0000010456false00000104562025-01-312025-01-310000010456exch:XNYSbax:CommonStock1.00PerValueMember2025-01-312025-01-310000010456exch:XCHIbax:CommonStock1.00PerValueMember2025-01-312025-01-310000010456exch:XNYSbax:GlobalNotes13Due2025Member2025-01-312025-01-310000010456exch:XNYSbax:GlobalNotes13Due2029Member2025-01-312025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2025 | | | | | |

| Baxter International Inc. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

| (State or other jurisdiction of incorporation) |

| |

| 1-4448 | 36-0781620 |

| (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

One Baxter Parkway, Deerfield, Illinois | 60015 |

| (Address of principal executive offices) | (Zip Code) |

| |

(224)948-2000 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $1.00 par value | | BAX (NYSE) | | New York Stock Exchange |

| | | | NYSE Chicago |

| 1.3% Global Notes due 2025 | | BAX 25 | | New York Stock Exchange |

| 1.3% Global Notes due 2029 | | BAX 29 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act: ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 31, 2025 (the “Closing Date”), Baxter International Inc. (the “Company”) completed the previously announced sale of all issued and outstanding equity interests of Vantive Health LLC, a Delaware limited liability company (the “KidneyCo”), Vantive Mexico LLC, a Delaware limited liability company (the “US-Mexico Holdco”), Gambro Renal Products, Inc., a Delaware corporation (the “Gambro Subsidiary”), RTS Worldwide Holdings Inc., a Delaware corporation (the “RTS Holdco” and, together with KidneyCo, the US-Mexico Holdco and the Gambro Subsidiary, the “US Corps”), Vantive Holding B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands (the “Dutch Holdco”), Vantive Health GmbH, a Swiss limited liability company (the “Swiss Holdco”), and Vantive Holding Limited, a Jersey corporation (the “Jersey Newco” and, together with the Dutch Holdco and the Swiss Holdco, the “Non-US Entities” and together with the US Corps, the “Divested Entities”) to Spruce Bidco I, Inc., a Delaware corporation (“US Bidco I”), Spruce Bidco II, Inc., a Delaware corporation (“US Bidco I”), Spruce Bidco I Limited, an Irish corporation (“Irish Bidco”), and CP Spruce Holdings, S.C.Sp, a Luxembourg special limited partnership (société en commandite spéciale) having its registered office at 2 avenue Charles de Gaulle, L-1653 Luxembourg and registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés, Luxembourg) under number B288011, represented by its managing general partner (associé commandité gérant) CP VIII Spruce GP S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée) having its registered office at 2 avenue Charles de Gaulle, L-1653 Luxembourg and registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés, Luxembourg) under number B287936 (together with US Bidco I, US Bidco II and Irish Bidco, “Buyer”), in accordance with the terms of the Equity Purchase Agreement, dated as of August 12, 2024, by and among Buyer and the Company (as amended by the First Amendment to the Equity Purchase Agreement dated as of January 31, 2025 (the “Amendment”), the “Purchase Agreement”). At signing of the Purchase Agreement, the Buyer and Seller agreed to an aggregate purchase price of $3.80 billion in cash, subject to certain closing cash, working capital and debt adjustments. After giving effect to the adjustment mechanisms in the Purchase Agreement, the Company received approximately $3.71 billion of net, pre-tax cash proceeds at closing of the transaction, subject to certain post-closing adjustments.

The Amendment provides that, among other things, the closing of the purchase and sale of the Interests (as defined in the Purchase Agreement) (excluding any transactions consummated at any Local Closing (as defined in the Purchase Agreement)) would be effective at 11:59 PM Eastern Time on the Closing Date.

Pursuant to the Purchase Agreement, (i) effective as of the Closing Date, each outstanding and unvested equity award or cash-based retention award granted to a Vantive Transferred Business Employee (as defined in the Purchase Agreement), other than (x) stock option awards that are underwater as of such date and (y) any portion of such outstanding and unvested equity awards that remained outstanding at the Closing Date and eligible for payout on the terms provided in the applicable award agreement for retirement eligible participants (each, an “LTIP Award”), vested on a pro rata basis, with such pro rata portion computed based on the number of calendar days elapsed from the start of the vesting period applicable to such LTIP Award through the Closing Date, relative to the total number of calendar days in such vesting period, (ii) any such accelerated portion was or will be settled within the time period set forth in the applicable award agreement (such treatment described in clauses and (i) and (ii), the “LTIP Award Treatment”) and (iii) Buyer became obligated to grant cash-based replacement awards in respect of the forfeited portion of each such LTIP Award (excluding stock option awards) in accordance with the terms and conditions of the Purchase Agreement.

