We

have entered into a sales agreement with US Tiger Securities, Inc., or US Tiger, dated December 17, 2021, relating to the sale of our

Class A ordinary shares offered by this prospectus supplement. Under this prospectus supplement we may offer and sell Class A ordinary

shares, $0.0001 par value per share, having an aggregate offering price of up to $10,400,000 from time to time through or to US Tiger,

acting as our agent. Sales of our Class A ordinary shares, if any, under this prospectus supplement will be made by any method permitted

that is deemed an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities

Act. US Tiger is not required to sell any specific amount, but will act as our distribution agent using commercially reasonable efforts

consistent with its normal trading and sales practices. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

The

compensation to the US Tiger for sales of Class A ordinary shares under the sales agreement will be at maximum commission rates ranging

from 1.0% to 3.0% of the gross sales price per share, depending upon the aggregate sales proceeds raised by the sales agent under the

sales agreement. The net proceeds, if any, that we receive from the sales of our Class A ordinary shares will depend on the number of

shares actually sold and the offering price for such shares. See “Plan of Distribution” beginning on page S-23 for additional

information regarding the compensation to be paid to US Tiger in connection with the sale of the Class A ordinary shares on our behalf,

US Tiger will be deemed to be an underwriter within the meaning of the Securities Act and the compensation of US Tiger will be deemed

to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to US Tiger with respect

to certain liabilities, including liabilities under the Securities Act.

You

should read this prospectus supplement in conjunction with the accompanying base prospectus, including any supplements and amendments

thereto. This prospectus supplement is qualified by reference to the accompanying base prospectus except to the extent that the information

in this prospectus supplement supersedes the information contained in the accompanying base prospectus. This prospectus supplement is

not complete without, and may not be delivered or utilized except in connection with, the accompanying base prospectus, including any

supplements and amendments thereto.

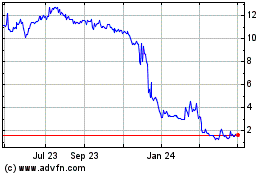

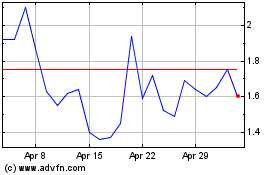

As

of the date hereof, the aggregate market value of our outstanding Class A Ordinary Shares held by non-affiliates was approximately $31.2

million based on 18,103,355 Class A Ordinary Shares and 5,497,715 Class B Ordinary Shares outstanding as of December 16, 2021, of which

16,172,819 Class A Ordinary Shares and 0 Class B Ordinary Shares were held by non-affiliates, and a per share price of $1.93, which was

the last reported price on the NASDAQ Capital Market of our Class A Ordinary Shares on December 1, 2021. We have not offered any securities

pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this

prospectus supplement and accordingly we may sell up to $10,404,513.56 of our Class A Ordinary Shares hereunder. Our Class A ordinary

shares are listed on the Nasdaq Capital Market under the symbol “ZCMD.” On December 16, 2021, the closing price for our Class

A ordinary shares, as reported on the Nasdaq Capital Market, was $1.79 per share. Our principal executive offices are located at Nanxi

Creative Center, Suite 218, 841 Yan’an Middle Road, Jing’An District, Shanghai, China 200040.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus, including the documents that we incorporate herein and therein by reference, contain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, objectives, assumptions or future

events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through

the use of words or phrases such as “may,” “will,” “could,” “should,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” “continue,” and similar expressions, or the negative of these terms, or similar

expressions. Accordingly, these statements involve estimates, assumptions, risks and uncertainties which could cause actual results to

differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors

discussed throughout this prospectus supplement and the accompanying prospectus, and in particular those factors referenced in the section

“Risk Factors.”

This

prospectus supplement and the accompanying prospectus contain forward-looking statements that are based on our management’s belief

and assumptions and on information currently available to our management. These statements relate to future events or our future financial

performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

|

|

●

|

the

direct and indirect impact of the novel coronavirus, or COVID-19, on our business and operations;

|

|

|

●

|

our

ability to continue normal operations and interactions with our users during the COVID-19 pandemic;

|

|

|

●

|

our

dependence upon external sources for the financing of our operations;

|

|

|

●

|

our

ability to obtain and maintain our strategic collaborations and to realize the intended benefits of such collaborations;

|

|

|

●

|

our

ability to effectively execute our business plan;

|

|

|

●

|

our

ability to continue to innovate and develop new products;

|

|

|

●

|

our

ability to maintain and grow our reputation and to achieve and maintain the market acceptance of our products;

|

|

|

●

|

our

ability to manage the growth of our operations over time;

|

|

|

●

|

our

ability to maintain adequate protection of our intellectual property and to avoid violation of the intellectual property rights of others;

|

|

|

●

|

our

ability to gain and maintain regulatory approvals;

|

|

|

●

|

our

ability to maintain relationships with existing customers and develop relationships with new customers; and

|

|

|

●

|

our

ability to compete and succeed in a highly competitive and evolving industry.

|

These

forward-looking statements are neither promises nor guarantees of future performance due to a variety of risks and uncertainties and other

factors more fully discussed in the “Risk Factors” section in this prospectus supplement and the risk factors and cautionary

statements described in other documents that we file from time to time with the SEC, specifically under “Item 3D. Risk Factors”

and elsewhere in our most recent Annual Report on Form 20-F for the period ended December 31, 2020, and our Current

Reports on Form 6-K.

Given

these uncertainties, readers should not place undue reliance on our forward-looking statements. These forward-looking statements speak

only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable

law, we do not undertake to update any forward-looking statements after the date of this prospectus supplement or the respective dates

of documents incorporated by reference that include forward-looking statements.

PROSPECTUS SUPPLEMENT

SUMMARY

Overview

We are not a Chinese operating

company but rather a holding company incorporated as an exempted company in Cayman Islands on April 16, 2019 (“Zhongchao Cayman”).

We have no substantive operations other than holding all of the issued and outstanding shares of Zhongchao Group Inc., or Zhongchao BVI,

established under the laws of the British Virgin Islands on April 23, 2019.

