false

0000803578

0000803578

2024-01-12

2024-01-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 12, 2024

WAVEDANCER, INC

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41092

|

54-1167364

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

12015 Lee Jackson Memorial Highway

Suite 210

Fairfax, VA 22030

(Address of principal executive offices, including zip code)

703-383-3000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

| Common Stock, par value $0.001 per share |

WAVD |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously announced, on November 15, 2023, WaveDancer, Inc., (“WAVD”) and its wholly owned subsidiary, FFN, Inc.(“FFN”), entered into an Agreement and Plan of Merger (“Merger Agreement”) with Firefly Neuroscience, Inc. (the “Company”). Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Merger Agreement, as further amended, modified, supplemented and/or restated by the First Amendment (as defined below).

On January 12, 2024, WAVD, FFN, and the Company made and entered into the First Amendment (the “First Amendment”) to the Merger Agreement. The First Amendment amends the terms and conditions of the Merger Agreement as follows:

|

•

|

Clarifies that the Effective Time shall be prior to or simultaneous with the Tellenger Sale;

|

|

•

|

Clarifies the capitalization of the Company;

|

|

•

|

Clarifies the treatment of Company Warrants at the Effective Time; and

|

|

•

|

Deletes the closing obligations related to the HSR Act.

|

The foregoing descriptions of the First Amendment and the Merger Agreement do not purport to be complete and are qualified in their entirety by reference to (i) the full text of the First Amendment, which is filed as Exhibit 2.1 hereto and is incorporated herein by reference, and (ii) the full text of the Merger Agreement, which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed on November 16, 2023.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

WAVEDANCER, INC. |

|

| |

|

|

|

|

Date: January 18, 2024

|

By:

|

/s/ Timothy G. Hannon

|

|

| |

|

Timothy G. Hannon

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 2.1

FIRST AMENDMENT TO AGREEMENT AND PLAN OF MERGER

This First Amendment (this “First Amendment”) to the Merger Agreement (as defined below) is made and entered into as of January 12, 2024, by and WaveDancer, Inc. a Delaware corporation (“Parent”), FFN Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Firefly Neuroscience, Inc., a Delaware corporation (the “Company”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Merger Agreement (defined below).

WHEREAS, Parent, Merger Sub, and the Company have entered into that certain Agreement and Plan of Merger, dated as of November 15, 2023 (the “Merger Agreement”)

WHEREAS, the Parties desire to amend the terms and conditions of the Merger Agreement to, among other things: (i) clarify that the Effective Time shall be prior to or simultaneous with the Tellenger Sale; (ii) clarify regarding the treatment of Company Warrants at the Effective Time; and (iii) deletion of the closing obligations related to the HSR Act.

NOW, THEREFORE, for and in consideration of the mutual covenants contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each Party hereto, the Parties agree as follows:

| |

1.

|

Amendment to Agreement. The Agreement is hereby amended as follows:

|

| |

a.

|

The last sentence of Section 1.02 of the Merger Agreement is deleted in its entirety and replaced with the following:

|

“The Merger will become effective at the time of the filing of such Certificate of Merger with the Secretary of State of the State of Delaware, or at such later time as may be specified in such Certificate of Merger with the consent of Parent and Company (the time as of which the Merger becomes effective being referred to as the “Effective Time”) and shall be prior to or simultaneous with the Tellenger Sale.”

| |

b.

|

A new Section 1.06(g) is hereby added as follows:

|

“(g) Company Warrants. Each Company Warrant that is outstanding and unexercised as of immediately prior to the Effective Time will be subject to Section 5.16. Prior to the Closing Date, and subject to the review and approval of Parent, Company will take all actions necessary to effect the transactions contemplated by this Section 1.06(g) under applicable Legal Requirements and all such Company Warrants, including delivering all notices required thereby and, if required, entering into termination agreements with the holders of such Company Warrants. In addition, promptly after the date of this Agreement, and in any event within twenty (20) Business Days before the Effective Time, and subject to the review and approval of Parent, Company shall deliver notice to all holders of Company Warrants setting forth such holders’ rights pursuant to this Agreement.”

