UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☐ |

Definitive Additional Materials |

| |

☒ |

Soliciting Material Under Rule 14a-12 |

| ALCOA CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Persons(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

☐ |

Fee paid previously with preliminary materials: |

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

On June 6, 2024, Alcoa Corporation

(“Alcoa”) filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) to be used

to solicit proxies to approve the issuance of shares of common stock and non-voting convertible preferred stock of Alcoa in connection

with a proposed transaction to acquire all of the shares of Alumina Limited in an all-stock transaction (the “Transaction”)

at a special meeting of its stockholders.

Item 1: On June 18, 2024,

Molly Beerman, Alcoa’s Executive Vice President and Chief Financial Officer, participated in the J.P. Morgan 2024 Energy, Power

and Renewables Conference (the “Conference”). The transcript of the Conference is filed herewith as Exhibit 1.

Caution Concerning Forward-Looking Statements

This communication contains statements that relate to future events

and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include those containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “may,” “outlook,” “potential,”

“plans,” “projects,” “reach,” “seeks,” “sees,” “should,” “strive,”

“targets,” “will,” “working,” “would,” or other words of similar meaning. All statements

by Alcoa Corporation (“Alcoa”) that reflect expectations, assumptions or projections about the future, other than statements

of historical fact, are forward-looking statements, including, without limitation, statements regarding the proposed transaction; the

ability of the parties to complete the proposed transaction; the expected benefits of the proposed transaction, the competitive ability

and position following completion of the proposed transaction; forecasts concerning global demand growth for bauxite, alumina, and aluminum,

and supply/demand balances; statements, projections or forecasts of future or targeted financial results, or operating performance (including

our ability to execute on strategies related to environmental, social and governance matters); statements about strategies, outlook, and

business and financial prospects; and statements about capital allocation and return of capital. These statements reflect beliefs and

assumptions that are based on Alcoa’s perception of historical trends, current conditions, and expected future developments, as

well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of

future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict.

Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can

give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated

by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited

to: (1) the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction;

(2) the prohibition or delay of the consummation of the proposed transaction by a governmental entity; (3) the risk that the proposed

transaction may not be completed in the expected time frame or at all; (4) unexpected costs, charges or expenses resulting from the proposed

transaction; (5) uncertainty of the expected financial performance following completion of the proposed transaction; (6) failure to realize

the anticipated benefits of the proposed transaction; (7) the occurrence of any event that could give rise to termination of the proposed

transaction; (8) potential litigation in connection with the proposed transaction or other settlements or investigations that may affect

the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; (9)

the impact of global economic conditions on the aluminum industry and aluminum end-use markets; (10) volatility and declines in aluminum

and alumina demand and pricing, including global, regional, and product-specific prices, or significant changes in production costs which

are linked to LME or other commodities; (11) the disruption of market-driven balancing of global aluminum supply and demand by non-market

forces; (12) competitive and complex conditions in global markets; (13) our ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (14) rising energy costs and interruptions or uncertainty in energy supplies; (15) unfavorable changes

in the cost, quality, or availability of raw materials or other key inputs, or by disruptions in the supply chain; (16) our ability to

execute on our strategy to be a lower cost, competitive, and integrated aluminum production business and to realize the anticipated benefits

from announced plans, programs, initiatives relating to our portfolio, capital investments, and developing technologies; (17) our ability

to integrate and achieve intended results from joint ventures, other strategic alliances, and strategic business transactions; (18) economic,

political, and social conditions, including the impact of trade policies and adverse industry publicity; (19) fluctuations in foreign

currency exchange rates and interest rates, inflation and other economic factors in the countries in which we operate; (20) changes in

tax laws or exposure to additional tax liabilities; (21) global competition within and beyond the aluminum industry; (22) our ability

to obtain or maintain adequate insurance coverage; (23) disruptions in the global economy caused by ongoing regional conflicts; (24) legal

proceedings, investigations, or changes in foreign and/or U.S. federal, state, or local laws, regulations, or policies; (25) climate change,

climate change legislation or regulations, and efforts to reduce emissions and build operational resilience to extreme weather conditions;