Zhongchao

BVI is also a holding company holding all of the outstanding equity of Zhongchao Group Limited, or Zhongchao HK, which was established

in Hong Kong on May 14, 2019. Zhongchao HK is also a holding company holding all of the outstanding equity of Beijing Zhongchao Zhongxing

Technology Limited, or Zhongchao WFOE, which was established on May 29, 2019 under the laws of the PRC. As a holding company with no material

operations of our own, we conduct a substantial majority of our operation through our wholly owned subsidiary, Beijing Zhongchao Zhongxing

Technology Limited, a PRC company (“Zhongchao WFOE”) and a variable interest entity in China, Zhongchao Medical Technology

(Shanghai) Co., Ltd. (“Zhongchao Shanghai” or the “VIE”) and its subsidiaries. Due to the existing contractual

arrangement, or the “VIE agreements”, among Zhongchao WFOE, Zhongchao Shanghai’s shareholders, and Zhongchao Shanghai,

we are able to consolidate the financial results of Zhongchao Shanghai under the U.S. GAAP, however, we do not hold equity interest in

Zhongchao Shanghai.

This

is an offering of the Class A Ordinary Shares of the offshore holding company in Cayman Islands, instead of shares of Zhongchao Shanghai

in China, therefore, you will not directly hold equity interests in Zhongchao Shanghai.

Zhongchao WFOE, Zhongchao Shanghai, and the shareholders of Zhongchao

Shanghai entered into a series of agreements on August 14, 2019 and September 10, 2020. VIE Agreements include the Equity Interest Pledge

Agreement, the Proxy Agreement and Power of Attorney, the Spouse Consent Letters, the Master Exclusive Service Agreement, Business Cooperation

Agreement, Exclusive Option Agreement. We control and receive the economic benefits of Zhongchao Shanghai’s business operations

through VIE Agreements among Zhongchao Shanghai, the shareholders of Zhongchao Shanghai, and Zhongchao WFOE through the VIE Agreements,

dated August 1, 2020 and September 10, 2020, which have not been tested in a court of law. Through the VIE Agreements among Zhongchao

WFOE, Zhaongchao Shanghai and Zhongchao Shanghai’s shareholders, we are regarded as the primary beneficiary of Zhongchao Shanghai,

and, therefore, we are able to consolidate the financial results of Zhaongchao Shanghai in our consolidated financial statements in accordance

with U.S. GAAP.

Because

we do not directly hold equity interests in our VIE, we are subject to risks due to uncertainty of the interpretation and the application

of the PRC laws and regulations, including but not limited to limitation on value-added telecommunication services and certain other businesses,

regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the VIE Agreements.

We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the

VIE structure, which would likely result in a material change in our operations and the value of Class A Ordinary Shares may depreciate

significantly or become worthless.

Because

we do not have ownership of Zhongchao Shanghai, we must rely on the shareholders of Zhongchao Shanghai, with our chief executive officer

controlled 76.4% equity interest in Zhongchao Shanghai, to comply with their contractual obligations. For a description of our corporate

structure and VIE contractual arrangements, see "Corporate History and Structure." See also "Risk Factors - Risks Related

to Our Corporate Structure" and "Risk Factors - Risks Related to Doing Business in China."

We

are subject to certain legal and operational risks associated with our VIE’s operations in China. PRC laws and regulations governing

our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in our VIE’s

operations, significant depreciation of the value of our Class A Ordinary Shares, or a complete hindrance of our ability to offer or continue

to offer our securities to investors. Recently, the PRC government initiated a series of regulatory actions and statements to regulate

business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing

supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope

of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We believe Zhoangchao Shanghai may not be subject to

cybersecurity review with the Cyberspace Administration of China (“CAC”) if the draft Measures for Cybersecurity Censorship

becomes effective as they are published, because (i) we do not maintain, nor do we intend to maintain in the future, personally identifiable

health information of patients and healthcare experts in China; and (ii) data processed in our business is less likely to have a bearing

on national security, thus it may not be classified as core or important data by the authorities. However, since these statements and

regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what

existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential

impact such modified or new laws and regulations will have on our daily business operations, the ability to accept foreign investments

and continually list on the Nasdaq Capital Market.

The following charts summarize

our corporate legal structure and identify our subsidiaries, our VIE and its subsidiaries before this offering.

Notes: All percentages reflect

the voting ownership interests instead of the equity interests held by each one of the shareholder of the Company given that each Class

B Ordinary Share will be entitled to 15 votes as compared to Class A Ordinary Share, each one of which will be entitled to 1 vote.

|

|

(1)

|

Represents

5,497,715 Class B Ordinary Shares held by Mr. Weiguang Yang (“Yang”), the 100% owner of More Healthy Holding Limited (“More

Healthy”).

|

|

|

(2)

|

Represents

an aggregate of 10,988,809 Class A Ordinary Shares including 9,638,741 Class A Ordinary Shares held by 11 shareholders of Company, each

one of which holds less than 5% voting ownership interests of the Company, as of the date of this prospectus supplement and 1,350,068

Class A Ordinary Shares to be issued upon exercise of the HF Warrant. See footnote 3 below.

|

|

|

(3)

|

In

order to directly hold equity interest in the Company, HF Capital Management Delta, Inc. (“HF Capital”) has to complete certain

registration and obtain approval with local governmental authority in PRC. As a part of reorganization and due to the aforementioned

factor, HF Capital was granted a warrant to purchase 1,350,068 Class A Ordinary Shares of the Company at a price $0.0001 per share or

such other amount agreed by the Company and HF Capital at a grant price of RMB 20,000,000 (approximately USD$2.9 million) conditioned

upon (i) HF Capital completes necessary registration and obtains approval with local governmental authority in PRC for its direct investment

in the Company and (ii) Zhongchao Shanghai shall have paid HF Capital RMB 20,000,000 as returned capital contribution in Zhongchao Shanghai.

