CNET Networks, Inc. (Nasdaq:CNET) today reported financial results

for the quarter ended June 30, 2007. �2007 is a transition year for

CNET Networks. We have made and will continue to make the changes

necessary to execute on the opportunity in front of us,� said Neil

Ashe, chief executive officer of CNET Networks. �With some of the

most important online media brands in the world, serving over 137

million people each month, CNET Networks is uniquely positioned and

has the foundation to thrive in the evolving media landscape.�

Second Quarter Financial and Operating Highlights Revenues - Total

revenues for the second quarter were $97.2 million, a 5 percent

increase compared to revenues of $92.4 million for the same period

of 2006. Excluding $2.2 million in revenue generated by businesses

closed in late 2006, total revenue would have increased 8 percent

in the second quarter of 2007. Operating Income (Loss) - Operating

loss totaled $965,000 during the second quarter of 2007 compared to

operating income of $4.8 million in the year ago quarter. Second

quarter 2007 reported operating loss reflects $2.9 million in costs

principally related to ongoing litigation concerning the Company�s

concluded stock option investigation. Second quarter 2006 reported

operating income reflects $1.4 million in stock option

investigation related costs. Operating income (loss) before

depreciation, amortization, and stock compensation expense was

$13.3 million for the second quarter of 2007 compared to $17.4

million in the year ago quarter. Excluding costs associated with

the Company�s stock option investigation and related matters of

$2.9 million during the second quarter and $1.4 million in the

year-ago quarter, operating income before depreciation,

amortization, and stock compensation expense was $16.2 million

compared to $18.8 million during the second quarter of 2006. The

profit margin of operating income (loss) during the second quarter

of 2007 was a loss of 1 percent as compared to a profit of 5

percent in the year ago quarter. Excluding costs associated with

the Company�s stock option investigation and related matters, the

profit margin of operating income before depreciation,

amortization, and stock compensation expense was 17 percent

compared to 20 percent in the year ago quarter. Net Income (Loss) �

Net loss for the second quarter of 2007 was $76,000, or breakeven

per diluted share. This compares with net profit of $5.2 million,

or $0.03 per diluted share during the second quarter of 2006. Net

profit for the second quarter of 2007 was negatively impacted by

$2.9 million in costs associated with the Company�s stock option

investigation and related matters which were partially offset by a

$1.6 million gain on private investments. Excluding stock

compensation expense, costs associated with the Company�s stock

option investigation and related matters, and realized gains on

investments, adjusted net income for the second quarter of 2007 was

$5.2 million, or $0.03 on a diluted share basis, compared to $11.2

million, or $0.07 per diluted share, during the same period of

2006. Cash Flow and Capital Expenditures - Net cash provided by

operating activities for the second quarter of 2007 was $17.5

million, up from $14.9 million for the second quarter of 2006.

Capital expenditures in the second quarter of 2007 were $8.5

million compared to $8.7 million in the second quarter of 2006.

Excluding costs associated with the Company�s stock option

investigation and related matters of $2.9 million in the second

quarter of 2007 and $1.4 million in the second quarter of 2006,

free cash flow for the second quarter of 2007 was $11.8 million

compared to $7.6 million in the year ago quarter. Free cash flow is

defined as cash flow from operating activities less net capital

expenditures. User Metrics - CNET Networks' global network of

Internet properties reached an average of 137 million unique

monthly users during the second quarter of 2007, an increase of 18

percent from the second quarter of 2006 (1). Average daily page

views were more than 74 million during the second quarter, down 19

percent from the year ago quarter (1). A reconciliation of the

non-GAAP measures used in this release to the most comparable GAAP

measure and further information regarding the Company's stock

compensation expense, discontinued operations and unusual gains are

included in the accompanying "Operating Income (Loss)

Reconciliation" and "Net Income (Loss) Reconciliation." Second

Quarter Business Highlights �Our focus remains on building a

vibrant and valuable company that seizes the long term opportunity

and creates value for all stakeholders. We will do so by continuing

to realize the potential and opportunity of our existing world

class brands, identifying new opportunities for growth, and

continuously striving to do what we do better,� said Ashe.

