LAKE FOREST, Ill., April 28 /PRNewswire-FirstCall/ -- Wintrust

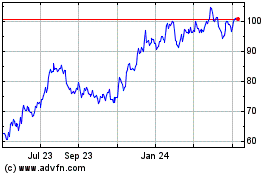

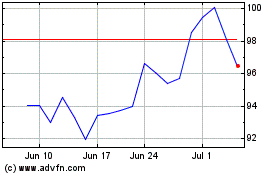

Financial Corporation ("Wintrust" or "the Company") (NASDAQ:WTFC)

announced quarterly net income of $6.4 million, or $0.06 per

diluted share, for the period ended March 31, 2009, an increase of

$0.04 per diluted share, compared to $2.0 million of net income, or

$0.02 per diluted share, recorded in the fourth quarter of 2008.

Compared to the first quarter of 2008, earnings per diluted share

decreased $0.34, on a $3.3 million decrease in net income.

Contributing to the decrease in earnings per diluted share in the

first quarter of 2009 compared to the first quarter of 2008 were

preferred share dividends, reducing net income available to common

shareholders by $5.0 million. Edward J. Wehmer, President and Chief

Executive Officer, commented, "We are pleased to report net income

of $6.4 million in the first quarter of 2009. Despite extremely

volatile economic conditions throughout the first quarter, our

banks reported increasing new loan volumes and deposit generation.

Given the nature of competitive conditions, reasonable pricing

metrics are returning to the marketplace." Mr. Wehmer noted, "We

recorded $10.0 million of net loan charge-offs and $14.5 million in

provision for credit losses in the first quarter. Both of these are

essentially the same as the amounts recorded in the previous

quarter. Non-performing loans increased in the first quarter as

weak economic conditions persist. Distressed real estate valuations

due to lack of sales activity, large property inventories,

decreasing numbers of potential buyers and other factors continue

to restrict the flow of these properties. We remain focused on

resolving existing problem credits and are working to identify

potential problem credits." Mr. Wehmer added, "Throughout the first

quarter we generated solid earning asset growth, lower priced

retail core deposits and improvements in loan pricing spreads on

new volumes. Record residential mortgage originations in excess of

$1.2 billion, primarily loan refinancing, were recorded in the

first quarter by our mortgage banking operations. This is nearly a

five-fold increase over the fourth quarter of 2008. In the first

quarter, more than $2.7 billion of credit was extended to new and

existing borrowers subsequent to the U.S. Treasury Department's

capital investment as part of the Capital Purchase Program. Our

successful community banking model continues to be a competitive

advantage in these tough economic times as our banks are

predominantly funded by a stable base of retail deposits rather

than by volatile wholesale funding vehicles. During the first

quarter, outstanding balances in our MaxSafe(R) suite of products,

which offer 15 times the level of FDIC insurance a customer can

achieve at a single charter bank, increased another $160 million to

$534 million. This product continues to be an effectively priced

deposit generation tool and is well received in the marketplace."

Mr. Wehmer summarized, "The challenges faced by the banking

industry in the first quarter most likely will continue throughout

2009. We have been preparing for this for some time and believe we

are in a position to take advantage due to our unique community

bank model. The Company has the capital available to meet lending

demands and to work through each problem credit, as well as

diversified retail deposit funding sources to support the quality

asset growth." Total assets of $10.8 billion at March 31, 2009

increased $161 million from December 31, 2008 and $1.1 billion from

March 31, 2008. Total deposits as of March 31, 2009 were $8.6

billion, an increase of $249 million from December 31, 2008 and

$1.1 billion from March 31, 2008. Total loans grew to $7.8 billion

as of March 31, 2009, an increase of $220 million, or 12% on an

annualized basis, over the $7.6 billion balance as of December 31,

2008 and an increase of $967 million, or 14%, over March 31, 2008.

The Company's loan portfolio includes a wide variety of loan types,

of which approximately 9% are commercial real estate construction

and land development related and 5% are residential real estate

construction and land development related. These projects are being

carefully monitored on an individual credit basis at each bank.

Total shareholders' equity is $1.1 billion, or a book value of

$32.64 per common share, at March 31, 2009, compared to $1.1

billion, or a book value of $33.03 per common share, at December

31, 2008 and $753 million, or a book value of $31.97 per common

share, at March 31, 2008. Wintrust's key operating measures and

growth rates for the first quarter of 2009 as compared to the

sequential and linked quarters are shown in the table below: % or %

or basis basis point point (bp) (bp) Change Change From From Three

Months Ended 4th 1st March 31, December 31, March 31, Quarter

Quarter ($in 2009 2008 2008 2008 (4) 2008 thousands, except per

share data) Net income $6,358 $1,955 $9,705 225% (34)% Net income

per common share - diluted $0.06 $0.02 $0.40 200% (85)% Net revenue

(1) $101,209 $82,117 $86,314 23% 17% Net interest income $64,782

$62,745 $61,742 3% 5% Net interest margin (2) 2.71% 2.78% 2.98%

(7)bp (27)bp Net overhead ratio (3) 1.53% 1.80% 1.64% (27)bp (11)bp

Return on average assets 0.24% 0.08% 0.42 16bp (18)bp Return on

average common equity 0.71% 0.22% 5.25 49bp (454)bp At end of

period ------- Total assets $10,818,941 $10,658,326 $9,732,466 6%

11% Total loans $7,841,447 $7,621,069 $6,874,916 12% 14% Total

deposits $8,625,977 $8,376,750 $7,483,582 12% 15% Total equity

$1,063,227 $1,066,572 $753,293 (1)% 41% (1) Net revenue is net

interest income plus non-interest income. (2) See "Supplemental

Financial Measures/Ratios" for additional information on this

performance measure/ratio. (3) The net overhead ratio is calculated

by netting total non-interest expense and total non-interest

income, annualizing this amount, and dividing by that period's

total average assets. A lower ratio indicates a higher degree of

efficiency. (4) Period-end balance sheet percentage changes are

annualized. Certain returns, yields, performance ratios, or

quarterly growth rates are "annualized" in this presentation to

represent an annual time period. This is done for analytical

purposes to better discern for decision-making purposes underlying

performance trends when compared to full-year or year-over-year

amounts. For example, balance sheet growth rates are most often

expressed in terms of an annual rate like 20%. As such, a 5% growth

rate for a quarter would represent an annualized 20% growth rate.

Additional supplemental financial information showing quarterly

trends can be found on the Company's website at

http://www.wintrust.com/ by choosing "Financial Reports" and then

choosing "Supplemental Financial Info." Impacting Comparative

Financial Results: Acquisitions, Stock Offerings/Regulatory Capital

and New Location Acquisitions On December 23, 2008, the Company

announced the acquisition by Wintrust Mortgage Corporation of

certain assets and the assumption of certain liabilities of the

mortgage banking business of Professional Mortgage Partners ("PMP")

of Downers Grove, Illinois. PMP was founded in 1999 and had

approximately $1.6 billion in annual mortgage originations in 2008.

The terms of the cash transaction were not disclosed, however, a

significant portion of the net purchase price for the PMP assets is

conditioned upon certain future profitability measures. The impact

related to the PMP transaction is included in Wintrust's

consolidated financial results only since the effective date of

acquisition. Subsequent to quarter-end, Wayne Hummer Asset

Management Company completed its previously announced agreement to

purchase certain assets and assume certain liabilities of Advanced

Investment Partners, LLC ("AIP"). AIP is an investment management

firm specializing in the active management of domestic equity

investment strategies. The terms of the transaction were not

disclosed. Stock Offerings/Regulatory Capital The Company announced

on December 19, 2008 that it had received the proceeds from the

$250 million investment in Wintrust by the U.S. Treasury

Department. The investment was made as part of the U.S. Treasury

Department's Capital Purchase Program, which is designed to infuse

capital into the nation's healthy banks in order to expand the flow

of credit to U.S. consumers and businesses on competitive terms to

promote the sustained growth and vitality of the U.S. economy. The

investment by the U.S. Treasury Department was comprised of $250

million in preferred shares, with a warrant to purchase 1,643,295

shares of Wintrust common stock at a per share exercise price of

$22.82 and a term of 10 years. If declared, dividends on the senior

preferred stock are payable quarterly in arrears at a rate of 5%

annually for the first five years and 9% thereafter. This

investment can, with the approval of the Federal Reserve, be

redeemed. The Company filed a shelf registration statement to

fulfill the requirement of the Capital Purchase Program that the

U.S. Department of Treasury be able to publicly sell the preferred

shares and warrant it purchased from Wintrust. On August 26, 2008,

the Company sold $50 million ($49.4 million net of issuance costs)

of non-cumulative perpetual convertible preferred stock in a

private transaction. If declared, dividends on the preferred stock

are payable quarterly in arrears at a rate of 8.00% per annum. The

shares are convertible into common stock at the option of the

holder at a price per share of $27.38. On and after August 26,

2010, the preferred stock will be subject to mandatory conversion

into common stock under certain circumstances. De Novo Banking

Location Activity In the second quarter of 2008, Wintrust opened a

banking location in Vernon Hills, Illinois (Libertyville Bank &

Trust Company). Financial Performance Overview For the first

quarter of 2009, net interest income totaled $64.8 million, an

increase of $3.0 million as compared to the first quarter of 2008

and an increase of $2.0 million as compared to the fourth quarter

of 2008. Average earning assets for the first quarter of 2009

increased by $1.4 billion compared to the first quarter of 2008.