The above chart assumes that HF Capital has not exercised such warrant.

|

|

|

(4)

|

Represents

RMB 2.74 million (approximately USD$0.4 million) subscribed capital contribution to Zhongchao Shanghai, as of the date of this prospectus

supplement.

|

|

|

(5)

|

Represents

RMB 9.70 million (approximately USD$1.4 million) subscribed capital contribution to Zhongchao Shanghai, as of the date of this prospectus

supplement.

|

|

|

(6)

|

Represents

RMB 1.35 million (approximately USD$0.2 million) subscribed capital contribution to Zhongchao Shanghai, as of the date of this prospectus

supplement.

|

|

|

(7)

|

Represents

RMB 3.00 million (approximately USD$0.4 million) subscribed capital contribution to Zhongchao Shanghai, as of the date of this prospectus

supplement. Shanghai Xingzhong Investment Management LP. Ltd., a limited partnership incorporated under the PRC laws (“Shanghai

Xingzhong”), the general partner of which is Weiguang Yang. As the general partner of Shanghai Xingzhong, Weiguang Yang exercises

the voting rights with respect to the shares held by Shanghai Xingzhong.

|

|

|

(8)

|

Represents

RMB 1.35 million (approximately USD$0.2 million) subscribed capital contribution to Zhongchao Shanghai, as of the date of this prospectus

supplement.

|

|

|

(9)

|

Beijing

Boya was incorporated under the PRC laws on April 27, 2020, of which 70% of its equity was owned by Zhongchao Shanghai and 30% of its

equity was entrusted to Zhongchao Shanghai by the other shareholder Zhengbo Ma through a certain share entrustment agreement on April

27, 2020.

|

|

|

(10)

|

Shanghai

Zhongxin, a PRC company, which was formerly known as Shanghai Jingyi, or Shanghai Jingyi Medical Technology Co., Ltd., a PRC company

and changed to its current name as Shanghai Zhongxin on November 16, 2020. On October 12, 2020, two shareholders of Shanghai Jingyi,

Li Dai and Hegang Ma, transferred their shares to Mr. Weiguang Yang. As a result, Mr. Weiguang Yang holds 49% of Shanghai Jingyi’s

equity and Zhongchao Shanghai holds 51% of its equity. On November 1, 2020, Mr. Weiguang Yang transferred certain parts of his shares

to Zhongchao Yixin and Zhongren Yixin. As a result, Mr. Weiguang Yang, Zhongchao Yixin, and Zhongren Yixin hold 19%, 20% and 10% of the

equity interest of Shanghai Jingyi, respectively. Through certain entrustment agreements, Mr. Weiguang Yang, Zhongchao Yixin and Zhongren

Yixin hold 19%, 20% and 10% of the equity interest of Shanghai Jingyi on behalf of Shanghai Zhongxun, respectively. As a result,

Shanghai Zhongxun owns 100% of Shanghai Zhongxin’s equity interest.

|

Company Information

Our Company

Through Zhongchao Shanghai

and its subsidiaries, we operated as a provider of healthcare information, education, and training services to healthcare professionals

and the public in China. We offer a wide range of online and onsite health information services, healthcare education programs, and healthcare

training products, consisting primarily of clinical practice training, open classes of popular medical topics, interactive case studies,

academic conference and workshops, continuing education courses, and articles and short videos with educational healthcare content to

healthcare professionals as well as the public. The services, programs, and products that we provide:

|

|

●

|

make

it easier for healthcare professionals to access healthcare reference sources, stay abreast of the latest medical information, learn

about new treatment options, earn continuing medical education credits and communicate with peers; and

|

|

|

●

|

enable

the public to obtain health information on a particular disease or condition, offer content on topics of individual interest, improve

public health consciousness, and promote people’s lifestyle.

|

Through Zhongchao Shanghai,

we provide healthcare information, education, and training services to the healthcare professionals under our “MDMOOC” brand,

which we believe is one of the leading consumer brands in China’s healthcare training and education sector, as evidenced by the

Securities Research Report on online medical care industry by Essence Securities Co., Ltd., a company provides securities services throughout

China, where we are considered as one of the main and typical public company proving medical training with doctor interactive and online

training platform and leading the Internet medical education industry. We provide our healthcare educational content to the public via

our “Sunshine Health Forums”, which, based on the amount of the registered users and daily review volume, we believe is one

of the largest platforms in China, for general healthcare knowledge and information to the public.

We commenced our operation,

through Zhongchao Shanghai, in August 2012 with a vision to offer a wide range of accessible and immediate healthcare information and

continuous learning and training opportunities for Chinese healthcare professionals. Since our inception, we have focused on developing

our information, education, and training programs to address the needs in the healthcare industry in China; and developing online platforms

and onsite activities to deliver our information services, education programs and training products.

In July 2020, we launched,

via Zhongchao Shanghai, focused patient management services to hospitals, pharmacies, pharmaceutical enterprises and non-profit organizations

and insurance companies via “Zhongxun”. In May 2021, Zhongchao Shanghai launched patient management service on the professional

field of tumor and rare diseases via “Zhongxin”.

MDMOOC-Healthcare Information, Education, and Training for Professionals

Online Platforms

We launched our first online

platform in a form of website, www.mdmooc.org, via Zhongchao Shanghai, under our “MDMOOC” brand in 2013 to provide information,

education, and training services to physicians and allied healthcare professionals, such as pharmacists and nurses primarily located in

China, via Internet-Plus solutions. Internet Plus refers to the applications of the internet and other information technology in conventional

industries, such as manufacturing, education and healthcare. It is an incomplete equation where various internet (mobile, cloud computing,

big data or Internet of Things) can be added to other traditional fields. Zhongchao Shanghai further launched the MDMOOC Wechat subscription

account and MDMOOC mobile App in 2015 and 2016, respectively (together with the website, the “MDMOOC online platform”). Healthcare

professionals in China can apply for registration with their healthcare qualification to get access to the MDMOOC online platform.

The programs available on

the MDMOOC online platform enable the users to timely obtain extension knowledge of precedents, treatments, and first-hand experiences

of various disease and other healthcare related matters. In addition, the MDMOOC online platform offers these professional users what

we believe is one of the largest online libraries of continuing medical education programs in China that are produced in association with

entities accredited by the National Health Commission of the PRC, such as Chinese Medical Association and Chinese Journal of Continuing

Medical Education. From the convenience of their home or office computer and mobile App, the professional users can access a variety of

accredited editorial resources and programs including online journal articles, medical conferences, and open classes and obtain continuing

medical education credits which are required for the healthcare qualification of doctors, nurses, and pharmacists.

We believe MDMOOC online platform

helps healthcare professionals improve their clinical knowledge and practice of medicine. Since launching in 2013, Zhongchao Shanghai

has been continuously developing the MDMOOC online platform with new forms of Internet-based education solutions. There are currently

approximately 2,976 education and training programs available on the MDMOOC online platform and free to the registered users. About 95%

of all the programs are self-developed by the research and development team. The original content of these programs, including daily medical

thesis, commentary, conference coverage, expert columns, and activities are written by the research and development team and authors from

widely respected academic institutions, and edited and managed by the in-house editorial staff. The remaining 5% of programs are created

under the purchase orders of the corporate or institution customers, where we develop customized programs with designated healthcare topics.

