ALLETE (NYSE:ALE) today reported third quarter 2010 earnings of

56 cents per share on net income of $19.6 million and revenue of

$224.1 million.

In the third quarter of 2009, company earnings were 49 cents per

share and net income was $16 million on revenue of $178.8 million.

Higher industrial sales were a primary reason for the 23 percent

year-over-year increase in net income.

“We’re pleased with these financial results,” said ALLETE CEO

and President Alan R. Hodnik. “And we are particularly pleased that

economic improvement was seen by customers in our service territory

compared to what was experienced a year ago.”

Quarterly net income in ALLETE’s Regulated Operations

segment improved from $16.6 million in 2009 to $22.1 million in

2010, due to a number of factors. The combination of higher rates

and electric sales were partially offset by significant increases

in operating, interest and depreciation expenses.

The Investments and Other segment recorded a quarterly

net loss of $2.5 million versus a net loss of $600,000 in the same

period a year ago. Higher operating expenses were a primary

contributor to the period over period decrease.

An increase in the average number of common shares outstanding,

with issuance proceeds used to fund the capital expenditure

program, had a dilutive impact of four cents per share for the

quarter.

Hodnik said he expects ALLETE to finish 2010 by recording

earnings in a range between $2.25 and $2.35 per share, excluding

the first quarter 12 cent per share non-recurring charge as a

result of the Patient Protection and Affordable Care Act.

ALLETE’s corporate headquarters are located in Duluth,

Minnesota. In addition to its electric utilities, Minnesota Power

in northeast Minnesota and Superior Water, Light & Power Co. in

northwest Wisconsin, ALLETE owns BNI Coal in Center, N.D. and has

an 8 percent equity interest in the American Transmission Co. In

late 2009, it purchased a 465-mile direct current transmission line

between Duluth, Minn. and Center, N.D. to transport renewable wind

energy from its Bison I Wind Energy Center, which is currently

under construction near New Salem, N.D. More information about the

company is available on ALLETE’s Web site at www.allete.com.

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE’s press releases and other communications may include

certain non-Generally Accepted Accounting Principles

(GAAP) financial measures. A “non-GAAP financial measure” is

defined as a numerical measure of a company’s financial

performance, financial position or cash flows that excludes (or

includes) amounts that are included in (or excluded from) the most

directly comparable measure calculated and presented in accordance

with GAAP in the company’s financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE’s

management believes that these non-GAAP financial measures provide

useful information to investors by removing the effect of variances

in GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company’s

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company’s ongoing

financial performance over the periods presented.

ALLETE, Inc.

Consolidated Statement of

Income

For the Periods Ended September 30,

2010 and 2009

Millions Except Per Share Amounts –

Unaudited

Quarter Ended Year to

Date

2010

2009 2010 2009 Operating Revenue

Operating Revenue $ 224.1 $ 178.8 $ 668.9 $ 550.7 Prior Year Rate

Refunds – –

– (7.6 ) Total Operating Revenue

224.1 178.8 668.9

543.1

Operating Expenses Fuel

and Purchased Power 79.0 69.8 233.1 199.4 Operating and Maintenance

89.8 67.5 262.9 224.7 Depreciation 20.0

16.1 59.8 46.8

Total Operating Expenses 188.8

153.4 555.8 470.9

Operating Income 35.3

25.4 113.1 72.2

Other Income (Expense) Interest Expense (9.7 ) (8.3 )

(28.1 ) (25.4 ) Equity Earnings in ATC 4.5 4.4 13.4 12.9 Other

0.6 0.8 3.8

3.8 Total Other Income (Expense)

(4.6 ) (3.1 ) (10.9 )

(8.7 )

Income Before Non-Controlling Interest and

Income Taxes 30.7 22.3 102.2 63.5

Income Tax Expense

11.2 6.5

40.5 21.5

Net Income

19.5 15.8 61.7

42.0 Less: Non-Controlling Interest in

Subsidiaries (0.1 ) (0.2 )

(0.3 ) (0.3 )

Net Income Attributable to

ALLETE $ 19.6 $ 16.0 $ 62.0

$ 42.3

Average Shares of Common

Stock Basic 34.4 32.8 34.1 31.8 Diluted 34.5

32.9 34.2

31.9

Basic Earnings Per Share of Common

Stock $ 0.57 $ 0.49 $ 1.82 $ 1.33

Diluted Earnings Per Share

of Common Stock $ 0.56 $ 0.49

$ 1.81 $ 1.33

Dividends Per Share of

Common Stock $ 0.44 $ 0.44 $

1.32 $ 1.32

Consolidated Balance Sheet

Millions – Unaudited

Sep. 30, Dec. 31,

Sep. 30, Dec. 31,

2010 2009

2010 2009

Assets Liabilities and Equity

Cash and Short-Term Investments

$ 92.3 $ 25.7 Current Liabilities $ 131.0 $ 133.1 Other Current

Assets 201.7 199.8 Long-Term Debt 784.2 695.8 Property, Plant and

Equipment 1,742.6 1,622.7 Other Liabilities 312.8 325.0 Regulatory

Assets 282.5 293.2 Regulatory Liabilities 46.0 47.1 Investment in

ATC 92.0 88.4 Deferred Income Taxes 321.0 253.1 Investments 134.4

130.5 Equity 984.1 939.0 Other 33.6

32.8

Total Assets $ 2,579.1 $ 2,393.1

Total Liabilities and Equity $

2,579.1 $ 2,393.1

Quarter Ended Year to Date September

30, September 30, ALLETE, Inc. 2010

2009 2010 2009 Income (Loss) Millions

Regulated Operations $ 22.1 $ 16.6 $ 65.2 $ 45.0 Investments and

Other (2.5 ) (0.6 )

(3.2 ) (2.7 ) Net Income Attributable to

ALLETE $ 19.6 $ 16.0 $

62.0 $ 42.3

Diluted Earnings Per Share

$ 0.56 $ 0.49 $ 1.81 $ 1.33

Statistical Data

Corporate Common Stock High $ 37.75 $ 34.57 $ 37.87 $ 34.57 Low $

33.16 $ 27.75 $ 29.99 $ 23.35 Close $ 36.43 $ 33.57 $ 36.43 $ 33.57

Book Value $ 27.23 $ 25.95 $ 27.23 $ 25.95

Kilowatt-hours

Sold Millions Regulated Utility Retail and Municipals

Residential 262 240 847 857 Commercial 374 352 1,074 1,061

Municipals 253 243 746 729 Industrial 1,799

984 4,956

3,182 Total Retail and Municipal 2,688 1,819 7,623

5,829 Other Power Suppliers 629

1,051 2,168 3,075

Total Regulated Utility 3,317 2,870 9,791 8,904

Non-regulated Energy Operations 27

56 87 162

Total Kilowatt-hours Sold 3,344

2,926 9,878

9,066

This exhibit has been furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, nor shall it be deemed incorporated by reference in

any filing under the Securities Act of 1933, except as shall be

expressly set forth by specific reference in such filing.

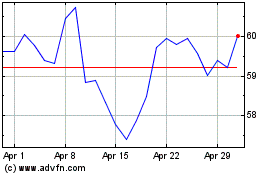

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024