false0001061027Viracta Therapeutics, Inc.00010610272025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 23, 2025 |

VIRACTA THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-51531 |

94-3295878 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2533 S. Coast Hwy. 101, Suite 210 |

|

Cardiff, California |

|

92007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 400-8470 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

VIRX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On January 23, 2025, Viracta Therapeutics, Inc. (the “Company”) entered into a Forbearance and Third Amendment (the “Third Amendment”) to the Loan and Security Agreement (the “Loan Agreement”), dated November 4, 2021, by and among the Company, Viracta Subsidiary, Inc., Oxford Finance LLC (“Oxford”), as collateral agent (“Collateral Agent”), and the Lenders (as defined in the Loan Agreement) thereunder, including Silicon Valley Bank, a division of First-Citizens Bank and Trust Company, and Oxford in its capacity as a Lender, as previously amended. The Third Amendment provides for the application of Company cash towards the outstanding obligations under the Loan Agreement, a security interest in the Company’s intellectual property, and a covenant that the Company shall limit its expenditures in compliance with an agreed upon budget between the Company and the Lenders, in each case in exchange for forbearance by the Collateral Agent and Lenders from exercising their rights and remedies against the Company in connection with the events of default that the Lenders have asserted under the Loan Agreement, as previously disclosed. Such forbearance shall continue until the earliest to occur of (a) the failure of the Company to comply with any of the terms or undertakings of the Third Amendment, (b) the occurrence of any other event of default other than previously identified events of default and (c) February 5, 2025. Under the terms of the Third Amendment, the Company provided a paydown payment to the Lenders in the amount of approximately $3.7 million towards the outstanding obligations under the Loan Agreement, in addition to a prior application of approximately $7.7 million of Company cash towards the obligations under the Loan Agreement, leaving a remaining balance of approximately $3.5 million in outstanding principal under the Loan Agreement.

The foregoing description of the Third Amendment is not complete and each is qualified in its entirety by reference to the full text of such amendment, a copy of which will be filed is filed as Exhibit 10.1 hereto.

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The information set forth above under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

Exhibit Number |

|

Description |

10.1+ |

|

Forbearance and Third Amendment to Loan and Security Agreement, dated January 23, 2025, by and among the Company, Oxford Finance LLC, and Silicon Valley Bank, a division of First-Citizens Bank and Trust Company. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

+ Portions of the exhibit have been omitted pursuant to Item 601(b)(10) of Regulation S-K. The Company agrees to furnish to the Securities and Exchange Commission a copy of any omitted portions of the exhibit upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

|

|

|

Date: |

January 24, 2025 |

By: |

/s/ Michael Faerm |

|

|

|

Michael Faerm

Chief Financial Officer |

Exhibit 10.1

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

FORBEARANCE AND THIRD AMENDMENT TO LOAN AND SECURITY AGREEMENT

THIS FORBEARANCE AND THIRD AMENDMENT TO LOAN AND SECURITY AGREEMENT (this “Amendment”) is entered into as of January 23, 2025, by and among OXFORD FINANCE LLC, a Delaware limited liability company with an office located at 115 South Union Street, Suite 300, Alexandria, Virginia 22314 (“Oxford”), as collateral agent (in such capacity, “Collateral Agent”), the Lenders listed on Schedule 1.1 thereof or otherwise a party thereto from time to time including Oxford in its capacity as a Lender, and SILICON VALLEY BANK, a division of First-Citizens Bank & Trust Company with an office located at 3003 Tasman Drive, Santa Clara, CA 95054 (“Bank” or “SVB”) (each a “Lender” and collectively, the “Lenders”), Viracta Therapeutics, Inc., a Delaware corporation, and Viracta Subsidiary, Inc., a Delaware corporation, each with offices located at 2533 S Coast Hwy 101, Suite 210, Cardiff, CA 92007 (individually and collectively, jointly and severally, “Borrower”).

