UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

THE AARON'S COMPANY, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 12, 2024 (September 5, 2024)

| | | | | |

THE AARON'S COMPANY, INC. |

(Exact name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Georgia | | 1-39681 | | 85-2483376 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 400 Galleria Parkway SE | Suite 300 | Atlanta | Georgia | | 30339-3194 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (678) 402-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.50 Par Value | AAN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. OTHER EVENTS

As previously disclosed, on June 16, 2024, The Aaron’s Company, Inc., a Georgia corporation (the “Company”) entered into an Agreement and Plan of Merger (the “merger agreement”) with IQVentures Holdings, LLC, an Ohio limited liability company (“IQV”), and Polo Merger Sub, Inc., a Georgia corporation that is a wholly-owned direct subsidiary of IQV (“Merger Sub”), providing for, subject to the satisfaction or waiver (if permissible under applicable law) of specified conditions, the acquisition of the Company by IQV at a price of $10.10 per share in cash. Subject to the terms and conditions of the merger agreement, Merger Sub will be merged with and into the Company (the “merger”), with the Company surviving the merger as a wholly-owned direct subsidiary of IQV. In connection with the merger agreement, the Company filed with the United States Securities and Exchange Commission (the “SEC”) a preliminary proxy statement on July 31, 2024 (the “Preliminary Proxy Statement”) and a definitive proxy statement on August 13, 2024 (the “Definitive Proxy Statement”). The Definitive Proxy Statement was first mailed to the Company’s shareholders on August 19, 2024.

Litigation Related to the Merger

Following the filing of the Preliminary Proxy Statement, and as of the date of this Current Report on Form 8-K, the Company has received certain Complaints and Demand Letters (as described below) on behalf of purported Company shareholders alleging deficiencies regarding the disclosures contained in the Preliminary Proxy Statement and Definitive Proxy Statement. While the Company believes that the disclosures set forth in the Preliminary Proxy Statement and the Definitive Proxy Statement comply fully with all applicable law and denies the allegations in the Complaints and Demand Letters, in order to moot the purported shareholders’ disclosure claims, avoid nuisance and possible expense and disruption to the merger, and provide additional information to its shareholders, the Company has determined to voluntarily supplement certain disclosures in the Definitive Proxy Statement with the supplemental disclosures set forth below (the “Supplemental Disclosures”). Nothing in the Supplemental Disclosures shall be deemed an admission of the legal merit, necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, the Company specifically denies all allegations that any additional disclosure was or is required or material.

On September 5, 2024, a lawsuit by a purported shareholder of the Company, captioned James O’Connor v. The Aaron’s Company, Inc., et al., was filed in the Supreme Court of the State of New York, New York County (the “O’Connor Complaint”), asserting individual claims against the Company and the members of the Company’s board of directors for negligent misrepresentation and concealment and negligence, in violation of New York common law, based upon information included in or omitted from the Definitive Proxy Statement. On September 6, 2024, a lawsuit by a purported shareholder of the Company, captioned John Clark v. The Aaron’s Company, Inc., et al., was filed in the Supreme Court of the State of New York, New York County (the “Clark Complaint” and, together with the O’Connor Complaint, the “Complaints”), asserting substantially the same claims to that of the O’Connor Complaint. The Complaints seek, among other relief, an injunction enjoining defendants from consummating the merger unless the Company discloses the material information allegedly omitted from the Definitive Proxy Statement, rescission of the merger in the event it is consummated without the Company disclosing the material information allegedly omitted from the Definitive Proxy Statement, and an award of costs including attorneys’ and experts’ fees and expenses.

In addition, as of the date of this Current Report on Form 8-K, the Company has received certain demand letters (the “Demand Letters”) alleging deficiencies regarding the disclosures contained in the Preliminary Proxy Statement and Definitive Proxy Statement.

It is possible that additional or similar complaints or demand letters may be received by the Company alleging similar or additional disclosure deficiencies between the date of this Current Report on Form 8-K and consummation of the merger. If any such additional or similar complaints or demand letters are received, the Company may not necessarily disclose such events.

