Xencor, Inc. (NASDAQ:XNCR), a clinical-stage biopharmaceutical

company developing engineered antibodies for the treatment of

cancer and other serious diseases, today reported financial results

for the first quarter ended March 31, 2024 and provided a review of

recent clinical and business highlights.

“We have focused our XmAb® clinical pipeline and discovery

activities on bispecific CD3 and CD28 T cell engagers, which

continue to show clinical validation for their potential in

treating patients with serious diseases. Our key clinical-stage

oncology programs in solid tumors include XmAb819 (ENPP3 x CD3) in

clear cell renal cell carcinoma, XmAb808 (B7-H3 x CD28) in prostate

cancer and other cancers, and XmAb541 (CLDN6 x CD3) in ovarian

cancer and other cancers, which are all now advancing in Phase 1

clinical studies. We plan to select our next T cell engager IND

candidate later this year,” said Bassil Dahiyat, Ph.D., president

and chief executive officer at Xencor. “Additionally, Xencor’s

best-in-class Xtend™ antibody half-life extension technology

continues to support improved outcomes for patients, with

Ultomiris® now approved in the U.S. for certain patients with

NMOSD, and we are especially delighted by recently published

results demonstrating an investigational antibody with Xtend was

effective in preventing malaria.”

Recent Clinical and Business Highlights

- First Patient Dosed in Phase 1 Study of XmAb®541 (CLDN6 x

CD3): XmAb541 is a bispecific antibody being developed for

patients with CLDN6-positive tumors including advanced ovarian

cancer. XmAb541 is designed to engage the immune system, activating

T cells for highly potent and targeted killing of tumor cells

expressing Claudin-6 (CLDN6), a tumor-associated antigen. Xencor’s

XmAb® 2+1 multivalent format used in XmAb541 enables greater

selectivity for cells expressing CLDN6 over similarly structured

Claudin family members, which may be expressed on normal tissue.

The first patient was recently dosed in a Phase 1 dose-escalation

study.

- FDA Approves Ultomiris® (Alexion Pharmaceuticals, Inc.) for

Adults with NMOSD: In March 2024, Ultomiris®

(ravulizumab-cwvz), which incorporates Xencor’s Xtend™ Fc Domain,

was approved in the United States as the first and only long-acting

C5 complement inhibitor for the treatment of adult patients with

anti-aquaporin-4 (AQP4) antibody-positive (Ab+) neuromyelitis

optica spectrum disorder (NMOSD). Ultomiris is also approved for

certain adults with NMOSD in Japan and the European Union (EU). As

part of Xencor’s recent Ultomiris royalty monetization, the Company

remains eligible for certain future royalties and milestone

payments. Ultomiris is a registered trademark of Alexion

Pharmaceuticals, Inc.

- Single Dose of Investigational Antibody with Xtend™ Confers

Protection Against Malaria Infection: Results from a Phase 2

National Institutes of Health (NIH)-sponsored clinical trial

published in the New England Journal of Medicine showed that a

single dose of L9LS, an experimental monoclonal antibody that

incorporates Xencor’s Xtend™ Fc Domain, was up to 77% effective in

preventing malaria in children in Mali for six months,

demonstrating the long duration of action that Xtend technology can

provide.

- New Chief Financial Officer Appointed: Bart Cornelissen

was appointed as Xencor’s senior vice president and chief financial

officer. He was most recently vice president, corporate finance at

Seagen Inc.

Financial Guidance: Based on current operating plans,

Xencor expects to end 2024 with between $475 million and $525

million in cash, cash equivalents and marketable debt securities,

and to have cash to fund research and development programs and

operations into 2027.

Financial Results for the First Quarter Ended March 31,

2024

Cash, cash equivalents and marketable debt securities totaled

$646.7 million as of March 31, 2024, compared to $697.4 million on

December 31, 2023.

Revenues for the first quarter ended March 31, 2024 were $12.8

million, compared to $19.0 million for the same period in 2023.

Total revenues earned in the first quarter of 2024 included

non-cash royalty revenue from Xencor’s Alexion and Morphosys/Incyte

agreements, compared to milestone revenue earned from the J&J

collaboration and royalties from the Alexion agreement in the first

quarter of 2023.

Research and development expenses for the first quarter ended

March 31, 2024 were $56.9 million, compared to $65.6 million for

the same period in 2023. Decreased research and development

spending for the first quarter of 2024 compared to 2023 reflects

changes in spending across multiple clinical-stage programs and

wind-down costs on terminated programs.

General and administrative expenses for the first quarter ended

March 31, 2024 were $13.8 million and were in line with $14.2

million for the same period in 2023.

Other expense, net, for the first quarter ended March 31, 2024

was $10.8 million, compared to $0.02 million for the same period in

2023. Increased other expense for the first quarter of 2024

compared to 2023 reflects impairment charge on equity investments,

partially offset by interest income earned on investments and

unrealized gain on equity investments.

Non-cash, stock-based compensation expense for the first quarter

ended March 31, 2024 was $11.4 million, compared to $12.6 million

for the same period in 2023.

Net loss for the first quarter ended March 31, 2024 was $68.0

million, or $(1.11) on a fully diluted per share basis, compared to

$60.8 million, or $(1.02) on a fully diluted per share basis, for

the same period in 2023.

The total shares outstanding were 61,634,685 as of March 31,

2024, compared to 60,381,600 as of March 31, 2023.

