false

2024

Q2

--12-31

0001829794

0001829794

2024-01-01

2024-06-30

0001829794

2024-08-05

0001829794

2024-06-30

0001829794

2023-12-31

0001829794

2024-04-01

2024-06-30

0001829794

2023-04-01

2023-06-30

0001829794

2023-01-01

2023-06-30

0001829794

VLCN:SeriesAConvertiblePreferredStockMember

2023-12-31

0001829794

us-gaap:CommonStockMember

2023-12-31

0001829794

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001829794

us-gaap:RetainedEarningsMember

2023-12-31

0001829794

us-gaap:CommonStockMember

2022-12-31

0001829794

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001829794

us-gaap:RetainedEarningsMember

2022-12-31

0001829794

2022-12-31

0001829794

VLCN:SeriesAConvertiblePreferredStockMember

2024-01-01

2024-06-30

0001829794

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001829794

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001829794

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001829794

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001829794

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001829794

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001829794

VLCN:SeriesAConvertiblePreferredStockMember

2024-06-30

0001829794

us-gaap:CommonStockMember

2024-06-30

0001829794

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001829794

us-gaap:RetainedEarningsMember

2024-06-30

0001829794

us-gaap:CommonStockMember

2023-06-30

0001829794

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001829794

us-gaap:RetainedEarningsMember

2023-06-30

0001829794

2023-06-30

0001829794

VLCN:WarrantsWithMay2024NotesMember

2024-01-01

2024-06-30

0001829794

VLCN:WarrantsWithMay2024NotesMember

2023-01-01

2023-06-30

0001829794

VLCN:May2024NotesAndWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:ConvertibleNotesAndWarrantsMember