(26) our ability to achieve our strategies or expectations relating to environmental, social, and governance considerations; (27) claims,

costs and liabilities related to health, safety, and environmental laws, regulations, and other requirements, in the jurisdictions in

which we operate; (28) liabilities resulting from impoundment structures, which could impact the environment or cause exposure to hazardous

substances or other damage; (29) our ability to fund capital expenditures; (30) deterioration in our credit profile or increases in interest

rates; (31) restrictions on our current and future operations due to our indebtedness; (32) our ability to continue to return capital

to our stockholders through the payment of cash dividends and/or the repurchase of our common stock; (33) cyber attacks, security breaches,

system failures, software or application vulnerabilities, or other cyber incidents; (34) labor market conditions, union disputes and other

employee relations issues; (35) a decline in the liability discount rate or lower-than-expected investment returns on pension assets;

and (36) the other risk factors discussed in Part I Item 1A of Alcoa’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023 and other reports filed by Alcoa with the SEC. These risks, as well as other risks associated with the proposed transaction,

are more fully discussed in the proxy statement. Alcoa cautions readers not to place undue reliance upon any such forward-looking statements,

which speak only as of the date they are made. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether

in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the

risks described above and other risks in the market. Neither Alcoa nor any other person assumes responsibility for the accuracy and completeness

of any of these forward-looking statements and none of the information contained herein should be regarded as a representation that the

forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell or the

solicitation of an offer to buy or sell any securities. This communication relates to the proposed transaction. On June 6, 2024, Alcoa

filed with the SEC a definitive proxy statement on Schedule 14A (the “Proxy Statement”) in connection with the proposed transaction.

Other documents regarding the proposed transaction may be filed with the SEC. This communication is not a substitute for the Proxy Statement

or any other document that Alcoa may file with the SEC and send to its stockholders in connection with the proposed transaction. The issuance

of the stock consideration in the proposed transaction will be submitted to Alcoa’s stockholders for their consideration. The Proxy

Statement contains important information about Alcoa, the proposed transaction and related matters. Before making any voting decision,

Alcoa’s stockholders should read all relevant documents filed or to be filed with the SEC completely and in their entirety, including

the Proxy Statement, as well as any amendments or supplements to those documents, because they contain or will contain important information

about Alcoa and the proposed transaction. Alcoa’s stockholders will be able to obtain a free copy of the Proxy Statement, as well

as other filings containing information about Alcoa, free of charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement

and other documents filed by Alcoa with the SEC may be obtained, without charge, by contacting Alcoa through its website at https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons related

to Alcoa may be deemed to be participants in the solicitation of proxies from Alcoa’s stockholders in connection with the proposed

transaction. Information about the directors and executive officers of Alcoa and their ownership of common stock of Alcoa is set forth

in the section entitled “Information about our Executive Officers” included in Alcoa’s annual report on Form

10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 21, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm),

in the section entitled “Director Nominees” included in its proxy statement for its 2024 annual meeting of stockholders,

which was filed with the SEC on March 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1675149/000119312524071354/d207257ddef14a.htm),

and in the sections entitled “Security Ownership of Certain Beneficial Owners and Management” and “Interests

of Alcoa Executive Officers and Directors in the Transaction” included in the Proxy Statement, which was filed with the SEC

on June 6, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/1675149/000119312524156116/d827161ddefm14a.htm). Additional

information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description

of their direct and indirect interests, by security holdings or otherwise, will be included in other relevant materials to be filed with

the SEC in connection with the proposed transaction when they become available. Free copies of these documents may be obtained as described

in the preceding paragraph.

Exhibit

1

ALCOA CORPORATION

Alcoa Corporation

delivered at the 2024 Energy, Power & Renewables Conference on Tuesday, June 18, 2024

Seth: [0:01] Hey, good morning,

everyone, and welcome back to the 2024 J.P. Morgan Energy, Power & Renewables Conference. We are very grateful to be hosting Alcoa

this morning. We are joined by Molly Beerman, the company CFO, and we have Jim Dwyer and Yolande Doctor from investor relations here

with us as well.

[0:20] Molly, thanks so much for joining

us. We really appreciate it. Maybe just to kick off, I will go give you a chance to set the scene, maybe for people who are a little

bit less familiar with the story. If you could give us an overview of the business and latest developments.

