Dated June 28, 2022

Filed Pursuant to Rule 433

Registration No. 333-237301

Supplementing the Preliminary Prospectus Supplement

dated

June 28, 2022 (to Prospectus dated March 20,

2020)

BERKSHIRE HILLS BANCORP INVESTOR PRESENTATION JUNE 2022

LEGAL DISCLOSURE FORWARD - LOOKING STATEMENTS This presentation contains “forward - looking statements” within the meaning of section 27A of the Securities Act of 1933, as amen ded, and section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our outlook for earnings, net interest margin, fe es, expenses, tax rates, capital and liquidity levels and other matters regarding or affecting Berkshire Hills Bancorp, Inc. (“Berkshire”) and its future busi nes s and operations. You can identify these statements from the use of the words “may,” “will,” “should,” “could,” “would,” “outlook,” “potential,” “estimate,” “pr oje ct,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. There are many factors that could cause actual results to differ significantly fr om expectations described in the forward - looking statements. For a discussion of such factors, please see Berkshire’s most recent reports on Forms 10 - K and 10 - Q filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov. You should not place undue reliance on for war d - looking statements, which reflect our expectations only as of the date of this presentation. Except as otherwise required by law, Berkshire does not undertake any obligation to update forward - looking statements. All forward - looking statements, express or implied, herein are qualified in their entirety by this cautionary statement. NON - GAAP FINANCIAL MEASURES This presentation contains both financial measures based on accounting principles generally accepted in the United States (“G AAP ”) and non - GAAP based financial measures, which are used where management believes them to be helpful in understanding Berkshire’s results of opera tio ns or financial position. Reconciliations of these non - GAAP financial measures to the most comparable GAAP measures are included in this presentation. The se disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable t o n on - GAAP performance measures that may be presented by other companies. Numbers in this presentation may not sum due to rounding. NO OFFER OR SOLICITATION This presentation is neither an offer to sell nor a solicitation of an offer to purchase any securities of Berkshire. There w ill be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the sec urities of any such jurisdiction. Any offer to sell or solicitation of an offer to purchase securities of Berkshire will be made only pursuant to a prospectus supp lem ent and prospectus filed with the SEC. Berkshire has filed a registration statement (including a prospectus) (File No. 333 - 237301) and a preliminary prospectus su pplement with the SEC for the offering to which this presentation relates. Before making an investment decision, you should read the prospectus and prelimi nar y prospectus supplement and the other documents that Berkshire has filed with the SEC for additional information about Berkshire and the offering. You ma y o btain these documents for free by visiting the SEC's website at www.sec.gov. Alternatively, Berkshire or any underwriter or dealer participating in the offe rin g will arrange to send you copies of the prospectus and preliminary prospectus supplement relating to the offering if you request by calling PNC Capital Market s L LC at 1 - 855 - 881 - 0697 or Keefe, Bruyette & Woods, A Stifel Company at 1 - 800 - 966 - 1559. The securities to which this presentation relates are not insured or guaranteed by the FDIC or any other governmental agency or public or private insurer. Neither the SEC nor any other regulator has approved or disproved of the securities of Berkshire or passed on the adequacy or ac curacy of this presentation. Any representation to the contrary is a criminal offense. THIRD PARTY SOURCES Certain information contained in this presentation and oral statements made during this presentation relate to or are based o n p ublications and data obtained from third party sources. While Berkshire believes these sources to be reliable as of the date of this presentation, Berkshir e h as not independently verified such information, and makes no representation as to its accuracy, adequacy, fairness or completeness. 2

ESG STRUCTURING AGENT PNC FIG Advisory, part of PNC Capital Markets LLC The Company intends to use an amount equal to the net proceeds from this offering to finance or refinance new or existing assets consistent with the Company’s Sustainable Financing Framework, as may be modified from time to time. Pending allocation to such assets, the net proceeds may be used for general corporate purposes, including supporting strategic and organic growth and the repayment of other outstanding indebtedness that has no association with carbon - intensive activities. USE OF PROCEEDS Keefe, Bruyette & Woods, A Stifel Company PNC FIG Advisory, part of PNC Capital Markets LLC JOINT BOOKRUNNERS Consistent with regulatory requirements for Tier 2 capital COVENANTS 10 year maturity, non call for 5 years MATURITY / CALL TYPE SEC Registered FORMAT Baa3 with a “Positive” Outlook by Moody’s (as of June 21, 2022) BBB - with a “Stable” Outlook by Kroll (as of May 10, 2022) RATING 1 $75.0 million SIZE Berkshire Hills Bancorp, Inc. (NYSE: BHLB) ISSUER 1 A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any tim e b y the assigning rating organization. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating. 2 Any such designation is provided for informational purposes only and (1) does not constitute an endorsement of any securities, product or project; (2) does not constitute investment or financial advice; and (3) does not represent any type of credit or securities rating or an assessment of the issuer's economic performance, financial obligations nor of its creditworthiness. OFFERING SUMMARY Fixed - to - Floating Rate Subordinated Notes Due 2032 SECURITY Sustainability Bond with Second Party Opinion provided by Sustainalytics ESG DESIGNATION 2 3

