false0001061027Viracta Therapeutics, Inc.00010610272025-02-032025-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 03, 2025 |

VIRACTA THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-51531 |

94-3295878 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2533 S. Coast Hwy. 101, Suite 210 |

|

Cardiff, California |

|

92007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 400-8470 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

VIRX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On February 3, 2025, the Board of Directors (the “Board”) of Viracta Therapeutics, Inc. (the “Company”) approved the termination of its employees, to be effective at 5:00 p.m. Pacific time on February 5, 2025 (the “Effective Time”), in connection with the planned wind down of the Company’s operations. The Company expects to incur one-time charges and cash expenditures associated with the workforce reduction of approximately $0.1 million, primarily related to employee wages and severance payments, benefits and related termination costs. The Company expects that these charges and costs will be incurred during the quarter ending March 31, 2025.

The estimates of charges, costs and expenses that the Company expects to incur in connection with the workforce reduction are subject to a number of assumptions and actual results may differ materially from estimates.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Directors

On February 3, 2025, in connection with the planned wind down of the Company’s operations, Roger Pomerantz, M.D., Flavia Borellini, Ph.D., Thomas E. Darcy, CPA, Ivor Royston, M.D., and Mark Rothera, representing all of the Company’s current Board members, each notified the Company of their respective resignations as members of the Board and all committees thereof, in each case effective as of the Effective Time. None of these resignations resulted from any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Departure of Officers

Also on February 3, 2025, it was determined that each of Mark Rothera, President and Chief Executive Officer, Michael Faerm, Chief Financial Officer, and Darrel P. Cohen M.D., Ph.D., Chief Medical Officer, would cease serving in their respective officer positions as of the Effective Time. In connection with the cessation of employment services, the Company expects to enter into post-employment consulting arrangements with each of such departing officers, on terms and conditions to be agreed upon between the Company and each of the respective individuals.

Appointment of Director and Officer

Also on February 3, 2025, and effective as of the Effective Time, the Board appointed Craig R. Jalbert, age 63, as the Company’s Chief Executive Officer, President, Chief Financial Officer, Treasurer and Corporate Secretary, and sole member of the Board. In such capacity, Mr. Jalbert will serve as the Company’s principal executive officer, principal financial officer and principal accounting officer. Mr. Jalbert’s term as director shall expire upon the election and qualification of his successor or upon his earlier resignation, death or removal.

Mr. Jalbert has served as a principal of the Foxborough, Massachusetts accounting firm of Verdolino & Lowey, P.C. since 1987. For over 30 years he has focused his practice in distressed businesses and has served, and continues to serve, in the capacities of officer and director for numerous firms in their wind-down phases.

As consideration for his services as an officer and director of the Company, Mr. Jalbert will be compensated in the amount of $50,000 per year for a period of three years. In connection with this management transition, the Board terminated the Company’s Outside Director Compensation Policy.

There are no family relationships between Mr. Jalbert and any director or executive officer of the Company, and Mr. Jalbert has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 8.01. Other Matters.

On February 5, 2025, the Company issued a press release announcing its plans to wind down its operations which is attached as Exhibit 99.1 to this current report and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

|

|

|

Date: |

February 5, 2025 |

By: |

/s/ Michael Faerm |

|

|

|

Michael Faerm

Chief Financial Officer |

Viracta Therapeutics Announces Wind Down of Operations

SAN DIEGO, February 5, 2025 – Viracta Therapeutics, Inc. (Nasdaq: VIRX), a clinical-stage precision oncology company focused on the treatment and prevention of virus-associated cancers that impact patients worldwide, announced today that the Company has terminated its employees and will wind down operations. The company is also exploring potential strategic alternatives for its development programs.

The board of directors appointed Craig R. Jalbert, age 63, as the Company’s CEO, President, CFO, Treasurer and Corporate Secretary, and sole member of the board to implement the wind down. Mr. Jalbert has served as a principal of the Foxborough, Massachusetts accounting firm of Verdolino & Lowey, P.C. since 1987. For over 30 years he has focused his practice in distressed businesses and has served, and continues to serve, in the capacities of officer and director for numerous firms in their wind-down phases.

Forward-Looking Statements

This communication contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding the Company’s plans to wind down operations and explore potential strategic alternatives. Risks and uncertainties related to Viracta that may cause actual results to differ materially from those expressed or implied in any forward-looking statement include, but are not limited to, the timing and prospects of the wind down process and the likelihood and viability of any potential strategic alternatives.

Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption "Risk Factors" and elsewhere in Viracta's reports and other documents that Viracta has filed, or will file, with the SEC from time to time and available at www.sec.gov.

The forward-looking statements included in this communication are made only as of the date hereof. Viracta assumes no obligation and does not intend to update these forward-looking statements, except as required by law or applicable regulation.

Contact Information:

Verdolino & Lowey, P.C.

124 Washington Street, Suite 101

Foxboro, MA 02035

Phone: 508-543-1720

Viracta@vlpc.com

v3.25.0.1

Document And Entity Information

|

Feb. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity Registrant Name |

Viracta Therapeutics, Inc.

|

| Entity Central Index Key |

0001061027

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-51531

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3295878

|

| Entity Address, Address Line One |

2533 S. Coast Hwy. 101, Suite 210

|

| Entity Address, City or Town |

Cardiff

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92007

|

| City Area Code |

(858)

|

| Local Phone Number |

400-8470

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

VIRX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

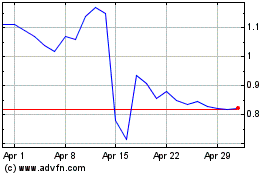

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Mar 2024 to Mar 2025