Alta Equipment Group Inc. (NYSE: ALTG) (“Alta”, "we", "our" or the

“Company”), a leading provider of premium material handling,

construction and environmental processing equipment and related

services, today announced financial results for the fourth quarter

and full year ended December 31, 2023.

CEO Comment:

Ryan Greenawalt, Chief Executive Officer of

Alta, said “The momentum in our business continued throughout the

balance of 2023 and as a result, we delivered solid financial and

operating results for the fourth quarter and 2023 fiscal year.

Total revenues grew 21.7% to $521.5 million for the fourth quarter

and increased 19.4% to $1.9 billion for the year. Our business

continues to benefit from the broad-based strength in our major

end-user markets. For the year, revenues from our Construction

Equipment segment grew 12.9% to $1.1 billion while Material

Handling revenues increased 19.4% to $681.5 million. As a result,

our high-margin parts and service business revenue increased 17.7%

to $519.6 million. One of our key priorities remains providing our

customers with best-in-class support to keep their fleets and job

sites running with as little down time as possible. Thus, we

continued to expand our field service population, ending the year

with more than 1,300 skilled technicians, which represents nearly

half of our 3,000 employees. Overall, we achieved record results in

2023.”

Mr. Greenawalt continued, “Our diversified

growth strategy continues to prove very successful. During the

year, we achieved organic revenues growth of 12.3% by increasing

our market share, expanding our product portfolio, investing in

rental fleet and entering new territories. The 16 acquisitions

we have completed since going public in 2020 are also major

contributors to our success, providing $537 million in revenues and

$65 million in Adjusted EBITDA. We are continuing to pursue

accretive acquisitions opportunities which would further expand the

scale and scope of product offerings for our customers. Of course,

our success would not be possible without the solid execution by

our dedicated team at Alta.”

In conclusion, Mr. Greenawalt commented, “Our

outlook for 2024 is positive as industry indicators support our

expectations for continued growth this year. Non-residential

construction starts are forecast to increase compared to 2023. The

material handling industry is forecasting another year of strong

lift truck deliveries that is likely to resemble, if not exceed,

the record year of lift truck deliveries in 2023. Additionally,

state DOT 2024 fiscal year budgets are more than 10% higher than

last year. And importantly, the sentiment from our customers is

consistent with strength we experienced in 2023. Finally, we are

very focused on continued growth and operating leverage in 2024

with the end goal of improving shareholder value.”

Full Year 2024 Financial Guidance and

Other Financial Notes:

- The Company released

its 2024 guidance range and expects to report Adjusted EBITDA

between $207.5 million and $217.5 million for the 2024 fiscal

year.

|

CONSOLIDATED RESULTS OF OPERATIONS(amounts

in millions unless otherwise noted) |

|

|

|

|

Three Months Ended December 31, |

|

|

Increase (Decrease) |

|

|

|

2023 |

|

|

2022 |

|

|

2023 versus 2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

$ |

298.1 |

|

|

$ |

238.2 |

|

|

$ |

59.9 |

|

|

|

25.1 |

% |

|

Parts sales |

|

69.1 |

|

|

|

61.3 |

|

|

|

7.8 |

|

|

|

12.7 |

% |

|

Service revenues |

|

60.8 |

|

|

|

52.4 |

|

|

|

8.4 |

|

|

|

16.0 |

% |

|

Rental revenues |

|

55.3 |

|

|

|

48.6 |

|

|

|

6.7 |

|

|

|

13.8 |

% |

|

Rental equipment sales |

|

38.2 |

|

|

|

28.1 |

|

|

|

10.1 |

|

|

|

35.9 |

% |

|

Total revenues |

|

521.5 |

|

|

|

428.6 |

|

|

|

92.9 |

|

|

|

21.7 |

% |

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

|

252.3 |

|

|

|

200.6 |

|

|

|

51.7 |

|

|

|

25.8 |

% |

|

Parts sales |

|

45.0 |

|

|

|

40.7 |

|

|

|

4.3 |

|

|

|

10.6 |

% |

|

Service revenues |

|

26.4 |

|

|

|

24.4 |

|

|

|

2.0 |

|

|

|

8.2 |

% |

|

Rental revenues |

|

6.8 |

|

|

|

5.7 |

|

|

|

1.1 |

|

|

|

19.3 |

% |

|

Rental depreciation |

|

30.0 |

|

|

|

26.0 |

|

|

|

4.0 |

|

|

|

15.4 |

% |

|

Rental equipment sales |

|

28.0 |

|

|

|

20.4 |

|

|

|

7.6 |

|

|

|

37.3 |

% |

|

Total cost of revenues |

|

388.5 |

|

|

|

317.8 |

|

|

|

70.7 |

|

|

|

22.2 |

% |

|

Gross profit |

|

133.0 |

|

|

|

110.8 |

|

|

|

22.2 |

|

|

|

20.0 |

% |

| General

and administrative expenses |

|

114.3 |

|

|

|

96.4 |

|

|

|

17.9 |

|

|

|

18.6 |

% |

| Non-rental depreciation and

amortization |

|

6.5 |

|

|

|

4.9 |

|

|

|

1.6 |

|

|

|

32.7 |

% |

|

Total operating expenses |

|

120.8 |

|

|

|

101.3 |

|

|

|

19.5 |

|

|

|

19.2 |

% |

|

Income from operations |

|

12.2 |

|

|

|

9.5 |

|

|

|

2.7 |

|

|

|

28.4 |

% |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, floor plan payable – new equipment |