BERKSHIRE HILLS BANCORP FRANCHISE OVERVIEW 4

COMPANY OVERVIEW • Berkshire Hills Bancorp, Inc. (NYSE: BHLB, or “Berkshire”) operates as the bank holding company for Berkshire Bank (the “Bank”), which was founded in 1846 • Berkshire’s vision is to be a high - performing, leading socially responsible community bank in New England, Upstate New York, and beyond • It sets itself apart through a focus on an exceptional customer experience that’s driven by its DigiTouchSM strategy, which utilizes FinTech partnerships to accelerate digitization of customer journeys on par with national banks, while retaining the personal touch of a community bank • With 105 full - service branches across CT, MA, NY, RI, and VT, Berkshire is well positioned in key high - growth markets 1Q 2022 FINANCIAL HIGHLIGHTS 3 Balance Sheet ($ in Millions) Total Assets $12,097 Total Loans HFI 7,267 Total Deposits 10,699 Loans HFI / Deposits (%) 67.9% Tangible Common Equity 1 1,066 Performance Ratios (%) Return on Average Assets (ROAA) 0.70 Pre - tax, Pre - provision Net Rev. ROAA (PPNR ROAA) 1 0.74 Return on Average Tangible Common Equity (ROATCE) 1 7.29 Total Non - Interest Income / Total Net Revenue 20.3 Net Interest Margin 2.61 Yield on Total Loans 3.61 Cost of Total Deposits 0.17 Efficiency Ratio 72.6 Asset Quality (%) ACL / Total Loans 1.37 NPAs/ Assets 0.26 NPLs/ Loans 0.41 NCOs/ Average Loans 0.15 Capital Ratios (%) TCE / TA 1 8.8 Tier 1 Leverage Ratio 10.3 CET1 Ratio 13.9 Tier 1 Capital Ratio 14.2 Total Capital Ratio 16.0 Market Data as of 6/21/2022 Market Capitalization ($ in Millions) $ 1,157.8 Price / Book Value 1 (x) 1.09x Price / Tangible Book Value 1 (x) 1.12x Price/ 2022 Estimated EPS 2 (x) 13.3x Price/ 2023 Estimated EPS 2 (x) 12.1x Dividend Yield (%) 1.93% COMPANY SNAPSHOT 1 Denotes a non - GAAP financial measure; see “Non - GAAP Reconciliation” slide in the appendix. 2 Based on S&P Global Market Intelligence median analyst estimates. 3 Financial metrics as of or for the 3 months ended March 31, 2022. 5

BEST Program Designed to Make Berkshire Bank a High - Performing, Leading Socially Responsible Community Bank in New England, Eastern New York & Beyond Top Quartile ESG Ranked Nationally Among All Banks Steady Progress on “BEST” Strategic Program Initiatives (Optimize, Digitize, Enhance) Towards High Performance Organic Growth Focus with Loan Growth “Inflection Point” Reached in 1Q22 Strong Capital Position (Consolidated CET1 Ratio approx. 13.9%) Diversified Loan Portfolio Mitigates Overall Credit Risk Exposure Conservative Credit Culture with 1.37% ACL / Loans vs. 0.41% NPL / Loans Strong Blend of New and Seasoned Berkshire Executives and Board Directors. Berkshire’s Exciting Strategic Transformation (“BEST”) Program Launched in May 2021 INVESTMENT HIGHLIGHTS Note: Financial metrics as of 3/31/22. 6

Nitin Mhatre oversees the vision and strategic direction of the Company as President and Chief Executive Officer . Prior to joining Berkshire in January 2021 , spent 25 years in banking at Webster Bank as Head of Community Banking and at Citigroup as Managing Director . George Bacigalupo is responsible for commercial banking, including commercial real estate, middle market, business banking, and asset based lending teams . Prior to joining Berkshire in 2011 , spent more than 30 years in banking at TD Bank and TD Banknorth . Subhadeep Basu oversees the accounting, treasury, tax, and investor relations functions . Prior to joining Berkshire in March 2021 , spent 24 years in banking at State Street as SVP Global Institutional Services and at Citigroup, Bank of America, and Ally Financial . Lucia Bellomia is responsible for retail banking, including the branch network, MyBanker program, call center, branch operations, sales and service delivery . Prior to joining Berkshire in September 2021 , spent 23 years in banking at Bank of America as SVP Community Banking and at PNC, Santander, and other institutions . Jennifer Carmichael is responsible for the internal audit function with oversight by the Audit Committee of the Board of Directors . Prior to joining Berkshire in 2016 , spent 18 years in banking at Accume Partners as Senior Audit Manager with Berkshire Bank as a client and at Ballston Spa National Bank . Jacqueline Courtwright leads all aspects of human resource strategy and oversees cultural development for Berkshire’s workforce . Prior to joining Berkshire in 2012 , spent 20 years in banking at Citizens Bank as HR Business Partner and District HR Manager at Key Bank . LEADERSHIP TEAM Strong blend of new and seasoned Berkshire executives and board directors. Berkshire’s Exciting Strategic Transformation (“BEST”) program launched in May 2021 Sean Gray is the Chief Operating Officer, responsible for operations, technology, strategy, 44 Business Capital (SBA lending), wealth management, and private banking . Prior to joining Berkshire in 2006 , spent 8 years in banking at Bank of America as Consumer Market Manager . Gregory Lindenmuth is responsible for enterprise risk management and credit administration as well as loan review, information security, and credit risk analytics . Prior to joining Berkshire in 2016 , spent 24 years in banking at the FDIC as Senior Risk Examiner . Gordon Prescott is the EVP General Counsel & Corporate Secretary . Prior to joining Berkshire in 2008 , spent 20 years in the legal profession in private practice and as in - house corporate counsel for various organizations . Ellen Steinfeld responsible for consumer lending and payments, including mortgage banking, home equity, and consumer installment lending . Prior to joining Berkshire in September 2021 , spent more than 30 years in banking at Innovative Lending Strategic Solutions as President and at TIAA - CREF . Deborah Stephenson is responsible for the compliance, Bank Secrecy Act, and Anti Money Laundering functions . Prior to joining Berkshire in 2014 , spent 19 years in banking at Country Bank as Division Leader for Retail Banking and at Woronoco Savings Bank . Jason White is responsible for information technology and digital transformation . Prior to joining Berkshire in 2019 , spent 25 years in banking at Savings Institute Bank & Trust as CIO prior to the acquisition . 7