Management Team Additions: CNET Networks recently announced new

additions to its senior management team that support the Company�s

long term strategy for growth and further strengthen its position

in today�s evolving media landscape. During the quarter, the

Company announced that it had hired former Time Warner executive

Jack Haire as Special Advisor to the CEO. (See press release

titled, �CNET Networks Hires Former Time Warner Executive Jack

Haire� June 28, 2007.) In this role, he will be dedicated to

optimizing the corporate advertising sales strategy in

collaboration with the Company's leadership team. The position was

created to provide experienced and dedicated executive leadership

to the sales organization in order to realize the full power of the

Company's brands. In the role of Special Advisor to the CEO, Haire

will focus on creating strategic relationships, mentoring a

world-class sales team and maximizing resources for growth. Earlier

this month, the Company announced that it had appointed Jose Martin

to senior vice president, human resources and Andy Sherman to

senior vice president, general counsel and corporate secretary.

(See press release titled, �CNET Networks Expands Executive

Management Team with Accomplished Human Resources and Legal

Leadership� July 10, 2007.) Prior to joining CNET Networks, Jose

Martin was group vice president of human resources at Electronic

Arts (EA). At EA, he was a key architect in shaping the global

talent management systems and culture, and oversaw the integration

of numerous company acquisitions. Prior to joining CNET Networks,

Andy Sherman served as vice president of legal at Sybase. He

assumed that position after playing an integral role in Sybase's

acquisition of Mobile 365, where he served as general counsel &

secretary. Sherman also served as general counsel and secretary at

Epiphany and the head of the international legal function at

PeopleSoft. Brand Highlights: During the second quarter, CNET

Networks continued to drive innovation and product developments

across its existing brands. Examples include: CNET (www.cnet.com)

launched the CNET Blog Network, a collection of blogs written by

leading industry experts and CNET editors about technology's

influence on a variety of topics, such as sports, politics, green

technology, parenting, and more. Available at

http://blogs.cnet.com, the bloggers were hand-selected by CNET

editors and chosen because of their knowledge, credibility, and

authenticity. The CNET Blog Networks further expands CNET's

coverage of technology and its impact on the world today. These

bloggers are expected to uphold the same journalism standards as

the CNET editors, so users can expect the same level of editorial

quality from contributors to the CNET Blog Network as they do from

CNET editors. CNET will be adding more topics and bloggers to the

CNET Blog Network in the coming months. TV.com (www.tv.com)

launched several new original video programs during the second

quarter that offer a unique blend of editorial commentary from

TV.com's line-up of entertainment experts, as well as from the

site's audience of passionate TV fans. Two of the most popular new

TV.com shows are �The Burning Question�, a weekly video where new

host, Laura Swisher, takes to the streets to hear people�s thoughts

on the latest TV-related news, and �Turbovision�, a witty daily

video overview of what will be on TV that night. The addition of

these new shows that revolve around TV culture make TV.com a

recurring stop for television fans that want to find new shows as

well as get closer to the shows they already love. GameSpot

(www.gamespot.com) launched new product innovations that enable

today's diverse and growing gaming audience to easily access and

consume informative, entertaining content about games. GameSpot now

features a streamlined game reviews system, a high-performance

content download manager, and a cinema-quality video player. The

game review process is now more straightforward with an overall

editor score ranging from 1 to 10, followed by a brief Good/Bad

summary, hosted video review, and an in-depth written review. Next

to the editor score, gamers can view the consumer and critic scores

to quickly gauge a game's performance according to not only

GameSpot's expert editorial staff, but also to other gamers and

critical reviewers. In addition, the site now offers a new

Flash-based video player providing users with compelling content

through cinema-quality video resolution and content channels that

introduce users to other new, popular, and similar videos. New

Growth Opportunities: CNET Networks continues to identify new

opportunities for growth, including partnership and acquisitions

that further extend the company�s distribution network, content

coverage, and/or audience. Recent highlights include: During the

quarter, as part of its new joint venture, News Corp. and NBC

Universal announced the addition of CNET Networks as a strategic

content provider and distributor. As part of this, CNET Networks

will provide thousands of clips to the new destination on a

non-exclusive basis and will also distribute the new site's library

of licensed content across its portfolio of properties. This

partnership, in addition to the deal that CNET Networks and CBS

Interactive announced last quarter, provide symbiotic ways to

improve the user experience across CNET Networks and its partner

sites, and ultimately create more value for the Company and its

media partners. In an effort to broaden GameSpot�s content coverage

and audience, CNET Networks acquired SportsGamer, an online

property serving a passionate community of sports game enthusiasts

with features such as game play strategy and tips, innovative

online stats and leaderboard tracking, how-to video segments, and

active user forums. The addition of SportsGamer further extends

GameSpot�s reach in the sport gaming segment and will complement

GameSpot�s existing coverage in this large and growing market.