|

(2.6 |

) |

|

|

(1.1 |

) |

|

|

(1.5 |

) |

|

|

136.4 |

% |

|

Interest expense – other |

|

(13.5 |

) |

|

|

(9.3 |

) |

|

|

(4.2 |

) |

|

|

45.2 |

% |

|

Other income |

|

2.5 |

|

|

|

0.7 |

|

|

|

1.8 |

|

|

|

257.1 |

% |

|

Total other expense, net |

|

(13.6 |

) |

|

|

(9.7 |

) |

|

|

(3.9 |

) |

|

|

40.2 |

% |

|

Loss before taxes |

|

(1.4 |

) |

|

|

(0.2 |

) |

|

|

(1.2 |

) |

|

|

600.0 |

% |

| Income

tax provision |

|

0.5 |

|

|

|

0.5 |

|

|

|

0.0 |

|

|

|

— |

|

|

Net loss |

|

(1.9 |

) |

|

|

(0.7 |

) |

|

|

(1.2 |

) |

|

|

171.4 |

% |

|

Preferred stock dividends |

|

(0.8 |

) |

|

|

(0.8 |

) |

|

|

— |

|

|

|

— |

|

|

Net loss available to common stockholders |

$ |

(2.7 |

) |

|

$ |

(1.5 |

) |

|

$ |

(1.2 |

) |

|

|

80.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

Increase (Decrease) |

|

|

|

2023 |

|

|

2022 |

|

|

2023 versus 2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

$ |

1,025.9 |

|

|

$ |

817.2 |

|

|

$ |

208.7 |

|

|

|

25.5 |

% |

|

Parts sales |

|

278.3 |

|

|

|

234.8 |

|

|

|

43.5 |

|

|

|

18.5 |

% |

|

Service revenues |

|

241.3 |

|

|

|

206.6 |

|

|

|

34.7 |

|

|

|

16.8 |

% |

|

Rental revenues |

|

202.4 |

|

|

|

180.1 |

|

|

|

22.3 |

|

|

|

12.4 |

% |

|

Rental equipment sales |

|

128.9 |

|

|

|

133.1 |

|

|

|

(4.2 |

) |

|

|

(3.2 |

)% |

|

Total revenues |

|

1,876.8 |

|

|

|

1,571.8 |

|

|

|

305.0 |

|

|

|

19.4 |

% |

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

New and used equipment sales |

|

853.6 |

|

|

|

683.2 |

|

|

|

170.4 |

|

|

|

24.9 |

% |

|

Parts sales |

|

183.2 |

|

|

|

157.4 |

|

|

|

25.8 |

|

|

|

16.4 |

% |

|

Service revenues |

|

103.4 |

|

|

|

90.7 |

|

|

|

12.7 |

|

|

|

14.0 |

% |

|

Rental revenues |

|

24.8 |

|

|

|

22.4 |

|

|

|

2.4 |

|

|

|

10.7 |

% |

|

Rental depreciation |

|

110.1 |

|

|

|

95.5 |

|

|

|

14.6 |

|

|

|

15.3 |

% |

|

Rental equipment sales |

|

94.5 |

|

|

|

103.0 |

|

|

|

(8.5 |

) |

|

|

(8.3 |

)% |

|

Total cost of revenues |

|

1,369.6 |

|

|

|

1,152.2 |

|

|

|

217.4 |

|

|

|

18.9 |

% |

|

Gross profit |

|

507.2 |

|

|

|

419.6 |

|

|

|

87.6 |

|

|

|

20.9 |

% |

| General

and administrative expenses |

|

430.3 |

|

|

|

362.3 |

|

|

|

68.0 |

|

|

|

18.8 |

% |

| Non-rental depreciation and

amortization |

|

22.5 |

|

|

|

16.5 |

|

|

|

6.0 |

|

|

|

36.4 |

% |

|

Total operating expenses |

|

452.8 |

|

|

|

378.8 |

|

|

|

74.0 |

|

|

|

19.5 |

% |

|

Income from operations |

|

54.4 |

|

|

|

40.8 |

|

|

|

13.6 |

|

|

|

33.3 |

% |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, floor plan payable – new equipment |

