All amounts are in United States dollars, unless otherwise

stated.

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) ("Alamos" or the

"Company") today reported mineral reserves and mineral resources

for the Mulatos Mine and nearby satellite deposits in Mexico, and

mineral resources for the Agi Dagi, Kirazli and Camyurt projects in

Turkey, as of December 31, 2012.

Highlights

-- Proven and Probable mineral reserves of 2.37 million ounces of gold at

Mulatos, replacing mineral reserves mined-out in 2012.

-- Increased Measured and Indicated mineral resources by 2% to 5.08 million

ounces of gold at a mix of cut-off grades, depending on the deposit.

-- Inferred mineral resources of 1.52 million ounces of gold at a mix of

cut-off grades, depending on the deposit.

The mineral resource estimate for the Company's Turkish projects

includes the June 2012 initial Inferred mineral resource estimate

at Camyurt. The Company plans to release an updated mineral

resource for Camyurt separately in the second quarter of 2013 in

order to incorporate all existing drill results.

Mineral Reserves

In 2012, the Company successfully replaced mined-out mineral

reserves at Mulatos, with total proven and probable reserves of

2.37 million ounces of gold at year-end. The replacement of reserve

ounces is attributable to the addition of new ounces at El Victor,

conversion of pit-contained mineral resources to mineral reserves,

and the use of a $1,400 per ounce gold price assumption compared to

$1,150 in 2011. A detailed summary of Proven and Probable mineral

reserves for the Mulatos Mine as of December 31, 2012 is presented

in Table 1 at the end of this press release.

Based on the 2013 budgeted average throughput rate at the

Mulatos Mine of 17,000 tonnes per day ("tpd") and a projected 500

tpd rate for the high grade mill, the overall expected life of the

Mulatos Mine remains at approximately nine years as of December 31,

2012. The life-of-mine waste-to-ore ratios as of December 31, 2012

for the Mulatos Mine and nearby satellite deposits are summarized

in Table 2 at the end of this press release.

Mineral Resources

Globally, the Company's Measured and Indicated mineral

resources, which are reported exclusive of mineral reserves, are

5.08 million ounces at a mix of cut-off grades, as of December 31,

2012. Reflecting the inclusion of the initial mineral resource

estimate from the Camyurt project as reported on June 28, 2012, the

Company's Inferred mineral resources as of December 31, 2012 total

1.52 million ounces. Detailed summaries of Alamos Gold's Global

Measured and Indicated, and Inferred mineral resources as of

December 31, 2012 are presented in Tables 3 and 4, respectively, at

the end of this press release.

Mulatos Mine (Mexico)

Measured and Indicated mineral resources at the Mulatos Mine and

its satellite deposits decreased slightly to 2.64 million ounces

and Inferred mineral resources also decreased slightly to 0.50

million ounces as of December 31, 2012 compared to the prior year.

The mineral resources are reported at a 0.5 g/t Au cut-off at

Mulatos and San Carlos, at a 2.5 g/t Au cut-off for the San Carlos

underground resources, and at a 0.3 g/t Au cut-off at El Realito

and Carricito areas. The slight decrease in Measured, Indicated,

and Inferred mineral resources is primarily attributable to the

conversion of mineral resources into Proven and Probable mineral

reserves.

Detailed summaries of Measured and Indicated mineral resources

and Inferred mineral resources for Mulatos are presented in Tables

5 and 6, respectively, at the end of this press release. The

reported mineral resources also benefitted from the delineation of

new resources through infill drilling and extension drilling, as

well as the initial reporting of mineral resources for the San

Carlos underground (Tables 7 and 8), Carricito (Tables 9 and 10)

and El Realito (Tables 11 and 12) project areas.

A map detailing the planned Mulatos Pit area is presented in

Figure 1 at the end of this press release. The locations of the

Cerro Pelon and La Yaqui mineral reserve areas, as well as other

regional targets within the Mulatos District, are shown in Figure 2

at the end of this press release.

Agi Dagi and Kirazli (Turkey)

Measured and Indicated mineral resources at Agi Dagi and

Kirazli, which are reported at a 0.2 g/t Au cut-off, increased 9.9%

to 2.44 million ounces of gold, as compared to the mineral

resources reported in December 2011. In addition, Measured and

Indicated mineral resources of silver increased 16.9% to 19.72

million ounces compared to the resource update in December 2011.

The increase in Measured and Indicated mineral resources is a

result of a combination of infill and resource expansion drilling

programs undertaken in 2012, resulting in the conversion of

Inferred mineral resources to the Indicated category.

Inferred mineral resources at Agi Dagi, Kirazli and Camyurt,

which are reported at a 0.2 g/t cut-off grade, contained 1.02

million ounces at year-end 2012, as compared to the 1.09 million

ounces reported in the December 31, 2011 mineral resource statement

(Agi Dagi and Kirazli) and June 28, 2012 press release (Camyurt).

The decrease of 6.4% was attributable to the conversion of some

Inferred mineral resources at Agi Dagi and Kirazli to Measured and

Indicated mineral resources. The Company expects to release an

update on the resource estimate for Camyurt in the second quarter

of 2013 in order to include all 2012 drill results.

Detailed summaries of the Measured and Indicated, and Inferred

mineral resources for Agi Dagi are presented in Tables 13 and 14,

respectively, at the end of this press release. The Measured and

Indicated, and Inferred mineral resources for Kirazli are presented

in Tables 15 and 16, respectively. Inferred mineral resources for

Camyurt are presented in Table 17, also presented at the end of the

press release. Figure 3 provides the location in Turkey of mineral

resource areas for the Agi Dagi project and Figure 4 provides the

location of the mineral resource area for the Camyurt project.