A.Collateral Agent, Borrower and Lenders have entered into that certain Loan and Security Agreement dated as of November 4, 2021, as amended by that certain First Amendment to Loan and Security Agreement dated as of August 26, 2022, and that certain Second Amendment to Loan and Security Agreement dated as of March 1, 2024 (as may be further amended, supplemented or otherwise modified from time to time, the “Loan Agreement”) pursuant to which Lenders have provided to Borrower certain loans in accordance with the terms and conditions thereof.

B.As set forth in that certain Notice of Events of Default, Acceleration of Obligations and Demand for Repayment from Collateral Agent to Borrower dated as of December 20, 2024 (the “December 20, 2024 Notice”), certain Specified Defaults (as such term is defined in the December 20, 2024 Notice, the “Existing Events of Default”) have occurred and are continuing under the Loan Documents.

C.Collateral Agent accelerated the Obligations pursuant to the December 20, 2024 Notice and prior to the Third Amendment Effective Date, has applied $7,706,993.82 to the outstanding Obligations (the “Initial Accelerated Paydown”), leaving an unpaid principal balance of $7,199,070.08, together with all other Obligations that are due and payable, including accrued but unpaid interest, the Final Payment, the Non-Utilization Fee (if any), plus all other outstanding Obligations that are then due and payable, including Lenders’ Expenses and interest at the Default Rate with respect to any past due amounts.

D.As a direct result of the occurrence of the Existing Events of Default, the Collateral and prospects for repayment of the outstanding Obligations have been materially impaired, greatly enhancing Lenders’ risk. Borrower acknowledges that the existence of the Existing Events of Default permit Collateral Agent and Required Lenders to exercise all rights and remedies available to them under applicable law and the Loan Documents, including by foreclosing on the Collateral and commencing litigation to collect on the Obligations.

E.Notwithstanding the foregoing, Borrower has requested that, rather than continuing to exercise the remedies available to them at the present time, Collateral Agent and Required Lenders, subject to the terms of this Amendment, refrain from exercising their remedies in connection with the Existing Events of Default during the Forbearance Period (as defined below). To partially mitigate the risk to Lenders and Collateral Agent of electing to refrain from exercising their remedies in connection with the Existing Events of Default during the Forbearance Period (as defined below), Borrower has agreed to grant to Collateral Agent, for the ratable benefit of Lenders, a first priority security interest in the Intellectual Property.

F.Although Collateral Agent and Required Lenders are not under any obligation to do so, Collateral Agent and Required Lenders are willing to forbear from exercising their rights and remedies against Borrower in connection with the Existing Events of Default during the Forbearance Period on the terms and conditions set forth in this Amendment, so long as Borrower complies with the terms, covenants and conditions set forth in this Amendment.

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

Agreement

NOW, THEREFORE, in consideration of the promises, covenants and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Borrower, the Required Lenders and Collateral Agent hereby agree as follows:

1.Definitions. Capitalized terms used but not defined in this Amendment shall have the meanings given to them in the Loan Agreement.

2.Forbearance. Subject to all the terms and conditions set forth herein, Collateral Agent and Lenders shall forbear from filing any legal action or instituting or enforcing any rights and remedies they may have against Borrower in connection with the Existing Events of Default immediately after completion of the Initial Accelerated Paydown (the “Forbearance Effective Date”) until the date which is the earliest to occur of (a) the failure after the date hereof of Borrower to comply with any of the terms or undertakings of this Agreement, (b) the occurrence after the date hereof of any other Event of Default (other than the Existing Events of Default) and (c) February 5, 2025 (the earliest such date, the “Forbearance Termination Date”). This Agreement does not constitute a waiver or release by Collateral Agent and Lenders of any obligations of Borrower pursuant to the Loan Documents of the Existing Events of Default, any other existing Event of Default or any Event of Default which may arise in the future after the date of execution of this Agreement. If Borrower does not comply with the terms of this Agreement, Collateral Agent and Lenders shall have no further obligations under this Agreement and shall be permitted to exercise at such time any rights and remedies against Borrower as they deem appropriate in their sole and absolute discretion. Borrower understands that Collateral Agent and Lenders have made no commitment and are under no obligation whatsoever to grant any additional extensions of time at the end of the Forbearance Period. The time period between the Forbearance Effective Date and the Forbearance Termination Date is referred to herein as the “Forbearance Period.”

