Wintrust Mortgage Corporation Acquires Mortgage Banking Assets of Professional Mortgage Partners

December 23 2008 - 9:00AM

PR Newswire (US)

LAKE FOREST, Ill., Dec. 23 /PRNewswire-FirstCall/ -- Wintrust

Financial Corporation ("Wintrust" or "the Company") (NASDAQ:WTFC)

announced the acquisition of certain assets and the assumption of

certain liabilities of the mortgage banking business of

Professional Mortgage Partners ("PMP") of Downers Grove, Illinois.

Founded in 1999 by President Barton Pitts and six other investors,

PMP built its business into a reputable mortgage banking operation

with 180 employees comprised of ten retail mortgage offices with

nearly $1.6 billion in annual mortgage originations in 2008. "The

staff hired from PMP and their offices which we assumed are a

perfect compliment to our Wintrust Mortgage Corporation

operations," said Edward J. Wehmer, President & CEO of

Wintrust. "Barton and his team bring a wealth of experience and

professionalism to the organization and their retail offices give

us expanded coverage across the greater Chicago metropolitan area."

"The addition of the staff hired from PMP and their offices will

create one of the strongest mortgage lenders in the Chicago area,"

stated David Hrobon, President of Wintrust Mortgage Corporation

(formerly known as WestAmerica Mortgage Company). "Combined we will

have more than 500 employees, 27 retail offices and, based on

historical results, almost $3 billion in annual mortgage

originations." "Joining Wintrust just made sense for us," observed

Pitts. "Their community focus, financial strength and commitment to

the customer fit perfectly with our philosophy at PMP. Teaming up

with Wintrust will allow us to continue to do what we do best, but

now with a $10 billion asset financial services holding company

behind us. "Barton Pitts will assume the role of Executive Vice

President for Wintrust Mortgage Corporation. Terms of the

Transaction The terms of this cash transaction are not being

disclosed by the parties; however, a significant portion of the

purchase price for the PMP assets is conditioned upon certain

future profitability measures. The transaction is not expected to

have a material effect on Wintrust's 2008 or 2009 earnings per

share. WINTRUST SUBSIDIARIES AND LOCATIONS Wintrust is a financial

holding company whose common stock is traded on the Nasdaq Stock

Market(R) (NASDAQ:WTFC). Its 15 community bank subsidiaries are:

Lake Forest Bank & Trust Company, Hinsdale Bank & Trust

Company, North Shore Community Bank & Trust Company in

Wilmette, Libertyville Bank & Trust Company, Barrington Bank

& Trust Company, Crystal Lake Bank & Trust Company,

Northbrook Bank & Trust Company, Advantage National Bank in Elk

Grove Village, Village Bank & Trust in Arlington Heights,

Beverly Bank & Trust Company in Chicago, Wheaton Bank &

Trust Company, State Bank of The Lakes in Antioch, Old Plank Trail

Community Bank, N.A. in New Lenox, St. Charles Bank & Trust

Company and Town Bank in Hartland, Wisconsin. The banks also

operate facilities in Illinois in Algonquin, Bloomingdale, Buffalo

Grove, Cary, Chicago, Clarendon Hills, Darien, Deerfield, Downers

Grove, Frankfort, Geneva, Glencoe, Glen Ellyn, Gurnee, Grayslake,

Highland Park, Highwood, Hoffman Estates, Island Lake, Lake Bluff,

Lake Villa, Lindenhurst, McHenry, Mokena, Mundelein, North Chicago,

Northfield, Palatine, Prospect Heights, Ravinia, Riverside,

Roselle, Sauganash, Skokie, Spring Grove, Vernon Hills, Wauconda,

Western Springs, Willowbrook and Winnetka, and in Delafield, Elm

Grove, Madison and Wales, Wisconsin. Additionally, the Company

operates various non-bank subsidiaries. First Insurance Funding

Corporation, one of the largest commercial insurance premium

finance companies operating in the United States, serves commercial

loan customers throughout the country. Tricom, Inc. of Milwaukee

provides high-yielding, short-term accounts receivable financing

and value-added out-sourced administrative services, such as data

processing of payrolls, billing and cash management services, to

temporary staffing service clients located throughout the United

States. Wintrust Mortgage Corporation engages primarily in the

origination and purchase of residential mortgages for sale into the

secondary market through origination offices located throughout the

United States. Loans are also originated nationwide through

relationships with wholesale and correspondent offices. Wayne

Hummer Investments, LLC is a broker-dealer providing a full range

of private client and brokerage services to clients and

correspondent banks located primarily in the Midwest. Wayne Hummer

Asset Management Company provides money management services and

advisory services to individual accounts. Wayne Hummer Trust

Company, a trust subsidiary, allows Wintrust to service customers'