Awards: Several of CNET Networks premier brands received industry

recognition for excellence in editorial and design during the

quarter. Two of the Company's newest additions are already

receiving accolades: BNET, the go-to-place for management, won an

EPpy Award for best design and CHOW, the place for people

passionate about food, won a respected Bert Greene Food Journalism

Award. In addition, earlier this month, CHOW was named as one of

the Top 50 Websites of 2007 by TIME Magazine. CNET.com and GameSpot

were once again recognized by the prestigious Webby and Maggie

Awards during the quarter. Business Outlook For the third quarter

of 2007, management anticipates total revenues of $95 million to

$103 million. Including approximately $5 million in non-cash stock

compensation expense, management estimates operating income in the

range of a loss of $1.5 million to income of $2.5 million for the

third quarter. Management expects operating income before

depreciation, amortization, and stock compensation expense of

between $14 million and $18 million for the quarter. Including

stock compensation expense of approximately $0.03 per diluted

share, earnings per share is expected to be in the range of $0.01

to $0.04 in the third quarter. For 2007, management is revising

estimates as follows. Total annual revenues are expected to be in

the range of $405 million to $430 million. Including $20 million in

stock compensation expense, management estimates operating income

between $18 million and $33 million. Management expects operating

income before depreciation, amortization and stock compensation

expense to be between $80 million and $95 million. Including stock

compensation expense of approximately $0.13 per diluted share and a

tax benefit of approximately $1.19 per share related to the

potential release of a portion of the Company�s deferred tax

valuation allowance in the fourth quarter of 2007, earnings per

share is expected to be in the range of $1.30 to $1.39 per share

for the year. Operating income guidance for the third quarter and

full-year 2007 does not consider ongoing costs associated with the

Company's stock option investigation and related matters. More

detailed guidance, as well as a table that reconciles operating

income before depreciation, amortization, and stock compensation

guidance to operating income (loss) guidance can be found on the

"Guidance to the Investment Community" sheet that accompanies this

press release. Conference Call and Webcast CNET Networks will host

a conference call to discuss its second quarter financial results

and business outlook beginning at 5:00 pm ET (2:00 pm PT), today,

July 26, 2007. To listen to the discussion, please visit

http://ir.cnetnetworks.com and click on the link provided for the

webcast conference call or dial (800) 344-1035 (international

dial-in: (706) 679-3076). A replay of the conference call will be

available via webcast at the URL listed above or by calling (800)

642-1687 (international dial-in: (706) 645-9291) and entering the

conference ID number 5243736. The Company's past financial news

releases, related financial and operating information, and access

to all Securities and Exchange Commission filings, can also be

accessed at http://ir.cnetnetworks.com. Safe Harbor This press

release and its attachments include forward-looking information and

statements that are subject to risks and uncertainties that could

cause actual results to differ materially. These statements are

only effective as of the date of this press release and CNET

Networks undertakes no duty to publicly revise or update these

forward-looking statements, whether as a result of new information,

future developments or otherwise. These forward-looking statements

include the statements under the sections entitled "Business

Outlook" which set forth our estimated financial performance for

the third quarter and full year of 2007, including future revenue,

expenses, operating income and earnings per share, and statements

regarding our growth prospects and expectations regarding the

future success of our products and services. In addition,

management expects to provide forward-looking information

statements on the conference call to be held shortly following the

issuance of this release, which are also subject to risks and

uncertainties that could cause actual results to differ materially.

The forward-looking statements in this release and on the

conference call are identified by the words "expect," "estimate,"

"target," "believe," "goal," "anticipate," "intend" and similar

expressions or are otherwise identified in the context in which

they are made as being forward-looking. These statements are only

effective as of the date of this release and we undertake no duty

to publicly update these forward-looking statements, whether as a

result of new information, future developments or otherwise. The

risks and uncertainties that could cause actual results to differ

materially from those projected include: a lack of growth or a

decrease in marketing spending on the Internet due to failure of

marketers to adopt the Internet as an advertising medium at the

rate that we currently anticipate; a lack of growth or decrease in

marketing spending on CNET Networks' properties in particular,

which could be prompted by competition from other media outlets,

both on and off the Internet; dissatisfaction with CNET Networks'