3.Limitation of Forbearance.

3.1The forbearance set forth in Section 2 above is effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right or remedy which Collateral Agent or Lenders may now have or may have in the future (or any obligations which Borrower may now have or may have in the future) under or in connection with any Loan Document.

3.2This Agreement shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents are hereby ratified and confirmed and shall remain in full force and effect.

4.Amendments to Loan Agreement.

4.1Definitions. The following defined terms in Section 13.1 of the Loan Agreement are hereby added as follows:

“Budget” means the budget attached as Exhibit B to the Third Amendment.

“IP Agreement” is that certain Intellectual Property Security Agreement entered into by and between Borrower and Collateral Agent dated as of the Third Amendment Effective Date, as such may be amended from time to time.

“Third Amendment” means that certain Forbearance and Third Amendment to Loan and Security Agreement, dated as of the Third Amendment Effective Date, by and among Collateral Agent, Lenders and Borrower.

“Third Amendment Effective Date” means January 23, 2025.

4.2Definitions. The following defined term in Section 13.1 of the Loan Agreement is hereby amended and restated as follows:

2

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

“Loan Documents” are, collectively, this Agreement, the Perfection Certificates, each Compliance Certificate, each Disbursement Letter, each Loan Payment/Advance Request Form and any Bank Services Agreement, the Post Closing Letter, the IP Agreement, any subordination agreements, any note, or notes or guaranties executed by Borrower or any Guarantor in favor of Collateral Agent or the Lenders, and any other present or future agreement entered into by Borrower or any Guarantor for the benefit of the Lenders and Collateral Agent in connection with this Agreement; all as amended, restated, or otherwise modified.

4.3Section 5.2 (Collateral). Section 5.2(d) is hereby amended and restated in its entirety as follows:

“(d) Borrower and each of its Subsidiaries is the owner or licensee of the Intellectual Property each respectively purports to own, free and clear of all Liens other than Permitted Liens. As of the Third Amendment Effective Date, (i) each of Borrower’s and its Subsidiaries’ material Patents is valid and enforceable and no material part of Borrower’s or its Subsidiaries’ Intellectual Property has been judged invalid or unenforceable, in whole or in part, and (ii) to the best of Borrower’s knowledge, no claim in writing against Borrower or any of its Subsidiaries has been made that any part of the Intellectual Property or any practice by Borrower or its Subsidiaries violates the rights of any third party except to the extent such claim could not reasonably be expected to have a Material Adverse Change. Except as noted on the Perfection Certificates or as disclosed to Bank in writing pursuant to Section 6.7(b) hereof, Borrower is not a party to, nor is it bound by, any Restricted License.”

4.4Section 6.2 (Financial Statements, Reports, Certificates). Section 6.2(a)(vii) is hereby amended and restated in its entirety as follows:

“(vii) prompt notice of: (1) from and after the Third Amendment Effective Date, (A) any material change in the composition of the Intellectual Property, (B) the registration of any copyright, including any subsequent ownership right of Borrower or any of its Subsidiaries in or to any copyright, patent or trademark, including a copy of any such registration, and (2) other than the Existing Events of Default (as defined in the Third Amendment), any event that could reasonably be expected to materially and adversely affect the value of the Intellectual Property; and”

4.5Section 6.4 (Taxes; Pensions). Section 6.4 hereby amended and restated in its entirety as follows:

“6.4 Taxes; Pensions. Timely file and require each of its Subsidiaries to timely file, all required tax returns and reports and, subject to Section 6.14, timely pay, and require each of its Subsidiaries to timely file, all foreign, federal, state, and local taxes, assessments, deposits and contributions owed by Borrower or its Subsidiaries, except to the extent permitted under Section 5.8 hereof or except to the extent prohibited under Section 6.14 hereof, and shall deliver to Lenders, promptly on demand, appropriate certificates attesting to such payments, and subject to Section 6.14 hereof, pay all amounts necessary to fund all present pension, profit sharing and deferred compensation plans in accordance with the terms of such plans.”