Figure 5 provides the location of the mineral resource area for the

Kirazli project.

San Carlos Drilling Results

Assay results from drilling at San Carlos were inadvertently

omitted from a press release issued by the Company on February 21,

2013 and are appended to this press release.

Qualified Persons

The independent Qualified Person for the National Instrument

43-101 compliant mineral reserve estimate is Herb Welhener, Vice

President of Independent Mining Consultants Inc. of Tucson,

Arizona, working in conjunction with the Company's exploration and

operations staff. Marc Jutras, P. Eng., M.A.Sc., Director of

Mineral Resources for Alamos, prepared the mineral resource

estimation for the Mulatos Mine, the Agi Dagi, Kirazli, and Camyurt

projects. Mark Odell, Principal, Practical Mining LLC, was

responsible for the presentation of the underground reserves in the

Escondida-Gap and San Carlos areas. Messieurs Welhener, Jutras, and

Odell are recognized as Qualified Persons according to the

requirements of National Instrument 43-101. Exploration programs at

Mulatos are directed by Ken Balleweg, P.Geo., B.Sc., M.Sc. Geology,

Alamos' Exploration Manager - Mexico, a Qualified Person as defined

by National Instrument 43-101.

Exploration programs at Mulatos are directed by Ken Balleweg,

B.Sc., M.Sc., P.Geo., Alamos' Exploration Manager - Mexico, a

Qualified Person as defined by National Instrument 43-101 of the

Canadian Securities Administrators.

Exploration programs at Agi Dagi and Kirazli are directed by

Jason Dunning, B.Sc., M.Sc., P.Geo., Alamos' Vice President of

Exploration, a Qualified Person as defined by National Instrument

43-101 of the Canadian Securities Administrators.

Drilling, sampling, QA/QC protocols and analytical methods for

individual resource areas are as outlined in the respective press

releases for these areas, in the Mulatos December 2012 technical

report, and the July 2012 Agi Dagi and Kirazli technical report,

which are available at www.sedar.com.

About Alamos

Alamos is an established Canadian-based gold producer that owns

and operates the Mulatos Mine in Mexico, and has exploration and

development activities in Mexico and Turkey. The Company employs

more than 600 people and is committed to the highest standards of

environmental management, social responsibility, and health and

safety for its employees and neighbouring communities. Alamos has

approximately $480 million in cash and equity investments, is

debt-free, and unhedged to the price of gold. As of March 14, 2013,

Alamos had 127,455,786 common shares outstanding (132,326,086

shares fully diluted), which are traded on the TSX and NYSE under

the symbol "AGI".

Cautionary Note

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained

herein. This News Release includes certain "forward-looking

statements". All statements other than statements of historical

fact included in this release, including without limitation

statements regarding forecast gold production, gold grades,

recoveries, waste-to-ore ratios, total cash costs, potential

mineralization and reserves, exploration results, and future plans

and objectives of Alamos, are forward-looking statements that

involve various risks and uncertainties. These forward-looking

statements include, but are not limited to, statements with respect

to mining and processing of mined ore, achieving projected recovery

rates, anticipated production rates and mine life, operating

efficiencies, costs and expenditures, changes in mineral resources

and conversion of mineral resources to proven and probable

reserves, and other information that is based on forecasts of

future operational or financial results, estimates of amounts not

yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill

results on wide spacings may not be indicative of the occurrence of

a mineral deposit. Such results do not provide assurance that

further work will establish sufficient grade, continuity,

metallurgical characteristics and economic potential to be classed

as a category of mineral resource. A mineral resource that is

classified as "inferred" or "indicated" has a great amount of

uncertainty as to its existence and economic and legal feasibility.

It cannot be assumed that any or part of an "indicated mineral

resource" or "inferred mineral resource" will ever be upgraded to a

higher category of resource. Investors are cautioned not to assume

that all or any part of mineral deposits in these categories will

ever be converted into proven and probable reserves.

Any statements that express or involve discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions or future events or performance (often, but

not always, using words or phrases such as "expects" or "does not

expect", "is expected", "anticipates" or "does not anticipate",

"plans", "estimates" or "intends", or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved) are not statements of historical fact

and may be "forward-looking statements." Forward-looking statements

are subject to a variety of risks and uncertainties that could

cause actual events or results to differ from those reflected in

the forward-looking statements.

There can be no assurance that forward-looking statements will

prove to be accurate and actual results and future events could

differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from Alamos' expectations include, among others, risks

related to international operations, the actual results of current

exploration activities, conclusions of economic evaluations and

changes in project parameters as plans continue to be refined as

well as future prices of gold and silver, as well as those factors

discussed in the section entitled "Risk Factors" in Alamos' Annual

Information Form. Although Alamos has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements.

Note to U.S. Investors

Alamos prepares its disclosure in accordance with the

requirements of securities laws in effect in Canada, which differ

from the requirements of U.S. securities laws. Terms relating to

mineral resources in this presentation are defined in accordance

with National Instrument 43-101 - Standards of Disclosure for

Mineral Projects under the guidelines set out in the Canadian

Institute of Mining, Metallurgy, and Petroleum Standards on Mineral

Resources and Mineral Reserves. The United States Securities and

Exchange Commission (the "SEC") permits mining companies, in their

filings with the SEC, to disclose only those mineral deposits that

a company can economically and legally extract or produce. Alamos

may use certain terms, such as "measured mineral resources",

"indicated mineral resources", "inferred mineral resources" and

"probable mineral reserves" that the SEC does not recognize (these

terms may be used in this presentation and are included in the

public filings of Alamos, which have been filed with the SEC and

the securities commissions or similar authorities in Canada).

