Filed by JEPLAN Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AP Acquisition Corp

Commission File No.: 001-41176

Filed September 21, 2023

AP Acquisition Corp and JEPLAN Announce Public

Filing of Registration Statement in Connection with the Proposed Business Combination

Tokyo,

Japan – September 21, 2023 – AP Acquisition Corp (NYSE: APCA) (“AP Acquisition” or the “SPAC”)

and JEPLAN, Inc. (“JEPLAN” or the “Company”), a leading PET (polyethylene terephthalate) chemical recycling technology

company, announced the public filing of a registration statement on Form F-4 (the “Registration Statement”) on September

8, 2023 with the U.S. Securities and Exchange Commission (the “SEC”) by JEPLAN Holdings, Inc., a Japanese corporation (kabushiki

kaisha) incorporated under the laws of Japan and a direct wholly-owned subsidiary of JEPLAN (“PubCo”), in connection with

the previously-announced proposed business combination involving AP Acquisition and JEPLAN (the “Business Combination”).

The Registration

Statement contains a preliminary proxy statement/prospectus in connection with the Business Combination. While the Registration

Statement has not yet become effective and the information contained therein is subject to change, it provides important information about

JEPLAN, PubCo, and the Business Combination.

A copy of the Registration Statement can be found on the SEC’s

website at www.sec.gov.

The Business

Combination is expected to close in the first quarter of 2024, subject to the Registration Statement being declared effective by the SEC,

the approval of the Business Combination by the respective shareholders of JEPLAN and AP Acquisition, and the satisfaction or waiver of

other customary closing conditions.

Capital Commitments from Sponsor and Strategic Partner

As previously

announced, on July 7, 2023, AP Acquisition entered into a deed of non-redemption (“Deed”) with Tokyo Century Corporation (“Tokyo

Century”), a strategic partner of AP Sponsor LLC, the sponsor of AP Acquisition (the “Sponsor”). Pursuant to

the Deed, Tokyo Century agreed that it will not elect to redeem 500,000 Class A ordinary shares of AP Acquisition in connection with the

Business Combination.

On September

8, 2023, the Sponsor entered into a subscription agreement with PubCo and AP Acquisition (the “Sponsor Subscription Agreement”)

to invest $5 million to acquire ordinary shares of PubCo at a purchase price of $10.00 per share in a private placement to be consummated

upon the closing of the Business Combination. Based on the Deed and the Sponsor Subscription Agreement, the total committed capital from

the Sponsor and Tokyo Century in the Business Combination amount to $10.0 million.

Keiichi

Suzuki, CEO of AP Acquisition, said “As the first Japanese sustainability focused SPAC, we are very happy to secure additional

support from our sponsor and Tokyo Century, which underscore their confidence in the deal. We are very confident that JEPLAN will play

a key role in the chemical recycling sector for plastics, including PET bottles and textile, to realize a truly global “circular

economy,” and we are proud of JEPLAN’s technology and operational excellence, which JEPLAN accumulated through commercial-scale

production in Kawasaki, Japan and its proven sales record to the world class beverage companies. JEPLAN is a company that should grow

as a truly innovative, global and ESG-oriented company in a global market like the NYSE. We are very happy to bring JEPLAN into global

investors’ considerations.”

Masaki

Takao, Founder and CEO of JEPLAN, said “JEPLAN has been working very hard to realize our vision, ‘BRING everyone

into circular economy’, and has been supported by many investors since our inception. We are now aiming to make our business more

global by raising funds through listing on the NYSE. We are pleased to have filed the Form F-4, representing one of the significant milestones

towards our listing on NYSE. Going forward, JEPLAN will use the anticipated funding from this transaction to expand the reach of our innovative

chemical recycling business globally.”

Engagement of Capital Market Advisor

JEPLAN has engaged UBS Securities LLC as its exclusive capital markets

adviser in connection with the Business Combination.

Advisors

Kirkland & Ellis is serving as international legal counsel, Mori,

Hamada & Matsumoto is serving as Japanese legal counsel and Maples and Calder (Cayman) LLP is serving as Cayman legal counsel to AP

Acquisition.

Greenberg Traurig, LLP is serving as U.S. legal counsel and Greenberg

Traurig Tokyo Law Offices is serving as Japanese legal counsel to JEPLAN. Mourant is serving as Cayman legal counsel to JEPLAN.

Shearman & Sterling LLP is serving as international legal counsel

to UBS Securities LLC.

