Current Report Filing (8-k)

December 07 2021 - 5:16PM

Edgar (US Regulatory)

false

0001042187

0001042187

2021-12-01

2021-12-01

--12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2021

YUNHONG CTI LTD.

(Exact name of registrant as specified in charter)

|

Illinois

|

|

000-23115

|

|

36-2848943

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

22160 N. Pepper Road, Lake Barrington, IL 60010

(Address of principal executive offices) (Zip Code)

(847) 382-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

CTIB

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 1, 2021, Yunhong CTI Ltd. (the “Company”), entered into a Stock Purchase Agreement (the “Purchase Agreement”) with ICY Mellon LLC (the “Investor”), pursuant to which the Company agreed to issue and sell, and the Investor agreed to purchase, 170,000 shares of the Company’s newly created Series D Convertible Preferred Stock (“Series D Preferred”). On December 1, 2021, pursuant to the Purchase Agreement, the Company issued the Investor a warrant (the “Warrant”) to purchase up to 128,572 shares of the Company’s common stock, at an exercise price of the lower of (a) $1.75 per Share, or (b) 85% of the lowest daily volume-weighted average price of the Common Stock during the 10 trading days prior to the date of exercise.

The above description of the Purchase Agreement and the Warrant is a summary only and is qualified in its entirety by reference to the full text of the Purchase Agreement and the Warrant attached as Exhibit10.1 and Exhibit10.2 hereto, respectively.

Item 5.03 is incorporated into this Item 1.01.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Series D Certificate of Designations

On December 1, 2021, the Company filed with the Secretary of State of the State of Illinois a Certificate of Designations, Preferences and Rights of Series D Preferred Stock (the “Series D Certificate of Designations”), which designates 170,000 shares of Series D Redeemable Convertible Preferred Stock, no par value per share (the “Series D Preferred”) with a stated value of $10.00 per share (as may be adjusted for any stock dividends, combinations or splits with respect to such shares) (the “Stated Value”).

Under the Series D Certificate of Designations, holders of the Series D Preferred will be entitled to receive quarterly dividends at the annual rate of 8% of the Stated Value. Such dividends may be paid in cash or in shares of Company common stock in the Company’s discretion. In the event of any liquidation, dissolution or winding up of the Company, the holders of record of shares of Series D Preferred will be entitled to receive, in preference to any distribution to the holders of the Company’s other equity securities (including the Company’s common stock), a liquidation preference equal to $10.00 per share plus all accrued and unpaid dividends.

Each holder of Series D Preferred shall have the right to convert the Stated Value of such shares, as well as accrued but unpaid declared dividends thereon (collectively the “Conversion Amount”) into shares of the Company’s common stock. The number of shares of common stock issuable upon conversion of the Conversion Amount shall equal the Conversion Amount divided by the conversion price of $1.00, subject to certain customary adjustments. The Series D Preferred may not be converted to common stock to the extent such conversion would result in the holder beneficially owning more than 4.99% of the Company’s outstanding common stock except as provided in the Series D Certificate of Designations.

Holders of Series D Preferred shall vote together with the holders of the Company’s common stock, Series A Convertible Preferred Stock and Series B Convertible Redeemable Preferred Stock on an as-if-converted basis, whereby each share of Series D Preferred will be entitled to 4.65 votes, subject to certain downward adjustments. In addition, so long as there are more than 37,500 shares of the Series D Preferred outstanding, the Company will be prohibited from taking certain actions without the consent of the holders of a majority of the outstanding shares of Series D Preferred, including among other actions the following: amend its Articles of Incorporation, as amended, the Series D Certificate of Designations or the by-laws of the Company in any manner to decrease the number of authorized shares of common stock or in any manner that would otherwise adversely affect the rights, preferences or privileges of the holders of the Series D Preferred, except for an amendment to increase the number of authorized shares of common stock.

This description of the Series D Certificate of Designations is a summary only and is qualified in its entirety by reference to the full text of the form of the Series D Certificate of Designations attached as Exhibit 3.1 hereto

Item 1.01 is incorporated into this Item 5.03.

|

Item 9.01 Financial Statements And Exhibits.

|

(d) Exhibits

The exhibit listed below is filed as an Exhibit to this Current Report on Form 8-K.

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 7, 2021

|

|

CTI INDUSTRIES CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ Jennifer Connerty

|

|

|

|

|

Jennifer Connerty

|

|

|

|

|

Chief Financial Officer

|

|

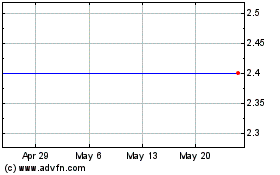

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Jun 2024 to Jul 2024

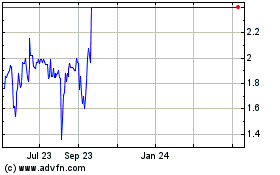

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Jul 2023 to Jul 2024