|

(8.4 |

) |

|

|

(2.7 |

) |

|

|

(5.7 |

) |

|

|

211.1 |

% |

|

Interest expense – other |

|

(48.6 |

) |

|

|

(29.1 |

) |

|

|

(19.5 |

) |

|

|

67.0 |

% |

|

Other income |

|

5.1 |

|

|

|

1.6 |

|

|

|

3.5 |

|

|

|

218.8 |

% |

|

Total other expense, net |

|

(51.9 |

) |

|

|

(30.2 |

) |

|

|

(21.7 |

) |

|

|

71.9 |

% |

|

Income before taxes |

|

2.5 |

|

|

|

10.6 |

|

|

|

(8.1 |

) |

|

|

(76.4 |

)% |

| Income

tax (benefit) provision |

|

(6.4 |

) |

|

|

1.3 |

|

|

|

(7.7 |

) |

|

NM |

|

|

Net income |

|

8.9 |

|

|

|

9.3 |

|

|

|

(0.4 |

) |

|

|

(4.3 |

)% |

|

Preferred stock dividends |

|

(3.0 |

) |

|

|

(3.0 |

) |

|

|

— |

|

|

|

— |

|

|

Net income available to common stockholders |

$ |

5.9 |

|

|

$ |

6.3 |

|

|

$ |

(0.4 |

) |

|

|

(6.3 |

)% |

NM - calculated change not meaningful

Conference Call Information:

Alta management will host a conference call and

webcast today at 5:00 p.m. Eastern Time today to discuss and answer

questions about the Company’s financial results for the fourth

quarter and full year ended December 31, 2023. Additionally,

supplementary presentation slides will be accessible on the

“Investor Relations” section of the Company’s website at

https://investors.altaequipment.com.

Conference Call Details:

| What: |

Alta Equipment Group Fourth

Quarter and Full Year 2023 Earnings Call and Webcast |

| Date: |

Thursday, March 14, 2024 |

| Time: |

5:00 p.m. Eastern Time |

| Live call: |

(833) 470-1428 |

| International: |

https://www.netroadshow.com/events/global-numbers?confId=60369 |

| Live call access code: |

570209 |

| Audio replay: |

866-813-9403 |

| Replay access code: |

468917 |

| Webcast: |

https://events.q4inc.com/attendee/783403425 |

The audio replay will be archived through March 28, 2024.

About Alta Equipment Group Inc.

Alta owns and operates one of the largest

integrated equipment dealership platforms in North America. Through

our branch network, we sell, rent, and provide parts and service

support for several categories of specialized equipment, including

lift trucks and other material handling equipment, heavy and

compact earthmoving equipment, crushing and screening equipment,

environmental processing equipment, cranes and aerial work

platforms, paving and asphalt equipment, other construction

equipment and allied products. Alta has operated as an equipment

dealership for 39 years and has developed a branch network that

includes over 80 total locations across Michigan, Illinois,

Indiana, Ohio, Pennsylvania, Massachusetts, Maine, Connecticut, New

Hampshire, Vermont, Rhode Island, New York, Virginia, Nevada and

Florida and the Canadian provinces of Ontario and Quebec. Alta

offers its customers a one-stop-shop for their equipment needs

through its broad, industry-leading product portfolio. More

information can be found at www.altg.com.

Forward Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Alta’s actual results may

differ from their expectations, estimates and projections and

consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “continue,” and similar expressions are

intended to identify such forward-looking statements. These

forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Most of these factors are

outside Alta’s control and are difficult to predict. Factors that

may cause such differences include, but are not limited to: supply

chain disruptions, inflationary pressures resulting from supply

chain disruptions or a tightening labor market; negative impacts on

customer payment policies and adverse banking and governmental

regulations, resulting in a potential reduction to the fair value

of our assets; the performance and financial viability of key

suppliers, contractors, customers, and financing sources; economic,

industry, business and political conditions including their effects

on governmental policy and government actions that disrupt our

supply chain or sales channels; fluctuations in interest rates; the

market price for our equipment; collective bargaining agreements

and our relationship with our union-represented employees; our

success in identifying acquisition targets and integrating

acquisitions; our success in expanding into and doing business in

additional markets; our ability to raise capital at favorable

terms; the competitive environment for our products and services;

our ability to continue to innovate and develop new business lines;

our ability to attract and retain key personnel, including, but not

limited to, skilled technicians; our ability to maintain our

listing on the New York Stock Exchange; the impact of cyber or

other security threats or other disruptions to our businesses; our

ability to realize the anticipated benefits of acquisitions or

divestitures, rental fleet and other organic investments or

internal reorganizations; federal, state, and local government

budget uncertainty, especially as it relates to infrastructure

projects and taxation; currency risks and other risks associated

with international operations; and other risks and uncertainties

identified in this presentation or indicated from time to time in

the section entitled “Risk Factors” in Alta’s annual report on Form

10-K and other filings with the U.S. Securities and Exchange

Commission. Alta cautions that the foregoing list of factors is not

exclusive, and readers should not place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Alta does not undertake or accept any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change

in events, conditions, or circumstances on which any such statement

is based.