• $5.7B Retail Deposits • 25 MyBankers with $415M Deposits – concierge banking to committed relationships • 105 branches – Year - end target of 100 branches, down from 130 at beginning of 2021 • Narmi fintech relationship – mobile account opening; mobile and web “single pane of glass” interface (2023) • $5.2B Loans • $4.8B Commercial Deposits • Four key loan portfolio verticals: CRE ($2.6B), Middle Market ($1.2B), ABL ($0.6B), and Business Banking ($0.4B) • Includes 44 Business Capital – top 20 national SBA 7A originator, $233M loans in portfolio, $784M total servicing portfolio • $2.1B Loans • Mortgage Lending: retail and correspondent channels ($1.6B) • Consumer HELOC, auto, and unsecured loans ($0.5B) • Card payments & products offered via correspondent banking relationship • $1.7B AUM • $400M Private Banking Deposits (included in Retail Deposits) • 2 Channels: Investment Management & Private Banking • Growing wealth team with expanding Socially Responsible Investing (SRI) offerings and oversight of investment/brokerage team Commercial Banking Consumer Lending & Payments Retail Banking Wealth Management CORE BUSINESSES FOCUSED ON BERKSHIRE’S FOOTPRINT Disciplined and coordinated business strategy serving our customers in the community across their professional and personal life stages 8 Note: Financial metrics as of 3/31/22 unless otherwise indicated. Amounts are end - of - period figures.

KEY FEE BUSINESS REVENUE Berkshire is recruiting talent and expanding key fee revenue businesses to support modest fee income growth in 2022 and to offset possible overdraft fee reduction • Consistently ranked as a top 20 national SBA 7a originator • Headquartered in Pennsylvania with primary markets being New England and Mid - Atlantic • Lenders in Denver, Chicago, Atlanta, and Miami • Record 2021 originations sold – $199M; $21M gain on sale revenue • Comprised of strong, seasoned team that delivers top - caliber advising, financial planning, brokerage, and trust services • Launched specialized offerings such as Socially Responsible Investing (SRI) and leading fixed income/short - term opportunities • Recruited business leader with national experience to build organic mortgage banking operation • Recruiting originators and building correspondent portal • Enhancing technology to support originations growth 9

“BEST” THREE - YEAR STRATEGIC PLAN We are ahead of plan at the one - year anniversary mark of our three - year “BEST” strategic plan that was announced in May 2021 • Optimize Physical Footprint • Optimize Processes & Procurement • Optimize Products / Pricing & Balance Mix for Improved Return on Equity • Digitize Account Opening & Customer Journeys • Digitize Marketing & Customer Insights / Service • Enable Seamless Tech Connections with FinTech / Sales Partners • Grow Profitable Originations & Balances • Enhance Banker & Customer Engagement • Enhance Capital Allocation & Deployment for Improved Return on Equity 10

*Improvement over FY2020 baseline, driven by “BEST” program over 3 years starting Q3’21; ** ESG Index ratings: MSCI, ISS - ESG, Sustainalytics, Bloomberg; 1 Numbers are on an adjusted basis. See appendix for discussion and reconciliation of non - GAAP financial measures. 2 Each quarter adjusted PPNR annualized ($ million); 3 J.D. Power as of 9/30/21. 100 - 105 bps 10 - 12% Top 25% Top 25% $180 - 200M ROA Increase ROA by 75 - 80bps* PPNR 2 Increase PPNR by $80 - 100M* ROTCE Increase ROTCE by 700 - 900bps* ESG Become top quartile bank by leading ESG indexes in US ** NPS 3 Become top quartile Net Promoter Score bank in New England BEST 3 YEAR TARGET for 2024 7.5 1Q22 1 72 88 22 ~50 % bps $M Percentile Percentile FY2020 109 24 3.2 39 N.A 7.3 4Q21 71 85 24 ~50 1Q 2022 – “BEST” PROGRESS VS. GOAL 11