Earning asset growth over the past 12 months was primarily a result

of the $912 million increase in average loans and $448 million

increase in liquidity management assets. The average earning asset

growth of $1.4 billion over the past 12 months was funded by a $780

million increase in the average balances of Savings, NOW, MMA and

Wealth Management deposits, an increase in the average balance of

net free funds of $382 million, an increase in the average balance

of brokered certificates of deposit of $114 million, an increase in

the average balance of retail certificates of deposit of $106

million and a decrease in the average balance of wholesale

borrowings (primarily notes payable) of $26 million. At March 31,

2009, $534 million of retail deposits were held in the Company's

MaxSafe(R) suite of products (certificates of deposit, MMA and

NOW). MaxSafe(R) is an innovative investment alternative that

provides up to 15 times the FDIC insurance security of a

traditional banking deposit or a total of $3.75 million for

interest-bearing accounts, by capitalizing on the Company's

multiple chartered subsidiaries and depositing a customer's funds

across all 15 of the Company's community banks. The net interest

margin for the first quarter of 2009 was 2.71%, compared to 2.98%

in the first quarter of 2008 and 2.78% in the fourth quarter of

2008. The decrease in the net interest margin in the first quarter

of 2009 when compared to the first quarter of 2008 is directly

attributable to two factors: first, interest rate compression as

the rates on certain variable rate retail deposit products were

unable to decline at the same magnitude as variable rate earning

assets and, second, the negative impact of an increased balance of

nonaccrual loans. In the first quarter of 2009, higher than

acceptable security pricing limited revenue from the Company's

covered call strategy. Historically, compression in the net

interest margin was effectively offset, as has consistently been

the case, by the Company's covered call strategy. An illustration

of the past effectiveness of this strategy is shown in the

Supplemental Financial Information section (see page titled "Net

Interest Margin (Including Call Option Income).") In the first

quarter of 2009, the yield on loans decreased 27 basis points and

the rate on interest-bearing deposits decreased 37 basis points

compared to the fourth quarter of 2008. Management believes

opportunities during 2009 for increasing credit spreads in the loan

portfolio and repricing of maturities of retail certificates of

deposits should help offset the effects of any continued interest

rate spread compression on variable rate retail deposits and the

unprecedented competitive retail deposit pricing given the current

economic conditions that have hindered net interest margin

expansion. Non-interest income totaled $36.4 million in the first

quarter of 2009, increasing $11.9 million, or 48%, compared to the

first quarter of 2008 and increasing $17.1 million, or 357% on an

annualized basis, compared to the fourth quarter of 2008. The

increase, in comparison to both prior periods, was primarily

attributable to increases in mortgage banking revenue. Mortgage

banking revenue increased $10.1 million when compared to the first

quarter of 2008 and $13.1 million when compared to the fourth

quarter of 2008. This was primarily attributable to a significant

increase in mortgage loans originated and sold to the secondary

market. Mortgages originated and sold totaled over $1.2 billion in

the first quarter of 2009 compared to $263 million in the fourth

quarter of 2008 and $463 million in the first quarter of 2008. In

the first quarter of 2009, Wintrust recognized $2.1 million of

other-than-temporary impairment ("OTTI") charges on certain

corporate debt investment securities compared to OTTI charges of

$3.9 million in the fourth quarter of 2008 and $1.9 million in the

first quarter of 2008. During the first quarter of 2009, the

Company recognized an increase of $8.8 million in trading income,

primarily resulting from the increase in market value of certain

securities held as trading assets. Offsetting the increase in

trading income was a decrease of $5.4 million on fees from covered

call options compared to the fourth quarter of 2008. Non-interest

expense totaled $77.0 million in the first quarter of 2009,

increasing $14.1 million, or 22%, compared to the first quarter of

2008 and $12.0 million, or 75% on an annualized basis, compared to

the fourth quarter of 2008. The increase compared to the fourth

quarter of 2008 was attributable to a $9.2 million increase in

salaries and employee benefits, increases in the FDIC deposit

insurance rates adding $1.3 million of additional expense and an

increase of $1.7 million in expenses related to OREO. The $9.2

million in salaries and employee benefits is attributable to an

increase in variable pay (commissions) of $5.2 million primarily as

a result of the higher mortgage loan origination volumes, $2.0

million of increased base salary and employee benefits as a result

of the PMP acquisition, $1.7 million from the seasonal impact of

payroll taxes and $0.3 million of other base pay and employee

benefits increases. Non-performing loans totaled $175.9 million, or

2.24% of total loans, at March 31, 2009, compared to $136.1

million, or 1.79% of total loans, at December 31, 2008 and $86.5

million, or 1.26% of total loans, at March 31, 2008. OREO of $41.5

million at March 31, 2009 increased $8.9 million compared to

December 31, 2008 and $36.6 million compared to March 31, 2008.

During the first quarter of 2009, 10 individual properties,

representing 6 lending relationships, were acquired by the Company

via foreclosure or deed in lieu of foreclosure. The fair value of

these properties totaled $21.5 million. Changes in fair value of

properties held and properties sold reduced the OREO balance by

$12.6 million during the first quarter of 2009. The $151.3 million

of non-performing loans as of March 31, 2009 classified as

residential real estate and home equity, commercial, consumer, and

other consumer consists of $52.3 million of residential real estate

construction and land development related loans, $51.5 million of

commercial real estate construction and land development related

loans, $23.9 million of residential real estate and home equity

related loans, $15.1 million of commercial real estate related

loans, $6.5 million of commercial related loans, and $2.0 million

of consumer related loans. Sixteen of these relationships exceed

$2.5 million in outstanding balances, approximating $93.8 million

of the $151.3 million in total outstanding balances. The Company

believes control and collection of these loans is very manageable.

At this time, management believes reserves are adequate to absorb

inherent losses that may occur upon the ultimate resolution of

these credits. The provision for credit losses totaled $14.5

million for the first quarter of 2009 compared to $14.5 million for

the fourth quarter of 2008 and $8.6 million in the first quarter of

2008. Net charge-offs for the first quarter totaled 51 basis points

on an annualized basis compared to 30 basis points on an annualized

basis in the first quarter of 2008 and 53 basis points on an

annualized basis in the fourth quarter of 2008. The allowance for

credit losses at March 31, 2009 increased to 0.97% compared to

0.94% at December 31, 2008 and 0.79% at March 31, 2008. WINTRUST

FINANCIAL CORPORATION SELECTED FINANCIAL HIGHLIGHTS Three Months

Ended (Dollars in thousands, except per March 31, share data) 2009

2008 Selected Financial Condition Data (at end of period): Total

assets $10,818,941 $9,732,466 Total loans 7,841,447 6,874,916 Total

deposits 8,625,977 7,483,582 Junior subordinated debentures 249,502

249,621 Total shareholders' equity 1,063,227 753,293 Selected

Statements of Income Data: Net interest income $64,782 $61,742 Net

revenue (1) 101,209 86,314 Income before taxes 9,774 14,910 Net

income 6,358 9,705 Net income per common share - Basic 0.06 0.41

Net income per common share - Diluted 0.06 0.40 Selected Financial

Ratios and Other Data: Performance Ratios: Net interest margin (2)

2.71% 2.98% Non-interest income to average assets 1.38 1.05

Non-interest expense to average assets 2.91 2.70 Net overhead ratio

(3) 1.53 1.64 Efficiency ratio (2) (4) 74.10 71.12 Return on

average assets 0.24 0.42 Return on average common equity 0.71 5.25

Average total assets $10,724,966 $9,373,539 Average total

shareholders' equity 1,061,654 743,997 Average loans to average

deposits ratio 93.4% 94.9% Common Share Data at end of period:

Market price per common share $12.30 $34.95 Book value per common

share $32.64 $31.97 Common shares outstanding 23,910,983 23,563,958

Other Data at end of period: Allowance for credit losses (5)

$75,834 $54,251 Non-performing loans $175,866 $91,414 Allowance for

credit losses to total loans (5) 0.97% 0.79% Non-performing loans

to total loans 2.24% 1.33% Number of: Bank subsidiaries 15 15

Non-bank subsidiaries 7 8 Banking offices 79 78 (1) Net revenue is

net interest income plus non-interest income. (2) See "Supplemental

Financial Measures/Ratios" for additional information on this

performance measure/ratio. (3) The net overhead ratio is calculated

by netting total non-interest expense and total non-interest

income, annualizing this amount, and dividing by that period's

total average assets. A lower ratio indicates a higher degree of

efficiency. (4) The efficiency ratio is calculated by dividing

total non-interest expense by tax-equivalent net revenues (less

securities gains or losses). A lower ratio indicates more efficient

revenue generation. (5) The allowance for credit losses includes

both the allowance for loan losses and the allowance for

lending-related commitments. WINTRUST FINANCIAL CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CONDITION (Unaudited)

(Unaudited) March 31, December 31, March 31, (In thousands) 2009

2008 2008 Assets Cash and due from banks $122,207 $219,794 $160,890

Federal funds sold and securities purchased under resale agreements

98,454 226,110 280,408 Interest bearing deposits with banks 266,512

123,009 11,280 Available-for-sale securities, at fair value

1,413,576 784,673 1,110,854 Trading account securities 13,815 4,399

1,185 Brokerage customer receivables 15,850 17,901 22,786 Mortgage

loans held-for-sale 218,707 61,116 102,324 Loans, net of unearned

income 7,841,447 7,621,069 6,874,916 Less: Allowance for loan

losses 74,248 69,767 53,758 Net loans 7,767,199 7,551,302 6,821,158

Premises and equipment, net 349,245 349,875 344,863 Accrued

interest receivable and other assets 263,145 240,664 188,607 Trade

date securities receivable - 788,565 395,041 Goodwill 276,310

276,310 276,121 Other intangible assets 13,921 14,608 16,949 Total

assets $10,818,941 $10,658,326 $9,732,466 Liabilities and

Shareholders' Equity Deposits: Non-interest bearing $745,194

$757,844 $670,433 Interest bearing 7,880,783 7,618,906 6,813,149

Total deposits 8,625,977 8,376,750 7,483,582 Notes payable 1,000

1,000 70,300 Federal Home Loan Bank advances 435,981 435,981

434,482 Other borrowings 250,488 336,764 293,091 Subordinated notes

70,000 70,000 75,000 Junior subordinated debentures 249,502 249,515

249,621 Trade date securities payable 7,170 - 236,217 Accrued

interest payable and other liabilities 115,596 121,744 136,880

Total liabilities 9,755,714 9,591,754 8,979,173 Shareholders'

equity: Preferred stock 282,662 281,873 - Common stock 26,766

26,611 26,416 Surplus 575,166 571,887 544,594 Treasury stock

(122,302) (122,290) (122,252) Retained earnings 315,855 318,793

314,038 Accumulated other comprehensive loss (14,920) (10,302)

(9,503) Total shareholders' equity 1,063,227 1,066,572 753,293

Total liabilities and shareholders' equity $10,818,941 $10,658,326

$9,732,466 WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) Three Months Ended

March 31, (In thousands, except per share data) 2009 2008 Interest

income Interest and fees on loans $106,887 $118,953 Interest

bearing deposits with banks 660 120 Federal funds sold and

securities purchased under resale agreements 61 634 Securities

14,327 16,081 Trading account securities 24 31 Brokerage customer

receivables 120 357 Total interest income 122,079 136,176 Interest

expense Interest on deposits 45,953 61,430 Interest on Federal Home

Loan Bank advances 4,453 4,556 Interest on notes payable and other

borrowings 1,870 2,770 Interest on subordinated notes 580 1,087

Interest on junior subordinated debentures 4,441 4,591 Total

interest expense 57,297 74,434 Net interest income 64,782 61,742

Provision for credit losses 14,473 8,555 Net interest income after

provision for credit losses 50,309 53,187 Non-interest income

Wealth management 5,926 7,865 Mortgage banking 16,232 6,096 Service

charges on deposit accounts 2,970 2,373 Gain on sales of premium

finance receivables 322 1,141 Losses on available-for-sale

securities, net (2,038) (1,333) Other 13,015 8,430 Total

non-interest income 36,427 24,572 Non-interest expense Salaries and

employee benefits 44,820 36,672 Equipment 3,938 3,926 Occupancy,

net 6,190 5,867 Data processing 3,136 2,798 Advertising and

marketing 1,095 999 Professional fees 2,883 2,068 Amortization of

other intangible assets 687 788 Other 14,213 9,731 Total

non-interest expense 76,962 62,849 Income before taxes 9,774 14,910

Income tax expense 3,416 5,205 Net income $6,358 $9,705 Dividends

on preferred shares 5,000 - Net income applicable to common shares

$1,358 $9,705 Net income per common share - Basic $0.06 $0.41 Net

income per common share - Diluted $0.06 $0.40 Cash dividends

declared per common share $0.18 $0.18 Weighted average common

shares outstanding 23,855 23,518 Dilutive potential common shares

221 582 Average common shares and dilutive common shares 24,076

24,100 SUPPLEMENTAL FINANCIAL MEASURES/RATIOS The accounting and

reporting policies of Wintrust conform to generally accepted

accounting principles ("GAAP") in the United States and prevailing

practices in the banking industry. However, certain non-GAAP

performance measures and ratios are used by management to evaluate

and measure the Company's performance. These include

taxable-equivalent net interest income (including its individual

components), net interest margin (including its individual

components) and the efficiency ratio. Management believes that

these measures and ratios provide users of the Company's financial

information a more meaningful view of the performance of the

interest-earning and interest-bearing liabilities and of the

Company's operating efficiency. Other financial holding companies

may define or calculate these measures and ratios differently.

Management reviews yields on certain asset categories and the net

interest margin of the Company and its banking subsidiaries on a

fully taxable-equivalent ("FTE") basis. In this non-GAAP

presentation, net interest income is adjusted to reflect tax-exempt

interest income on an equivalent before-tax basis. This measure

ensures comparability of net interest income arising from both

taxable and tax-exempt sources. Net interest income on a FTE basis

is also used in the calculation of the Company's efficiency ratio.

The efficiency ratio, which is calculated by dividing non-interest

expense by total taxable-equivalent net revenue (less securities

gains or losses), measures how much it costs to produce one dollar

of revenue. Securities gains or losses are excluded from this

calculation to better match revenue from daily operations to

operational expenses. A reconciliation of certain non-GAAP

performance measures and ratios used by the Company to evaluate and

measure the Company's performance to the most directly comparable

GAAP financial measures is shown below: Three Months Ended March

31, (Dollars in thousands) 2009 2008 (A) Interest income (GAAP)

$122,079 $136,176 Taxable-equivalent adjustment: - Loans 158 200 -

Liquidity management assets 451 511 - Other earning assets 11 13

Interest income - FTE $122,699 $136,900 (B) Interest expense (GAAP)

57,297 74,434 Net interest income - FTE $65,402 $62,466 (C) Net

interest income (GAAP) (A minus B) $64,782 $61,742 (D) Net interest

margin (GAAP) 2.68% 2.95% Net interest margin - FTE 2.71% 2.98% (E)

Efficiency ratio (GAAP) 74.54% 71.71% Efficiency ratio - FTE 74.10%

71.12% LOANS, NET OF UNEARNED INCOME % Growth From From March 31,

December 31, March 31, December 31, March 31, 2009 2008 2008

2008(1) 2008 (Dollars in thousands) Balance: -------- Commercial

and commercial real estate $4,933,355 $4,778,664 $4,534,383 13% 9%

Home equity 920,412 896,438 695,446 11 32 Residential real estate

280,808 262,908 233,556 28 20 Premium finance receivables 1,418,156

1,346,586 1,017,011 22 39 Indirect consumer loans(2) 154,257

175,955 230,771 (50) (33) Other loans 134,459 160,518 163,749 (66)