Table 1: Proven and Probable Mineral Reserves at Mulatos Project Area as of

December 31, 2012

----------------------------------------------------------------------------

PROVEN AND PROBABLE RESERVES (1,2,3,4,5,6,7,8,9)

As at December 31, 2012

----------------------------------------------------------------------------

Proven (2) Probable (2)

RESERVE AREA Tonnes Grade Contained Tonnes Grade Contained

(000) (g/t Au) Ounces (000) (g/t Au) Ounces

----------------------------------------------------------------------------

Mulatos Mine (3, 4, 5) 8,928 1.17 334,545 50,755 0.85 1,393,514

----------------------------------------------------------------------------

UG Reserve(6, 7) 194 6.61 41,436 975 4.73 148,227

----------------------------------------------------------------------------

Existing stockpiles 3,721 1.90 227,364 - - -

----------------------------------------------------------------------------

La Yaqui (6) - - - 1,574 1.58 79,826

----------------------------------------------------------------------------

Cerro Pelon (7) - - - 2,673 1.64 140,525

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 12,843 1.46 603,345 55,977 0.98 1,762,092

----------------------------------------------------------------------------

----------------------------------------------------------------------------

PROVEN AND PROBABLE RESERVES (1,2,3,4,5,6,7,8,9)

As at December 31, 2012

----------------------------------------------------------------------------

Proven + Probable (2)

RESERVE AREA Tonnes Grade Contained

(000) (g/t Au) Ounces

----------------------------------------------------------------------------

Mulatos Mine (3, 4, 5) 59,683 0.90 1,728,059

----------------------------------------------------------------------------

UG Reserve(6, 7) 1,169 5.04 189,663

----------------------------------------------------------------------------

Existing stockpiles 3,721 1.90 227,364

----------------------------------------------------------------------------

La Yaqui (6) 1,574 1.58 79,826

----------------------------------------------------------------------------

Cerro Pelon (7) 2,673 1.64 140,525

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 68,820 1.07 2,365,437

----------------------------------------------------------------------------

Notes for Table 1:

(1) The Company's mineral reserves as at December 31, 2012 are classified in

accordance with the Canadian Institute of Mining Metallurgy and

Petroleum's "CIM Standards on Mineral Resources and Reserves, Definition

and Guidelines" as per Canadian Securities Administrator's National

Instrument 43-101 requirements.

(2) Tonnes are rounded to the closest "000s" and grades are rounded to the

closest "0.00"s.

(3) The mineral reserve estimate for the Mulatos Mine incorporates the

Estrella, Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor,

and San Carlos areas.

(4) Mineral reserve cut-off grade for the Mulatos Mine is determined as a

net of process value of $0.10 per tonne for each model block. The

determination was based on a $1,400 per ounce gold price, a December

2012 resource and recovery model, and the 2013 budget costs based on the

actual cost figures from current mining operations.

(5) Pit-contained mineral reserves for the Escondida high-grade zone are

221,000 tonnes grading 10.31 g/t Au for 73,260 ounces and San Carlos is

241,600 tonnes grading 0.81g/t Au for 62,866 ounces.

(6) Underground reserves are design-contained and reported at a 2.5 g/t Au

cut-off grade, with a 5% mining loss and 10% dilution.

(7) Underground reserves include 45,000 tonnes at Escondida Deep, grading

8.08 g/t Au for 11,700 ounces, and 1,124,000 tonnes at San Carlos

grading 4.92 g/t Au for 177,900 ounces,

(8) Mineral reserve gold cut-off grade for the La Yaqui Pit is a 0.30 g/t

gold. The determination was based on an $800 per ounce gold price, a May

2009 resource model, gold recovery at the current mining operations, and

the 2010 budget costs based on the actual cost figures from current

mining operations.

(9) Mineral reserve gold cut-off grade for the Cerro Pelon Pit is determined

as a net of process value of $0.10 per tonne, for each model block. The

determination was based on an $800 per ounce gold price, a November 2009

resource model, gold recovery at the current mining operations, and the

2010 budget costs based on the actual cost figures from current mining

operations.

Table 2: Mulatos Project Area Life-of-Mine Waste-to-Ore Ratios as of

December 31, 2012

----------------------------------------------------------------------------

Mulatos Project Area Life-of-Mine Waste-to-Ore Ratios as of December 31,

2012(1)

----------------------------------------------------------------------------

Project Waste-to-Ore Ratio

----------------------------------------------------------------------------

Mulatos Mine 1.04

----------------------------------------------------------------------------

Cerro Pelon Pit 2.13

----------------------------------------------------------------------------

La Yaqui Pit 0.16

----------------------------------------------------------------------------

San Carlos Pit 1.51

----------------------------------------------------------------------------

Notes for Table 2:

(1) The life-of-mine waste-to-ore ratio for the Mulatos Mine incorporates

the Estrella, Escondida, Puerto del Aire, El Salto, Mina Vieja, and El

Victor areas. San Carlos open pit waste-to-ore ratio is presented

separately.