2023-01-01

2023-06-30

0001829794

2024-02-01

2024-02-29

0001829794

2024-03-01

2024-03-31

0001829794

2024-03-31

0001829794

VLCN:May2024NotesMember

2024-05-22

0001829794

VLCN:May2024NotesMember

2024-05-21

2024-05-22

0001829794

VLCN:May2024NoteWarrantsMember

2024-05-22

0001829794

2024-06-10

2024-06-11

0001829794

VLCN:JordanDavisMember

2024-01-12

2024-01-13

0001829794

srt:ChiefExecutiveOfficerMember

2024-01-29

2024-01-30

0001829794

srt:ChiefFinancialOfficerMember

2024-01-29

2024-01-30

0001829794

2024-06-05

2024-06-06

0001829794

VLCN:VolconYouthMotorcyclesMember

2024-01-01

2024-06-30

0001829794

VLCN:VolconYouthMotorcyclesMember

2024-06-30

0001829794

VLCN:StagSuspensionComponentMember

2024-06-30

0001829794

VLCN:StagSuspensionComponentMember

2024-04-01

2024-06-30

0001829794

VLCN:StagSuspensionComponentMember

2024-01-01

2024-06-30

0001829794

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2024-06-30

0001829794

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2024-06-30

0001829794

us-gaap:VehiclesMember

2024-06-30

0001829794

VLCN:InternalUseManufacturedVehiclesMember

2024-06-30

0001829794

us-gaap:FurnitureAndFixturesMember

2024-06-30

0001829794

us-gaap:ComputerEquipmentMember

2024-06-30

0001829794

VLCN:FuturePaymentsForInventoryMember

2024-06-30

0001829794

us-gaap:MachineryAndEquipmentMember

2024-06-30

0001829794

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001829794

us-gaap:VehiclesMember

2023-12-31

0001829794

VLCN:InternalUseManufacturedVehiclesMember

2023-12-31

0001829794

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001829794

us-gaap:LeaseholdImprovementsMember

2024-06-30

0001829794

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001829794

us-gaap:ComputerEquipmentMember

2023-12-31

0001829794

VLCN:FinancingArrangementMember

us-gaap:VehiclesMember

2023-03-31

0001829794

VLCN:FinancingArrangementMember

us-gaap:VehiclesMember

srt:MaximumMember

2023-03-01

2023-03-31

0001829794

VLCN:FinancingArrangementMember

us-gaap:VehiclesMember

srt:MinimumMember

2023-03-01

2023-03-31

0001829794

VLCN:FinancingArrangementMember

us-gaap:VehiclesMember

2023-03-01

2023-03-31

0001829794

VLCN:SeniorConvertibleNotesMember

2022-08-24

0001829794

VLCN:NoteWarrantsMember

2022-08-24

0001829794

VLCN:ConvertibleNotesMember

2022-08-24

0001829794

VLCN:ConvertibleNotesMember

VLCN:NoteWarrantsMember

2022-08-24

0001829794

VLCN:ConvertibleNotesMember

2022-08-23

2022-08-24

0001829794

VLCN:ConvertibleNotesMember

VLCN:NoteWarrantsMember

2022-08-23

2022-08-24

0001829794

VLCN:ConvertibleNotesMember

2023-04-01

2023-06-30

0001829794

VLCN:ConvertibleNotesMember

2023-01-01

2023-06-30

0001829794

VLCN:NewSeniorConvertibleNotesMember

2023-05-24

0001829794

VLCN:NewWarrantsMember

2023-05-24

0001829794

VLCN:NewNotesAndNewWarrantsMember

2023-05-24

0001829794

VLCN:SeriesANotesMember

2023-05-24

0001829794

VLCN:SeriesBNotesMember

2023-05-24

0001829794

VLCN:SeriesBNotesMember

2023-08-03

0001829794

us-gaap:MeasurementInputDiscountRateMember

VLCN:May2023NotesMember

2024-01-01

2024-06-30

0001829794

VLCN:May2023NotesMember

2024-04-01

2024-06-30

0001829794

VLCN:May2023NotesMember

2024-01-01

2024-06-30

0001829794

VLCN:NoteWarrantsMember

2022-08-01

2022-08-31

0001829794

VLCN:ExchangeWarrantsMember

2022-08-01

2022-08-31

0001829794

VLCN:WarrantInducementAgreementMember

VLCN:ExchangeWarrantsMember

2023-09-01

2023-09-30

0001829794

VLCN:WarrantInducementAgreementMember

VLCN:ReloadWarrantsMember

2023-09-30

0001829794

VLCN:WarrantInducementAgreementMember

VLCN:ReloadWarrantsMember

2023-09-01

2023-09-30

0001829794

VLCN:PublicOfferingMember

2023-09-01

2023-09-30

0001829794

VLCN:PublicOfferingMember

2023-09-30

0001829794

VLCN:May2023WarrantsMember

2023-09-30

0001829794

VLCN:May2023NotesMember

2023-10-11

2023-10-13

0001829794

VLCN:May2023WarrantsMember

2023-10-20

0001829794

VLCN:May2023NotesMember

2024-02-01

2024-02-02

0001829794

VLCN:May2023NotesMember

2024-02-12

0001829794

VLCN:May2023NotesMember

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001829794

VLCN:May2023NotesMember

VLCN:UnamortizedDebtIssuanceCostsMember

2024-04-01

2024-06-30

0001829794

VLCN:May2023NotesExchangedMember

VLCN:SeriesAConvertiblePreferredStockMember

2024-04-01

2024-06-30

0001829794

VLCN:May2023NotesMember

VLCN:UnamortizedIssuanceCostsMember

2024-01-01

2024-06-30

0001829794

VLCN:May2023WarrantsMember

2024-06-30

0001829794

VLCN:NewNotesMember

2024-06-30

0001829794

VLCN:SeriesAExchangeNotesMember

2024-06-30

0001829794

VLCN:SeriesBExchangeNotesMember

2024-06-30

0001829794

VLCN:May2023NotesMember

2024-06-30

0001829794

VLCN:May2024NotesMember

2024-04-01

2024-06-30

0001829794

VLCN:May2024NotesMember

2024-01-01

2024-06-30

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputSharePriceMember

2023-05-23

2023-05-24

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputSharePriceMember

2023-08-02

2023-08-03

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-05-23

2023-05-24

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-08-02

2023-08-03

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputConversionPriceMember

2023-05-23

2023-05-24

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputConversionPriceMember

2023-08-02

2023-08-03

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputExpectedTermMember

2023-05-23

2023-05-24

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputExpectedTermMember

2023-08-02

2023-08-03

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-05-23

2023-05-24

0001829794

VLCN:ConversionFeatureLiabilitiesMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-08-02

2023-08-03

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputSharePriceMember

2023-05-23

2023-05-24

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputSharePriceMember

2023-08-02

2023-08-03

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-05-23

2023-05-24

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-08-02

2023-08-03

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputConversionPriceMember

2023-05-23

2023-05-24

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputConversionPriceMember

2023-08-02

2023-08-03

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputExpectedTermMember

2023-05-23

2023-05-24

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputExpectedTermMember

2023-08-02

2023-08-03

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-05-23

2023-05-24

0001829794

VLCN:WarrantLiabilitiesMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-08-02

2023-08-03

0001829794

VLCN:ConversionFeatureNewNotesMember

2023-05-24

0001829794

VLCN:ConversionFeatureNewNotesMember

2023-08-03

0001829794

VLCN:ConversionFeatureSeriesAExchangeNotesMember

2023-05-24

0001829794

VLCN:ConversionFeatureSeriesAExchangeNotesMember

2023-08-03

0001829794

VLCN:ConversionFeatureSeriesBExchangeNotesMember

2023-05-24

0001829794

VLCN:ConversionFeatureSeriesBExchangeNotesMember

2023-08-03

0001829794

VLCN:NewWarrantsMember

2023-05-24

0001829794

VLCN:NewWarrantsMember

2023-08-03

0001829794

VLCN:ExchangeWarrantsMember

2023-05-24

0001829794

VLCN:ExchangeWarrantsMember

2023-08-03

0001829794

2023-05-24

0001829794

2023-08-03

0001829794

VLCN:May2023NotesMember

2023-05-23

2023-06-30

0001829794

VLCN:May2023NotesMember

2023-01-01

2023-12-31

0001829794

VLCN:SeriesAWarrantMember

2023-11-16

2023-11-17

0001829794

VLCN:SeriesBWarrantMember

2023-11-16

2023-11-17

0001829794

VLCN:SeriesAAndBWarrantsMember

2023-10-01

2023-12-31

0001829794

VLCN:SeriesAWarrantMember

2024-06-28

0001829794

VLCN:SeriesAWarrantMember

2024-06-30

0001829794

VLCN:SeriesBWarrantMember

2024-05-17

0001829794

VLCN:SeriesBWarrantMember

2024-04-01

2024-06-30

0001829794

VLCN:SeriesBWarrantMember

2024-01-01

2024-06-30

0001829794

VLCN:SeriesBWarrantMember

2024-05-16

2024-05-17

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

us-gaap:MeasurementInputPriceVolatilityMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

us-gaap:MeasurementInputExpectedTermMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

VLCN:MeasurementInputFutureTermMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

VLCN:MeasurementInputProbabilityRateMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesAWarrantMember

2023-12-31

0001829794

VLCN:SeriesBWarrantMember

2023-12-31

0001829794

VLCN:SeriesAWarrantsMember

2023-12-31

0001829794

VLCN:SeriesBWarrantsMember

2023-12-31

0001829794

VLCN:SeriesAWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:SeriesBWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:SeriesAWarrantsMember

2024-06-30

0001829794

VLCN:SeriesBWarrantsMember

2024-06-30

0001829794

VLCN:PinkPossumMember

2022-01-01

2022-12-31

0001829794

VLCN:StagLeaseMember

2023-01-01

2023-12-31

0001829794

VLCN:PinkPossumMember

2021-03-26

0001829794

VLCN:HighbridgeMember

2021-03-25

0001829794

VLCN:MrOkonskyMember

2023-01-01

2023-01-02

0001829794

us-gaap:CommonStockMember

2023-06-14

0001829794

us-gaap:PreferredStockMember

2023-06-14

0001829794

2023-10-11

2023-10-13

0001829794

2024-02-01

2024-02-02

0001829794

VLCN:PublicOfferingMember

2023-05-23

2023-05-24

0001829794

VLCN:PublicOfferingMember

2023-05-24

0001829794

VLCN:PublicOfferingMember

2023-09-17

2023-09-18

0001829794

VLCN:PublicOfferingMember

2023-09-18

0001829794

VLCN:PublicOfferingMember

VLCN:UnderwriterMember

2023-09-18

0001829794

VLCN:ConversionOfMay2023NotesAndWarrantsMember

2024-06-30

0001829794

VLCN:ExerciseOfPlacementAgentWarrantsMember

2024-06-30

0001829794

us-gaap:SeriesAPreferredStockMember

2024-03-04

0001829794

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-06-30

0001829794

2024-06-06

0001829794

us-gaap:SeriesAPreferredStockMember

2024-06-30

0001829794

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001829794

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2024-07-01

2024-08-02

0001829794

VLCN:CommonUnitsMember

2023-11-16

2023-11-17

0001829794

VLCN:PreFundedUnitsMember

2023-11-16

2023-11-17

0001829794

VLCN:PreFundedWarrantsMember

2023-12-30

2023-12-31

0001829794

VLCN:SeriesBWarrantsMember

VLCN:UnderwriterMember

2023-11-16

2023-11-17

0001829794

VLCN:SeriesAAndBWarrantsMember

VLCN:UnderwriterMember

2023-11-16

2023-11-17

0001829794

VLCN:SeriesAAndSeriesBWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:SeriesAWarrantsMember

2024-06-30

0001829794

VLCN:SeriesAWarrantsMember

2024-06-05

2024-06-06

0001829794

VLCN:SeriesAWarrantsMember

2024-06-06

0001829794

VLCN:SeriesAWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:SeriesBWarrantsMember