*Use of Non-GAAP Financial

Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

accounting principles generally accepted in the United States

(“GAAP”), we disclose non-GAAP financial measures, including

Adjusted EBITDA, Adjusted total net debt and floor plan payables,

Adjusted net income, and Adjusted basic and diluted net income per

share, in this press release because we believe they are useful

performance measures that assist in an effective evaluation of our

operating performance when compared to our peers, without regard to

financing methods or capital structure. We believe such measures

are useful for investors and others in understanding and evaluating

our operating results in the same manner as our management.

However, such measures are not financial measures calculated in

accordance with GAAP and should not be considered as a substitute

for, or in isolation from, net income, revenues, operating profit,

debt, or any other operating performance measures calculated in

accordance with GAAP.

We define Adjusted EBITDA as net income before

interest expense (not including floorplan interest paid on new

equipment), income taxes, depreciation and amortization,

adjustments for certain one-time or non-recurring items and other

adjustments. We exclude these items from net income in arriving at

Adjusted EBITDA because these amounts are either non-recurring or

can vary substantially within the industry depending upon

accounting methods and book values of assets, capital structures

and the method by which the assets were acquired. Management uses

Adjusted total net debt and floor plan payables to reflect the

Company's estimated financial obligations less cash and floor plan

payables on new equipment ("FPNP"). The FPNP is used to finance the

Company's new inventory, with its principal balance changing daily

as equipment is purchased and sold and the sale proceeds are used

to repay the notes. Consequently, in managing the business,

management views the FPNP as interest bearing accounts payable,

representing the cost of acquiring the equipment that is then

repaid when the equipment is sold, as the Company's floor plan

credit agreements require repayment when such pieces of equipment

are sold. The Company believes excluding the FPNP from the

Company's total debt for this purpose provides management with

supplemental information regarding the Company's capital structure

and leverage profile and assists investors in performing analysis

that is consistent with financial models developed by Company

management and research analysts. Adjusted total net debt and floor

plan payables should be considered in addition to, and not as a

substitute for, the Company's debt obligations, as reported in the

Company's Consolidated Balance Sheets in accordance with U.S. GAAP.

Adjusted net income is defined as net income adjusted to reflect

certain one-time or non-recurring items and other adjustments.

Adjusted basic and diluted net income per share is defined as

adjusted net income divided by the weighted average number of basic

and diluted shares, respectively, outstanding during the period.

Certain items excluded from Adjusted EBITDA, Adjusted total net

debt and floor plan payables, Adjusted net income, Adjusted basic

and diluted net income per share are significant components in

understanding and assessing a company’s financial performance. For

example, items such as a company’s cost of capital and tax

structure, certain one-time or non-recurring items as well as the

historic costs of depreciable assets, are not reflected in Adjusted

EBITDA or Adjusted net income. Our presentation of Adjusted EBITDA,

Adjusted total net debt and floor plan payables, Adjusted net

income, Adjusted basic and diluted net income per share should not

be construed as an indication that results will be unaffected by

the items excluded from these metrics. Our computation of Adjusted

EBITDA, Adjusted total net debt and floor plan payables, Adjusted

net income, Adjusted basic and diluted net income per share may not

be identical to other similarly titled measures of other companies.

For a reconciliation of non-GAAP measures to their most comparable

measures under GAAP, please see the table entitled “Reconciliation

of Non-GAAP Financial Measures” at the end of this press

release.

Contacts

Investors:Kevin IndaSCR

Partners, LLCkevin@scr-ir.com(225) 772-0254

Media:Glenn MooreAlta Equipment

Group, LLCglenn.moore@altg.com(248) 305-2134

|

CONSOLIDATED BALANCE SHEETS(in millions,

except share and per share amounts) |

| |

| |

|

December 31,2023 |

|

|

December 31,2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

31.0 |

|

|

$ |

2.7 |

|

|

Accounts receivable, net of allowances of $12.4 and $13.0 as of

December 31, 2023 and 2022, respectively |

|

|

249.3 |

|

|

|

232.8 |

|

|

Inventories, net |

|

|

530.7 |

|

|

|

399.7 |

|

|

Prepaid expenses and other current assets |

|

|

27.0 |

|

|

|

28.1 |

|

|

Total current assets |

|

|

838.0 |

|

|

|

663.3 |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

Property and equipment, net |

|

|

464.8 |

|

|

|

377.8 |

|

|

Operating lease right-of-use assets, net |

|

|

110.9 |

|

|

|

113.6 |

|

|

Goodwill |

|

|

76.7 |

|

|

|

69.2 |

|

|

Other intangible assets, net |

|

|

66.3 |

|

|

|

60.7 |

|

|

Other assets |

|

|

14.2 |

|

|

|

6.0 |

|

|

TOTAL ASSETS |

|

$ |

1,570.9 |

|

|

$ |

1,290.6 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Floor plan payable – new equipment |