services, or economic difficulties in our clients' businesses; an

increase in the competitiveness of the market for qualified

employees or changes in our stock price or volatility, both of

which could increase our estimated stock compensation expenses for

2007; economic conditions such as weakness in corporate or consumer

spending, which could prompt a reduction in overall advertising

expenditures or expenditures specifically on our properties; the

failure of existing advertisers to meet or renew their advertising

commitments as we anticipate, which would cause us to not meet our

financial projections; the failure to attract advertisers outside

of our traditional technology and consumer electronics categories,

which would cause us to not meet our financial projections; a

continued decline in revenues from our print publications as

advertising dollars shift to other media; the acquisition of

businesses or the launch of new lines of business, which could

decrease our cash position, increase operating expense, and dilute

operating margins; an increase in intellectual property licensing

fees, which could increase operating expense, including

amortization; the risk of future impairment of our intangible

assets, goodwill or investments based on a decline in our business

or investments; and general risks associated with our business. For

additional discussion regarding the risks related to CNET Networks'

business, see its Annual Report on Form 10-K for the year ended

December 31, 2006 and subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, including disclosures under the

captions "Risk Factors" and "Management's Discussion and Analysis

of Financial Conditions and Results of Operations," which are filed

with the Securities and Exchange Commission and are available on

the SEC's website at www.sec.gov. About CNET Networks, Inc. CNET

Networks, Inc. (Nasdaq:CNET) (www.cnetnetworks.com) is an

interactive media company that builds brands for people and the

things they are passionate about, such as gaming, music,

entertainment, technology, business, food, and parenting. The

Company's leading brands include CNET, GameSpot, TV.com, MP3.com,

CHOW, UrbanBaby, ZDNet, BNET, and TechRepublic. Founded in 1992,

CNET Networks has a strong presence in the US, Asia, and Europe.

(1) CNET Networks Internal Log Data, April 2007 to June 2007. CNET

Networks, Inc. Consolidated Statements of Operations Unaudited (in

thousands, except per share data) � Three Months Ended Six Months

Ended June 30, June 30, 2007 � 2006 � 2007 � 2006 � � Revenues $

97,191 $ 92,377 $ 189,288 $ 176,027 � Operating expenses: Cost of

revenues (1) 41,743 39,862 85,225 80,551 Sales and marketing (1)

27,405 24,689 53,331 47,652 General and administrative (1) 15,949

13,623 32,029 28,382 Stock option investigation and related matters

2,859 1,401 7,288 1,401 Depreciation 6,991 5,265 14,480 10,087

Amortization of intangible assets 3,209 � 2,710 � 6,429 � 5,449 �

Total operating expenses 98,156 � 87,550 � 198,782 � 173,522 � �

Operating income (loss) (965 ) 4,827 (9,494 ) 2,505 � Non-operating

income (expense): Realized gains on investments 1,600 - 1,600 500

Interest income 934 1,280 1,572 2,432 Interest expense (1,327 )

(659 ) (2,673 ) (1,318 ) Other, net (223 ) (83 ) 78 � 57 � Total

non-operating income 984 � 538 � 577 � 1,671 � Income (loss) from

continuing operations before income taxes 19 5,365 (8,917 ) 4,176

Income tax expense 95 � 205 � 277 � 281 � Income (loss) from

continuing operations (76 ) 5,160 (9,194 ) 3,895 Loss from

discontinued operations - � - � - � (37 ) � Net income (loss) $ (76

) $ 5,160 � $ (9,194 ) $ 3,858 � � Basic net income (loss) per

share $ 0.00 � $ 0.03 � $ (0.06 ) $ 0.03 � � Diluted net income

(loss) per share $ 0.00 � $ 0.03 � $ (0.06 ) $ 0.03 � � Shares used

in calculating basic net income (loss) per share 151,333 � 149,549

� 150,858 � 148,857 � � Shares used in calculating diluted net

income (loss) per share 151,333 � 152,775 � 150,858 � 152,927 � �

(1) Includes stock compensation expense, which was allocated as

follows: Cost of revenues $ 1,209 $ 1,939 $ 2,974 $ 3,874 Sales and

marketing 573 876 1,416 1,772 General and administrative 2,275 �

1,818 � 4,830 � 3,743 � $ 4,057 � $ 4,633 � $ 9,220 � $ 9,389 �

CNET Networks, Inc. Consolidated Balance Sheets Unaudited (in

thousands) � June 30, December 31, 2007 � 2006 � ASSETS Current

Assets: Cash and cash equivalents $ 59,514 $ 31,327 Investments in

marketable debt securities 25,920 30,372 Accounts receivable, net

71,839 89,265 Other current assets 11,970 � 10,512 � Total current

assets 169,243 161,476 � Investments in marketable debt securities

- 13,915 Restricted cash 1,634 2,200 Property and equipment, net

73,985 72,625 Other assets 14,815 15,554 Intangible assets, net

33,148 34,978 Goodwill 141,252 � 133,059 � Total assets $ 434,077 �

$ 433,807 � � LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable $ 8,365 $ 10,055 Accrued liabilities