About AP Acquisition

AP Acquisition is a blank check company incorporated as a Cayman Islands

exempted company on April 22, 2021, for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization,

reorganization or other similar business combination with one or more target businesses.

About JEPLAN

JEPLAN, founded

in 2007 and headquartered in Kanagawa, Japan, is a global leader of PET chemical recycling technology and producer of chemically recycled

resins in commercial scale. JEPLAN utilizes its commercialized proprietary PET chemical recycling technology to produce r-PET and

r-BHET resins for use in the manufacturing and distribution of r-PET products, including PET bottles, textiles, and other plastic-based

materials and products. JEPLAN’s aim is to realize a “circular economy” in which waste products are collected, recycled,

and distributed back into the market for continued use.

Forward-Looking Statements

This press release contains certain forward-looking

statements within the meaning of the federal securities laws with respect to the Business Combination, including statements regarding

the benefits of the Business Combination, the anticipated timing of the Business Combination, the technologies and products and services

offered by JEPLAN and the markets in which it operates, and JEPLAN’s business plans. These forward-looking statements generally

are identified by the words “believe,” “project,” “forecast,” “predict,” “expect,”

“anticipate,” “estimate,” “intend,” “seek,” “strategy,” “future,”

“outlook,” “target,” “opportunity,” “plan,” “potential,” “may,”

“seem,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions that predict or indicate future events or trends or that are not statements

of historical matters. Forward-looking statements include, but are not limited to, predictions, projections and other statements about

future events that are based on current expectations and assumptions of JEPLAN’s, PubCo’s and SPAC’s management, whether

or not identified in this press release, and, as a result, are subject to risks and uncertainties. These forward-looking statements are

provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an

assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible

to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of JEPLAN, PubCo, and SPAC. Many

factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but

not limited to: (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely

affect the price of PubCo’s securities, (ii) the risk that the Business Combination may not be completed by SPAC’s business

combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by SPAC, (iii) the

failure to satisfy the conditions to the consummation of the Business Combination, including the adoption of the business combination

agreement by the respective shareholders of SPAC and JEPLAN, the satisfaction of the minimum cash amount following redemptions by SPAC’s

public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in

determining whether or not to pursue the Business Combination, (v) the occurrence of any event, change or other circumstance that

could give rise to the termination of the business combination agreement, (vi) the effect of the announcement or pendency of the

Business Combination on JEPLAN’s business relationships, performance, and business generally, (vii) risks that the Business

Combination disrupts current plans of JEPLAN and potential difficulties in its employee retention as a result of the Business Combination,

(viii) the outcome of any legal proceedings that may be instituted against JEPLAN or SPAC related to the business combination agreement

or the Business Combination, (ix) failure to realize the anticipated benefits of the Business Combination, (x) the inability

to maintain the listing of SPAC’s securities or to meet listing requirements and maintain the listing of PubCo’s securities

on the New York Stock Exchange, (xi) the risk that the price of PubCo’s securities may be volatile due to a variety of factors,

including changes in the highly competitive industries in which PubCo plans to operate, variations in performance across competitors,

changes in laws, regulations, technologies, natural disasters or health epidemics/pandemics, national

security tensions, and macro-economic and social environments affecting its business, and changes in the combined capital

structure, (xii) the inability to implement business plans, forecasts, and other expectations after the completion of the Business

Combination, identify and realize additional opportunities, and manage its growth and expanding operations, (xiii) the risk that

JEPLAN may not be able to successfully expand its products and services domestically and internationally, (xiv) the risk that JEPLAN

and its current and future collaborative partners are unable to successfully market or commercialize JEPLAN’s proposed licensing

solutions, or experience significant delays in doing so, (xv) the risk that JEPLAN may never achieve or sustain profitability, (xvi) the

risk that JEPLAN will need to raise additional capital to execute its business plan, which many not be available on acceptable terms or

at all, (xvii) the risk relating to scarce or poorly collected raw materials for JEPLAN’s PET recycling business; (xviii) the

risk that JEPLAN may not be able to consummate planned strategic acquisitions, including joint ventures in connection with its proposed

licensing business, or fully realize anticipated benefits from past or future acquisitions, joint ventures, or investments; (xix) the

risk that JEPLAN’s patent applications may not be approved or may take longer than expected, and that JEPLAN may incur substantial

costs in enforcing and protecting its intellectual property; (xx) the risk that JEPLAN may be subject to competition from current

collaborative partners in the use of jointly developed technology once applicable collaborative arrangements expire; (xxi) risks relating

to JEPLAN’s ability to continue as a going concern; and (xxii) risks related to the equipment malfunction that occurred at JEPLAN’s

