0.25 per barrel of oil

equivalent at Petroleum and US$0.02 per pound at Escondida. 6. Slide 10: WAIO C1 cost: excludes third party royalties, exploration expenses, depletion of production stripping, demurrage, exchange rate gains/losses, net inventory movement and other

income. Operational readiness costs relating to South Flank of US$0.19/t have been excluded from the C1 calculation. H1 FY21 C1 unit costs excludes the impact from COVID-19 that was reported as an exceptional

item of US$0.31/t. 7. Slide 12: Dividend: represents final dividend determined by the Board for FY20 and paid in September 2020. 8. Slide 13: WAIO, Antamina, Cerrejón, NSWEC & Petroleum exploration: ROCE truncated for illustrative

purposes. 9. Slide 13: Antamina and Cerrejón: equity accounted investments; average capital employed represents BHP’s equity interest. 10. Slide 13: Positive ROCE results for Potash project due to favourable exchange rate impacts on tax

expense. 11. Slide 19: No less than 1% pre-tax profit (3 year rolling average). 12. Slide 27: Refer to 11 November 2019 Petroleum Briefing available at: https://www.bhp.com/-/media/documents/media/reports-and-presentations/2019/191111_petroleumbriefing.pdf?la=en Financial results 16 February 2021 40

BHP

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BHP Group Limited and BHP Group Plc

|

|

|

|

|

|

|

Date: February 16, 2021

|

|

|

|

By:

|

|

/s/ Geof Stapledon

|

|

|

|

|

|

Name:

|

|

Geof Stapledon

|

|

|

|

|

|

Title:

|

|

Acting Group Company Secretary

|

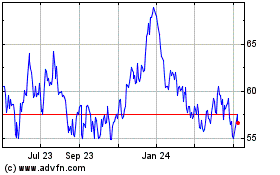

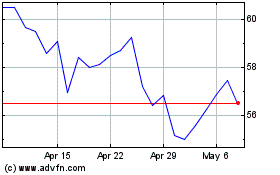

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024