The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Purchase

Agreement, which was filed with the U.S. Securities and Exchange Commission as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed on August 13, 2024, and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In accordance with the terms and conditions of the Purchase Agreement, effective as of the Closing Date, Chris Toth ceased serving as Executive Vice President and Group President, Kidney Care, and as an executive officer of the Company. In connection therewith, Mr. Toth became entitled to receive the LTIP Award Treatment in respect of his outstanding and unvested LTIP Awards as described in Item 2.01 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: January 31, 2025 | | | | | | | | |

| BAXTER INTERNATIONAL INC. |

| | |

| By: | /s/ Joel T. Grade |

| Name: | Joel T. Grade |

| Title: | Executive Vice President, Chief Financial Officer and Interim Chief Accounting Officer |

| | |

AMENDMENT 1 TO THE EQUITY PURCHASE AGREEMENT

This AMENDMENT 1 TO THE EQUITY PURCHASE AGREEMENT (this “Amendment”), is entered into as of January 31, 2025, by and among Spruce Bidco I, Inc., a Delaware corporation (“US Bidco I”), Spruce Bidco II, Inc., a Delaware corporation (“US Bidco II”), Spruce Bidco I Limited, an Irish corporation (“Irish Bidco”), and CP Spruce Holdings, S.C.Sp, a Luxembourg special limited partnership (société en commandite spéciale) having its registered office at 2 avenue Charles de Gaulle, L-1653 Luxembourg and registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés, Luxembourg) under number B288011, represented by its managing general partner (associé commandité gérant) CP VIII Spruce GP S.à r.l., a Luxembourg private limited liability company (société à responsabilité limitée) having its registered office at 2 avenue Charles de Gaulle, L-1653 Luxembourg and registered with the Luxembourg Trade and Companies Register (Registre de Commerce et des Sociétés, Luxembourg) under number B287936 (“Lux Bidco”, together with US Bidco I, US Bidco II and Irish Bidco, “Buyer”), and Baxter International Inc., a Delaware corporation (“Seller”).

W I T N E S S E T H:

WHEREAS, Seller and Buyer are parties to that certain Equity Purchase Agreement, dated as of August 12, 2024, by and between Seller and Buyer (the “Purchase Agreement”);

WHEREAS, pursuant to Section 8.1 (Amendment; Waiver) of the Purchase Agreement, the Purchase Agreement may be amended by an instrument in writing signed by each of the Parties;

WHEREAS, each of the Parties desires to amend the Purchase Agreement as described below by entering into this Amendment;

NOW, THEREFORE, in consideration of the premises and the mutual representations, warranties, covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties intending to be legally bound, agree as follows:

Section 1.1 Defined Terms. Unless context otherwise requires, capitalized terms used but not otherwise defined herein shall have the respective meanings ascribed to them in the Purchase Agreement.

Section 1.2Amendments. Seller and Buyer hereby agree that, pursuant to Section 8.1 (Amendment; Waiver) of the Purchase Agreement, the Purchase Agreement is hereby amended as follows:

(a)Section 1.2(a) of the Purchase Agreement is hereby amended by replacing the second last sentence with the following:

“The Closing will be effective as of 11:59 p.m. Eastern Time on the Closing Date (the “Effective Time”).”

(b)The definition of “Cash” is hereby amended and restated as follows:

