Wisconsin Energy Beats Earnings Est. - Analyst Blog

April 30 2013 - 12:50PM

Zacks

Wisconsin Energy

Corporation (WEC) posted first-quarter 2013 net operating

earnings of 76 cents per share, beating the Zacks Consensus

Estimate by 5 cents. The 2 cent year-over-year rise in

earnings was primarily driven by higher earnings at the company’s

We Power operations, positive impacts from the share repurchase

program, and increase in electricity consumption by the

residential, small commercial as well as industrial customers.

Total Revenue

Wisconsin Energy reported total revenue of $1,275.2 million,

beating the Zacks Consensus Estimate by $25.2 million. On a

year-over-year basis, revenues increased 7.1% on higher demand for

natural gas in winter.

First-Quarter Operational Update

Total operating expenses increased 6.6% year over year to $954.2

million due to a rise in cost of goods sold, and higher fuel and

purchased power costs, other operation and maintenance costs and

depreciation and amortization expenses.

However, this increase in operating expenses was more than offset

by higher revenues. Operating margin was 25.2% compared with 24.8%

a year-ago.

Financials

Cash and cash equivalents as of Mar 31, 2013 were $24.7 million

versus $35.6 million as of Dec 31, 2012.

Long-term debt decreased to $4.4 billion as of Mar 31, 2013 from

$4.5 billion as of Dec 31, 2012.

Cash from operating activities during the first three months of

2013 was $330.3 million versus $340.5 million in the year-ago

comparable period.

Capital expenditures were $133.6 million, down from $142.3 million

incurred in the prior-year quarter.

Guidance

Wisconsin Energy reaffirmed its earnings guidance for 2013 at $2.38

to $2.48 per share.

Other Company Releases

Brookfield Infrastructure Partners L.P. (BIP) is

slated to release its first quarter earnings on May 2. The Zacks

Consensus Estimate is 84 cents per share.

Calpine Corp. (CPN) is slated to release its first

quarter earnings on May 2. The Zacks Consensus Estimate is a loss

of 6 cents per share.

ALLETE Inc. (ALE) is slated to release its first

quarter earnings on May 8. The Zacks Consensus Estimate is 75 cents

per share.

Our Take

Not only did Wisconsin Energy outperform earnings and revenues, it

also enjoyed a rise in consumption of electricity by residential,

and small commercial and industrial customers in the first quarter.

In addition, it served 3,000 electricity and 6,000 natural gas

additional customers at the end of the quarter against the year-ago

quarter.

Moreover, we expect Wisconsin Energy’s ‘Power the Future’ plan, and

its internal growth projects including a biomass plant in

Rothschild to act as catalysts for its future performance.

Wisconsin Energy Corporation currently has a Zacks Rank #3

(Hold).

Milwaukee, Wis.-based Wisconsin Energy Corporation generates and

distributes electricity in Southeastern, East Central, and Northern

Wisconsin, as well as in the Upper Peninsula of Michigan. The

company also distributes natural gas.

ALLETE INC (ALE): Free Stock Analysis Report

BROOKFIELD INFR (BIP): Free Stock Analysis Report

CALPINE CORP (CPN): Free Stock Analysis Report

WISC ENERGY CP (WEC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

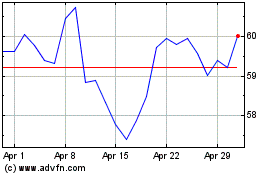

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2023 to Jul 2024