4.6Section 6.5 (Insurance). The first sentence of Section 6.5 is hereby amended and restated in its entirety as follows:

“Subject to Section 6.14, keep Borrower’s and its Subsidiaries’ business and the Collateral insured for risks and in amounts standard for companies in Borrower’s and its Subsidiaries’ industry and location and as Collateral Agent may reasonably request.”

4.7Section 6.7 (Protection of Intellectual Property Rights). Section 6.7(a) is hereby amended and restated in its entirety as follows:

“(a) in each case subject to Section 6.14: (i) protect, defend and maintain the validity and enforceability of its Intellectual Property that is material to Borrower’s business; (ii) promptly advise Collateral Agent in writing of material infringement by a third party of its Intellectual Property; and (iii) not allow any Intellectual Property material to Borrower’s business to be abandoned, forfeited

3

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

or dedicated to the public without Collateral Agent’s prior written consent. From and after the Third Amendment Effective Date, if Borrower or any of its Subsidiaries (i) obtains any patent, registered trademark or servicemark, registered copyright, registered mask work, or any pending application for any of the foregoing, whether as owner, licensee or otherwise, or (ii) applies for any patent or the registration of any trademark or servicemark, then Borrower or such Subsidiary shall substantially contemporaneously provide written notice thereof to Collateral Agent and each Lender and shall execute such intellectual property security agreements and other documents and take such other actions as Collateral Agent shall reasonably request in its good faith business judgment to perfect and maintain a first priority perfected security interest in favor of Collateral Agent, for the ratable benefit of the Lenders, in such property. The Collateral may be subject to Permitted Liens. If Borrower or any of its Subsidiaries decides to register any copyrights or mask works in the United States Copyright Office, Borrower or such Subsidiary shall: (x) provide Collateral Agent and each Lender with at least fifteen (15) days prior written notice of Borrower’s or such Subsidiary’s intent to register such copyrights or mask works together with a copy of the application it intends to file with the United States Copyright Office (excluding exhibits thereto); (y) execute an intellectual property security agreement and such other documents and take such other actions as Collateral Agent may reasonably request in its good faith business judgment to perfect and maintain a first priority perfected security interest in favor of Collateral Agent, for the ratable benefit of the Lenders, in the copyrights or mask works intended to be registered with the United States Copyright Office; and (z) record such intellectual property security agreement with the United States Copyright Office contemporaneously with filing the copyright or mask work application(s) with the United States Copyright Office. Borrower or such Subsidiary shall promptly provide to Collateral Agent and each Lender with evidence of the recording of the intellectual property security agreement necessary for Collateral Agent to perfect and maintain a first priority perfected security interest in such property.”

4.8Section 6.14 (Compliance with Budget). The following new Section 6.14 of the Loan Agreement is hereby added to the Loan Agreement:

“6.14 Compliance with Budget. Borrower shall limit its expenditures in accordance with the Budget; provided, however, a variance of up to [*] of actual, aggregate expenditures for any “key line item” in the Budget above the total, cumulative budgeted amount for such line item shall not be a violation of this Section 6.14. Beginning on the first Tuesday after the Third Amendment Effective Date and on every other Tuesday thereafter, on or prior to 12:00 noon Eastern time on each such Tuesday, Borrower shall deliver to Collateral Agent and Lenders [*] for such prior two-week period.”

4.9Section 7.1 (Dispositions). Section 7.1 of the Loan Agreement is hereby amended and restated in its entirety as follows:

“7.1 Dispositions. Convey, sell, lease, transfer, assign, or otherwise dispose of (including, without limitation, pursuant to a Division) (collectively, “Transfer”), or permit any of its Subsidiaries to Transfer, all or any part of its business or property, except for Transfers (a) of Inventory in the ordinary course of business; (b) of worn out, surplus or obsolete Equipment or furniture; (c) in connection with Permitted Liens, Permitted Investments or distributions and other payments permitted by Section 7.7, and Permitted Licenses; (d) consisting of the sale or issuance of any Shares that is not, and does not immediately result in, a Change in Control; (e) by and between Borrower and any other Borrower or Guarantor; (f) consisting of Borrower’s use or transfer of money or Cash Equivalents in connection with transactions not prohibited hereunder, subject to Section 6.14, and consistent with the Budget; (g) by any Subsidiary to Borrower in connection with any liquidation or dissolution of such Subsidiary that is otherwise permitted hereunder; (h) consisting of the sale of clinical assets so long as (I) if such Transfer is not consistent with the Budget, such Transfer has been approved in advance and in writing by Collateral Agent and the Required Lenders and (II) at least [*] from each such Transfer approved pursuant to this clause (h) are paid to Collateral Agent for the ratable benefit of the Lenders for application to the Term Loans within [*] of the receipt of such proceeds; (i) of Inventory, Equipment, Intellectual Property and other non-clinical assets so long as (I) such Transfer is consistent with the Budget or has been approved in advance and in writing by Collateral Agent and the Required Lenders and (II) [*] from

4

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

each such Transfer approved pursuant to this clause (i) are used to prepay the Term Loans within [*] of the receipt of such proceeds; and (j) mandated or otherwise necessary and appropriate destruction or other transfer of pre-clinical and clinical trial supplies.”

4.10Section 8.2 (Covenant Default). Section 8.2(a) of the Loan Agreement is hereby amended and restated as follows:

“(a) Borrower or any of its Subsidiaries fails or neglects to perform any obligation in Sections 6.2 (Financial Statements, Reports, Certificates), 6.4 (Taxes), 6.5 (Insurance), 6.6 (Operating Accounts) or 6.7 (Protection of Intellectual Property Rights), 6.9 (Notice of Litigation and Default), 6.12 (Creation/Acquisition of Subsidiaries) or 6.14 (Compliance with Budget), or Borrower violates any covenant in Section 7; or”

4.11Exhibit A (Collateral). Exhibit A to the Loan Agreement is hereby amended and restated as set forth on Exhibit A to this Amendment.

5.Limitation of Forbearance and Amendment.

5.1The forbearance and amendments set forth in Sections 2 and 4 above are effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right, remedy or obligation which Lenders or Borrower may now have or may have in the future under or in connection with any Loan Document, as amended hereby.

5.2This Amendment shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents are hereby ratified and confirmed and shall remain in full force and effect.

6.Representations and Warranties. To induce Collateral Agent and the Required Lenders to enter into this Amendment, Borrower hereby represents and warrants to Collateral Agent and the Required Lenders as follows:

6.1Immediately after giving effect to this Amendment (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct in all material respects as of such date) and (b) no Event of Default (other than the Existing Events of Default) has occurred and is continuing;

6.2Borrower has the power and due authority to execute and deliver this Amendment and to perform its obligations under the Loan Agreement, as amended by this Amendment;

6.3The organizational documents of Borrower delivered to Collateral Agent on the Effective Date, as updated pursuant to subsequent deliveries by or on behalf of Borrower to the Collateral Agent on or prior to the Third Amendment Effective Date, remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

6.4The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not contravene (i) any material law or regulation binding on or affecting Borrower, (ii) any material contractual restriction with a Person binding on Borrower, (iii) any order, judgment or decree of any court or other governmental or public body or authority, or subdivision thereof, binding on Borrower, or (iv) the organizational documents of Borrower;

6.5The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on Borrower, except as already has been obtained or made;

5

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

6.6This Amendment has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

7.1FOR GOOD AND VALUABLE CONSIDERATION, Borrower hereby forever relieves, releases, and discharges Collateral Agent and each Lender and their respective present or former employees, officers, directors, agents, representatives, attorneys, and each of them, from any and all claims, debts, liabilities, demands, obligations, promises, acts, agreements, costs and expenses, actions and causes of action, of every type, kind, nature, description or character whatsoever, whether known or unknown, suspected or unsuspected, absolute or contingent, arising out of or in any manner whatsoever connected with or related to facts, circumstances, issues, controversies or claims existing or arising from the beginning of time through and including the date of execution of this Amendment (collectively “Released Claims”).

