Wintrust Financial Corporation Announces Pricing of $110 Million Public Offering of Non-Cumulative Perpetual Convertible Pref...

March 14 2012 - 9:22AM

Wintrust Financial Corporation ("Wintrust" or the "Company")

(Nasdaq:WTFC) today announced the pricing of 110,000 shares, or

$110,000,000 aggregate liquidation preference, of Non-Cumulative

Perpetual Convertible Preferred Stock, Series C ("Preferred

Stock"). Wintrust has granted the underwriters a 30-day option to

purchase up to an additional 16,500 shares, or $16,500,000

aggregate liquidation preference, of Preferred Stock to cover

over-allotments, if any.

Wintrust intends to use the net proceeds for general corporate

purposes, which may include, without limitation, investments at the

holding company level, providing capital to support our growth,

acquisitions or other business combinations, including

FDIC-assisted acquisitions, and reducing or refinancing existing

debt.

Dividends will be payable on the Preferred Stock when, as, and

if, declared by Wintrust's Board of Directors on a non-cumulative

basis quarterly in arrears on January 15, April 15, July 15 and

October 15 of each year, beginning on April 15, 2012 at a rate of

5.00% per year on the liquidation preference of $1,000 per

share.

The holders of the Preferred Stock will have the right at any

time to convert each share of Preferred Stock into 24.3132 shares

of Wintrust common stock, which represents an initial conversion

price of $41.13 per share of Wintrust common stock, plus cash in

lieu of fractional shares. The initial conversion price

represents a 17.5% conversion premium to the volume-weighted

average price of Wintrust common stock on March 13, 2012 of

approximately $35.00 per share. The conversion rate, and thus the

conversion price, will be subject to adjustment under certain

circumstances. On or after April 15, 2017, Wintrust will have

the right under certain circumstances to cause the Preferred Stock

to be converted into shares of Wintrust common stock, plus cash in

lieu of fractional shares.

RBC Capital Markets and BofA Merrill Lynch are acting as joint

book-running managers and Sandler O'Neill + Partners, L.P. and

Wells Fargo Securities are acting as co-managers for the

offering.

This press release shall not constitute an offer to sell or the

solicitation of any offer to buy any securities, nor shall there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction. The offering will only be made by means of a

prospectus and a related prospectus supplement, copies of which may

be obtained from: RBC Capital Markets, LLC, Three World Financial

Center, 200 Vesey Street, 8th Floor, New York, New York 10281,

Telephone: (877) 822-4089 or BofA Merrill Lynch, 4 World Financial

Center, New York, New York 10080, Attn: Prospectus Department or

email dg.prospectus_requests@baml.com.

About Wintrust

Wintrust is a financial holding company with assets of

approximately $16 billion whose common stock is traded on the

NASDAQ Global Select Market. Wintrust operates fifteen community

banks that provide a full complement of commercial and consumer

loan and deposit products and services through approximately 100

banking facilities in the Chicago and Milwaukee metropolitan areas.

Wintrust also provides brokerage, trust and investment services to

customers primarily in the Midwest, as well as customers of the

banks, and provides services in mortgage banking, insurance premium

financing and several specialty-lending niches.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Investors are

cautioned that such statements are predictions and that actual

events or results may differ materially. Wintrust's expected

financial results or other plans are subject to a number of risks

and uncertainties. For a discussion of such risks and

uncertainties, which could cause actual results to differ from

those contained in the forward-looking statements, see "Risk

Factors" and the forward-looking statement disclosure contained in

each of Wintrust's preliminary prospectus supplement dated March

13, 2012, and Wintrust's Annual Report on Form 10-K for the most

recently ended fiscal year. Forward-looking statements speak

only as of the date made and Wintrust undertakes no duty to update

the information.

CONTACT: Edward J. Wehmer,

President & Chief Executive Officer

David A. Dykstra,

Senior Executive Vice President & Chief Operating Officer

(847) 615-4096

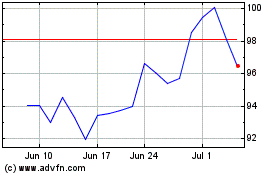

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

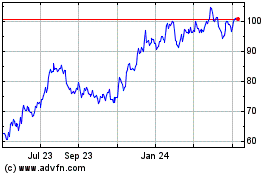

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024