PRT Plant in August 2023, including that another operational malfunction or other disruption at JEPLAN’s recycling facilities may

occur. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors, any other factors discussed

in this press release and the other risks and uncertainties described in the “Risk Factors” sections of PubCo’s Registration

Statement on Form F-4, as filed with the SEC on September 8, 2023, and as amended from time to time (the “Registration Statement”),

as such factors may be updated from time to time in PubCo’s filings with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

There may be additional risks that neither JEPLAN, PubCo, or SPAC presently know or that JEPLAN, PubCo, and SPAC currently believe are

immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Forward-looking statements

reflect JEPLAN’s, PubCo’s, and SPAC’s expectations, plans, or forecasts of future events and views only as of the date

they are made. JEPLAN, PubCo, and SPAC anticipate that subsequent events and developments will cause JEPLAN’s, PubCo’s, and

SPAC’s assessments to change. However, while JEPLAN, PubCo, and SPAC may elect to update these forward-looking statements at some

point in the future, JEPLAN, PubCo, and SPAC specifically disclaim any obligation to do so. These forward-looking statements should not

be relied upon as representing JEPLAN’s, PubCo’s, and SPAC’s assessments of any date subsequent to the date of this

press release. Accordingly, readers are cautioned not to put undue reliance on forward-looking statements, and JEPLAN, PubCo, and SPAC

assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future

events, or otherwise, unless required to by applicable securities law. Neither JEPLAN, PubCo, nor SPAC gives any assurance that PubCo

will achieve its expectations.

Additional

Information and Where to Find It

This press release relates to the Business

Combination by and among PubCo, SPAC, Merger Sub, and JEPLAN. PubCo filed the Registration Statement with the SEC on September 8,

2023, which includes a proxy statement/prospectus of SPAC. The proxy statement/prospectus will be sent to all SPAC and JEPLAN shareholders.

PubCo and SPAC also will file other documents regarding the Business Combination with the SEC. This press release does not contain all

the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment

decision or any other decision in respect of the Business Combination. Before making any voting decision, investors and security holders

of SPAC and JEPLAN are urged to read the Registration Statement, the proxy statement/prospectus contained therein and all other relevant

documents filed or that will be filed with the SEC in connection with the Business Combination as they become available because they will

contain important information about JEPLAN, SPAC, PubCo, and the Business Combination.

Investors and security holders will be able

to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by PubCo

and SPAC through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by PubCo and SPAC may

be obtained free of charge by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa, Japan or by telephone at +81

44-223-7898, and to SPAC at 10 Collyer Quay, #14-06 Ocean Financial Centre, Singapore or

by telephone at +65 6808-6510.

Participants in Solicitation

JEPLAN, PubCo, and SPAC and their respective

directors and officers and other members of management may, under SEC rules, be deemed to be participants in the solicitation of proxies

from SPAC’s shareholders with the Business Combination and the other matters set forth in the Registration Statement. Information

about SPAC’s directors and executive officers and their ownership of SPAC’s securities is set forth in SPAC’s filings

with the SEC, including SPAC’s 2022 Form 10-K. To the extent that holdings of SPAC’s securities by its directors and

executive officers have changed since the amounts reflected in the 2022 Form 10-K, such changes will be reflected on Statements of

Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons

who may be deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus regarding the Business

Combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This press release shall not constitute a

“solicitation” as defined in Section 14 of the U.S. Securities Exchange Act of 1934, as amended. This press release shall

not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws

of any such jurisdiction. No offering of securities in the Business Combination shall be made except by means of a prospectus meeting

the requirements of the U.S. Securities Act of 1933, as amended.

Contacts:

For AP Acquisition Corp

Keiichi Suzuki, CEO

Email: info@apacquisitioncorp.com

For JEPLAN Inc.

Email: info@jeplan.co.jp

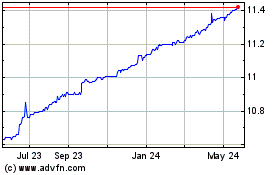

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

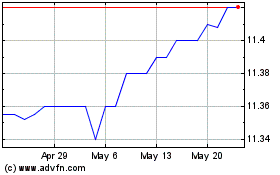

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024