7.2In furtherance of this release, Borrower expressly acknowledges and waives any and all rights under Section 1542 of the California Civil Code, which provides as follows:

“A general release does not extend to claims which the creditor does not know or suspect to exist in his or her favor at the time of executing the release, which if known by him or her must have materially affected his or her settlement with the debtor.” (Emphasis added.)

7.3By entering into this release, Borrower recognizes that no facts or representations are ever absolutely certain and it may hereafter discover facts in addition to or different from those which it presently knows or believes to be true, but that it is the intention of Borrower hereby to fully, finally and forever settle and release all matters, disputes and differences, known or unknown, suspected or unsuspected in relation to the Released Claims; accordingly, if Borrower should subsequently discover that any fact that it relied upon in entering into this release was untrue, or that any understanding of the facts was incorrect, Borrower shall not be entitled to set aside this release by reason thereof, regardless of any claim of mistake of fact or law or any other circumstances whatsoever. Borrower acknowledges that it is not relying upon and has not relied upon any representation or statement made by Collateral Agent or Lenders with respect to the facts underlying this release or with regard to any of such party’s rights or asserted rights.

7.4This release may be pleaded as a full and complete defense and/or as a cross-complaint or counterclaim against any action, suit, or other proceeding that may be instituted, prosecuted or attempted in breach of this release. Borrower acknowledges that the release contained herein constitutes a material inducement to Collateral Agent and the Lenders to enter into this Amendment, and that Collateral Agent and the Lenders would not have done so but for Collateral Agent’s and the Lenders’ expectation that such release is valid and enforceable in all events.

8.Loan Document. Borrower, Lenders and Collateral Agent agree that this Amendment shall be a Loan Document. Except for the agreement by Collateral Agent and Lenders to forbear on the terms set forth in Section 2, the Loan Agreement and the other Loan Documents shall continue in full force and effect without alteration or amendment. This Amendment and the Loan Documents represent the entire agreement about this subject matter and supersede prior negotiations or agreements.

9.Effectiveness. This Amendment shall be deemed effective as of the Third Amendment Effective Date upon (a) the due execution and delivery of this Amendment by the parties hereto, (b) the due execution and delivery of the IP Agreement by the parties thereto, (c) execution and/or delivery of all such other agreements, documents and deliverables required by Collateral Agent in connection with this Amendment, and (d) receipt by Collateral Agent and the Lenders of the remaining paydown in the amount of $3,743,006.18.

10.Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, and all of which, taken together, shall constitute one and the same instrument. Delivery by

6

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

electronic transmission (e.g. “.pdf”) of an executed counterpart of this Amendment shall be effective as a manually executed counterpart signature thereof.

11.Governing Law. This Amendment and the rights and obligations of the parties hereto shall be governed by and construed in accordance with the laws of the State of California.

[Balance of Page Intentionally Left Blank]

7

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

IN WITNESS WHEREOF, the parties hereto have caused this Forbearance and Third Amendment to Loan and Security Agreement to be executed as of the date first set forth above.

|

|

|

BORROWER: |

|

|

|

|

|

VIRACTA THERAPEUTICS, INC. |

|

|

|

|

|

|

|

|

By /s/ Mark Rothera |

|

|

Name: Mark Rothera Title: President and Chief Executive Officer VIRACTA SUBSIDIARY, INC. By /s/ Mark Rothera Name: Mark Rothera Title: President and Chief Executive Officer |

|

|

|

|

|

|

|

|

[Signature Page to Forbearance and Third Amendment to Loan and Security Agreement]

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

|

|

|

COLLATERAL AGENT AND LENDER: |

|

|

|

|

|

OXFORD FINANCE LLC By /s/ Colette H. Featherly Name: Colette H. Featherly Title: Senior Vice President |

|

|

|

|

|

|

LENDER: OXFORD FINANCE FUNDING 2020-1, LLC By /s/ Colette H. Featherly____________________ Name: Colette H. Featherly Title: Secretary OXFORD FINANCE FUNDING 2023-1, LLC By /s/ Colette H. Featherly____________________ Name: Colette H. Featherly Title: Secretary OXFORD FINANCE CREDIT FUND II LP By: Oxford Finance Advisors, LLC, its manager By /s/ Colette H. Featherly____________________ Name: Colette H. Featherly Title: Senior Vice President OXFORD FINANCE CREDIT FUND III LP By: Oxford Finance Advisors, LLC, its manager By /s/ Colette H. Featherly____________________ Name: Colette H. Featherly Title: Senior Vice President FIRST-CITIZENS BANK & TRUST COMPANY By /s/ Laura Scott Name: Laura Scott Title: Managing Director |

|

|

|

|

|

[Signature Page to Forbearance and Third Amendment to Loan and Security Agreement]