Molly Beerman: [0:39] Thanks,

Seth, and good morning to everyone. Alcoa is an integrated aluminum company. We have assets in bauxite mining, alumina refining, and

aluminum smelting and casting. Through direct or indirect ownership, we have 27 locations in nine countries.

[0:57] We're organized into two business

segments, alumina and aluminum. Our alumina assets are mostly within our Alcoa World Alumina and Chemicals joint venture, 40 percent

ownership by our partner, Alumina Limited. Those assets include five of the top 20 mines and refineries outside of China.

[1:24] Within aluminum, we're a top

five global producer outside of China. We have a smelting portfolio of energy...I'm sorry. We run our smelting portfolio on 87 percent

renewable energy. Our locations are located near our customer's major markets and our carbon intensity is one third of the industry average.

[1:49] The company has three strategic

priorities. Reduce complexity, that means we simplify the way that we operate and structure the company. We drive returns for our shareholders

continuously looking at our competitive position. We advance sustainably, so both financially and operationally, to ensure we remain

a premier pure play aluminum company well into the future.

[2:18] It's been an action-packed first

half of the year for Alcoa. We announced the acquisition of our 40 percent JV partner, Alumina Limited, and we are heading toward closing

that transaction on or about August 1st. We're also taking actions to improve our portfolio and to improve our profitability.

[2:40] Lastly, we're well positioned

to take advantage of improving markets, both in terms of commodity prices and demand. We will be reporting second quarter earnings coming

up here next month, and we expect to see improved EBITDA performance primarily on higher prices as well as the actions that we're taking.

[3:01] There are two call outs related

to our second quarter earnings. The first is with the high run up in API and the improved EBITDA, we always guide to the alumina costs

within the aluminum segment. Those will be $10 million higher than our prior guidance. Additionally, we're seeing about $10 million of

cost impact related to the ramp down of the Kwinana refinery that is curtailing by the end of June.

[3:33] Lastly, we have about $5 million

in additional energy costs in Spain. All in all, though, we expect to report significantly improved financial results for the second

quarter, and dial in or listen into the earnings call next month. With that, I'll be happy to take your questions, Seth.

Seth: [3:55] Excellent. Thanks

very much. Maybe starting off just at a high level, if you could update us on fundamentals in the aluminum market globally, how things

are going in different regions where inventory levels sit.

Molly: [4:11] Alcoa sees the

overall aluminum market to be in balance right now, but that is subject to the speed of demand recovery outside of China, as well as

expected seasonal curtailments of smelters inside of China. We see demand stabilizing this year with potential for additional recovery

in the second half of the year.

[4:34] Across all of our regions, primarily

North America and Europe, in all of the end sectors, we're seeing anywhere from one to four percent demand growth, with the exception

of european building and construction, that is still hampered by the high interest rates.

[4:52] If you look at Alcoa's value-add

products, again, we're seeing demand growth, primarily transportation and electrical sectors, but do see some recovery in the packaging

sector as well.

[5:07] In terms of supply, there are

not many new projects coming online right now. We had expected the Yunnan smelters to restart in China. They have done so. That added

about 1.2 million metric tons per year, but we still see China staying within their 45 million cap. No signs that they're going to exceed

that yet.

Seth: [5:32] If we turn to the

market for alumina, and maybe you could give us a similar update, including how you talked about our curtailment that's underway at Kwinana

and how that's affecting the supply side of the market.

Molly: [5:51] In alumina, you're

seeing the highest prices since the last two years, and really related to supply concerns. Chinese refineries are curtailing, primarily

due to bauxite shortages as well as environmental issues. We see political instability in Guinea affecting supply.

[6:11] Then in Australia, we have our

Kwinana curtailment going on now, as well as the disruptions in gas supply for the Queensland refineries. All of that is really impacting

alumina price. Recall that alumina is not stored easily, so almost any reaction in the supply shows up in price very quickly.

Seth: [6:35] Excellent. About

a month ago, we saw the copper price, the premium of copper to aluminum, exceed about four times. I know you've talked before about the

potential for substitution at levels above three and a half, I think.