2024-06-30

0001829794

VLCN:SeriesBWarrantsMember

2024-05-16

2024-05-17

0001829794

VLCN:SeriesBWarrantsMember

2024-05-17

0001829794

VLCN:NoteWarrantsMember

2024-06-30

0001829794

VLCN:FullyVestedWarrantsMember

VLCN:PlacementAgentMember

2024-06-30

0001829794

VLCN:NoteWarrantsMember

2023-05-01

2023-05-31

0001829794

VLCN:ExchangeWarrantsMember

2023-05-01

2023-05-31

0001829794

VLCN:ExchangeWarrantsMember

2023-05-31

0001829794

VLCN:NewWarrantsMember

2023-05-31

0001829794

VLCN:ReloadWarrantsMember

2024-06-30

0001829794

2023-10-28

2023-10-29

0001829794

VLCN:NoteWarrantsMember

2024-05-22

0001829794

VLCN:CommonStockWarrantsMember

2023-12-31

0001829794

VLCN:CommonStockWarrantsMember

2024-01-01

2024-06-30

0001829794

VLCN:CommonStockWarrantsMember

2024-06-30

0001829794

VLCN:Volcon2021PlanMember

2024-06-30

0001829794

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

0001829794

us-gaap:RestrictedStockUnitsRSUMember

2023-04-01

2023-06-30

0001829794

VLCN:Plan2021Member

2022-12-31

0001829794

us-gaap:PerformanceSharesMember

VLCN:Volcon2021PlanMember

2023-02-05

2023-02-06

0001829794

us-gaap:PerformanceSharesMember

2023-02-05

2023-02-06

0001829794

us-gaap:PerformanceSharesMember

2023-01-01

2023-06-30

0001829794

VLCN:Volcon2021PlanMember

VLCN:PerformanceMilestonesFor2023Member

2022-12-31

0001829794

us-gaap:StockOptionMember

2024-04-01

2024-06-30

0001829794

us-gaap:StockOptionMember

2024-01-01

2024-06-30

0001829794

us-gaap:StockOptionMember

2023-04-01

2023-06-30

0001829794

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001829794

us-gaap:StockOptionMember

2024-06-30

0001829794

us-gaap:StockOptionMember

2023-12-31

0001829794

VLCN:CostOfGoodsSoldMember

2024-04-01

2024-06-30

0001829794

VLCN:CostOfGoodsSoldMember

2023-04-01

2023-06-30

0001829794

VLCN:CostOfGoodsSoldMember

2024-01-01

2024-06-30

0001829794

VLCN:CostOfGoodsSoldMember

2023-01-01

2023-06-30

0001829794

VLCN:SalesAndMarketingMember

2024-04-01

2024-06-30

0001829794

VLCN:SalesAndMarketingMember

2023-04-01

2023-06-30

0001829794

VLCN:SalesAndMarketingMember

2024-01-01

2024-06-30

0001829794

VLCN:SalesAndMarketingMember

2023-01-01

2023-06-30

0001829794

VLCN:ProductDevelopmentMember

2024-04-01

2024-06-30

0001829794

VLCN:ProductDevelopmentMember

2023-04-01

2023-06-30

0001829794

VLCN:ProductDevelopmentMember

2024-01-01

2024-06-30

0001829794

VLCN:ProductDevelopmentMember

2023-01-01

2023-06-30

0001829794

VLCN:GeneralAndAdministrativeMember

2024-04-01

2024-06-30

0001829794

VLCN:GeneralAndAdministrativeMember

2023-04-01

2023-06-30

0001829794

VLCN:GeneralAndAdministrativeMember

2024-01-01

2024-06-30

0001829794

VLCN:GeneralAndAdministrativeMember

2023-01-01

2023-06-30

0001829794

VLCN:ConvertibleNotesMember

2024-01-01

2024-06-30

0001829794

VLCN:ConvertibleNotesMember

2023-01-01

2023-06-30

0001829794

us-gaap:PreferredStockMember

2024-01-01

2024-06-30

0001829794

us-gaap:WarrantMember

2024-01-01

2024-06-30

0001829794

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001829794

us-gaap:StockOptionMember

2024-01-01

2024-06-30

0001829794

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001829794

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-06-30

0001829794

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30,

2024

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to__________

Commission file number: 001-40867

Volcon, Inc.

(Exact Name of Registrant as Specified in

Its Charter)

| Delaware |

|

84-4882689 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

| 3121 Eagles Nest Street, Suite 120, Round Rock, TX |

|

78665 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(512) 400-4271

(Registrant's Telephone Number, Including Area

Code)

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

VLCN |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

| Non-Accelerated Filer ☒ |

Smaller Reporting Company ☒ |

| |

Emerging Growth Company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No ☒

The registrant had 4,661,782 shares of common stock

outstanding at August 5, 2024.

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

VOLCON, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

| | |

| |

| | |

June 30, 2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 2,052,175 | | |

$ | 7,983,346 | |

| Restricted cash | |

| 105,000 | | |

| 210,000 | |

| Accounts receivable, net of allowance for doubtful accounts of $53,295 and $70,359 at June 30, 2024 and December 31, 2023, respectively | |

| 301,845 | | |

| 203,303 | |

| Inventory | |

| 9,586,328 | | |

| 8,973,134 | |

| Inventory deposits | |

| 1,015,847 | | |

| 258,316 | |

| Prepaid expenses and other current assets | |

| 963,253 | | |

| 1,904,197 | |

| Total current assets | |

| 14,024,448 | | |

| 19,532,296 | |

| Long term assets: | |

| | | |

| | |

| Property and equipment, net | |

| 625,166 | | |

| 1,258,607 | |

| Other long-term assets | |

| 199,281 | | |

| 199,281 | |

| Right-of-use assets - operating leases | |

| 941,303 | | |

| 1,136,213 | |

| Total assets | |

$ | 15,790,198 | | |

$ | 22,126,397 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY(DEFICIT) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 962,390 | | |

$ | 831,184 | |

| Accrued liabilities | |

| 1,735,981 | | |

| 3,128,906 | |

| Vendor settlements - short-term | |

| 1,833,937 | | |

| – | |

| Current portion of notes payable | |

| 6,784 | | |

| 15,278 | |

| Convertible notes, net of discount and issuance costs | |

| – | | |

| 30,149,579 | |

| May 2024 Notes | |

| 1,416,470 | | |

| – | |

| Warrant liabilities | |

| 70,970 | | |

| 5,971,067 | |

| Right-of-use operating lease liabilities, short-term | |

| 421,034 | | |

| 399,611 | |

| Customer deposits | |

| 169,777 | | |

| 417,485 | |

| Total current liabilities | |

| 6,617,343 | | |

| 40,913,110 | |

| | |

| | | |

| | |

| Notes payable, net of current portion | |

| 32,226 | | |

| 69,138 | |

| Vendor settlements - long-term | |

| 683,493 | | |

| – | |

| Right-of-use operating lease liabilities, long-term | |

| 559,749 | | |

| 775,170 | |

| Total liabilities | |

| 7,892,811 | | |

| 41,757,418 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity (deficit): | |

| | | |

| | |

| Preferred stock: $0.00001 par value, 5,000,000 shares authorized, 25,000 shares designated, 6,375 shares outstanding as of June 30, 2024 and no shares issued and outstanding as of December 31, 2023. | |

| – | | |

| – | |

| Common stock: $0.00001 par value, 250,000,000 shares authorized, 1,642,685 shares issued and outstanding as of June 30, 2024 and 10,305 shares issued and outstanding as of December 31, 2023 | |

| 16 | | |

| – | |

| Additional paid-in capital | |

| 155,357,971 | | |

| 101,175,117 | |

| Accumulated deficit | |

| (147,460,600 | ) | |

| (120,806,138 | ) |

| Total stockholders’ equity (deficit) | |

| 7,897,387 | | |

| (19,631,021 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

$ | 15,790,198 | | |

$ | 22,126,397 | |

The accompanying notes are an integral part

of these unaudited consolidated financial statements.