““Cash” means, as of any specified time, all cash and cash equivalents, currency on hand, cash balances in deposits with banks or financial institutions, negotiable instruments, checks, money orders, marketable securities, short-term instruments and other cash equivalents (to the extent convertible to cash within ninety (90) days), in each case, of the Business and the Vantive Group Entities determined in accordance with the Accounting Principles; provided, that Cash shall (without duplication) (a) be increased by checks, drafts, wires and other similar instruments in transit that have been received and deposited but have not cleared into the bank accounts of, the Business (to the extent the respective amounts of such checks, drafts, wires and other similar instruments are not included in the calculation of Net Working Capital), (b) be reduced by the aggregate amount of all checks, drafts, wires and other similar instruments issued and outstanding but uncleared as of such time (to the extent the respective amounts of such checks, drafts and other similar instruments are not included in the calculation of Net Working Capital), (c) exclude any cash and cash equivalents which is not freely usable because it is subject to restrictions or limitations on use or distribution by Contract, Law or Order, calculated in accordance with the Accounting Principles, other than Foreign Restricted Cash; provided that, for purposes of this item (c), such cash and cash equivalents shall be excluded solely to the extent of such restriction or limitation, and (d) be reduced for any applicable amounts (i) distributed or otherwise paid to Seller prior to the Effective Time, (ii) used to repay Indebtedness or Seller Transaction Expenses (but solely to the extent such repayment reduces Closing Indebtedness or Closing Seller Transaction Expenses for purposes of this Agreement) or to settle or otherwise eliminate intercompany balances and accounts pursuant to Section 4.21(a), in each case, prior to the Effective Time or (iii) distributed or otherwise paid to Seller or its Subsidiaries (other than the Vantive Group Entities) after the Closing pursuant to Section 4.20(g). Notwithstanding the foregoing or anything else contained in this Agreement, the calculations of Cash, Closing Cash Consideration, Final Cash Consideration, Excess Closing Cash, Estimated Cash Adjustment and Closing Cash Adjustment shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time (including any payments or contributions from Buyer or any of its Affiliates or any use of cash on balance sheet by Buyer or any of its Affiliates on the Closing Date).”

(c)The definition of “Closing Cash Adjustment” is hereby amended and restated as follows:

““Closing Cash Adjustment” means the aggregate (which may be positive or negative) of the results of the following sums, calculated in respect of each of the jurisdictions specified in Section A.13 of the Seller Disclosure Letter: (i) the Closing Cash in such jurisdiction, minus (ii) the Minimum Cash Target for such jurisdiction, which Cash amounts shall in each case be calculated in U.S. dollars and in accordance with the Accounting Principles; provided, however, that if the Closing Cash in any jurisdiction exceeds the “Maximum Cash” for such jurisdiction in Section A.13 of the Seller Disclosure Letter, then the Closing Cash for such jurisdiction shall be capped at such “Maximum Cash”. For the avoidance of doubt, (x) the term “Maximum Cash” shall be determined on an aggregate basis for the jurisdictions included in Group A as set forth in Appendix A.13, as amended hereby and (y) to the extent that the aggregate Closing Cash Adjustment is positive, it shall be an increase to Final Cash Consideration, and to the extent the aggregate Closing Cash Adjustment is negative, it shall be a deduct to Final Cash Consideration.”

(d)The definition of “Estimated Cash Adjustment” is hereby amended and restated as follows:

““Estimated Cash Adjustment” means the aggregate (which may be positive or negative) of the results of the following sums, calculated in respect of each of the jurisdictions specified in Section A.13 of the Seller Disclosure Letter: (i) the Estimated Cash in such jurisdiction, minus (ii) the Minimum Cash Target for such jurisdiction, which Cash amounts shall in each case be calculated in U.S. dollars and in accordance with the Accounting Principles; provided, however, that if the Estimated Cash in any jurisdiction exceeds the “Maximum Cash” for such jurisdiction in Section A.13 of the Seller Disclosure Letter, then the Estimated Cash for such jurisdiction shall be capped at such “Maximum Cash”. For the avoidance of doubt, (x) the term “Maximum Cash” shall be determined on an aggregate basis for the jurisdictions included in Group A as set forth in Appendix A.13, as amended hereby and (y) to the extent that the aggregate Estimated Cash Adjustment is positive, it shall be an increase to Closing Cash Consideration, and to the extent the aggregate Estimated Cash Adjustment is negative, it shall be a deduct to Closing Cash Consideration.”

(e)The definition of “Excess Closing Cash” is hereby amended and restated as follows:

““Excess Closing Cash” means, with respect to any Excess Cash Jurisdiction, the amount by which Closing Cash in such jurisdiction exceeds the “Maximum Cash” for such jurisdiction in Section A.13, which amount shall be a fixed functional currency equivalent of such U.S. dollar excess amount calculated as of the Closing Date using the relevant

exchange rate published in Bloomberg on the Business Day immediately prior to Closing Date. For the avoidance of doubt, in respect of the jurisdictions included in Group A as set forth in Appendix A.13, as amended hereby, there shall not be any Excess Closing Cash unless the total Closing Cash for Group A exceeds $180 million, and then any such excess shall be determined on a jurisdiction-by-jurisdiction basis (not as a grouping).”

