0001061027falseViracta Therapeutics, Inc.00010610272024-12-182024-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 18, 2024 |

VIRACTA THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-51531 |

94-3295878 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2533 S. Coast Hwy. 101, Suite 210 |

|

Cardiff, California |

|

92007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 400-8470 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

VIRX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Reference is made to that certain Loan and Security Agreement dated as of November 4, 2021, as amended by that certain First Amendment to Loan and Security Agreement dated as of August 26, 2022 and by that certain Second Amendment to Loan and Security Agreement dated as of March 1, 2024 (as amended, the “Loan Agreement”) by and between Viracta Therapeutics, Inc. (the “Company”), Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (“SVB”), Oxford Finance LLC, a Delaware limited liability company (“Oxford”), as lender and collateral agent under the Loan Agreement, and the other lenders party thereto.

On December 20, 2024, the Company received a notice of events of default, acceleration of obligations and demand for repayment under the Loan Agreement from Oxford, in its capacity as collateral agent and lender, which asserted that events of default have occurred under Section 8.3 and Section 8.5 of the Loan Agreement. The notice therefore asserted that all obligations under the Loan Agreement are now immediately due and payable, the obligations under the Loan Agreement shall accrue interest at the default rate thereunder, and that Oxford reserved all rights, powers, privileges and remedies provided under the Loan Agreement and applicable law. The total obligations owed under the Loan Agreement as of the date hereof that have been accelerated and declared payable by Oxford are $15.7 million and any additional interest due upon final payment and any expenses that become payable by the Company under the Loan Agreement.

A description of the Loan Agreement is contained in the Company’s Annual Report on Form 10-K filed with the SEC on March 7, 2024, as well as the Company’s Quarterly Reports on Form 10-Q filed with the SEC on May 9, 2024, August 14, 2024, and November 13, 2024, which descriptions are incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 18, 2024, Barry J. Simon, M.D. informed the Company of his resignation as a member of the Board of Directors (the “Board”) of the Company, and from all committees of the Board on which he served. Dr. Simon’s resignation is not the result of any disagreement with the Company related to its operations, policies, or practices.

Item 8.01. Other Matters.

On December 26, 2024, the Company issued a press release announcing its plans to close NAVAL-1, the ongoing Phase 2 clinical trial of Nana-val in relapsed/refractory EBV+ lymphomas, and to seek strategic alternatives, which is attached as Exhibit 99.1 to this current report and is incorporated by reference herein.

Forward-Looking Statements

Certain of the statements made in this report are forward looking, such as those, among others, relating to the total obligations due and payable under the Loan Agreement, the closure of NAVAL-1, and the Company’s plans to seek strategic alternatives. Actual results or developments may differ materially from those projected or implied in these forward-looking statements. Forward-looking statements are subject to the occurrence of many events outside of the Company’s control. Actual results and the timing of events may differ materially from those contemplated by such forward-looking statements due to numerous factors that involve substantial known and unknown risks and uncertainties. These risks and uncertainties include, among other things, the risk that the expenses related to the Loan Agreement may be greater than expected, the process of closing NAVAL-1 may deviate from expectations, and the Company’s process to seek strategic alternatives may not proceed as expected. More information about the risks and uncertainties faced by the Company is contained under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q filed with the SEC on November 14, 2024 and in its subsequent filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on forward-looking statements which are current only as of the date hereof. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

Exhibit Number |

|

Description |

99.1 |

|

Press Release, dated December 26, 2024 |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

|

|

|

Date: |

December 26, 2024 |

By: |

/s/ Michael Faerm |

|

|

|

Michael Faerm

Chief Financial Officer |

Viracta Therapeutics Announces Closure of NAVAL-1 Clinical Trial and Exploration of Strategic Alternatives

SAN DIEGO, December 26, 2024 – Viracta Therapeutics, Inc. (Nasdaq: VIRX), a clinical-stage precision oncology company focused on the treatment and prevention of virus-associated cancers that impact patients worldwide, today announced that its Board of Directors has initiated a process to explore a broad range of strategic alternatives.