BERKSHIRE HILLS BANCORP – A LEADER IN SOCIAL RESPONSIBILITY 1 As of 3/31/2022, U.S. Small Business Administration. 2 Originated and referred loans 3 Balances as of 12/31/2021 4 Offered through Berkshire Bank Wealth Management. 5 Mighty Deposits: $64 of every $100 is reinvested back in local communities. Mighty Deposit is a third - party comparison tool that helps the public better understand where their money goes after depositing at a bank or credit union. Fueling Small Business Community Financing & Philanthropy Financial Access & Empowerment Environmental Sustainability • Top 15 SBA 7(a) Lender in the Nation 1 • ~$1B in PPP Loans to 7,000+ small businesses 2 • $342M Small Business loan balances 3 • $25M Foundation Giving over the last 10 years • 397k+ hours of employee volunteer service since 2009 • 1k+ company - sponsored volunteer events in the last 5 years • 246k+ people benefited from financial literacy programs • Socially Responsible Investing Portfolios 4 • Nearly 70% higher reinvestment in our neighborhoods than industry banking 5 • $300M goal for lending in low - carbon projects • Transitioning electricity supply towards 100% renewable • Strong policies govern lending activities to protect the environment 12

Social Green Sustainability Green Uses Renewable Electricity Generation Green Buildings Renewable Energy Technology Energy Efficiency Social Uses 1 Affordable Housing Workforce Housing Financial Inclusion & Access BERKSHIRE’S SUSTAINABLE FINANCING FRAMEWORK 1 Capex must be used towards a targeted population. Source: berkshirebank.com/sustainable - finance Berkshire’s Sustainable Financing Framework has identified the following areas of investments that would support its “BEST” Community Comeback 13 • Berkshire is committed to purpose - driven, community - dedicated banking that enhances value for all stakeholders • As part of that commitment, Berkshire launched its “BEST” Community Comeback, a multibillion - dollar strategic initiative to reinvest in its communities and power their financial potential by fueling small businesses, providing community financing and philanthropy, offering financial access and empowerment and advancing environmental sustainability

BERKSHIRE HILLS BANCORP FINANCIAL HIGHLIGHTS 14

Financial Performance Solid improvement in EPS and ROTCE QoQ and YoY 1 • Adj EPS $0.43 (+4% and +37% QoQ and YoY respectively) • Adj Non - Interest Expenses of $68.5m (flat QoQ and - 8% YoY respectively) • Adj ROTCE 7.49% (+15bps and +145bps QoQ and YoY respectively) • PPNR of $22.0M (+3% QoQ and - 18% YoY respectively) Balance Sheet Strength Loan Growth “Inflection Point” reached; Capital redeployment to shareholders continues • Reached a Total Loan Growth inflection point after seven quarters (see pg. 18) o Average and End of Period Loans +3.1% and +6.5% QoQ respectively o Driven by strong loan originations (+58% QoQ and +245% YoY) • Repurchased ~1 million shares (~$29.3 million in value) and paid a dividend of ~$6.2 million • Maintained Capital strength with 13.9% CET1 ratio “BEST” Strategy Progress Steady progress on “BEST” program initiatives towards high performance • Tech stack modernization continues; Narmi partnership expanded for ‘DigiTouch’ customer experience • Optimization initiatives including corporate footprint rationalization continue to self - fund “BEST” program • Ranked 9th most “Trustworthy Bank” on Newsweek’s 2022 list of “America’s Most Trustworthy Companies” • Board enhancement – Dr. Mihir A. Desai joined the Board • Building originations growth engine – frontline banker hires driving up loan originations 1 Numbers and comparisons are on an adjusted basis. See appendix for discussion and reconciliation of non - GAAP financial measures. Percent changes may not add / equate precisely due to rounding. 1Q22 – HIGHLIGHTS OF THE QUARTER 15

5,495 5,230 4,947 4,847 5,024 2,374 2,186 2,044 1,919 1,950 1Q21 2Q21 7,869 3Q21 1Q22 4Q21 7,416 6,991 6,766 6,974 +3% Consumer & Residential Commercial 170 220 193 424 511 64 90 38 84 294 1Q21 2Q21 3Q21 4Q21 1Q22 311 234 232 508 805 +245% +58% 1 Balances exclude Mid - Atlantic loans which were sold in 3Q21. Figures in millions ($M). INCREASED ORIGINATIONS DRIVE LOAN GROWTH INFLECTION POINT AVERAGE LOAN BALANCES 1 LOAN ORIGINATIONS – FUNDED 16

NON - ACCRUING LOANS / LOANS (%) NET CHARGE - OFFS / AVERAGE LOANS 2 (%) ALLOWANCE FOR CREDIT LOSSES ($M) ACL / LOANS 1 (%) HISTORICAL ASSET QUALITY $52 $61 $64 $89 $127 $106 $99 2017Y 2018Y 2019Y CECL Adoption @ 1/1/20 2020Y 2021Y 1Q22 0.62% 0.68% 0.67% 0.94% 1.71% 1.56% 1.37% 2017Y 2018Y 2019Y CECL Adoption @ 1/1/20 2020Y 2021Y 1Q22 0.28% 0.36% 0.42% 0.80% 0.52% 0.41% 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 0.19% 0.18% 0.35% 0.41% 0.29% 0.15% 2017Y 2018Y 2019Y 2020Y 2021Y 1Q22 17 1 Excluding PPP Loans. 2 Figure is YTD annualized.