Such 5% of programs are only available to certain registered users with program passcodes provided by the corporate or institution customers.

The revenues are mainly sourced from these 5% of programs.

Zhongchao Shanghai currently

provide the proprietary interactive programs via Practice Improvement (PI), a problem-based and case-based form of healthcare course,

which integrates state-of-the-art treatment information and clinical cases for particular diseases into interactive practice modules;

Community of Practice Share (COPS), an online and live clinical experience sharing platform that creates the most effective discussion

in a particular healthcare domain or medical area due to the common interests of the users; Continuing Professional Development (CPD),

a section of the platform that provides discussions and articles focusing on the future development and the differences between Continuing

Medical Education (CME) and Continuing Professional Development (CPD), and other general information of physician competency framework

and Meta-analysis. Our original, exclusive and proprietary content includes innovative features such as after-class quiz, key point summary

and highlight during the courses, and peer-review and comments.

We believe that our ability

to create, source, edit and organize online healthcare-related content, interactive education services, and training programs has made

MDMOOC online platform one of the leading health destinations and most recognized information platform in healthcare sector in China.

As of the date of this prospectus supplement, the MDMOOC online platform has more than 680,000 registered users, and we have collaborated

with more than 2 million healthcare experts including over 700,000 physicians, and 1,300,000 allied healthcare professionals in medical

academics, associations, and leading hospitals to develop training programs on needed basis.

Onsite Education Activities

In addition to healthcare

information, education, and training via Internet-Plus, we organize onsite healthcare and medical training sessions and academic conferences

from time to time under our “MDMOOC” brand. For instance, in January 2019, through Zhongchao Shanghai, we launched EWMA-certified

(defined as below) wound-management collaboration training programs, covering the topics including but not limited to basic concepts of

acute and chronic wounds, management of different levels of surgical and non-surgical wounds, the construction of different levels of

wound centers, and medical staff collaboration in the process of wound management.

Zhongchao Shanghai cooperates

with Beijing Chronic Disease Prevention and Health Education Research Association and Professor Yixin Zhang from the Ninth People’s

Hospital of Shanghai Jiao Tong University School of Medicine to create courses titled “Essential Course for Wound Care Management”

and “Advanced Course for Surgical Wound Treatment”. These courses have been certified and authorized by the European Wound

Management Association (EWMA), a European not-for-profit umbrella organization, linking national wound management organizations, individuals

and groups with interest in wound care. Zhongchao Shanghai plans to hold four (4) training programs for Essential Course for Wound Care

Management and two (2) training programs for Advanced Course for Surgical Wound Treatment. Each program will accept no more than twenty

(20) applicants who shall hold academic credential above undergraduate. It also require all applicants to have more than six-year working

experience in the field of wound repair. Zhongchao Shanghai will issue a certificate to each of the applicant upon completion of the training

as their proof of achievement and ability in the wound management and treatment.

As of the date of this prospectus

supplement, Zhongchao Shanghai has successfully held the first short-term training program for Essential Course for Wound Care Management

in Fujian, China from March 28, 2019 to April 4, 2019 and its first training program for Advanced Course for Surgical Wound Treatment

from June 23, 2019 to June 30, 2019 in Jiangsu, China. Zhongchao Shanghai further held the second and third training programs for Essential

Course for Wound Care Management in Zhejiang, China from August 25, 2019 to August 31, 2019 and our second and third training programs

for Advanced Course for Surgical Wound Treatment from December 1, 2019 to December 7, 2019 in Jilin, China. As a result of the outbreak

of COVID-19 pandemic, Zhongchao Shanghai postponed its original plan to hold the future training programs in the 1st quarter

of 2020 in Zhengzhou, Henan Province. However, it successfully held the postponed Essential Courses for Wound Care Management and the

Advanced Courses for Wound Treatment in Xi’an from September 10, 2020 to September 19, 2020, and in Hangzhou from December 18, 2020

to December 26, 2020, respectively.

We believe the combination

of online and onsite services would provide the end-users the greatest convenience. With more choices of the forms of healthcare education,

we enrich the learning experience of our end-users.

New Plug-in to Certain Programs- Assistance in Patient-Aid Projects

Commencing from the fourth

quarter of 2018, in addition to providing training and education courses through our platforms, Zhongchao Shanghai has been engaged by

certain customers on a project basis to establish individual columns on our MDMOOC online platform to provide training and knowledge of

certain drug treatment for healthcare professionals and patients. Most of the drug treatments are cancer-related or rare disease-related.

Zhongchao Shanghai establishes online columns to facilitate qualified patients to obtain free drug treatment from not-for-profit organizations

(“NFPs”) till the earlier of the expiration of contract period or the free drugs are completely delivered. For each column,

Zhongchao Shanghai plugs in features to manage the drug treatment including reviewing patients’ applications, tracking their usage

of drugs, and collecting related information (such programs with new plug-in features are hereinafter referred as the “patient-aid

projects”). Those customers are existing customers of us. They provide those drugs sponsored by pharmaceutical companies without

charge to qualified patients and we charge those customers on our services in connection with the online columns and related training

and management. In this way, we believe not only can we facilitate the clinical application of those drugs, but also benefit patients.

As of the date of this prospectus

supplement, Zhongchao Shanghai has established nearly 25 columns, including 10 columns for drug treatment related to lung cancer, liver

cancer, and extended blood cancer, and 47 columns for drug treatment of rare diseases, including drug treatment for pulmonary fibrosis,

multiple sclerosis, and systemic lupus erythematosus. The total number of patients covered under these patient-aid projects reached nearly

46,375 by the end of 2020. Zhongchao Shanghai launched 6 columns for the treatment of rare diseases, including columns for the treatment

of Fabry disease launched in mid-2020. We expect the numbers of columns for both cancer-related treatment and treatment of rare diseases

to continue increase and to have covered more than 66,000 patients by the end of 2021

Sunshine Health Forums-Healthcare Information

and Education for the Public

Our goal is not only to provide

continuing education and training to healthcare professionals but to promote healthy lifestyle and provide healthcare knowledge to the

public. In order to achieve that, Zhongchao Shanghai develops and operates the Sunshine Health Forums, online education-for-all platforms

that disseminate articles and features related to healthcare and wellness education, medical behavior intervention, and newly developed

health technology and application. Zhongchao Shanghai launched our Sunshine Health Forums in a form of website, www.ygjkclass.com, in

May 2016 followed by WeChat subscription account in August 2016, and mobile App in 2017. Zhongchao Shanghai establishes one forum for

each category of diseases for the convenience of the public. Zhongchao Shanghai cooperates with certain well-known we-media platforms

in China, including but not limited Toutiao.com, Yidianzixun.com, Douyin.com, CN-Healthcare.com, iQiyi, Youku, and Huoshan.com to streamline

its articles co-produced by healthcare professionals and itself.