48,230 80,335 Revolving credit facility 60,000 60,000 Current

portion of long-term debt 12,155 � 13,850 � Total current

liabilities 128,750 164,240 � Non-current liabilities: Long-term

debt 3,587 4,498 Other liabilities 4,506 � 726 � Total liabilities

136,843 � 169,464 � � Stockholders' equity: Common stock; 400,000

shares authorized; 151,598 issued at June 30, 2007 and 151,315

issued at December 31, 2006 15 15 Additional paid-in-capital

2,897,898 2,857,238 Accumulated other comprehensive loss (10,193 )

(11,357 ) Treasury stock, at cost; 1,510 shares outstanding at June

30, 2007 and December 31, 2006 (30,453 ) (30,453 ) Accumulated

deficit (2,560,033 ) (2,551,100 ) Total stockholders' equity

297,234 � 264,343 � Total liabilities and stockholders' equity $

434,077 � $ 433,807 � CNET Networks, Inc. Statements of Cash Flows

Unaudited (in thousands) � Six Months Ended June 30, 2007 � 2006 �

Cash flows from operating activities: Net income (loss) $ (9,194 )

$ 3,858 Adjustments to reconcile net income (loss) to net cash

provided by operating activities: Depreciation and amortization

20,909 15,536 Fair value remeasurement (702 ) - Noncash stock

compensation expense 9,220 9,389 Other noncash items, net (107 )

(253 ) Provision for doubtful accounts 1,023 1,740 Gain on sale of

business, net - (778 ) Gains on sales of privately held investments

(1,600 ) (500 ) Changes in operating assets and liabilities, net of

acquisitions: Accounts receivable 17,376 15,806 Other assets (1,434

) 2,215 Accounts payable (2,101 ) 862 Accrued liabilities (6,252 )

(3,806 ) Other long-term liabilities 1,385 � (19 ) Net cash

provided by operating activities 28,523 � 44,050 � � Cash flows

from investing activities: Purchase of marketable debt securities

(8,839 ) (31,090 ) Proceeds from sales of marketable debt

securities 28,259 23,812 Proceeds from sales of investments in

privately held companies 1,600 2,531 Release of restricted funds

604 - Purchases of other intangible assets (293 ) - Cash paid for

acquisitions, net of cash acquired (15,701 ) (6,259 ) Sale of

leasehold improvements 2,349 - Purchases of property and equipment

(18,055 ) (17,431 ) Net cash used in investing activities (10,076 )

(28,437 ) � Cash flows from financing activities: Net proceeds from

issuance of stock 9,305 7,018 Principal payments on borrowings (27

) (47 ) Net cash provided by financing activities 9,278 � 6,971 �

Net increase in cash and cash equivalents 27,725 22,584 Effect of

exchange rate changes on cash and cash equivalents 462 561 Cash and

cash equivalents at the beginning of the period 31,327 � 55,895 �

Cash and cash equivalents at the end of the period $ 59,514 � $

79,040 � CNET Networks, Inc. Quarterly Statistical Highlights

Unaudited Q2-07 Q1-07 Q4-06 Q3-06 Q2-06 � Total Quarterly Revenue

($mm) $ 97.2 $ 92.1 $ 118.0 $ 93.3 $ 92.4 � Revenue Distribution

(%) (a) Marketing Services 88 % 87 % 89 % 86 % 86 % Licensing, Fees

and User 12 % 13 % 11 % 14 % 14 % � Segment Revenue ($mm) U.S.