|

$ |

297.8 |

|

|

$ |

211.5 |

|

|

Floor plan payable – used and rental equipment |

|

|

99.5 |

|

|

|

45.3 |

|

|

Current portion of long-term debt |

|

|

7.7 |

|

|

|

4.2 |

|

|

Accounts payable |

|

|

97.0 |

|

|

|

90.8 |

|

|

Customer deposits |

|

|

17.4 |

|

|

|

27.9 |

|

|

Accrued expenses |

|

|

59.7 |

|

|

|

55.1 |

|

|

Current operating lease liabilities |

|

|

15.9 |

|

|

|

14.8 |

|

|

Current deferred revenue |

|

|

16.2 |

|

|

|

14.1 |

|

|

Other current liabilities |

|

|

23.9 |

|

|

|

7.5 |

|

|

Total current liabilities |

|

|

635.1 |

|

|

|

471.2 |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

|

|

|

|

Line of credit, net |

|

|

315.9 |

|

|

|

217.5 |

|

|

Long-term debt, net of current portion |

|

|

312.3 |

|

|

|

311.2 |

|

|

Finance lease obligations, net of current portion |

|

|

31.1 |

|

|

|

15.4 |

|

|

Deferred revenue, net of current portion |

|

|

4.2 |

|

|

|

4.9 |

|

|

Guaranteed purchase obligations, net of current portion |

|

|

2.5 |

|

|

|

4.7 |

|

|

Long-term operating lease liabilities, net of current portion |

|

|

99.6 |

|

|

|

101.9 |

|

|

Deferred tax liability |

|

|

7.7 |

|

|

|

6.4 |

|

|

Other liabilities |

|

|

12.8 |

|

|

|

17.6 |

|

|

TOTAL LIABILITIES |

|

|

1,421.2 |

|

|

|

1,150.8 |

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value per share, 1,000,000 shares

authorized, 1,200,000 Depositary Shares representing a 1/1000th

fractional interest in a share of 10% Series A Cumulative Perpetual

Preferred Stock, $0.0001 par value per share, issued and

outstanding at both December 31, 2023 and 2022 |

|

|

— |

|

|

|

— |

|

| Common

stock, $0.0001 par value per share, 200,000,000 shares authorized;

32,369,820 and 32,194,243 issued and outstanding at

December 31, 2023 and 2022, respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

233.8 |

|

|

|

222.8 |

|

| Treasury

stock at cost, 862,182 shares of common stock held at both

December 31, 2023 and 2022 |

|

|

(5.9 |

) |

|

|

(5.9 |

) |

|

Accumulated deficit |

|

|

(76.4 |

) |

|

|

(74.2 |

) |

|

Accumulated other comprehensive loss |

|

|

(1.8 |

) |

|

|

(2.9 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

|

149.7 |

|

|

|

139.8 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

1,570.9 |

|

|

$ |

1,290.6 |

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS(in

millions, except share and per share amounts) |

|

|

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2021 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