SUPPLEMENTAL DISCLOSURES

The Supplemental Disclosures are being filed to amend and supplement the information in the Definitive Proxy Statement. The Supplemental Disclosures are incorporated by reference into, and should be read in conjunction with, the Definitive Proxy Statement, which should be read in its entirety. To the extent defined terms are used but not defined herein, they have the meanings set forth in the Definitive Proxy Statement.

The disclosure in the section entitled “The Merger—Background of the Merger” beginning on page 24 of the Definitive Proxy Statement is hereby amended and supplemented as follows:

The fourth full paragraph on page 26 of the Definitive Proxy Statement is hereby amended and supplemented by adding the following underlined and bolded text:

On November 28, 2023, the Company and BasePoint executed a mutual confidentiality and standstill agreement. Such agreement, which is customarily entered into by potential transaction constituents at the inception of preliminary merger or business combination discussions, contained various provisions regarding the definition and maintenance of confidential information, restrictions on the use and permitted users of such information, customary exceptions allowing the disclosure of such information in certain circumstances, and various standstill covenants generally prohibiting the recipients of such confidential information from initiating and conducting certain unsolicited and hostile actions against the Company (including offers to purchase and acquisitions of securities in the open market or by other means, the submission of uninvited offers and proposals to acquire or enter into a business combination with the Company, the solicitation of proxies in certain defined circumstances, the taking of certain actions and the making of certain public announcements regarding any intention to seek to control or influence the management or directors of the Company, and acting in concert with other persons to seek to do any of the foregoing). The agreement did not include any provision prohibiting BasePoint from making any request that the Company waive the standstill restrictions. The standstill covenants would terminate following the execution of the merger agreement.

The final full paragraph beginning on page 29 of the Definitive Proxy Statement disclosure is hereby amended and supplemented by adding the following underlined and bolded text:

On April 9, 2024, the Board held a special meeting by video conference at which the Board reviewed the updated indications of interest received from each of IQV and Party B and discussed potential next steps. Representatives of Jones Day advised the directors of their fiduciary duties under the circumstances and discussed other related legal matters. Management discussed current business trends and the Operating Case, which reflected management’s view of the most likely outcome of the various initiatives identified in the Full Initiatives Case. In light of discussions with the Board, and in order to provide more fulsome context around potential business outcomes due to the challenges continuing to face the Company as a result of the difficult economic and operating environment, J.P. Morgan also presented an assessment of the valuation of the Company based on a pre-initiatives forecast, as discussed in further detail under “—Prospective Financial Information” (the “Pre-Initiatives Case”), which reflected the Company’s forecasted performance assuming specified strategic initiatives identified in the Full Initiatives Case were not attempted. After discussion, the Board determined that it would use the Operating Case for purposes of any assessment of the valuation of the Company and directed J.P. Morgan to use the Operating Case for purposes of its financial analyses and, to the extent applicable, any related opinion. In making this determination, the Board considered the Company's current performance against plan, market conditions and ongoing economic and industry challenges, and other execution risks related to the initiatives identified in the Full Initiatives Case. Representatives of J.P. Morgan also discussed the revised indications of interest from IQV and Party B, including the financing certainty of the IQV proposal in particular. Following discussion of the revised indications of interest with the representatives of J.P. Morgan, the Board instructed management to provide the counterparties with a draft

merger agreement and to seek the possibility of achieving higher value from IQV and Party B prior to May 2, 2024. In addition, the Board instructed J.P. Morgan to reach out to four additional parties other than IQV and Party B that management and J.P. Morgan had identified as being reasonably likely to have interest in pursuing, and the financial capacity to consummate, a possible acquisition of the Company. These parties included two potential financial buyers, including Party A, and two potential strategic buyers. The Board determined that such outreach appropriately balanced the potential benefits of contacting other potential buyers with the risks that had been discussed at its meetings on February 13, 2024 and March 12 and March 13, 2024.