(18) Total loans, net of unearned income $7,841,447 $7,621,069

$6,874,916 12% 14% Mix: ---- Commercial and commercial real estate

63% 63% 66% Home equity 12 12 10 Residential real estate 4 3 3

Premium finance receivables 18 18 15 Indirect consumer loans (2) 2

2 4 Other loans 1 2 2 Total loans, net of unearned income 100% 100%

100% (1) Annualized (2) Includes autos, boats, snowmobiles and

other indirect consumer loans. DEPOSITS % Growth From From March

31, December 31, March 31, December 31, March 31, 2009 2008 2008

2008(1) 2008 (Dollars in thousands) Balance: -------- Non-interest

bearing $745,194 $757,844 $670,433 (7)% 11% NOW 1,064,663 1,040,105

1,013,603 10 5 Wealth Management deposits ((2)) 833,291 716,178

647,798 66 29 Money market 1,313,157 1,124,068 797,215 68 65

Savings 406,376 337,808 325,096 82 25 Time certificates of deposit

4,263,296 4,400,747 4,029,437 (13) 6 Total deposits $8,625,977

$8,376,750 $7,483,582 12% 15% Mix: ---- Non-interest bearing 9% 9%

9% NOW 12 12 13 Wealth Management deposits (2) 10 9 9 Money market

15 13 11 Savings 5 4 4 Time certificates of deposit 49 53 54 Total

deposits 100% 100% 100% (1) Annualized (2) Represents deposit

balances at the Company's subsidiary banks from brokerage customers

of Wayne Hummer Investments, trust and asset management customers

of Wayne Hummer Trust Company and brokerage customers from

unaffiliated companies which have been placed into deposit accounts

of the Banks. NET INTEREST INCOME The following table presents a

summary of Wintrust's average balances, net interest income and

related net interest margins, calculated on a fully tax-equivalent

basis, for the first quarter of 2009 compared to the first quarter

of 2008 (linked quarters): For the Three Months Ended For the Three

Months Ended March 31, 2009 March 31, 2008 (Dollars in Average

Interest Rate Average Interest Rate thousands) -----------

Liquidity management assets(1)(2)(7) $1,839,161 $15,499 3.42%

$1,391,400 $17,346 5.01% Other earning assets (2)(3)(7) 22,128 155

2.85 26,403 401 6.10 Loans, net of unearned income (2)(4)(7)

7,924,849 107,045 5.48 7,012,642 119,153 6.83 Total earning

assets(7) $9,786,138 $122,699 5.08% $8,430,44 $136,900 6.53%

Allowance for loan losses (72,044) (51,364) Cash and due from banks

107,550 124,745 Other assets 903,322 869,713 Total assets

$10,724,966 $9,373,539 Interest-bearing Deposits $7,747,879 $45,953

2.41% $6,747,980 $61,430 3.66% Federal Home Loan Bank Advances

435,982 4,453 4.14 426,911 4,556 4.29 Notes payable and other

borrowings 301,894 1,870 2.51 332,019 2,770 3.36 Subordinated Notes

70,000 580 3.31 75,000 1,087 5.73 Junior subordinated debentures

249,506 4,441 7.12 249,635 4,591 7.28 Total interest- bearing

liabilities $8,805,261 $57,297 2.64% $7,831,545 $74,434 3.82%

Non-interest bearing deposits 733,911 642,917 Other Liabilities

124,140 155,080 Equity 1,061,654 743,997 Total liabilities and

shareholders' equity $10,724,966 $9,373,539 Interest rate spread

(5)(7) 2.44% 2.71% Net free funds/ contribution(6) $980,877 0.27

$598,900 0.27 Net interest Income /Net interest margin (7) $65,402

2.71% $62,466 2.98% (1) Liquidity management assets include

available-for-sale securities, interest earning deposits with

banks, federal funds sold and securities purchased under resale

agreements. (2) Interest income on tax-advantaged loans, trading

account securities and securities reflects a tax-equivalent

adjustment based on a marginal federal corporate tax rate of 35%.

The total adjustments for the three months ended March 31, 2009 and

2008 were $620,000 and $724,000, respectively. (3) Other earning

assets include brokerage customer receivables and trading account

securities. (4) Loans, net of unearned income, include mortgages

held-for-sale and non-accrual loans. (5) Interest rate spread is

the difference between the yield earned on earning assets and the

rate paid on interest-bearing liabilities. (6) Net free funds are

the difference between total average earning assets and total

average interest-bearing liabilities. The estimated contribution to

net interest margin from net free funds is calculated using the

rate paid for total interest-bearing liabilities. (7) See

"Supplemental Financial Measures/Ratios" for additional information

on this performance measure/ratio. The following table presents a

summary of Wintrust's average balances, net interest income and

related net interest margins, calculated on a fully tax-equivalent

basis, for the first quarter of 2009 compared to the fourth quarter

of 2008 (sequential quarters): For the Three Months Ended For the

Three Months Ended March 31, 2009 December 31, 2008 (Dollars in

thousands) Average Interest Rate Average Interest Rate Liquidity

management assets (1)(2)(7) $1,839,161 $15,499 3.42% $1,607,707

$18,455 4.57% Other earning assets (2)(3)(7) 22,128 155 2.85 21,630

214 3.94 Loans, net of unearned income (2)(4)(7) 7,924,849 107,045

5.48 7,455,418 107,744 5.75 Total earning assets (7) $9,786,138

$122,699 5.08% $9,084,755 $126,413 5.54% Allowance for loan losses

(72,044) (67,342) Cash and due from banks 107,550 127,700 Other

assets 903,322 915,093 Total assets $10,724,966 $10,060,206

Interest- bearing deposits $7,747,879 $45,953 2.41% $7,271,505

$50,740 2.78% Federal Home Loan Bank advances 435,982 4,453 4.14

439,432 4,570 4.14 Notes payable and other borrowings 301,894 1,870

2.51 379,914 2,387 2.50 Subordinated notes 70,000 580 3.31 73,364

770 4.11 Junior subordinated debentures 249,506 4,441 7.12 249,520

4,606 7.22 Total interest- bearing liabilities $8,805,261 $57,297

2.64% $8,413,735 $63,073 2.98% Non-interest bearing deposits

733,911 705,616 Other liabilities 124,140 93,873 Equity 1,061,654

846,982 Total liabilities and shareholders' equity $10,724,966

$10,060,206 Interest rate spread (5)(7) 2.44% 2.56% Net free funds/

contribution (6) $980,877 0.27 $671,020 0.22 Net interest

income/Net interest margin (7) $65,402 2.71% $63,340 2.78% (1)

Liquidity management assets include available-for-sale securities,

interest earning deposits with banks, federal funds sold and

securities purchased under resale agreements. (2) Interest income

on tax-advantaged loans, trading account securities and securities

reflects a tax-equivalent adjustment based on a marginal federal

corporate tax rate of 35%. The total adjustments for the three

months ended March 31, 2009 was $620,000 and for the three months

ended December 31, 2008 was $594,000. (3) Other earning assets

include brokerage customer receivables and trading account

securities. (4) Loans, net of unearned income, include mortgages

held-for-sale and non-accrual loans. (5) Interest rate spread is

the difference between the yield earned on earning assets and the

rate paid on interest-bearing liabilities. (6) Net free funds are

the difference between total average earning assets and total

average interest-bearing liabilities. The estimated contribution to

net interest margin from net free funds is calculated using the

rate paid for total interest-bearing liabilities. (7) See

"Supplemental Financial Measures/Ratios" for additional information

on this performance measure/ratio. The higher level of net interest

income recorded in the first quarter of 2009 compared to the fourth

quarter of 2008 was attributable to increasing credit spreads on

new loan volumes and the ability to raise interest-bearing deposits

at more reasonable rates and strong earning asset growth. Average

earning asset growth of $701 million in the first quarter of 2009

compared to the fourth quarter of 2008 was comprised of $469

million of loan growth and $231 million of liquid management asset

growth. This growth was primarily funded by a $476 million increase

in the average balances of interest-bearing liabilities and an

increase in the average balance of net free funds of $310 million.

Management believes opportunities during 2009 for continuing to

increase credit spreads in the loan portfolio and favorable

repricing of maturing retail certificates of deposit should help

offset the effects of any additional interest rate spread

compression on variable rate retail deposits and the unprecedented

competitive retail deposit pricing given the current economic

conditions that have hindered net interest margin expansion.