Media $ 73.7 $ 74.2 $ 93.5 $ 73.5 $ 72.8 International Media 23.5

17.9 24.5 19.8 19.6 � Advertiser Metrics CNET Networks Top 100 US

Advertisers' Renewal Rate (Q-to-Q) 95 % 96 % 96 % 96 % 100 % CNET

Networks Top 100 US Advertisers' % of Network Revenue 52 % 57 % 57

% 54 % 55 % � Select Business Metrics Network Unique Users (mm)

137.4 143.7 135.8 124.5 116.2 Network Average Daily Page Views (mm)

74.9 81.2 84.8 86.3 92.8 � Balance Sheet Highlights ($mm) Cash $

59.5 $ 45.3 $ 31.3 $ 78.7 $ 79.0 Marketable Debt Securities � 25.9

� � 27.4 � � 44.3 � � 60.9 � � 62.0 � Total Cash and Investments $

85.4 $ 72.7 $ 75.6 $ 139.6 $ 141.0 � Days Sales Outstanding (DSO)

67 74 69 73 67 � Total Debt $ 75.8 $ 77.0 $ 78.3 $ 143.3 $ 143.3 �

� (a) Marketing Services - sales of advertisements on our Internet

network through impression-based and activity-based advertising,

and sales of advertisements in our print publications. Licensing,

Fees and User - licensing our product database and online content,

subscriptions to online services, subscriptions to our online

services and print publications. CNET Networks, Inc. Business

Outlook Q2-07 Q3-07 estimate FY 2007 estimate $ in millions, except

per share Actual Low - High Low - High � � Total Revenues $97.2

$95.0 - $103.0 $405.0 - $430.0 � Operating income before

depreciation, amortization, stock option investigation and related

matters and stock compensation expense $16.1 $14.0 - $18.0 $80.0 -

$95.0 � Depreciation expense $7.0 $7.4 $30.0 � Amortization expense

$3.2 $3.1 $12.0 � Stock compensation expense $4.0 $5.0 $20.0 �

Stock option investigation and related matters $2.9 -- -- �

Operating income (loss) ($1.0) ($1.5) - $2.5 $18.0 - $33.0 �

Interest income (expense), net ($0.4) ($0.4) ($2.0) � Other income

(expense), net $1.4 -- -- � Tax (expense) benefit ($0.1) $4.0 $183

� GAAP EPS (including stock compensation expense) $0.00 $0.01 -

$0.04 $1.30 - $1.39 � � � � � � Note: Operating income guidance for

the third quarter and full year 2007 does not consider ongoing fees

related to the stock option investigation and related matters. �

Note: Earnings per share guidance for the full year 2007 reflects

the non-cash financial statement impact of the likely release of a

portion of the deferred tax asset related valuation allowance in

the fourth quarter of 2007. CNET Networks, Inc. Business Segments �

CNET Networks' primary areas of measurement and decision-making

include two principal business segments, U.S. Media and

International Media. U.S. Media consists of an online media network

focused on topics that people are highly interested in such as

technology, entertainment, community and business. International

Media includes media properties under several of the same brands as

our sites in the United States with additional brands represented

in markets such as China, France, Germany and the United Kingdom

and several print publications in China. Management believes that

segment operating income (loss) before depreciation, amortization,

stock option investigation and related matters and stock

compensation expenses is an appropriate measure of evaluating the

operating performance of the company's segments. However, segment

operating income (loss) before depreciation, amortization, stock

option investigation and related matters and stock compensation

expense should not be considered a substitute for operating income,

cash flows or other measures of financial performance or liquidity

prepared in accordance with generally accepted accounting

principles. � (Unaudited) (in thousands) U.S. International Media

Media Other (1) Total Three Months Ended June 30, 2007 Revenues $

73,676 $ 23,515 $ - $ 97,191 Operating expenses 59,452 21,587 �

17,117 � 98,156 � Operating income (loss) $ 14,224 $ 1,928 � $

(17,117 ) $ (965 ) � Three Months Ended June 30, 2006 Revenues $

72,795 $ 19,582 $ - $ 92,377 Operating expenses 55,333 18,206 �

14,011 � 87,550 � Operating income $ 17,462 $ 1,376 � $ (14,011 ) $

4,827 � � U.S. International Media Media Other (1) Total Six Months

Ended June 30, 2007 Revenues $ 147,914 $ 41,374 $ - $ 189,288

Operating expenses 119,434 41,931 � 37,417 � 198,782 � Operating

income (loss) $ 28,480 $ (557 ) $ (37,417 ) $ (9,494 ) � Six Months

Ended June 30, 2006 Revenues $ 140,560 $ 35,467 $ - $ 176,027

Operating expenses 111,854 35,341 � 26,327 � 173,522 � Operating

income $ 28,706 $ 126 � $ (26,327 ) $ 2,505 � � (1) For the three

months ended June 30, 2007, "Other" includes depreciation and

amortization expenses of $10.2 million, stock compensation expense

of $4.0 million, and stock option investigation and related matters

of $2.9 million, respectively. For the three months ended June 30,

2006, "Other" includes $8.0 million of depreciation and

amortization expenses, $4.6 million of stock compensation expense,

and $1.4 million of stock option investigation and related matters,

respectively. For the six months ended June 30, 2007, "Other"

