Wintrust Plans Expansion of Its Asset Management Business, Enters Into Agreement to Acquire Great Lakes Advisors

May 04 2011 - 4:01PM

Wintrust Financial Corporation (Wintrust) (Nasdaq:WTFC), announced

it has entered into an agreement to acquire Great Lakes Advisors,

Inc. (GLA), a Chicago-based investment manager with approximately

$2.4 billion in assets under management and which specializes in

domestic equity and fixed income investment strategies for

institutional clients. Upon completion of the transaction GLA will

merge with Wintrust's existing asset management business, Wintrust

Capital Management, LLC. The combined firm will operate its

asset management business as "Great Lakes Advisors, LLC, a Wintrust

Wealth Management Company" and will have assets under management of

nearly $4.5 billion.

Edward Wehmer, President and CEO of Wintrust, commented on the

pending transaction: "Building our asset management capabilities is

a strategic priority for us and this merger will represent a major

step forward. With the acquisition of Great Lakes Advisors, we will

establish ourselves as a major player in the institutional investor

market in the Midwest." Tom Kiley, who is a Managing Director of

Great Lakes Advisors and will become CEO of the combined company

upon completion of the merger, shared his perspective: "This merger

will bring together two firms that share many common values and

operate distinct but complementary lines of business. By leveraging

the strengths of both organizations, we are better positioned to

serve clients and can employ our expanded resources and scale to

further enhance our investment strategies and client service."

Tom Zidar, Chairman and CEO of Wintrust Wealth Management,

added: "We are excited to be joining forces with Great Lakes

Advisors. Their leadership team has an outstanding reputation and

investment track record. We look forward to bringing their

expertise and capabilities to our private clients and growing the

combined business."

The terms of the transaction are not being disclosed. The

transaction is expected to be completed late in the second quarter

of 2011, subject to regulatory approval and certain closing

conditions.

About Wintrust

Wintrust is a financial holding company with assets of

approximately $14 billion whose common stock is traded on the

NASDAQ Global Select Market. Wintrust operates fifteen community

bank subsidiaries that are located in the greater Chicago and

Milwaukee market areas. Additionally, the Company operates various

non-bank subsidiaries including one of the largest commercial

insurance premium finance companies operating in the United States,

a company providing short-term accounts receivable financing and

value-added out-sourced administrative services to the temporary

staffing services industry, companies engaging primarily in the

origination and purchase of residential mortgages for sale into the

secondary market throughout the United States, and companies

providing wealth management services. Currently, Wintrust operates

more than 85 banking offices.

About Wintrust Wealth Management

Wintrust Wealth Management provides a comprehensive suite of

wealth management services and oversees over $10 billion in client

assets. Wintrust Wealth Management consists of Wintrust's three

wealth management companies comprised of Wayne Hummer Investments,

Wintrust Capital Management and The Chicago Trust

Company. Since 1931, Wayne Hummer Investments has been

providing a full range of investment products and services tailored

to meet the specific needs of individual investors throughout the

country. Wintrust Capital Management is the investment advisory

affiliate of Wayne Hummer Investments. Wintrust Capital Management

manages assets for private clients, public and corporate pensions,

Taft-Hartley funds, as well as portfolios for The Chicago Trust

Company. The Chicago Trust Company provides trust and investment

products and services to individuals and businesses in Wintrust

community bank markets.

About Great Lakes Advisors

Great Lakes Advisors, Inc. is an independent investment

management firm organized in 1990. Headquartered in Chicago, Great

Lakes currently manages approximately $2.4 billion in equity, fixed

income, and balanced fund separate accounts for a diverse group of

clients including public funds, endowment/foundations, Taft Hartley

plans, religious communities, Socially Responsible Investors,

corporations and financial intermediary relationships.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Investors are cautioned

that such statements are predictions and that actual events or

results may differ materially. Wintrust's expected financial

results or other plans are subject to a number of risks and

uncertainties. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" and the

forward-looking statement disclosure contained in Wintrust's Annual

Report on Form 10-K for the most recently ended fiscal year.

Forward-looking statements speak only as of the date made and

Wintrust undertakes no duty to update the information.

CONTACT: Edward J. Wehmer, President & Chief Executive Officer

David A. Dykstra, Senior Executive Vice President & Chief

Operating Officer

Thomas P. Zidar, Chairman and CEO - Wintrust Wealth Management

(847) 615-4096

www.wintrust.com

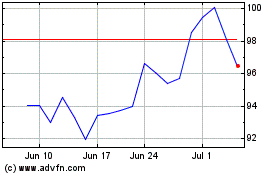

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

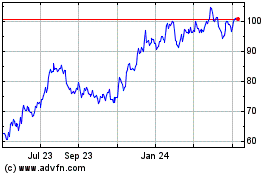

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024