9.5% 9.5% 9.9% 10.5% 10.3% 14.2% 14.3% 15.3% 15.0% 13.9% 14.4% 14.6% 15.6% 15.3% 14.2% 16.6% 16.7% 17.7% 17.3% 16.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 1Q21 2Q21 3Q21 4Q21 1Q22 Leverage Ratio CET1 Ratio Tier 1 Ratio Total Capital Ratio Pro - Forma with $100M Raise HISTORICAL AND PRO - FORMA CAPITALIZATION 1 Assumes 20% risk - weighting on new assets. 17.2% 18

BERKSHIRE HILLS BANCORP LOAN AND DEPOSIT COMPOSITION 19

DIVERSIFIED LOAN PORTFOLIO Total: $7.3B Category Balance ($M) % of Total C&I 1,318.4 18.1% Real Estate: CRE - Owner Occupied 609.5 8.4% CRE - Non - Owner Occupied 2,026.8 27.9% Multifamily 604.5 8.3% Land & Construction 310.8 4.3% Home Equity 244.6 3.4% Residential Mortgage 1,697.8 23.4% Consumer & Other 454.9 6.3% Total Loans 7,267.3 100.0% State Balance ($M) % of Total Massachusetts 3,260.2 44.9% New York 1,606.5 22.1% Connecticut 706.5 9.7% Rhode Island 297.6 4.1% Other New England 422.1 5.8% Pennsylvania / New Jersey 405.5 5.6% Other 568.9 7.8% Total Loans 7,267.3 100.0% Note: Financial metrics as of 3/31/22. Balances may not sum to exactly 100% due to rounding. 20 C&I 18.1% CRE - Owner Occupied 8.4% CRE - Non - Owner Occupied 27.9% Multifamily 8.3% Land & Construction 4.3% Home Equity 3.4% Residential Mortgage 23.4% Consumer & Other 6.3% MA 44.9% NY 22.1% CT 9.7% RI 4.1% Other New England 5.8% PA / NJ 5.6% Other 7.8% BREAKDOWN BY CATEGORY BREAKDOWN BY GEOGRAPHY

DDA/NOW 44% Money Market 29% Time 14% Savings 11% Brokered 2% Note: Financial metrics as of 3/31/22 unless otherwise indicated. 1 Deposit mix by geography as of June 2021 FDIC data. DEPOSIT FRANCHISE MIX BY CUSTOMER TYPE MIX BY ACCOUNT TYPE MIX BY GEOGRAPHY 1 COST OF DEPOSITS Peak 1.19% Current 0.17% 0.00% 0.40% 0.80% 1.20% 1.60% 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 • Our value proposition is driven by local responsiveness, sophisticated solutions, and advanced technology to meet the customer where they are • Within Berkshire's branch footprint, we are a top regional bank in deposit share. Through execution of the BEST Plan, we seek to continue consolidating market share • Competitor consolidations present further opportunity to win market share 21 Total Avg. Deposits: $10.0B Personal 56% Commercial 39% Municipal 3% ICS 1% Other 2% MA 60% NY 18% CT 14% VT 4% RI 3%

BERKSHIRE HILLS BANCORP 1Q 2022 HIGHLIGHTS 22

• On an adjusted basis: o Expenses flat QoQ and - 8% YoY as a result of continued focus on expense management o Provision benefit of $4M driven by improved credit performance and continued economic recovery o EPS +4% QoQ and +37% YoY o PPNR +3% QoQ and - 18% YoY 1 Numbers and comparisons are on an adjusted basis. See appendix for discussion and reconciliation of non - GAAP financial measures. Percent changes may not add / equate precisely due to rounding. Figures in millions ($M) unless otherwise indicated. 1Q 2022 FINANCIAL HIGHLIGHTS – INCOME STATEMENT GAAP Basis ($M) 1Q21 4Q21 1Q22 QoQ (%) YoY (%) Net Interest Income, Non - FTE 75.1 69.3 69.1 0% - 8% Non - Interest Income 26.2 21.4 20.7 - 3% - 21% Revenue 101.3 90.7 89.7 - 1% - 11% Non - Interest Expense 78.2 69.4 68.6 - 1% - 12% After - Tax Income (Loss) 13.0 20.2 20.2 0% 55% EPS 0.26 0.42 0.42 0% 62% ROTCE 4.98% 7.37% 7.29% NIM 2.62% 2.60% 2.61% Adjusted Basis ($M) 1 1Q21 4Q21 1Q22 QoQ (%) YoY (%) Net Interest Income 75.1 69.3 69.1 0% - 8% Non - Interest Income 26.2 20.5 21.4 5% - 18% Revenue 101.3 89.8 90.5 1% - 11% Provision for Credit Losses 6.5 - 3.0 - 4.0 - 33% - 162% Non - Interest Expense 74.7 68.5 68.5 0% - 8% After - Tax Income (Loss) 16.0 20.2 20.8 3% 30% EPS 0.32 0.42 0.43 4% 37% ROTCE 6.04% 7.34% 7.49% ROA 0.51% 0.71% 0.72% PPNR 26.6 21.2 22.0 3% - 18% 23