Corporate Information

Our principal executive office

is located on the 841 Yan’an Middle Road, Jing’An District, Shanghai, China 200040. Our telephone number is 021-32205987.

We maintain a website at http://izcmd.com that contains information about our Company, though no information contained on our website

is part of this prospectus.

Implications of Being An Emerging Growth

Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the

JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise

applicable generally to public companies. These provisions include:

|

|

●

|

only

two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure;

|

|

|

●

|

reduced

disclosure about our executive compensation arrangements;

|

|

|

●

|

no non-binding advisory votes on executive compensation or golden parachute

arrangements;

|

|

|

●

|

exemption from the auditor attestation requirement in the assessment of

our internal control over financial reporting; and

|

|

|

●

|

an

exemption from new or revised financial accounting standards until they would apply to private companies and from compliance with any

new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation.

|

We

may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first

sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended. However,

if certain events occur before the end of such five-year period, including if we become a “large accelerated filer,” our annual

gross revenues exceed $1.07 billion or we issue more than $1.00 billion of non-convertible debt in any three-year period, we will cease

to be an emerging growth company before the end of such five-year period.

In

addition, Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to

take advantage of the extended transition period for complying with new or revised accounting standards and acknowledge such election

is irrevocable pursuant to Section 107 of the JOBS Act.

Potential PRC Approval Required for This

Offering

On

July 6, 2021, the relevant PRC government authorities published the Opinions on Strictly Cracking Down Illegal Securities Activities in

Accordance with the Law. These opinions call for strengthened regulation over illegal securities activities and supervision on overseas

listings by China-based companies and propose to take effective measures, such as promoting the construction of relevant regulatory systems

to deal with the risks and incidents faced by China-based overseas-listed companies. As of the date of this prospectus supplement, no

official guidance or related implementation rules have been issued in relation to these recently issued opinions and the interpretation

and implementation of these opinions remain unclear at this stage. We could be subject to additional requirements that we obtain pre-approval

of the CSRC and potentially other regulatory authorities to pursue this offering, including a cybersecurity review potentially required

under the draft revised Measures for Cybersecurity Review. See “Risk Factors — Risks Related to Doing Business

in China — The approval of the China Securities Regulatory Commission or other PRC regulatory agencies may be required

in connection with this offering under PRC law.”

As

of the date of this prospectus supplement, there are no PRC laws and regulations in force explicitly requiring that we obtain any permission

from PRC authorities including the CSRC to issue securities to foreign investors. Based on existing PRC laws and regulations, as advised

by our PRC legal advisor, neither we nor our subsidiaries are required to obtain any pre-approval from the CSRC to conduct this offering,

subject to interpretation of the existing PRC laws and regulations by the PRC government authorities. As of the date of this prospectus

supplement, we have not received any inquiry, notice, warning, sanctions or any regulatory objections to this offering from the CSRC.

THE OFFERING

|

Issuer

|

|

Zhongchao Inc.

|

|

|

|

|

|

Securities Offered

|

|

Class A Ordinary Shares having an aggregate offering price of up to $10,400,000.

|

|

|

|

|

|

Manner of Offering

|

|

We have entered into the sales agreement with US Tiger, dated December

17, 2021, relating to the sale of our Class A Ordinary Shares offered by this prospectus supplement and the accompanying prospectus. In

accordance with the terms of the sales agreement, under this prospectus supplement and the accompanying prospectus we may offer and sell

Class A Ordinary Shares, $0.0001 par value per share, having an aggregate offering price of up to $10,400,000 from time to time through

or to the sales agent. Sales of our Class A Ordinary Shares, if any, under this prospectus supplement will be made by any method permitted

that is deemed an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended. See the section

entitled “Plan of Distribution” on page S-23 of this prospectus supplement.

|

|

|

|

|

|

Nasdaq

|

|

“ZCMD”

|

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds of this offering for general corporate purposes. See the section entitled “Use of Proceeds” on page S-22 of this prospectus supplement.

|

|

|

|

|

|

Risk Factors

|

|

Investing in our Class A Ordinary Shares involves risks. You should carefully consider the risks described under “Risk Factors” in this prospectus supplement and the accompanying prospectus, in our most recent Annual Report on Form 20-F as well as the other information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus before making a decision to invest in our Class A Ordinary Shares.

|

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should carefully consider the risks referenced below and described in the documents incorporated by

reference in this prospectus supplement and the accompanying prospectus, as well as other information we include or incorporate by reference

into this prospectus supplement and the accompanying prospectus, before making an investment decision. Our business, financial condition

or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our

securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus

supplement, the accompanying prospectus and the documents incorporated herein and therein by reference also contain forward-looking statements

that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements

as a result of certain factors, including the risks referenced below and described in the documents incorporated herein by reference,

including (i) our annual report on Form 20-F, as amended, for the fiscal year ended December 31, 2020, which is on

file with the SEC and is incorporated herein by reference, and (ii) other documents we file with the SEC that are deemed incorporated

by reference into this prospectus supplement and the accompanying prospectus.

Risks Related to This Offering

Management will have

broad discretion as to the use of the proceeds from this offering and may not use the proceeds effectively.

Because

we have not designated the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad

discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated

at the time of the offering. Our management may use the net proceeds for corporate purposes that may not improve our financial condition

or market value.

Our shareholders will

experience significant dilution upon the issuance of Class A Ordinary Shares.

The

offering price per share in this offering may exceed the net tangible book value per share of our Class A Ordinary Shares. Assuming that

an aggregate of 5,810,055 Class A Ordinary Shares are sold at an assuming price of $1.79 per share, which was the last reported sale price

of our Class A Ordinary Shares on the Nasdaq Capital Market on December 17, 2021, pursuant to this prospectus supplement and the accompanying

prospectus for gross proceeds of $10.4 million before deducting commissions and estimated aggregate offering expenses payable by

us, you would experience immediate dilution of approximately $0.0853 per share. See the section entitled “Dilution” on page S-23

of this prospectus supplement for a more detailed illustration of the dilution you would incur if you participate in this offering.