| |

c.

|

Section 2.02(a) is hereby deleted in its entirety and replaced with the following:

|

“(a) The authorized capital stock of Company consists of: (i) 2,470,000,000 shares of Company Common Stock, par value $0.00001 per share, of which 49,948,700 shares are issued and outstanding and which, (A) 4,439,950 are issuable pursuant to the Company Option Plan, (B) 8,435,169 are issuable upon the exercise of various warrants of the Company (the “Company Warrants”), (C) an amount of shares equal to $400,000 at the go-public price of $1.72 per share, estimated to be 232,558, are issuable upon the vesting of RSUs (the “Company RSUs”), and (ii) 30,000,000 shares of preferred stock, of which 2,375,000 are designated Series C Preferred Stock and 1,538,132 are issued and outstanding (the “Series C Preferred Stock”). All outstanding shares of Company Common Stock and Series C Preferred Stock (collectively the “Company Capital Stock”) are duly authorized, validly issued, fully paid and non-assessable and were issued in compliance with all applicable federal and state securities Legal Requirements. No shares of Company Capital Stock are held in Company’s treasury as of the date of this.”

| |

d.

|

Section 2.02(b) is hereby deleted in its entirety and replaced with the following:

|

“(b) As of the date of this Agreement, no more than 12% of the Company Common Stock can be issued to employees, consultants and non-employee directors pursuant to the Company Option Plan, under which options were outstanding for an aggregate of 4,439,950 shares of Company Common Stock. All shares of Company Common Stock subject to issuance as aforesaid, upon issuance on the terms and conditions specified in the instruments pursuant to which they are issuable, would be duly authorized, validly issued, fully paid and non-assessable. Section 2.02(b) of the Company Disclosure Schedule lists each director and officer of the Company who is a holder of Company Capital Stock and the number and type of shares of such stock held by such holder, each outstanding Company Option, Company RSUs, Company Warrant.”

| |

e.

|

Section 5.16 of the Merger Agreement is deleted in its entirety and replaced with the following:

|

“Section 5.16 Company Options; Preferred Stock; Company RSU, Company Warrants.

(a) At the Effective Time, each Company Option that is outstanding and unexercised immediately prior to the Effective Time under the Company Option Plan, whether or not vested, will be converted into and become an option to purchase Parent Common Stock (each, an “Assumed Option”), and Parent shall assume the Company Option Plan and the terms of the stock option agreement by which such Company Option is evidenced (but with changes to such documents as Parent and Company mutually agree are appropriate to reflect the substitution of the Company Options by Parent to purchase shares of Parent Common Stock). All rights with respect to Company Common Stock under Company Options assumed by Parent will thereupon be converted into rights with respect to Parent Common Stock. Accordingly, from and after the Effective Time: (i) each Company Option assumed by Parent may be exercised solely for shares of Parent Common Stock; (ii) the number of shares of Parent Common Stock subject to each Company Option assumed by Parent will be determined by multiplying (x) the number of shares of Company Common Stock that were subject to such Company Option, as in effect immediately prior to the Effective Time by (y) the Exchange Ratio and rounding the resulting number down to the nearest whole number of shares of Parent Common Stock; (iii) the per share exercise price for the Parent Common Stock issuable upon exercise of each Company Option assumed by Parent will be determined by dividing (x) the per share exercise price of Company Common Stock subject to such Company Option, as in effect immediately prior to the Effective Time, by (y) the Exchange Ratio and rounding the resulting exercise price up to the nearest thousandth of a cent; and (iv) any restriction on the exercise of any Company Option assumed by Parent will continue in full force and effect, and the term, exercisability, method of exercise, vesting schedule, and other provisions of such Company Option will otherwise remain unchanged; provided, however, that: (1) to the extent provided under the terms of a Company Option, such Company Option assumed by Parent in accordance with this Section 5.16(a) will, in accordance with its terms, be subject to further adjustment as appropriate to reflect any stock split, division or subdivision of shares, stock dividend, reverse stock split, consolidation of shares, reclassification, recapitalization or other similar transaction with respect to Parent Common Stock subsequent to the Effective Time; and (2) the Parent Board or a committee thereof will succeed to the authority and responsibility of the Company Board or any committee thereof with respect to each Company Option assumed by Parent. Notwithstanding anything to the contrary in this Section 5.16(a), the conversion of each Company Option (regardless of whether such option qualifies as an “incentive stock option” within the meaning of Section 422 of the Code) into an option to purchase shares of Parent Common Stock will be made in a manner consistent with Treasury Regulation Section 1.424-1, such that the conversion of a Company Option will not constitute a “modification” of such Company Option for purposes of Section 409A or Section 424 of the Code. It is the intention of the parties that each Company Option so assumed by Parent shall qualify following the Effective Time as an incentive stock option as defined in Section 422 of the Code to the extent permitted under Section 422 of the Code and to the extent such Company Option qualified as an incentive stock option prior to the Effective Time.