includes depreciation and amortization expenses of $20.9 million,

stock compensation expense of $9.2 million, and stock option

investigation and related matters of $7.3 million, respectively.

For the six months ended June 30, 2006, "Other" includes

depreciation and amortization expenses of $15.5 million, stock

compensation expense of $9.4 million, and stock option

investigation and related matters of $1.4 million, respectively.

CNET Networks, Inc. Operating Income (Loss) Reconciliation

(Unaudited) (in thousands) Three Months Ended Six Months Ended June

30, June 30, 2007 � 2006 2007 � 2006 Operating income (loss) $ (965

) $ 4,827 $ (9,494 ) $ 2,505 Stock compensation expense 4,057 4,633

9,220 9,389 Depreciation 6,991 5,265 14,480 10,087 Amortization of

intangible assets 3,209 � 2,710 6,429 � 5,449 Operating income

before depreciation, amortization and stock compensation expense

13,292 17,435 20,635 27,430 � Stock option investigation and

related matters 2,859 � 1,401 7,288 � 1,401 Operating income before

depreciation, amortization, stock compensation expense and stock

option investigation and related matters $ 16,151 � $ 18,836 $

27,923 � $ 28,831 � We believe that "operating income before

depreciation, amortization and stock compensation expense" and

"operating income before depreciation, amortization, stock

compensation expense and stock option investigation and related

matters" are useful to management and investors as a supplement to

our GAAP (generally accepted accounting principles in the United

States) financial measures for evaluating the ability of the

business to generate cash from operations. Depreciation and

amortization are non-cash items, which include amounts related to

past transactions and expenditures that are not necessarily

reflective of the current cash or capital requirements of the

business. Excluding non-cash stock compensation expense allows

management to make financial and operating decisions and evaluate

the business based on recurring operating results. Stock option

investigation and related matters are expenses settled in cash but

are not reflective of the ability of our business to generate cash.

� Management refers to "operating income before depreciation,

amortization, stock compensation expense" and "operating income

before depreciation, amortization, stock compensation expense and

stock option investigation and related matters" in making operating

decisions and for planning and compensation purposes. A limitation

associated with these measures is that they do not reflect the

costs of certain capitalized tangible and intangible assets used in

generating revenue and the cash expenditures associated with our

stock option investigation and related matters. Management

compensates for these limitations by relying primarily on our GAAP

financial measures, such as capital expenditures and operating

income (loss), and using "operating income before depreciation,

amortization and stock compensation expense" and "operating income

before depreciation, amortization, stock compensation expense and

stock option investigation and related matters" only on a

supplemental basis. Although depreciation and amortization are

non-cash charges, the capitalized assets being depreciated and

amortized will often have to be replaced in the future, and these

measures do not reflect any cash requirements for such

replacements. These measures also do not take into account interest

expense, or the cash requirements necessary to service interest or

principal payments on our debt. Nor do these measures reflect

changes in, or cash requirements for, our working capital needs.

"Operating income before depreciation, amortization, stock

compensation expense and stock option investigation and related

matters" should be considered in addition to, and not as a

substitute for, other measures of financial performance or

liquidity prepared in accordance with GAAP. CNET Networks, Inc. Net

Income (Loss) Reconciliation (Unaudited) (in thousands, except per

share data) � Three Months Ended Six Months Ended June 30, June 30,

2007 � 2006 2007 � 2006 � � Net income (loss) $ (76 ) $ 5,160 $

(9,194 ) $ 3,858 � � Stock compensation expense (1) 4,057 4,633

9,220 9,389 Stock option investigation and related matters (2)

2,859 1,401 7,288 1,401 Realized gains on investments (3) (1,600 )