It is not possible

to predict the actual number of shares we will sell under the sales agreement, or the gross proceeds resulting from those sales.

Subject

to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice

to the sales agent at any time throughout the term of the sales agreement. The number of shares that are sold through the sales agent

after delivering a placement notice will fluctuate based on a number of factors, including the market price of the Class A Ordinary Shares

during the sales period, the limits we set with the sales agent in any applicable placement notice, and the demand for our Class A Ordinary

Shares during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently

possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales.

The Class A Ordinary

Shares offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely

pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution

and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and

numbers of shares sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering.

Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower

than the prices they paid.

Risks Related To Doing Business in China

Uncertainties with respect to the PRC legal

system could have a material adverse effect on us.

The

PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. We

conduct our business primarily through our subsidiaries established in China. These subsidiaries are generally subject to laws and regulations

applicable to foreign investment in China. However, since these laws and regulations are relatively new and the PRC legal system continues

to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations

and rules involves uncertainties, which may limit legal protections available to us. Recently, the General Office of the Central Committee

of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down

on Illegal Securities Activities According to Law,” or the Opinions, which was made available to the public on July 6, 2021. The

Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision

over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems will

be taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity and data privacy protection

requirements and etc. The Opinions and any related implementing rules to be enacted may subject us to compliance requirement in the future.

In addition, some regulatory requirements issued by certain PRC government authorities may not be consistently applied by other government

authorities (including local government authorities), thus making strict compliance with all regulatory requirements impractical, or in

some circumstances impossible. For example, we may have to resort to administrative and court proceedings to enforce the legal protection

that we enjoy either by law or contract. However, since PRC administrative and court authorities have discretion in interpreting and implementing

statutory and contractual terms, it may be more difficult to predict the outcome of administrative and court proceedings and the level

of legal protection we enjoy than in more developed legal systems. These uncertainties may impede our ability to enforce the contracts

we have entered into with our business partners, customers and suppliers. In addition, such uncertainties, including any inability to

enforce our contracts, together with any development or interpretation of PRC law that is adverse to us, could materially and adversely

affect our business and operations. Furthermore, intellectual property rights and confidentiality protections in China may not be as effective

as in the United States or other more developed countries. We cannot predict the effect of future developments in the PRC legal system,

including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local

regulations by national laws. These uncertainties could limit the legal protections available to us and other foreign investors, including

you. In addition, any litigation in China may be protracted and result in substantial costs and diversion of our resources and management

attention.

The approval of the

China Securities Regulatory Commission or other PRC regulatory agencies may be required in connection with this offering under PRC law.

The

Regulations on Mergers of Domestic Enterprises by Foreign Investors, or the M&A Rules, purport to require offshore special purpose

vehicles that are controlled by PRC companies or individuals and that have been formed for the purpose of seeking a public listing on

an overseas stock exchange through acquisitions of PRC domestic companies or assets to obtain CSRC approval prior to publicly listing

their securities on an overseas stock exchange. The interpretation and application of the regulations remain unclear. If CSRC approval

is required, it is uncertain how long it will take for us to obtain such approval, and any failure to obtain or a delay in obtaining CSRC

approval for this offering may subject us to sanctions imposed by the CSRC and other PRC regulatory agencies.

Our

PRC counsel has advised us that, based on its understanding of the current PRC laws and regulations, we will not be required to submit

an application to the CSRC for its approval of this offering and the listing and trading of the Class A Ordinary Shares on Nasdaq under

the M&A Rules because the CSRC currently has not issued any definitive rule or interpretation concerning whether offerings like

ours under this prospectus are subject to this regulation. However, our PRC counsel has further advised us that there remains some uncertainty

as to how the M&A Rules will be interpreted or implemented in the context of an overseas offering, and its opinions summarized above

are subject to any new laws, rules and regulations or detailed implementations and interpretations in any form relating to the M&A

Rules. We cannot assure you that relevant PRC government agencies, including the CSRC, would reach the same conclusion as our PRC counsel.

Furthermore,

on July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council

jointly promulgated the Opinions on Strictly Cracking Down on Illegal Securities Activities in Accordance with the Law, pursuant to which

PRC regulators are required to accelerate rulemaking related to overseas issuance and listing of securities, and improvement to the laws

and regulations related to data security, cross-border data flow, and management of confidential information. Numerous regulations, guidelines

and other measures have been or are expected to be adopted under the umbrella of or in addition to the Cybersecurity Law and Data Security

Law, including (i) the draft Measures for the Security Assessment for Cross-border Transfer of Personal Information published by

the Cyberspace Administration of China, or CAC, in 2019, which may, upon enactment, require security review before transferring personal

information out of China, and (ii) draft amendment to the Cybersecurity Review Measures in July 2021, which provides that, among

others, an application for cyber security review shall be made by an issuer who is a critical information infrastructure operator or a

data processing operator as defined therein before such issuer’s listing in a foreign country if the issuer possesses personal information

of more than one million users, and that the relevant governmental authorities in the PRC may initiate cybersecurity review if such governmental

authorities determine an operator’s cyber products or services, data processing or potential listing in a foreign country affect

or may affect national security. The draft measures were released for public comment only, and the draft provisions and anticipated adoption

or effective date are subject to changes and thus its interpretation and implementation remain substantially uncertain. We cannot predict

the impact of the draft measures, if any, on the operations of Zhongchao Shanghai at this stage, and we will closely monitor and assess

any development in the rule-making process. As there are still uncertainties regarding the interpretation and implementation of such regulatory

guidance, we cannot assure you that we will be able to comply with new regulatory requirements relating to our future overseas capital

raising activities and we may become subject to more stringent requirements with respect to matters including data privacy, and cross-border

investigation and enforcement of legal claims.

Notwithstanding

the foregoing, as of the date of this prospectus supplement, there are no PRC laws and regulations in force explicitly requiring that

we obtain any permission from PRC authorities to issue securities to foreign investors, and we have not received any inquiry, notice,

warning, sanction or any regulatory objection to this offering from the CSRC, the CAC or any other PRC authorities that have jurisdiction

over our operations. Our PRC counsel has advised us that, based on the above and its understanding of the current PRC laws and regulations,

as of the date of this prospectus supplement, we are not required to submit an application to the CSRC, the CAC for the approval of this

offering and the listing and trading of the Class A Ordinary Shares on Nasdaq. However, our PRC counsel has further advised us there remains

significant uncertainty as to the enactment, interpretation and implementation of regulatory requirements related to overseas securities

offering and other capital markets activities. If it is determined in the future that CSRC, the CAC or other approval were required for

this offering, we may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines

and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or

restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material adverse effect

on our business, financial condition, results of operations and prospects, as well as the trading price of the Class A Ordinary Shares.