(b) Immediately prior to the Effective Time, to the extent that any issued and outstanding Series B Preferred Stock or Series C Preferred Stock is outstanding, such Series B Preferred Stock or Series C Preferred Stock shall convert into Company Common Stock pursuant to the terms of the Certificate of Incorporation, as amended, of the Company.

(c) At the Effective Time, each Company RSU that is outstanding immediately prior to the Effective Time under the Company Option Plan shall accelerate and vest pursuant to the terms of such Company RSU. The holders of the Company RSU shall receive shares of the Parent Common Stock based on the terms as set forth in the applicable Company RSU agreements relating thereto, as in effect immediately prior to the Effective Time.

(d) At the Effective Time, each Company Warrant that is outstanding and unexercised immediately prior to the Effective Time, will be converted into and become a warrant to purchase Parent Common Stock (each, an “Assumed Warrant”), and Parent shall assume the terms of the Company Warrant by which such Company Warrant is evidenced (but with changes to such documents as Parent and Company mutually agree are appropriate to reflect the substitution of the Company Warrant by Parent to purchase shares of Parent Common Stock). All rights with respect to Company Common Stock under the Company Warrant assumed by Parent will thereupon be converted into rights with respect to Parent Common Stock. Accordingly, from and after the Effective Time: (i) each Company Warrant assumed by Parent may be exercised solely for shares of Parent Common Stock; (ii) the number of shares of Parent Common Stock subject to each Company Warrant assumed by Parent will be determined by multiplying (x) the number of shares of Company Common Stock that were subject to such Company Warrant, as in effect immediately prior to the Effective Time by (y) the Exchange Ratio and rounding the resulting number down to the nearest whole number of shares of Parent Common Stock; (iii) the per share exercise price for the Parent Common Stock issuable upon exercise of each Company Warrant assumed by Parent will be determined by dividing (x) the per share exercise price of Company Common Stock subject to such Company Warrant, as in effect immediately prior to the Effective Time, by (y) the Exchange Ratio and rounding the resulting exercise price up to the nearest thousandth of a cent; and (iv) any restriction on the exercise of any Company Warrant assumed by Parent will continue in full force and effect, and the term, exercisability, method of exercise, vesting schedule, and other provisions of such Company Warrant will otherwise remain unchanged; provided, however, that to the extent provided under the terms of a Company Warrant assumed by Parent in accordance with this Section 5.16(d) will, in accordance with its terms, be subject to further adjustment as appropriate to reflect any stock split, division or subdivision of shares, stock dividend, reverse stock split, consolidation of shares, reclassification, recapitalization or other similar transaction with respect to Parent Common Stock subsequent to the Effective Time.