VOLCON, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30,

2024 AND 2023

(Unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | | |

June 30, 2024 | | |

June 30, 2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 940,863 | | |

$ | 519,300 | | |

$ | 1,974,411 | | |

$ | 1,689,758 | |

| Cost of goods sold | |

| (3,113,429 | ) | |

| (334,647 | ) | |

| (4,735,009 | ) | |

| (1,564,628 | ) |

| Gross margin | |

| (2,172,566 | ) | |

| 184,653 | | |

| (2,760,598 | ) | |

| 125,130 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 543,671 | | |

| 2,380,617 | | |

| 1,304,235 | | |

| 4,169,987 | |

| Product development | |

| 805,550 | | |

| 1,166,732 | | |

| 1,620,495 | | |

| 2,953,083 | |

| General and administrative expenses | |

| 2,007,514 | | |

| 1,568,700 | | |

| 4,088,308 | | |

| 3,458,791 | |

| Total operating expenses | |

| 3,356,735 | | |

| 5,116,049 | | |

| 7,013,038 | | |

| 10,581,861 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (5,529,301 | ) | |

| (4,931,396 | ) | |

| (9,773,636 | ) | |

| (10,456,731 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 8,589 | | |

| 10,618 | | |

| 21,443 | | |

| 16,503 | |

| Loss on extinguishment of Convertible Notes | |

| – | | |

| (22,296,988 | ) | |

| (1,647,608 | ) | |

| (22,296,988 | ) |

| Gain (loss) on change in fair value of financial liabilities | |

| 5,111,291 | | |

| 5,792,788 | | |

| (14,727,696 | ) | |

| 5,792,788 | |

| Interest expense | |

| (196,997 | ) | |

| (1,603,216 | ) | |

| (526,965 | ) | |

| (3,383,235 | ) |

| Total other income (expense) | |

| 4,922,883 | | |

| (18,096,798 | ) | |

| (16,880,826 | ) | |

| (19,870,932 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before provision for income taxes | |

| (606,418 | ) | |

| (23,028,194 | ) | |

| (26,654,462 | ) | |

| (30,327,663 | ) |

| Provision for income taxes | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (606,418 | ) | |

$ | (23,028,194 | ) | |

$ | (26,654,462 | ) | |

$ | (30,327,663 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share – basic | |

$ | (1.51 | ) | |

$ | (19,110.53 | ) | |

$ | (110.71 | ) | |

$ | (26,417.82 | ) |

| Net loss per common share – diluted | |

$ | (1.51 | ) | |

$ | (19,110.53 | ) | |

$ | (110.71 | ) | |

$ | (26,417.82 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding – basic | |

| 401,802 | | |

| 1,205 | | |

| 240,759 | | |

| 1,148 | |

| Weighted average common shares outstanding – diluted | |

| 401,802 | | |

| 1,205 | | |

| 240,759 | | |

| 1,148 | |

The accompanying notes are an integral part

of these unaudited consolidated financial statements.

VOLCON, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’

EQUITY (DEFICIT)

FOR THE SIX MONTHS ENDED JUNE 30, 2024

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Series A Convertible Preferred Stock | | |

Common stock | | |

Additional | | |

| | |

| |

| | |

Number of Shares | | |

Amount | | |

Number Shares | | |

Amount | | |

paid -in capital | | |

Accumulated deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at January 1, 2024 | |

| – | | |

$ | – | | |

| 10,305 | | |

$ | – | | |

$ | 101,175,117 | | |

$ | (120,806,138 | ) | |

$ | (19,631,021 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for exercise of pre-funded warrants | |

| – | | |

| – | | |

| 739 | | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for exercise of Series A warrants | |

| – | | |

| – | | |

| 138,593 | | |

| – | | |

| 17,352,653 | | |

| – | | |

| 17,352,653 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proceeds received for exercise of buydown warrants | |

| – | | |

| – | | |

| 78 | | |

| – | | |

| 3,500 | | |

| – | | |

| 3,500 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for conversion of convertible notes | |

| – | | |

| – | | |

| 39,762 | | |

| – | | |

| 7,395,907 | | |

| – | | |

| 7,395,907 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of Convertible Notes | |

| 24,698 | | |

| – | | |

| – | | |

| – | | |

| 24,716,118 | | |

| – | | |

| 24,716,118 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of Preferred Stock for common stock | |

| (18,323 | ) | |

| – | | |

| 1,244,081 | | |

| 15 | | |

| (15 | ) | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for exercise of Series B Warrants | |

| – | | |

| – | | |

| 117,605 | | |

| 1 | | |

| – | | |

| – | | |

| 1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Reclassification of warrant liability to equity | |

| – | | |

| – | | |

| – | | |

| – | | |

| 3,405,662 | | |

| – | | |

| 3,405,662 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Proceeds received for Issuance of warrants with May 2024 Notes, net of issuance costs of $111,194 | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,023,200 | | |

| – | | |

| 1,023,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| – | | |

| – | | |

| – | | |

| – | | |

| 285,829 | | |

| – | | |

| 285,829 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for reverse stock split due to rounding | |

| – | | |

| – | | |

| 91,522 | | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (26,654,462 | ) | |

| (26,654,462 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2024 | |

| 6,375 | | |

$ | – | | |

| 1,642,685 | | |

$ | 16 | | |

$ | 155,357,971 | | |

$ | (147,460,600 | ) | |

$ | 7,897,387 | |

The accompanying notes are an integral part

of these unaudited consolidated financial statements.

VOLCON, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS'

EQUITY (DEFICIT)

FOR THE SIX MONTHS ENDED JUNE 30, 2023

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common stock | | |

| | |

| | |

| |

| | |

Number | | |

| | |

Additional paid-in | | |

Accumulated | | |

| |

| | |

of Shares | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at January 1, 2023 | |

| 1,086 | | |

$ | – | | |

$ | 76,369,940 | | |

$ | (75,734,927 | ) | |

$ | 635,013 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for exercise of stock options and vesting of restricted stock units | |

| 2 | | |

| – | | |

| 25,000 | | |

| – | | |

| 25,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of common stock for public offering, net of issuance costs of $501,300 | |

| 267 | | |

| – | | |

| 3,998,700 | | |

| – | | |

| 3,998,700 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| 6 | | |

| – | | |

| 1,682,827 | | |

| – | | |

| 1,682,827 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (30,327,663 | ) | |

| (30,327,663 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2023 | |

| 1,361 | | |

$ | – | | |

$ | 82,076,467 | | |

$ | (106,062,590 | ) | |

$ | (23,986,123 | ) |

The accompanying notes are an integral part

of these unaudited consolidated financial statements.

VOLCON, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited)

| | |

| | |

| |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | |

| Cash flow from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (26,654,462 | ) | |

$ | (30,327,663 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Loss on extinguishment of convertible notes | |

| 1,314,065 | | |

| 22,296,988 | |

| Loss (gain) on change in fair value of financial liabilities | |

| 14,893,051 | | |

| (5,792,788 | ) |

| Gain on exercise of Series B Warrants | |

| (165,355 | ) | |

| – | |

| Loss on conversion of notes to common stock | |

| 333,544 | | |

| – | |

| Stock-based compensation | |

| 285,829 | | |

| 1,682,827 | |

| Loss on write down of inventory and inventory deposits | |

| 57,262 | | |

| 165,324 | |

| Loss (gain) on sale/write off of property & equipment | |

| 618,738 | | |

| (6,423 | ) |

| Bad debt (recovery) expense | |

| (16,378 | ) | |

| 51,198 | |

| Non-cash interest expense | |

| 498,657 | | |

| 3,385,204 | |

| Amortization of right-of-use assets | |

| 194,910 | | |

| 181,677 | |

| Depreciation and amortization | |

| 197,237 | | |

| 106,625 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (82,162 | ) | |

| 580,155 | |

| Inventory | |

| (347,144 | ) | |

| 786,821 | |

| Inventory deposits | |

| (1,080,843 | ) | |

| (1,847,714 | ) |

| Prepaid assets and other current assets | |

| 940,944 | | |

| (954,117 | ) |

| Accounts payable | |

| 131,205 | | |

| (381,252 | ) |

| Accrued liabilities and vendor settlements | |

| 1,124,505 | | |

| (626,788 | ) |

| Right-of-use liabilities - operating leases | |

| (193,998 | ) | |

| (174,365 | ) |

| Customer deposits | |

| (247,708 | ) | |

| 295,739 | |

| Net cash used in operating activities | |

| (8,198,103 | ) | |

| (10,578,552 | ) |

| Cash flow from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (255,754 | ) | |

| (393,291 | ) |

| Proceeds from sale of property and equipment | |

| 15,157 | | |

| – | |

| Proceeds from insurance settlement | |

| 58,058 | | |

| – | |

| Proceeds from sale of vehicles | |

| – | | |

| 89,000 | |

| Net cash used in investing activities | |

| (182,539 | ) | |

| (304,291 | ) |

| Cash flow from financing activities: | |

| | | |

| | |

| Repayment of notes payable | |

| (45,402 | ) | |

| (72,859 | ) |

| Proceeds from issuance of May 2024 Notes and warrants, net of issuance costs of $245,150 | |

| 2,255,851 | | |

| – | |

| Proceeds from exercise of Series B Warrants | |

| 130,522 | | |

| – | |

| Proceeds from exercise of buy down warrants | |

| 3,500 | | |

| – | |

| Proceeds from issuance of common stock from public offering, net of issuance costs of $501,300 | |

| – | | |

| 3,998,700 | |

| Proceeds from issuance of convertible notes and warrants, net of issuance costs of $586,968 | |

| – | | |

| 3,913,032 | |

| Proceeds from exercise of stock options | |

| – | | |

| 25,000 | |

| Net cash provided by financing activities | |

| 2,344,471 | | |

| 7,863,873 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| (6,036,171 | ) | |

| (3,018,970 | ) |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD | |

| 8,193,346 | | |

| 11,537,842 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | |

$ | 2,157,175 | | |

$ | 8,518,872 | |

SUPPLEMENTAL CASH FLOW INFORMATION

| | |

2024 | | |

2023 | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 26,267 | | |

$ | 4,648 | |

| Cash paid for income taxes | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Non-cash transactions | |

| | | |

| | |

| Conversion of Convertible Notes for common stock | |

$ | 7,414,025 | | |

$ | – | |

| Exchange of Convertible Notes for Preferred Stock | |

$ | 24,716,118 | | |

$ | – | |

| Reclassification of warrant liability to equity for cashless exercise of Series A Warrants | |

$ | 17,352,653 | | |

$ | – | |

| Reclassification of warrant liability to

equity for modification of Series B Warrants | |

$ | 3,405,662 | | |

$ | – | |

| Exchange of finished goods inventory with vendor for raw materials inventory | |

$ | 323,312 | | |

$ | – | |

| Acquisition of property and equipment with note payable | |

$ | – | | |

$ | 96,024 | |

The accompanying notes are an integral part

of these unaudited consolidated financial statements.

VOLCON, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 – ORGANIZATION, NATURE OF OPERATIONS

AND GOING CONCERN

Organization and Nature of Operations

Volcon, Inc. (“Volcon” or the “Company”)

was formed on February 21, 2020, as a Delaware corporation, under the name Frog ePowersports, Inc. The Company was renamed Volcon, Inc.

on October 1, 2020. Volcon designs and sells all-electric off-road powersport vehicles.

On January 5, 2021, the Company created Volcon

ePowersports, LLC (“Volcon LLC”), a Colorado wholly-owned subsidiary of the Company, to sell Volcon vehicles and accessories

in the United States. Volcon LLC is no longer used for selling vehicles and accessories.

Going Concern

The accompanying interim consolidated financial

statements have been prepared assuming that the Company will continue as a going concern. The Company has recurring losses and has generated

negative cash flows from operations since inception.

In February and March 2024, certain holders of

the May 2023 Convertible Notes issued in May 2023 converted approximately $7.4 million of principal to common stock. In March 2024, the

holders exchanged the remaining May 2023 Convertible Notes of $24.7 million for Series A Convertible Preferred Stock (“Preferred

Stock”) with a $1,000 per share value and an initial conversation price of $133.00 per share for common stock (see Note 10). All

covenants from the Convertible Notes were terminated upon this exchange.

As discussed further in Note 7 below, on May 22,

2024, the Company issued senior notes with an aggregate principal amount of $2,942,170 due May 22, 2025 (the “May 2024 Notes”)

for net proceeds of $2,255,851. The holders of the May 2024 Notes also received fully vested warrants (the “May 2024 Note Warrants”)

to purchase 101,463 shares of the Company’s common stock at an exercise price of $29.00 per share. The May 2024 Note Warrants are

exercisable beginning November 23, 2024 and expire November 23, 2029.

Management anticipates that our cash on hand as

of June 30, 2024 plus the cash expected to be generated from operations will not be sufficient to fund planned operations beyond one year

from the date of the issuance of the financial statements as of and for the three and six months ended June 30, 2024. There can be no

assurance that additional funding, if needed, would be available to the Company on acceptable terms, or at all. These factors raise substantial

doubt regarding our ability to continue as a going concern. The consolidated financial statements do not include any adjustments that

may result should the Company be unable to continue as a going concern.

Nasdaq Compliance

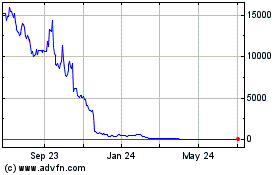

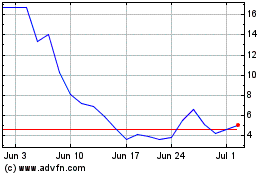

On July 5, 2023, the Company received a notice

from Nasdaq that it was not in compliance with Nasdaq’s Listing Rule 5550(b)(2), which requires that it maintain a market value

of listed securities (“MVLS”) of $35 million. MVLS is calculated by multiplying the Company’s shares outstanding by

the closing price of its common stock. On December 19, 2023, the Company received a notice from Nasdaq that it was not in compliance with

Nasdaq’s Listing Rule 5550(a)(2), as the minimum bid price of its common stock had been below $1.00 per share for 30 consecutive

business days.

On December 26, 2023, the Company was notified

by Nasdaq that it is not in compliance with Nasdaq’s Listing Rule 5810(c)(3)(A)(iii) as the closing bid price of our common stock

had been below $0.10 for ten consecutive trading days from December 11, 2023 through December 22, 2023 and was subject to delisting on

January 2, 2024. On January 4, 2024, the Company received notice from Nasdaq that it did not meet the MVLS requirement and it was subject

to delisting. The Company submitted a hearing request to Nasdaq’s Hearings Department for both of these matters, which stayed the

suspension of the Company’s common stock. The Company participated in a hearing with Nasdaq’s Hearings Department on March

26, 2024 and on April 2, 2024, they informed the Company that the Company has until June 24, 2024 to regain compliance with the above

listing rules.

On June 11, 2024, the Company received a notice

from the Nasdaq that the Company no longer met the minimum 500,000 publicly held shares requirement for Nasdaq and, as such, it no longer

complied with Listing Rule 5550(a)(4). Furthermore, the notice indicated that this matter would serve as an additional basis for delisting

the Company’s securities from Nasdaq, that the Panel would consider this matter in their decision regarding the Company’s

continued listing on Nasdaq, and that the Company should present its views with respect to this additional deficiency to the Panel in

writing no later than June 18, 2024. On June 18, 2024, the Company submitted a letter to Nasdaq notifying them that the Company was in

compliance with Listing Rule 5550(a)(4) due to the issuance of additional shares of common stock from the conversion of Preferred Stock

to common stock by certain Preferred Stockholders.

On July 17, 2024, Nasdaq informed the Company

that it had regained compliance with the above listing rules but will continue to be monitored for ongoing compliance.

Employment Matters

On January 13, 2024, the Company’s Chief

Executive Officer (“CEO”), Jordan Davis, resigned his employment with the Company effective February 2, 2024. The Company

entered into a 30-day consulting agreement with Mr. Davis and paid him $12,500.

On January 30, 2024, John Kim, an independent

board member of the Company signed an employment agreement with the Company to become the CEO effective February 3, 2024. Mr. Kim’s

salary is $800,000 and he has an annual bonus of $250,000. Mr. Kim will also receive 5% of the gross proceeds or other consideration if

the Company completes a sale of substantially all of its assets or otherwise enters into a change of control transaction. Mr. Kim is also

entitled to an equity award equal to 10% of the Company’s fully diluted equity, subject to stockholder approval of an increase in

the shares available under the 2021 Plan or a new equity plan.

On January 30, 2024, Greg Endo, the Company’s

Chief Financial Officer, signed a new employment agreement with the Company. Mr. Endo’s salary will be increased to $300,000 and

he will have an annual bonus of up to 50% of his salary as determined by the compensation committee of the board of directors. Mr. Endo

has agreed to a reduction in the salary to $238,500 through the end of 2024. Mr. Endo will also receive 5% of the gross proceeds or other

consideration if the Company completes a sale of substantially all of its assets or otherwise enters into a change of control transaction.

Mr. Endo is also entitled to an equity award equal to 4% of the Company’s fully diluted equity, subject to stockholder approval

of an increase in the shares available under the 2021 Plan or a new equity plan.

On February 23, 2024, Katherine Hale resigned

her position as Chief Marketing Officer. Ms. Hale was provided a severance amount of $112,500 which was paid out over three monthly installments

beginning in March 2024.

Impact of Russia and Ukraine Conflict

On February 24, 2022, Russia invaded Ukraine. The conflict between Russia and Ukraine could impact the availability of nickel, an element

used in the production of lithium ion cells used in batteries that power our vehicles. The shortage of these cells could have an impact

on our ability to produce vehicles to meet our customers’ demands. In addition, sanctions against Russia could impact the price

of elements, including nickel, that are used in the production of batteries which would result in higher costs to produce our vehicles.

These sanctions have also impacted the U.S. and global economies and could result in an economic recession which could cause a broader

disruption to the Company’s supply chain and distribution network and customer demand for our products.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Interim Unaudited Financial Information

The accompanying interim consolidated financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.

GAAP”) and should be read in conjunction with the financial statements and notes thereto included in our Annual Report on Form 10-K

for the year ended December 31, 2023, which was filed with the Securities and Exchange Commission ("SEC") on March 28, 2024.

Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with U.S.

GAAP have been omitted from this report on Form 10-Q pursuant to the rules and regulations of the SEC.

Results for the interim periods in this report

are not necessarily indicative of future financial results and have not been audited by our independent registered public accounting firm.

In the opinion of management, the accompanying unaudited consolidated financial statements include all adjustments necessary to present

fairly our interim consolidated financial statements as of June 30, 2024, and for the three and six months ended June 30, 2024 and 2023.

These adjustments are of a normal recurring nature and consistent with the adjustments recorded to prepare the annual audited consolidated

financial statements as of December 31, 2023.

Basis of Presentation

The accompanying consolidated financial statements

include the accounts of the Company and its wholly owned subsidiary. All intercompany accounts, transactions and balances have been eliminated

in consolidation.

As discussed in Note 10, the Company

completed a reverse 1

for 100 stock split on June 6, 2024, a reverse 1 for 45 stock split on February 2, 2024 and a reverse 1 for 5 stock split on October 13, 2023. All share and per share amounts

have been adjusted to reflect the impact of these reverse stock splits.

Use of Estimates

The preparation of the financial statements in

conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of any contingent assets and liabilities as of the dates of the financial statements and the reported amounts of expenses

during the reporting periods.

Making estimates requires management to exercise

judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed

at the date of the financial statements, which management considered in formulating its estimate, could change in the near term due to

one or more future confirming events. Accordingly, actual results could differ significantly from those estimates.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include short-term investments

with original maturities of 90 days or less at the date of purchase. The recorded value of our cash and cash equivalents approximates

their fair value. There were no cash equivalents as of June 30, 2024 or December 31, 2023. Restricted cash includes cash restricted as

collateral for the Company’s corporate credit cards.

Revenue Recognition

For sales to dealers or distributors, revenue

is recognized when transfer of control of the product is made as there is no acceptance period or right of return. Revenue is measured

as the amount of consideration the Company expects to receive in exchange for transferring control of vehicles, parts, and accessories.