[6:53] I assume that that premium would

have to be maintained for a period of time in order to see that impact. What are your updated thoughts on that topic of the potential

for substitution?

Molly: [7:07] We do see substitution

happening now because really we've been over that 3.5 to one ratio for some time now. The easiest substitution really is in the transmission

line, so your high voltage line where the lightweight aluminum serves it well.

[7:26] Where you'll have difficulty

in substitution is where it's more technical, or they can't accommodate the higher size or dimensions of the aluminum wire and cable.

We're seeing substitution not only in the electrical network, the distribution networks, industrial HVAC, as well as some in auto products.

Seth: [7:54] Great.

Molly: [7:55] I'm just going

to mention one more thing. As we talk to suppliers for both aluminum and copper wire and cable, they report that about 10 to 15 percent

of the products are able to be substituted over time. Remember, sometimes they're being used in very technical applications, so it's

not an easy switch.

[8:18] One additional adder is, if you

look at the analyst estimates for demand growth for the substitution, anywhere from half a million metric tons up to 2 million metric

tons per year by 2030.

Seth: [8:35] Excellent. Maybe

shifting gears a little bit to some of the company's strategic initiatives, can you update us on potential buyers of the San Ciprián

complex? I think in the past you've talked about potentially getting bids sometime in June. What have you seen on that front?

Molly: [8:56] Our San Ciprián,

it's both a smelter and refinery there. That site has built up considerable losses. We are in the process now...really two main work

streams. One is to try to find a viable energy contract for both natural gas for the refinery as well as power for the smelter. Both

of those sites are fully exposed. We cannot run economically without power.

[9:24] In parallel, we are going through

a sale process. At this point we have received letters of interest or bids, and we're working with the potential buyers. I can't say

too much more about that. We're under confidentiality.

[9:39] We have made very clear that

a successful buyer has to have the financial wherewithal as well as the technical capabilities to be able to continue to operate the

site. We are looking for guarantees for both the workers and Alcoa that all of our obligations, current and future, will be covered.

Seth: [10:01] Excellent. Another

topic in terms of financial initiatives. I think you've talked about potentially about $650 million of cost savings that the company

is looking for over the next few years. You talked earlier about taking action to improve profitability.

[10:19] How have the cost savings materialized

year to date versus your expectations. What areas are driving most of the cost savings right now? Where is there still room to accelerate

that?

Molly: [10:32] We announced that

program with our fourth quarter earnings in January, and we defined several steps to take out $645 million of cost. The first step was

related to raw material improvements, and that had about $310 million improvement. That particular step is sequential.

[10:54] At this point, we're well on

track to realize that 310 in a year over year basis. Prices of caustic have come down tremendously. Maybe they've leveled off recently,

but on a year over basis we're seeing exactly what we expected.

[11:09] In terms of coke and pitch,

which are involved in our smelting process, those prices continue to decline. We're seeing improvement there. We will have that year-over-year

benefit in raw materials.

[11:23] The second step was $100 million

productivity and competitiveness program. That basically is hundreds of initiatives across Alcoa to reduce costs on a sustainable basis.

Basically, every department manager in the company lost five to six percent percent of their budget. Those initiatives are on track.

Our target there is to deliver the full $100 million by the end of the first quarter of 2025.

[11:55] The next group of steps were

related to the portfolio we talked about, the Kwinana curtailment that's targeted to deliver a $70 million improvement. That full realization

will not take place until 2025.

[12:11] We had another step related

to Warrick improvements. That's our smelter in Indiana. That was a $90 million improvement. $60 million of that was related to operational

efficiencies. That's tied into a restart of the third line at Warrick, which has now been completed.

[12:28] That restart, improvements in

the cost absorption there, as well as another list of improvement initiatives are on track to deliver that $60 million.

[12:41] Additionally, we are hoping

to get another $30 million in IRA benefits. We'll know more about that by the end of the year.

[12:50] Then the last one on the list

is the Alumar smelter. We expect that restart to deliver about $75 million in improvement, and that one would be fully realized in 2025.

It was a two-year program, but each of the steps has a little bit of different timing, which is why I wanted to step you through them.