Table 3: Global Measured and Indicated Mineral Resources as of December 31,

2012

----------------------------------------------------------------------------

Global Measured & Indicated Mineral Resources (1,2,3,4,5,6,8) as at

December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

Mexico

----------------------------------------------------------------------------

Mulatos 0.5 78,235 0.99 2,481,018

----------------------------------------------------------------------------

San Carlos UG 2.5 433 4.55 63,294

----------------------------------------------------------------------------

El Realito 0.3 1,200 1.35 52,020

----------------------------------------------------------------------------

Carricito 0.3 1,915 0.76 46,944

----------------------------------------------------------------------------

Total 81,783 1.01 2,643,276

----------------------------------------------------------------------------

Turkey

----------------------------------------------------------------------------

Agi Dagi 0.2 93,944 0.56 3.56 1,698,975 10,762,590

----------------------------------------------------------------------------

Kirazli 0.2 32,330 0.71 8.61 738,914 8,953,576

----------------------------------------------------------------------------

Camyurt

----------------------------------------------------------------------------

Total 126,274 0.60 4.86 2,437,889 19,716,166

----------------------------------------------------------------------------

Combined Total 5,081,165 19,716,166

----------------------------------------------------------------------------

Table 4: Global Inferred Mineral Resources as of December 31, 2012

----------------------------------------------------------------------------

Global Inferred Mineral Resources (1,3,4,5,6,7,8) as at December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

Mexico

----------------------------------------------------------------------------

Mulatos 0.5 15,991 0.90 461,257

----------------------------------------------------------------------------

San Carlos UG 2.5 14 6.07 2,730

----------------------------------------------------------------------------

El Realito 0.3 236 1.09 8,256

----------------------------------------------------------------------------

Carricito 0.3 1,290 0.71 29,305

----------------------------------------------------------------------------

Total 17,531 0.89 501,548

----------------------------------------------------------------------------

Turkey

----------------------------------------------------------------------------

Agi Dagi 0.2 18,944 0.41 2.54 251,202 1,549,119

----------------------------------------------------------------------------

Kirazli 0.2 6,698 0.59 8.17 126,659 1,760,020

----------------------------------------------------------------------------

Camyurt 0.2 24,557 0.81 4.77 639,531 3,766,129

----------------------------------------------------------------------------

Total 50,199 0.63 4.38 1,017,392 7,075,268

----------------------------------------------------------------------------

Combined Total 1,518,940 7,075,268

----------------------------------------------------------------------------

Notes for Tables 3 & 4:

(1) The updated mineral resource estimate at Mulatos incorporates the

Estrella, Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor,

and San Carlos areas.

(2) In-pit measured and indicated mineral resource blocks are exclusive of

pit-contained reserves.

(3) Measured and indicated and inferred mineral resources outside of the

Mulatos Mine have no economic restrictions and are tabulated by gold

cut-off grade.

(4) Measured and indicated and inferred resources at Carricito and El

Realito are pit-constrained, applying a $1,500/oz gold price, 55 degrees

pit slopes, and an $8.55/t operating cost.

(5) Measured and indicated and inferred resources for the Agi Dagi project,

which includes the Baba, Ayitepe, Deli, and Fire Tower zones, are pit

constrained with cut-off determined as a net of process value of $0.10

per tonne, for each model block. The determination was based on a

US$1,500 per ounce gold price and a US$28.00 per ounce silver price, a

December 2012 resource model, average pit slope angle of 38 degrees,

and estimated costs and recoveries based on the pre-feasibility study

specifications. The resources were then tabulated by gold cut-off grade.

(6) Measured and indicated, and inferred resources for the Kirazli project,

including Rockpile, are pit constrained with cut-off determined as a net

of process value of $0.10 per tonne, for each model block. The

determination was based on a US$1,500 per ounce gold price and a

US$28.00 per ounce silver price, a December 2012 resource model, average

pit slope angle of 38 degrees, and estimated costs and recoveries based

on the pre-feasibility study specifications. The resources were then

tabulated by gold cut-off grade.

(7) Inferred resources for the Camyurt project are pit-constrained, using a

$1,250 per ounce gold price, a 60:1 Ag:Au value ratio (Au equivalent =

Au + ((Ag/60) (i) Ag recovery)), an average pit slope angle of 45

degrees, estimated costs based on the Pre-feasibility study, and

recoveries for Au and Ag based on grade ranges. Only oxide and

transition material were considered in the pit run. Please refer to the

Company's June 28th, 2012 press release.

(8) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 5: Measured and Indicated Mineral Resources as of December 31, 2012 -

Mulatos Project Area

----------------------------------------------------------------------------

Mulatos Mine - Measured and Indicated Mineral Resources(1,2,3,6) as at

December 31, 2012

----------------------------------------------------------------------------

Measured Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 646 4.05 84,019 3,957 3.45 438,778

----------------------------------------------------------------------------

1.5 1,132 3.04 110,789 7,962 2.66 681,972

----------------------------------------------------------------------------

1.0 2,513 2.03 164,106 18,438 1.79 1,063,553

----------------------------------------------------------------------------

0.7 4,737 1.46 223,079 38,616 1.29 1,598,418

----------------------------------------------------------------------------

0.5 7,663 1.12 277,100 70,572 0.97 2,203,918

----------------------------------------------------------------------------

0.3 13,084 0.83 347,799 134,860 0.69 3,003,441

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Mulatos Mine - Measured and Indicated Mineral Resources(1,2,3,6) as at

December 31, 2012

----------------------------------------------------------------------------

Measured + Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 4,603 3.53 522,797

----------------------------------------------------------------------------

1.5 9,094 2.71 792,761

----------------------------------------------------------------------------

1.0 20,951 1.82 1,227,659

----------------------------------------------------------------------------

0.7 43,353 1.31 1,821,497

----------------------------------------------------------------------------

0.5 78,235 0.99 2,481,018

----------------------------------------------------------------------------

0.3 147,944 0.70 3,351,240

----------------------------------------------------------------------------

Table 6: Inferred Mineral Resources as of December 31, 2012 - Mulatos

Project Area

----------------------------------------------------------------------------

Mulatos Mine - Inferred Mineral Resources (1, 2, 3, 6) as at December 31,

2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.00 626 3.27 65,851

----------------------------------------------------------------------------

1.50 1,547 2.36 117,193

----------------------------------------------------------------------------

1.00 3,616 1.70 197,996

----------------------------------------------------------------------------

0.70 7,433 1.25 299,577

----------------------------------------------------------------------------

0.50 15,991 0.90 461,257

----------------------------------------------------------------------------

0.30 33,698 0.63 679,487

----------------------------------------------------------------------------

Notes for Tables 5 & 6:

(1) The updated mineral resource estimate incorporates the Estrella,

Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor, and San

Carlos areas.

