Wayne Hummer Asset Management Continues to Attract Wall Street Talent

February 02 2009 - 11:10AM

PR Newswire (US)

Melissa R. Brown, CFA Joins as Head of Institutional Division;

Steven M. Bohn Joins as Head of Financial Services Division LAKE

FOREST, Ill., Feb. 2 /PRNewswire-FirstCall/ -- Wayne Hummer Asset

Management Company, a subsidiary of Wintrust Financial Corporation

(NASDAQ: WTFC) announced the appointment of Melissa R. Brown, CFA

as Managing Director, Chief Investment Strategist and Head of the

newly formed Institutional Clients Division. Ms. Brown will

spearhead the firm's expansion into institutional asset management,

primarily focused on the consultant marketplace nationally, and

expects to assume her post at the end of February. Steven M. Bohn

has been appointed Managing Director and Head of the Financial

Services Division, effective immediately. Mr. Bohn will lead

distribution efforts targeted at registered investment advisors and

third party platforms. Ms. Brown joins Wayne Hummer from Goldman

Sachs Asset Management and brings tremendous expertise in the

institutional arena with both sell- and buy-side perspective. Most

recently, she served as a senior partner co-heading the Client

Portfolio Management function in the Quantitative Investment

Strategies Group. Her experience at Goldman Sachs also includes

serving as Senior U.S. Portfolio Manager and as Head of Product

Strategy for the Global Quantitative Equities Group. In addition,

Ms. Brown served as a widely respected sell-side analyst for 15

years with Prudential Securities as director of Quantitative Equity

Research, and regularly appeared on Institutional Investor's annual

"All-Star" list. Ms. Brown holds a B.S. in Economics from the

University of Pennsylvania's Wharton School and a M.B.A in Finance

from New York University. Mr. Bohn brings over 23 years of

investment experience in sales and product development with both

bulge bracket and boutique investment firms. His career includes

serving as Managing Director for Lyster Watson & Company,

Senior Vice President for Lazard Asset Management, and Director and

Senior Vice President for Merrill Lynch Business Financial

Services. He has extensive expertise in both product development

and asset management distribution strategies through third party

platforms and the institutional marketplace. Mr. Bohn received his

B.S. in Economics from Northern Illinois University. "Melissa and

Steve are key strategic additions to our team," says Dan Cardell,

President and Chief Investment Officer of Wayne Hummer Asset

Management Company. "Their arrival allows us to move forward with a

comprehensive segment-based approach to the market and puts the

necessary distribution capabilities in place to support future

product development and product-focused acquisitions." Ms. Brown

added, "I see Wayne Hummer on a strong upward trajectory. Joining a

team that is committed to building a world-class asset management

organization, has an entrepreneurial culture, and shares my

investment philosophy is very attractive. I look forward to the

opportunity to help build a business once again." ABOUT WAYNE

HUMMER WEALTH MANAGEMENT Wayne Hummer Wealth Management provides a

comprehensive suite of wealth management services and oversees

nearly $6 billion in client assets. Since 1931, Wayne Hummer

Investments has been providing a full-range of investment products

and services tailored to meet the specific needs of individual

investors throughout the country. Wayne Hummer Asset Management

Company is the investment advisory affiliate of Wayne Hummer

Investments. Wayne Hummer Asset Management Company manages assets

for private clients, public and corporate pensions, Taft-Hartley

funds, as well as portfolios for Wayne Hummer Trust Company. Wayne

Hummer Trust Company provides trust and investment products and

services to individuals and businesses in Wintrust community bank

markets. WINTRUST SUBSIDIARIES AND LOCATIONS Wintrust is a

financial holding company whose common stock is traded on the

Nasdaq Stock Market (NASDAQ:WTFC). Its 15 community bank

subsidiaries are: Lake Forest Bank & Trust Company, Hinsdale

Bank & Trust Company, North Shore Community Bank & Trust

Company in Wilmette, Libertyville Bank & Trust Company,

Barrington Bank & Trust Company, Crystal Lake Bank & Trust

Company, Northbrook Bank & Trust Company, Advantage National

Bank in Elk Grove Village, Village Bank & Trust in Arlington

Heights, Beverly Bank & Trust Company in Chicago, Wheaton Bank

& Trust Company, State Bank of The Lakes in Antioch, Old Plank

Trail Community Bank, N.A. in New Lenox, St. Charles Bank &

Trust Company and Town Bank in Hartland, Wisconsin. The banks also

operate facilities in Illinois in Algonquin, Bloomingdale, Buffalo

Grove, Cary, Chicago, Clarendon Hills, Darien, Deerfield, Downers

Grove, Frankfort, Geneva, Glencoe, Glen Ellyn, Gurnee, Grayslake,

Highland Park, Highwood, Hoffman Estates, Island Lake, Lake Bluff,

Lake Villa, Lindenhurst, McHenry, Mokena, Mundelein, North Chicago,

Northfield, Palatine, Prospect Heights, Ravinia, Riverside,

Roselle, Sauganash, Skokie, Spring Grove, Vernon Hills, Wauconda,

Western Springs, Willowbrook and Winnetka, and in Delafield, Elm

Grove, Madison and Wales, Wisconsin. Additionally, the Company

operates various non-bank subsidiaries. First Insurance Funding

Corporation, one of the largest commercial insurance premium

finance companies operating in the United States, serves commercial

loan customers throughout the country. Tricom, Inc. of Milwaukee

provides high-yielding, short-term accounts receivable financing

and value-added out-sourced administrative services, such as data