(e) Parent shall file with the SEC, promptly after the Effective Time, a registration statement on Form S-8 (or any successor or alternative form), relating to the shares of Parent Common Stock issuable with respect to Company Options assumed by Parent in accordance with this Section 5.16.

| |

f.

|

Section 6.01(b) of the Merger Agreement is deleted in its entirety and replaced with the following:

|

“ (b) [Reserved].”

| |

g.

|

Section 6.03(l) of the Merger Agreement is deleted in its entirety and replaced with the following:

|

“ (l) Parent Restructuring and Tellenger Sale. The Parent Restructuring shall have been completed to the satisfaction of the Company and the Tellenger Sale shall be consummated pursuant to the Stock Purchase Agreement simultaneous with, or immediately after, the Effective Time, that is satisfactory to the Company.”

| |

h.

|

The definition for “Performance Warrants”, “Series C Warrants” and “Company Restricted Share” shall be deleted in its entirety from Exhibit A of the Merger Agreement.

|

| |

i.

|

The definition for “Company Option Plan” is hereby deleted in its entirety and replaced with the following:

|

“ “Company Option Plan” means the 2023 Omnibus Equity Incentive Compensation Plan and/or the 2007 Share Option Plan, as applicable.”

| |

j.

|

The definition for “Exchange Ratio” is hereby deleted in its entirety and replaced with the following:

|

“ “Exchange Ratio” means the following ratio (rounded to six decimal places): the quotient obtained by dividing (a) the Merger Shares by (b) the Company Outstanding Shares which shall be calculated in the same manner as set forth on Schedule B.”

| |

k.

|

Attachment 2.02(b) – Capitalization Table of Section 2.02 of the Company Disclosure Schedule is hereby deleted in its entirety and replaced with Exhibit A.

|

| |

2.

|

No Other Changes. Except as expressly provided in this Amendment, the Agreement shall remain in full force and effect upon its original terms. This Amendment and the Agreement constitute an integrated agreement with respect to the subject matter hereof and thereof. This Amendment may be amended, modified, and supplemented only in accordance with the terms of the Agreement.

|

| |

3.

|

Governing Law. This Amendment shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts made and performed in such State, without reference to such State’s or any other state’s or other jurisdiction’s principles of conflict of laws.

|

| |

4.

|

Counterparts. This Amendment may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same instrument.

|

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties hereto have caused this Amendment to be executed as of the date first written above by their respective officers thereunto duly authorized.

| |

|

|

|

|

| |

COMPANY

FIREFLY NEUROSCIENCE, INC.

|

|

| |

|

|

|

|

| |

|

By: |

/s/ Jon Olsen |

|

| |

|

Name: |

Jon Olsen |

|

| |

|

Title: |

Chief Executive Officer |

|

| |

|

|

|

|

| |

MERGER SUB

FFN MERGER SUB, INC.

|

|

| |

|

|

|

|

| |

|

By: |

/s/ G. James Benoit, Jr. |

|

| |

|

Name: |

G. James Benoit, Jr. |

|

| |

|

Title: |

Chief Executive Officer |

|

| |

|

|

|

|

| |

PARENT

WAVEDANCER, INC.

|

|

| |

|

|

|

|

| |

|

By: |

/s/ G. James Benoit, Jr. |

|

| |

|

Name: |

G. James Benoit, Jr. |

|

| |

|

Title: |

Chief Executive Officer |

|

v3.23.4

Document And Entity Information

|

Jan. 12, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

WAVEDANCER, INC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 12, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41092

|

| Entity, Tax Identification Number |

54-1167364

|

| Entity, Address, Address Line One |

12015 Lee Jackson Memorial Highway

|

| Entity, Address, Address Line Two |

Suite 210

|

| Entity, Address, City or Town |

Fairfax

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22030

|

| City Area Code |

703

|

| Local Phone Number |

383-3000

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000803578

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

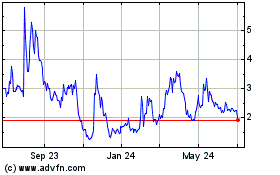

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Mar 2024 to Apr 2024

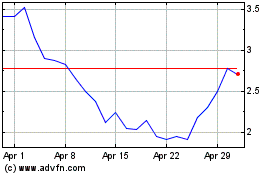

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Apr 2023 to Apr 2024