Upcoming Investor Conferences

Company management will participate at multiple upcoming

investor conferences:

- RBC Capital Markets Global Healthcare Conference Date:

Tuesday, May 14, 2024 Presentation Time: 2:05 p.m. ET / 11:05 a.m.

PT Location: New York City

- BofA Securities Health Care Conference Date: Wednesday,

May 15, 2024 Presentation Time: 4:40 p.m. ET / 1:40 p.m. PT

Location: Las Vegas

Live webcasts of the presentations will be available under

“Events & Presentations” in the Investors section of the

Company’s website located at www.xencor.com. Replays of the events

will be available on the Xencor website for at least 30 days

following the presentations.

About Xencor

Xencor is a clinical-stage biopharmaceutical company developing

engineered antibodies for the treatment of patients with cancer and

other serious diseases. More than 20 candidates engineered with

Xencor's XmAb® technology are in clinical development, and three

XmAb medicines are marketed by partners. Xencor's XmAb engineering

technology enables small changes to a proteins structure that

result in new mechanisms of therapeutic action. For more

information, please visit www.xencor.com.

Forward-Looking Statements

Certain statements contained in this press release may

constitute forward-looking statements within the meaning of

applicable securities laws. Forward-looking statements include

statements that are not purely statements of historical fact, and

can generally be identified by the use of words such as

“potential,” “can,” “will,” “plan,” “may,” “could,” “would,”

“expect,” “anticipate,” “seek,” “look forward,” “believe,”

“committed,” “investigational,” and similar terms, or by express or

implied discussions relating to Xencor’s business, including, but

not limited to, statements regarding planned presentations of

clinical data, planned clinical trials, projected financial

resources, the quotations from Xencor's president and chief

executive officer, and other statements that are not purely

statements of historical fact. Such statements are made on the

basis of the current beliefs, expectations, and assumptions of the

management of Xencor and are subject to significant known and

unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements and the timing of

events to be materially different from those implied by such

statements, and therefore these statements should not be read as

guarantees of future performance or results. Such risks include,

without limitation, the risks associated with the process of

discovering, developing, manufacturing and commercializing drugs

that are safe and effective for use as human therapeutics and other

risks, including the ability of publicly disclosed preliminary

clinical trial data to support continued clinical development and

regulatory approval for specific treatments, in each case as

described in Xencor's public securities filings. For a discussion

of these and other factors, please refer to Xencor's annual report

on Form 10-K for the year ended December 31, 2023 as well as

Xencor's subsequent filings with the Securities and Exchange

Commission. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

This caution is made under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, as amended to

date. All forward-looking statements are qualified in their

entirety by this cautionary statement and Xencor undertakes no

obligation to revise or update this press release to reflect events

or circumstances after the date hereof, except as required by

law.

Xencor, Inc. Selected Consolidated Balance Sheet Data

(in thousands)

March 31,

December 31,

2024

2023

(Unaudited) Cash, cash equivalents and marketable debt securities -

current

$

491,401

$

551,515

Other current assets

70,851

71,645

Marketable debt securities - long term

155,342

145,892

Other long term assets

166,661

183,640

Total assets

$

884,255

$

952,692

Total current liabilities

79,402

84,709

Deferred income - long term

113,367

125,183

Other long term liabilities

79,299

73,667

Total liabilities

272,068

283,559

Total stockholders' equity

612,187

669,133

Total liabilities and stockholders’ equity

$

884,255

$

952,692

Xencor, Inc. Consolidated Statements of Loss and

Comprehensive Loss (in thousands, except share and per share

data)

Three months Ended March

31,

2024

2023

(Unaudited)

Revenue

$

12,805

$

18,962

Operating expenses Research and development

56,873

65,552

General and administrative

13,787

14,154

Total operating expenses

70,660

79,706

Loss from operations

(57,855

)

(60,744

)

Other income (expense), net

(10,854

)

(19

)

Loss before income tax

(68,709

)

(60,763

)

Income tax expense

—

—

Net loss

(68,709

)

(60,763

)

Net loss attributable to non-controlling interest

(676

)

—

Net loss attributable to Xencor, Inc.

(68,033

)

(60,763

)

Other comprehensive income (loss): Net unrealized gain

(loss) on marketable debt securities available-for-sale

(1,445

)

3,327

Comprehensive loss attributable to Xencor, Inc.

$

(69,478

)

$

(57,436

)

Net loss per common share attributable to Xencor,

Inc.: Basic and Diluted

$

(1.11

)

$

(1.02

)

Weighted average common shares used to compute net loss per

share attributable to Xencor, Inc. Basic and Diluted

61,212,324

59,771,674

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507540009/en/

For Investors: Charles Liles cliles@xencor.com (626)

737-8118

For Media: Cassidy McClain Inizio Evoke

cassidy.mcclain@inizioevoke.com (619) 694-6291

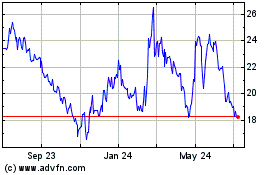

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Oct 2024 to Nov 2024

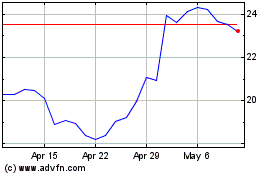

Xencor (NASDAQ:XNCR)

Historical Stock Chart

From Nov 2023 to Nov 2024