Wintrust Financial Corporation ("Wintrust") (Nasdaq:WTFC) announced

today the opening of its downtown Chicago lending office. Branded

Wintrust Commercial Banking, the office currently has a dozen

commercial lenders in place as well as additional wealth management

staff.

Temporarily housed in Wintrust's Wayne Hummer Wealth Management

offices at 222 South Riverside Drive in Chicago, the group will

move to dedicated office space in July, filling the 22nd

floor at 190 South LaSalle Street.

The new lending group further expands Wintrust's targeting of

mid-market businesses and brings the commercial lending and

Treasury Management services typically provided at Wintrust's

suburban banks into Chicago.

"The time was right to fill the void of homegrown banks in

Chicago," said Edward Wehmer, President and CEO of Wintrust.

"Wintrust has been built upon Midwestern values and client service

and we are ready and well poised to bring old fashioned banking to

Chicago's commercial sector."

The group will be led by John McKinnon, who has been brought in

as Chairman of the group. McKinnon joins Wintrust after more than

40 years with JP Morgan Chase. He will lead a strong group of

veteran commercial bankers, all with extensive experience and prior

success.

Joining the team as Executive Vice President after 26 years with

JP Morgan Chase, Paul Carlisle will provide strategic day-to-day

leadership for the Chicago lending group.

Carlisle will be supported by a team of experienced Managing

Directors, including John Dvorak, Bill Ryan, Chris Newton and Bob

Shanahan, who currently leads Wintrust's Asset-Based Lending Team,

Wintrust Business Credit. Each will lead a specialized lending team

in order to provide specific expertise, extensive coverage and

exceptional customer service.

Additional lenders include David Wyent, Kyle Rosborg, Tim

Kramer, Kam Kniss, Dan Harvey, Jason Girardin and John Hoppe.

William Robin and Jack Myers from Wintrust Business Credit are also

joining the group. Rounding out the office are Commercial Loan

Officer Troy Pierce and Credit Analyst Michael Bragg.

Joining the new lending teams will be a specialized wealth

management team focused on meeting the needs of mid-market business

owners. Led by Braden Smith, as Executive Vice President-Wealth

Management, the team includes Patrick Rule, Vice President-Wealth

Management and Scott Fortiano, Vice President of Investments.

"We are excited to see our new downtown lending office unfold,"

concluded Wehmer. "We have brought on experienced and successful

bankers and we are going to allow them to do what makes them

successful."

ABOUT WINTRUST

Wintrust is a financial holding company with assets of

approximately $13 billion whose common stock is traded on the

Nasdaq Stock Market (Nasdaq:WTFC). Wintrust operates fifteen

community bank subsidiaries that are located in the greater Chicago

and Milwaukee market areas. Additionally, the Company operates

various non-bank subsidiaries including one of the largest

commercial insurance premium finance companies operating in the

United States, a company providing short-term accounts receivable

financing and value-added out-sourced administrative services to

the temporary staffing services industry, companies engaging

primarily in the origination and purchase of residential mortgages

for sale into the secondary market throughout the United States,

and companies providing wealth management services including

broker-dealer, money management services, advisory services, and

trust and estate services. Currently, Wintrust operates more than

80 banking offices.

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the

meaning of federal securities laws. Forward-looking information can

be identified through the use of words such as "intend," "plan,"

"project," "expect," "anticipate," "believe," "estimate,"

"contemplate," "possible," "point," "will," "may," "should,"

"would" and "could." Forward-looking statements and information are

not historical facts, are premised on many factors and assumptions,

and represent only management's expectations, estimates and

projections regarding future events. Similarly, these

statements are not guarantees of future performance and involve

certain risks and uncertainties that are difficult to predict,

which may include, but are not limited to, those listed below and

the Risk Factors discussed under Item 1A of the Company's 2009

Annual Report on Form 10-K and in any of the Company's subsequent

SEC filings. The Company intends such forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995, and is including this statement for

purposes of invoking these safe harbor provisions. Such

forward-looking statements may be deemed to include, among other

things, statements relating to the Company's future financial

performance, the performance of its loan portfolio, the expected

amount of future credit reserves and charge-offs, delinquency

trends, growth plans, regulatory developments, securities that the

Company may offer from time to time, and management's long-term

performance goals, as well as statements relating to the

anticipated effects on financial condition and results of

operations from expected developments or events, the Company's

business and growth strategies, including future acquisitions of

banks, specialty finance or wealth management businesses, internal

growth and plans to form additional de novo banks or branch

offices. Actual results could differ materially from those

addressed in the forward-looking statements as a result of numerous

factors, including the following:

-

negative economic conditions that adversely affect the economy,

housing prices, the job market and other factors that may affect

the Company's liquidity and the performance of its loan portfolios,

particularly in the markets in which it operates;

-

the extent of defaults and losses on the Company's loan

portfolio, which may require further increases in its allowance for

credit losses;

-

estimates of fair value of certain of the Company's assets and

liabilities, which could change in value significantly from period

to period;

-

changes in the level and volatility of interest rates, the

capital markets and other market indices that may affect, among

other things, the Company's liquidity and the value of its assets

and liabilities;

-

a decrease in the Company's regulatory capital ratios, including

as a result of further declines in the value of its loan

portfolios, or otherwise;

-

effects resulting from the Company's participation in the

Capital Purchase Program, including restrictions on dividends and

executive compensation practices, as well as any future

restrictions that may become applicable to the

Company;

-

legislative or regulatory changes, particularly changes in

regulation of financial services companies and/or the products and

services offered by financial services companies;

-

increases in the Company's FDIC insurance premiums, or the

collection of special assessments by the

FDIC;

-

competitive pressures in the financial services business which

may affect the pricing of the Company's loan and deposit products

as well as its services (including wealth management services);

-

delinquencies or fraud with respect to the Company's premium

finance business;

-

the Company's ability to comply with covenants under its

securitization facility and credit facility;

-

credit downgrades among commercial and life insurance providers

that could negatively affect the value of collateral securing the

Company's premium finance loans;

-

any negative perception of the Company's reputation or financial

strength;

-

the loss of customers as a result of technological changes

allowing consumers to complete their financial transactions without

the use of a

bank;

-

the ability of the Company to attract and retain senior

management experienced in the banking and financial services

industries;

-

failure to identify and complete favorable acquisitions in the

future, or unexpected difficulties or developments related to the

integration of recent acquisitions, including with respect to any

FDIC-assisted

acquisitions;

-

unexpected difficulties or unanticipated developments related to

the Company's strategy of de novo bank formations and openings,

which typically require over 13 months of operations before

becoming profitable due to the impact of organizational and

overhead expenses, the startup phase of generating deposits and the

time lag typically involved in redeploying deposits into

attractively priced loans and other higher yielding earning

assets;

-

changes in accounting standards, rules and interpretations and

the impact on the Corporation's financial

statements;

-

significant litigation involving the Company;

and

-

the ability of the Company to receive dividends from its

subsidiaries.

Therefore, there can be no assurances that future actual results

will correspond to these forward-looking statements. The

reader is cautioned not to place undue reliance on any

forward-looking statement made by or on behalf of

Wintrust. Any such statement speaks only as of the date the

statement was made or as of such date that may be referenced within

the statement. The Company undertakes no obligation to release

revisions to these forward-looking statements or reflect events or

circumstances after the date of this press release.

Persons are advised, however, to consult further disclosures

management makes on related subjects in its reports filed with the

Securities and Exchange Commission and in its press releases.

CONTACT: Wintrust Financial Corporation

Edward J. Wehmer, President & Chief Executive Officer

David A. Dykstra, Senior Executive Vice President

& Chief Operating Officer

(847) 615-4096

www.wintrust.com

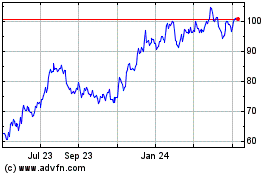

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

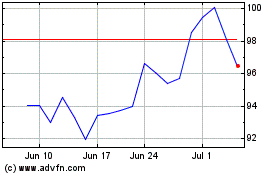

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024