The final full paragraph beginning on page 33 of the Definitive Proxy Statement disclosure is hereby amended and supplemented by adding the following underlined and bolded text:

On June 4, 2024, representatives of J.P. Morgan, Jones Day, Stephens and King & Spalding convened a conference call to discuss open issues in the merger agreement, including price and valuation, the treatment of outstanding incentive long-term equity and cash awards, the reverse termination fee in the event IQV failed to close the merger, the Board’s ability to terminate the merger agreement in the event the Board is presented with a proposal superior to IQV’s proposal and the outside date for the termination of the merger agreement. The advisors also discussed next steps, which would involve King & Spalding revising the draft merger agreement and redistributing it to Jones Day. Representatives of King & Spalding also communicated that IQV desired to communicate with Mr. Lindsay regarding potential employment and related compensation and benefits plans for Mr. Lindsay and key members of the Company’s senior management in the event a transaction were to be consummated. These discussions represented the initial conversation among the parties regarding potential employment and compensation and benefits programs for Mr. Lindsay and members of the Company’s senior management team following the closing of the potential transaction. Following the conference call, Stephens circulated a revised proposal from IQV on the treatment of the Company’s outstanding long-term equity and cash incentive awards, which would pay certain types of awards in cash at closing in accordance with their terms, and require deferral of certain payouts under other awards.

The fourth full paragraph on page 34 of the Definitive Proxy Statement is hereby amended and supplemented by adding the following underlined and bolded text and deleting the following stricken text:

On June 10, 2024, the Board held a special meeting by video conference at which the Board received updates from management, J.P. Morgan and Jones Day regarding the status of the process with IQV. Representatives of J.P. Morgan and Jones Day discussed the primary outstanding issues related to price and the treatment of outstanding incentive long-term equity and cash awards. Representatives of Jones Day summarized the considerations regarding the proposed treatment of the outstanding long-term equity and cash incentive awards and potential alternatives, which would require the approval of the Compensation Committee of the Board (the “Compensation Committee”). A representative of Jones Day explained potential alternatives for the treatment of options, other long-term equity and cash awards and other executive and employee compensation and benefits matters in the transaction that had been proposed by IQV and elements of the proposed treatment as to which the Company’s directors and officers could have interests that are different from, or in addition to, the interests of the Company’s shareholders generally. Following discussion, the Board authorized Timothy Johnson, Chair of the Compensation Committee, and Mr. Lindsay to engage in discussions with IQV regarding further increases in price as well as the proposed treatment of the Company’s outstanding long-term equity and cash incentive awards. The Board also authorized Mr. Lindsay to engage in initial discussions with IQV regarding his expectations in connection with retaining related to employment and compensation and benefits programs for Mr. Lindsay and the other key members of the management team following the closing of the potential transaction.

The first full paragraph on page 35 of the Definitive Proxy Statement is hereby amended and supplemented by adding the following underlined and bolded text:

On June 13, 2024, Mr. Lindsay and representatives of IQV held an in-person meeting in Atlanta. Although no written proposal was presented, the IQV representatives expressed their desire that Mr. Lindsay continue to lead the Company following the closing and the parties discussed post-closing roles and the types of compensation arrangements that could be implemented for Mr. Lindsay and the Company’s management team. In particular, the representatives of IQV suggested that they were interested in retaining the management team. While no specific proposal was presented, the representatives of IQV noted that an arrangement for Mr. Lindsay could include a roll-over or deferral of certain amounts payable to him at closing and employment terms intended to cover at least the first year following the completion of the transaction. Representatives of IQV also suggested that a proposal for management following the transaction could include compensation plans that would provide profit sharing interests. The parties did not negotiate any specific terms of any compensation or benefits arrangements during the meeting. Following this conversation, in consultation with Messrs. Johnson and Robinson, J.P. Morgan and Jones Day, Mr. Lindsay contacted IQV and Jones Day contacted King & Spalding, to communicate that, in order to proceed with a potential transaction on the parties’ preferred timeline, Mr. Lindsay’s outstanding long-term equity and cash compensation awards would need to be afforded the same treatment as the other plan participants. Mr. Lindsay and IQV further agreed that any discussion regarding Mr. Lindsay’s and the rest of the management team's post-transaction compensation would need to be deferred until after a definitive agreement had been signed, although such agreement on terms would not be a condition to closing.