NON-INTEREST INCOME For the first quarter of 2009, non-interest

income totaled $36.4 million, an increase of $11.9 million compared

to the first quarter of 2008. The increase was primarily

attributable to increases in mortgage banking revenue and trading

income. Offsetting these increases were lower levels of fees from

covered call options, lower wealth management revenue, lower gains

on sales of premium finance receivables and higher OTTI charges.

The following table presents non-interest income by category for

the periods presented: Three Months Ended March 31, (Dollars in $ %

thousands) 2009 2008 Change Change Brokerage $3,819 $5,038 (1,219)

(24) Trust and asset management 2,107 2,827 (720) (25) Total wealth

management 5,926 7,865 (1,939) (25) Mortgage banking 16,232 6,096

10,136 166 Service charges on deposit accounts 2,970 2,373 597 25

Gain on sales of premium finance receivables 322 1,141 (819) (72)

Losses on available-for-sale securities, net (2,038) (1,333) (705)

53 Other: Fees from covered call options 1,998 6,780 (4,782) (71)

Bank Owned Life Insurance 286 613 (327) (53) Trading income 8,744

33 8,711 NM Administrative services 482 713 (231) (32)

Miscellaneous 1,505 291 1,214 NM Total other 13,015 8,430 4,585 54

Total non-interest income $36,427 $24,572 11,855 48 NM = Not

Meaningful Wealth management is comprised of the trust and asset

management revenue of Wayne Hummer Trust Company and the asset

management fees, brokerage commissions, trading commissions and

insurance product commissions at Wayne Hummer Investments and Wayne

Hummer Asset Management Company. Wealth management totaled $5.9

million in the first quarter of 2009 and $7.9 million in the first

quarter of 2008. Decreased asset valuations due to the equity

market declines over the past 12 months have hindered the revenue

growth from trust and asset management activities. Continued

uncertainties surrounding the equity markets overall have slowed

the growth of the brokerage component of wealth management revenue.

Mortgage banking includes revenue from activities related to

originating, selling and servicing residential real estate loans

for the secondary market. For the quarter ended March 31, 2009,

this revenue source totaled $16.2 million, an increase of $10.1

million when compared to the first quarter of 2008. The increase

was primarily attributable to $12.5 million from gains recognized

on loans sold to the secondary market offset by $2.4 million from

changes in the fair market value of mortgage servicing rights,

valuation fluctuations of mortgage banking derivatives, fair value

accounting for certain residential mortgage loans held for sale and

increased recourse obligation for loans previously sold. Future

growth of mortgage banking is impacted by the interest rate

environment and current residential housing conditions and will

continue to be dependent upon both. Mortgages originated and sold

totaled over $1.2 billion in the first quarter of 2009 compared to

$263 million in the fourth quarter of 2008 and $427 million in the

first quarter of 2008. The positive impact of the PMP transaction,

completed at the end of 2008, contributed to mortgage banking in

the first quarter of 2009. Service charges on deposit accounts

totaled $3.0 million for the first quarter of 2009, an increase of

$597,000, or 25%, when compared to the same quarter of 2008. The

majority of deposit service charges relates to customary fees on

overdrawn accounts and returned items. The level of service charges

received is substantially below peer group levels, as management

believes in the philosophy of providing high quality service

without encumbering that service with numerous activity charges.

Wintrust did not sell any premium finance receivables in the first

quarter of 2009 but recognized $322,000 of gains in the first

quarter of 2009 on clean-up calls of previous sales. Wintrust sold

$115 million of premium finance receivables in the first quarter of

2008, recognizing $1.1 million of net gains. Sales of these

receivables in future quarters are dependent upon an improvement in

the market conditions impacting both sales of these loans and the

opportunity for securitizing these loans as well as liquidity and

capital management considerations. Wintrust recognized $2.0 million

of net losses on available-for-sale securities in the first quarter

of 2009 compared to net losses of $1.3 million in the first quarter

of 2008. In the first quarter of 2009, this amount included $2.1

million of OTTI charges on certain corporate debt investment

securities compared to $1.9 million of OTTI charges in the first

quarter of 2008. Other non-interest income for the first quarter of

2009 totaled $13.0 million compared to $8.4 million in the first

quarter of 2008. The largest component of the increase in other

income was an increase in trading income as the Company recognized

$8.1 million in trading income resulting from the increase in

market value of certain securities held as trading assets.

Miscellaneous income benefited comparatively in the current quarter

as the first quarter of 2008 included a $0.9 million OTTI charge on

certain investment partnerships. Offsetting these increases were

fees from certain covered call option transactions decreasing by

$4.8 million. Historically, compression in the net interest margin

was effectively offset, as has consistently been the case, by the

Company's covered call strategy. Management has been able to

effectively use the proceeds from selling covered call options to

offset net interest margin compression and administers such sales

in a coordinated process with the Company's overall asset/liability

management. The covered call option contracts are written against

certain U.S. Treasury and agency securities held in the Company's

portfolio for liquidity and other purposes. In the first quarter of

2009, higher than acceptable security pricing limited revenue from

the Company's covered call strategy. An illustration of the past

effectiveness of this strategy is shown in the Supplemental

Financial Information section (see page titled "Net Interest Margin

(Including Call Option Income)."). Other non-interest income for

the first quarter of 2009 totaled $13.0 million compared to $8.4

million in the first quarter of 2008. The largest component of the

increase in other income was an increase in trading income as the

Company recognized $8.1 million in trading income resulting from

the increase in market value of certain CMOs held as trading

assets. Miscellaneous income benefited comparatively in the current

quarter as the first quarter of 2008 included a $0.9 million OTTI

charge on certain investment partnerships. Offsetting these

increases were fees from certain covered call option transactions

decreasing by $4.8 million. Historically, compression in the net

interest margin was effectively offset, as has consistently been

the case, by the Company's covered call strategy. Management has

been able to effectively use the proceeds from selling covered call

options to offset net interest margin compression and administers

such sales in a coordinated process with the Company's overall

asset/liability management. The covered call option contracts are

written against certain U.S. Treasury and agency securities held in

the Company's portfolio for liquidity and other purposes. In the

first quarter of 2009, higher than acceptable security pricing

limited revenue from the Company's covered call strategy. An

illustration of the past effectiveness of this strategy is shown in

the Supplemental Financial Information section (see page titled

"Net Interest Margin (Including Call Option Income).").

NON-INTEREST EXPENSE Non-interest expense for the first quarter of

2009 totaled $77.0 million and increased approximately $14.1

million, or 22%, from the first quarter 2008 total of $62.8

million. The following table presents non-interest expense by

category for the periods presented: Three Months Ended March 31, $

% (Dollars in thousands) 2009 2008 Change Change Salaries and

employee benefits $44,820 $36,672 8,148 22 Equipment 3,938 3,926 12

- Occupancy, net 6,190 5,867 323 6 Data processing 3,136 2,798 338

12 Advertising and marketing 1,095 999 96 10 Professional fees

2,883 2,068 815 39 Amortization of other intangible assets 687 788

(101) (13) Other: Commissions - 3rd party brokers 704 985 (281)

(29) Postage 1,180 986 194 20 Stationery and supplies 768 742 26 4

FDIC insurance 3,013 1,286 1,727 134 OREO expenses, net 2,356 58

2,298 NM Miscellaneous 6,192 5,674 518 9 Total other 14,213 9,731

4,482 46 Total non-interest expense $76,962 $62,849 14,113 22 NM =

Not Meaningful Salaries and employee benefits comprised 58% of

total non-interest expense in the first quarter of 2009 and 2008.

