Current Report Filing (8-k)

January 06 2023 - 4:16PM

Edgar (US Regulatory)

0001551152false00015511522023-01-062023-01-060001551152us-gaap:CommonStockMemberexch:XCHI2023-01-062023-01-060001551152exch:XNYSus-gaap:CommonStockMember2023-01-062023-01-060001551152exch:XNYSabbv:Sec1500SeniorNotesDue2023Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec1.375SeniorNotesDue2024Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec1250SeniorNotesDue2024Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec0.750SeniorNotesDue2027Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec2.125SeniorNotesdue2028Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec2625SeniorNotesDue2028Member2023-01-062023-01-060001551152exch:XNYSabbv:Sec2125SeniorNotesDue2029Member2023-01-062023-01-060001551152abbv:Sec1.250SeniorNotesdue2031Memberexch:XNYS2023-01-062023-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 6, 2023

ABBVIE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35565 | | 32-0375147 |

| (State or other Jurisdiction | | (Commission File Number) | | (IRS Employer |

| of Incorporation) | | | | Identification No.) |

_____________________________________________________

1 North Waukegan Road

North Chicago, Illinois 60064-6400

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (847) 932-7900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | | ABBV | | New York Stock Exchange |

| | | | Chicago Stock Exchange |

| | | | |

| 1.500% Senior Notes due 2023 | | ABBV23B | | New York Stock Exchange |

| 1.375% Senior Notes due 2024 | | ABBV24 | | New York Stock Exchange |

| 1.250% Senior Notes due 2024 | | ABBV24B | | New York Stock Exchange |

| 0.750% Senior Notes due 2027 | | ABBV27 | | New York Stock Exchange |

| 2.125% Senior Notes due 2028 | | ABBV28 | | New York Stock Exchange |

| 2.625% Senior Notes due 2028 | | ABBV28B | | New York Stock Exchange |

| 2.125% Senior Notes due 2029 | | ABBV29 | | New York Stock Exchange |

| 1.250% Senior Notes due 2031 | | ABBV31 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

Reported GAAP earnings and adjusted non-GAAP earnings for the fourth quarter of 2022 are expected to include acquired IPR&D and milestones expense of $243 million on a pre-tax basis, representing an unfavorable impact of $0.14 to both GAAP diluted earnings per share and adjusted non-GAAP diluted earnings per share. Results for the quarter ended December 31, 2022 have not been finalized and are subject to our financial statement closing procedures. There can be no assurance that our final results will not differ from these preliminary estimates.

While acquired IPR&D and milestones expense may be incurred upon execution of collaborations, licensing agreements, and other asset acquisitions, AbbVie does not forecast acquired IPR&D and milestones expense due to uncertainty of the future occurrence and timing of these transactions. Adjusted diluted earnings per share guidance for 2022 previously announced on October 28, 2022 excluded the impact of acquired IPR&D and milestones expense that may be incurred beyond the third quarter of 2022. AbbVie’s full-year 2022 adjusted diluted earnings per share guidance range, including the impact of fourth quarter 2022 acquired IPR&D and milestones expense, is $13.70 - $13.74. AbbVie’s fourth quarter 2022 adjusted diluted earnings per share guidance range, including the impact of fourth quarter 2022 acquired IPR&D and milestones expense, is $3.51 - $3.55.

Furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference is guidance for 2022 including the estimated acquired IPR&D and milestones expense incurred during the fourth quarter of 2022.

The information set forth in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "Filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities thereof, nor shall it be incorporated by reference into future filings by AbbVie Inc. under the Exchange Act or under the Securities Act of 1933, as amended, except to the extent specifically provided in any such filing.

Forward-Looking Statements

Some statements in this Current Report on Form 8-K are, or may be considered, forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995. The words "believe," "expect," "anticipate," "project" and similar expressions, among others, generally identify forward-looking statements. AbbVie cautions that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the failure to realize the expected benefits of AbbVie’s acquisition of Allergan or to promptly and effectively integrate Allergan’s business, challenges to intellectual property, competition from other products, difficulties inherent in the research and development process, adverse litigation or government action, and changes to laws and regulations applicable to our industry. Additional information about the economic, competitive, governmental, technological and other factors that may affect AbbVie's operations is set forth in Item 1A, "Risk Factors," of AbbVie's 2021 Annual Report on Form 10-K, which has been filed with the Securities and Exchange Commission, as updated by its Quarterly Reports on Form 10-Q and in other documents that AbbVie subsequently files with the Securities and Exchange Commission that update, supplement or supersede such information. AbbVie undertakes no obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | ABBVIE INC. |

| | | | |

| Date: | January 6, 2023 | By: | /s/ Scott T. Reents |

| | | | Scott T. Reents |

| | | | Executive Vice President, |

| | | | Chief Financial Officer |

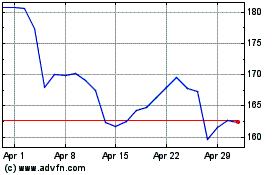

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Jun 2024 to Jul 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Jul 2023 to Jul 2024