(f)The definition of “Estimated Closing Statement” is hereby amended and restated as follows:

““Estimated Closing Statement” means the written statement delivered pursuant to Section 1.4(a), setting forth Seller’s good-faith calculations of the Closing Cash Consideration determined in accordance with the Accounting Principles, which shall take into account, and set forth as separate line items, all items establishing the basis for such calculations, including (i) a good-faith calculation of the Net Working Capital as of the Effective Time (which shall be prepared in a format consistent with Exhibit I) (the “Estimated Net Working Capital”) and (ii) good-faith estimates of Cash as of the Effective Time (“Estimated Cash”), the Estimated Cash Adjustment, Indebtedness as of immediately prior to the Closing (“Estimated Indebtedness”) and Seller Transaction Expenses as of immediately prior to the Closing (“Estimated Seller Transaction Expenses”), in each case, assuming that the Pre-Closing Reorganization occurs as of immediately prior to the Closing. Notwithstanding the foregoing or anything else contained in this Agreement, the Estimated Closing Statement shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time.”

(g)The definition of “Post-Closing Statement” is hereby amended and restated as follows:

““Post-Closing Statement” means the written statement delivered pursuant to Section 1.4(b)(i), setting forth Seller’s good-faith calculations of the Final Cash Consideration and the Post-Closing Adjustment in a manner consistent with the Accounting Principles, which shall take into account, and set forth as separate line items, all items establishing the basis for such calculations, including (i) a good-faith calculation of the Net Working Capital as of the Effective Time (which shall be prepared in a format consistent with Exhibit I) (the “Closing Net Working Capital”) and (ii) the amount of Cash as of the Effective Time (“Closing Cash”), Closing Cash Adjustment, Indebtedness as of immediately prior to the Closing (“Closing Indebtedness”) and Seller Transaction Expenses as of immediately prior to the Closing (“Closing Seller Transaction Expenses”), in each case, assuming that the Pre-Closing Reorganization occurs as of immediately

prior to the Closing. Notwithstanding the foregoing or anything else contained in this Agreement, the Post-Closing Statement shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time.”

(h)The definition of “Indebtedness” is hereby amended by adding the following as a new last sentence:

“Notwithstanding the foregoing or anything else contained in this Agreement, the calculations of Indebtedness, Estimated Indebtedness and Closing Indebtedness shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time (including any payoff of any Indebtedness by Buyer or any of its Affiliates on the Closing Date).”

(i)The definition of “Net Working Capital” is hereby amended by adding the following as a new last sentence:

“Notwithstanding the foregoing or anything else contained in this Agreement, the calculations of Net Working Capital, Estimated Net Working Capital and Closing Net Working Capital shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time (including any payoff of any liabilities by Buyer or any of its Affiliates on the Closing Date).”

(j)The definition of “Seller Transaction Expenses” is hereby amended by adding the following as a new last sentence:

“Notwithstanding the foregoing or anything else contained in this Agreement, the calculations of Seller Transaction Expenses, Estimated Seller Transaction Expenses and Closing Seller Transaction Expenses shall be prepared excluding any actions taken by Buyer or any of its Affiliates at or following the Closing and prior to the Effective Time (including any payoff of any Seller Transaction Expenses by Buyer or any of its Affiliates on the Closing Date).”

(k)Section 3(b) of the Accounting Principles is hereby amended and restated as follows:

“b. be prepared on the basis that the Business is a going concern, and shall exclude (i) the effect of any change of control and any change in assets or liabilities as a consequence of the consummation of the Transactions (except, in each case, with respect to the definitions of “Indebtedness” and “Seller Transaction Expenses”), (ii) the effect of any change of Law or GAAP thereof after the Closing (except as specified in clause (3)(d)), (iii) purchase accounting adjustments applied by the Buyer

and (iv) the effects of any post-Closing reorganizations or the post-Closing actions or obligations of the Buyer (in each case, other than the Pre-Closing Reorganization (including any applicable deferred transfers pursuant to Sections 1.6 and 4.17 of the Agreement), which occurs as of immediately prior to the Closing);”

(l)Section 1.6(d) of the Purchase Agreement is hereby amended and restated as follows:

“(d) Consideration for the Deferred Vantive Local Businesses. No later than two (2) Business Days prior to the date of the payment of Cash Consideration (as defined in the applicable Business Transfer Agreement) or the Purchase Price (as defined in the applicable Share Transfer Agreement) that is required by applicable Law to be paid by Buyer or the applicable Vantive Group Entity in connection with a Local Closing, Seller shall transfer, or cause to be transferred, to Buyer or the applicable Vantive Group Entity by wire transfer of immediately available funds to the account designated in writing by Buyer an amount in U.S. Dollars equal to such Cash Consideration or such Purchase Price. On the date of the applicable Local Closing (or such later date agreed and provided for in the applicable Business Transfer Agreement or Share Transfer Agreement), Buyer or its designee shall pay to Seller or, where applicable, such Subsidiary or other designee of Seller such Cash Consideration or such Purchase Price converted into the foreign currency of Seller pursuant to Section 2.04 of the applicable Business Transfer Agreement or Section 2.2 of the applicable Share Transfer Agreement.”

(m)Appendix A.13 of the Seller Disclosure Letter is hereby amended and replaced in full with the revised version of Appendix A.13 that is attached hereto as Exhibit A.

(n)Seller shall be responsible for any Excess WHT Exposure as contemplated in Appendix A.13, as amended hereby.

“Excess WHT Exposure” means an amount equal to the excess of the Total Closing WHT Exposure over the Total Benchmark WHT Exposure.

“Total Benchmark WHT Exposure” means $5,900,000.

“Total Closing WHT Exposure” means the aggregate of the following for all jurisdictions in Group A as set forth in Appendix A.13: the Closing Cash for each jurisdiction in such group, as set forth in the column labelled “Closing Cash” of Appendix A.13, multiplied by the WHT Rate for such jurisdiction.

“WHT Rate” means, with respect to each jurisdiction in Group A set forth in Appendix A.13, the percentage set forth in column labelled “WHT Rate.”

(o)For the avoidance of doubt, Seller’s responsibility for such withholding taxes shall not be duplicative of any withholding taxes that were taken into account in the computation of the Intercompany Tax Amount pursuant to Appendix A.14 or any Taxes that are applicable to the transfer of any portion of Collections to be transferred to Seller or its designated Subsidiary pursuant to Section 4.20(g) of the Purchase Agreement.

(p)This Amendment clarifies that the term “Maximum Cash” shall be determined on an aggregate basis for the jurisdictions included in Group A as set forth in Appendix A.13, as amended hereby.

(q)The first sentence of Section 4.20(g) is hereby amended and restated as follows:

In furtherance of the foregoing Section 4.20(a), to the extent that any Vantive Group Entity holds any portion of the Collections in any jurisdiction included in Group A in Section A.13 of the Seller Disclosure Letter which portion constitutes Cash as of the Effective Time in excess of the applicable aggregate “Maximum Cash” for such Group, which amount shall be a fixed functional currency equivalent of such U.S. dollar excess amount calculated as of the Closing Date using the relevant exchange rate published in Bloomberg on the Business Day immediately prior to Closing Date, Buyer shall, subject to the following sentence of this Section 4.20(g), use reasonable best efforts to cause such portion of the Collections to be transferred to Seller or its designated Subsidiaries (which such transfer may involve needing to first distribute or otherwise transfer such Collections from the entity that holds it to a direct or indirect owner of such entity organized in another jurisdiction), in each case net of any Taxes or other reasonable and documented out-of-pocket costs and expenses incurred by Buyer or any of its Subsidiaries (including any Vantive Group Entity) as a result of or relating to any such transfer or distribution and transfer.

(r)Section 4.20(h) is hereby amended and restated as follows:

In furtherance of the foregoing Section 4.20(d) and Section 4.20(g), following the Closing, Buyer shall promptly provide (or cause to be provided) to Seller any information reasonably requested by Seller to facilitate Seller’s determination of (i) the amount of Collections in any jurisdiction in Section A.13 of the Seller Disclosure Letter which portion constitutes Cash as of the Effective Time in such jurisdiction in excess of the applicable “Maximum Cash” for such jurisdiction and (ii) the Excess Cash Jurisdictions, in each case, no later than ten (10) Business Days following the Closing Date.

