0001595527

false

0001595527

2023-08-11

2023-08-11

0001595527

us-gaap:CommonStockMember

2023-08-11

2023-08-11

0001595527

us-gaap:RightsMember

2023-08-11

2023-08-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 11, 2023

American

Strategic Investment Co.

(Exact Name of Registrant as Specified in Charter)

|

Maryland |

|

001-39448 |

|

46-4380248 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

|

650

Fifth Avenue, 30th Floor

New

York, New York 10019 |

| (Address, including zip code, of Principal Executive Offices) |

| |

| Registrant’s telephone number, including area code: (212)

415-6500 |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class

A common stock, $0.01 par value per share |

|

NYC |

|

New

York Stock Exchange |

| Class

A Preferred Stock Purchase Rights |

|

true |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Common

Stock [Member]

Item 7.01. Regulation FD Disclosure.

Earnings Call Script

On August 11, 2023, American Strategic Investment

Co. (the “Company”) hosted a conference call to discuss its financial and operating results for the quarter ended June 30,

2023. A transcript of the pre-recorded portion of the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As previously disclosed, a replay of the entire conference call is available through November 11, 2023 by telephone as follows:

Toll Free Dial in Number: 1 (800) 770-2030

Toll Dial in Number: 1 (647) 362-9199

Conference ID: 5954637

The information set forth in Item 7.01 of this

Current Report on Form 8-K and in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that Section. The information set forth in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall

not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended,

regardless of any general incorporation language in such filing.

The statements in this press release that are

not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause

actual results or events to be materially different. The words “may,” “will,” “seeks,” “anticipates,”

“believes,” “expects,” “estimates,” “projects,” “plans,” “intends,”

“should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties and other factors, many

of which are outside of the Company’s control, which could cause actual results to differ materially from the results contemplated

by the forward-looking statements. These risks and uncertainties include (a) the anticipated benefits of the Company’s election

to terminate its status as a real estate investment trust, (b) whether the Company will be able to successfully acquire new assets or

businesses, (c) the potential adverse effects of (i) the global COVID-19 pandemic, including actions taken to contain or treat COVID-19,

(ii) the geopolitical instability due to the ongoing military conflict between Russia and Ukraine, including related sanctions and other

penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the global economy

and financial markets, and (iii) inflationary conditions and higher interest rate environment, and (d) that any potential future acquisition

is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, as well as those risks

and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December

31, 2022 filed on March 16, 2023 and all other filings with the Securities and Exchange Commission after that date including but not limited

to the subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as such risks, uncertainties and other important factors

may be updated from time to time in the Company’s subsequent reports. Further, forward-looking statements speak only as of the date

they are made, and the Company undertakes no obligation to update or revise any forward-looking statement to reflect changed assumptions,

the occurrence of unanticipated events or changes to future operating results, unless required to do so by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description |

| 99.1 |

Transcript |

| 104 |

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

American Strategic Investment Co. |

| |

|

|

| Date: August 11, 2023 |

By: |

/s/ Edward M. Weil, Jr. |

| |

|

Edward M. Weil, Jr. |

| |

|

Chief Executive Officer, President, and Secretary |

Exhibit 99.1

American Strategic Investment Co (NYSE: NYC) Second Quarter Earnings

Call

Executives

Michael Weil - President & CEO

Christopher Masterson – CFO

Operator

Good morning and welcome to the American Strategic Investment Company's

Second Quarter Earnings Call. [Operator Instructions]. I would now like to turn the conference over to Curtis Parker, Senior Vice President.

Please go ahead.

Curtis

Thank you. Good morning, everyone and thank you for joining us for

our Second Quarter 2023 Earnings Call. This event is being webcast in the Investor Relations section of our website. Joining me today

on the call to discuss the quarter's results are Michael Weil, American Strategic Investment Company's Chief Executive Officer, and Chris

Masterson, the Chief Financial Officer.

The following information contains forward-looking statements, which

are subject to risks and uncertainties. Should one or more of these risks or uncertainties materialize, actual results may differ materially

from those expressed or implied by the forward-looking statements. We refer all of you to our SEC filings including the Form 10-K

filed for the year ended December 31, 2022, filed on March 16, 2023, and all subsequent SEC filings for a more detailed discussion

of the risk factors that could cause these differences.

Any forward-looking statements provided during this conference call

are only made as of the date of this call. As stated in our SEC filings, the Company disclaims any intent or obligation to update or revise

these forward-looking statements except as required by law. Also, during today's call, we will discuss non-GAAP financial measures, which

we believe can be useful in evaluating the company's financial performance. These measures should not be considered in isolation or as

a substitute for our financial results prepared in accordance with GAAP. A reconciliation of these measures to the most directly comparable

GAAP measure is available in our earnings release which is posted on our website at www.americanstrategicinvestment.com. Please also refer

to our earnings release for more detailed information about what we consider to be implied investment grade tenants, a term we will use

throughout today's call.

I will now turn the call over to Michael Weil, Chief Executive Officer.

Please go ahead, Mike.

Mike Weil

Thanks, Curtis. Good morning and thank you all for joining us today.

The second quarter was extremely productive, as our ongoing focus on leasing activity throughout our portfolio continued to produce positive

results. We signed four new leases during the second quarter that totaled over 26,000 square feet that will generate $1.5 million of straight-line

rent. As a result, we grew in-place occupancy to 85.1% from 84.0% at the end of the prior quarter, a 110 basis point increase in just

three months. Our portfolio weighted average remaining lease term was 6.8 years, as over 40% of our leases extend beyond the year 2030,

which we believe increases the stability of the real estate we own. Of our Top 10 tenants, 79% are what we consider to be investment grade,

showing the quality of our tenant roster. These tenants had a remaining lease term of 9.1 years, providing further stability in our portfolio.

We executed two leases during the second quarter that I'd like to highlight

because we believe they illustrate the strength of our leasing platform. The first is a lease expansion with an existing tenant at 9 Times

Square. The expansion doubled this tenant's occupancy in the building to over 17,500 feet. Accordingly, we doubled the annual SLR from

this tenant by $500,000 to $1.0 million. There are six years of lease term on the expansion, which matches the expiration date of the

original lease. Second, at 8713 Fifth Avenue in Brooklyn, we executed a ten-year lease renewal with one of the largest healthcare systems

in the Northeast. From a financial standpoint, this transaction maintained the current annual straight-line rent and required no leasing

commission. We will maintain our proactive leasing approach, as our portfolio management expertise and strong tenant relationships have

led to increased occupancy for two quarters in a row and our highest occupancy rate since the fourth quarter of 2020.

Our asset management approach contributes to the long-term strength

of our $834 million, 1.2 million square foot portfolio of New York City real estate. Our portfolio consists of eight office and retail

condominiums, all located New York City, primarily in Manhattan. We have built a pure-play New York City portfolio featuring a number

of large, investment grade tenants including Weill Cornell Medical, CVS, and government agencies. Across our portfolio, 37% of our tenant

base operates in resilient industries, including government agencies and financial firms.

Touching on the quarterly results, the efforts of our asset and property

management teams resulted in Adjusted EBITDA more than doubling and Cash NOI growth of 7.7% compared to the prior year. The increases

were achieved through a reduction in G&A and operating expenses, coupled with our ongoing leasing success. Compared to the first quarter,

Adjusted EBITDA grew by almost 47% and Core FFO increased by $0.54 per share.

On the balance sheet, our debt was 100% fixed rate, including debt

that is swapped to fixed rate, with an attractive weighted-average effective interest rate of 4.4% and a weighted-average maturity of

3.7 years. Our financing is very attractive in the current lending environment, and we are pleased that we have no maturities this year

and limited maturities through 2025, insulating us from the refinancing risk that other New York City building owners have been experiencing.

Our net leverage was a modest 41%.

We are committed to strengthening our existing portfolio of real estate

assets as we explore additional income-generating investments. In recent years we have taken advantage of opportunities to invest in the

long-term future of our portfolio, and we believe that expanding the scope of our assets is the next step forward for the company.

With that, I'll turn it over to Chris Masterson to go over the

second quarter results. Chris?

Christopher Masterson

Thanks Mike. Second quarter 2023 revenue was $15.8 million, compared

to $16.2 million in the second quarter of 2022 and up incrementally from $15.5 million in the first quarter 2023, as newly commenced leases

began to pay rent. The company's second quarter GAAP net loss attributable to common stockholders was $10.9 million, compared to a net

loss of $13.0 million in the second quarter of 2022.

For the second quarter of 2023, Adjusted EBITDA increased by $2.1 million,

or 219%, to $3.0 million compared to $0.9 million in 2022. Cash net operating income increased by $0.6 million, or 7.7%, to $7.5 million

from $6.9 million in the second quarter of 2022. Our FFO attributable to common stockholders was a negative $4.0 million. Core FFO improved

to negative $1.7 million, or negative $0.74 per share. As always, a reconciliation of GAAP net income to non-GAAP measures can be found

in our earnings release and quarterly supplemental and on our website.

At quarter end, we had a relatively conservative balance sheet based

on our Net Leverage of 41%, a weighted-average interest rate of 4.4%, and almost four years of weighted-average debt maturity. We have

limited debt maturities through 2025 and none this year. As we have previously discussed, all of our debt is fixed-rate or swapped to

fixed rate, after we locked in interest rates while they were broadly at historic lows.

I'll turn the call back to Mike for some closing remarks.

Mike Weil

Thanks, Chris.

We executed on our leasing pipeline last quarter, driving occupancy

up 1.1% to 85.1% and adding $1.5 million in annualized straight-line rent. Our new leasing and lower operating expenses resulted in quarter-over-quarter

growth in Adjusted EBITDA and Cash NOI. We believe the long-term lease extensions and expansions we signed this quarter signal our tenants'

commitments to the properties we own in New York City, and we remain focused on maximizing the value of these properties through our continued

proactive asset management strategy.

In May, we announced that upon the completion of a proposed merger

between Global Net Lease and the Necessity Retail REIT, Chris and I would resign our positions as CFO and CEO of ASIC. As such, this may

be the last time that Chris and I get to discuss the company's results with you. We'd like to thank you for your insight, support, and

ownership of ASIC over the years and we take great comfort leaving the company in the hands of Michael Anderson and Joe Marnikovic, who

we have recommended to the board for the positions of CEO and CFO, respectively. Michael and Joe have both been long-time employees of

our advisor, AR Global. Michael started with us in 2013 and has risen to become AR Global's general counsel. Joe joined us in 2017 and

currently serves as AR Global's CFO. I believe I speak for Michael, Joe and the board when I say that we are excited about the opportunities

ahead of us. Thank you for joining us today. Operator, please open the lines for questions.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

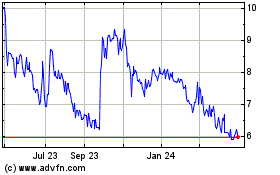

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

From Apr 2024 to May 2024

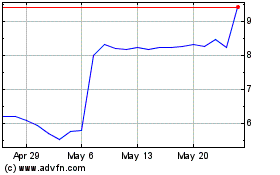

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

From May 2023 to May 2024