(2) In-pit measured and indicated mineral resource blocks are exclusive of

pit-contained reserves.

(3) Measured and indicated and inferred mineral resources outside of the

Mulatos Mine have no economic restrictions and are tabulated by gold

cut-off grade.

(4) Underground resources are presented at a 2.5 g/t Au cut-off grade for

the San Carlos area.

(5) Measured and indicated and inferred resources at Carricito and El

Realito are pit-constrained, applying a $1,500/oz gold price, 55 degrees

pit slopes, and an $8.55/t operating cost.

(6) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 7: Measured and Indicated Mineral Resources as of December 31, 2012 -

San Carlos Underground

----------------------------------------------------------------------------

San Carlos Underground - Measured and Indicated Resources (4, 6) as at

December 31, 2012

----------------------------------------------------------------------------

Measured Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

3.0 40 5.91 7,605 273 5.15 45,225

----------------------------------------------------------------------------

2.5 57 4.96 9,092 376 4.48 54,202

----------------------------------------------------------------------------

2.0 89 3.99 11,404 558 3.74 67,143

----------------------------------------------------------------------------

----------------------------------------------------------------------------

San Carlos Underground - Measured and Indicated Resources (4, 6) as at

December 31, 2012

----------------------------------------------------------------------------

Measured + Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

3.0 313 5.25 52,830

----------------------------------------------------------------------------

2.5 433 4.55 63,294

----------------------------------------------------------------------------

2.0 647 3.78 78,547

----------------------------------------------------------------------------

Table 8: Inferred Mineral Resources as of December 31, 2012 - San Carlos

Underground

----------------------------------------------------------------------------

San Carlos Underground - Inferred Mineral Resources (4, 6) as at December

31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

3.0 14 6.07 2,730

----------------------------------------------------------------------------

2.5 14 6.07 2,730

----------------------------------------------------------------------------

2.0 20 4.96 3,191

----------------------------------------------------------------------------

Notes for Tables 7 & 8:

(1) The updated mineral resource estimate incorporates the Estrella,

Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor, and San

Carlos areas.

(2) In-pit measured and indicated mineral resource blocks are exclusive of

pit-contained reserves.

(3) Measured and indicated and inferred mineral resources outside of the

Mulatos Mine have no economic restrictions and are tabulated by gold

cut-off grade.

(4) Underground resources are presented at a 2.5 g/t Au cut-off grade for

the San Carlos area.

(5) Measured and indicated and inferred resources at Carricito and El

Realito are pit-constrained, applying a $1,500/oz gold price, 55 degrees

pit slopes, and an $8.55/t operating cost.

(6) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 9: Measured and Indicated Mineral Resources as of December 31, 2012 -

Carricito Project Area

----------------------------------------------------------------------------

Carricito - Measured and Indicated Mineral Resources (5,6) as at December

31, 2012

----------------------------------------------------------------------------

Measured Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 2 2.69 173 28 2.27 2,045

----------------------------------------------------------------------------

1.5 5 2.02 324 133 1.84 7,889

----------------------------------------------------------------------------

1.0 16 1.47 757 384 1.43 17,684

----------------------------------------------------------------------------

0.7 31 1.15 1,151 775 1.13 28,112

----------------------------------------------------------------------------

0.5 54 0.91 1,573 1,294 0.92 38,100

----------------------------------------------------------------------------

0.3 74 0.78 1,846 1,841 0.76 45,098

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Carricito - Measured and Indicated Mineral Resources (5,6) as at December

31, 2012

----------------------------------------------------------------------------

Measured + Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 30 2.30 2,218

----------------------------------------------------------------------------

1.5 138 1.85 8,213

----------------------------------------------------------------------------

1.0 400 1.43 18,441

----------------------------------------------------------------------------

0.7 806 1.13 29,263

----------------------------------------------------------------------------

0.5 1,348 0.92 39,673

----------------------------------------------------------------------------

0.3 1,915 0.76 46,944

----------------------------------------------------------------------------

Table 10: Inferred Mineral Resources as of December 31, 2012 - Carricito

Project Area

----------------------------------------------------------------------------

Carricito - Inferred Mineral Resources (5,6) as at December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 1 2.02 65

----------------------------------------------------------------------------

1.5 90 1.74 5,047

----------------------------------------------------------------------------

1.0 222 1.41 10,046

----------------------------------------------------------------------------

0.7 464 1.11 16,554

----------------------------------------------------------------------------

0.5 812 0.89 23,143

----------------------------------------------------------------------------

0.3 1,290 0.71 29,305

----------------------------------------------------------------------------

Notes for Tables 9 & 10:

(1) The updated mineral resource estimate incorporates the Estrella,

Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor, and San

Carlos areas.

(2) In-pit measured and indicated mineral resource blocks are exclusive of

pit-contained reserves.

