Wintrust Financial Corporation Receives Proceeds From $250 Million Investment by U.S. Treasury

December 19 2008 - 4:01PM

PR Newswire (US)

LAKE FOREST, Ill., Dec. 19 /PRNewswire-FirstCall/ -- Wintrust

Financial Corporation ("Wintrust" or "the Company") (NASDAQ:WTFC)

announced today it has received the proceeds from the $250 million

investment in Wintrust by the U.S. Treasury Department. The

investment was made as part of the U.S. Treasury Department's

Capital Purchase Program, which is designed to infuse capital into

the nation's healthy banks in order to expand the flow of credit to

U.S. consumers and businesses on competitive terms to promote the

sustained growth and vitality of the U.S. economy. Edward J.

Wehmer, President and Chief Executive Officer, stated, "In August,

2008, Wintrust completed a successful convertible preferred stock

offering raising $50 million in new equity to augment its capital

ratios that were already all above the level required to be

categorized as "well capitalized". With this additional capital

from the Capital Purchase Program, our capital position is even

stronger, and provides an excellent opportunity for our

organization to more quickly return to our strategic growth plan.

We look forward to using the proceeds from this sale for general

corporate purposes which include additional capital to grow lending

operations and to position Wintrust for additional market

opportunities." The investment by the U.S. Treasury Department is

comprised of $250 million in senior preferred shares, with warrants

to purchase 1,643,295 shares of Wintrust common stock at a per

share exercise price of $22.82 and a term of 10 years. The senior

preferred stock will pay a cumulative dividend at a coupon rate of

5% for the first five years and 9% thereafter. This investment can,

with the approval of the Federal Reserve, be redeemed in the first

three years with the proceeds from the issuance of certain

qualifying Tier 1 capital or after three years at par value plus

accrued and unpaid dividends. The Company's recently filed

universal shelf registration statement will fulfill the requirement

of the Capital Purchase Program that Treasury be able to publicly

sell the preferred shares and warrants it purchased from Wintrust.

WINTRUST SUBSIDIARIES AND LOCATIONS Wintrust is a financial holding

company whose common stock is traded on the Nasdaq Stock Market(R)

(NASDAQ:WTFC). Its 15 community bank subsidiaries are: Lake Forest

Bank & Trust Company, Hinsdale Bank & Trust Company, North

Shore Community Bank & Trust Company in Wilmette, Libertyville

Bank & Trust Company, Barrington Bank & Trust Company,

Crystal Lake Bank & Trust Company, Northbrook Bank & Trust

Company, Advantage National Bank in Elk Grove Village, Village Bank

& Trust in Arlington Heights, Beverly Bank & Trust Company

in Chicago, Wheaton Bank & Trust Company, State Bank of The

Lakes in Antioch, Old Plank Trail Community Bank, N.A. in New

Lenox, St. Charles Bank & Trust Company and Town Bank in

Hartland, Wisconsin. The banks also operate facilities in Illinois

in Algonquin, Bloomingdale, Buffalo Grove, Cary, Chicago, Clarendon

Hills, Darien, Deerfield, Downers Grove, Frankfort, Geneva,

Glencoe, Glen Ellyn, Gurnee, Grayslake, Highland Park, Highwood,

Hoffman Estates, Island Lake, Lake Bluff, Lake Villa, Lindenhurst,

McHenry, Mokena, Mundelein, North Chicago, Northfield, Palatine,

Prospect Heights, Ravinia, Riverside, Roselle, Sauganash, Skokie,

Spring Grove, Vernon Hills, Wauconda, Western Springs, Willowbrook

and Winnetka, and in Delafield, Elm Grove, Madison and Wales,

Wisconsin. Additionally, the Company operates various non-bank

subsidiaries. First Insurance Funding Corporation, one of the

largest commercial insurance premium finance companies operating in

the United States, serves commercial loan customers throughout the

country. Tricom, Inc. of Milwaukee provides high- yielding,

short-term accounts receivable financing and value-added

out-sourced administrative services, such as data processing of

payrolls, billing and cash management services, to temporary

staffing service clients located throughout the United States.