- (1,600 ) (500 ) Fair value remeasurement (4) - - (702 ) - Loss

from discontinued operations (5) - � - - � (37 ) Effect on earnings

from stock compensation, stock option investigation and related

matters, gains on investments, fair value remeasurment and

discontinued operations 5,316 � 6,034 14,206 � 10,253 � Net income

excluding stock compensation, stock option investigation and

related matters, gains on investments, fair value remeasurment and

discontinued operations $ 5,240 � $ 11,194 $ 5,012 � $ 14,111 � � �

Diluted net income (loss) per share $ 0.00 � $ 0.03 $ (0.06 ) $

0.03 � � � Shares used in calculating diluted net income (loss) per

share 151,333 � 152,775 150,858 � 152,927 � Diluted net income per

share excluding stock compensation expense, stock option

investigation and related matters, gains on investments, fair value

remeasurement and discontinued operations $ 0.03 � $ 0.07 $ 0.03 �

$ 0.09 � Shares used in calculating diluted net income per share

excluding stock compensation expense, stock option investigation

and related matters, gains on investments, fair value remeasurement

and discontinued operations 152,794 � 152,775 152,599 � 152,927 � �

(1) During the three and six months ended June 30, 2007, the

Company recorded $4.0 million and $9.2 million on noncash stock

compensation expense, respectively. During the three and six months

ended June 30, 2006, the Company recorded $4.6 million and $9.4

million of noncash stock compensation expense, respectively. (2)

During the three and six months ended June 30, 2007, $2.9 million

and $7.3 million of charges related to our stock option

investigation and related matters were incurred, respectively.

During the three and six months ended June 30, 2006, $1.4 million

of charges related to our stock option investigation and related

matters were incurred. (3) The Company recognized gains of $1.6

million during the three and six months ended June 30, 2007 and

$0.5 million during the six months ended June 30, 2006 on sales of

privately held investments. (4) In the six months ended June 30,

2997, the Company recognized a gain from the remeasurement of a

liability related to our stock option extensions to former

employees. (5) The Company recognized a loss from discontinued

operations for the six months ended June 30, 2006. � Adjusted net

income is defined as net income excluding stock compensation

expense, costs associated with the Company's stock option

investigation and related matters and realized gains on

investments. Management believes that adjusted net income and

adjusted net income per share are useful to investors as

supplements to GAAP net income and net income per share in

evaluating the performance of our core businesses. Stock

compensation expense is non-cash, the costs associated with the

Company's stock option investigation and related matters are not

related to our core business, as are gain on investments. In

addition, management uses adjusted net income and adjusted net

income per share in making operating decisions and for planning and

compensation purposes. A limitation of adjusted net income is that

it does not exclude all non-cash items which have an impact on GAAP

net income, such as depreciation and amortization, and adjusted net

income excludes items, such as the litigation costs related to our

stock option investigation, which have a cash impact on the

Company. Adjusted net income and adjusted net income per share

should be considered in addition to, and not as a substitute for,

other measures of financial performance or liquidity prepared in

accordance with GAAP. CNET Networks, Inc. Cash Flows from Operating

Activities Reconciliation (Unaudited) (in thousands) � Three Months

Ended Six Months Ended June 30, June 30, 2007 2006 2007 2006 � Cash

flows from operating activities $ 17,487 $ 14,872 $ 28,523 $ 44,050

� Capital expenditures (1) (8,515) (8,720) (15,706) (17,431) � Free

cash flow 8,972 6,152 12,817 26,619 � Stock option investigation

and related matters 2,859 1,401 7,288 1,401 � Free cash flow

excluding stock option investigation and related matters $ 11,831 $

7,553 $ 20,105 $ 28,020 � (1) Capital expenditures for the six

months ended June 30, 2007 are net of $2,349 in cash proceeds under

a sale-leaseback transaction related to certain leasehold

improvements made during the first quarter of 2007. � Free Cash

Flow is defined as net cash provided by operating activities less

net capital expenditures. The Company believes that free cash flow

provides useful information about the amount of cash generated by

the business after the purchase of property and equipment. A

limitation of free cash flow is that is does not represent the

total increase or decrease in the cash balance for the period. Free

cash flow should be considered in addition to, and not as a

substitute for, other measures of financial performance prepared in

accordance with US GAAP.

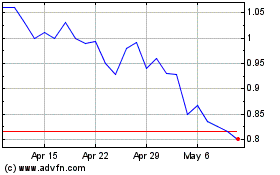

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

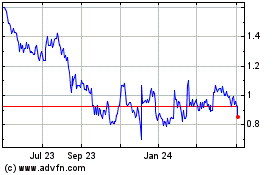

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024