(3) Measured and indicated and inferred mineral resources outside of the

Mulatos Mine have no economic restrictions and are tabulated by gold

cut-off grade.

(4) Underground resources are presented at a 2.5 g/t Au cut-off grade for

the San Carlos area.

(5) Measured and indicated and inferred resources at Carricito and El

Realito are pit-constrained, applying a $1,500/oz gold price, 55 degrees

pit slopes, and an $8.55/t operating cost.

(6) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 11: Measured and Indicated Mineral Resources as of December 31, 2012 -

El Realito Project Area

----------------------------------------------------------------------------

El Realito - Measured and Indicated Mineral Resources (5,6) as at December

31, 2012

----------------------------------------------------------------------------

Measured Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 17 3.89 2,147 165 4.05 21,509

----------------------------------------------------------------------------

1.5 26 3.17 2,625 260 3.19 26,622

----------------------------------------------------------------------------

1.0 42 2.43 3,248 487 2.27 35,506

----------------------------------------------------------------------------

0.7 55 2.05 3,611 747 1.77 42,501

----------------------------------------------------------------------------

0.5 70 1.73 3,897 906 1.56 45,434

----------------------------------------------------------------------------

0.3 88 1.46 4,123 1,112 1.34 47,897

----------------------------------------------------------------------------

----------------------------------------------------------------------------

El Realito - Measured and Indicated Mineral Resources (5,6) as at December

31, 2012

----------------------------------------------------------------------------

Measured + Indicated

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 182 4.03 23,657

----------------------------------------------------------------------------

1.5 285 3.19 29,247

----------------------------------------------------------------------------

1.0 528 2.28 38,754

----------------------------------------------------------------------------

0.7 802 1.79 46,112

----------------------------------------------------------------------------

0.5 976 1.57 49,331

----------------------------------------------------------------------------

0.3 1,200 1.35 52,020

----------------------------------------------------------------------------

Table 12: Inferred Mineral Resources as of December 31, 2012 - El Realito

Project Area

----------------------------------------------------------------------------

El Realito - Inferred Mineral Resources (5,6) as at December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Contained

(g/t Au) (000s) (g/t Au) Ounces Au

----------------------------------------------------------------------------

2.0 15 3.86 1,819

----------------------------------------------------------------------------

1.5 32 2.67 2,739

----------------------------------------------------------------------------

1.0 102 1.65 5,413

----------------------------------------------------------------------------

0.7 169 1.33 7,222

----------------------------------------------------------------------------

0.5 197 1.23 7,787

----------------------------------------------------------------------------

0.3 236 1.09 8,256

----------------------------------------------------------------------------

Notes for Tables 11 & 12:

(1) The updated mineral resource estimate incorporates the Estrella,

Escondida, Puerto del Aire, El Salto, Mina Vieja, El Victor, and San

Carlos areas.

(2) In-pit measured and indicated mineral resource blocks are exclusive of

pit-contained reserves.

(3) Measured and indicated and inferred mineral resources outside of the

Mulatos Mine have no economic restrictions and are tabulated by gold

cut-off grade.

(4) Underground resources are presented at a 2.5 g/t Au cut-off grade for

the San Carlos area.

(5) Measured and indicated and inferred resources at Carricito and El

Realito are pit-constrained, applying a $1,500/oz gold price, 55 degrees

pit slopes, and an $8.55/t operating cost.

(6) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 13: Measured and Indicated Mineral Resources as of December 31, 2012

- Agi Dagi Project

----------------------------------------------------------------------------

Agi Dagi Project - Measured & Indicated Mineral Resources (1, 4) December

31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

1.00 8,285 2.12 13.58 563,698 3,616,513

----------------------------------------------------------------------------

0.80 12,700 1.69 10.19 689,817 4,161,522

----------------------------------------------------------------------------

0.60 22,341 1.26 7.20 903,359 5,173,368

----------------------------------------------------------------------------

0.40 44,314 0.87 5.08 1,245,870 7,240,993

----------------------------------------------------------------------------

0.20 93,944 0.56 3.56 1,698,975 10,762,590

----------------------------------------------------------------------------

0.10 141,696 0.42 2.88 1,925,361 13,117,540

----------------------------------------------------------------------------

Table 14: Inferred Mineral Resources as of December 31, 2012 - Agi Dagi

Project

----------------------------------------------------------------------------

Agi Dagi Project - Inferred Mineral Resources (1,4) December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

1.00 597 1.44 3.74 27,728 71,699

----------------------------------------------------------------------------

0.80 1,195 1.17 3.58 44,795 137,524

----------------------------------------------------------------------------

0.60 2,771 0.89 3.66 79,382 325,932

----------------------------------------------------------------------------

0.40 6,868 0.65 3.39 143,072 748,223

----------------------------------------------------------------------------

0.20 18,944 0.41 2.54 251,202 1,549,119

----------------------------------------------------------------------------

0.10 30,882 0.31 1.99 307,010 1,971,906

----------------------------------------------------------------------------

Notes for Tables 13 & 14:

(1) Measured and indicated and inferred resources for the Agi Dagi project,

which includes the Baba, Ayitepe, Deli, and Fire Tower zones, are pit

constrained with cut-off determined as a net of process value of $0.10

per tonne, for each model block. The determination was based on a

US$1,500 per ounce gold price and a US$28.00 per ounce silver price, a

December 2012 resource model, average pit slope angle of 38 degrees,

and estimated costs and recoveries based on the pre-feasibility study

specifications. The resources were then tabulated by gold cut-off grade.