The disclosure is hereby amended and supplemented by adding the following underlined and bolded text as the fourth full paragraph on page 36 of the Definitive Proxy Statement:

In the weeks following announcement of the transaction, representatives of IQV and Mr. Lindsay continued discussion of potential employment arrangements and compensation and benefits programs for Mr. Lindsay and the rest of the management team. However, these discussions are not expected to be completed prior to the closing of the transaction.

The disclosure in the section entitled “The Merger—Prospective Financial Information” beginning on page 40 of the Definitive Proxy Statement is hereby amended and supplemented as follows:

The disclosure under the subheading “Prospective Financial Information” on page 43 of the Definitive Proxy Statement is hereby amended and supplemented by adding the following underlined and bolded text:

| | | | | | | | | | | | | | | | | |

Prospective Financial Information ($ in millions) |

| YEAR | 2024E | 2025E | 2026E | 2027E | 2028E |

| Revenue | | | | | |

| Pre-Initiatives Case | $ | 2,155 | | $ | 2,228 | | $ | 2,282 | | $ | 2,316 | | $ | 2,330 | |

| Aaron's Business | 1,524 | 1,563 | 1,582 | 1,599 | 1,599 |

BrandsMart(2) | 631 | 665 | 698 | 717 | 731 |

| Operating Case | 2,155 | | 2,248 | | 2,366 | | 2,496 | | 2,633 | |

| Aaron's Business | 1,524 | 1,569 | 1,608 | 1,654 | 1,693 |

BrandsMart(2) | 631 | 679 | 758 | 842 | 940 |

| Full Initiatives Case | 2,155 | | 2,278 | | 2,469 | | 2,710 | | 3,007 | |

| Aaron's Business | 1,524 | 1,585 | 1,659 | 1,763 | 1,883 |

BrandsMart(2) | 631 | 693 | 810 | 947 | 1,124 |

Adjusted EBITDA(1) | | | | | |

| Pre-Initiatives Case | $ | 120 | | $ | 121 | | $ | 117 | | $ | 108 | | $ | 89 | |

| Operating Case | 120 | | 123 | | 123 | | 125 | | 125 | |

| Full Initiatives Case | 120 | | 136 | | 155 | | 186 | | 228 | |

Adjusted Free Cash Flow(3) | | | | | |

| Pre-Initiatives Case | $ | 28 | | $ | 65 | | $ | 69 | | $ | 73 | | $ | 65 | |

| Operating Case | 28 | | 55 | | 44 | | 53 | | 57 | |

| Full Initiatives Case | 28 | | 43 | | 30 | | 43 | | 70 | |

Unlevered Free Cash Flow(4) | $ | 31 | | $ | 53 | | $ | 39 | | $ | 47 | | $ | 49 | |

1 Adjusted EBITDA as presented in the prospective financial information included herein is calculated as earnings (loss) before income tax expense plus the sum of interest expense, depreciation, amortization, and stock-based compensation. Adjusted EBITDA is a non-GAAP financial measure and should not be considered as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of net earnings (loss) to Adjusted EBITDA for each period presented is set forth below:

2 BrandsMart revenues are net of intercompany eliminations.

The disclosure in the section entitled “The Merger—Opinion of J.P. Morgan” beginning on page 45 of the Definitive Proxy Statement is hereby amended and supplemented as follows:

The third full paragraph on page 47 of the Definitive Proxy Statement is hereby amended and supplemented by adding the following underlined and bolded text:

Discounted Cash Flow Analysis. J.P. Morgan conducted a discounted cash flow analysis for the purpose of determining an implied fully diluted equity value per share for Company common stock. J.P. Morgan calculated the unlevered free cash flows that the Company is expected to generate during fiscal years 2024E through 2028E, based on the Operating Case. J.P. Morgan also calculated a range of terminal values for the Company at the end of this period by applying a terminal growth rate ranging from 1% to 2%, based on guidance provided by the Company’s management, to estimates of the unlevered terminal free cash flows for the Company at the end of fiscal year 2028, based on the Operating Case. J.P. Morgan then discounted the unlevered free cash flow estimates and the range of terminal values to present values as of March 31, 2024 using a range of discount rates from 10% to 12%, which range was chosen by J.P. Morgan based upon an analysis of the weighted average cost of capital of the Company. The present values of the unlevered free cash

flow estimates and the range of terminal values were then adjusted for the Company’s estimated net debt as of March 31, 2024, which estimated net debt, as provided by the Company’s management, was $172 million. This analysis indicated a range of implied share equity value for Company common stock (rounded to the nearest $0.25) of $4.50 to $7.00, which J.P. Morgan compared to the merger consideration of $10.10 per share of Company common stock.

Cautionary Note Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K (this “Report”) that are not historical facts are “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “believe,” “expect,” “expectation,” “anticipate,” “may,” “could,” “should,” “intend,” “seek,” “estimate,” “plan,” “target,” “project,” “likely,” “will,” “forecast,” “future,” “outlook,” or other similar words, phrases, or expressions. These risks and uncertainties include factors such as (i) the ability to obtain regulatory approval and meet other closing conditions to the proposed transaction, including shareholder approval; (ii) the ability of IQV to obtain financing for the proposed transaction; (iii) potential adverse reactions or changes to business relationships resulting from the announcement, pendency or inability to complete the proposed transaction on the expected timeframe or at all; (iv) litigation relating to the proposed transaction; (v) the inability to retain key personnel, or potential diminished productivity due to the impact of the proposed transaction on the Company’s current and prospective employees, key management, customers, suppliers, franchisees and business partners; and (vi) the other risks and uncertainties discussed under “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and in other documents that the Company files from time to time with the SEC. Statements in this Report that are “forward-looking” include without limitation statements about IQV’s proposed transaction to acquire the Company (including the anticipated benefits, results, effects and timing of the proposed transaction). You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this Report.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the transaction between the Company and IQV. The Company has previously announced that a special meeting of shareholders will be held on September 25, 2024, at 4:00 p.m. local time, at the law offices of Jones Day, located at 1221 Peachtree Street N.E., Suite 400, Atlanta, GA 30361, to obtain shareholder approval of the proposed transaction. In connection with the transaction, the Company has filed relevant materials with the SEC, including the Definitive Proxy Statement. INVESTORS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE DEFINITIVE PROXY STATEMENT, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. Investors may obtain a free copy of these materials and other documents filed by the Company with the SEC at the SEC’s website at www.sec.gov, at the Company’s website at www.aarons.com or by sending a written request to the Company in care of the Corporate Secretary, at The Aaron’s Company, Inc., 400 Galleria Parkway, S.E., Suite 300, Atlanta, Georgia 30339.

Participants in the Solicitation

The directors and executive officers of the Company, and other persons, may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding the Company’s directors and executive officers is available in the Company’s definitive proxy statement filed with the SEC on March 21, 2024 in connection with the Company’s 2024 annual meeting of shareholders. Additional information regarding persons who may be deemed participants in the solicitation of proxies and a description of their interests, by security holdings or otherwise, is included in the Definitive Proxy Statement and may be included in other relevant materials to be filed with the SEC in connection with the proposed transaction. These documents can be obtained free of charge from the sources indicated above.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE AARON'S COMPANY, INC. |

| | By: | /s/ C. Kelly Wall |

Date: | September 12, 2024 | | C. Kelly Wall

Chief Financial Officer |

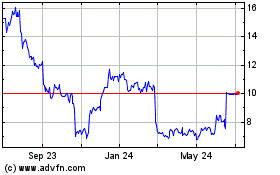

Aarons (NYSE:AAN)

Historical Stock Chart

From Nov 2024 to Dec 2024

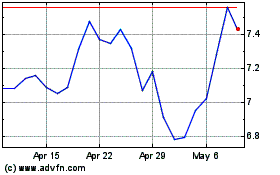

Aarons (NYSE:AAN)

Historical Stock Chart

From Dec 2023 to Dec 2024