New and used equipment sales |

$ |

1,025.9 |

|

|

$ |

817.2 |

|

|

$ |

568.8 |

|

|

Parts sales |

|

278.3 |

|

|

|

234.8 |

|

|

|

178.5 |

|

|

Service revenues |

|

241.3 |

|

|

|

206.6 |

|

|

|

165.5 |

|

|

Rental revenues |

|

202.4 |

|

|

|

180.1 |

|

|

|

155.5 |

|

|

Rental equipment sales |

|

128.9 |

|

|

|

133.1 |

|

|

|

144.5 |

|

|

Total revenues |

|

1,876.8 |

|

|

|

1,571.8 |

|

|

|

1,212.8 |

|

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

New and used equipment sales |

|

853.6 |

|

|

|

683.2 |

|

|

|

478.0 |

|

|

Parts sales |

|

183.2 |

|

|

|

157.4 |

|

|

|

123.4 |

|

|

Service revenues |

|

103.4 |

|

|

|

90.7 |

|

|

|

68.2 |

|

|

Rental revenues |

|

24.8 |

|

|

|

22.4 |

|

|

|

20.6 |

|

|

Rental depreciation |

|

110.1 |

|

|

|

95.5 |

|

|

|

85.3 |

|

|

Rental equipment sales |

|

94.5 |

|

|

|

103.0 |

|

|

|

122.9 |

|

|

Total cost of revenues |

|

1,369.6 |

|

|

|

1,152.2 |

|

|

|

898.4 |

|

|

Gross profit |

|

507.2 |

|

|

|

419.6 |

|

|

|

314.4 |

|

| General

and administrative expenses |

|

430.3 |

|

|

|

362.3 |

|

|

|

285.9 |

|

|

Non-rental depreciation and amortization |

|

22.5 |

|

|

|

16.5 |

|

|

|

10.5 |

|

|

Total operating expenses |

|

452.8 |

|

|

|

378.8 |

|

|

|

296.4 |

|

|

Income from operations |

|

54.4 |

|

|

|

40.8 |

|

|

|

18.0 |

|

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

Interest expense, floor plan payable – new equipment |

|

(8.4 |

) |

|

|

(2.7 |

) |

|

|

(1.7 |

) |

|

Interest expense – other |

|

(48.6 |

) |

|

|

(29.1 |

) |

|

|

(22.3 |

) |

|

Other income |

|

5.1 |

|

|

|

1.6 |

|

|

|

0.7 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(11.9 |

) |

|

Total other expense, net |

|

(51.9 |

) |

|

|

(30.2 |

) |

|

|

(35.2 |

) |

|

Income (loss) before taxes |

|

2.5 |

|

|

|

10.6 |

|

|

|

(17.2 |

) |

| Income

tax (benefit) provision |

|

(6.4 |

) |

|

|

1.3 |

|

|

|

3.6 |

|

|

Net income (loss) |

|

8.9 |

|

|

|

9.3 |

|

|

|

(20.8 |

) |

|

Preferred stock dividends |

|

(3.0 |

) |

|

|

(3.0 |

) |

|

|

(2.6 |

) |

|

Net income (loss) available to common

stockholders |

$ |

5.9 |

|

|

$ |

6.3 |

|

|

$ |

(23.4 |

) |

|

Basic income (loss) per share |

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

(0.74 |

) |

|

Diluted income (loss) per share |

$ |

0.18 |

|

|

$ |

0.20 |

|

|

$ |

(0.74 |

) |

|

Basic weighted average common shares

outstanding |

|

32,447,754 |

|

|

|

32,099,247 |

|

|

|

31,706,329 |

|

|

Diluted weighted average common shares

outstanding |

|

32,877,507 |

|

|

|

32,301,663 |

|

|

|

31,706,329 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS(in

millions) |

|

|

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2021 |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

8.9 |

|

|

$ |

9.3 |

|

|

$ |

(20.8 |

) |

|

Adjustments to reconcile net income to net cash flows used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

132.6 |

|

|

|

112.0 |

|

|

|

95.8 |

|

|

Amortization of debt discount and debt issuance costs |

|

2.0 |

|

|

|

1.8 |

|

|

|

2.0 |

|

|

Imputed interest |

|

1.0 |

|

|

|

0.3 |

|

|

|

0.2 |

|

|

Loss (gain) on sale of property and equipment |

|

0.2 |

|

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

Gain on sale of rental equipment |

|

(34.4 |

) |

|

|

(30.1 |

) |

|

|

(21.6 |

) |

|

Provision for inventory obsolescence |

|

2.2 |

|

|

|

1.4 |

|

|

|

0.9 |

|

|

Provision for losses on accounts receivable |

|

7.2 |

|

|

|

5.0 |

|

|

|

4.2 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

11.9 |

|

|

Change in fair value of derivative instruments |

|

(0.6 |

) |

|

|

— |

|

|

|

— |

|

|

Stock-based compensation expense |

|

4.3 |

|

|

|

2.7 |

|

|

|

1.2 |

|

|

Gain on bargain purchase of business |

|

(1.5 |

) |

|

|

— |

|

|

|

— |

|

|

Changes in deferred income taxes |

|

(10.1 |

) |

|

|

(1.2 |

) |

|

|

3.6 |

|

|

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

(16.6 |

) |

|

|

(34.7 |

) |

|

|

(40.7 |

) |

|

Inventories |

|

(286.3 |

) |

|

|

(272.6 |

) |

|

|

(154.1 |

) |

|

Proceeds from sale of rental equipment |

|

128.9 |

|

|

|

133.1 |

|

|

|

144.5 |

|

|

Prepaid expenses and other assets |

|

0.5 |

|

|

|

(4.1 |

) |

|

|

(10.7 |

) |

|

Manufacturers floor plans payable |

|

122.5 |

|

|

|

77.3 |

|

|

|

(14.6 |

) |

|

Accounts payable, accrued expenses, customer deposits, and other

current liabilities |

|

7.3 |

|

|

|

26.7 |

|

|

|

30.2 |

|

|

Leases, deferred revenue, net of current portion and other

liabilities |

|

(4.3 |

) |

|

|

(0.7 |

) |

|

|

(1.2 |

) |

|

Net cash provided by operating activities |

|

63.8 |

|

|

|

26.0 |

|

|

|

30.7 |

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Expenditures for rental equipment |