processing of payrolls, billing and cash management services, to

temporary staffing service clients located throughout the United

States. Wintrust Mortgage Corporation (formerly known as

WestAmerica Mortgage Company) engages primarily in the origination

and purchase of residential mortgages for sale into the secondary

market through origination offices located throughout the United

States. Loans are also originated nationwide through relationships

with wholesale and correspondent offices. Wayne Hummer Investments,

LLC is a broker-dealer providing a full range of private client and

brokerage services to clients and correspondent banks located

primarily in the Midwest. Wayne Hummer Asset Management Company

provides money management services and advisory services to

individual accounts. Wayne Hummer Trust Company, a trust

subsidiary, allows Wintrust to service customers' trust and

investment needs at each banking location. Wintrust Information

Technology Services Company provides information technology

support, item capture and statement preparation services to the

Wintrust subsidiaries. FORWARD-LOOKING STATEMENTS This document

contains forward-looking statements within the meaning of federal

securities laws. Forward-looking information in this document can

be identified through the use of words such as "may," "will,"

"intend," "plan," "project," "expect," "anticipate," "should,"

"would," "believe," "estimate," "contemplate," "possible," and

"point." The forward-looking information is premised on many

factors, some of which are outlined below. The Company intends such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and is including this

statement for purposes of invoking these safe harbor provisions.

Such forward-looking statements may be deemed to include, among

other things, statements relating to the Company's projected

growth, anticipated improvements in earnings, earnings per share

and other financial performance measures, and management's

long-term performance goals, as well as statements relating to the

anticipated effects on financial results of condition from expected

developments or events, the Company's business and growth

strategies, including anticipated internal growth, plans to form

additional de novo banks and to open new branch offices, and to

pursue additional potential development or acquisitions of banks,

wealth management entities or specialty finance businesses. Actual

results could differ materially from those addressed in the

forward-looking statements as a result of numerous factors,

including the following: -- Competitive pressures in the financial

services business which may affect the pricing of the Company's

loan and deposit products as well as its services (including wealth

management services). -- Changes in the interest rate environment,

which may influence, among other things, the growth of loans and

deposits, the quality of the Company's loan portfolio, the pricing

of loans and deposits and interest income. -- The extent of

defaults and losses on our loan portfolio. -- Unexpected

difficulties or unanticipated developments related to the Company's

strategy of de novo bank formations and openings. De novo banks

typically require 13 to 24 months of operations before becoming

profitable, due to the impact of organizational and overhead

expenses, the startup phase of generating deposits and the time lag

typically involved in redeploying deposits into attractively priced

loans and other higher yielding earning assets. -- The ability of

the Company to obtain liquidity and income from the sale of premium

finance receivables in the future and the unique collection and

delinquency risks associated with such loans. -- Failure to

identify and complete acquisitions in the future or unexpected

difficulties or unanticipated developments related to the

integration of acquired entities with the Company. -- Legislative

or regulatory changes or actions, or significant litigation

involving the Company. -- Changes in general economic conditions in

the markets in which the Company operates. -- The ability of the

Company to receive dividends from its subsidiaries. -- The loss of

customers as a result of technological changes allowing consumers

to complete their financial transactions without the use of a bank.

-- The ability of the Company to attract and retain senior

management experienced in the banking and financial services

industries. -- The risk that the terms of the U.S. Treasury

Department's Capital Purchase Program could change. -- Distressed

global credit and capital markets; -- Changes in market interest

rates and loan and deposit pricing in the Company's markets; -- The

effect of continued margin pressure on the Company's financial

results; -- Additional deterioration in asset quality; -- The

possible need for further increases in our allowance for credit

losses; -- Additional charges related to asset impairments; --

Legislative or regulatory changes, particularly changes in the

regulation of financial services companies and/or the products and

services offered by financial services companies; -- The other risk

factors set forth in the Company's filings with the Securities and

Exchange Commission. DATASOURCE: Wintrust Financial Corporation

CONTACT: Tom Zidar, Chairman & Chief Executive Officer,

+1-312-431-6593, or Dan Cardell, President and Chief Investment

Officer, +1-312-431-6559, both of Wayne Hummer Asset Management Web

Site: http://www.wintrust.com/

Copyright

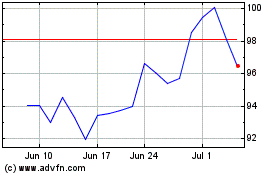

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

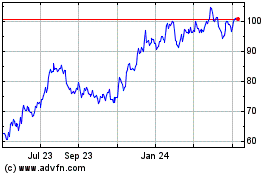

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024