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

EXHIBIT A

Description of Collateral

The Collateral consists of all of Borrower’s right, title and interest in and to the following personal property:

All goods, Accounts (including health-care receivables), Equipment, Inventory, contract rights or rights to payment of money, leases, license agreements, franchise agreements, General Intangibles (including all Intellectual Property, except as noted below), commercial tort claims, documents, instruments (including any promissory notes), chattel paper (whether tangible or electronic), cash, deposit accounts, fixtures, letters of credit rights (whether or not the letter of credit is evidenced by a writing), securities, and all other investment property, supporting obligations, and financial assets, whether now owned or hereafter acquired, wherever located; and

all Borrower’s Books relating to the foregoing, and any and all claims, rights and interests in any of the above and all substitutions for, additions, attachments, accessories, accessions and improvements to and replacements, products, proceeds and insurance proceeds of any or all of the foregoing.

Notwithstanding the foregoing, the Collateral does not include (a) any interest of Borrower as a lessee or sublessee under a real property lease; (b) rights held under a license that are not assignable by their terms without the consent of the licensor thereof (but only to the extent such restriction on assignment is enforceable under applicable law); (c) any interest of Borrower as a lessee under an Equipment lease if Borrower is prohibited by the terms of such lease from granting a security interest in such lease or under which such an assignment or Lien would cause a default to occur under such lease; provided, however, that upon termination of such prohibition, such interest shall immediately become Collateral without any action by Borrower or Collateral Agent; (d) more than sixty-five percent (65%) of the presently existing and hereafter arising issued and outstanding shares of capital stock owned by Borrower of any Foreign Subsidiary which shares entitle the holder thereof to vote for directors or any other matter, but only to the extent that pledging greater than sixty-five percent (65%) of such stock of such Foreign Subsidiary would result in a material net increase in tax liability for Borrower and such Foreign Subsidiary taken as a whole (taking into account (i) any applicable offsets related to credits for the underlying foreign income taxes in the case of additional US income taxes required to be paid as a result of a deemed dividend and (ii) the application of net operating loss carry forwards, if any); or (e) any intent-to-use trademark or service mark applications of Borrower.

Notwithstanding the foregoing, the Collateral shall exclude (i) the assets commonly known as “TAK-580/DAY101” and “vosaroxin” (the “Monetized Assets”), and (ii) automatically and as of such consummation, upon the consummation of a sale, license or other monetization (the “Asset Sale”) of the assets commonly known as “Vecabrutinib” and “SNS-510” (the “Sold Assets”), the Sold Assets; provided, however, that the Collateral shall include any consideration or other proceeds of the Monetized Assets and the Sold Assets received by Borrower, whether under a sale of the Monetized Assets or the Asset Sale or otherwise, whether now owned or hereafter acquired.

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

Exhibit B

Budget

[*]

[*] = Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) is the type that the registrant treats as private or confidential.

v3.24.4

Document And Entity Information

|

Jan. 23, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 23, 2025

|

| Entity Registrant Name |

Viracta Therapeutics, Inc.

|

| Entity Central Index Key |

0001061027

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-51531

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3295878

|

| Entity Address, Address Line One |

2533 S. Coast Hwy. 101, Suite 210

|

| Entity Address, City or Town |

Cardiff

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92007

|

| City Area Code |

(858)

|

| Local Phone Number |

400-8470

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

VIRX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

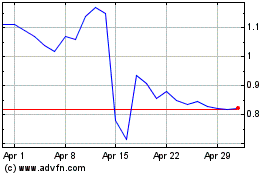

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Mar 2024 to Mar 2025