trust and investment needs at each banking location. Wintrust

Information Technology Services Company provides information

technology support, item capture and statement preparation services

to the Wintrust subsidiaries. FORWARD-LOOKING STATEMENTS This

document contains forward-looking statements within the meaning of

federal securities laws. Forward-looking information in this

document can be identified through the use of words such as "may,"

"will," "intend," "plan," "project," "expect," "anticipate,"

"should," "would," "believe," "estimate," "contemplate,"

"possible," and "point." The forward-looking information is

premised on many factors, some of which are outlined below. The

Company intends such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in the Private Securities Litigation Reform Act of 1995, and is

including this statement for purposes of invoking these safe harbor

provisions. Such forward-looking statements may be deemed to

include, among other things, statements relating to the Company's

projected growth, anticipated improvements in earnings, earnings

per share and other financial performance measures, and

management's long-term performance goals, as well as statements

relating to the anticipated effects on financial results of

condition from expected developments or events, the Company's

business and growth strategies, including anticipated internal

growth, plans to form additional de novo banks and to open new

branch offices, and to pursue additional potential development or

acquisitions of banks, wealth management entities or specialty

finance businesses. Actual results could differ materially from

those addressed in the forward-looking statements as a result of

numerous factors, including the following: -- Competitive pressures

in the financial services business which may affect the pricing of

the Company's loan and deposit products as well as its services

(including wealth management services). -- Changes in the interest

rate environment, which may influence, among other things, the

growth of loans and deposits, the quality of the Company's loan

portfolio, the pricing of loans and deposits and interest income.

-- The extent of defaults and losses on our loan portfolio. --

Unexpected difficulties or unanticipated developments related to

the Company's strategy of de novo bank formations and openings. De

novo banks typically require 13 to 24 months of operations before

becoming profitable, due to the impact of organizational and

overhead expenses, the startup phase of generating deposits and the

time lag typically involved in redeploying deposits into

attractively priced loans and other higher yielding earning assets.

-- The ability of the Company to obtain liquidity and income from

the sale of premium finance receivables in the future and the

unique collection and delinquency risks associated with such loans.

-- Failure to identify and complete acquisitions in the future or

unexpected difficulties or unanticipated developments related to

the integration of acquired entities with the Company. --

Legislative or regulatory changes or actions, or significant

litigation involving the Company. -- Changes in general economic

conditions in the markets in which the Company operates. -- The

ability of the Company to receive dividends from its subsidiaries.

-- The loss of customers as a result of technological changes

allowing consumers to complete their financial transactions without

the use of a bank. -- The ability of the Company to attract and

retain senior management experienced in the banking and financial

services industries. -- The risk that the terms of the U.S.

Treasury Department's Capital Purchase Program could change. -- The

other risk factors set forth in the Company's filings with the

Securities and Exchange Commission. Therefore, there can be no

assurances that future actual results will correspond to these

forward-looking statements. The reader is cautioned not to place

undue reliance on any forward looking statement made by or on

behalf of Wintrust. Any such statement speaks only as of the date

the statement was made or as of such date that may be referenced

within the statement. The Company undertakes no obligation to

release revisions to these forward-looking statements or reflect

events or circumstances after the date of this press release.

Persons are advised, however, to consult further disclosures

management makes on related subjects in its reports filed with the

Securities and Exchange Commission and in its press releases.

DATASOURCE: Wintrust Financial Corporation CONTACT: Edward J.

Wehmer, President & Chief Executive Officer, or David A.

Dykstra, Senior Executive Vice President & Chief Operating

Officer, +1-847-615-4096, both of Wintrust Financial Corporation

Web site: http://www.wintrust.com/

Copyright

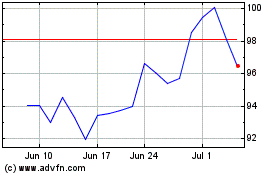

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

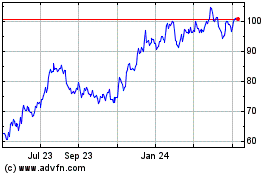

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024