Seth: [13:10] Excellent. Ihere

are a couple of pivot points there for things that I wanted to ask about in addition. One was the IRA, which you mentioned. Can you talk

about the Section 45X provisions and your confidence that those will expand to additional raw materials year?

Molly: [13:32] In the fourth

quarter of '23, we did announce that we got the first tranche of IRA funding. That provided $37 million in credits, basically the cost

of goods sold in our Warwick smelter as well as our Massena, New York smelter.

[13:49] Now we are waiting word on a

second tranche of funding through the IRA. This would apply a 10 percent cost funding related to direct materials. The government's taken

some extra time. They want to make sure there's no double counting in the supply chain.

[14:06] We do expect that clarification

by the end of the year, and we're hopeful that that'll come through. That should be another $30 to $35 million of funding for those two

smelters.

Seth: [14:18] Does that have

a significant impact on changing the company's position at all in the global cost curve?

Molly: [14:27] That funding alone

does not make a material impact on the cost curve. However, that, with our efforts to improve our competitiveness and our profitability,

we do expect to show up in the cost curves.

Seth: [14:43] Excellent. Very

good. I wanted to ask about capital allocation. You talked about Kwinana and the curtailment there. What are the cash outlays that are

usually necessary to idle smelters and refineries?

Molly: [15:05] Curtailing and

closure costs will vary significantly by specific assets. If you look back in time, when we curtailed our refinery in Point Comfort,

Texas, or even our Suriname refinery, you'll see there were significant costs there.

[15:22] We just announced Kwinana going

down. That took a restructuring charge in the first quarter of about $200 million. We will see cash of about $140 million go out in the

second half of the year. That will cover the severance as well as water management costs for that site. While it's not set, you can look

back in history and see generally the cost of curtailing and closing.

Seth: [15:51] That 200 million,

is all of that cash? There's the delta between the 140 and the 200 is still ahead...

Molly: [15:59] That will be cash

that will be dispersed beyond 2024.

Seth: [16:03] 2024, OK.

Molly: [16:04] Typically, at

a curtailment, you'll see primarily cash costs. At a closure, you'll also have a write-down of assets. That will be a non-cash part of

those restructuring charges.

Seth: [16:17] Excellent. Wanted

to ask a little bit about policy. We've seen some policy support for the aluminum industry recently having to do with Russia and having

to do with some support through protectionism and reshoring. What are your thoughts on how these various policy currents will affect

the company?

Molly: [16:47] On the Russia

sanctions, Alcoa had been advocating for those for the last two years and we're very appreciative of both the US government and UK government

for taking actions on those. Before those sanctions, Russian aluminum supply was 90 percent of what was in the LME warehouse. We believe

that that distorted the base price for our product.

[17:11] Now, since the sanctions, we

do expect then that the product base price LME can be based on the true supply and demand fundamentals and no longer on a product that

nobody wants because everyone was self-sanctioning away from Russian metal.

[17:28] We're glad to have that sanction

in place. Now we're looking forward and hoping that the European Union will take similar action and place sanctions on products there.

[17:40] In terms of what's impacting

the US more, we've seen some recent tariff and trade actions. The first is the tripling of the 301 tariffs, but that applies specifically

to a group of rolled products.

[17:56] Not impacting us directly, but

it does impact our customers. It's good for the rolling mills that we serve, so we'll be glad to send them more prime metal as needed

if they have domestic demand increase there. We've also seen the exemptions remove on 232 for some slab products that also could be favorable

to domestic production.

[18:22] Lastly, on the extrusions anti-dumping

case, they are investigating if products are being imported into the US that have been heavily subsidized by foreign governments, so

they're being sold at unduly low prices and that could impose additional duties there.

[18:39] When you look at those three

actions together, that's almost 750,000 tons that could be a shift into domestic supply to avoid those tariffs. Potential improvements

there for the industry.

Seth: [18:58] Excellent. We talked

a little bit about the curtailment. I wanted to talk a little bit also about additions. You mentioned Warwick and the additional line

there, and the ramp at Alumar. Can you talk about the steps that are necessary, where these assets are headed in terms of their ramp,

and the level of profitability that you expect here once they're ramped up?