|

(62.2 |

) |

|

|

(63.9 |

) |

|

|

(42.3 |

) |

|

Expenditures for property and equipment |

|

(12.4 |

) |

|

|

(12.8 |

) |

|

|

(8.1 |

) |

|

Proceeds from sale of property and equipment |

|

0.5 |

|

|

|

1.2 |

|

|

|

2.3 |

|

|

Guaranteed purchase obligations expenditures |

|

(3.1 |

) |

|

|

(0.4 |

) |

|

|

(1.9 |

) |

|

Expenditures for acquisitions, net of cash acquired |

|

(45.6 |

) |

|

|

(86.7 |

) |

|

|

(63.4 |

) |

|

Net cash used in investing activities |

|

(122.8 |

) |

|

|

(162.6 |

) |

|

|

(113.4 |

) |

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Expenditures for debt issuance costs |

|

— |

|

|

|

— |

|

|

|

(1.7 |

) |

|

Extinguishment of long-term debt |

|

— |

|

|

|

— |

|

|

|

(153.1 |

) |

|

Proceeds from line of credit and long-term borrowings |

|

379.6 |

|

|

|

413.2 |

|

|

|

633.2 |

|

|

Principal payments on line of credit, long-term debt, and finance

lease obligations |

|

(288.3 |

) |

|

|

(298.3 |

) |

|

|

(386.2 |

) |

|

Proceeds from non-manufacturer floor plan payable |

|

188.4 |

|

|

|

149.9 |

|

|

|

105.3 |

|

|

Payments on non-manufacturer floor plan payable |

|

(179.7 |

) |

|

|

(121.9 |

) |

|

|

(110.1 |

) |

|

Preferred stock dividends paid |

|

(3.0 |

) |

|

|

(3.0 |

) |

|

|

(2.6 |

) |

|

Common stock dividends declared and paid |

|

(7.6 |

) |

|

|

(3.7 |

) |

|

|

— |

|

|

Other financing activities |

|

(2.1 |

) |

|

|

0.7 |

|

|

|

(1.0 |

) |

|

Net cash provided by financing activities |

|

87.3 |

|

|

|

136.9 |

|

|

|

83.8 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

NET CHANGE IN CASH |

|

28.3 |

|

|

|

0.4 |

|

|

|

1.1 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash, Beginning of year |

|

2.7 |

|

|

|

2.3 |

|

|

|

1.2 |

|

|

Cash, End of period |

$ |

31.0 |

|

|

$ |

2.7 |

|

|

$ |

2.3 |

|

| Supplemental schedule

of noncash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Noncash asset purchases: |

|

|

|

|

|

|

|

|

|

Net transfer of assets from inventory to rental fleet within

property and equipment |

$ |

180.2 |

|

|

$ |

122.9 |

|

|

$ |

165.3 |

|

|

Common stock as consideration for business acquisition |

|

6.3 |

|

|

|

2.7 |

|

|

|

— |

|

|

Contingent and non-contingent consideration for business

acquisitions |

|

2.0 |

|

|

|

12.7 |

|

|

|

0.9 |

|

|

Supplemental disclosures of cash flow

information |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

$ |

53.6 |

|

|

$ |

28.0 |

|

|

$ |

20.2 |

|

|

Cash paid for income taxes |

$ |

5.7 |

|

|

$ |

1.0 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(in millions, except share and per share

amounts) |

|

|

|

|

December 31, |

|

|

December 31, |

|

| Debt and Floor Plan

Payables Analysis |

2023 |

|

|

2022 |

|

|

Senior secured second lien notes |

$ |

315.0 |

|

|

$ |

315.0 |

|

| Line of

credit |

|

317.5 |

|

|

|

219.5 |

|

| Floor

plan payable – new equipment |

|

297.8 |

|

|

|

211.5 |

|

| Floor

plan payable – used and rental equipment |

|

99.5 |

|

|

|

45.3 |

|

| Finance

lease obligations |

|

38.8 |

|

|

|

19.6 |

|

|

Total debt |

|

1,068.6 |

|

|

|

810.9 |

|

|

Adjustments: |

|

|

|

|

|

| Floor

plan payable – new equipment |

|

(297.8 |

) |

|

|

(211.5 |

) |

|

Cash |

|

(31.0 |

) |

|

|

(2.7 |

) |

|

Adjusted total net debt and floor plan

payables(1) |

$ |

739.8 |

|

|

$ |

596.7 |

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net (loss) income available to common