74.7 68.5 68.5 - 8% 0% Adj Expenses 1Q 2022 FINANCIAL HIGHLIGHTS – EXPENSES • Continued expense discipline resulting in flat expenses QoQ and - 8% YoY o Expenses have remained flat/in range of ~$68M per quarter since 2Q21 o Continuing to manage headwinds from wage inflation • Self - funding investments to drive growth and transformation • Compensation & Benefits – 1% QoQ and - 3% YoY ($M) 1Q21 4Q21 1Q22 QoQ (%) YoY (%) Compensation & Benefits 38.7 37.8 37.5 - 1% - 3% Occupancy & Equipment 11.0 9.7 10.1 3% - 9% Technology & Comm. 8.6 8.6 8.5 - 1% - 1% Professional Services 6.6 2.4 2.7 14% - 59% Other Expenses 9.7 10.0 9.7 - 3% 0% Expenses (Adjusted) 1 74.7 68.5 68.5 0% - 8% Merger, Restr ., & Other Non - Op 3.5 0.9 0.0 - 98% - 99% Expenses (GAAP) 78.2 69.4 68.6 - 1% - 12% 24 1 1Q21 includes the insurance business expenses. See appendix for discussion and reconciliation of non - GAAP financial measures. Pe rcent changes may not add / equate precisely due to rounding. Figures in millions ($M) unless otherwise indicated. ($M) 1Q21 4Q21 1Q22

26.2 20.5 21.4 - 18% 5% 1 Adjusted income excludes securities and other gains (losses). 1Q21 includes three quarters of the insurance business revenues . Numbers and comparisons are on an adjusted basis. See appendix for discussion and reconciliation of non - GAAP financial measures. Percent cha nges may not add / equate precisely due to rounding. Figures in millions ($M) unless otherwise indicated. 1Q 2022 FINANCIAL HIGHLIGHTS – FEE REVENUE • Adjusted non - interest income +5% QoQ and - 18% YoY o QoQ growth driven primarily by higher Wealth Management, swap fees and lower tax credit impairments offset by lower SBA lending revenues o YoY decrease largely driven by sale of the insurance business in 3Q21 o Lower SBA lending revenue was driven by reduction of SBA guarantees from 90% to 75% and seasonality 1Q21 4Q21 1Q22 ($M) 1Q21 4Q21 1Q22 QoQ (%) YoY (%) Deposit Related Fees 7.1 7.5 7.4 - 2% 3% Loan Fees & Revenue 10.2 9.1 8.3 - 9% - 19% Insurance Commis . & Fees 3.1 0.0 0.0 --- - 100% Wealth Management Fees 2.8 2.6 2.6 2% - 5% Mortgage Banking Fees 0.8 0.3 0.0 - 93% - 98% Other 2.1 1.0 3.2 219% 47% Adjusted Non - Interest Income 26.2 20.5 21.4 5% - 18% Securities & Other Gain (Loss) 0.0 1.0 - 0.7 --- --- Total Non - Interest Income 1 26.2 21.4 20.7 - 3% - 21% Adj. Non - Int Rev. 25 ($M)

119 1Q21 113 1.72% 1.69% 2Q21 1.66% 4Q21 1.56% 3Q21 1.37% 1Q22 124 106 99 10 5 2 4 3 0.15% 0.26% 0.51% 0.21% 1Q21 2Q21 0.12% 3Q21 4Q21 1Q22 - 74% - 32 % Allowance for Credit Losses (ACL) ACL / Total Loans Ex PPP Net Charge Offs QTD Annualized NCO/Average Loans 35 19 22 43 20 0.92% 48 2Q21 35 56 37 1.18% 1Q21 0.87% 3Q21 59 1.15% 4Q21 66 30 0.69% 91 1Q22 78 50 Accruing Delinquent NPL Total Delinquent & NPL/Total Loans NET CHARGE OFFS ALLOWANCE FOR CREDIT LOSSES DELINQUENCY TRENDS 6.5 0 (4.0) (3.0) (4.0) (1) 1 Represents provision expense / benefit each quarter ($M). • Credit quality continues to significantly improve over the last several quarters • Provision benefit of $4M driven by improved credit performance and continued economic recovery • ACL / Total Loans Ex. PPP down 19 bps QoQ and 35 bps YoY to 1.37% in 1Q22 1Q 2022 FINANCIAL HIGHLIGHTS – ASSET QUALITY 26 ($M) ($M) ($M)