(2) Measured and indicated, and inferred resources for the Kirazli project,

including Rockpile, are pit constrained with cut-off determined as a net

of process value of $0.10 per tonne, for each model block. The

determination was based on a US$1,500 per ounce gold price and a

US$28.00 per ounce silver price, a December 2012 resource model, average

pit slope angle of 38 degrees, and estimated costs and recoveries based

on the pre-feasibility study specifications. The resources were then

tabulated by gold cut-off grade.

(3) Inferred resources for the Camyurt project are pit-constrained, using a

$1,250 per ounce gold price, a 60:1 Ag:Au value ratio (Au equivalent =

Au + ((Ag/60) (i) Ag recovery)), an average pit slope angle of 45

degrees, estimated costs based on the Pre-feasibility study, and

recoveries for Au and Ag based on grade ranges. Only oxide and

transition material were considered in the pit run. Please refer to the

Company's June 28th, 2012 press release.

(4) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 15: Measured and Indicated Mineral Resources as of December 31, 2012 -

Kirazli Project

----------------------------------------------------------------------------

Kirazli Project - Measured & Indicated Mineral Resources (2,4) December 31,

2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

1.00 5,134 2.27 18.78 374,733 3,099,973

----------------------------------------------------------------------------

0.80 6,173 2.04 16.96 404,963 3,365,603

----------------------------------------------------------------------------

0.60 9,293 1.63 14.62 486,298 4,368,157

----------------------------------------------------------------------------

0.40 17,493 1.07 11.08 599,329 6,229,710

----------------------------------------------------------------------------

0.20 32,330 0.71 8.61 738,914 8,953,576

----------------------------------------------------------------------------

0.10 39,990 0.60 8.23 777,800 10,577,150

----------------------------------------------------------------------------

Table 16: Inferred Mineral Resources as of December 31, 2012 - Kirazli

Project

----------------------------------------------------------------------------

Kirazli Project - Inferred Mineral Resources (2,4) December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

1.00 959 1.51 10.46 46,622 322,452

----------------------------------------------------------------------------

0.80 1,260 1.37 10.93 55,416 442,682

----------------------------------------------------------------------------

0.60 2,094 1.10 9.53 74,154 641,354

----------------------------------------------------------------------------

0.40 3,696 0.83 8.70 98,719 1,034,183

----------------------------------------------------------------------------

0.20 6,698 0.59 8.17 126,659 1,760,020

----------------------------------------------------------------------------

0.10 8,460 0.50 8.09 136,327 2,201,668

----------------------------------------------------------------------------

Notes for Tables 15 & 16:

(1) Measured and indicated and inferred resources for the Agi Dagi project,

which includes the Baba, Ayitepe, Deli, and Fire Tower zones, are pit

constrained with cut-off determined as a net of process value of $0.10

per tonne, for each model block. The determination was based on a

US$1,500 per ounce gold price and a US$28.00 per ounce silver price, a

December 2012 resource model, average pit slope angle of 38 degrees,

and estimated costs and recoveries based on the pre-feasibility study

specifications. The resources were then tabulated by gold cut-off grade.

(2) Measured and indicated, and inferred resources for the Kirazli project,

including Rockpile, are pit constrained with cut-off determined as a net

of process value of $0.10 per tonne, for each model block. The

determination was based on a US$1,500 per ounce gold price and a

US$28.00 per ounce silver price, a December 2012 resource model, average

pit slope angle of 38 degrees, and estimated costs and recoveries based

on the pre-feasibility study specifications. The resources were then

tabulated by gold cut-off grade.

(3) Inferred resources for the Camyurt project are pit-constrained, using a

$1,250 per ounce gold price, a 60:1 Ag:Au value ratio (Au equivalent =

Au + ((Ag/60) (i) Ag recovery)), an average pit slope angle of 45

degrees, estimated costs based on the Pre-feasibility study, and

recoveries for Au and Ag based on grade ranges. Only oxide and

transition material were considered in the pit run. Please refer to the

Company's June 28th, 2012 press release.

(4) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

Table 17: Inferred Mineral Resources as of December 31, 2012 - Camyurt

Project

----------------------------------------------------------------------------

Camyurt - Inferred Mineral Resources (3,4) December 31, 2012

----------------------------------------------------------------------------

Cut-off Tonnes Grade Grade Contained Contained

(g/t Au) (000s) (g/t Au) (g/t Ag) Ounces Au Ounces Ag

----------------------------------------------------------------------------

1.00 6,630 1.54 8.04 328,281 1,713,882

----------------------------------------------------------------------------

0.80 9,895 1.33 7.16 423,123 2,277,863

----------------------------------------------------------------------------

0.60 13,511 1.16 6.35 503,915 2,758,500

----------------------------------------------------------------------------

0.40 18,416 0.98 5.48 580,266 3,244,750

----------------------------------------------------------------------------

0.20 24,557 0.81 4.77 639,531 3,766,129

----------------------------------------------------------------------------

0.10 27,612 0.74 4.43 656,933 3,932,721

----------------------------------------------------------------------------

Notes for Tables 17:

(1) Measured and indicated and inferred resources for the Agi Dagi project,

which includes the Baba, Ayitepe, Deli, and Fire Tower zones, are pit

constrained with cut-off determined as a net of process value of $0.10

per tonne, for each model block. The determination was based on a

US$1,500 per ounce gold price and a US$28.00 per ounce silver price, a

December 2012 resource model, average pit slope angle of 38 degrees,

and estimated costs and recoveries based on the pre-feasibility study

specifications. The resources were then tabulated by gold cut-off grade.