Section 1.3Integration with Agreement. This Amendment is executed, and shall be considered, as an amendment to the Purchase Agreement and, as provided for in Section 8.1 (Amendment; Waiver) of the Purchase Agreement, shall form a part thereof, and the

provisions of the Purchase Agreement, as amended by this Amendment, are hereby ratified and confirmed in all respects.

Section 1.4Miscellaneous. The provisions of Sections 8.1 (Amendment; Waiver), 8.3 (Counterparts), 8.4 (Governing Law), 8.5 (Notices), 8.6 (Entire Agreement), 8.9 (Interpretation; Construction) and 8.11 (Successors and Assigns) are incorporated in this Agreement by reference as if fully set forth herein, mutatis mutandis.

Section 1.5No Other Amendments. Except as specifically modified in this Amendment, all of the provisions of the Purchase Agreement remain unchanged and continue in full force and effect. Unless the context otherwise requires, after the date hereof, any reference to the Purchase Agreement shall mean the Purchase Agreement as amended hereby.

[remainder of page intentionally left blank and signature pages follow]

IN WITNESS WHEREOF, the Parties have caused this Agreement to be executed by persons duly empowered to bind the Parties to perform their respective obligations hereunder as of the first date written above.

| | | | | | | | | | | |

| BAXTER INTERNATIONAL INC. |

| | | |

| By: | /S/ Joel Grade | | |

| Name: Joel Grade | |

| Title: Executive Vice President, |

| Chief Financial Officer and Interim |

| Chief Accounting Officer |

[Signature Page to the Amendment to Equity Purchase Agreement]

| | | | | | | | | | | | | | |

| SPRUCE BIDCO I, INC. | | |

| | | | |

| By: | /S/ Robert Schmidt | | |

| Name: Robert Schmidt | | |

| Title: Authorized Signatory | | |

| | | | |

| | | | |

| SPRUCE BIDCO II, INC. | | |

| | | | |

| By: | /S/ Robert Schmidt | | |

| Name: Robert Schmidt | | |

| Title: Authorized Signatory | | |

| | | | |

| | | | |

| SPRUCE BIDCO I LIMITED | | |

| | | | |

| By: | /S/ William Cagney | | |

| Name: William Cagney | | |

| Title: Authorized Signatory | | |

| | | | |

| | | | |

| CP SPRUCE HOLDINGS, S.C.Sp | | |

| represented by its managing general partner | | |

| (associé commandité gérant), | | |

| CP VIII Spruce GP S.à r.l. | | |

| | | | |

| By: | /S/ William Cagney | | |

| Name: William Cagney | | |

| Title: Manager and | | |

| Authorized Signatory | | |

| | | | |

| By: | /S/ William Cagney | | |

| Name: William Cagney | | |

| Title: Manager and | | |

| Authorized Signatory | | |

[Signature Page to the Amendment to Equity Purchase Agreement]

Document and Entity Information Document

|

Jan. 31, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 31, 2025

|

| Entity Registrant Name |

Baxter International Inc.

|

| Entity Central Index Key |

0000010456

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-4448

|

| Entity Tax Identification Number |

36-0781620

|

| Entity Address, Address Line One |

One Baxter Parkway

|

| Entity Address, City or Town |

Deerfield

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60015

|

| City Area Code |

224

|

| Local Phone Number |

948-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock, $1.00 Per Value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

BAX (NYSE)

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.3% Global Notes due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.3% Global Notes due 2025

|

| Trading Symbol |

BAX 25

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.3% Global Notes due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.3% Global Notes due 2029

|

| Trading Symbol |

BAX 29

|

| Security Exchange Name |

NYSE

|

| CHICAGO STOCK EXCHANGE, INC | Common Stock, $1.00 Per Value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value

|

| Trading Symbol |

BAX (NYSE)

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_CommonStock1.00PerValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_GlobalNotes13Due2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bax_GlobalNotes13Due2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

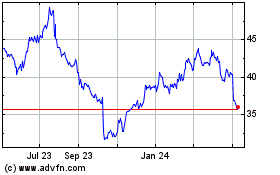

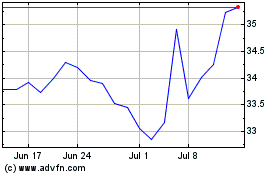

Baxter (NYSE:BAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baxter (NYSE:BAX)

Historical Stock Chart

From Feb 2024 to Feb 2025