Salaries and employee benefits expense increased $8.1 million, or

22%, in the first quarter of 2009 compared to the first quarter of

2008 primarily as a result of higher commission and incentive

compensation expenses related to mortgage banking activities and

the incremental costs of the PMP staff. The large increase in

salaries and employee benefits is attributable to an increase in

variable pay (commissions) of $4.7 million primarily as a result of

the higher mortgage loan origination volumes, $2.0 million of

increased base salary and employee benefits as a result of the PMP

acquisition and $1.4 million from seasonal base pay and employee

benefits increases. Professional fees include legal, audit and tax

fees, external loan review costs and normal regulatory exam

assessments. Professional fees for the first quarter of 2009 were

$2.9 million, an increase of $815,000, or 39%, compared to the same

period of 2008. These increases are primarily a result of increased

legal costs related to non-performing loans. FDIC insurance totaled

$3.0 million in the first quarter of 2009, an increase of $1.7

million, or 134%, compared to $1.3 million in the first quarter of

2008. The FDIC increased deposit insurance rates dramatically at

the beginning of 2009 in response to the current economic

conditions. Miscellaneous expense includes expenses such as ATM

expenses, net OREO expenses, correspondent bank charges, directors'

fees, telephone, travel and entertainment, corporate insurance,

dues and subscriptions and lending origination costs that are not

deferred. Miscellaneous expenses in the first quarter of 2009

increased $518,000, or 9%, compared to the same period in the prior

year with the largest component increase related to a $252,000

increase in net lending origination costs. ASSET QUALITY Allowance

for Credit Losses Three Months Ended March 31, (Dollars in

thousands) 2009 2008 Allowance for loan losses at beginning of

period $69,767 $50,389 Provision for credit losses 14,473 8,555

Charge-offs: ------------ Commercial and commercial real estate

loans 7,890 3,957 Home equity loans 511 - Residential real estate

loans 152 219 Premium finance receivables 1,351 883 Indirect

consumer loans 361 258 Consumer and other loans 121 94 Total

charge-offs 10,386 5,411 Recoveries: ----------- Commercial and

commercial real estate loans 208 40 Home equity loans 1 -

Residential real estate loans - - Premium finance receivables 141

128 Indirect consumer loans 29 45 Consumer and other loans 15 12

Total recoveries 394 225 Net charge-offs (9,992) (5,186) Allowance

for loan losses at period end $74,248 $53,758 Allowance for

lending-related commitments at period end $1,586 $493 Allowance for

credit losses at period end $75,834 $54,251 Annualized net

charge-offs by category as a percentage of its own respective

category's average: Commercial and commercial real estate loans

0.65% 0.35% Home equity loans 0.23 - Residential real estate loans

0.14 0.27 Premium finance receivables 0.35 0.27 Indirect consumer

loans 0.81 0.36 Consumer and other loans 0.27 0.16 Total loans, net

of unearned income 0.51% 0.30% Net charge-offs as a percentage of

the provision for loan losses 69.04% 60.62% Loans at period-end

$7,841,447 $6,874,916 Allowance for loan losses as a percentage of

loans at period-end 0.95% 0.78% Allowance for credit losses as a

percentage of loans at period-end 0.97% 0.79% The allowance for

credit losses is comprised of the allowance for loan losses and the

allowance for lending-related commitments. The allowance for loan

losses is a reserve against loan amounts that are actually funded

and outstanding while the allowance for lending-related commitments

relates to certain amounts that Wintrust is committed to lend but

for which funds have not yet been disbursed. The allowance for

lending-related commitments (separate liability account) represents

the portion of the provision for credit losses that was associated

with unfunded lending-related commitments. The provision for credit

losses may contain both a component related to funded loans

(provision for loan losses) and a component related to

lending-related commitments (provision for unfunded loan

commitments and letters of credit). Non-performing Loans The

following table sets forth Wintrust's non-performing loans at the

dates indicated. March 31, December 31, March 31, (Dollars in

thousands) 2009 2008 2008 Loans past due greater than 90 days and

still accruing: Residential real estate and home equity (1) $726

$617 $387 Commercial, consumer and other 4,958 14,750 8,557 Premium

finance receivables 9,722 9,339 8,133 Indirect consumer loans 1,076

679 635 Total past due greater than 90 days and still accruing

16,482 25,385 17,712 Non-accrual loans: Residential real estate and

home equity (1) 9,209 6,528 3,655 Commercial, consumer and other

136,397 91,814 51,233 Premium finance receivables 12,694 11,454

13,542 Indirect consumer loans 1,084 913 399 Total non-accrual

159,384 110,709 68,829 Total non-performing loans: Residential real

estate and home equity (1) 9,935 7,145 4,042 Commercial, consumer

and other 141,355 106,564 59,790 Premium finance receivables 22,416

20,793 21,675 Indirect consumer loans 2,160 1,592 1,034 Total

non-performing loans $175,866 $136,094 $86,541 Total non-performing

loans by category as a percent of its own respective category's

period-end balance: Residential real estate and home equity (1)

0.83% 0.62% 0.44% Commercial, consumer and other 2.79 2.16 1.27

Premium finance receivables 1.58 1.54 2.13 Indirect consumer loans

1.40 0.90 0.45 Total non-performing loans 2.24% 1.79% 1.26%

Allowance for loan losses as a percentage of non-performing loans

42.22% 51.26% 62.12% (1) Residential real estate and home equity

loans that are non-accrual and past due greater than 90 days and

still accruing do not include non- performing mortgage loans

held-for-sale. These balances totaled $0 as of March 31, 2009 and

December 31, 2008, respectively, and $2.1 million as of March 31,

2008. Mortgage loans held-for sale are carried at either fair value

or at the lower of cost or market applied on an aggregate basis by

loan type. Charges related to adjustments to record the loans at

fair value are recognized in mortgage banking revenue. The

provision for credit losses totaled $14.5 million for the first

quarter of 2009, $14.5 million in the fourth quarter of 2008 and

$8.6 million for the first quarter of 2008. For the quarter ended

March 31, 2009, net charge-offs totaled $10.0 million compared to

$9.9 million in the fourth quarter of 2008 and $5.2 million

recorded in the first quarter of 2008. On a ratio basis, annualized

net charge-offs as a percentage of average loans were 0.51% in the

first quarter of 2009, 0.53% in the fourth quarter of 2008, and

0.30% in the first quarter of 2008. Management believes the

allowance for loan losses is adequate to provide for inherent

losses in the portfolio. There can be no assurances however, that

future losses will not exceed the amounts provided for, thereby

affecting future results of operations. The amount of future

additions to the allowance for loan losses will be dependent upon

management's assessment of the adequacy of the allowance based on

its evaluation of economic conditions, changes in real estate

values, interest rates, the regulatory environment, the level of

past-due and non-performing loans, and other factors. The increase

from the end of the prior quarter reflects the continued economic

weaknesses in the Company's markets and is the result of an

individual review of a significant number of individual credits as

well as the overall risk factors impacting certain types of

credits, specifically credits with residential development

collateral valuation exposure. Non-performing Residential Real

Estate and Home Equity The non-performing residential real estate

and home equity loans totaled $9.9 million as of March 31, 2009.

The balance increased $5.9 million from March 31, 2008 and

increased $2.8 million from December 31, 2008. The March 31, 2009

non-performing balance is comprised of $4.9 million of residential

real estate (20 individual credits) and $5.0 million of home equity

loans (23 individual credits). On average, this is approximately

three non-performing residential real estate loans and home equity

loans per chartered bank within the Company. The Company believes

control and collection of these loans is very manageable. At this

time, management believes reserves are adequate to absorb inherent

losses that may occur upon the ultimate resolution of these

credits. Non-performing Commercial, Consumer and Other The

commercial, consumer and other non-performing loan category totaled

$141.4 million as of March 31, 2009 compared to $106.6 million as

of December 31, 2008 and $59.7 million as of March 31, 2008.

Management is pursuing the resolution of all credits in this

category. However, given the current state of the residential real

estate market, resolution of certain credits could span a lengthy

period of time until market conditions stabilize. At this time,

management believes reserves are adequate to absorb inherent losses

that may occur upon the ultimate resolution of these credits.

Non-performing Loan Composition The $151.3 million of

non-performing loans as of March 31, 2009 classified as residential

real estate and home equity, commercial, consumer, and other

consumer consists of $52.3 million of residential real estate

construction and land development related loans, $51.5 million of

commercial real estate construction and land development related

loans, $23.9 million of residential real estate and home equity

related loans, $15.1 million of commercial real estate related

loans, $6.5 million of commercial related loans and $2.0 million of

consumer related loans. Sixteen of these relationships exceed $2.5

million in outstanding balances, approximating $93.8 million in

total outstanding balances. At this time, management believes

reserves are adequate to absorb inherent losses that may occur upon

the ultimate resolution of these credits. Non-performing Premium

Finance Receivables The table below presents the level of

non-performing premium finance receivables as of March 31, 2009 and

2008, and the amount of net charge-offs for the quarters then

ended. (Dollars in thousands) March 31, 2009 March 31, 2008

Non-performing premium finance receivables $22,416 $21,675 - as a

percent of premium finance receivables outstanding 1.58% 2.13% Net

charge-offs of premium finance receivables $1,210 $755 - annualized

as a percent of average premium finance receivables 0.35% 0.27% As

noted below, fluctuations in this category may occur due to timing

and nature of account collections from insurance carriers. The

Company's underwriting standards, regardless of the condition of

the economy, have remained consistent. We anticipate that net

charge-offs and non-performing asset levels in the near term will

continue to be at levels that are within acceptable operating

ranges for this category of loans. Management is comfortable with

administering the collections at this level of non-performing

premium finance receivables. The ratio of non-performing premium

finance receivables fluctuates throughout the year due to the

nature and timing of canceled account collections from insurance

carriers. Due to the nature of collateral for premium finance

receivables it customarily takes 60-150 days to convert the

collateral into cash collections. Accordingly, the level of

non-performing premium finance receivables is not necessarily

indicative of the loss inherent in the portfolio. In the event of

default, Wintrust has the power to cancel the insurance policy and

collect the unearned portion of the premium from the insurance

carrier. In the event of cancellation, the cash returned in payment

of the unearned premium by the insurer should generally be

sufficient to cover the receivable balance, the interest and other

charges due. Due to notification requirements and processing time

by most insurance carriers, many receivables will become delinquent

beyond 90 days while the insurer is processing the return of the

unearned premium. Management continues to accrue interest until

maturity as the unearned premium is ordinarily sufficient to

pay-off the outstanding balance and contractual interest due.