To maximize its cash runway while the Board conducts its review of strategic alternatives, Viracta has elected to close its ongoing pivotal Phase 2 clinical trial of Nana-val in relapsed/refractory EBV+ lymphomas (the NAVAL-1 trial). The company emphasized that its decision to voluntarily close the trial is not the result of any new safety finding.

“As we continue to look for ways to conserve resources and maximize value for the company, we made the very difficult decision to close the NAVAL-1 study while the Board undertakes its strategic review,” stated Mark Rothera, President and Chief Executive Officer of Viracta. “I would like to thank the physicians and patients who participated in this important study, as well as the Viracta team members who worked so tirelessly on this program. I continue to believe that Nana-val has the potential to improve the treatment of relapsed/refractory EBV+ lymphomas, and I remain hopeful that it will one day be approved.”

Viracta is making this announcement to inform shareholders and the public that the Company is engaging in discussions for strategic alternatives with the goal of maximizing value. Potential alternatives include, but are not limited to, a merger, licensing agreement, sale or other strategic transaction.

There can be no assurance that the exploration of strategic alternatives will result in any agreements or transactions, or as to the timing of any such agreements or transactions. Viracta does not intend to discuss or disclose further developments regarding the exploration of strategic alternatives unless and until its Board of Directors has approved a specific action or otherwise determined that further disclosure is appropriate or required by law.

About Viracta Therapeutics, Inc.

Viracta is a clinical-stage precision oncology company focused on the treatment and prevention of virus-associated cancers that impact patients worldwide. Viracta’s lead product candidate is an all-oral combination therapy of its proprietary investigational drug, nanatinostat, and the antiviral agent valganciclovir (collectively referred to as Nana-val). Nana-val is currently being evaluated in multiple ongoing clinical trials, including a potentially registrational, global, multicenter, open-label Phase 2 basket trial for the treatment of multiple subtypes of relapsed or refractory (R/R) Epstein-Barr virus-positive (EBV+) lymphoma (NAVAL-1), as well as a multinational, open-label Phase 1b/2 clinical trial for the treatment of patients with recurrent or metastatic (R/M) EBV+ nasopharyngeal carcinoma (NPC) and other advanced EBV+ solid tumors. Viracta is also pursuing the application of its “Kick and Kill” approach in other virus-related cancers.

For additional information, please visit www.viracta.com.

Forward-Looking Statements

This communication contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding: Viracta’s process to explore strategic alternatives, the closure of the NAVAL-1 trial, and the potential clinical benefit of Nana-val. Risks and uncertainties related to Viracta that may cause actual results to differ materially from those expressed or implied in any forward-looking statement include, but are not limited to: Viracta's plans to research, develop, and commercialize its current and future product candidates; the clinical utility, potential benefits, and market acceptance of Viracta's product candidates; and Viracta's estimates regarding its ability to fund ongoing operations into 2025, future expenses, capital requirements, and need for additional financing in the future.

If any of these risks materialize or underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption "Risk Factors" and elsewhere in Viracta's reports and other documents that Viracta has filed, or will file, with the SEC from time to time and available at www.sec.gov.

The forward-looking statements included in this communication are made only as of the date hereof. Viracta assumes no obligation and does not intend to update these forward-looking statements, except as required by law or applicable regulation.

Contact Information:

Viracta Therapeutics, Inc.

ir@viracta.com

SOURCE Viracta Therapeutics, Inc.

v3.24.4

Document And Entity Information

|

Dec. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 18, 2024

|

| Entity Registrant Name |

Viracta Therapeutics, Inc.

|

| Entity Central Index Key |

0001061027

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-51531

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3295878

|

| Entity Address, Address Line One |

2533 S. Coast Hwy. 101, Suite 210

|

| Entity Address, City or Town |

Cardiff

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92007

|

| City Area Code |

(858)

|

| Local Phone Number |

400-8470

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

VIRX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

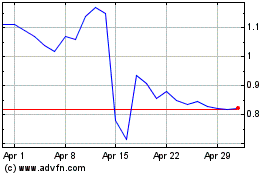

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Mar 2024 to Mar 2025