413 294 165 649 489 444 360 306 383 609 783 1,062 1Q22 1Q21 3Q21 331 24 2Q21 4Q21 - 69% - 14% FHLB Borrowings & Other Brokered Deposits DEPOSITS (AVG BAL) 1 WHOLESALE FUNDING (AVG BAL) 2 2,537 2,787 2,901 3,038 2,968 1,705 1,610 1,528 1,469 1,401 5,042 5,109 5,065 5,083 5,361 1Q22 1Q21 9,494 4Q21 2Q21 9,730 9,284 9,506 3Q21 9,590 +5% + 1% Non - interest bearing NOW, Money Market, Savings (N, M & S) Customer CDs 1Q 2022 FINANCIAL HIGHLIGHTS – FUNDING TRENDS 23 1 Deposit amounts exclude Mid - Atlantic branch interest bearing deposits. Brokered deposits include $79M in reciprocal NOW and money market brokered deposits. 2 Wholesale excludes $97M of subordinated borrowings. • Low cost NOW, Money Market and Savings deposits +6% YoY • Customer CD yields continue repricing lower; 1Q22 Cost of CDs at 62bps, down 33bps YoY • Non - interest bearing deposits +17% YoY to $3B • High cost wholesale funding - 14% QoQ and - 69% YoY • Prepaid FHLB Borrowing in 3Q21; EOP 4Q21 FHLB borrowing at $13.3m 1Q21 2Q21 3Q21 4Q21 1Q22 N, M & S Cost 0.20% 0.12% 0.10% 0.10% 0.10% Customer CD Cost 0.95% 0.81% 0.73% 0.68% 0.62% 1Q21 2Q21 3Q21 4Q21 1Q22 Brokered Cost 1.44% 1.26% 1.20% 1.12% 0.93% FHLB Borr . & Other 1.95% 2.05% 2.41% 3.21% 2.95% 27 ($M) ($M)

BERKSHIRE HILLS BANCORP APPENDIX 28

DEBT RATINGS 1 AND SUSTAINABILITY DESIGNATION Type Moody’s Kroll Berkshire Hills Bancorp Inc. (Holdco) Senior Unsecured Debt BBB Baseline Credit Assessment Baa2 Subordinated Debt Baa3 BBB - Short - Term Debt K3 Outlook Positive Stable Berkshire Bank (Bank) Deposit A3 BBB+ Senior Unsecured Debt BBB+ Baseline Credit Assessment Baa2 Subordinated Debt BBB Short - Term Deposit P - 2 K2 Short - Term Debt P - 2 K2 Outlook Positive Stable Sustainability Bond with Second Party Opinion provided by Sustainalytics ESG Designation 2 29 1 A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any tim e b y the assigning rating organization. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating. 2 Any such designation is provided for informational purposes only and (1) does not constitute an endorsement of any securities, product or project; (2) does not constitute investment or financial advice; and (3) does not represent any type of credit or securities rating or an assessment of the issuer's economic performance, financial obligations nor of its creditworthiness.

Offering Assumptions Debt Refinancing

Assumptions Gross Proceeds ($000): $75,000 Total Sub - Debt Called $75,000 Coupon: 5.500% Sub - Debt Coupon 6.875% Double Leverage 1Q'22

Equity Investment in Subsidiaries $1,067,783 Consolidated Equity $1,093,861 Current Double Leverage Ratio 97.6% Pro - Forma Equity Investment

in Subsidiaries 1 $1,067,783 Pro - Forma Consolidated Equity $1,093,861 Pro - Forma Double Leverage Ratio 97.6% Interest Coverage 1Q'22

Total Deposit Interest $4,174 Borrowings & Other Interest $1,586 Total Interest Expense $5,760 Pre - Tax Income $25,194 Preferred

Dividend $0 Interest Coverage (including deposit expense) 5.4x Interest Coverage (excluding deposit expense) 16.9x New Holding Company

Subordinated Debt Expense (5.50%) $1,031 Assumed Repayment of Holding Company Subordinated Debt (6.875%) $1,289 Pro - Forma Interest

Coverage (including deposit expense) 5.6x Pro - Forma Interest Coverage (excluding deposit expense) 20.2x DOUBLE LEVERAGE AND INTEREST

COVERAGE 1 Berkshire intends to keep net proceeds of this offering at the holding company level. 30