Non-performing Indirect Consumer Loans Total non-performing

indirect consumer loans were $2.2 million at March 31, 2009,

compared to $1.6 million at December 31, 2008 and $1.0 million at

March 31, 2008. The ratio of these non-performing loans to total

indirect consumer loans was 1.40% at March 31, 2009 compared to

0.90% at December 31, 2008 and 0.45% at March 31, 2008. As noted in

the Allowance for Credit Losses table, net charge-offs as a percent

of total indirect consumer loans were 0.81% for the quarter ended

March 31, 2009 compared to 0.36% in the same period in 2008. At the

beginning of the third quarter of 2008, the Company ceased the

origination of indirect automobile loans. This niche business

served the Company well over the past 12 years in helping de-novo

banks quickly, and profitably, grow into their physical structures.

Competitive pricing pressures significantly reduced the long-term

potential profitably of this niche business. Given the current

economic environment and the retirement of the founder of this

niche business, exiting the origination of this business was deemed

to be in the best interest of the Company. The Company will

continue to service its existing portfolio during the duration of

the credits. Other Real Estate Owned The table below presents a

summary of other real estate owned as of March 31, 2009 and shows

the changes in the balance from December 31, 2008 for each property

type: Residential Residential Real Estate Commercial Total Real

Estate Development Real Estate Balance (Dollars in thousands $ # R

$ # R $ # R $ # R Balance at December 31, 2008 $6,907 12 12 $21,712

46 14 $3,953 7 4 $32,572 65 30 Transfers at fair value 2,800 1 1

17,583 8 4 1,137 1 1 21,520 10 6 Fair value adjustments (19) - -

207 - - (276) - - (88) - - Resolved (1,407) (6) (6) (11,080) (9)

(5) - - - (12,487) (15) (11) Balance at March 31, 2009 $8,281 7 7

28,422 45 13 4,814 8 5 41,517 60 25 Balance at March 31, 2008

$4,873 $ - balance # - number of properties R - number of

relationships WINTRUST SUBSIDIARIES AND LOCATIONS Wintrust is a

financial holding company whose common stock is traded on the

Nasdaq Stock Market (NASDAQ:WTFC). Its 15 community bank

subsidiaries are: Lake Forest Bank & Trust Company, Hinsdale

Bank & Trust Company, North Shore Community Bank & Trust

Company in Wilmette, Libertyville Bank & Trust Company,

Barrington Bank & Trust Company, Crystal Lake Bank & Trust

Company, Northbrook Bank & Trust Company, Advantage National

Bank in Elk Grove Village, Village Bank & Trust in Arlington

Heights, Beverly Bank & Trust Company in Chicago, Wheaton Bank

& Trust Company, State Bank of The Lakes in Antioch, Old Plank

Trail Community Bank, N.A. in New Lenox, St. Charles Bank &

Trust Company and Town Bank in Hartland, Wisconsin. The banks also

operate facilities in Illinois in Algonquin, Bloomingdale, Buffalo

Grove, Cary, Chicago, Clarendon Hills, Darien, Deerfield, Downers

Grove, Frankfort, Geneva, Glencoe, Glen Ellyn, Gurnee, Grayslake,

Highland Park, Highwood, Hoffman Estates, Island Lake, Lake Bluff,

Lake Villa, Lindenhurst, McHenry, Mokena, Mundelein, North Chicago,

Northfield, Palatine, Prospect Heights, Ravinia, Riverside,

Roselle, Sauganash, Skokie, Spring Grove, Vernon Hills, Wauconda,

Western Springs, Willowbrook and Winnetka, and in Delafield, Elm

Grove, Madison and Wales, Wisconsin. Additionally, the Company

operates various non-bank subsidiaries. First Insurance Funding

Corporation, one of the largest commercial insurance premium

finance companies operating in the United States, serves commercial

loan customers throughout the country. Tricom, Inc. of Milwaukee

provides high-yielding, short-term accounts receivable financing

and value-added out-sourced administrative services, such as data

processing of payrolls, billing and cash management services, to

temporary staffing service clients located throughout the United

States. Wintrust Mortgage Corporation (formerly known as

WestAmerica Mortgage Company) engages primarily in the origination

and purchase of residential mortgages for sale into the secondary

market through origination offices located throughout the United

States. Loans are also originated nationwide through relationships

with wholesale and correspondent offices. Wayne Hummer Investments,

LLC is a broker-dealer providing a full range of private client and

brokerage services to clients and correspondent banks located

primarily in the Midwest. Wayne Hummer Asset Management Company

provides money management services and advisory services to

individual accounts. Wayne Hummer Trust Company, a trust

subsidiary, allows Wintrust to service customers' trust and

investment needs at each banking location. Wintrust Information

Technology Services Company provides information technology

support, item capture and statement preparation services to the

Wintrust subsidiaries. FORWARD-LOOKING STATEMENTS This document

contains forward-looking statements within the meaning of federal

securities laws. Forward-looking information in this document can

be identified through the use of words such as "may," "will,"

"intend," "plan," "project," "expect," "anticipate," "should,"

"would," "believe," "estimate," "contemplate," "possible," and

"point." Forward-looking statements and information are not

historical facts, are premised on many factors, and represent only

management's expectations, estimates and projections regarding

future events. Similarly, these statements are not guarantees of

future performance and involve certain risks and uncertainties that

are difficult to predict, which may include, but are not limited

to, those listed below and the Risk Factors discussed in Item 1A on

page 20 of the Company's 2008 Form 10-K. The Company intends such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and is including this

statement for purposes of invoking these safe harbor provisions.

Such forward-looking statements may be deemed to include, among

other things, statements relating to the Company's projected

growth, anticipated improvements in earnings, earnings per share

and other financial performance measures, and management's

long-term performance goals, as well as statements relating to the

anticipated effects on financial results of condition from expected

developments or events, the Company's business and growth

strategies, including anticipated internal growth, plans to form

additional de novo banks and to open new branch offices, and to

pursue additional potential development or acquisitions of banks,

wealth management entities or specialty finance businesses. Actual

results could differ materially from those addressed in the

forward-looking statements as a result of numerous factors,

including the following: -- Competitive pressures in the financial

services business which may affect the pricing of the Company's

loan and deposit products as well as its services (including wealth

management services). -- Changes in the interest rate environment,

which may influence, among other things, the growth of loans and

deposits, the quality of the Company's loan portfolio, the pricing

of loans and deposits and net interest income. -- The extent of

defaults and losses on the Company's loan portfolio, which may

require further increases in its allowance for credit losses. --

Distressed global credit and capital markets. -- The ability of the

Company to obtain liquidity and income from the sale of premium

finance receivables in the future and the unique collection and

delinquency risks associated with such loans. -- Legislative or

regulatory changes, particularly changes in regulation of financial

services companies and/or the products and services offered by

financial services companies. -- Failure to identify and complete

acquisitions in the future or unexpected difficulties or

unanticipated developments related to the integration of acquired

entities with the Company. -- Significant litigation involving the

Company. -- Changes in general economic conditions in the markets

in which the Company operates. -- The ability of the Company to

receive dividends from its subsidiaries. -- Unexpected difficulties

or unanticipated developments related to the Company's strategy of

de novo bank formations and openings. De novo banks typically

require over 13 months of operations before becoming profitable,

due to the impact of organizational and overhead expenses, the

startup phase of generating deposits and the time lag typically

involved in redeploying deposits into attractively priced loans and

other higher yielding earning assets. -- The loss of customers as a

result of technological changes allowing consumers to complete

their financial transactions without the use of a bank. -- The

ability of the Company to attract and retain senior management

experienced in the banking and financial services industries. --

The risk that the terms of the U.S. Treasury Department's Capital

Purchase Program could change. -- The effect of continued margin

pressure on the Company's financial results. -- Additional

deterioration in asset quality. -- Additional charges related to

asset impairments. -- The other risk factors set forth in the

Company's filings with the Securities and Exchange Commission.