The CSRC, the CAC or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this offering

before settlement and delivery of the Class A Ordinary Shares. Consequently, if you engage in market trading or other activities in anticipation

of and prior to settlement and delivery, you do so at the risk that settlement and delivery may not occur. In addition, if the CSRC, the

CAC or other regulatory agencies later promulgate new rules requiring that we obtain their approvals for this offering, we may be unable

to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or

negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of the Class A Ordinary

Shares.

China’s economic,

political and social conditions, as well as changes in any government policies, laws and regulations may be quick with little advance

notice and, could have a material adverse effect on our business and cause the value of our Class A Ordinary Shares worthless.

Our

business, financial condition, results of operations and prospects are subject, to a significant extent, to economic, political and legal

developments in China. For example, as a result of recent proposed changes in the cybersecurity regulations in China that would require

certain Chinese technology firms to undergo a cybersecurity review before being allowed to list on foreign exchanges, this may have the

effect of further narrowing the list of potential businesses in China’s consumer, technology and mobility sectors that we intend

to focus on for our business combination or the ability of the combined entity to list in the United States.

China’s

economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level

of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant

growth in the past two to three decades, growth has been uneven, both geographically and among various sectors of the economy. Demand

for target services and products depends, in large part, on economic conditions in China. Any slowdown in China’s economic growth

may cause our potential customers to delay or cancel their plans to purchase our services and products, which in turn could reduce our

net revenues.

Although

China’s economy has been transitioning from a planned economy to a more market oriented economy since the late 1970s, the PRC government

continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises

significant control over China’s economic growth through allocating resources, controlling the incurrence and payment of foreign

currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Changes in any of these policies, laws and regulations may be quick with little advance notice and could adversely affect the economy

in China and could have a material adverse effect on our business and the value of our Class A ordinary shares.

The

PRC government has implemented various measures to encourage foreign investment and sustainable economic growth and to guide the allocation

of financial and other resources. However, we cannot assure you that the PRC government will not repeal or alter these measures or introduce

new measures that will have a negative effect on us, or more specifically, we cannot assure you that the PRC government will not initiate

possible governmental actions or scrutiny to us, which could substantially affect our operation and the value of our Ordinary Shares may

depreciate quickly. China’s social and political conditions may change and become unstable. Any sudden changes to China’s

political system or the occurrence of widespread social unrest could have a material adverse effect on our business and results of operations.

Furthermore,

our Company, our VIE and our subsidiaries, and our investors may face uncertainty about future actions by the government of China that

could significantly affect the VIE and its operations, including the enforceability of the contractual arrangements. As of the date of

this prospectus supplement, neither our Company nor our VIE has received or was denied permission from Chinese authorities to list on

U.S. exchanges. However, there is no guarantee that our Company or VIE will receive or not be denied permission from Chinese authorities

to list on U.S. exchanges in the future.

The Chinese government

exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations

at any time, which could result in a material change in our operations and cause the value of our Class A Ordinary Shares worthless.

The

Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through

regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those

relating to securities regulation, data protection, cybersecurity and mergers and acquisitions and other matters. The central or local

governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require

additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Government

actions in the future could significantly affect economic conditions in China or particular regions thereof, and could require us to materially

change our operating activities or divest ourselves of any interests we hold in Chinese assets. Our business may be subject to various

government and regulatory interference in the provinces in which we operate. We may incur increased costs necessary to comply with existing

and newly adopted laws and regulations or penalties for any failure to comply. Our operations could be adversely affected, directly or

indirectly, by existing or future laws and regulations relating to our business or industry.

Given

recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted

overseas and/or foreign investment in China-based issuers, any such action could significantly limit or completely hinder our ability

to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Recently,

the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued

the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, or the Opinions, which was made available to

the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and

the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction

of relevant regulatory systems, will be taken to deal with the risks and incidents of China-concept overseas listed companies. As

of the date of this prospectus supplement, we have not received any inquiry, notice, warning, or sanctions from PRC government authorities

in connection with the Opinions.

On

June 10, 2021, the Standing Committee of the National People’s Congress of China, or the SCNPC, promulgated the PRC Data Security

Law, which took effect in September 2021. The PRC Data Security Law imposes data security and privacy obligations on entities and individuals

carrying out data activities, and introduces a data classification and hierarchical protection system based on the importance of data

in economic and social development, and the degree of harm it will cause to national security, public interests, or legitimate rights

and interests of individuals or organizations when such data is tampered with, destroyed, leaked, illegally acquired or used. The PRC

Data Security Law also provides for a national security review procedure for data activities that may affect national security and imposes

export restrictions on certain data an information.

In

early July 2021, regulatory authorities in China launched cybersecurity investigations with regard to several China-based companies that

are listed in the United States. The Chinese cybersecurity regulator announced on July 2, 2021 that it had begun an investigation of Didi

Global Inc. (NYSE: DIDI) and two days later ordered that the company’s app be removed from smartphone app stores. On July 5, 2021,

the Chinese cybersecurity regulator launched the same investigation on two other Internet platforms, China’s Full Truck Alliance

of Full Truck Alliance Co. Ltd. (NYSE: YMM) and Boss of KANZHUN LIMITED (Nasdaq: BZ). On July 24, 2021, the General Office of the Communist

Party of China Central Committee and the General Office of the State Council jointly released the Guidelines for Further Easing the Burden

of Excessive Homework and Off-campus Tutoring for Students at the Stage of Compulsory Education, pursuant to which foreign investment

in such firms via mergers and acquisitions, franchise development, and variable interest entities are banned from this sector.