Wintrust Mortgage Corporation engages primarily in the origination

and purchase of residential mortgages for sale into the secondary

market through origination offices located throughout the United

States. Loans are also originated nationwide through relationships

with wholesale and correspondent offices. Wayne Hummer Investments,

LLC is a broker-dealer providing a full range of private client and

brokerage services to clients and correspondent banks located

primarily in the Midwest. Wayne Hummer Asset Management Company

provides money management services and advisory services to

individual accounts. Wayne Hummer Trust Company, a trust

subsidiary, allows Wintrust to service customers' trust and

investment needs at each banking location. Wintrust Information

Technology Services Company provides information technology

support, item capture and statement preparation services to the

Wintrust subsidiaries. FORWARD-LOOKING STATEMENTS This document

contains forward-looking statements within the meaning of federal

securities laws. Forward-looking information in this document can

be identified through the use of words such as "may," "will,"

"intend," "plan," "project," "expect," "anticipate," "should,"

"would," "believe," "estimate," "contemplate," "possible," and

"point." The forward-looking information is premised on many

factors, some of which are outlined below. The Company intends such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and is including this

statement for purposes of invoking these safe harbor provisions.

Such forward-looking statements may be deemed to include, among

other things, statements relating to the Company's projected

growth, anticipated improvements in earnings, earnings per share

and other financial performance measures, and management's

long-term performance goals, as well as statements relating to the

anticipated effects on financial results of condition from expected

developments or events, the Company's business and growth

strategies, including anticipated internal growth, plans to form

additional de novo banks and to open new branch offices, and to

pursue additional potential development or acquisitions of banks,

wealth management entities or specialty finance businesses. Actual

results could differ materially from those addressed in the

forward-looking statements as a result of numerous factors,

including the following: -- Competitive pressures in the financial

services business which may affect the pricing of the Company's

loan and deposit products as well as its services (including wealth

management services). -- Changes in the interest rate environment,

which may influence, among other things, the growth of loans and

deposits, the quality of the Company's loan portfolio, the pricing

of loans and deposits and interest income. -- The extent of

defaults and losses on our loan portfolio. -- Unexpected

difficulties or unanticipated developments related to the Company's

strategy of de novo bank formations and openings. De novo banks

typically require 13 to 24 months of operations before becoming

profitable, due to the impact of organizational and overhead

expenses, the startup phase of generating deposits and the time lag

typically involved in redeploying deposits into attractively priced

loans and other higher yielding earning assets. -- The ability of

the Company to obtain liquidity and income from the sale of premium

finance receivables in the future and the unique collection and

delinquency risks associated with such loans. -- Failure to

identify and complete acquisitions in the future or unexpected

difficulties or unanticipated developments related to the

integration of acquired entities with the Company. -- Legislative

or regulatory changes or actions, or significant litigation

involving the Company. -- Changes in general economic conditions in

the markets in which the Company operates. -- The ability of the

Company to receive dividends from its subsidiaries. -- The loss of

customers as a result of technological changes allowing consumers

to complete their financial transactions without the use of a bank.

-- The ability of the Company to attract and retain senior

management experienced in the banking and financial services

industries. -- The risk that the terms of the U.S. Treasury

Department's Capital Purchase Program could change. -- The other

risk factors set forth in the Company's filings with the Securities

and Exchange Commission. Therefore, there can be no assurances that

future actual results will correspond to these forward-looking

statements. The reader is cautioned not to place undue reliance on

any forward looking statement made by or on behalf of Wintrust. Any

such statement speaks only as of the date the statement was made or

as of such date that may be referenced within the statement. The

Company undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after

the date of this press release. Persons are advised, however, to

consult further disclosures management makes on related subjects in

its reports filed with the Securities and Exchange Commission and

in its press releases. DATASOURCE: Wintrust Financial Corporation

CONTACT: Edward J. Wehmer, President & Chief Executive Officer,

or David A. Dykstra, Senior Executive Vice President & Chief

Operating Officer, both of Wintrust Financial Corporation,

+1-847-615-4096 Web site: http://www.wintrust.com/

Copyright

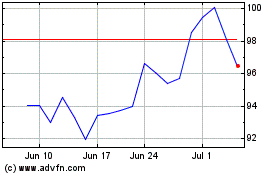

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

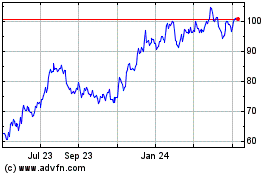

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024