stockholders |

$ |

(2.7 |

) |

|

$ |

(1.5 |

) |

|

$ |

5.9 |

|

|

$ |

6.3 |

|

|

Depreciation and amortization |

|

36.5 |

|

|

|

30.9 |

|

|

|

132.6 |

|

|

|

112.0 |

|

| Interest

expense |

|

16.1 |

|

|

|

10.4 |

|

|

|

57.0 |

|

|

|

31.8 |

|

| Income

tax provision (benefit) |

|

0.5 |

|

|

|

0.5 |

|

|

|

(6.4 |

) |

|

|

1.3 |

|

|

EBITDA(1) |

$ |

50.4 |

|

|

$ |

40.3 |

|

|

$ |

189.1 |

|

|

|

151.4 |

|

|

Transaction costs(2) |

|

0.6 |

|

|

|

0.9 |

|

|

|

1.6 |

|

|

|

1.2 |

|

| Non-cash

adjustments(3) |

|

(1.5 |

) |

|

|

— |

|

|

|

(1.5 |

) |

|

|

— |

|

|

Stock-based incentives(4) |

|

1.0 |

|

|

|

0.8 |

|

|

|

4.3 |

|

|

|

2.7 |

|

| Other

expenses(5) |

|

1.0 |

|

|

|

1.0 |

|

|

|

3.3 |

|

|

|

2.5 |

|

|

Preferred stock dividend(6) |

|

0.8 |

|

|

|

0.8 |

|

|

|

3.0 |

|

|

|

3.0 |

|

|

Showroom-ready equipment interest expense(7) |

|

(2.6 |

) |

|

|

(1.1 |

) |

|

|

(8.4 |

) |

|

|

(2.7 |

) |

|

Adjusted EBITDA(1) |

$ |

49.7 |

|

|

$ |

42.7 |

|

|

$ |

191.4 |

|

|

$ |

158.1 |

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net (loss) income available to common

stockholders |

$ |

(2.7 |

) |

|

$ |

(1.5 |

) |

|

$ |

5.9 |

|

|

$ |

6.3 |

|

|

Transaction costs(2) |

|

0.6 |

|

|

|

0.9 |

|

|

|

1.6 |

|

|

|

1.2 |

|

| Non-cash

adjustments(3) |

|

(1.5 |

) |

|

|

— |

|

|

|

(1.5 |

) |

|

|

— |

|

|

Intangible amortization(8) |

|

2.5 |

|

|

|

1.9 |

|

|

|

8.9 |

|

|

|

5.9 |

|

|

Stock-based incentives(4) |

|

1.0 |

|

|

|

0.8 |

|

|

|

4.3 |

|

|

|

2.7 |

|

| Other

expenses(5) |

|

1.0 |

|

|

|

1.0 |

|

|

|

3.3 |

|

|

|

2.5 |

|

|

Adjusted net income available to common

stockholders(1) |

$ |

0.9 |

|

|

$ |

3.1 |

|

|

$ |

22.5 |

|

|

$ |

18.6 |

|

|

Basic net (loss) income per share |

$ |

(0.08 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.18 |

|

|

$ |

0.20 |

|

|

Diluted net (loss) income per share |

$ |

(0.08 |

) |

|

$ |

(0.05 |

) |

|

$ |

0.18 |

|

|

$ |

0.20 |

|

|

Adjusted basic net income per

share(1) |

$ |

0.03 |

|

|

$ |

0.10 |

|

|

$ |

0.69 |

|

|

$ |

0.58 |

|

|

Adjusted diluted net income per

share(1) |

$ |

0.03 |

|

|

$ |

0.10 |

|

|

$ |

0.68 |

|

|

$ |

0.58 |

|

|

Basic weighted average common shares

outstanding |

|

32,498,618 |

|

|

|

32,122,673 |

|

|

|

32,447,754 |

|

|

|

32,099,247 |

|

|

Diluted weighted average common shares

outstanding |

|

33,285,422 |

|

|

|

32,336,014 |

|

|

|

32,877,507 |

|

|

|

32,301,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Non-GAAP measure(2) Expenses related to

acquisition, capital raising and debt refinancing activities(3)

Bargain purchase gain on acquisition(4) Non-cash equity-based

compensation expenses(5) Other non-recurring expenses inclusive of

severance payments, greenfield startup, legal and consulting costs,

and non-cash adjustments to earnout contingencies(6) Expenses

related to preferred stock dividend payments(7) Interest expense

associated with showroom-ready new equipment interest included in

total interest expense above(8) Incremental expense associated with

the amortization of other intangible assets relating to acquisition

accounting

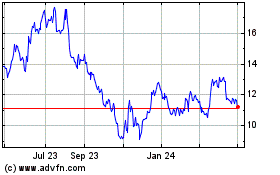

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

From Dec 2024 to Jan 2025

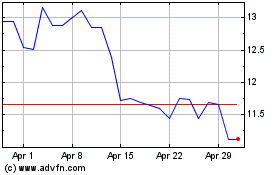

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

From Jan 2024 to Jan 2025