March 31, June 30, Sept. 30, Dec. 31, March 31, (in thousands) 2021 2021 2021 2021 2022 Total revenue (A) 101,286$ 97,404$ 145,003$ 90,721$ 89,744$ Adj: Net securities losses (1) 31 484 166 106 745 Adj: Net (gains) on sale of business operations and assets - - (51,885) (1,057) - Total adjusted revenue (2) (B) 101,317$ 97,888$ 93,284$ 89,770$ 90,489$ Total non-interest expense (C) 78,154$ 68,872$ 69,460$ 69,407$ 68,550$ Less: Merger, restructuring and other expense (3,486) (6) (1,425) (864) (18) Adjusted non-interest expense (2) (D) 74,668$ 68,866$ 68,035$ 68,543$ 68,532$ Pre-tax, pre-provision net revenue (PPNR) (A-C) 23,132$ 28,532$ 75,543$ 21,314$ 21,194$ Adjusted pre-tax, pre-provision net revenue (PPNR) (B-D) 26,649 29,022 25,249 21,227 21,957 Net income 13,031$ 21,636$ 63,749$ 20,248$ 20,196$ Adj: Net securities losses (1) 31 484 166 106 745 Adj: Net (gains) on sale of business operations and assets - - (51,885) (1,057) - Adj: Restructuring expense and other expense 3,486 6 1,425 864 18 Adj: Income taxes (expense)/benefit (533) (22) 12,240 11 (170) Total adjusted income (2) (E) 16,015$ 22,104$ 25,695$ 20,172$ 20,789$ (in millions, except per share data) Total average assets (F) 12,468$ 12,417$ 11,925$ 11,427$ 11,493$ Total average shareholders' equity (G) 1,159 1,174 1,149 1,181 1,189 Total average tangible shareholders' equity (2)(3) (H) 1,125 1,141 1,118 1,151 1,160 Total average tangible common shareholders' equity (2)(3) (I) 1,125 1,141 1,118 1,151 1,160 Total tangible shareholders' equity, period-end (2)(3) (J) 1,142 1,143 1,147 1,153 1,066 Total tangible common shareholders' equity, period-end (2)(3) (K) 1,142 1,143 1,147 1,153 1,066 Total tangible assets, period-end (2)(3) (L) 12,724 12,241 11,815 11,525 12,069 Total common shares outstanding, period-end (thousands) (M) 50,988 50,453 48,657 48,667 47,792 Average diluted shares outstanding (thousands) (N) 50,565 50,608 48,744 48,340 48,067 GAAP earnings per common share, diluted (2) 0.26$ 0.43$ 1.31$ 0.42$ 0.42$ Adjusted earnings per common share, diluted (2) (E/N) 0.32 0.44 0.53 0.42 0.43 Tangible book value per common share, period-end (2) (K/M) 22.39 22.66 23.58 23.69 22.30 Total tangible shareholders' equity/total tangible assets (2) (J/L) 8.98 9.34 9.71 10.00 8.83 Performance ratios (4) GAAP return on equity 4.50 % 7.37 % 22.18 % 6.86 % 6.79 % Adjusted return on equity (2) (E/G) 5.53 7.53 8.94 6.83 6.99 Return on tangible common equity (2)(5) 4.98 7.92 23.14 7.37 7.29 Adjusted return on tangible common equity (2)(5) (E+Q)/(I) 6.04 8.08 9.53 7.34 7.49 GAAP return on assets 0.42 0.70 2.14 0.71 0.70 Adjusted return on assets (2) 0.51 0.71 0.86 0.71 0.72 PPNR from continuing operations/assets (2) 0.74 0.92 2.53 0.75 0.74 Adjusted PPNR/assets (2) 0.85 0.93 0.85 0.74 0.76 Efficiency ratio (2)(6) (D-Q)/(B+O+R) 71.32 67.82 68.76 71.98 72.61 Net interest margin, FTE 2.62 2.62 2.56 2.60 2.61 Supplementary data (in thousands) Tax benefit on tax-credit investments (7) (O) 41$ 79$ 2,195$ 2,057$ 596$ Non-interest income charge on tax-credit investments (8) (P) (33) (175) (1,789) (1,448) (357) Net income on tax-credit investments (O+P) 9 (96) 406 609 239 Intangible amortization (Q) 1,319$ 1,297$ 1,296$ 1,288$ 1,286$ Fully taxable equivalent income adjustment (R) 1,494 1,660 1,586 1,604 1,524 NON - GAAP RECONCILIATION (BY QUARTER) 31

NON - GAAP RECONCILIATION – NOTES (1) Net securities losses/(gains) include the change in fair value of Berkshire’s equity securities in compliance with Berkshire' s a doption of ASU 2016 - 01. (2) Non - GAAP financial measure. (3) Total tangible shareholders' equity is computed by taking total shareholders' equity less the intangible assets at period - end. T otal tangible assets is computed by taking intangible assets at period - end. (4) Ratios are annualized and based on average balance sheet amounts, where applicable. Quarterly data may not sum to year - to - date d ata due to rounding. (5) Adjusted return on tangible equity is computed by dividing the total adjusted income/(loss) adjusted for the tax - effected amorti zation of intangible assets, assuming a 27% marginal rate, by tangible equity. (6) Efficiency ratio is computed by dividing total adjusted tangible non - interest expense by the sum of total net interest income on a fully taxable equivalent basis and total adjusted non - interest income adjusted to include tax credit benefit of tax shelter investment s. Berkshire uses this non - GAAP measure to provide important information regarding its operational efficiency. (7) The tax benefit is the direct reduction to the income tax provision due to tax credits and deductions generated from investme nts in historic rehabilitation and low - income housing. (8) The non - interest income charge is the reduction to the tax - advantaged investments, which are incurred as the tax credits are gen erated. 32

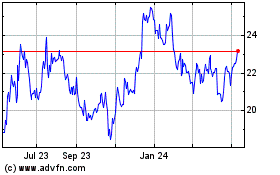

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2024 to Aug 2024

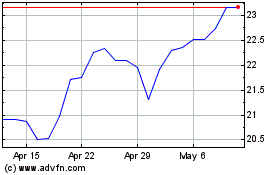

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Aug 2023 to Aug 2024