On

July 10, 2021, the Cyberspace Administration of China, or the CAC, released the Cybersecurity Review Measures (Revised Draft for Solicitation

of Comments), or the Revised Draft, pursuant to which operator holding more than one million users/users’ (which to be further specified)

individual information shall be subject to cybersecurity review before listing abroad. The cybersecurity review will evaluate, among others,

the risk of critical information infrastructure, core data, important data, or a large amount of personal information being influenced,

controlled or maliciously used by foreign governments after going public overseas. The procurement of network products and services, data

processing activities and overseas listing should also be subject to cybersecurity review if they concern or potentially pose risks to

national security. According to the effective Cybersecurity Review Measures, online platform/website operators of certain industries may

be identified as critical information infrastructure operators by the CAC, once they meet standard as stated in the National Cybersecurity

Inspection Operation Guide, and such operators may be subject to cybersecurity review. The scope of business operations and financing

activities that are subject to the Revised Draft and the implementation thereof is not yet clear. As of the date of this prospectus supplement,

we have not been informed by any PRC governmental authority of any requirement that we file for approval for this offering.

On

August 17, 2021, the State Council promulgated the Regulations on the Protection of the Security of Critical Information Infrastructure,

or the Regulations, which took effect on September 1, 2021. The Regulations supplement and specify the provisions on the security of critical

information infrastructure as stated in the Cybersecurity Review Measures. The Regulations provide, among others, that protection department

of certain industry or sector shall notify the operator of the critical information infrastructure in time after the identification of

certain critical information infrastructure.

On

August 20, 2021, the SCNPC promulgated the Personal Information Protection Law of the PRC, or the Personal Information Protection Law,

which took effect on November 1, 2021. As the first systematic and comprehensive law specifically for the protection of personal information

in the PRC, the Personal Information Protection Law provides, among others, that (i) an individual’s consent shall be obtained to

use sensitive personal information, such as biometric characteristics and individual location tracking, (ii) personal information operators

using sensitive personal information shall notify individuals of the necessity of such use and impact on the individual’s rights,

and (iii) where personal information operators reject an individual’s request to exercise his or her rights, the individual may

file a lawsuit with a People’s Court.

Given

that the above mentioned newly promulgated laws, regulations and policies were recently promulgated or issued, and have not yet taken

effect (as applicable), their interpretation, application and enforcement are subject to substantial uncertainties.

We

also face risks relating to our corporate structure. Investors in our Class A Ordinary Shares are not purchasing equity interests in the

VIE domiciled in China under our control or in our PRC subsidiaries but instead are purchasing equity interests in a Cayman Islands holding

company. You may never directly hold equity interests in our PRC operating companies. If the PRC government deems that our contractual

arrangements with the consolidated VIEs domiciled in China under our control do not comply with PRC regulatory restrictions on foreign

investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted

differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations.

It

is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what

they would provide. PRC regulatory authorities could disallow this structure, which would materially adversely affect our operations and

the value of our Class A Ordinary Shares, and could cause the value of such securities to significantly decline or become worthless.

Our VIE or the holding

company may be subject to approval or other requirement from PRC authorities in connection with this offering, and, if required, we cannot

assure you that we will be able to obtain such approval or satisfy such requirement. If we failed to obtain such approval or satisfy such

requirement, we may not able to continue listing on U.S. exchange, continue to offer securities to investors, or materially affect the

interest of the investors and the value of our Class A Ordinary Shares may decrease or become worthless.

We,

our subsidiaries, or VIE are currently not required to obtain permission or approval from the PRC authorities including CSRC or Cyberspace

Administration of China for the VIE’s operation, nor have we, our subsidiaries, or VIE applied for or received any denial for the

VIE’s operation. However, recently, the General Office of the Central Committee of the Communist Party of China and the General

Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to

Law,” or the Opinions, which was made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the

administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies.

Effective measures, such as promoting the construction of relevant regulatory systems will be taken to deal with the risks and incidents

of China-concept overseas listed companies, and cybersecurity and data privacy protection requirements and similar matters. The Opinions

and any related implementing rules to be enacted may subject us to compliance requirement in the future.

Given

the current regulatory environment in the PRC, we are still subject to the uncertainty of interpretation and enforcement of the rules

and regulations in the PRC, which can change quickly with little advance notice, and any future actions of the PRC authorities. It is

uncertain when and whether the Company will be required to obtain permission from the PRC government to list on U.S. exchanges or enter

into VIE Agreements (including retroactively), and even if such permission is obtained, whether it will be denied or rescinded. As a result,

our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to our business

or industry.

PRC laws and regulations

governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may impair our

ability to operate profitably.

There

are substantial uncertainties regarding the interpretation and application of PRC laws and regulations including, but not limited to,

the laws and regulations governing our business and the enforcement and performance of our arrangements with customers in certain circumstances.

The laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may

involve substantial uncertainty. The effectiveness and interpretation of newly enacted laws or regulations, including amendments to existing

laws and regulations, may be delayed, and our business may be affected if we rely on laws and regulations which are subsequently adopted

or interpreted in a manner different from our understanding of these laws and regulations. New laws and regulations that affect existing

and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new

PRC laws or regulations may have on our business.

The

PRC legal system is a civil law system based on written statutes. Unlike the common law system, prior court decisions under the civil

law system may be cited for reference but have limited precedential value. Since these laws and regulations are relatively new and the

PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and the enforcement

of these laws, regulations and rules involves uncertainties.

In

1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The

overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign

investments in China. However, China has not developed a fully integrated legal system, and recently enacted laws and regulations may

not sufficiently cover all aspects of economic activities in China. In particular, the interpretation and enforcement of these laws and

regulations involve uncertainties. Since PRC administrative and court authorities have significant discretion in interpreting and implementing

statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative and court proceedings and the

level of legal protection we enjoy. These uncertainties may affect our judgment on the relevance of legal requirements and our ability

to enforce our contractual rights or tort claims. In addition, the regulatory uncertainties may be exploited through unmerited or frivolous

legal actions or threats in attempts to extract payments or benefits from us.

Furthermore,

the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or

at all and may have retroactive effect. As a result, we may not be aware of our violation of any of these policies and rules until sometime

after the violation. In addition, any administrative and court proceedings in China may be protracted, resulting in substantial costs

and diversion of resources and management attention.

From

time to time, we may have to resort to administrative and court proceedings to enforce our legal rights. However, since PRC administrative

and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult

to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal

systems. Furthermore, the PRC legal system is based in part on government policies and internal rules (some of which are not published

in a timely manner or at all) that may have retroactive effect. As a result, we may not be aware of our violation of these policies and

rules until sometime after the violation. Such uncertainties, including uncertainty over the scope and effect of our contractual, property

(including intellectual property) and procedural rights, and any failure to respond to changes in the regulatory environment in China

could materially and adversely affect our business and impede our ability to continue our operations.

Recently,

the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued

the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which was made

available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities,