AMC Entertainment Holdings, Inc. (NYSE: AMC) (“AMC” or “the

Company”), announced today that it has completed its previously

disclosed $350 million at-the-market (“ATM”) equity offering

launched on November 9, 2023 and repurchased debt or exchanged debt

for equity thereby reducing liabilities by $62.28 million.

AMC raised $350 million of new equity capital, before

commissions and fees, through the sale of approximately 48.0

million shares, at an average price of approximately $7.29 per

share.

Using a portion of the proceeds raised through the ATM offering,

AMC repurchased $50 million principal amount of its 10% second lien

notes due 2026 at an average discount of 19.67%, plus accrued

interest. In addition, AMC exchanged $12.275 million principal

amount of its 10% second lien notes due 2026 plus accrued interest

for approximately 1.6 million shares of Class A common stock with

an implied value of $8.19 per share (based on the aggregate

principal amount and accrued interest exchanged).

Commenting on the capital transactions, AMC Chairman and CEO

Adam Aron said, “Successfully raising an additional $350 million of

equity capital and reducing debt by more than $62 million in a

single month underscores our continued commitment to strengthen our

balance sheet by bolstering liquidity and methodically reducing

debt levels.”

Aron continued, “Thus far in 2023, AMC has raised $865 million

of gross equity capital and lowered liabilities by approximately

$440 million by reducing our corporate borrowings by approximately

$350 million and repaying more than $90 million of COVID-19 related

deferred rent liabilities. Our commitment to strengthening the

balance sheet is further evidenced by the more than $1 billion

reduction in our corporate borrowings and deferred rent liabilities

since December 31, 2020.”

Aron concluded, “Through methodically fortifying our financial

position as we progress along our recovery trajectory, we ensure

our ability to manage through industry challenges, including the

ongoing impact of the Hollywood strikes earlier this year, and

position AMC to thrive in the future as we deliver value to our

shareholders.”

About AMC Entertainment Holdings, Inc.

AMC is the largest movie exhibition company in the United

States, the largest in Europe and the largest throughout the world

with approximately 900 theatres and 10,000 screens across the

globe. AMC has propelled innovation in the exhibition industry by:

deploying its Signature power-recliner seats; delivering enhanced

food and beverage choices; generating greater guest engagement

through its loyalty and subscription programs, website, and mobile

apps; offering premium large format experiences and playing a wide

variety of content including the latest Hollywood releases and

independent programming. For more information, visit

www.amctheatres.com.

Website Information

This press release, along with other news about AMC, is

available at www.amctheatres.com. We routinely post information

that may be important to investors in the Investor Relations

section of our website, www.investor.amctheatres.com. We use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD, and we encourage investors to consult that section of our

website regularly for important information about AMC. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document. Investors interested in automatically receiving

news and information when posted to our website can also visit

www.investor.amctheatres.com to sign up for email alerts.

Forward-Looking Statements

This communication includes “forward-looking statements” within

the meaning of the federal securities laws, including the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. In many cases, these forward-looking statements may be

identified by the use of words such as “will,” “may,” “could,”

“would,” “should,” “believes,” “expects,” “anticipates,”

“estimates,” “intends,” “indicates,” “projects,” “goals,”

“objectives,” “targets,” “predicts,” “plans,” “seeks,” and

variations of these words and similar expressions. Examples of

forward-looking statements include statements we make regarding our

recovery trajectory, the use of proceeds from the ATM equity

offering, changing market dynamics and capitalizing on

opportunities to further strengthen AMC’s balance sheet. Any

forward-looking statement speaks only as of the date on which it is

made. These forward-looking statements may include, among other

things, statements related to AMC’s current expectations regarding

the performance of its business, financial results, liquidity and

capital resources, and the impact to its business and financial

condition of, and measures being taken in response to, the COVID-19

virus, and are based on information available at the time the

statements are made and/or management’s good faith belief as of

that time with respect to future events, and are subject to risks,

trends, uncertainties and other facts that could cause actual

performance or results to differ materially from those expressed in

or suggested by the forward-looking statements. These risks,

trends, uncertainties and facts include, but are not limited to:

the sufficiency of AMC’s existing cash and cash equivalents and

available borrowing capacity; availability of financing upon

favorable terms or at all; AMC’s ability to obtain additional

liquidity, which if not realized or insufficient to generate the

material amounts of additional liquidity that will be required

unless it is able to achieve more normalized levels of operating

revenues, likely would result with AMC seeking an in-court or

out-of-court restructuring of its liabilities; the impact of the

COVID-19 virus on AMC, the motion picture exhibition industry, and

the economy in general; increased use of alternative film delivery

methods or other forms of entertainment; the continued recovery of

the North American and international box office; AMC’s significant

indebtedness, including its borrowing capacity and its ability to

meet its financial maintenance and other covenants and limitations

on AMC's ability to take advantage of certain business

opportunities imposed by such covenants; shrinking exclusive

theatrical release windows; the seasonality of AMC’s revenue and

working capital; intense competition in the geographic areas in

which AMC operates; risks relating to impairment losses, including

with respect to goodwill and other intangibles, and theatre and

other closure charges; motion picture production and performance;

general and international economic, political, regulatory and other

risks; AMC’s lack of control over distributors of films;

limitations on the availability of capital, , including on the

authorized number of common stock; dilution of voting power through

the issuance of preferred stock; AMC’s ability to achieve expected

synergies, benefits and performance from its strategic initiatives;

AMC’s ability to refinance its indebtedness on favorable terms;

AMC’s ability to optimize its theatre circuit; AMC’s ability to

recognize interest deduction carryforwards, net operating loss

carryforwards, and other tax attributes to reduce future tax

liability; supply chain disruptions, labor shortages, increased

cost and inflation; and other factors discussed in the reports AMC

has filed with the SEC. Should one or more of these risks, trends,

uncertainties, or facts materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by the forward-looking

statements contained herein. Accordingly, we caution you against

relying on forward-looking statements, which speak only as of the

date they are made. Forward-looking statements should not be read

as a guarantee of future performance or results and will not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. For a detailed

discussion of risks, trends and uncertainties facing AMC, see the

section entitled “Risk Factors” in AMC’s 2022 Form 10-K for the

year ended December 31, 2022 and Form 10-Q for the quarter ended

June 30, 2023, each as filed with the SEC, and the risks, trends

and uncertainties identified in AMC’s other public filings. AMC

does not intend, and undertakes no duty, to update any information

contained herein to reflect future events or circumstances, except

as required by applicable law.

Category: Company Release

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231211436218/en/

INVESTOR RELATIONS: John Merriwether, 866-248-3872

InvestorRelations@amctheatres.com

MEDIA CONTACTS: Ryan Noonan, (913) 213-2183

rnoonan@amctheatres.com

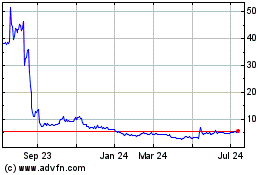

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

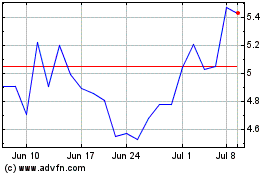

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Nov 2023 to Nov 2024