Beginning in February 2023 the Company began selling the Brat E-Bike and Volcon Youth motorcycles directly to consumers in addition to

dealers. Revenue for direct to consumer sales is recognized when transfer of control of the product is made to the consumer.

Consideration that is received in advance of the

transfer of goods is recorded as customer deposits until delivery has occurred or the customer cancels their order, and the consideration

is returned to the customer. Sales and other taxes the Company collects concurrent with revenue-producing activities are excluded from

revenue. The Company’s sales do not presently have a financing component.

Sales promotions and incentives. The Company

provides for estimated sales promotions and incentives, which are recognized as a component of sales in measuring the amount of consideration

the Company expects to receive in exchange for transferring goods or providing services. Examples of sales promotion and incentive programs

include rebates, distributor fees, dealer co-op advertising and volume incentives. Sales promotions and incentives are estimated based

on contractual requirements. The Company records these amounts as a liability in the balance sheet until they are ultimately paid. Adjustments

to sales promotions and incentives accruals are made as actual usage becomes known to properly estimate the amounts necessary to generate

consumer demand based on market conditions as of the balance sheet date.

Shipping and handling charges and costs. The

Company records shipping and handling amounts charged to the customer and related shipping costs as a component of cost of goods sold

when control has transferred to the customer.

Product Warranties

The Company provides a one-year warranty on vehicles,

and a two-year warranty on the battery pack. The Company accrues warranty reserves at the time revenue is recognized. Warranty reserves

include the Company’s best estimate of the projected cost to repair or to replace any items under warranty, based on actual warranty

experience as it becomes available and other known factors that may impact the evaluation of historical data. The Company reviews its

reserves quarterly to ensure that the accruals are adequate to meet expected future warranty obligations and will adjust estimates as

needed. Factors that could have an impact on the warranty reserve include the following: changes in manufacturing quality, shifts in product

mix, changes in warranty coverage periods, product recalls and changes in sales volume. Warranty expense is recorded as a component of

cost of goods sold in the statement of operations and is recognized as a current liability.

Inventory and Inventory Deposits

Inventories and prepaid inventory deposits are

stated at the lower of cost (first-in, first-out method) or net realizable value.

Certain vendors require the Company to pay an

upfront deposit before they manufacture and ship the Company’s vehicles, parts or accessories. These payments are classified as

prepaid inventory deposits on the balance sheet until title and risk of loss transfers to the Company, at which time they are classified

as inventory.

Raw materials inventory costs include the cost

of parts, including duties, tariffs and shipping. Work in process and finished goods include the cost of parts, labor and manufacturing

overhead costs associated with the assembly of the vehicle. Finished goods also include accessories for the vehicle and branded merchandise

such as hats and shirts.

Through August 2022 the Company assembled the

Grunt motorcycle in a leased facility. The Company ceased assembly operations at the end of August and outsourced the assembly of the

Grunt to a third party.

The Company transferred substantially all of its raw materials and

work-in-process inventory for the Grunt to the third party manufacturer in the second quarter of 2023. Title to the inventory transferred

to the third party manufacturer and it provides the Company with a credit towards future purchases of the Grunt EVO.

Property and Equipment

Property and equipment are valued at cost. Additions

are capitalized and maintenance and repairs are charged to expense as incurred. Gains and losses on dispositions of equipment are reflected

in operations. Depreciation is recorded using the straight-line method over the estimated useful lives of the assets as follows:

| Schedule of estimated useful lives of the

assets |

|

|

| Category |

|

Estimated

Useful Lives |

| Machinery, tooling and equipment |

|

3-7 years |

| Vehicles |

|

5 years |

| Internal use manufactured vehicles |

|

1 year |

| Furniture & Fixtures |

|

5 years |

| Computers |

|

3 years |

Leasehold improvements are depreciated over the

shorter period of their estimated useful life or term of the lease.

Long-Lived Assets

The Company’s long-lived assets are reviewed

for impairment whenever events or changes in circumstances indicate that the historical carrying cost value of an asset may no longer

be appropriate. The Company assesses recoverability of the asset by comparing the undiscounted future net cash flows expected to result

from the asset to the carrying value. If the carrying value exceeds the undiscounted future net cash flows of the asset, an impairment

loss is measured and recognized. An impairment loss is measured as the difference between the net book value and the fair value of the

long-lived asset.

Leases

Right-of-use (“ROU”) assets represent

the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation

to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the lease commencement date based on

the estimated present value of lease payments over the lease term. Leases with an initial term of 12 months or less are not recorded on

the balance sheet; the Company recognizes lease expenses for these leases on a straight-line basis over the lease term. The Company does

not separate non-lease components from the lease components to which they relate, and instead accounts for each separate lease and non-lease

component associated with that lease component as a single lease component.

ASC 842 defines initial direct costs as only the

incremental costs of signing a lease. Initial direct costs related to leasing that are not incremental are expensed as general and administrative

expenses in our statements of operations.

The Company’s operating lease agreements

primarily consist of leased real estate and are included within ROU assets – operating leases and ROU lease liabilities –

operating leases on the balance sheets. The Company’s lease agreements may include options to extend the lease, which are not included

in minimum lease payments unless they are reasonably certain to be exercised at lease commencement. The Company's leases do not provide

an implicit rate, the Company uses its estimated incremental borrowing rate based on the information available at commencement date in

determining the present value of lease payments.

Research and Development Expenses

The Company records research and development expenses

in the period in which they are incurred as a component of product development expenses.

Income Taxes

Deferred taxes are determined utilizing the “asset

and liability” method, whereby deferred tax asset and liability account balances are determined based on the differences between

financial reporting and the tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in

effect when the differences are expected to reverse. The Company provides a valuation allowance, when it's more likely than not that deferred

tax assets will not be realized in the foreseeable future. Deferred tax liabilities and assets are classified as current or non-current

based on the underlying asset or liability or if not directly related to an asset or liability based on the expected reversal dates of

the specific temporary differences.

Fair Value of Financial Instruments

ASC Topic 820 Fair Value Measurements and Disclosures (“ASC Topic 820”) provides a framework for measuring fair value

in accordance with generally accepted accounting principles.

ASC Topic 820 defines fair value

as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. ASC Topic 820 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions

developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market

participant assumptions developed based on the best information available in the circumstances (unobservable inputs).

The fair value hierarchy consists

of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC Topic 820 are

described as follows:

| |

· |

Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that are accessible at the measurement date. |

| |

· |

Level 2 — Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| |

· |

Level 3 — Inputs that are unobservable for the asset or liability. |

The following section describes

the valuation methodologies that the Company used to measure different financial instruments at fair value.

Debt

The fair value of the Company’s

debt, which approximated the carrying value of the Company’s debt as of June 30, 2024 and December 31, 2023. Factors that the Company

considered when estimating the fair value of its debt included market conditions, and term of the debt. The level of the debt would be

considered as Level 2.

The Company relies on the guidance

provided by ASC Topic 480, Distinguishing Liabilities from Equity, to classify certain convertible instruments. The Company first

determines whether a financial instrument should be classified as a liability. The Company will determine the liability classification

if the financial instrument is mandatorily redeemable, or if the financial instrument, other than outstanding shares, embodies a conditional

obligation that the Company must or may settle by issuing a variable number of its equity shares.