(2) Measured and indicated, and inferred resources for the Kirazli project,

including Rockpile, are pit constrained with cut-off determined as a net

of process value of $0.10 per tonne, for each model block. The

determination was based on a US$1,500 per ounce gold price and a

US$28.00 per ounce silver price, a December 2012 resource model, average

pit slope angle of 38 degrees, and estimated costs and recoveries based

on the pre-feasibility study specifications. The resources were then

tabulated by gold cut-off grade.

(3) Inferred resources for the Camyurt project are pit-constrained, using a

$1,250 per ounce gold price, a 60:1 Ag:Au value ratio (Au equivalent =

Au + ((Ag/60) (i) Ag recovery)), an average pit slope angle of 45

degrees, estimated costs based on the Pre-feasibility study, and

recoveries for Au and Ag based on grade ranges. Only oxide and

transition material were considered in the pit run. Please refer to the

Company's June 28th, 2012 press release.

(4) Mineral resources are not mineral reserves and do not have demonstrated

economic viability.

To view Figures 1 through 5 associated with this release, please visit the

following link: http://media3.marketwire.com/docs/agi-fig1-5.pdf

San Carlos - Composite Intervals(1)

Include intervals at greater than 0.30 g/t Au over a 3 metres minimum width,

no assay cut

----------------------------------------------------------------------------

TOTAL

DRILLING DEPTH FROM TO INT. GOLD

DRILLHOLE METHOD (m) (m) (m) (m) (g/t)

----------------------------------------------------------------------------

12SC164 RC 477.13 407.01 410.06 3.05 0.953

----------------------------------------------------------------------------

12SC165 RC 461.89 No Intervals

----------------------------------------------------------------------------

12SC166 RC 464.94 No Intervals

----------------------------------------------------------------------------

12SC167 RC 379.57 347.56 352.13 4.57 1.048

----------------------------------------------------------------------------

12SC169 RC 457.32 No Intervals

----------------------------------------------------------------------------

12SC170 RC 457.32 No Intervals

----------------------------------------------------------------------------

12SC171 RC 420.73 No Intervals

----------------------------------------------------------------------------

12SC172 RC 457.32 No Intervals

----------------------------------------------------------------------------

12SC173 RC 449.70 No Intervals

----------------------------------------------------------------------------

12SC174 178.35 187.50 9.15 0.817

192.07 202.74 10.67 0.534

216.46 219.51 3.05 0.580

227.13 230.18 3.05 0.504

243.90 248.48 4.58 0.723

RC 274.39 253.05 260.67 7.62 0.530

----------------------------------------------------------------------------

12SC175 76.22 111.28 35.06 0.687

118.90 123.48 4.58 0.825

RC 135.67 129.57 135.67 6.10 1.436

----------------------------------------------------------------------------

12SC176 219.51 228.66 9.15 3.806

Inc. 221.04 222.56 1.52 16.850

231.71 240.85 9.14 0.388

RC 274.39 257.62 274.39 16.77 0.631

----------------------------------------------------------------------------

12SC177 430.9 442 11.1 1.924

Inc.430.9 433 2.10 5.59

451.50 456.15 4.65 7.729

CORE 531.55 Inc.451.50 453.10 1.60 19.85

----------------------------------------------------------------------------

12SC178 429.65 447.20 17.55 3.839

Inc.429.65 433.80 4.15 10.517

CORE 501.25 464.40 476.10 11.70 0.529

----------------------------------------------------------------------------

12SC178B 410.6 412.6 2.00 0.407

419.2 422.2 3.00 0.573

438.4 455.7 17.3 5.154

Inc. 439.60 440.60 1.00 45.200

Inc. 443.35 444.35 1.00 9.840

CORE 476.3 Inc. 449.35 450.35 1.00 12.950

----------------------------------------------------------------------------

12SC178C CORE 479.60

----------------------------------------------------------------------------

12SC179 RC/CORE

----------------------------------------------------------------------------

12SC180 RC/CORE

----------------------------------------------------------------------------

12SC181 147.87 157.01 9.14 0.834

RC 182.93 163.11 166.16 3.05 0.462

----------------------------------------------------------------------------

12SC182 118.90 132.62 13.72 0.940

RC 152.44 147.87 152.44 4.57 0.418

----------------------------------------------------------------------------

12SC183 248.48 254.57 6.09 12.850

Inc. 248.48 251.52 3.04 24.325

RC 304.88 294.21 304.88 10.67 0.643

----------------------------------------------------------------------------

12SC184 RC 248.48 233.23 237.8 4.57 1.271

----------------------------------------------------------------------------

13SC185 RC 422.26 No Intervals

----------------------------------------------------------------------------

13SC189 RC 487.8 No Intervals

----------------------------------------------------------------------------

(1) Due to the exploratory nature of this program and the variable

orientations of the mineralized zones, the intersections presented

herein may not necessarily represent the true width of mineralization

(2) RC = Reverse Circulation Hole

(3) Number in bold represent intervals greater than 35 metres(i)grams/tonne

(35gmt)

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Contacts: Alamos Gold Inc. Jo Mira Clodman Vice President,

Investor Relations (416) 368-9932 x 401 Alamos Gold Inc. Scott K.

Parsons Manager, Investor Relations (416) 368-9932 x 439

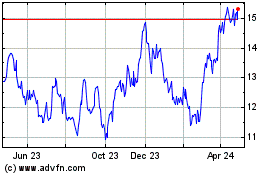

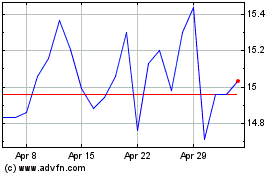

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jul 2023 to Jul 2024