Molly: [19:27] Starting with

Warrick, we did complete the restart of the third line there in the first quarter. That came up on time, on budget, no safety issues.

As mentioned, that should really improve our cost absorption for the site and the profitability there.

[19:43] We'll still have additional

actions to take at Warwick, but that will continue over time again to deliver the $60 million operational improvement we're going after.

[19:55] When you look at the Alumar

smelter in Brazil, we've been at that restart now for two years. That's been a challenging one. The asset had been curtailed for eight

years. The equipment was not in as good a shape as we had hoped. We had issues with raw materials supply as well as quality. We lost

our trained and knowledgeable staff over the eight years.

[20:19] We have been busy adding expert

support. We've changed some of the leadership there. I think we're over the worst of the equipment issues now. We've had a little bit

of a change in direction. We purposefully slowed the restart there. We took some of the unstable pots off offline, trying to improve

the overall line stability.

[20:41] Now we're letting the folks

on the ground set the course and the pace for the restart. We won't predict now when they will finish, but it is going much more smoothly,

much more stably now.

[20:54] That asset we do believe in.

It will be profitable once we complete the restart. It's got a very competitive long-term energy contract, 100 percent renewable sources.

We're able to monetize some VAT credits that we didn't have an ability to do before the restart. We're selling into a market that's in

deficit for aluminum. It has a lot of good advantages. We do believe we'll get there over time.

Seth: [21:24] Excellent. Very

good. Wanted to ask one question on the sustainability front. Aluminum is a material that's pretty much infinitely recyclable. Your customers

and producers continue to push for lower carbon consumption. Could you speak to what the company is doing in terms of developing lower

carbon and carbon-free products?

Molly: [21:56] Our Sustana brand

covers our low carbon products. We have them both in alumina and aluminum. We've seen continued demand for those products over the last

few years, particularly demand for our EcoLum, our low-carbon aluminum in Europe, but also seeing more demand coming out of our North

American customers recently as well.

[22:21] For EcoLum, we see those volumes

increasing and the margins overall are improving about 20 percent year over year. Still very modest in terms of financial impact, but

as our customers are getting very serious and aggressive about reaching their decarbonization goals, we see them turning more and more

to our product. In Europe, about half of our product now going out is our low-carbon product.

[22:49] We see good potential for the

future for those sales. We hope as well that the premiums will come up as the supply is constrained. Right now, there's plenty of supply

to meet the demand. I think as customers get more and more aggressive, the supply will get tighter.

Seth: [23:09] Excellent. Very

good. Maybe just to wrap us up here as we get toward the end, any closing comments you have and maybe also an opportunity to lay out

anything you feel like it's important for investors to understand about Alcoa that they don't understand right now.

Molly: [23:33] As I mentioned

earlier, it's a really exciting time for Alcoa. We are scheduled to close our Alumina Limited acquisition. We believe that will be beneficial

for both sets of shareholders. Great support for that. Coming to shareholder votes on the 16th and 18th of July, and scheduled and on

time for close on August 1st.

[23:57] Second, we talked about the

portfolio actions. We're really demonstrating our bias for action and moving aggressively to position the portfolio to be profitable

through all the market cycles.

[24:09] Lastly, I think that the markets

are working in our favor right now. We see very positive outlook and expect prices to continue to hold and improve. We see demand right

now really stable. For us in particular, I would say strong in our markets in all sectors. Thank you for your time. I appreciate your

interest in Alcoa.

Seth: [24:31] Excellent. Thanks

very much, Molly. We really appreciate it.

Molly: [24:34] Thank you.

[24:35] [applause]

Webcasting and transcription services

provided through MAP Digital, Inc.

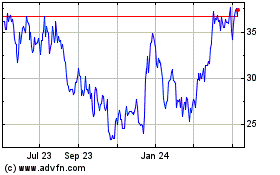

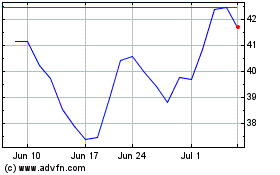

Alcoa (NYSE:AA)

Historical Stock Chart

From May 2024 to Jun 2024

Alcoa (NYSE:AA)

Historical Stock Chart

From Jun 2023 to Jun 2024