The Company accounts for derivative

instruments in accordance with ASC Topic 815, Derivatives and Hedging (“ASC Topic 815”), and all derivative instruments

are reflected as either assets or liabilities at fair value on the consolidated balance sheets. The Company uses estimates of fair value

to value its derivative instruments. Fair value is defined as the price to sell an asset or transfer a liability in an orderly transaction

between able and willing market participants. In general, the Company’s policy in estimating fair values is to first look at observable

market prices for identical assets and liabilities in active markets, where available. When these are not available, other inputs are

used to model fair value such as prices of similar instruments, yield curves, volatilities, prepayment speeds, default rates and credit

spreads, relying first on observable data from active markets. Depending on the availability of observable inputs and prices, different

valuation models could produce materially different fair value estimates. The values presented may not represent future fair values and

may not be realizable. The Company categorizes its fair value estimates in accordance with ASC Topic 820, based on the hierarchical framework

associated with the three levels or price transparency utilized in measuring financial instruments at fair value as discussed above.

Once the Company determines that a financial instrument

should not be classified as a liability, the Company determines whether the financial instrument should be presented between the liability

section and the equity section of the balance sheet (“temporary equity”). The Company will determine temporary equity classification

if the redemption of the financial instrument is outside the control of the Company (i.e. at the option of the holder). Otherwise, the

Company accounts for the financial instrument as permanent equity.

Initial Measurement

The Company records its financial

instruments classified as a liability, temporary equity or permanent equity at issuance at the fair value, or cash received.

Subsequent Measurement -

Financial instruments classified as liabilities

The Company records the fair

value of its financial instruments classified as liabilities at each subsequent measurement date. The changes in fair value of its financial

instruments classified as liabilities are recorded as other expense/income. The Monte Carlo simulation is used to determine the fair value

of derivatives for instruments with embedded conversion features and for free standing warrants as discussed further in Note 8.

Additional Disclosures Regarding Fair Value

Measurements

The carrying value of cash,

accounts receivable, inventory, other assets, and accounts payable and accrued expenses approximate their fair value due to the short-term

maturity of those items.

Warrant Liabilities and Convertible Liabilities

The fair value of the derivative liabilities and warrant liabilities

is classified as Level 3 within the Company’s fair value hierarchy. Refer to Note 8, Derivative Instruments, for further discussion

of the measurement of fair value of the derivatives and their underlying assumptions.

Stock-Based Compensation

The Company has a stock-based incentive award

plan for employees, consultants and directors. The Company measures stock-based compensation at the estimated fair value on the grant

date and recognizes the amortization of stock-based compensation expense on a straight-line basis over the requisite service period, or

when it is probable criteria will be achieved for performance-based awards. Fair value is determined based on assumptions related to the

fair value of the Company common stock, stock volatility and risk-free rate of return. The Company has elected to recognize forfeitures

when realized.

Concentration Risk

The Company outsources certain portions of product

design and development for its vehicles to third parties. In addition, the Company has outsourced the manufacturing of all of its vehicles

to third party manufacturers, including one manufacturer for two of its vehicles, the Stag and Grunt EVO, and this third party is also

performing product design and development services on the Stag.

One supplier provides the battery and drivetrain

components for the Company’s utility terrain vehicle, the Stag. The components are critical to the operation of the Stag. The Company

also sources some of the other components from third party suppliers and the third party manufacturer sources other components from third

party suppliers or fabricates them from materials sourced from third parties.

On January 8, 2024, the Company notified the manufacturer

of the Volcon Youth motorcycles that it was terminating the co-branding and distribution agreement with them due to lower than anticipated

sales of these units. In March 2024, the Company agreed to allow the manufacturer to keep all fully paid for units manufactured and held

by the manufacturer, cease selling the Volcon Youth Motorcycles as of June 30, 2024, and pay cash of $2,070,000 which includes a payment

of $370,000 in March 2024 and $100,000 monthly for seventeen months starting April 2024. The settlement was recorded in the financial

statements for the year ended December 31, 2023. The balance of the liability as of June 30, 2024, is $1,400,000. As discussed below, the

Company has written down this inventory to its estimated net realizable value.

In June 2024, the Company was notified by

the manufacturer of a suspension component for the Stag that due to the Company’s initial production forecast provided by the

third party manufacturer of the Stag, the vendor had acquired raw materials to fulfill several months’ worth, of this component

needed for the forecast. Although the Company had provided updated forecasts to the third party manufacturer of the Stag, the

revised forecasts were not provided timely to this vendor. The Company entered into an agreement to pay for the excess raw materials

by making weekly payments in the amount of $15,704

over an eighteen-month period once the Company can validate the inventory quantities and amounts paid by the vendor, which is

expected to be completed by August 2024. The Company recorded a liability of $633,936

and $483,493

in vendor settlements current and long-term, respectively, as of June 30, 2024 and an expense of $1,117,429

in costs of goods sold for the three and six months ended June 30, 2024.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements

are issued by the Financial Accounting Standard Board or other standard setting bodies that the Company adopts as of the specified effective

date. The Company does not believe that the impact of recently issued standards that are not yet effective will have a material impact

on the Company’s financial position or results of operations upon adoption.

NOTE 3 – INVENTORY

Inventory consists of the following:

| Schedule of inventory | |

| | |

| |

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Raw materials | |

$ | 7,557,689 | | |

$ | 6,770,892 | |

| Finished goods | |

| 2,028,639 | | |

| 2,202,242 | |

| Total inventory | |

$ | 9,586,328 | | |

$ | 8,973,134 | |

As of June 30, 2024, the Company has purchase

commitments for future payments due for inventory of $352,004.

NOTE 4 – LONG – LIVED ASSETS

Property and Equipment

Property and equipment consist of the following:

| Schedule of property and equipment | |

| | |

| |

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Machinery, tooling and equipment | |

$ | 282,232 | | |

$ | 1,015,568 | |

| Vehicles | |

| 193,670 | | |

| 213,528 | |

| Internal use manufactured vehicles | |

| 195,559 | | |

| 22,906 | |

| Fixtures & furniture | |

| 90,768 | | |

| 90,768 | |

| Leasehold improvements | |

| 44,663 | | |

| 44,663 | |

| Computers | |

| 220,588 | | |

| 221,571 | |

| | |

| 1,027,480 | | |

| 1,609,004 | |

| Less: Accumulated depreciation | |

| (402,314 | ) | |

| (350,397 | ) |

| Total property and equipment | |

$ | 625,166 | | |

$ | 1,258,607 | |

Depreciation expense for the three and six months

ended June 30, 2024 was $99,517 and $197,237, respectively. Depreciation expense for the three and six months ended June 30, 2023 was

$53,330 and $103,718, respectively.

NOTE 5 – NOTES PAYABLE

In March 2023, the Company entered into two

financing arrangements to purchase two vehicles. The total principal of these arrangements is $96,024

with interest rates of 11.44%

and 8.63%

and monthly payments totaling $1,923

are due through February 2028 and $908