Therefore, there can be no assurances that future actual results

will correspond to these forward-looking statements. The reader is

cautioned not to place undue reliance on any forward-looking

statement made by or on behalf of Wintrust. Any such statement

speaks only as of the date the statement was made or as of such

date that may be referenced within the statement. The Company

undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after

the date of this press release. Persons are advised, however, to

consult further disclosures management makes on related subjects in

its reports filed with the Securities and Exchange Commission and

in its press releases. CONFERENCE CALL, WEB CAST AND REPLAY The

Company will hold a conference call at 1:00 p.m. (CDT) Wednesday,

April 29, 2009 regarding first quarter 2009 results. Individuals

interested in listening should call (877) 365-7575 and enter

Conference ID #95822026. A simultaneous audio-only web cast and

replay of the conference call may be accessed via the Company's web

site at (http://www.wintrust.com/), Investor News and Events,

Presentations & Conference Calls. The text of the first quarter

2009 earnings press release will be available on the Company's web

site at (http://www.wintrust.com/), Investor News and Events, Press

Releases. WINTRUST FINANCIAL CORPORATION - SUPPLEMENTAL FINANCIAL

INFORMATION Selected Financial Highlights - 5 Quarter Trends

(Dollars in thousands, except per share data) Selected Financial

Condition Data (at end of period): Three Months Ended March 31,

December 31, September 30, June 30, March 31, 2009 2008 2008 2008

2008 Total assets $10,818,941 $10,658,326 $9,864,920 $9,923,077

$9,732,466 Total loans 7,841,447 7,621,069 7,322,545 7,153,603

6,874,916 Total deposits 8,625,977 8,376,750 7,829,527 7,761,367

7,483,582 Junior subordinated debentures 249,502 249,515 249,537

249,579 249,621 Total shareholders' equity 1,063,227 1,066,572

809,331 749,025 753,293 Selected Statements of Income Data: Net

interest income $64,782 $62,745 $60,680 $59,400 $61,742 Net revenue

(1) 101,209 82,117 82,810 93,004 86,314 Income (loss) before taxes

9,774 2,727 (4,518) 17,522 14,910 Net income (loss) 6,358 1,955

(2,448) 11,276 9,705 Net income (loss) per common share - Basic

0.06 0.02 (0.13) 0.48 0.41 Net income (loss) per common share -

Diluted 0.06 0.02 (0.13) 0.47 0.40 Selected Financial Ratios and

Other Data: Performance Ratios: Net interest margin (2) 2.71% 2.78%

2.74% 2.77% 2.98% Non-interest income to average assets 1.38 0.77

0.89 1.40 1.05 Non-interest expense to average assets 2.91 2.57

2.54 2.71 2.70 Net overhead ratio (3) 1.53 1.80 1.65 1.31 1.64

Efficiency ratio (2)(4) 74.10 75.22 76.64 69.54 71.12 Return on

average assets 0.24 0.08 (0.10) 0.47 0.42 Return on average equity

0.71 0.22 (1.59) 5.97 5.25 Average total assets $10,724,966

$10,060,206 $9,881,554 $9,682,454 9,373,539 Average total

shareholders' equity 1,061,654 846,982 765,892 760,253 743,997

Average loans to average deposits ratio 93.4% 93.5% 94.1% 94.6%

94.9% Common Share Data at end of period: Market price per common

share $12.30 $20.57 $29.35 $23.85 $34.95 Book value per common

share $32.64 $33.03 $32.07 $31.70 $31.97 Common shares outstanding

23,910,983 23,756,674 23,693,799 23,625,841 23,563,958 Other Data

at end of period: Allowance for credit losses (5) $75,834 $71,352

$66,820 $58,126 $54,251 Non-performing loans $175,866 $136,094

$113,041 $86,806 $86,541 Allowance for credit losses to total loans

(5) 0.97% 0.94% 0.91% 0.81% 0.79% Non-performing loans to total

loans 2.24% 1.79% 1.54% 1.21% 1.26% Number of: Bank subsidiaries 15

15 15 15 15 Non-bank subsidiaries 7 7 8 8 8 Banking offices 79 79

79 79 78 (1) Net revenue includes net interest income and

non-interest income. (2) See "Supplemental Financial

Measures/Ratios" for additional information on this performance

measure/ratio. (3) The net overhead ratio is calculated by netting

total non-interest expense and total non-interest income,

annualizing this amount, and dividing by that period's total

average assets. A lower ratio indicates a higher degree of

efficiency. (4) The efficiency ratio is calculated by dividing

total non-interest expense by tax-equivalent net revenue (less

securities gains or losses). A lower ratio indicates more efficient

revenue generation. (5) The allowance for credit losses includes

both the allowance for loan losses and the allowance for

lending-related commitments. WINTRUST FINANCIAL CORPORATION -

SUPPLEMENTAL FINANCIAL INFORMATION Consolidated Statements of

Condition - 5 Quarter Trends (Unaudited)

(Unaudited)(Unaudited)(Unaudited) March 31, December 31, September

30, June 30, March 31, (In thousands) 2009 2008 2008 2008 2008

Assets Cash and due from banks $122,207 $219,794 $158,201 $166,857

$160,890 Federal funds sold and securities purchased under resale

agreements 98,454 226,110 35,181 73,311 280,408 Interest- bearing

deposits with banks 266,512 123,009 4,686 6,438 11,280 Available-

for-sale securities, at fair value 1,413,576 784,673 1,469,500

1,590,648 1,110,854 Trading account securities 13,815 4,399 2,243

1,877 1,185 Brokerage customer receivables 15,850 17,901 19,436

19,661 22,786 Mortgage loans held-for-sale 218,707 61,116 68,398

118,379 102,324 Loans, net of unearned income 7,841,447 7,621,069

7,322,545 7,153,603 6,874,916 Less: Allowance for loan losses

74,248 69,767 66,327 57,633 53,758 Net loans 7,767,199 7,551,302

7,256,218 7,095,970 6,821,158 Premises and equipment, net 349,245

349,875 349,388 348,881 344,863 Accrued interest receivable and

other assets 263,145 240,664 209,970 208,574 188,607 Trade date

securities receivable - 788,565 - - 395,041 Goodwill 276,310

276,310 276,310 276,311 276,121 Other intangible assets 13,921

14,608 15,389 16,170 16,949 Total assets $10,818,941 $10,658,326

$9,864,920 $9,923,077 $9,732,466 Liabilities and Shareholders'

Equity Deposits: Non-interest bearing $745,194 $757,844 $717,587

$688,512 $670,433 Interest bearing 7,880,783 7,618,906 7,111,940

7,072,855 6,813,149 Total deposits 8,625,977 8,376,750 7,829,527

7,761,367 7,483,582 Notes payable 1,000 1,000 42,025 41,975 70,300

Federal Home Loan Bank advances 435,981 435,981 438,983 438,983

434,482 Other borrowings 250,488 336,764 296,391 383,009 293,091

Subordinated notes 70,000 70,000 75,000 75,000 75,000 Junior

subordinated debentures 249,502 249,515 249,537 249,579 249,621

Trade date securities payable 7,170 - 2,000 97,898 236,217 Accrued

interest payable and other liabilities 115,596 121,744 122,126

126,241 136,880 Total liabilities 9,755,714 9,591,754 9,055,589

9,174,052 8,979,173 Shareholders' equity: Preferred stock 282,662

281,873 49,379 - - Common stock 26,766 26,611 26,548 26,478 26,416

Surplus 575,166 571,887 551,453 547,792 544,594 Treasury stock

(122,302) (122,290) (122,290) (122,258) (122,252) Retained earnings

315,855 318,793 318,066 325,314 314,038 Accumulated other

comprehensive loss (14,920) (10,302) (13,825) (28,301) (9,503)

Total shareholders' equity 1,063,227 1,066,572 809,331 749,025

753,293 Total liabilities and shareholders' equity $10,818,941